BE155-7-SP International Financial Reporting

Module Code And Title : BE155-7-SP International Financial Reporting

Introduction

An international financial reporting system is a set of various accounting rules and regulations that provide guidance to public companies to maintain transparency in financial reporting. Through the adaptation of IFRS in the business module, a company can be able to maintain its data and record in the proper way. Proper maintenance of data and accounting records boost the financial position of a business and its ethics.

These techniques in the accounting record system provide an opportunity for a business to easily compare its financial position to its competitors. Other than this, an adaptation of one accounting principle in the global market creates competitiveness in the more through which performance of both global markets as well as the company can be increased.

The following assignment sheds light on the implication of IFRS in the world market. Apart from this, various issues and problems while implication of this accounting principle is also being highlighted through which better understanding about the topic can be possible.

Problem statement and background of problem

As IFRS principle aims to implement one accounting rule for record of entries and data maintenance of company and organization, various issues and problems while its implication has been found. As accounting principles and records are varying from country to country it is not possible to follow rules and regulations proved by IFRS. in this situation, proper implication of one accounting rule for financial reporting system can be properly followed.

Difference between GAAP and IFRS: the major issue faced by various countries and organizations while implication of one accounting rule is the difference between GAAP and IFRS. Generally accepted accounting principles are followed by the US country and its organization while the “international financial reporting system” is followed by various other countries such as Canada. South Africa, a European country.

In this situation variance using the accounting principle for record maintenance creates barriers to promoting one accounting principle for financial reporting. As stated by Hong et al. (2018), while preparing the balance sheet in GAAP principle current assets are listed on the top whereas in IFRS system non-current assets are listed on the top. Apart from this, guidelines of GAAP are step by financial accounting standard board and guidance of IFRS issued by international accounting standard board.

Most US countries followed GAAP guidelines while other than US country IFRS is being followed. In this situation, the presence of two major and intentionally accepted accounting principles creates. issues to implement guidelines of IFRS in an effective way. On the other hand, the valuation of inventory in the booth accounting system is treated directly. In GAAP inventory is valued on LIFO, FIFO or weighted average method. While on the other hand, IFRS does not consider LIFO methods of valuation of inventory. Due to this variance, companies and organizations are facing issues to compare their financial position with other rival companies.

High implication costs: another major issue of implementation of IFRS in an effective way is its high implementation of costs. As stated by Pignatel and Tchuigoua (2020), various businesses and organizations that belong to small, medium enterprises cannot be able to afford the expenses of implementation of its rules and regulation. Apart from this, to implement a policy of IFRS a firm and business need to change its organizational culture and business activity. In this situation, various businesses and organizations hesitate to use this accounting principle in their business module.

Thus, due to lack of flexibility, its implication in the global market is affected. Furthermore, implementation of this accounting principle will not be beneficial for the business and organization which has a brand in the US market. As the US market follows GAAP, a company that follows IFRS accounting principle is unable to complete its financial position to its rival company.

Required training to follow IFRS: in order to maintain data and records according to IFRS police a business and organization need to hire a highly skilled and knowledgeable accountant. Apart from this extra training and development expense also has to be borne by the companies while the implication of IFRS policies (Downes et al. 2018).

In order to follow accounting principles of IFRS, it is necessary for the business to know the various treatment of accounting entries. Apart from this, various modern tools and techniques are used by the IFRS while maintaining a record of business translation. In this situation, companies need to provide extra training and development processes to follow IFRS rules in an effective way.

Higher compliance issue: an accounting principle and guideline must need to be flexible and with fewer complaints issues. Through these principles, a business is able to increase its reliability of financial reporting and attract investors to its business activity. On analysis of IFRS started an issue while implication in the global market it has been found that due to variance in the principle of local market accounting entries high compliance issue has been generated (Tsalavoutas et al. 2020). As adjusting of tax rate and other accounting entries varies from country to country in this situation sometimes IFRS rules for these entries seem ineffective due to this, a business and organization faced various issues while analysis of its financial performance.

Moreover, an increase in compliance issues directly affected the financial position of the business and its profitability. Thus, in order to implement this, IFRS needs to focus on the elimination of various factors which create barriers to the smooth implication of its accounting principle.

Increase amount of work of accountant: implication of IFRS framework in business practises increase amount of work of an accountant. Accountants need to maintain both local as well as global account principles. In this situation, there is a high risk of errors in accounting entries. Apart from this, firms need to bear the high cost of implication which result in creating constraints in maintaining smooth operation while recording transactions.

Due to this, issue of IFRS a company is unable to practise the accounting principle of IFRS in an effective manner. In this situation, IFRS needs to increase the flexibility of its framework which increases reliability and cost competitiveness.

Critique of literature and analysis of different possible arguments

“International financial system” is a set of different types of latest rules and policy that assist different public and private organisations to propose a transparency accounting statement that may be comparable at global level. Any business organisation maintains their books of accounting to observe the financial performance of the organisation properly. As opined by Simpson and Tamayo (2020), the accounting process of an organisation is maintained through rules and proper system that is relevant in that country where business organisations perform business. Sometimes the adopted system of a country is different from other countries.

Possible impact of adoption of “international financial reporting system (IFRS)”

The term reporting is to indicate the process of submitting required financial statements to a country’s tax authority to calculate tax liability organisations. Organisation is prepared their financial statement as per rules and regulations of the country in order to assist improved transparency of financial statements. As stated by Subiyanto and Ghozali (2021),

there are different benefits and problems an organisation may face while adopting IFRS in their business organisation. The first benefit is consistency and integrity of the financial statements as it is comparable at international level. Maximum rule of IFRS is considered from the London accounting system that is latest and developed as per future innovation in the accounting system. Further, the quality of financial accounting is automatically improved by different mutilation organisations. As the whole world is adopting IFRS.

The developing country and developing country are also able to compare financial statements of different organisations that operate business in that country. Any multinational organisation is required to pay tax in different countries as they perform their business at global level in different countries. As opined by Salah, (2020), thus it is necessary for that organisation to prepare a financial statement that is valid and comparable in any country.

That is possible through adoption of IFRS by all developed and developing countries. Each country wants to attract new business and multinational business for the improved economic condition of the country. Nevertheless, it is important for that country to be considered an effective financial system that should be comparable with other country’s financial systems. As argued by Ibanichuka and Asukwo (2018), the country may face different propel to consider this factor in their country as the process of IFRS is different from countries financial system. Nevertheless, the country may be able to attract organisations through adopting IFRS by restructuring the country’s financial reporting system.

Impact on economic while IFRS adopt at global level

The term economic refers to the financial situation of different markets as well as the country as compared with previous market conditions. The economic condition of any country depends on financial performance of business industry at global level and different countries local business industries. As stated by Nasrawi and Thabit (2020), thus the process of comparing financial performance of different business organisations of different countries is complicated while each business organisation prepares financial statements and data as per their home country’s rules and regulations.

As argued by Khdir and Białek (2020), this is the main problem while investors compare financial performance of different business industries. Investors are key elements that play a prime role to support a business through investing in that business. Any business organisation is also able to expand business at local and global levels through capital acquired from different financial resources.

The IFRS enables an effective process to prepare financial statements that may be easily compared with other countries’ financial statements. That plays a prime role to support investors to meet their needs of comparing the financial performance of different businesses before investing in that organisation. In 2009 global businesses and different countries faced several problems due to the bad economic condition of different businesses and developed countries.

As opined by Ugwu and Okoye (2018), at that time the main reason behind the global economic crisis was low investment made by investors in the business industry and with the draw of investment from the business industry. After that, different countries take decisions to attract investors to invest in the business industry and also privatise different public organisations to boost that organisation through investors’ capital.

After 2009 different developed countries want to adopt IFRS to improve the quality and accuracy of financial statements of different businesses at global level. There are different benefits to stakeholders for performing financial operations as per IFRS. The first stockholder easily understands the investment practice and “return on investment”. That is the main objective of any stakeholder before investing in business.

Main argument

Main Argument refers to the difference between different FRS of different countries and IFRS. As opined by Hong and Paik (2018), it is the most important factor for any country to understand and identify the difference between their “financial reporting system” and IFRS that may be adopted by that country. Besides, the process of adoption by different markets and countries are also discussed in this topic.

As argued by Lucchese and Carlo (2020), After all, different reasons for not being interested in the adoption of IFRS by country are observed and indicated below paragraph. Last topic in main argument that is needed to discuss is the impact of implementing IFRS in the market on stakeholders of different business organisations is discussed.

Difference between US GAAP and IFRS

GAAP is a financial system that is popular and in process in the US market. Thus the accounting system is normally developed by the “Financial Standards Accounting Board” (FSAB) and “Governmental Accounting Standards Board” (GASB) to ensure better quality and accuracy of the financial system in the country. As stated by Prather and Boyar (2018), there are different type features of GAAP which are considered by the US business industry for adoption in financial practice.

This accounting follows the “Principle of Regularity” that indicates that financial statements must be updated on a regular basis. Besides, it also assists businesses to correct errors made by organisations in the previous recording process. Second principle is the “Principle of Consistency” this is to assist business organisations to carry forward financial data from one year to next year. As credit by Lin et al. (2019), it also ensures comparability of data from one year to next year. According to this principle, an organisation needs to disclose the reason behind updating financial data and statements in a financial statement.

The third principle is the “Principle of Sincerity” which supports investors’ understanding of the financial situation of an organisation. As opined by Bui and Le (2020), apart from this fourth principle is indicate the “Principle of Permanence of Methods’ ‘ which means continually of method must be maintained in financial statement so that investors compared financial performance of one year with previous year.

“Principle of Non-Compensation” principle must be maintained to improve transparency of statements and not entertain any types of debt compensation. “Principle of Continuity” is application while business valuing assets it means business in continuing their operation. The principle of “Principle of Materiality ” must be considered to disclose financial data in reports of an organisation. These are the main and significant features of GAAP.

On the other hand, IFRS is simple to understand and implement in financial procurement of any business organisation. The first requirement in IFRS is any business organisation must consist of a balance sheet that indicates the financial position of the business organisation. It must be considered that any prepaid or outstanding expenses must be disclosed in balance sheets along with “assets and liability”.

next requirement that must be considered is to prepare a “profit and loss statement” for one financial year that consists of all income and expenses of an organisation for a certain period. The income statement is to support investors and different stakeholders so businesses can understand the current financial situation of the business organisation. As opined by Album and Album (2020), the third requirement of IFRS is a statement for “change in equity” of the organisation. This statement must consist of “earning per share” and change in earring per year must be summarised in the statement. Fourth statement is cash flow that must consist of the cash flow of the organisation through four cash flow activities.

Adoption of IFRS by US market

The US market is an effective and prime business market among different business markets at global level. The US has currently used GAAP to perform financial procurement and publish financial statements on a global level. The US and different developed countries have made a commitment that they take action to shift towards a global accounting system that boosts our economy as well as the global economy. As stated by Bui and Le (2020), the commitment is coming while the whole world has faced an economic crisis due to bad business performance and low financial activities at global level.

The US government, as well as public sectors, have not indicated interest to adopt IFRS due to different issues faced by the domestic business industry.

Domestic business refers to those business industries that perform business operations at local and domestic levels. Thus they would like to use GAAP as this financial system is already in use for the past year. Further, the “Securities and Exchange Commission” (SEC) is also willing to not adopt IFRS in their stock market due to negative impact may be noticed in local inventors and economic conditions may be worse. Besides, the political factors are also responsible for failing to converge IFRS in the country.

As argued by Subiyanto and Ghozali (2021), governments are not taking any steps to promote new technology as well as skills development programmes that are needed to implement IFRS in organisations. Even the financial authority of the US has developed new guidelines to present cost-related resolving lines.

Reason behind not adoption IFRS by different country

IFRS is a global accounting system that is mainly developed as an “international accounting standard board” that’s main aim is to coordinate between different countries’ business organisations and financial operations of different countries. It is observed that nearly 140 countries are easily adopting IFRS and performing financial operations through rules and policy.

Maximum developing countries adopt IFRS as maximum businesses of that country are performed with support of foreign investment. The Names of adoption countries are “South Korea, Brazil, the European Union, India, Hong Kong, Australia, Malaysia, Pakistan”. On the other hand, different developed countries like the US have not implemented IFRS till now due to several reasons. As argued by Simpson and Tamayo (2020),

maximum developed countries are not implemented as they have a fair amount of distraction from domestic investors. As a result, the financial performance of domestic businesses is shifting downward. The first reason behind the adoption by the US is not to distract the local investors and restructure the financial policy of the country. Restructure of financial authority as well as develop new rules and regulations for that related with IFRS.

Realization of stakeholders for adoption of IFRS

Stakeholders are key elements and factors for any business industry in order to perform business. Investors and suppliers must observe financial performance and previous financial performance of organisations for entertainers in business practice. Investors of any country always want to compare the financial performance of several companies before “investing in the industry”. While the world would implement a single and simple financial system in the country. As argued by Hong and Paik (2018), that positive impact is seen in the stakeholder in terms of comparability of financial statements of two other countries’ business industries.

On the other hand, suppliers of different countries can easily understand the financial position of that country through statements that are prescribed according to IFRS. Stakeholders are more interested in engaging in those business organisations which continuously improve business profitability and growth. Besides, its suppliers of business easily understand that organisations are how to perform payment of their suppliers. Further other stakeholders such as skilled employees and business partners are also comparing financial performance before playing a significant role to perform business activities of the organisation.

Discussion and conclusion

Discussion

Adopted by a large number of country

While analyzing various aspects of IFRS it has been noted that major leading organizations of the world market such as Canada, European countries and South Korea and India are using accounting standards of IFRS to maintain a record of business activity (Ifrs.org). Through the analysis of their statement, it has been found this accounting principle financial performance of businesses reduces the investment risk of business. Apart from this, implications of the IFRS accounting principle in the accounting entries of companies reduce cost and increase reliability.

A company is easily able to compare its financial performance of business with other rival companies. In this situation, comparing the financial performance of one company to another provides a wider range of scope to increase competitors in the market (Bertrand et al. 2021). Moreover, implication of one set of accounting principles in the business organization provides a wide range of scope to the stakeholder prospect. Stakeholders through these techniques can easily compare their various company markets which increases their decision-making ability.

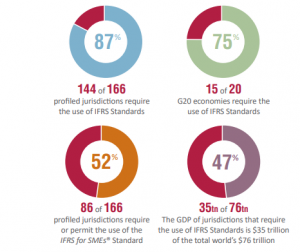

Besides this, cross border translation and free flow of capital can be described through the implication of IFRS in the business module which seems to have financial benefits for the company. Other than this, provided in the figure where it can be seen that 75%of G-20 countries have an adaptation of the IFRS accounting principle. Adaptation of this accounting principle increases the ability of businesses in term of maintaining records of financial data in a proper way.

Figure: IFRS standard used by the company (Source: Ifrs.org)

Figure: IFRS standard used by the company (Source: Ifrs.org)

Moreover, major leading organizations and countries are opting for this accounting principle to prepare their financial statement. In this situation, an increase in the number of users increases global market competitiveness which is beneficial for both stakeholders and customers.

Contribution to a global market

Increase in transparency: On analysis of IFRS in contribution to the global market, it has been noted that implication of the accounting principle of IFRS transparency in business is ensured. Transparency is an important factor that affects business productivity and profitability. In order to attain sustainability in the world market, a company needs to enhance transparency in the business activity (Saha et al. 2019).

Through the implication of IFRS in the financial reporting system, a company can be able to provide a more accurate and actual financial position of business in the market. Based on this, transparency in business operations can be well maintained (Bui et al. 2020). This ensures better services to its stakeholders and customers which is being attracted through its financial position in the market. Furthermore, investors are able to analyze performance of a business by comparing its financial position with other companies which provide a wide range of opportunity to make decisions regarding investment.

Enhance business accountability: “international financial reporting system” ensures to maintain high accountability in the business operation through minimizing information gaps. In order to increase financial performance of a business, it is quite necessary for the company to reduce information gaps by providing a wide range of information to capital providers such as investors, creditors and promoters.

Through this, an optimum level of accountability is being maintained in the business market which ensures business sustainability (Gao and Sidhu, 2018). Other than this, as the financial report of a company that follows IFRS accounting principle is broadly accepted in the world market, this enables a business to increase brand value. In this situation, it has been found that IFRS implication in the business operational activity increases the financial health of a business as well as global brand value.

Global brand value is a significant factor that positively increases the customer base of a company (Hsu, and Reid, 2021). Through increasing customer base in the world market, a business is able to increase its productivity and profitability which financial benefits for the company.

An increase in accountability of business and management ensures business promote ownership and reduce conflict in the business activity. Based on this, a company is able to increase build trust between an organization and its stakeholders which boost its financial position.

Increase efficiency: Another major contribution of the “International financial reporting system” is that it increases the efficiency of the business in terms of identifying opportunities and risks associated with the investment regarding a decision. Investment decisions are quite significant for both company and stakeholders prospects (Efretuei, et al. 2019). In order to make a decision reading investment, various aspects of business such as balance sheet, cash flow position and ratio analysis are considered.

In this situation, IFRS accounting principle and guidance aim to procure a wide range of information and data which is essential for making decisions regarding investment. Through the efficiency of investors in terms of analyzing making decisions is implemented. Apart from this, the efficiency of business can also increase through the implication of the principle of IFRS (Agyei-Boapeah et al. 2020).

Business ability to maintain its proper record of data and information is being increased. Apart from this, reduction in costs and economic use of resources can be ensured through implication of IFRS principles in the business module. Thus, it can be said that implications of IFRS increase efficiency of both investors and business which increase competition in the world market.

Conclusion

Based on analysis of the whole assignment it has been concluded that IFRS has certain issues such as differences between GAAP and high cost of implication charge. Moreover, other issues such as compliance issues and high amount of work pressure are also there while implication of IFRS in business operation. This issue creates constraints and barriers to establishing one set of accounting rules and policies in the world market.

Moreover, on analysis of various contributions of IFRS in the global market, it has been concluded that adoption of IFRS increases business transparency and its comparability. Apart from this, implication of this accounting principle increases business efficiency and accountability which boost financial options in the world market. Thus, it can be concluded that IFRS implication provides a wider range of opportunities to attain business sustainability.

Reference

Journals

Agyei-Boapeah, H., Machokoto, M., Amankwah-Amoah, J., Tunyi, A. and Fosu, S., 2020, July. IFRS adoption and firm value: African evidence. In Accounting Forum (Vol. 44, No. 3, pp. 238-261). Routledge. available at: https://www.researchgate.net/profile/Henry-Agyei-Boapeah/publication/341436660_IFRS_adoption_and_firm_value_African_evidence/links/5ece358792851c9c5e5f7fec/IFRS-adoption-and-firm-value-African-evidence.pdf

Albu, N., Albu, C.N. and Gray, S.J., 2020, July. Institutional factors and the impact of international financial reporting standards: the Central and Eastern European experience. In Accounting Forum (Vol. 44, No. 3, pp. 184-214). Routledge. Available at: https://www.tandfonline.com/doi/pdf/10.1080/01559982.2019.1701793

Al-Nasrawi, S.A. and Thabit, T., 2020. The influence of the environmental factors on the adoption of the international accounting system IAS/IFRS: Case of Iraq. Journal of Accounting, Finance and Auditing Studies, 6(1), pp.66-85. https://www.um.edu.mt/library/oar/bitstream/123456789/49964/1/JAFAS6%281%29A5.pdf

Bertrand, J., De Brebisson, H. and Burietz, A., 2021. Why choose IFRS? Benefits of voluntary adoption by European private companies. International Review of Law and Economics, 65, p.105968. Available at: https://www.sciencedirect.com/science/article/am/pii/S0144818820301812

Bui, N.T., Le, O.T.T. and Dao, H.M., 2020. Estimation of Benefits and Difficulties When Applying IFRS in Vietnam: From Business Perspective. International Journal of Financial Research, 11(4), pp.165-179. Available at: https://www.researchgate.net/profile/Ngoc-Thi/publication/343509712_Estimation_of_Benefits_and_Difficulties_When_Applying_IFRS_in_Vietnam_From_Business_Perspective/links/5f2d5d9592851cd302e6166a/Estimation-of-Benefits-and-Difficulties-When-Applying-IFRS-in-Vietnam-From-Business-Perspective.pdf

Bui, N.T., Le, O.T.T. and Dao, H.M., 2020. Estimation of Benefits and Difficulties When Applying IFRS in Vietnam: From Business Perspective. International Journal of Financial Research, 11(4), pp.165-179. available at: https://www.researchgate.net/profile/Ngoc-Thi/publication/343509712_Estimation_of_Benefits_and_Difficulties_When_Applying_IFRS_in_Vietnam_From_Business_Perspective/links/5f2d5d9592851cd302e6166a/Estimation-of-Benefits-and-Difficulties-When-Applying-IFRS-in-Vietnam-From-Business-Perspective.pdf

Downes, J.F., Flagmeier, V. and Godsell, D., 2018. Product market effects of IFRS adoption. Journal of Accounting and Public Policy, 37(5), pp.376-401. Available at: https://e-tarjome.com/storage/panel/fileuploads/2019-05-14/1557811523_E11110-e-tarjome.pdf

Efretuei, E., Usoro, A. and Koutra, C., 2019. Complex Information and Accounting Standards: Evidence from UK Narratives. Available at SSRN 3429610. Available at:

Gao, R. and Sidhu, B.K., 2018. The impact of mandatory international financial reporting standards adoption on investment efficiency: Standards, enforcement, and reporting incentives. Abacus, 54(3), pp.277-318. Available at: https://espace.library.uq.edu.au/view/UQ:1f69c2f/UQ1f69c2f_OA.pdf?dsi_version=05e78eb9be813408a794f210d2de4834

Hong, P.K., Paik, D.G. and Smith, J.V.D.L., 2018. A study of long-lived asset impairment under US GAAP and IFRS within the US institutional environment. Journal of International Accounting, Auditing and Taxation, 31, pp.74-89. Available at: https://scholarship.richmond.edu/cgi/viewcontent.cgi?article=1034&context=accounting-faculty-publications

Hong, P.K., Paik, D.G. and Smith, J.V.D.L., 2018. A study of long-lived asset impairment under US GAAP and IFRS within the US institutional environment. Journal of International Accounting, Auditing and Taxation, 31, pp.74-89. Available at: https://scholarship.richmond.edu/cgi/viewcontent.cgi?article=1034&context=accounting-faculty-publications

Hsu, Y.L. and Reid, G.C., 2021. Stated preferences for the adoption of IFRS and UK GAAP: case study vignettes. Asian Journal of Economics, Business and Accounting, pp.20-30. Available at: https://www.journalajeba.com/index.php/AJEBA/article/download/30368/56983

Ibanichuka, E.A.L. and Asukwo, I.S., 2018. International financial reporting standards adoption and financial performance of petroleum marketing entities in Nigeria. International Journal of Advanced Academic Research Accounting & Economic Development, 4(2), pp.1-15. Available at: https://www.ijaar.org/articles/Volume4-Number2/Accounting-Economic-Development/ijaar-aed-v4n2-feb18-p24.pdf

Khdir, S.H. and Białek-Jaworska, A., 2020. IFRS adoption in emerging markets: the case of Iraq. Zeszyty Teoretyczne Rachunkowości, (106 (162)), pp.177-190. Available at: http://cejsh.icm.edu.pl/cejsh/element/bwmeta1.element.desklight-14a539f6-51af-4d89-829c-6481909bda5d/c/11_B5_Sarhad.pdf

Lin, S., Riccardi, W.N., Wang, C., Hopkins, P.E. and Kabureck, G., 2019. Relative effects of IFRS adoption and IFRS convergence on financial statement comparability. Contemporary Accounting Research, 36(2), pp.588-628. Available at: https://www.ifrs.org/content/dam/ifrs/events-and-conferences/2016/october/research-forum/car-session-3-steve-lin.pdf

Lucchese, M. and Carlo, F.D., 2020. Inventories Accounting under US-GAAP and IFRS Standards: The Differences That Hinder the Full Convergence. International Journal of Business and Management, 15(7), pp.180-195. Available at: https://pdfs.semanticscholar.org/7e59/e57a7a1a3e7c302e971cdee0642f4d799956.pdf

Pignatel, I. and Tchuigoua, H.T., 2020. Microfinance institutions and International Financial Reporting Standards: an exploratory analysis. Research in International Business and Finance, 54, p.101309. Available at: https://www.sciencedirect.com/science/article/am/pii/S0275531920302415

Prather-Kinsey, J., Boyar, S. and Hood, A.C., 2018. Implications for IFRS principles-based and US GAAP rules-based applications: Are accountants’ decisions affected by work location and core self-evaluations?. Journal of International Accounting, Auditing and Taxation, 32, pp.61-69. Available at: http://www.anthonychood.com/wp-content/uploads/2018/03/Prather-Kinsey-2018-JIAAT-CSE-Accounting.pdf

Saha, A., Morris, R.D. and Kang, H., 2019. Disclosure overload? An empirical analysis of International Financial Reporting Standards disclosure requirements. Abacus, 55(1), pp.205-236. available at: https://www.researchgate.net/profile/Amitav-Saha-2/publication/331955573_Disclosure_Overload_An_Empirical_Analysis_of_International_Financial_Reporting_Standards_Disclosure_Requirements/links/605e6932a6fdccbfea0b4352/Disclosure-Overload-An-Empirical-Analysis-of-International-Financial-Reporting-Standards-Disclosure-Requirements.pdf

Salah, W., 2020. The international financial reporting standards and firm performance: A systematic review. Applied Finance and Accounting, 6(2), pp.1-10. Available at: https://core.ac.uk/download/pdf/327332347.pdf

Simpson, A. and Tamayo, A., 2020. Real effects of financial reporting and disclosure on innovation. Accounting and Business Research, 50(5), pp.401-421. Available at: https://www.tandfonline.com/doi/pdf/10.1080/00014788.2020.1770926

Subiyanto, B. and Ghozali, I., 2021. Empirical Study of the Relationship between Managerial Accounting Discretion and Innate Factors with the Quality of Financial Reporting. DEGRES, 20(1), pp.59-73. Available at: https://www.degres.pw/index.php/asbl/article/download/4/4

Tsalavoutas, I., Tsoligkas, F. and Evans, L., 2020. Compliance with IFRS mandatory disclosure requirements: a structured literature review. Journal of International Accounting, Auditing and Taxation, 40, p.100338. available at: https://www.researchgate.net/profile/Ioannis-Tsalavoutas/publication/338357435_Compliance_with_IFRS_mandatory_disclosure_requirements_a_structured_literature_review/links/5e84c9a8a6fdcca789e60c06/Compliance-with-IFRS-mandatory-disclosure-requirements-a-structured-literature-review.pdf

Ugwu, J.I. and Okoye, E.I., 2018. Accounting for the effect of foreign direct investment on economic growth, post IFRS adoption in selected Sub-Saharan African countries (1999-2015). International Journal of Academic Research in Accounting, Finance and Management Sciences, 8(2), pp.73-94. Available at: http://eprints.gouni.edu.ng/1382/1/ugwu%20and%20prof%20Emma.pdf

Websites

Ifrs.org, 2021, About IFRS, Available at: https://www.ifrs.org/content/dam/ifrs/around-the-world/adoption/use-of-ifrs-around-the-world-overview-sept-2018.pdf [Accessed on: 8 January, 2022]

Know more about UniqueSubmission’s other writing services: