Acquisition Assignment

In this study, the key success factors in the acquisition will be critically analyzed and evaluated that would be adopted by Company B in the acquisition process. These success factors are most important for identifying current lack of integration in the due diligence

. Additionally, if these factors are not considered during the acquisition then it would be a reason for lack of organization wellness. In addition to this, the study also includes the post-acquisition integration matrix which plays an essential role to identify the need of intensive care of company A.

This report also considers the recommendation for both company A and B to be successful in the international market. Additionally, some recommendations are also provided that are supportive for increasing the shareholder’s value.

Analysis and evaluation of key success factors in the acquisition process

In the acquisition process, the financial success provides the effective outcome of the decision. This process considers due diligence such as target choice and negotiations that must be fulfilled. In this, Co B must contribute and respect to Co A to achieve the targets.

The key success factor in acquisition process includes planning, synergy, management competence, communication, culture mismatch, size mismatch, etc (Gomes et al., 2013). The organization should consider effective planning for the success because it provides achievable target to the organization.

The financial success of the acquired organization is based on the effective synergy, where both companies should cooperate with each other. Management competence of Co B must valuable that can handle all the tasks of the Co A efficiently and manage the employees.

The reporting system and communication system of both companies must be supportive to handle the daily task of the organization. The communication system also creates a relationship between the organization and help to make successful this acquisition (Cartwright and Cooper, 2014).

During the acquisition process, both organizations have different culture and size so the organizational structure needs to change their system. For this, the organization must develop new and effective organizational structure which can reduce the confusions. In addition to this, the evaluation systems of both the companies are also different. It directly and indirectly, affects the employees and they expect more by the use of different evaluation system.

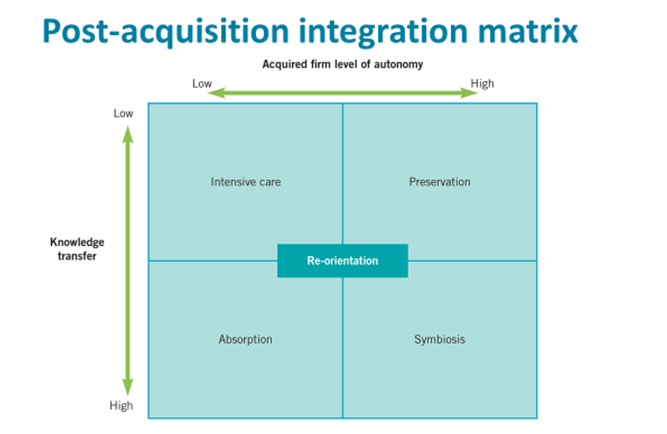

Post-acquisition integration matrix

After the acquisition, it is identified that company A has a low level of autonomy as well as low knowledge transfer. It is because the company wants to increase the shareholder’s value as well as also want to adopt the business deliverables for short time period (Schweizer and Patzelt, 2012). The main reason behind low level of autonomy is that approximately 10% of the employees are disabled to work effectively.

Additionally, Co A wants to use autocratic leadership style for effectively managing the employees. Hence, Co A needs to focus on the intensive care by using the benefits of acquisition process (Cartwright and Cooper, 2012). In which, Co A can improve the quality, develop the staff, use innovative ideas of Co B, financial development, organizational fit, effective information system, effective leadership and shareholder’s value.

According to the post-acquisition integration matrix, it is identified that if Co A had a high level of autonomy and low knowledge transfer then it was preservation for the company. In preservation situation, the organization should focus on the nurturing to increase the benefits.

Additionally, both levels of autonomy and knowledge transfer are high then it will show symbiosis. Management must prepare the preservation boundary and gradual process (Galpin and Herndon, 2014). The post-acquisition integration matrix shows that if the level of autonomy is low and knowledge transfer is high then the company is in the absorption situation. In this situation, the management should decide to carry out the acquisition process for success.

Successful integration to support the strategy of increasing shareholder value

This acquisition process will provide a differentiated environment to the employees of Co A with a different culture (Dörnyei, 2014). It will increase knowledge and skills of the employees. An organization might move towards more successful by using five drivers as corporate integration.

These five divers are integration strategy, integration team, communication, speed and aligned measure. As par, the integration strategy, Co B must create the impression that Co A will always be there. This strategy helps to Co A for effectively adopting the practices of Co B.

In the integration strategy, Co B should focus on the employees and management of Co A by impacting positively. On the other hand, integration team must take leadership from Co A to increase the morale of top management of the acquired organization (Josephs, 2012).

The resources of Co A will be helpful to take decisions according to the need of the market. Moreover, Co B might provide the leadership in the hand of the acquired company to increase the co-evolution to increase the organizational performance.

In addition to this, the effective communication might also be helpful for more successful integration where the customers of Co A must understand new opportunities.

So, the company must focus on the effective communication to make understand the customers (Agarwal et al., 2012). Moreover, the employees of Co A must understand their new responsibilities or roles to effectively acquiring the business. Fast decisions must be taken by management after the acquisition. Additionally, the cost reduction and measurement system should also be used to increase shareholder’s value.

From the above analysis, it is concluded that the acquisition process included different success factor for increasing the fitness of the organization. At the same time, it is also concluded that company A is in intensive care situation of post-acquisition integration matrix. In this situation, the company should focus on the business practices to reduce the risks.

The company only focuses on the creation of value in the market to increase the shareholder’s value. In addition, it can also be concluded that the organization should increase their shareholder’s value by the use of different integration strategies. These strategies will also support the co-evolution, perhaps symbiosis, and absorption for improvement in the shareholder’s value.

Agarwal, R., Anand, J., Bercovitz, J. and Croson, R., 2012. Spillovers across organizational architectures: The role of prior resource allocation and communication in post‐acquisition coordination outcomes. Strategic Management Journal, 33(6), pp.710-733.

Cartwright, S. and Cooper, C.L., 2012. Managing mergers acquisitions and strategic alliances. USA: Routledge.

Cartwright, S. and Cooper, C.L., 2014. Mergers and acquisitions: The human factor. USA: Butterworth-Heinemann.

Dörnyei, Z., 2014. The psychology of the language learner: Individual differences in second language acquisition. USA: Routledge.

Galpin, T.J. and Herndon, M., 2014. The complete guide to mergers and acquisitions: Process tools to support M&A integration at every level. UK: John Wiley & Sons.

Gomes, E., Angwin, D.N., Weber, Y. and Yedidia Tarba, S., 2013. Critical success factors through the mergers and acquisitions process: revealing pre‐and post‐M&A connections for improved performance. Thunderbird international business review, 55(1), pp.13-35.

Josephs, J.L., 2012. HRMS: current usage, future directions and the promise of integration with unified data streams suited to post-acquisition mining. Bioanalysis, 4(5), pp.471-476.

Schweizer, L. and Patzelt, H., 2012. Employee commitment in the post-acquisition integration process: The effect of integration speed and leadership. Scandinavian journal of management, 28(4), pp.298-310.

Having read this I believed it was rather enlightening. I appreciate you finding the time and energy to put this article together. I once again find myself personally spending way too much time both reading and commenting. But so what, it was still worth it!

https://twrd.in/eswrxNU

After I initially left a comment I seem to have clicked the -Notify me when new comments are added- checkbox and from now on every time a comment is added I recieve 4 emails with the exact same comment. Is there a way you can remove me from that service? Thanks!

https://al.wpcookie.pro

Remarkable! Its in fact awesome article, I have got much clear idea on the topicof from this piece of writing.

https://suba.me/