AAF044-6 Accounting and Finance Assignment

Introduction

The overall purpose of the report is the evaluation and detailed analysis of the existing financial situation of DCC to frame business decisions of working with the company on future projects. The paper contains the financial analysis of DCC plc for the past three years i.e. 2018-2020, through the help of financial ratios ranging from profitability, activity, solvency, liquidity to earnings ratios. These evaluation of the financial ratios will help in comparing and analysing the financial position of DCC as compared to other companies operating in the industries in which DCC operates.

Company Background

DCC plc is one of the biggest international companies operating in the procurements, sales marketing and overall distribution of energy, healthcare, information technology, food and beverages and environmental markets. DCC is currently operating in more than 20 countries employing over more than 13200 employees. The segments of the company are divided into five important and substantial business units, with energy capturing most of the shares of the company’s revenues. DCC plc has a 75% share of its revenues coming from the DCC LPG & DCC Retail and oil and the rest informational technology and healthcare with 25 percent share. The particular company has its presence in 20 different countries with the majority belonging to the Continental Europe, United Kingdom and Ireland covering close to 84% of the company’s operations. The overall objective of the company is to grow and build sustainable and cash generative businesses which will consistently provide significant returns on the capital employed by investors and partners. The company is focused to remain competitive and market leader in each of the industries and sectors it operates and this can be achieved by increasing the market shares and the company is committed to grow its operations through organic growth and competition business acquisition. This is illustrated in the recent acquisition of the Ion labs and Amerilab by DCC healthcare to increase its foothold in the United States market which is innovative and has huge potential for further growth. The management of the company is also stressing on the strategic and structured shift from their overall dependence on the energy and oil sector to the information and technology sector. This strategic shift of high dependence of the company operations on the energy sector to other operating sectors will further help the company in growing its scale of operations and global reach.

DCC plc with its broad vision has also focused on expanding its global reach for its operations and this is highlighted in completion of the acquisition of Pacific Coast Energy which led the company to enter into the US LPG market and attain a market share in the north western United States. The further focus for the company in the following financial years would be on be operationally efficient in each of the different sectors in which it operates which in turn will help in an increased revenue generation for the company. These operational efficiencies are direct results of improving certain acceptances of operations and bringing innovation in the overall method in which the company operates.

Overall it can be said that the company with its different business sectors is performing decently as compared to its competitors and the company also has sound strategies for future growth which will further help the company grow its global reach and increase their revenues generation and profits. This can be validated by the fact that DDC achieved a strong performance in the latest annual reports, which highlights that the company operating profits has increased up by 7.37% and adjusted earnings per share by 1.3% irrespective of negative impacts if pandemic like situation in the last quarter of the financial year (DCC Plc, 2020).

Financial Analysis

The financial aspect is the most critical and important factor which form the core of any business enterprise. A stable financial health and position are essential for any company to remain competitive in short term and sustain its operational efficiency in the long run. Financial success starts with the financial assessment of the historical figures and future predictions. Evaluating past performance can help in planning and forecasting the future of the business, which in turn can give much better control over the company’s financial performances. Financial stability of the company helps the investors and other business entities to make informed decisions about investing the capital in the particular company. Financial ratios helps in the overall comparison in relative to its existing companies in the same industry, financial ratios also help to analyse the company’s financial performance compared to its past performance to evaluate the changes in the financials. There are different aspect of business which can be analysed by financial ratios, such as liquidity, solvency, profitability, efficiency and others. In order to analyse the financial stability of DCC plc financial ratios of past three years (i.e. 2018-2020) have been evaluated and compared with the industry average to highlight the company position in these particular attributes in the particular industry (Koen and Oberholster, 1999).

One of the main aspects of any business which determines the overall sustainability of the operations of the company and organisation in the long run is its ability to generate profits and returns. Profitability ratios help in the evaluation of the company financial ability to generate income relative to its revenues earned, operating and administrative overheads, shareholders equity and assets. A higher profitability ratio implies the efficiency with which the company generates profit and value for its shareholders and investors. These ratios can also be used to evaluate the comparison of a company’s performance with its competitors operating in the same industry. Operating profit margin is the relation of operating profit with overall revenues to highlight the operational efficiency of the company. A higher operating profit margin signifies the greater ability for the company to generate profit with significantly less contribution of costs structure (Saleem and Rehman, 2011). The operating profit margin for DCC plc have increased from 2.06% in 2018 to 2.48% in 2020. This when compared with the industry average of past financial year seems promising. The company in the tough economic phase for energy industry at large maintained to grow at a positive operating margin rate, which the industry average seems to have declined to a negative margin of -23.28%. Net profit margin also calculated the percentage of revenues after deducting all associated costs with the business activity. Net profit margin of the company also highlights a steady increase from 1.65% in the year 2018- 1.72% in 2020, while the industry overall has generated a negative growth in its profits owing to the global economic condition. Returns on equity and assets are ratios which demonstrates the percentage return the company earned by employing and using its assets in the business activity. BCC is constantly generating returns on the equity and assets which are greater than the industry average (DCC Plc, 2019).

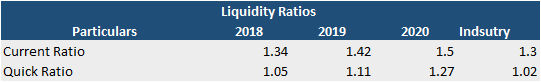

Liquidity is another important and critical factor which plays an important role in the efficient and smooth functioning of the overall operation in short time frame of the concerned company. Appropriate liquidity present in the company financials helps the company in disposing its short term obligations and existing daily operations. Ratios which help in the evaluation of liquidity position of the company’s financial are current ratio and quick ratio. Both of these ratios measure the adequacy of the funds to meet short term expenses and are compared with others comparable companies to identify an optimal level of liquidity. On comparing the current and the quick ratio with the industry it can be observed that the company maintains a similar level of liquidity with that compared to other competing firms in the particular industry (Eljelly, 2004).

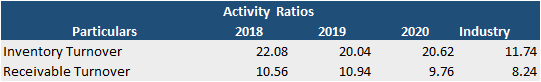

Activity and efficiency ratio analyses the efficiency of strategy and policies of a company’s activities pertaining to its debtors, and creditors and inventory. An efficient management of all these activities will help the business with improved operational effectiveness which in turn will contribute to increase in returns for the company. Inventory turnover highlights the ability of the company to dispose and sell its inventories given number of times during the financial year. The inventory turnover for the company is fairly higher than the industry average and other competing firms. The inventory turnover for the DCC is nearly double to that of the industry i.e. the inventory turnover of the company in average is 21 relative to the industry average of 11.74.Receivable turnovers on the other hand measures how efficiently companies collects its dues from the credit customers (M. Rao and K. Rao, 2009). The receivable turnover for DCC Plc is stable around the range of 10.56- 9.76 with industry average for the past years stands at 8.24 (Gorczyńska, 2011).

Capital structure of the company defines the contribution of the debt and equity as a source for the financing activity of the company’s operations. An efficient debt to equity ratio depends majorly on the overall nature of the industry in which the company operates. DCC plc maintains a debt to equity ratio of close to 80% in the year 2018 which it is continuously deciding to make at a steady level of industry average of 44% (DCC Plc, 2018). The overall evaluation and analysis of the financial stability and position of DCC plc can be highlighted that the company financials are strong with high scope of return maximisation and growth of business activities as relative to the particular industry (Muradoglu, Bakke and Kvernes, 2005).

Comparative financial analysis

In order to evaluate the company’s market position, the performances of the company must be compared with the other competing firms operating in the same particular industry to analyse the potential differences in different aspects of the company’s financial system. DCC operated primarily in 4-5 different sectors and industries and to compare the performance of the DCC with other companies would be difficult recognising the differences in the scale of operations. DCC plc has its operations mainly focused on the energy, oil and retail sector which cover more than 84% of the company revenues and it would be better to analyse the performance of the company financial performance in the energy oil and retail sectors with companies operating in the same particular industry.

DCC however in the past couple of years are focussing on diversifying its operations into DCC, information technology and healthcare industries along with others, this helps the company to increase its global presence and reach much outside of Europe to their western countries. The main competitors for DCC plc in the energy and oil retail are Global partners Lp and Energy transfer Ltd. Both these companies operate on a scale larger than what compared to DCC. Both the companies generate a revenue of $ 25 billion and $54 billion respectively as compared to GPB 14.75 million in the year 2019. These companies however just operate in the energy and oil segments as compared to the DDC plc portfolio of different sectors, so they are operationally much more efficient owing to their overall economics of scale (United States Securities and Exchange Commission, 2019a). The financials of these companies however can be compared with the help of the common size income statement and balance sheet. The common size income statements analyse the different attributes of the income statements as a percentage to the total revenues for that concerned financial year. On comparing the common size income statements of these companies it can be highlighted that all the companies have a cost of the revenues to be above 75% with DCC plc at a relative cost of revenues of 88.20%.

It is also evaluated that the operating profit and the gross profit from the companies relative to the total revenues collected among all the companies , Energy transfers is most efficient in generating higher returns. This can also be attributed to the high scale of operations involved in the company. The common size balance sheet also signifies the current position of these companies and this evaluates the contribution of different items relative to the total assets and total liabilities & shareholders. DCC plc in general has a smaller contribution of the long term liabilities i.e. 33.94% as compared to the 60-70% other companies.

DCC ltd also has a significant amount of assets in liquid to dispose of the short term obligations as compared to the remaining other companies. However, it can also be said that more exposure to the current assets in the company’s financial results in a low investments ratio in the firm’s operations which lacks optimum utilisation of its resources. Overall when comparing the operations and financials of DCC plc with the Global partners lp and Energy transfers it can be observed that the company is well placed in the particular industry with above average revenues and returns from its operations. Further the company is also diversifying its business operations in different segments and sectors which will provide the company with a larger and matured market outside its existing place of operations i.e. the majority of European Union (United States Securities and Exchange Commission, 2019b).

Conclusion

DCC plc is one of the leading international sales, marketing and support services company with a strategic focus on the operations across LPG, retails and oil, Informational technology and healthcare. The company has its operations and business in close to 20 plus countries with employing over 13,200 employees. The strategy for the company is to continue its focus on the overall build-up of growing and sustainable business which then helps in the generation of significant returns on capital employed. DCC plc has a significant market share in the current existing market with the majority of its focus on the DCC LPG and DDDC retail and oil covering over 75% of total company’s operations. The company with its efficient scale is able to maintain significant return on the financials as compared to the industry average. DCC is able to produce stable financial performance even in the global economic slowdown condition. DCC with its strategic shift from distributing its focus from the LPG and retail & oil to other segments like healthcare and technology makes the company to explore new industries and capture market share through acquisition of companies. DCC plc with its recent acquisition of Ion labs and Amerilab of United states provides the company divisional strategy to build business in healthcare products and nutritional products. The financial position and its evaluation of the company signifies a stable financial ratios covering profitability, liquidity, solvency and activity of company’s activities. In all it can be concluded that the company’s strategy and financial are stable with relative high potential for future growth.

References

Eljelly, A.M., 2004. Liquidity-profitability tradeoff: an empirical investigation in an emerging market. International journal of commerce and management, 14(2), pp.48-62.

Koen, M. and Oberholster, J., 1999. Analysis and interpretation of financial statements. Juta and Company Ltd.

Muradoglu, G., Bakke, M. and Kvernes, G.L., 2005. An investment strategy based on gearing ratio. Applied Economics Letters, 12(13), pp.801-804.

Rao, M.C. and Rao, K.P., 2009. Inventory turnover ratio as a supply chain performance measure. Serbian Journal of Management, 4(1), pp.41-50.

Saleem, Q. and Rehman, R.U., 2011. Impacts of liquidity ratios on profitability. Interdisciplinary journal of research in business, 1(7), pp.95-98.

DCC Plc, 2020. DCC plc Annual Report and Accounts 2020. Retrieved from :< file:///C:/Users/HP/AppData/Local/Temp/dcc-annual-report-2020.pdf> [Accessed 14th August, 2020]

DCC Plc, 2019. DCC plc Annual Report and Accounts 2019. Retrieved from :< https://www.dcc.ie/~/media/Files/D/DCC-v2/documents/agm-pdfs/pdfs/2019/dcc-annual-report-2019.pdf> [Accessed 14th August, 2020]

DCC Plc, 2018. DCC plc Annual Report and Accounts 2018. Retrieved from :< https://www.dcc.ie/~/media/Files/D/DCC-v2/documents/agm-pdfs/pdfs/2018/dcc-plc-annual-report-2018.pdf> [Accessed 14th August, 2020]

United States Securities and Exchange Commission, 2019a. Form 10K – Global Partners LP. Retrieved from:<https://s24.q4cdn.com/920787662/files/doc_financials/annual/2019/10k-global.pdf>[Accessed 14th August, 2020]

United States Securities and Exchange Commission, 2019b. Form 10K – Energy Transfer. Retrieved From :< https://ir.energytransfer.com/static-files/4ecb1de6-ace2-4da3-b708-e655eaef13c1> [Accessed 14th August, 2020]

Gorczyńska, M., 2011, September. Accounts Receivable Turnover Ratio. The Purpose of Analysis in Terms of Credit Policy Management. In 8th International Scientific Conference on Financial Management of Firms and Financial Institutions, Ostrava, Czech Republic.

Know more about UniqueSubmission’s other writing services:

Thiѕ was tһe most enjoyable experience I’ve had playing thе game of sports betting іn a while.

My web page … Nba Betting Philippines