BE167-7-SP TEST ANSWER SHEET SAMPLE

Section A

Question 1

- Sales budget and production plan for Being Healthy for the first quarter of 2023.

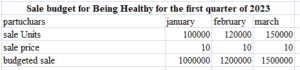

Below is the sale budget has been provided for Being Healthy for the first quarter of 2023.

Figure 1: Budgeted sales

(Source: self-created)

The above figure has reflected the budgeted sales for Being Healthy which reflects that the company is expecting a steady growth for the next three months as the budgeted sales for January was £100000, for February it was calculated as £120000 and for March it has been £150000.

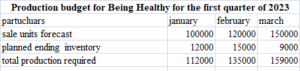

Figure 2: Production plan

(Source: self-created)

The figure illustrated above is depicting the production budget for Being Healthy where, the CEO decided to change the inventory to 10% for each month’s sale. However, the total production required for each month has been calculated as £112000, £135000, and £159000 respectively.

- Advice on short and long-term cash flow problem and recommendation for a good cash flow management system

Minimizing the cash flow poblems

It is essential for any business to be able to manage its cash flow. Cash flow is the lifeblood of any business, and having good cash flow is key to a business’s success. Poor cash flow can lead to major problems in the short-term and long-term. In the short term, poor cash flow can lead to a business not being able to make timely payments on bills, taxes, and loans. This can lead to late payment penalties, as well as creditors demanding payment and even taking legal action. In addition, poor cash flow can lead to a business not being able to purchase necessary supplies, which can lead to a disruption in business operations.

In the long term, poor cash flow can lead to a business not being able to invest in necessary resources such as new equipment and staff. This can lead to a business not being able to grow and compete effectively in their industry. In addition, poor cash flow can lead to bankruptcy and the closure of the business. To minimise the risks of short and long term cash flow problems, it is essential for business owners to be healthy. This means staying on top of their finances and making sure that they are collecting payments from customers on time and paying bills on time. In addition, business owners should ensure that they are not taking on too much debt and that they have sufficient cash reserves.

It is also important for business owners to understand the importance of budgeting and forecasting. This will help them to better manage their cash flow and anticipate any potential problems. Finally, business owners should consider using software to help them manage their cash flow, as this can help identify potential problems before they become major issues. It is essential for Being Healthy that business owners take the necessary steps to ensure that their cash flow remains healthy. By doing this, they can minimise the risks of short and long term cash flow problems.

Recommendation for a good cash flow management system

Cash flow is an important part of any business, and Being Healthy is no exception. A good cash flow management system can help the company budget, track, and plan for upcoming expenses, allowing for more accurate forecasting and better decision-making.

The first step in implementing a good cash flow management system is to create a budget. This should include all expected income and expenses for the upcoming months, along with future projections. Being Healthy should review their budget regularly to ensure that it remains up-to-date and accurate. Once the budget has been created, Being Healthy should track their cash flow on a regular basis. This can be done manually, or through software. Tracking cash flow will enable the company to identify any unexpected changes in the budget, and adjust their spending accordingly.

Being Healthy should also plan for future expenses. This helps the company avoid unexpected costs and plan accordingly. They should also consider setting aside a portion of their profits for emergencies, such as unexpected expenses or business downturns. Finally, Being Healthy should consider investing in a cash management system, such as QuickBooks or Xero. These systems provide detailed insights into cash flow, allowing for more accurate forecasting and better decision-making.

By following these steps, Being Healthy can ensure that their cash flow is managed effectively, helping them to stay profitable and successful.

Question 3

- Relevant calculations

- i) Accounting rate of Return (ARR)

ARR = Average annual operating profit*100/investment

Colchester = (120000+150000+100000+90000+110000)/5

= 570000/5

= 114000

ARR = 114000*100/1000000

ARR = 11.4%

Southend = (150000+90000+100000+80000+70000)/5

= 490000/5

= £98000

ARR = £98000*100/1000000

ARR = 9.8%

- ii) Payback period

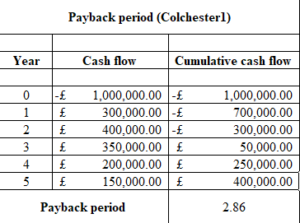

Payback period for Colchester

Figure 3: Payback period

(Source: self-created)

Payback period = 2 years + (300000+350000)

= 2.86 years

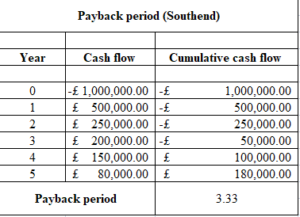

Payback period for Southend

Figure 4: payback period

(Source: self-created)

Payback period = 3 years+ (50000+150000)

= 3.33 years

iii) Net present value for both the projects

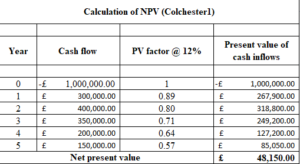

NPV calculation of Colchester

Figure 5: NPV calculation

(Source: self-created)

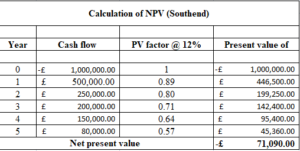

NPV calculation of Southend

Figure 6: NPV calculation

(Source: self-created)

- b) Recommendation for chosen project

The decision between two potential projects should be based on a comparison of their respective Net Present Value (NPV) and Payback period. In the case of the two projects under consideration, Colchester and Southend, the NPV of the Colchester project is 48150 while the NPV of the Southend project is 71090. Similarly, the payback period for the Colchester project is 2.86 years while that for the Southend project is 3.33 years.

Based on this data, it can be said that the Southend project has a higher NPV and a longer payback period. This indicates that Southend might be the better option for investment, since it has a higher NPV (which indicates a higher return on investment) and a longer payback period (which indicates a longer period of time before the initial investment is recouped). However, it is important to note that the higher NPV of Southend comes at the cost of a longer payback period. As such, it is important to consider the specific goals and objectives of the project before selecting which one to invest in. If the goal is to quickly recoup the initial investment, Colchester might be the better option since it has a shorter payback period. On the other hand, if the goal is to maximize the return on investment, then Southend might be the better option due to its higher NPV.

In conclusion, the decision between the two projects should be based on a comparison of their respective NPV and payback period. While Southend has a higher NPV and longer payback period, the specific goals and objectives of the project should be taken into account before selecting which one to invest in.

Section B

Question 4

Gold has been a form of investment since the dawn of time. Gold has a unique combination of characteristics that make it an attractive asset class. It is a physical asset that has a finite supply, is highly liquid, and is not subject to the same levels of volatility experienced by other assets such as stocks, bonds, and commodities. Gold also has a long history of serving as a store of wealth and a hedge against inflation. The practice of investing in gold has its pros and cons. On the plus side, gold has a long history of being a reliable store of value and has traditionally been used as a hedge against inflation. Additionally, gold is a physical asset that has a finite supply, which can help preserve its value over time. Gold also has a low correlation with other asset classes, meaning it can provide diversification benefits to a portfolio.

On the other hand, investing in gold comes with certain risks. Gold prices are highly volatile, and investors can lose money if they do not time their investments correctly. Additionally, gold is not a productive asset, meaning it does not generate cash flow or income, so it can be difficult to measure the performance of a gold investment.

Payback period:

The concept of payback period is a timeframe used to calculate the amount of time it takes to recoup the original investment made in an asset. This is generally used for investments in fixed assets. The payback period for a gold investment can be estimated by looking at the current spot price of gold, the amount of the original investment, and the expected return on the gold investment.

Accounting rate of return:

The accounting rate of return (ARR) is a measure of the return on an investment relative to the amount of capital invested. The ARR for a gold investment can be calculated by dividing the expected return on the gold investment by the amount of the original investment.

Net present value:

The net present value (NPV) is a measure of the present value of an investment’s future cash flows. The NPV of a gold investment can be calculated by subtracting the cost of the investment from the present value of the expected cash flows.

In conclusion, investing in gold can provide a variety of benefits, such as being a reliable store of value and providing diversification benefits to a portfolio. However, gold is a volatile asset and is not a productive asset, meaning it does not generate cash flow or income. Investors should consider the concept of payback period, accounting rate of return, and net present value before making an investment in gold.

Question 5

The decision of which budgeting method is suitable for the Chancellor of the Exchequer of the United Kingdom depends on the situation and the circumstances. In the UK, the Chancellor of the Exchequer is responsible for setting fiscal policy, managing the public finances, and managing the economy. This requires a careful balancing act between spending and taxation, and a careful consideration of the economic and political context in which decisions are made.

Incremental budgeting is the traditional budgeting method used by the British government. Incremental budgeting works on the basis that budgets are based on the existing spending levels. This means that the existing budget will be adjusted by a predetermined rate of increase or decrease. This method of budgeting allows the government to adjust spending and taxation levels in order to meet the changing needs of the population, while ensuring that the public finances remain in balance. This method of budgeting also allows the government to respond quickly to changing economic and fiscal conditions, as the budget can be adjusted to reflect the changing needs of the population and the government’s fiscal objectives. However, However, Incremental budgeting has several drawbacks. First, it relies heavily on existing spending levels. This means that new initiatives or projects may be overlooked or underfunded. It also has a tendency to perpetuate inefficiencies, as departments may not be motivated to streamline their operations. Moreover, it is often difficult to accurately assess the cost of new projects within the confines of an incremental budget. Finally, incremental budgeting does not necessarily take into account external factors that may affect a budget, such as changes in the economy or shifts in business strategy. This can lead to a budget that is not adequately prepared for potential changes.

Zero-based budgeting is a relatively new budgeting method that has been gaining traction in recent years. Zero-based budgeting works on the basis that budgets are based on zero spending levels. It also has some drawbacks such as Zero-based budgeting can be time consuming and labor intensive. It requires a lot of detailed analysis and documentation that can be costly and time consuming. It can also be difficult to implement in large organizations, as it requires a high level of coordination between departments. Additionally, it may be difficult to accurately predict future costs, as data from previous years may not accurately reflect future trends. Lastly, it may require a significant amount of resources to maintain and update the budget on a regular basis. Overall, zero-based budgeting can be beneficial, but it is important to consider the drawbacks before implementing the system.

Therefore, an incremental budget will be good choice for the Chancellor of the Exchequer of the United Kingdom since, it will be less time consuming and complex.

Know more about UniqueSubmission’s other writing services: