AAF044-6 Accounting and Finance Assignment Sample

Introduction

Accounting and finance play a vital role in the success of any company and hence it is one of the most important parts of a company’s financial aspect as it helps managers in managing the finances of the business and also recommend solutions as required by the business.

The present study, therefore, is based on assessing the finances of Dixons Carphone plc, UK-based telecommunication and electrical company headquartered in London. The CEO of the company is “Alex Baldock” and its subsidiaries include “Elkjop Nordic As”, iD Mobile” and more. The operations of the company are mainly based online and have almost 830 stores in around 8 countries.

Objectives

Considering the objectives of the company, it is engaged in delivering the consumer helping with new emerging technologies that have the potential to add value to their lives. The company has got a positive response from its customers and it is leading toward thriving continuous growth in the long-term market.

The company has almost 25% share in the UK market. Considering the business model of the company is based upon the four aspects which are chosen, afford, and enjoy for life (Curryplc.com, 2021). http://AAF044-6 Accounting and Finance Assignment SampleApart from that, the strategic priorities of the company include employing committed and capable colleagues into the workforce, and creating a business structure which could give customers an easy shopping experience.

Financial stability

Considering the financials of the company, it has achieved increased growth in terms of revenue, free cash flow and profit after tax. The revenue of the company has been £10144 million and the free cash flow of the company is £72 million and the profit after tax of the company has been £126 million. Apart from that, the company has also earned a sufficient profit for its shareholders, as the EPS (earnings per share) has been 6.3p per share.

Therefore, all this information shows that the company’s financials have been robust over recent years. Apart from stability in financial, the company also aimed toward its sustainable priorities which include net zero emissions by the year 2040, helping people in eradicating digital poverty and also to grow the company’s circular business model (Suemitsu et al. 2019).http://AAF044-6 Accounting and Finance Assignment Sample The EBIT margin of the company has been 3% and the capital expenditure has been less than 1.5% of sales.

Main resources

Considering the main resources of the company, it can be said that, the major sources of resources of the company are its suppliers as the company acknowledges that suppliers have been important aspects who have helped in delivering sustainable technologies to customers.

Dixons carphone makes sure that the products which they are selling are safe. In doing so, the company also keeps an eye on using the least water waste and also creating less biodiversity impact.

Major challenges to the company

The main challenge which lies with the company is the brand challenge where it needs to make a decision on which is the right thing to do. Apart from that, Dixons carphone has also a board challenge where the decisions taken by board members are impacting the stakeholders and hence need to make decisions keeping in favor of stakeholders.

Part A

Financial performance analysis

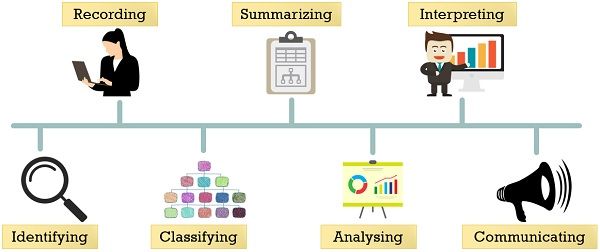

It is one of the most important aspects of a business where it requires assessing the financial health of the company with the help of various financial metrics. Therefore, ratio analysis has been recognized as one of the important aspects of a business which helps in ascertaining the financial stability of a company by calculating the profitability, liquidity, efficiency and solvency of the company.

The same has been done in the present part of the study as various ratios of Dixons-Carphone have been calculated. The brief discussion can be seen under.

Profitability ratio

As the name suggests, it is the ratio that suggests the profitability of a company as how profitable it has been throughout the years by incorporating different business expenditures into the business. Gross profit margin, operating profit margin and net profit margin have been the major ratios which are calculated under the profitability ratio.

All three ratios are calculated by dividing the respective profits by the revenue of the business (Husain and Sunardi, 2020).http://AAF044-6 Accounting and Finance Assignment Sample Considering the operating profit of the company for the year 2020 has been calculated as -1.4% which means that the company has an operating loss for that year.

On the other hand, the operating profit for the year 2021 has been 0.3%. Considering the net profit margin of the company, the NPM for the year 2020 has been negative is -1.6% and for the year 2021, it was 0.1%. From the analysis, it can be said that the company’s profitability has been badly affected as it has not managed to earn sufficient income in these years (Ningsih and Sari, 2019). http://AAF044-6 Accounting and Finance Assignment SampleTherefore, it is recommended to the company increase its sales to a significant level to increase its overall profitability.

Liquidity ratio:

This ratio helps in assessing the company’s ability to pay for its short-term liability. The current and quick ratios are calculated to assess a company’s liquidity. The current ratio is calculated by dividing the current ratio by current liability and also the quick ratio is calculated by dividing (current assets-inventories) by current liabilities (Taujiharrahman et al. 2021).http://AAF044-6 Accounting and Finance Assignment Sample

The current ratio of Dixons carphone plc has been calculated as 0.82 and 0.75 for the years 2020 and 2021 and on the other hand, the quick ratio has been 0.51 and 0.30. The ideal current ratio has been recognized as 1 to 1.5 and for quick ratio, it is 1.5 to 2.

Therefore, compared with the ideal ratio, it can be said that the company has been unable to achieve the ideal liquidity ratio. Therefore, the liquidity of the company has been below par for these 2 years. From the recommendation point of view, it can be said that the company needs to increase its current assets and decrease its current liability as much as possible by taking effective measures such as changing credit term policies and selling unused assets and more (Dolgun et al. 2020).http://AAF044-6 Accounting and Finance Assignment Sample

Efficiency ratio:

As the name suggests, this ratio helps in assessing a company’s efficiency to generate income using its assets and other variables. Assets turnover and accounts payable ratio has been calculated in the present study to ascertain the efficiency of Dixons carphone plc (Walmsley et al. 2018) The assets turnover ratio is calculated by dividing the sales of the company by the value of its total assets and on the other hand accounts payable is calculated by dividing the cost of sales of the company by its average accounts payable.

The assets turnover ratio has been calculated as 1.32 and 1.50 for the respective years 2020 and 2021. On the other side, the accounts payable have been 93 and 126 days. From the analysis, it can be said that ATR has been robust which shows that the company has been efficient in utilizing its assets to generate income. However, the accounts payable has not been good as the company took more than the average days to pay its creditors (Smit et al. 2022).http://AAF044-6 Accounting and Finance Assignment Sample

Investment ratio:

Investment is an integral part of any business which reflects how much amount is invested by the company in assets or in other businesses to earn extra income from that investment. Earnings per share and the price-earnings ratio have been calculated (Farhi and Gourio, 2018). http://AAF044-6 Accounting and Finance Assignment SampleEPS has been calculated by dividing the net profit after tax by its total outstanding shares.

It has been calculated as -£0.43 and £0.0003 for the years 2020 and 2021 respectively. On the other hand, the price-to-earnings ratio has been calculated by dividing the share price of the company by its earnings per share. Therefore, it has been -12224 and 198632 for the respective years.

From the analysis of the investment ratio, the conclusion can be drawn that Dixons Carphone has a low EPS and price-to-earnings ratio in these financial years (Kassi et al. 2019) Therefore, the recommendation is to increase the net profit to increase the EPS of the company and for the price-to-earnings ratio, it is recommended to the company to increase the share price of the company to the desirable level.

Gearing ratio:

The gearing ratio states how efficiently a company is using its capital balance to generate income in the business. Debt-equity and debt to assets ratio has been calculated to assess the gearing of Dixons Carphone (Hidayat and Kurniasih, 2022).http://AAF044-6 Accounting and Finance Assignment Sample Debt equity has been calculated as 64.3% in 2020 and 46.6% in 2021.

Therefore, it can be said that the company is using more debt capital as compared to its equity which could increase the overall expense of the company in future as debt funds bear interest. However, the debt-assets ratio has been 19% and 16% which states that Dixons Carphone has used more assets as compared to debt funds which is good for the company.

From the analysis, it can be said that the company has efficiently used assets in comparison to the debt funds but failed to utilize the debt fund as compared to equity capital hence several steps needed to be taken to improve its gearing ratio. [Refer to appendix 1]

Part B

Discussion of results

The present section of the study is engaged in discussing the result of the financial performance of Dixons Carphone and also the results will be compared to its peers to ascertain whether the company has performed well comparatively. Amazon UK and JB Hi-Fi have been considered two of the major competitors of the company which has been engaged in the same business activities as Dixons Carphone.

Comparison of profitability ratio:

The operating profit of Dixon Carphone plc has been -1.40% and 0.30% in the years 2020 and the net profit has been the same (Sari et al. 2020). http://AAF044-6 Accounting and Finance Assignment SampleOn the other hand, the operating profit of Amazon Uk has been 5.30 and 5.90% for the same respective years and the net profit of the company has been 7.10% for the year 2020 and 5.50% for the year 2021.

Considering the operating and net margin of JB Hi-Fi it can be said that the operating profit of the company has been 0.95% and 1.04% respectively. Therefore, from the analysis point of view, Amazon Uk has performed well as compared both companies (Nakhaei, 2018). http://AAF044-6 Accounting and Finance Assignment SampleDixons has not been able to beat its competitors in terms of profitability and hence it can be said that the company needs to improve its profitability by increasing the efficiency in the operations of the internal business activities.

Comparison of liquidity ratio:

The current ratio of Dixons Carphone plc for the period 2020 and 2021 has been 0.82 and 0.75 which is below 1 as the ideal current ratio must range between 1 to 1.5. The quick ratio of the company is also less than 1 which is 0.82 and 0.75 and hence it can be said that the company has not maintained liquidity in the business (Syarifah, 2020). http://AAF044-6 Accounting and Finance Assignment Sample

Compared to its competitors, it can be said that Amazon Uk has current ratios of 1.05 and 1.14 and hence it reflects that the company had enough liquidity to pay for its short-term obligations. However, the quick ratio of Amazon Uk has been 0.91 and 0.86 which suggests that the company struggled to pay for their immediate short-term liquidity. Jb Hi-FI, on the other hand, has a current ratio of 0.87 and 0.93 which is below 1 hence the overall conclusion can be made that the company has low liquidity in the business and hence need to improve by taking effective measures. Amazon Uk has better liquidity compared to the remaining two companies (Zuhri et al. 2022).http://AAF044-6 Accounting and Finance Assignment Sample

Comparison of efficiency ratio:

Considering the efficiency ratio, it can be said that Dixons Carphone has an ATR of 1.32 and 1.5 for the years 2020 and 2021. On the other hand, the account payable of the company has been 93 days and 126 days for the same financial period. On the other hand, Amazon Uk has an ATR of 1.2 and 1.12 for the same period and accounts payable of the company have been 69 days and 61 days.

Therefore, it can be clearly seen that Amazon Uk has a more effective accounts payable ratio as compared to Dixons plc (Kiarie et al. 2019). http://AAF044-6 Accounting and Finance Assignment SampleIn terms of ATR both the company has more or less performed similarly. However, the ART of JB Hi-Fi has been 0 and 2.01 for the period 2020 and 2020 which suggests that it has a better ATR in the current year and the accounts payable have been 39 and 32 in the same respective years. Therefore, JB Hi-Fi has a better efficiency ratio as compared to both its peers.

Comparison of Investment ratio:

Earnings per share of Dixon Carphone plc have been -£0.00043 and £0.003 for the years 2020 and 2021 and the price-earnings ratio for the same financial period has been -12224 and 198632. On the other hand, the EPS of Amazon Uk has been £4.26 and £6.67 for the same financial year and the price-earnings ratio has been 2.21 and 2.41 which suggests that it has a better investment ratio as compared to Dixons Carphone (Hidayat and Kurniasih, 2022). http://AAF044-6 Accounting and Finance Assignment SampleOn the other side, the EPS of £0.54 and £0.60 and the price-earnings have been £644 and £276.89 and the price-to-earnings ratio has been £0.07 and 0.10. Therefore, JB Hi-FI again has a better investment ratio as compared to Amazon Uk and Dixons Carphone.

Comparison of gearing ratio:

The debt-equity ratio of Dixons Carphone has been 47% and 64% for the years 2020 and 2021 approximately. The debt-assets ratio of the company has been 19% and 16% approximately. On the other hand, JB Hi-FI has a debt-equity ratio of 31% and 10% approximately and a debt-assets ratio of 12 and 4% in the same financial period. Amazon Uk has debt-equity ratios of 34 and 35% and a debt-equity ratio of 10 and 12%. [Refer to appendix 2]

Conclusion

In the conclusion, it can be said that a financial analysis of Dixon Carphone has been done where the conclusion can be drawn that the company has failed to attain sufficient profit from its business and hence needs to take sufficient strategies such as decreasing the operational cost, increasing the unit price of the products to increase the revenue which ultimately will increase the profitability.

The liquidity of the company has also been low as compared to its peers and also from the ideal ratio. Therefore, proper cash inflow maintenance is recommended which could increase the current assets and hence the current ratio. Though the ART of Dixons Carphone has been robust, payable ratio needs improvement and changing credit term policies could help robust the ratio.

The company has a poor investment ratio where it failed to earn sufficient income for its shareholders and also the price-earnings ratio has been inefficient. Its peer competitors Amazon Uk and JB Hi-Fi have performed comparatively well and hence, it can be said that necessary implementation is required to improve the overall performance of the company. These recommendations are expected to improve the financials of Dixons Carphone for the forthcoming years.

Reference

Journals

Dolgun, M.H., Ng, A. and Mirakhor, A., 2020. Need for calibration: applying a maximum threshold to liquidity ratio for Islamic banks. International Journal of Islamic and Middle Eastern Finance and Management.

Farhi, E. and Gourio, F., 2018. Accounting for macro-finance trends: Market power, intangibles, and risk premia (No. w25282). National Bureau of Economic Research.

Hidayat, F. and Kurniasih, A., 2022. Financial Performance Determinants of Financing Companies Listed on the Indonesia Stock Exchange. Saudi J Econ Fin, 6(4), pp.141-146.

Husain, T. and Sunardi, N., 2020. Firm’s Value Prediction Based on Profitability Ratios and Dividend Policy. Finance & Economics Review, 2(2), pp.13-26.

Kassi, D.F., Rathnayake, D.N., Louembe, P.A. and Ding, N., 2019. Market risk and financial performance of non-financial companies listed on the Moroccan stock exchange. Risks, 7(1), p.20.

Kiarie, J., Kirori, G.N. and Wachira, D., 2019. Moderating Effect of Gearing Ratio on the Relationship between Loyalty Programs and Financial Performance of Selected Firms in Service Industry in Kenya. Journal of Economics, 3(1).

Nakhaei, H., 2018. Does EVA Have More Information Content with Stock Return than Profitability Ratios? Evidence from Malaysia. Iranian Journal of Accounting, Auditing and Finance, 2(3), pp.1-16.

Ningsih, S. and Sari, S.P., 2019. Analysis Of The Effect Of Liquidity Ratios, Solvability Ratios And Profitability Ratios On Firm Value In Go Public Companies In The Automotive And Component Sectors. International Journal of Economics, Business and Accounting Research (IJEBAR), 3(04).

Sari, Y., Nofinawati, S.B. and Alfadri, F., 2020. The Effect Of profitability Ratios On financial distress in Islamic commercial Banks in Indonesia. Journal Sharia Of Banking, 14.

Smit, A., Van der Niet, B. and Botha, M., 2022. Evaluating The Effect of Fair Value Adjustments to Investment Property Based on Profitability Ratios. Journal of Accounting and Investment, 23(2), pp.330-347.

Suemitsu, M., Asano, T., Inoue, T. and Noda, S., 2019. High-efficiency thermophotovoltaic system that employs an emitter based on a silicon rod-type photonic crystal. ACS Photonics, 7(1), pp.80-87.

Syarifah, S., 2021. Effect of Earnings Management, Liquidity Ratio, Solvency Ratio and Ratio Profitability of Bond Ratings in Manufacturing:(Case Study Sub-Sector Property and Real Estate Sector Companies listed on the Indonesia Stock Exchange (IDX)). International Journal of Business, Economics, and Social Development, 2(2), pp.89-97.

Taujiharrahman, D., Yuningrum, H., Yahya, I., Fuadi, N.F.Z. and Hartono, S.B., 2021. Liquidity Ratio Analysis of Syariah Bank During the Covid-19 Virus Pandemic.

Walmsley, T.G., Walmsley, M.R., Varbanov, P.S. and Klemeš, J.J., 2018. Energy Ratio analysis and accounting for renewable and non-renewable electricity generation: A review. Renewable and Sustainable Energy Reviews, 98, pp.328-345.

Zuhri, M.A., Pratama, A. and Purba, R.B., 2022. An Analysis of Decentralization, Regional Dependence, Regional Independence, Effectiveness and Efficiency of Pad, Expenditure Efficiency, and Shopping Harmony in Assessing Regional Financial Performance (Case Study in Government Pekanbaru City). Rowter Journal, 1(2), pp.115-126.

Websites:

Curryplc.com, 2021 Results, Reports & Presentations. Available at: https://www.currysplc.com/investors/results-reports-presentations/?year=2021 [Accessed on: 17/08/2022]