AAF044-6 Accounting and Finance Sample

1. Introduction

Accounting plays a major role in the way of running the business due to assisting in the way of tracking the expense and also the investors. Along with that, it has been making sure of compliance, and also giving investors, better management governance meant with the “Qualitative financial information” which can be utilized in the process of decision making. In the market current era, it can be observed that there has been established higher tough competition.

In this kind of situation, the company has gone by the way of effective in all over the competitiveness and also follow the assignment. It is mainly based on the transport organization in the UK that is My Hermes. The main mission of the company is to offer the most convenient way to receive, return, and also send the return parcels without adding any kind of cost on earth. The main vision of the company is to utilize the data to get more detailed insights into the needs of customers and also the development of the products.

My Hermes offers more reliable service in international delivery services in all over 190 countries worldwide. This company mainly operates inside the Hermes group to determine the services given in various business areas such as product & sourcing, logistics & Transport, and distribution and fulfilment. The company has brought people together from the approx. 95 nations.

Along with that it mainly stands for the string togetherness sense and also the diversity togetherness on the behalf of exclusion. It happens especially at the time when it comes to more than 18000 employees all over the world (Hermesworld.com, 2022). The main aim of the report is to analyses the continuous budget performance for the 12 months so that organizations can able to make better decisions to enhance their position in the organizations. In addition, the company needs to invest in a shorter payback period because it can be also more profitable on the basis of analysis.

2. Continuous budgeting

2.1 Identification application of continuous budgeting for a budget system

The budget is the main estimation process related to the future expense and income related to the organization by the way of maintaining the organization’s position. Along with that, it has taken capable to make better effective decisions as per the basis of outcomes appear for managing the financial cash flow from the company.

As per the view of Emerging and Wojcik-Jurkiewicz (2018), the market current era has shown the highest number of competitors like DX plc and Royal Mail plc which mainly highlights the performance of the organization. The company needs to adopt a continuous budgetary system gives assists the organization to maintain its cash flow for making sure resource economic utilization. As determined the organization has not used a proceeds budget because the organization’s performance in the way of the strategic position all over the competitiveness has affected (Kobulov, 2022).

In the continuous budget, the closing previous month’s balance becomes the next month’s opening balance which highlights the organization can make better predictions on the expenses and income in a more major way. This kind of budget mainly gives and also set the scope for reducing the issues of rigidness. Along with that, it has increased the budget flexibility for making rapid decisions which can be made better differentiate annual budgets (Meena et al. 2020, p.104). It highlights the using various budget assistance in the way of organization management in adopting the alters in various factors which impact the business.

| Continuous budgeting | ||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sept | Oct | Nov | Dec | |

| Opening cash balance | £ 27 | -£ 18 | £ 10 | £ 120 | £ 249 | £ 391 | £ 485 | £ 799 | £ 750 | £ 607 | £ 441 | £ 627 |

| Income | £ 285 | £ 395 | £ 602 | £ 619 | £ 522 | £ 520 | £ 631 | £ 433 | £ 262 | £ 444 | £ 629 | £ 426 |

| Finance income | £ 8 | £ 17 | £ 22 | £ 16 | £ 24 | £ 30 | £ 35 | £ 38 | £ 25 | £ 20 | £ 23 | £ 28 |

| Total income | £ 320 | £ 394 | £ 634 | £ 755 | £ 795 | £ 941 | £ 1,151 | £ 1,270 | £ 1,037 | £ 1,071 | £ 1,093 | £ 1,081 |

| Expenditure | ||||||||||||

| operating expenses | £ 256 | £ 286 | £ 429 | £ 416 | £ 318 | £ 353 | £ 258 | £ 310 | £ 332 | £ 371 | £ 380 | £ 332 |

| interest expenses | £ 24 | £ 37 | £ 25 | £ 37 | £ 34 | £ 35 | £ 27 | £ 30 | £ 27 | £ 31 | £ 24 | £ 28 |

| rent & rates | £ 36 | £ 37 | £ 36 | £ 38 | £ 35 | £ 45 | £ 43 | £ 48 | £ 42 | £ 44 | £ 44 | £ 35 |

| salary | £ 22 | £ 24 | £ 24 | £ 15 | £ 17 | £ 23 | £ 24 | £ 29 | £ 29 | £ 28 | £ 18 | £ 19 |

| Total expenses | £ 338 | £ 384 | £ 514 | £ 506 | £ 404 | £ 456 | £ 352 | £ 520 | £ 430 | £ 630 | £ 466 | £ 414 |

| Surplus/ deficit | -£ 18 | £ 10 | £ 120 | £ 249 | £ 391 | £ 485 | £ 799 | £ 750 | £ 607 | £ 441 | £ 627 | £ 667 |

Table 1: Continuous budgeting

(Source: Self-developed)

The business current era environment is more dynamic and also change into the micro and macro environment changes. As per the above-given table, it has been shown that Hermes’s total income is £320 in January and it increased in the month of Dec to £1,081. The opening balance of the organization has shown at £27 has increased till December at £627. The expenses are lower than the total income earned which is a good sign of the company’s progress. It has shown that the organization has made more effective strategies related to cost control and reduction.

2.2 Challenges faced at the time application of continuous budget

Absence of suitable data: In the way of achieving an effective and suitable budget, it is also needed to make better necessary for the organization to improve the business (Rogeljet al. 2019, p.33). It is also necessary to make better data amounts and also valid information for its management by the way of future estimations related to the expenses and income.

As MyHermes is not utilizing the continuous budget as before the management faced challenges withdrawing the future expenses and income related to the organization. As per the information taken from Sofyani (2018), the budget success is shown in accuracy and also data adequate. In this initial phase, the budget has shown less information, then it came in all over the issues related to the company’s income and expenses estimation.

Intense aim on the result of financial: The profit and income estimation related to the organization which is the core features by the way of organization can capable to enhance the all over performance. Therefore, with the effect of that quintessence aim is needed in the way of making of budget (Panichella et al. 2021, p.70).

In the phase of initial, the company faced various challenges related to the financial result estimation in absence of data systems management information. In addition, the organization has spent a high number of financial resources at the time of data use and data collection.

Demand alteration in the organization framework: The implication related to the proceeded budget demand in various changes in the business organization framework. For example, budget success mainly depends on the variance and budget control analysis. It happens at the time of making decisions on the changes in the organization’s structure, culture, technology, policies, and also strategies. Its core values assist in the way of improving business growth and performance (Aldawood and Skinner, 2019).

This situation has aimed the My Hermes to make divergent alters in the monitoring process and also make managerial decisions. Along with that, these alterations have been generated with various fences for the organization to make better and appropriate activity control. It is the best process which is quite lengthy as well which affects the organization’s rate of success and also the process of decision making.

The MyHermes performance changed because of the business divergent aspects which affected the business (Grohset al. 2018, p.110). For example, the organization has aligned with the more available resources of financial for directing and controlling the variance and activity analysis.

3. Discussion on cash in today instead of cash in the future and payback period

Higher purchasing power

The power of a company or an individual depends on the services or commodities that we acquire for our purposes. The purchasing power also depends on the rate of inflation and it can be seen that the inflation rate is rising up (Arvidsson, 2018). For instance, in Uk, the average rent in 1970 was different, approximately $100 and now it had reached $ 1000 per month.

Thus, it can be seen that the value of money is getting decreased. This is the reason that an opportunity to get cash sources now is much more beneficial to get the same amount after 10 years.

It is because in the upcoming years the value of commodities will increase and this will reduce the purchasing power of the consumers.

Thus, if cash can be received currently then it is expected that the purchasing power will be more and compared to that the estimation of different commodities is also limited so that the maintenance cost of various objectives could be limited (Woon et al. 2019). There are also various modes of opportunity which can help to improve the mode of operation for estimating business opportunities.

No risk

If an individual is getting the money in the present time range then means he had recovered the money and it is safe in his own circumstances. The chances of getting bad debt also reduce if cash can be received on a due date range. If money can be received sooner than it can be invested in some other domain from which revenue can be generated (Abuseif and Gou, 2018).

The time value of money also depends on the mode of operation and also ensures that organizations and individuals can recover the money as per their own preferences.

Let’s assume that a bank had leaded money of $ 50000 to an individual and after 1 year he came back to return the money. In this situation, the bank needs to collect the money and reinvest it in some other domains. If the bank would not collect the money then the chance of getting a bad debt gets increased (Imteaz et al. 2021). Depending on the situation the overall improving facilities implicate the mode and operation of business actions which helps an organization to gain the opportunity.

Opportunity cost

The opportunity cost is also an important aspect of getting the money on time. The opportunity cost refers to the ability of an individual to invest money as per the preferences of the consumer. The faster an individual receives the money the easier it is for him to reinvest it in some other domains. Opportunity cost depends on the time value of the money and the way an individual handles it (Abreu et al. 2018).

Other than these opportunities are situations, an opportunity received today may not arrive in tomorrow. This is the reason it is always preferable to collect money in the present scenario rather than collecting the money in the future.

Other than this the mode of opportunity cost also depends on the type of activities that the company perform which can help to regain the strength of the operations for future reference. Creating a systematic approach is also helpful in terms of improving the opportunity of the business. Developing operational measures is also helpful if business entities can be managed efficiently (Mökander and Floridi, 2021). There are several types of functions which helps business to create new pathways for survival.

Suggestion on shorter payback period

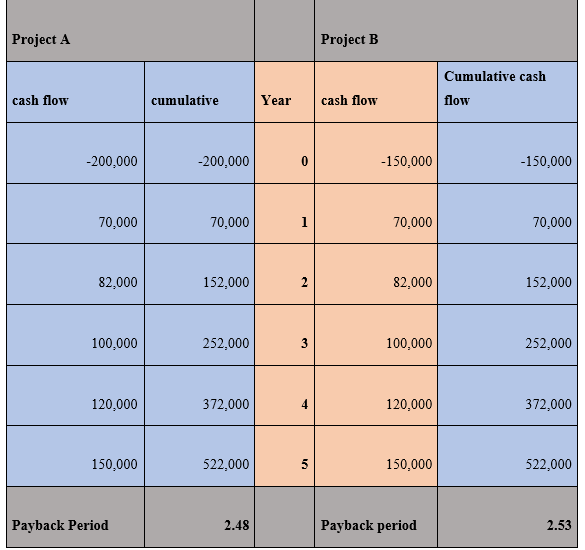

Table 2: Evaluation of payback period

(Source: Self-made)

In this situation, the evaluation of the payback period is done considering two different projects. The payback period is often calculated so that it could be easier for the management to decide which venture is more beneficial and which venture is not that effective.

In the above table, the initial investment done by project A was 200000 and the initial investment from project B is 150000. However, the inflow of cash after investing the money was the same for both ventures (Vanness et al. 2021). This is the reason why the payback period for project A is 2.48 years and for project B it is 2.53.

It means project A can recover the money within a short period range however for project B the time range to pay back is more. Project A is more beneficial compared to project B. It is suggested that investing in a short-term payback period is better.

4. Auditing activities in My Hermes

The auditing department mainly analyses the financial position of a company by evaluating the values of the business and based on its suggestion for growing the business is provided. In the year 2021 as per the auditing report, the financial health of the company is getting better and it helped the business to expand at a faster rate (Devine et al. 2021).

The value of the revenue is 9 billion and it can be seen that the increase rate is 42%. Apart from this the recurring income from operating sources is also getting increased and reached a valuation of 3.5 billion. The growth rate of this rise in income is 78% and the net income amounts to 2.4 billion which had helped companies to grow faster for better future objectives.

The consolidated revenue of the company had reached 8982 million and the current rate of exchange is getting increased to 41%. In the last two years, the rate was 33% and this year had suddenly increased to a tremendous rate so that the objectives of the business get fulfilled (Abhishek and MS, 2019). The auditing department helped to highlight the areas in which the company had done better and the areas that need to be mitigated.

The auditing committee had also suggested as My Hermes is a travelling-based company thus the strategy is essential to make based on the location of the organization.

Depending on the mode of business opportunities the rate and implementation of operation are needed. There are various forms of operation that are needed to estimate the operational overhead. The locational revenue generation is also provided in detail for instance in Asia the sales had increased by 45%, in Japan the rate had increased by 25%, in America it had increased by 57% (agaportal.de, 2022).

The viewpoints that are discussed in the auditing operation are helpful when the need for business opportunities is essential for controlling the operation in a proper way (Rikhardsson et al. 2019).

There are different modes of operational activities that are depending on the sources of business and the chances of getting more options can be estimated for business implications. Depending on the situation the operational output is different and this can lead the business to various forms of objectives.

In 2021 the organization also received support from the federal government and received funding of 20.2 billion. This reflects that after getting the funding to such a larger extent it is important for the company to manage the operations of the business for better implications of objectives. The mode of operational activities is essential so that the financial planning and management can be done in a better and more precise way (Dasaklis et al. 2020).

Depending on the sources of the business, it can also be seen that mitigating the variation, the need and development measures are different for the business operation. Thus, creating a different form of business objectives is essential for operating the need and preferences of the business. Depending on the business opportunities the sources of employment options are mandatory.

There are various modes of operation that are identified in the auditing report. It is stated that the business had strategically used the financial objectives and helped the business to fulfil the mode of operation in the long run. Depending on business objectives the mode of business is essential to carry the sources of actions.

The financial objectives of the business also get fulfilled if the objectives of the business are maintained in an estimated manner. The need of estimating these opportunities and the future threat that can hamper the functioning of business is essential to managing the operational objectives.

The exporting and the services of the company are developed better so that the resources factors of the company could get better in the long run. Depending on the mode of operation, the business objects get better in the long run. There is various mode of operation which can help business to improve the mode of objectives in the long run. Depending on the situational objectives there are different forms of business which can help to develop more modes of operation in the long run.

It can be concluded that as per the basis of the above analysis, it can be easily determined that My Hermes faced challenges at the time of application of the continuous budge. It happens due to the absence of an accurate face for the estimation of future expenses and income.

Alternatively, it can be added more concluded to the organization which has taken divergent alters in the company’s culture because of the continuous budget application. It has affected on My Hermes’s performance in the way of maintaining profitability and also profitability in its initial phase.

Along with that, it has been shown the analysis of payback which can be concluded that choosing the project which has shorter tenure sound strategies as shown by the low level of risk associated with the project. In this situation, it has determined on taking like strategies for giving huge range scope or My Hermes to maintain and also increase the financial performance and also strategies position in the market.

Reference list

Abhishek N, D. and MS, D., 2019. Application of robotics in accounting and auditing of business and financial information. Inspira-Journal of Modern Management & Entrepreneurship (JMME) Volume, 9, pp.01-05.

Abreu, P.W., Aparicio, M. and Costa, C.J., 2018, June. Blockchain technology in the auditing environment. In 2018 13th Iberian Conference on Information Systems and Technologies (CISTI) (pp. 1-6). IEEE.

Abuseif, M. and Gou, Z., 2018. A review of roofing methods: Construction features, heat reduction, payback period and climatic responsiveness. Energies, 11(11), p.3196.

agaportal.de, 2022, Retrieved from:https://www.agaportal.de/_Resources/Persistent/6/2/8/6/6286b4c148eb19c311cd1e555b93a385f1764d65/e-jb-2021.pdf, [Retrieved on 3rd September, 2022]

Aldawood, H. and Skinner, G., 2019. Reviewing cyber security social engineering training and awareness programs—Pitfalls and ongoing issues. Future Internet, 11(3), p.73.

Arvidsson, N., 2018. The future of cash. In The Rise and Development of FinTech (pp. 85-98). Routledge.

Dasaklis, T.K., Casino, F. and Patsakis, C., 2020, July. A traceability and auditing framework for electronic equipment reverse logistics based on blockchain: The case of mobile phones. In 2020 11th International Conference on Information, Intelligence, Systems and Applications (IISA (pp. 1-7). IEEE.

Devine, S., Neumann, C., Otto, A.R., Bolenz, F., Reiter, A. and Eppinger, B., 2021. Seizing the opportunity: Lifespan differences in the effects of the opportunity cost of time on cognitive control. Cognition, 216, p.104863.

Emerling, I. and Wojcik-Jurkiewicz, M., 2018. The risk associated with the replacement of traditional budget with performance budgeting in the public finance sector management. Ekonomicko-manazerskespektrum, 12(1), pp.55-63.

Grohs, J.R., Kirk, G.R., Soledad, M.M. and Knight, D.B., 2018. Assessing systems thinking: A tool to measure complex reasoning through ill-structured problems. Thinking Skills and Creativity, 28, pp.110-130.

Hermesworld.com, 2022, About us, Available at: https://www.hermesworld.com/int/about-us/, [Accessed on: 06th September 2022]

Imteaz, M.A., Bayatvarkeshi, M. and Karim, M.R., 2021. Developing generalised equation for the calculation of payback period for rainwater harvesting systems. Sustainability, 13(8), p.4266.

Kobulov, K., 2020. Modeling the processes of forming a strategy for the revenue potential of local budgets. Архивнаучныхисследований, 35.

Meena, R.S., Lal, R. and Yadav, G.S., 2020. Long-term impact of topsoil depth and amendments on carbon and nitrogen budgets in the surface layer of an Alfisol in Central Ohio. Catena, 194, p.104752.

Mökander, J. and Floridi, L., 2021. Ethics-based auditing to develop trustworthy AI. Minds and Machines, 31(2), pp.323-327.

Panichella, S., Gambi, A., Zampetti, F. and Riccio, V., 2021, May. Sbst tool competition 2021. In 2021 IEEE/ACM 14th International Workshop on Search-Based Software Testing (SBST) (pp. 20-27). IEEE.

Rikhardsson, P., Singh, K. and Best, P., 2019. Exploring continuous auditing solutions and internal auditing: A research note. Accounting and Management Information Systems, 18(4), pp.614-639.

Rogelj, J., Forster, P.M., Kriegler, E., Smith, C.J. and Séférian, R., 2019. Estimating and tracking the remaining carbon budget for stringent climate targets. Nature, 571(7765), pp.335-342.

Sofyani, H., 2018. Does performance-based budgeting have a correlation with performance measurement system? Evidence from local government in Indonesia. Foundations of Management, 10(1), pp.163-176.

Vanness, D.J., Lomas, J. and Ahn, H., 2021. A health opportunity cost threshold for cost-effectiveness analysis in the United States. Annals of internal medicine, 174(1), pp.25-32.

Woon, Y.B., Ling, L., Tan, W.L. and Chow, M.F., 2019, October. Community rainwater harvesting financial payback analyses-case study in Malaysia. In IOP Conference Series: Materials Science and Engineering (Vol. 636, No. 1, p. 012019). IOP Publishing.

Know more about UniqueSubmission’s other writing services: