Accounting and Finance AAF044-6

Introduction

Accounting and Finance play an integral part in order to improve the overall performance of an organization. It helps in publishing a theoretical, experimental and empirical paper that mainly helps contribute to the finance discipline. In this report the company Dixons-Car phone plc. is chosen to analyze the performance of their business and to make the business more effective and profitable. The company deals in electric and telecommunication retailing of electronic products and smart phones in order to provide repair, installation, maintenance as well as technical support. In this study, the competitive market that were chosen for the company is Best Buy Co. Inc., which also deals in electronic products like digital cameras, music, video games, and refrigerators and so on.

Part A: Financial Projection of Dixons-Car phone plc.

Financial projection helps in estimating the expenses and incomes of the company and forecasting the future performance of the organization. Estimation of expenses and revenue helps in generating the financial statement of an organization. In order to monitor performance, it is important that the company record their transactions regularly. In this report, the company has evaluated its performance for the years 2021 and 2020. Different ratio calculation has been analyzed to check the financial health of the retail company.

Profitability Ratio

Definition

The profitability Ratio is calculated to analyze the performance of the company. The Profitability Ratio measures the revenue generated by the company and the overall ability of the company is analyzed for a specific period of time. As per the viewpoint of Almeida et al. (2020), it helps in determining the overall cash that is available in the company. This ratio shows the utilization of the assets in a company in order to produce value and profits for the shareholders.

Analyses

In this study, two ratios are calculated to check the ability of the company and to measure the overall revenue generated by Dixons-Car phone plc Gross Profit Margin (GPM) and Net Profit Margin(NPM).

GPM depicts that the organization has incurred 0% and 1% in both years that is 2021 and 2020. On the other hand, the NPM of the company for the last two years are 0% and 2%.

| Dixons-Carphone | ||

| 2021(£m) | 2020 (£m) | |

| NPM | 0% | -2% |

| GPM | 0% | -1% |

Table 1: Calculation of Profitability Ratio

(Source: Self-Created)

Impact

The above analysis depicts the company’s profitability and ability to generate revenue are poor and the company needs to incur more revenue organization. Above all, it also depicts that the company is inefficient to incur any profit in two years. As per Arrieta et al. (2020), the livelihood of employees, managers and owners is very ineffective in this company. Moreover, the company does not have positive goodwill in the market as well as with the employees.

Liquidity Ratio

Definition

The Liquidity Ratio plays a major role in determining the ability of debtors for paying debt obligations without elevating any external capital. As opined by Battiston et al. (2021) this ratio helps in checking the solvency condition of an organization. It also measures the short-term obligation of the company in order to pay any debts in the future. In this study, two ratios are taken under the Liquidity Ratio, which are the Current Ratio, and the Quick Ratio.

Analyses

The Current Ratio shows that the company sustained 0.75 and 0.82 for two years. As stated by DANG et al. (2020) the values depict that the company performed better in the year 2020. Therefore, the company can satisfy other payables and all the current debts by the year 2020.

The Quick Ratio helps in measuring the overall capacity to pay all the current liabilities of the company without selling any stocks or inventories from the organization. According to Garanina et al. (2021,), the Quick Ratio for the company Dixons-Car phone plc shows 0.30 and 0.51 ratios for the years 2021 and 2020 (Currysplc.com, 2022). This shows that the company performed better in the year 2020 and is eligible to pay all its liabilities without selling any inventories of the company.

|

Dixons-Carphone |

||

| 2021(£m) | 2020 (£m) | |

| Current ratio | 0.75 | 0.82 |

| Quick ratio | 0.30 | 0.51 |

Table2: Calculation of Liquidity Ratio

(Source: Self-Created)

Impacts

The current ratio performed better in 2020 which means that the company is stable and can pay all the debts whereas the Quick Ratio performed better in the year 2020 and is eligible to pay all its liabilities without selling any inventories company. Both these ratios help the company in incurring more cash in the business in order to generate higher revenue.

Efficiency Ratio

Definition

The Efficiency Ratio helps in analyzing a company’s internal factors. It checks how well the company utilizes their assets as well as liabilities in the organization. As per the viewpoint of Han et al. (2018), this ratio has the ability to employ the company’s resources such as assets, capital, inventories and cash flows. This helps in indicating the company’s profit for a particular time. Here, toes ratios are chosen under Efficiency Ratio which is Asset Turnover Ratio and Receivable Turnover Ratio. Both these ratios help in determining the ability to generate resources for the organization.

Analyses

The Asset Turnover Ratio shows that the company has incurred 1.50 and 1.32 for the years 2021 and 2020 (Currysplc.com, 2022). This shows that the company has performed better in the year 2021. Receivable Turnover Ratio shows that the company has incurred 17.62 and 12.24 in both years. This depicts that the company performed better in 2021.

|

Dixons-Carphone |

||

| 2021(£m) | 2020 (£m) | |

| Asset Turnover | 1.50 | 1.32 |

| Receivable turnover | 17.62 | 12.24 |

Table2: Calculation of Efficiency Ratio

(Source: Self-Created)

Impacts

The above analysis depicts that the company is efficient enough to generate revenue by using its assets as the organization indicates a higher Asset Turnover Ratio in 2021 whereas the company can also manage all the credits that are extended to the consumers as the Receivable Turnover Ratio performed better in 2021 (Currysplc.com, 2022).

All this ratio evaluates the company’s performance and helps them in making ample profit in the organization. Above all, with this ratio analysis, the company tries to reduce their cost in order to earn more profits in the market. According to Irman and Purwati, (2020), it also helps the company in placing all the data in manageable terms so that the company can understand their position in the market by making the process lucid and effective.

Part B: Comparative Financial Projection of Dixons-Car phone plc and Best Buy Co. Inc.

Comparison on Profitability of both the companies

Graphical Representation

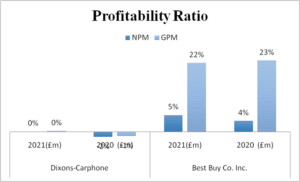

The below graph shows that both companies have different profitability and the ability to generate revenue is different. The Dixons-Car phone has evaluated its profitability by evaluating two ratios NPM and GPM. Analyzing this graph, it can be said that the competitor company has performed better (bestbuy.com,2022). The NPM of the competitor company is 5% and 4% for the two years 2021 and 2020 whereas the GPM of the company is 22% and 23%. This elevates the overall performance of Best Buy Co (bestbuy.com,2022). Inc to a much better level. As opined by Kumoro et al. (2020) the values clearly illustrate that Best Buy Co. Inc has the ability to earn more profit in the market.

Figure 1: Profitability Ratio

(Source: Self-Created)

Summarization

Therefore, it is illustrated that both companies’ performances are different and the profit generated in the two years are different. In the above graph, it is represented that the sales revenue generated by both the companies are different. As stated by Kurniawan, (2021) the performance of Best Buy Co. Inc shows that it can cover all the fixed costs, depreciation and dividends of the company (bestbuy.com,2022). The purchasing policies of the company are effective and indicated higher revenue. However, Dixons-Car phone plc has elevated huge loss, therefore, the purchasing policy of this company is poor and it is unable to perform well in the competitive market (Currysplc.com, 2022).

Comparison of the Liquidity of both the companies

Graphical Representation

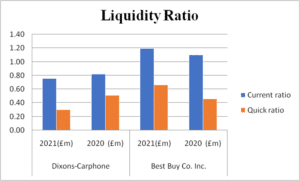

In this case also, the competitor market has performed well and their ability to convert all the assets of the company into cash is better. The higher ratio of the competitor market illustrates that the company is sufficient to pay all its debts on time whereas the parent company ratio is below 1. This shows that the company is unable to pay its debts on time and is unable to raise any kind of funds in the future. According to Lusiana et al. (2021), the parent company is unable to meet the upcoming liabilities from the market and is insufficient to meet any obligations in future. All the long and short-term obligations of the company are not at all flexible and therefore it is not easily tradable. The competitor company has depicted a 1.19 and 1.10 current ratio and 0.66 and 0.46 quick ratio for two consecutive years (Currysplc.com, 2022).

Figure 2: Liquidity Ratio

(Source: Self-Created)

Summarization

Summarizing all the points it can be said that the competitive company has all the benefits for meeting their obligations and can clearly meet all their debts. As per Mahdi and Khaddafi, (2020), the solvency of this company is also fair that illustrating that the company can generate from the investors or shareholders at any time. The goodwill of the company is also fair so the investors can provide loans and funds to the company whenever needed. This is the overall representation of both companies (Tumanggor, 2020). The parent company is unable to ask for any funds from the investors, as they do not have sufficient cash available in the market. Therefore, it is important that the company meets all its obligation in order to make its business effective and profitable.

Comparison of Efficiency of both the companies

Graphical Representation

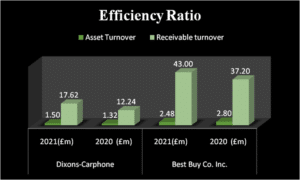

The Graphical Representation shown below illustrates that the parent company is the clear winner. Dixons-Car phone elevates that their investment ability is very effective and can invest in different markets to make their business profitable. An efficiency ratio of 50% or less is considered the optimal ratio. As per the viewpoint of Martina, (2019), a higher efficiency ratio depicts the expenses of the company. Therefore, it can be said that here the parent company has performed well and can make the utmost investment in order to expand its business. Moreover, the performance of Best Buy Co. Inc was not up to the mark as the efficiency of the ratio is not optimum and therefore the company is unable to generate sufficient revenue in the market. Best Buy Co. Inc has inculcated 2.48 and 2.80 Asset Turnover Ratio and 43.00 and 37.20 Receivable turnover for two years (bestbuy.com,2022).

Figure 2: Efficiency Ratio

(Source: Self-Created)

Summarization,

Therefore, it can be summarized that the parent company has performed better here and the ability to make use of their equity is much better for the organization (Niknam et al. 2020). The overall productivity of the market is very effective and can make the utmost investments in different organizations. The parent company has optimum costs available in order to raise higher revenue. The competitor company is ineffective in this case and is unable to raise any kind of revenue. The company is not delegated enough to make a profit in different markets. The strength of the company is very ineffective and is not sufficient to raise the utmost revenue or cost in different sectors. The capital structure of the company is not effective enough that the investors can make investments in these markets.

Therefore, after summarizing all the points it can be illustrated that the overall profit is earned by the competitor company. The overall performance of Best Buy Co. Inc is very lucid and all the factors help in generating ample profits. All the ratios mentioned in this study help in comparing all the values of the company and help in giving lucid data of the figures that are mentioned in the financial statements. This way the company can make fair changes and can make better decisions making for the company. All the figures mentioned in the calculation are expressed lucidly and make it very understandable and easy for the managers to make an effective decision for the company. It also helps in determining the proper amount inculcated or invested in the organization so that the business does not suffer any kind of risk in future and can perform better as compared to all other businesses’ available different sectors.

Opportunities & Challenges faced by Dixons-Car phone plc.

Opportunities

Fair relation with consumers

The company Dixons-Car phone plc has built a very fair relationship with their consumers, especially during the time of pandemic as different electrical, as well as telecommunication, has kept the consumers intact in this period (Paiva et al. 2021). The application of the company such as Television, mobile phones and fitness trackers has kept the consumers intact and has also helped the company to build good relationships with the consumers. During the time of the pandemic, the company raised its revenue by 11%. The Company has built fair trust among the consumers and has utilized its staff in building their expertise.

Positive impact on online proposition

Online marketing in the current era is expanding and the company is well versed to introduce different electronic products in new markets (Patin et al. 2020). Therefore, the company is efficient enough to meet all the needs of its consumers and is inculcating new electronic products in order to build interest among the customers.

Challenges

Issue of security

All retail businesses dealing with electronic appliances have the fear of data breaches. Therefore, the company is in constant fear of saving its data from hackers (Prasetyaningrum et al. 2022). This company has seen tough times as it faced various data breaches in the company and the overall performance of the company was highly affected by the organization.

Changing trends

As this kind of electronic market is not stable and it keeps changing, therefore, there are utmost fluctuations observed in the company. Therefore, the company can incur losses at any time in their business and can face huge revenue losses (Satria, 2019). However, in recent times, the company has faced huge losses, as they do not have sufficient costs to make new products in the business. Due to this reason, the competitor market has taken full advantage of their losses and has overpowered the company’s goodwill and profits.

Penalties

As the company has incurred huge loss and has almost indebted, therefore, the company has incurred various penalties (Sausan et al. 2020). This has made the company fully decentralized and ineffective. The company has also lost a majority of their customers as various new companies took over the company.

Conclusion

From the above context, it is concluded that Dixons-Car phone plc’s overall performance is compared with its competitor Best Buy Co. Inc. The study showed that the competitor company was better than the parent company. Different ratio analyses and calculation is done in the business that clearly shows that Best Buy Co. Inc’s performance was better and has generated higher profits and revenue. The challenges and opportunities of the parent company are also shown in the report.

Reference List

Journals

Almeida, F., Santos, J.D. and Monteiro, J.A., 2020. The challenges and opportunities in the digitalization of companies in a post-COVID-19 World. IEEE Engineering Management Review, 48(3), pp.97-103.

Arrieta, A.B., Díaz-Rodríguez, N., Del Ser, J., Bennetot, A., Tabik, S., Barbado, A., García, S., Gil-López, S., Molina, D., Benjamins, R. and Chatila, R., 2020. Explainable Artificial Intelligence (XAI): Concepts, taxonomies, opportunities and challenges toward responsible AI. Information fusion, 58, pp.82-115.

Battiston, S., Monasterolo, I., Riahi, K. and van Ruijven, B.J., 2021. Accounting for finance is key for climate mitigation pathways. Science, 372(6545), pp.918-920.

DANG, H.N., PHAM, C.D., NGUYEN, T.X. and NGUYEN, H.T.T., 2020. Effects of corporate governance and earning quality on listed Vietnamese firm value. The Journal of Asian Finance, Economics and Business, 7(4), pp.71-80.

Garanina, T., Hussinki, H. and Dumay, J., 2021. Accounting for intangibles and intellectual capital: A literature review from 2000 to 2020. Accounting & Finance, 61(4), pp.5111-5140.

Han, J., He, J., Pan, Z. and Shi, J., 2018. Twenty years of accounting and finance research on the Chinese capital market. Abacus, 54(4), pp.576-599.

Irman, M. and Purwati, A.A., 2020. Analysis on the influence of current ratio, debt to equity ratio and total asset turnover toward return on assets on the otomotive and component company that has been registered in Indonesia Stock Exchange Within 2011-2017. International Journal of Economics Development Research (IJEDR), 1(1), pp.36-44.

Kumoro, D.F.C., Novitasari, D., Yuwono, T. and Asbari, M., 2020. Analysis of the Effect of Quick Ratio (QR), Total Assets Turn Over (TATO), and Debt To Equity Ratio (DER) on Return On Equity (ROE) at PT. XYZ. Journal of Industrial Engineering & Management Research, 1(3), pp.166-183.

Kurniawan, A., 2021. Analysis of the effect of return on asset, debt to equity ratio, and total asset turnover on share return. Journal of Industrial Engineering & Management Research, 2(1), pp.64-72.

Lusiana, M., Haat, M.H.C., Saputra, J., Yusliza, M.Y., Muhammad, Z. and Bon, A.T., 2021. A review of green accounting, corporate social responsibility disclosure, financial performance and firm value literature. In Proceedings of the International Conference on Industrial Engineering and Operations Management (pp. 5622-5640).

Mahdi, M. and Khaddafi, M., 2020. The Influence of Gross Profit Margin, Operating Profit Margin and Net Profit Margin on the Stock Price of Consumer Good Industry in the Indonesia Stock Exchange on 2012-2014. International Journal of Business, Economics, and Social Development, 1(3), pp.153-163.

Martina, S., 2019. The effect of quick ratio, debt to equity ratio, earning per share, price to book value and return on equity on stock return with money supply as moderated variables (Study of Banking Companies Listed on Indonesia Stock Exchange Period 2008-2017). International Journal of Public Budgeting, Accounting and Finance, 2(3), pp.1-10.

Niknam, S., Dhillon, H.S. and Reed, J.H., 2020. Federated learning for wireless communications: Motivation, opportunities, and challenges. IEEE Communications Magazine, 58(6), pp.46-51.

Paiva, S., Ahad, M.A., Tripathi, G., Feroz, N. and Casalino, G., 2021. Enabling technologies for urban smart mobility: Recent trends, opportunities and challenges. Sensors, 21(6), p.2143.

Patin, J.C., Rahman, M. and Mustafa, M., 2020. Impact of total asset turnover ratios on equity returns: dynamic panel data analyses. Journal of Accounting, Business and Management (JABM), 27(1), pp.19-29.

Prasetyaningrum, T., Kustiyah, E. and Marwanti, F.S., 2022. FINANCIAL PERFORMANCE ASSESSED FROM QUICK RATIO, CURRENT RATIO, RETURN ON INVESTMENT, NET PROFIT MARGIN IN MANUFACTURING COMPANIES LISTED IN INDONESIA STOCK EXCHANGE 2017-2019. International Journal of Economics, Business and Accounting Research (IJEBAR), 6(1).

Satria, R., 2019. Pengaruh Current Ratio, Debt To Equity Ratio, Receivable TurnOver dan Inventory TurnOver Terhadap Gross Profit Margin Pada PT Hanjaya Mandala Sampoerna Tbk Periode 2008-2018. Jurnal Ilmiah Feasible (JIF), 1(2), pp.170-181.

Sausan, F.R., Korawijayanti, L. and Ciptaningtias, A.F., 2020. The effect of return on asset (ROA), debt to equity ratio (DER), earning per share (EPS), total asset turnover (TATO) and exchange rate on stock return of property and real estate companies at Indonesia stock exchange period 2012-2017. Ilomata International Journal of Tax and Accounting, 1(2), pp.103-114.

Tumanggor, M., 2020. The Influence of Current Ratio, Quick Ratio and Net Profit Margin on Return on Assets at PT. Hero Supermarket Tbk. PINISI Discretion Review, 1(1), pp.137-146.

Wisesa, O., Adriansyah, A. and Khalaf, O.I., 2020, September. Prediction analysis sales for corporate services telecommunications company using gradient boost algorithm. In 2020 2nd International Conference on Broadband Communications, Wireless Sensors and Powering (BCWSP) (pp. 101-106). IEEE.

Websites

Bestbuy.com, (2022). Anniversary Sales Event . Available at: https://www.bestbuy.com/

Currysplc.com, (2022). We help everyone enjoy amazing technology. Available at: https://www.currysplc.com/

Know more about UniqueSubmission’s other writing services: