Assignment 010 International Marketing and Brand Management Sample

Introduction

Attractive brand recognition efficiently helps an organisation to ensure a distinctive competitive advantage by positively influencing customer purchasing behaviour. In this concern, the present assignment will pay attention to the critically enlightening brand analysis of a UK oriented renowned retail service provider Morrisons. The assignment will cover brand analysis concerning brand introduction and portfolio, brand elements and others. Moreover, an international market analysis will also be conducted for this purpose by considering three culturally distinct markets. Lastly, suitable strategies for market entry will also be highlighted with recommendations for standardization and others.

Part 1 Brand Analysis

Brand Introduction

Morrison’s has paid attention to enhance their brand recognition, which is distinctively underpinned by the organisational growth, rebuild and sustain the strategy. Extensive brand image has been helping the organisation to emerge as the fourth largest grocery retailer across the UK. In 2019, Morrisons was able to obtain a 10.4% share of the grocery market in the UK (Coppola, 2021). Moreover, the present year has also witnessed an 8.7% enhancement of the organisational sales as compared to the same period with the previous year circumstances (Coppola, 2021). The mentioned statistics reveal unprecedented growth in the sales of Morrison’s.

A leading role has been played by the organisation as brand image and brand recognition due to which an increasing number of customers are attracted towards availing the products and services of Morrison’s. The organisational brand introduction can also be detected by notifying the competitiveness. Morrison’s tries to rapidly invest in their pricing and product specification improvement concerning the favourite items of their potential consumers (Morrisons-corporate, 2021). This attribute is also helping the company to enlarge its brand value to a fair extent.

On the other hand, Morrison’s has also ensured to comply with the current market trends and consumer preferences. Due to this reason, the company started their online services where both the shopping and payment options are available to the consumers. Distinctive discounts and vouchers are also provided by Morrisons as an integral part of attracting consumers, which also supports the extensive brand image of Morrison’s.

Brand Portfolio / Availability

Morrisons provide different grocery products, food and beverages items and others. Moreover, fresh food and tasty dishes are also offered by the organisation, which features a selection of meals in a cost-optimised manner. The prohibition of online food services and grocery delivery has been adding a fair value to the organisational brand portfolio. However, Morrisons has recently moved forward to diversify its entire brand portfolio into more general merchandise.

This attribute can be helpful for them to compete in an efficient manner with the other existing market rivals like Sainsbury’s, Asda, Tesco, and others (Lee, 2017). A customer-first approach is usually undertaken by the organisation, which has been empowering the organisational brand availability across their current operational markets. With 491 stores across the UK market and 24000 consumers in a week for organisational stores, Morrison’s has ensured distinctive diversification of their brand portfolio due to which an increasing number of customers are attracted towards their services (Coppola, 2021).

Brand Elements

Figure 1: Morrisons logo

(Source: Morrisons, 2021)

Some of the distinct brand elements of Morrisons are the use of words such as fresh, crispy, cheesy, and others. These are some of the terms, the organisation uses to connect with their target consumers. These distinct elements along with the logo of other companies help them to define themselves as an organisation that specialises in fresh produce and edibles (Morrisons, 2021). The organisation has also utilised their establishment year ‘since 1899’ which again helps in defining their long-term presence in the markets as well as a reputation that helps them to sustain their business for such a long period of time.

Brand Equity

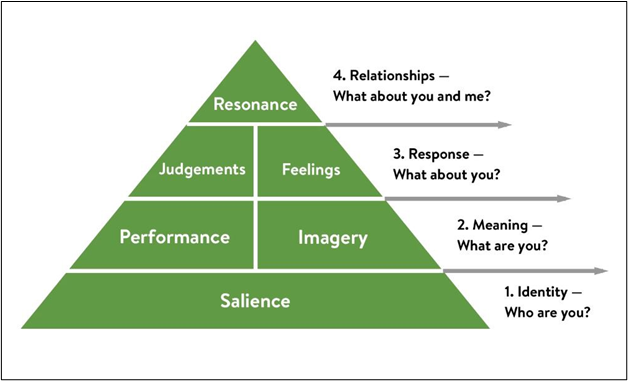

Figure 2: Keller’s Brand equity model

(Source: Jain, 2017)

Keller’s brand equity model can be utilised to study the brand equity of Morrisons. In this regard in terms of identity, the organisation clearly defines their operations and mode of business by defining itself as a retail grocery. Moreover, the company also specifies the kind of products they deal with while also emphasising the freshness of their products. This significantly increases their points of differentiation in terms of branding.

Moreover, with the use of imagery and performance in the market, the organisation has effectively established itself as a distinct grocery retail store in the UK market (Świtała et al. 2018). The organization chooses to serve as per the demand of the consumers which effectively enhances their performance thereby positively adding to their brand equity, Furthermore, advertisements play a major role in terms of imagery which distinctly increases the recognition and familiarity among consumers regarding their brand.

In terms of response, the organisation has had fairly reputable customer service which has helped them to maintain a satisfied consumer base in the UK. The company ensures they gather the feedback of their customers that allows them to understand their feelings and also their views towards the different products and services of the company. This plays a major role in understanding how consumers are judging the organisation and its services helping them to identify the scope of improvement (Marketing Week, 2021).

Organisation also has several programs to connect with their target consumers, which have played a major role in establishing a positive relationship with their target consumers. These are some of the elements that have helped the organisation to maintain an effective brand equity level in its existing markets (Younas, 2017).

Brand Mantra

The organisation has a distinct brand Mantra that it portrays as “From a Bradford market stall to the UK’s 4th largest supermarket chain” (Morrison, 2021). This is also the organisation’s positioning statement, that allows them to connect with the target consumers which aims to focus upon the sustainability of their operations and the quality of their products. The brand mantra of the company clearly portrays their competitive aspect and also depicts their point of parity by identifying themselves as a supermarket chain.

Part 2 International Market Analyses

Morrisons has a limited global presence therefore to expand the organisation requires markets where the company and its products and services can be aligned with the market culture. In this regard, the three distinct markets that have been chosen for the organisation are France, Germany, and Spain (Jafari-Sadeghi et al. 2021). The following slipped and competitor analysis would help in identifying the most feasible market in which the company can expand their operations

SLEPT analysis of France

| Social | ● Rapid change in consumer preferences

● Increasing literacy rate at about 99% (World Education Services, 2021) ● Consumers are now more health-conscious |

| Legal | ● Antitrust laws

● Wage legislation ● Pricing regulations |

| Economical | ● Growth in GDP by 5.8% (Trading economics, 2021)

● Reducing unemployment rate ● Stable exchange rate |

| Political | ● Government unable to create jobs (L&E Global, 2020)

● Support to the retail industry ● Requirements related to product labelling ● Part of EU |

| Technological | ● Technological developments (Vyt and Cliquet, 2017)

● Use of AI ● Use of IoT |

France is one of the countries where consumer preferences change from time to time depending upon the changing trends. However, it has been seen that the number of local grocery stores in France is more popular among consumers due to the fact that most major retail stores do not specialise in grocery. It creates an opportunity for Morrisons with their products (Peiffer-Smadja and Torre, 2018). The literacy rate in France is 99%, which indicates that the company would not only get consumers who are conscious about the products that they purchase but would also help the organisation to obtain a skilled workforce. In addition, consumers in France have reflected their inclination towards health consciousness due to which they buy only products that are of higher quality and this can be another opportunity for Morrisons to sell their top-quality products.

In terms of legal aspects, there are a number of laws and regulations that the organisation needs to follow to operate in the markets without any hindrance. The country has stringent antitrust laws that prevent companies from working together in order to regulate prices. Legal regulations such as minimum wage and fixed-wage regulations are another aspect of concern for Morrisons to maintain their workforce (Allain et al. 2017).

In terms of the economic environment, it can be stated that the growth of France has sprung back up after the covid-19 pandemic and is currently at 5.8%. Therefore, entering the markets of France can help the organisation to achieve favourable growth (Valdano et al. 2021). While on the other hand due to the growth in the country’s economy the unemployment rate has also been decreasing which is another indication that the company might achieve a steady workforce.

In terms of political factors, it has been seen that the government of France has been facing a number of conflicts and agitations within the country due to its inability to create jobs. While on the other hand, the Government of France extensively supports the retail industry as well as is a part of the European nation, which again strengthens the political environment of the country (Shi et al. 2018). However, the government has stringent product labelling regulations, which Morrisons need to follow thoroughly.

In terms of technical aspects, it has been seen that utilisation of technology is quite evident in the markets of France, especially in the retail industry. Companies consistently utilise technology to improve their understanding of consumer behaviour in purchasing patterns (Vyt and Cliquet, 2017). Furthermore, organisations have also implemented IoT and developed applications that help consumers to purchase products.

SLEPT analysis of Germany

| Social | ● Conscious consumers (Rombach et al. 2018)

● Changing preferences of consumers |

| Legal | ● Stringent consumer laws

● Labour laws ● Regulations on export and import (Kuhn et al. 2020) |

| Economical | ● Stable currency and growth rate

● GDP growth rate of 3.6% in 2021 (Statista, 2021) |

| Political | ● Stable political condition

● Part of EU |

| Technological | ● Highly innovative towards the development of technology and its implementation

● Support of government and non-government entities in technology (Braun et al. 2017) |

Germany is another favourable market for Morrisons as the social environment consists of health-conscious consumers and therefore the demand for high-quality products would be quite necessary. Moreover, consumer preferences keep changing in the German market. This is mostly due to the fact that the German population is quite diverse and people belonging from all segments are a part of it (Fuest et al. 2020).

This leads to the differences in change tastes and preferences and this can be a difficult area for the company to focus upon. Hence, it would be essential to segment the market and target consumers based on the existing products and services Morrisons have.

In terms of the legal environment, the country has trends in consumer laws to protect the rights of their consumers therefore the organisation would need to utilise these terms and conditions of service quite thoroughly. In case the company finds itself in a conflict with any consumer there might be chances that Morrisons would face a lawsuit and if proven guilty the company might face severe fines and in adverse cases, the company might lose the licence to operate in the country (Assad et al. 2020).

The country also has trained in labour laws and regulations on export and import and this would require medicines to maintain a positive and healthy working environment for all its employees. Since Morrisons would mostly source its products back from the UK, the regulations on imports can have an effect on the company’s operational costs.

In terms of the economic environment, the country has a stable currency and a growth rate, which can be identified as a positive factor considering the markets of Germany. Furthermore, after the coronavirus pandemic, the GDP growth rate of the country has also increased to 3.6% after 2020 and this can again be considered as a positive factor for entering the markets of Germany (Martin, 2020).

The political environment present in Germany is also stable which reflects that the company would not find it difficult to attain the support of the government in terms of receiving trade licences and other clearances (Kahl, 2020). Even, the country is also a part of the European Union it again stabilizes and helps in maintaining political harmony ensuring there would not be any internal or external conflict.

In terms of the technological environment, Germany has reflected a highly innovative approach towards adopting and developing new technology. Therefore, operating in the market in Germany would allow more reasons to get access to these technologies, which can help them in improving their business operations (Aue, 2020). Furthermore, the support from Government and non-government entities in terms of developing technology is another factor that indicates that operating in Germany can be a technological official aspect for Morrisons.

SLEPT analysis of Spain

| Social | Unique social culture (de Madariaga and del Hoyo, 2019)

Demographic diversity |

| Legal | Extensive digital laws

Labour and consumer laws |

| Economical | GDP growth of 6.3% (Statista, 2021)

Increasing consumer purchasing power |

| Political | High fiscal deficit

Corruption in government |

| Technological | Advanced technological environment (Castañeda, 2018)

Significantly low government support towards technology |

Considering the social factors present in the external environment of Spain, it depicts a very unique social culture that is highly diverse (Garmendia et al. 2021). Therefore, consumer preferences might vary from one individual to another and this is something that the organisation needs to be cautious about. Furthermore, the country also has a demographic diversity, which would require the organisation to adopt specific and targeted segmentation strategies of the market (Tena-Monferrer et al. 2021).

In terms of legal aspects, the country has extensive digital laws for the protection of copyrights and trademarks, which can help the organisation to protect its product from being copied or from infringements. Similarly, the country also has stringent labour laws and consumer laws, which would require the company to maintain a positive environment for both its workforce as well as consumers.

In terms of economic factors, the country has exceptionally improved its GDP growth after the covid-19 pandemic and at present, it is growing at 6.3%. The growing GDP also indicates an increase in consumer purchasing power, which can be considered a positive aspect for Morrisons (Tena-Monferrer et al. 2021).

In terms of political factors, the country has been facing a high fiscal deficit. This can be a problematic aspect for the country, as Morrisons might not face a favourable political environment in Spain. Furthermore, the corruption levels in the Spanish government are quite high and this is another threat in the political environment of Spain, which can pose a downside for entering the Spanish market.

When it comes to the technological environment, it has been seen that the country has adopted several advanced technologies to improve the different industries operating in the country (García et al. 2021). However, the government is not as supportive as other European nations in terms of developing high tech infrastructure within the country.

Competitor analysis

France

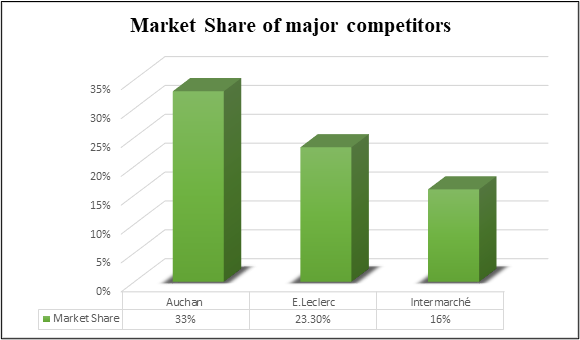

Auchan is a French multinational retail group, which is based in Croix, France. This company serves many areas including Spain, Russia, China, Portugal, Italy, United Arab Emirates, and many others. The company is the 35th largest employer in the world. The Auchan Group has a market share of over 9.6% with revenue of €50,986 million.

The company deals with products in Hypermarkets, Convenience stores and Supermarkets. In 2019, Auchan became the world’s largest retailer with its presence in countries like France, Poland, Romania, Luxembourg, and Italy. Over 55 years, the company has been a committed retailer for their customers with a sales growth of 33% (Kuipers et al. 2021).

E.Leclerc is a cooperative society and hypermarket chain of France, which operates semi-independent stores under the Leclerc brand. The company has been serving worldwide since it started expanding its business. Leclerc has a market share of over 22.3% with total revenue of US$ 56.87 billion. They deal with the products in discount stores, supermarkets, hypermarkets, and supermarkets. In 2018, the company had a revenue of over 72.96%. There are 721 E.Leclerc stores in France and 690 drive stores (Valdano et al. 2021).

Figure 3: Market Share of major competitors

(Source: Nicolaï and Grange, 2021)

Intermarché is the brand of French commercial supermarket and a part of huge retail group Les Mousquetaires that was named under EX Offices. It serves areas like France, Portugal, Monaco, Belgium and Poland. Its subsidiaries are Intermarché Hyper, Intermarché Contact, Intermarché Super and Intermarché Express. Intermarché has a revenue of over €36.4 billion with a market share of 16% in 2020 (Kuipers et al. 2021). All the above three competitors have huge brand value and as a result, France will not be a better place for Morrisons to expand their business. Large competition can create threats for the business with losses of customers and the downfall of brand value.

Spain

Aldi is a discount supermarket chain, who have their stores in over 20 countries with more than 10,000 stores across the world. The products in which they lead are grocery and household essentials. The company has a total revenue of over US$91.9 billion with a total market share of 8.2%. Aldi has started to offer organic products according to the demands of the customers (Blazquez et al. 2021). The products they carry are much less expensive than other products like fruits, beef, vegetables, snacks, and dog food. There is not even a little evidence of gluten and artificial items in their organic selections.

Caprabo is one of the leading supermarket companies of Spain with hypermarkets and supermarkets in Mainland Spain, Canary Island and the Balearic Islands. This company mainly deals with online shopping and delivery services all over Spain. It has a turnover of 1.671 million euros and the company has been trading for 45 years (Garmendia et al. 2021).

Mercadona is one of the supermarkets of Spain with over 1,636 stores in the area where it is serving. The company is ranked as the ninth most reputable company across the world, which was even listed in Forbes magazine. The company offers gluten-free products to their customers.

It has a market share of 23.2% with total revenue of US$ 28 billion (García et al. 2021). Mercadona is one of the most successful supermarkets in Spain with innovative actions in their marketing and distribution of their products. All these organizations can create hurdles for Morrisons in the business. Large business brands can become the reason for failure in the host country.

Germany

Just as the other countries, Germany also has a diverse number of organisations operating in the retail industry and among these; some of the top competitors that can be an issue for Morrisons would be Edeka, Schwarz and Rewe. It would be essential for the organisation to adopt a differentiation strategy in order to establish a presence in the markets of Germany (Böttcher et al. 2021).

Due to the high competition in the German market, it would also be necessary for the organisation to undertake extensive marketing strategies so that the target consumers can be informed and attractive. Edeka has a market share of 20.3%, while Schwarz is a major retail giant and is one of the most popular and profitably running retail stores in the German market.

Similarly, Rewa is just behind Schwarz with a market share of 17.3% (Winterstein, and Habisch, 2021). These are the three most competitive companies that Morrisons need to be wary about. Thus, studying their market strategy can be a helpful option for the organisation to create an accountable position in the German market

Part 3 Strategy for Market Entry

Justification for entering a new market

Morrisons is the largest supermarket chain in the United Kingdom situated in Bradford, England. The company is trying to enter the German market for expansion of their business and as Germany has large chains of supermarkets with a dynamic economy, it will be helpful for them to flourish their production and business.

Germany is the centre of transport networks and with better technology and well-trained professionals; it makes an excellent environment for creativity in innovations (Masiero et al. 2017). Germany ranks the highest power of purchasing among the other countries in Europe. The infrastructure will also help in setting up a business there, as approximately 38,000 km of railway communication with 830,000km of roads will make it easy to reach the goal of the business.

For setting up business in a foreign country, a stable economic and political environment is needed and Germany has one. The place does not safeguard the sovereignty of citizens but it also looks after the freedom of competition. There are certain advantages to expanding business there as it is the country of immigration, and over 1.2 million people will have migrated there in Germany in 2020. Germany provides professional support and funding for the business, all the states of Germany have professional information centres for help and a support programme of the Government that provides funding too (Putra, 2021).

Market entry strategy

A business looks to expand internationally for more profits, acquisition of better skills and lower costs but to enter a foreign market some strategies are needed to prosper there. For Morrisons, these two strategies will work for their business expansion.

Joint Venture: In emerging markets, creating an alliance with other companies is one of the preferable market strategies. Through this, Morrisons can get hold of the mastery of its partners’ local knowledge, infrastructure and reputation and can lead to a rapid business expansion (Connelly et al. 2019). By making alliances with the organisations like EDEKA and REWE can be beneficial for Morrisons to develop their market easily as they are the topmost retail companies in Germany.

Licensing: It refers to giving legal rights to the company. It involves a company as a licensor who grants the other company to use their intellectual property for some period of time. Under licensing, the company can sell products and give offers to the customers under the name of the licensor company (Jiang and Shi, 2018). For Morrisons, this market entry strategy will be more beneficial than the joint venture strategy because in licensing, entering foreign markets is quick and easy. It helps the company to hop through the tariff barriers and borders with lower requirements of capital.

As a primary step, the organisation needs to attain permits of operation and register the organisation in the German market. Thereafter the company needs to look out for possible locations where the stores can be step up. At the same time, the company can also offer franchising however considering the negligible brand identity in Germany this might not work out. Therefore the company would need to start operating from new locations and slowly expand to others.

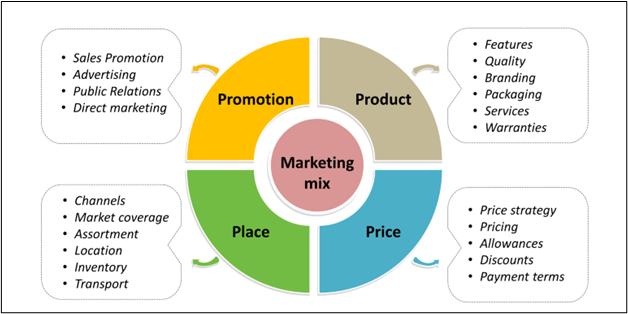

Marketing mix

Product

The German market is a little different from that of the United Kingdom therefore the organisation would need to choose specific products that suit the requirements of the consumers present in the market. Morrisons has a diverse number of products that it sells in the markets of the UK and a similar number of products can be introduced in the German market considering the preferences of consumers (Mauliandini et al. 2021). Food items like fresh fruit, wine, vegetables, beer and other edibles would need to be the prime focus of the organisation while operating in the markets and Germany. Furthermore, Morrisons also needs to focus extensively upon the branding mostly because they are entering the German market as a new organisation; hence, this would allow them to establish themselves as a visible brand.

Place

In terms of place, Morrisons needs to open at least four new stores in the major cities of Germany to extract the maximum number of consumers. Once these four stores start operating successfully, Morrisons will be able to understand the kind of expansion strategy they need to devise so that the number of stores can be increased. It is also essential for the organisation to keep their stores arranged in proper order so that it can be convenient for consumers to come and leave without cluttering the exits (Purohit et al. 2021). In-store advertisements can also be incorporated and this can help the organisation to achieve advertisements from other companies whose products Morrisons would sell apart from their own.

Figure 4: 4P Marketing mix

Price

In terms of pricing, it has been seen that German consumers prefer discounted items; therefore, Morrisons needs to adopt a flexible pricing strategy to suit the requirements and preferences of consumers. Offering discounts can be an attractive way to achieve a higher number of consumers in the German market and this can work out particularly well to compete against other major retail organisations in Germany (Sankham and Putsom, 2021).

Promotion

Morrisons needs to position itself as a discount price offering retail Grocery Company. Moreover, in terms of positioning and strategy, the organisation also needs to focus on the quality of the products to attract the maximum number of consumers. The company would also need to extensively utilise online as well as conventional marketing channels to communicate with the target consumers and inform them about their arrival in the German market (Hänninen et al. 2021).

Points of parity

The points of parity that define Morrison’s approach and business operations is that it is a discount price offer in grocery retail stores. This would be something that would help consumers to relate the brand to the existing retail organisations operating in the markets of Germany. Furthermore, another point of parity that Morrisons has with their competitors is the kinds of products and services the organisation provides, which would again help consumers to relate to the existing retail stores (Morrisons, 2021).

Points of differentiation

Among the points of differentiation in the organisation can point out the quality of their products as well as their extensive reputation gained in the markets of the UK. The company can also utilise their sustainable operations as a point of differentiation, which can help them to stand apart from its competitors and appeal to its target consumers (Morrisons, 2021).

Conclusion

Based on the findings of the above study it can be identified that Morrisons has a distinct brand image in the market in which it operates and has been successfully operating for more than a century. Therefore, expansion into new markets is a probable option for the organisation. The above study has helped in the identification of three distinct markets with different cultures that are France, Germany and Spain. The external market analysis and competitor analysis in the respective market have helped in identifying that the German market is the most profitable option the company has in terms of international expansion. Furthermore, study also defines the way the organisation can undertake its expansion strategy by defining the marketing mix and the points of parity and differentiation the organisation has with its existing competitors in the German market.

References

Allain, M.L., Chambolle, C., Turolla, S. and Villas‐Boas, S.B., 2017. Retail mergers and food prices: Evidence from France. The Journal of Industrial Economics, 65(3), pp.469-509.

Assad, S., Clark, R., Ershov, D. and Xu, L., 2020. Algorithmic pricing and competition: Empirical evidence from the German retail gasoline market.

Aue, R., 2020. Spatial effects of price regulation and competition. A dynamic approach to the German retail pharmacy market. work in progress.

Blazquez, M., Henninger, C.E., Alexander, B. and Franquesa, C., 2020. Consumers’ knowledge and intentions towards sustainability: A Spanish fashion perspective. Fashion Practice, 12(1), pp.34-54.

Böttcher, T.P., Rickling, L., Gmelch, K., Weking, J. and Krcmar, H., 2021. Towards the Digital Self-Renewal of Retail: The Generic Ecosystem of the Retail Industry. In 16. International Conference on Wirtschaftsinformatik.

Braun, T., Hennig, A. and Lottermoser, B.G., 2017. The need for sustainable technology diffusion in mining: Achieving the use of belt conveyor systems in the German hard-rock quarrying industry. Journal of Sustainable Mining, 16(1), pp.24-30.

Castañeda, N., 2018. Apprenticeship in early Neolithic societies: the transmission of technological knowledge at the flint mine of Casa Montero (Madrid, Spain), ca. 5300–5200 cal BC. Current Anthropology, 59(6), pp.716-740.

Connelly, B.L., Shi, W., Hoskisson, R.E. and Koka, B.R., 2019. Shareholder influence on joint venture exploration. Journal of Management, 45(8), pp.3178-3203.

Coppola, D., 2021. Percentage change in sales at Morrisons in Great Britain compared to a year earlier from January 2015 to March 2021. [Online]. Available at: <https://www.statista.com/statistics/386745/morrisons-sales-percentage-change-great-britain-uk/> [Accessed 10 July 2021]

de Madariaga, C.J. and del Hoyo, J.J.G., 2019. Enhancing of the cultural fishing heritage and the development of tourism: A case study in Isla Cristina (Spain). Ocean and Coastal Management, 168, pp.1-11.

Fuest, C., Neumeier, F. and Stöhlker, D., 2020. The pass-through of temporary VAT rate cuts: Evidence from German retail prices (No. 341). ifo Working Paper.

García, J.R., Pacce, M., Rodrigo, T., de Aguirre, P.R. and Ulloa, C.A., 2021. Measuring and forecasting retail trade in real time using card transactional data. International Journal of Forecasting, 37(3), pp.1235-1246.

Garmendia, A., Elorza, U., Aritzeta, A. and Madinabeitia‐Olabarria, D., 2021. High‐involvement HRM, job satisfaction and productivity: A two wave longitudinal study of a Spanish retail company. Human Resource Management Journal, 31(1), pp.341-357.

Hänninen, M., Kwan, S.K. and Mitronen, L., 2021. From the store to omnichannel retail: looking back over three decades of research. The International Review of Retail, Distribution and Consumer Research, 31(1), pp.1-35.

Jafari-Sadeghi, V., Garcia-Perez, A., Candelo, E. and Couturier, J., 2021. Exploring the impact of digital transformation on technology entrepreneurship and technological market expansion: The role of technology readiness, exploration and exploitation. Journal of Business Research, 124, pp.100-111.

Jain, R.A.M.Y.A., 2017. Basic branding concepts: brand identity, brand image and brand equity. International Journal of Sales & Marketing Management Research and Development (IJSMMRD) Vol, 7, pp.1-8.

Jiang, B. and Shi, H., 2018. Intercompetitor licensing and product innovation. Journal of Marketing Research, 55(5), pp.738-751.

Kahl, M.P., 2020. Impact of cross-border competition on the German retail gasoline market-German-Polish border (No. 392). Working Paper Series in Economics.

Kuhn, T., Enders, A., Gaiser, T., Schäfer, D., Srivastava, A.K. and Britz, W., 2020. Coupling crop and bio-economic farm modelling to evaluate the revised fertilization regulations in Germany. Agricultural Systems, 177, p.102687.

Kuipers, M.A., Nuyts, P.A., Willemsen, M.C. and Kunst, A.E., 2021. Tobacco retail licencing systems in Europe. Tobacco Control.

L&E Global, 2020. The French Brief – France in the Era of Unemployment. [Online]. Available at:https://knowledge.leglobal.org/corona/country/france/the-french-brief-france-in-the-era-of-unemployment/> [Accessed 19 July 2021]

Lee, M., 2017. Brand value must go into the mix at Morrisons. [Online]. Available at: <https://www.thegrocer.co.uk/marketing/brand-value-must-go-into-the-mix-at-morrisons/550419.article> [Accessed 10 July 2021]

Lim, X.J., Cheah, J.H., Ng, S.I., Basha, N.K. and Soutar, G., 2021. Will you stay or will you go? The effects anthropomorphism presence and the marketing mix have on retail app continuance use intention. Technological Forecasting and Social Change, 168, p.120763.

Marketing Week, 2021. ‘Food can be a force for good’: Morrisons launches first ad as part of new brand positioning. [Online]. Available at: https://www.marketingweek.com/food-can-be-a-force-for-good-morrisons-launches-first-ad-as-part-of-new-brand-positioning/ [Accessed on 10 July 2021]

Martin, S., 2020. Market transparency and consumer search-Evidence from the German retail gasoline market (No. 350). DICE Discussion Paper.

Masiero, G., Ogasavara, M.H. and Risso, M.L., 2017. Going global in groups: a relevant market entry strategy?. Review of International Business and Strategy.

Mauliandini, A., Munir, A.R. and Laba, A.R., 2021. The Effect of Marketing Mix and Retail Mix on Consumer Loyalty of Gelael Supermarket in Makassar City. SEIKO: Journal of Management & Business, 2(2), pp.274-281.

Morrison, 2021. About us. [Online]. Available at: <https://www.morrisons-corporate.com/about-us/?utm_source=groceries&utm_medium=internal&utm_campaign=footer_link> [Accessed 19 July 2021]

Morrisons Corporate, 2021. Strategy. [Online]. Available at: <https://www.morrisons-corporate.com/about-us/strategy/> [Accessed 10 July 2021]

Morrisons, 2021. Welcome to Morrisons groceries online. [Online]. Available at: https://groceries.morrisons.com/webshop/startWebshop.do [Accessed on 10 July 2021]

Nicolaï, M. and Grange, C., 2021. The Digital Transformation of Retail During the Covid-19 Pandemic: A Comparative Study in Canada, China, And France.

Osseiran, G., 2020. Higher education massification and the changing graduate labour market in the Spanish retail banking industry: a case study. Oxford Review of Education, 46(1), pp.63-78.

Peiffer-Smadja, O. and Torre, A., 2018. Retail decentralization and land use regulation policies in suburban and rural communities: The case of the Ile-de-France region. Habitat International, 72, pp.27-38.

Purohit, S., Paul, J. and Mishra, R., 2021. Rethinking the bottom of the pyramid: Towards a new marketing mix. Journal of Retailing and Consumer Services, 58, p.102275.

Putra, M.P., 2021. An Analysis of Big Data Analytics, IoT and Augmented Banking on Consumer Loan Banking Business in Germany. Journal of Research on Business and Tourism, 1(1), pp.16-36.

Rombach, M., Widmar, N.O., Byrd, E. and Bitsch, V., 2018. Do all roses smell equally sweet? Willingness to pay for flower attributes in specialized retail settings by German consumers. Journal of Retailing and Consumer Services, 40, pp.91-99.

Sankham, S. and Putsom, S., 2021. The Relationship between Marketing Mix Perception and Consumer Choice of Convenience Stores in Muak Lek Municipality, Muak Lek District, Saraburi. St. Theresa Journal of Humanities and Social Sciences, 7(1), pp.23-37.

Shi, Y., Lim, J.M., Weitz, B.A. and France, S.L., 2018. The impact of retail format diversification on retailers’ financial performance. Journal of the Academy of Marketing Science, 46(1), pp.147-167.

Statista, 2021. Germany: Growth rate of the real gross domestic product (GDP) from 2016 to 2026. [Online]. Available at: https://www.statista.com/statistics/375203/gross-domestic-product-gdp-growth-rate-in-germany/> [Accessed 19 July 2021]

Statista, 2021. Spain: Real gross domestic product (GDP) growth from 2016 to 2026. [Online]. Available at: https://www.statista.com/statistics/263610/gross-domestic-product-gdp-growth-in-spain/> [Accessed 19 July 2021]

Świtała, M., Gamrot, W., Reformat, B. and Bilińska-Reformat, K., 2018. The influence of brand awareness and brand image on brand equity–an empirical study of logistics service providers. Journal of Economics & Management, 33, pp.96-119.

Tena-Monferrer, S., Fandos-Roig, J.C., Sánchez-García, J. and Callarisa-Fiol, L.J., 2021. Shopping motivation in consumer loyalty formation process: the case of Spanish retail. International Journal of Retail & Distribution Management.

Trading economics, 2021. France GDP. [Online]. Available at: <https://tradingeconomics.com/france/gdp> [Accessed 19 July 2021]

Valdano, E., Lee, J., Bansal, S., Rubrichi, S. and Colizza, V., 2021. Highlighting socio-economic constraints on mobility reductions during COVID-19 restrictions in France can inform effective and equitable pandemic response. Journal of travel medicine, 28(4), p.taab045.

Venkateswaran, P.S., 2021. Impact of Retail Service Quality and Store Service Quality on Patronage Intention towards Organized Retail Industry. Turkish Journal of Computer and Mathematics Education (TURCOMAT), 12(3), pp.1462-1471.

Vyt, D. and Cliquet, G., 2017. Towards a fairer manager performance measure: a DEA application in the retail industry. The International Review of Retail, Distribution and Consumer Research, 27(5), pp.450-467.

Winterstein, J. and Habisch, A., 2021. Is local the new organic? Empirical evidence from German regions. British Food Journal.

World Education Services, 2021. EDUCATION SYSTEM PROFILES, Education in France. [Online]. Available at: <https://wenr.wes.org/2015/09/education-france#:~:text=The%20country%20boasts%20a%2099,universities%2C%20was%20founded%20in%201215> [Accessed 19 July 2021]

Younas, S., 2017. Impact of Social media brand communication on Brand Knowledge: Mediating role of Brand Image & Brand Awareness Application of CBBE model theory of Keller. Journal of Management Info, 4(4), pp.12-18.

Know more about UniqueSubmission’s other writing services: