AC60049E Advance Taxation Assignment Sample

Here’s the best sample of AC60049E Advance Taxation Assignment, written by field expert.

Introduction

The tax is one of the significant terms of the economic that pay a significant role in the development of the economic performance of a country (Bach et al., 2013). In this, corporate tax is also known as the company tax that is direct tax. It is applicable on the income of the company or business entity. This report is very significant in the context developing the understanding on the tax. In the first part, this report discusses current developments in corporation tax and role of corporation tax as Government fiscal policy tools in the UK. In the next part, this report critically evaluates and analyse any ethical and strategic tax issues faced by companies in the UK. Furthermore, this report discusses how the charge to UK Corporation Tax applies to a non – UK resident companies compared to a UK resident companies and how the expected trading losses of UK overseas operation will be relieved in the UK.

A. Current developments in corporation tax and role of corporation tax as Government fiscal policy tools in the UK

Current developments in corporation tax in UK

In this, it is found that the government of UK have taken the significant decisions regarding the corporate tax rate in the country those are determined below:

- From 1 April 2017, the reduction on the corporate tax rate as 19% will apply

- From 1 April 2017, the utilisation rule will apply. Under this rule companies can forward their loss in the next years to 50% of the earned profit (Liu, 2018).

- This will apply in the case of the 5 million pound sterling and for banks it will concern maximum loss offset is limited to 25% (Liu, 2018).

- From 1 April 2017, the new rules of the interest rate will also apply as the deductibility. It will also concern the fixed expenses ratio equal to 30% of the UK earnings before interest taxes

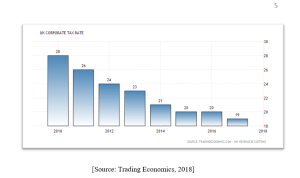

- In the financial year between 2008-10, the rate of the corporate tax was 28% in UK that has changed in the year 2011. Now, the new rate of the corporate tax was found 26% in 2011 (Liu, 2018).

- In the next financial year 2012, it has found that corporate tax crate changed again and reduced by 2%. Now, new tax rate was found 24% in the financial year 2012.

- Furthermore, it the year 2013, it was found new corporate tax rate was determined by 23% with the deduction of the 1%.

- In the financial year 2014, a significant deduction was determined in the corporate tax will apply 21% in this year .

- Furthermore, in the financial year 2015, it is found that the government of the UK reduced the tax rate by 20%, where 1% reduction was found. In the financial year 2016, the tax rate was same as the year 2015.

- In the year 2017, again 1% reduction was found in the corporate tax rate of the UK.

- In budget of the year 2018, Mr Hammond developed proposal to reduce the corporate tax by 17% to motivate the people to open for business

Role of corporation tax as Government fiscal policy tools in the UK

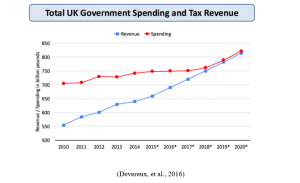

Typically, fiscal policy includes the two main tools that are known as the tax rate of the country and government spending. In the economic system of a country, tax rate has a significant impact on the spending of the government. It determines the spending power of the government in the coming days. In instant, if the government has to desire to spend much then government increases tax rate for increasing income (Conefrey & Gerald, 2011).

The fiscal policy of UK also contains the use of the government spending as well as the direct and indirect taxation. In the financial budget of the company, the main objective of the government is to increase the income of the government and to make the effective spending on the country development. At the same time, the UK has also aim to affect the income and demand in the market by determining the fiscal policy (Devereux et al., 2014) The UK’s government also determined the fiscal policy with aim of changing the pattern of spending on the different aspect such the scarce resources allocated to renewable energy and health care service.

The UK’s government also has an objective by controlling the tools of the objective such as redistribution of income & wealth in the economic. In this way, the below figure shows the tax revenue and government spending of the UK in the recent years:

Government Spending

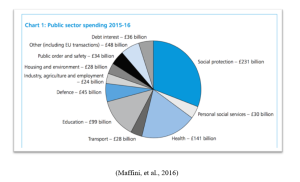

The UK government spends money in the lots of the different areas. The following graph shows the spending of UK’s government in year 2015-16:

On the basis of the above graph, it can be determined that social protection is one of the main area that is considered by the UK government during the social protection. At the same time, health is another main area that where UK government spent too much. In the context of the education, UK’s government also spends well. The main objective of behind these expenditures is to make the development of the society.

B. Critically evaluation and analysis any ethical and strategic tax issues faced by companies in the UK.

The practical aspect of the business is never easy for an owner because it has to face the lots of the issue and challenges in the operation. In this, taxation issue is one of the ethical issues that is faced by the each company in the UK. It is because in the business environment each company is liable to pay the accurate tax and taxation rules are developed by the UK’s government. The taxation liabilities create the financial liabilities and burden on the small companies in the UK (Feld, et al, 2016). The internal service revenue estimates that a company has to pay one third part of the income as the taxation on the earning of the $1 million. Accuracy-Related Penalties is also known as a significant taxation issue for a company that is operating in the UK. Under this, a company is liable to pay accurate tax. It cannot present the taxation liabilities fake manner. For this, there is significant and stick law in the UK where the licence of the business can be disclosed.

At the same time, it is also found that current taxation system of the UK is also very complicated. It is very difficult for a new organisation to understand the requirement of the taxation in the effective manner. Due to this, companies have to pay high tax in the some complicated situations. At the same time, the major issue is related to decline in the net profit of the companies. The taxation liabilities lead to decreases the profitability of the company. The taxation issue has become the significant liabilities in the business corporation. It is also represents the fundamental risk in the business environment of the UK (Meade, 2013). The taxation system of the UK changes according the government rules and regulation that creates the additional burden on the companies’ business operation. In the each financial year, the company in the UK has to represent the statement of the income front of the government. In order to complete this task companies has to need the additional human resource. Mainly the calculation of the taxation in the business is responsibility of the financial department.

As the concerning of income tax liability, companies have to take the various strategic decisions on the investment and expenditures. In regard of this, companies looks for the such kinds of the investments that are taxable free in the business with the aim of the improving the business model of the companies. Along with this, ethical and strategic issues and challenges also include the consideration on the donation and charitable work of the company (Ward & Rhodes, 2014). It is because these kinds of the investment are special elements that are considered in the taxation of the UK. Due to this, companies that are operating in the UK, faces the issue and challenges.

C. UK Corporation Tax applies to a non – UK resident companies compared to a UK resident companies

Resident companies in the UK pay the tax according legal taxation system in the UK. These treat the income tax on the UK permanents establishments. On the other hand, non-resident companies are subject that are considered as the K PE plus UK income tax. In additionally, the non resident companies that are doing business in the UK have to make the payment UK corporation tax on their profits. At the same time, organisations that are doing the business do not have a UK trade may pay the tax under the specific tax system.

In the UK, both kinds of the companies that are operating the business activities are liable to pay the tax that are determined the current taxation system. Accounting the current taxation system, it is found that the government of the UK has decided to pay the 19% for the business entities on their taxation system. However, there is an expectation that it will decline by 17% in the next financial year as form 1 April 2018 (Liu, 2018).

In the business environment of the UK, the non trading companies are liable to pay the tax on the trading activities. If a firm gets any other income then it is considered as the subject of the UK income tax. At the current rate, this taxation rate is 20% that does not contain any allowances. Even through, this charge most commonly considered in the context of the UK rental income that earned by non resident company in the UK. In the UK, there is an NRL scheme that requires the NRL’s letting agent (Conefrey & Gerald, 2011).

Along with this, in the future as the financial year 2019, there is some expectation that non resident companies in the UK will be also responsible for use of the UK property. However, there is not much clearance on this topic and it can also be considered from the April 2020. At the same time, the income and gains that are achieved by the non resident companies through the UK property will also be subject of the corporate tax. Beside of this, resident companies that are operating in the UK are liable to pay those kinds corporate without any deduction. These things show that resident companies in the UK are treaded more strictly as compared to non resident companies (Barnes, 2017). The main reason behind the kind of the freedom is to motivate the foreign companies to inter in the UK market. It supported the economic performance of the company. At the same time, the government of the UK also provides the tax relief to the non resident companies in the UK. The taxation system of the UK allowed the companies to carry forward the loss for the next year up to 50%. It provides the flexibility to the non resident companies in the UK and motivate them to continue their business.

Conclusion

From the above discussion, it can be concluded that the current rate of the corporate tax is 19% in the UK. But, at the same time, it has also expected that it will decline by 17% in by April 2018. The income generated as the tax is used on the social development of the country. It also spend on the education and health care sector. In the context of the financial planning, each company also develops the strategic plan to manage the corporate taxation liabilities. At the same time, it can also be analysed that company non resident companies get various benefit in the context of the taxation as compared to resident companies.

References

Bach, S., Haan, P., & Ochmann, R. (2013). Taxation of married couples in Germany and the UK: One-earner couples make the difference. International Journal of Microsimulation, 6(3), 3-24.

Barnes, P. (2017). Stock market scams, shell companies, penny shares, boiler rooms and cold calling: The UK experience. International Journal of Law, Crime and Justice, 48, 50-64.

Conefrey, T., & Gerald, J. D. F. (2011). The macro-economic impact of changing the rate of corporation tax. Economic Modelling, 28(3), 991-999.

Devereux, M. P., Liu, L., & Loretz, S. (2014). The elasticity of corporate taxable income: New evidence from UK tax records. American Economic Journal: Economic Policy, 6(2), 19-53.

Devereux, M., Habu, K., Lepoev, S., & Maffini, G. (2016). G20 corporation tax ranking.

Feld, L. P., Ruf, M., Scheuering, U., Schreiber, U., & Voget, J. (2013). Effects of territorial and worldwide corporation tax systems on outbound M&As.

Liu, M. L. (2018). Where Does Multinational Investment Go with Territorial Taxation? Evidence from the UK. International Monetary Fund.

Maffini, G., Xing, J., & Devereux, M. P. (2016). The impact of investment incentives: evidence from UK corporation tax returns (No. 085).

Meade, J. E. (2013). The Structure and Reform of Direct Taxation (Routledge Revivals). UK: Routledge.

Trading Economics (2018). UK corporate tax rate. [Online] Retrieved from. https://tradingeconomics.com/united-kingdom/corporate-tax-rate

Ward, M., & Rhodes, C. (2014). Small businesses and the UK economy. Standard Note: SN/EP/6078. Office for National Statistics.

________________________________________________________________________________

Know more about UniqueSubmission’s other writing services: