Here is Sample of BE284 Strategic Management Assignment

Introduction

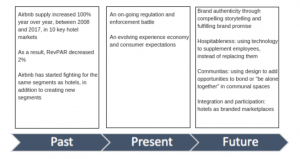

As a consequence of the rise of Airbnb, the hotel industry is being pushed to rethink its very existence as well as its long-term financial viability, which is a terrible position to be in at this moment in time. A study conducted by Dogru, Mody, and Suess found that between 2008 and 2017, hotel RevPAR decreased by 0.02 percent across all sectors, including the hospitality business. This occurred during a period during which Airbnb supply expanded by 1 percent (2018). The report notes that the number of available Airbnb rooms rose by more than 100 percent when compared to the previous year, implying that the “real” loss in RevPAR for hotels of all sorts during this time period was just 2 percent (Strømmen-Bakhtia,r2019), according to the authors.

Business overview

As a consequence of the increased availability of Airbnb, many industry watchers expected a 4 percent reduction in real revenue per available room (RevPAR) for luxury hotels. This, on the other hand, turned out to be a wildly erroneous prediction. Even though Airbnb had a less significant effect than expected on the overall average daily price and occupancy rates than expected, the overall impact was still significant, as projected. In response to the growing availability of Airbnb lodgings in Boston, the city’s RevPAR has declined by 2.5 percent over the prior decade, a fall that has been ascribed to the increased availability of Airbnb apartments. As a consequence of the increasing popularity of Airbnb, hotels witnessed a 2.5 percent decrease in revenue per available room (RevPAR) in 2016. In response to the worldwide economic slump, revenue per available room (RevPAR) has decreased by 4.3 percent for midscale facilities and by 2.3 percent for luxury establishments. In addition, the increase in availability assists Airbnb’s attempts to increase its portion of the hotel industry’s market share by boosting the availability of its properties. The city of New York reported that, during the first three months of 2016 (Alrawadieh,2022).

PESTEL

In the last year, the number of Airbnb listings has increased by more than one hundred percent, with the United States proving to be the firm’s most successful market to yet, according to data from the company.

| P | Its most major opponents in the Chinese market are two of the company’s local competitors, Tujia and Xiaozhu, both of which are based in the country. |

| E | According to the firm’s website, the company has substantial expansion potential in growing markets such as Africa and India, among other places. |

| S | According to reports, Niido, the company’s new hotel-like brand, is aimed at real estate developers who want to convert whole buildings into Airbnb flats rather than individual units, rather than individual units (Anwar,2018) |

| T | It is critical for the business’s long-term viability that it does not become overly regulated as a consequence of the significant economic advantages given by Airbnb. Otherwise, the industry will lose its competitive edge. (Doggrell2020)

|

| E | The good news for those who reside in the United States is that Airbnb will not continue to grow at its current rate indefinitely and will eventually reach a point where it will become saturated. Inevitably, the firm will hit saturation, which will be a detrimental outcome (Anwar,, 2018a). |

| L | A direct result of the present situation, the company has resolved that in order to survive, it must investigate new techniques of expanding supply levels. |

VRIO

In return for their efforts, renters who list their houses on the various websites of Airbnb and Niido each get a 25 percent part of the money collected by the respective companies.

| V | This property has been subjected to a comprehensive study and assessment in terms of quality, design, maintenance, and a range of other features and amenities. The results of this examination and evaluation are available here. |

| R | By offering Airbnb Plus, the firm has pushed beyond its core concept of “targeting a different market” in order to capture sectors that have historically been targeted by hotels, such as the leisure family market, business travellers, and rich tourists, to mention a few examples. |

| I | The lack of information about efficient techniques for regulating these improvements in the sharing economy has led to growing worry about the risk of over-regulating Airbnb, which might restrict the company’s capacity to expand further.

|

| O | These are the ones to look out for: Other topics that are brought up in this book include customisation, communitas, localness, hospitability (both real and virtual), chance, and ethical consumerism, to mention just a few (to name a few). |

Porter Value Chain model analyse

- It has received a favourable review. Additionally, they give a quick and efficient check-in process, as well as high-speed internet access and fully-equipped kitchens for the convenience of its guests, among other things. 4.8 or higher on TripAdvisor, and they are well-known for going above and beyond to ensure that their travellers have a pleasant experience while in their company.

- On the company’s website, visitors may book Airbnb Experiences, which include a range of activities such as hiking, surfing, and food and wine excursions, among others. Budget-friendly vacation lodgings such as yurts, treehouses, and boats are just a few of the unusual housing options accessible to individuals looking for adventure and uniqueness in their vacation accommodations.

- Contrary to their best efforts, traditional hotel companies will be unable to compete on any level in this industry, regardless of their size.

- Users who fall into this category now have access to a new market as a result of the efforts of Airbnb, which has “created” one for them.

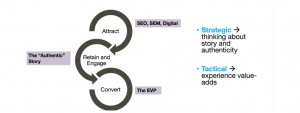

- In order to grow sales, marketing and experience designers must first determine what the consumer gets out of their travel experience before introducing new efforts to improve customer happiness with the product.

SWOT

| Strength

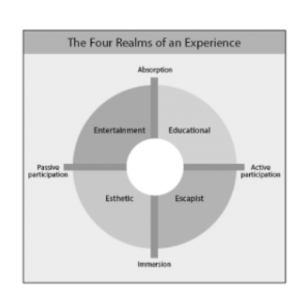

Upon reflection, when Pine and Gilmore invented the word “experience economy” in 1998, they were referring to an umbrella concept that included four components: escape from everyday life; educational opportunities; entertainment opportunities; and aesthetics

|

Weakness

They had a good idea what they were doing (Vieira,2018). These individuals were referring to the concept of “experience economy,” which is derived from the word “experiential economy,” which literally means “experiential economy.” |

| Opportunities

There are four components to the concept that these individuals were referring to: escape, education, entertainment, and a visually appealing appearance. It is feasible to make advantage of these features in order to give clients with distinctive experiences, which will result in increased client loyalty and repeat business

|

Threats

Several years of scientific investigation have led to these conclusions, which have been confirmed by the scientific community. Incorporating these themes into all of its contacts with customers in a fresh and creative manner has allowed Airbnb to radically change the experience economy. |

In part because of its strong emphasis on sharing and its ability to foster a sense of belonging among its clients, Airbnb has completely changed the landscape of the experience-oriented business as a whole. Airbnb’s popularity and profitability have resulted in the introduction of six new aspects of the experience economy into the framework of travel experiences. Among the many topics to take into account are: personalization, communitas, localness, hospitality, chance, and ethical consumerism, to name a few of the more prominent examples.

3 corporate strategies that Airbnb can pursue for the next 5 years

When the researchers of a recent study revealed that Airbnb had exceeded hotels in every section of this newly established and expanding housing market, they were taken aback (Mody et al., 2017). While hotels provide more flexibility in terms of customization, Airbnb outperforms them due to the vast number of houses and settings available, the ability to provide true micro-segmentation, and the capacity to find the “perfect match” between tourists and hosts (Dolnicar, 2018). Clients can expect a completely different experience each and every time they stay in one of the company’s properties because no two Airbnb homes are alike, further distinguishing them and enabling them to have a completely different experience each and every time they stay in one of the company’s properties. Airbnb flats provide a variety of benefits, including the opportunity to share space with other travellers and/or the host, as well as access to “the local”—that café or charming tiny firm that only locals are aware of. It is true that hotels can compete effectively on an equal basis with other companies in various sectors. However, the relationship between these dimensions and brand memorability was just as strong for both hotels and Airbnb as it was for other brands, demonstrating the importance of hotels engaging customers by leveraging “the right” dimensions for the brand — those that are consistent with the brand’s mission, story, and personality, for example — rather than simply leveraging “any” dimensions, as was the case for other brands.

how your suggested strategies, regarding to Airbnb’s culture and history

Mody, Suess, and Lehto conducted a study in which they discovered that when it comes to hospitability, both hotels and Airbnb are on an equal footing in terms of service and quality, no matter where you stay (2018). Guests are frequently not greeted by the host when they arrive at a property as a result of the growing number of “investment units” on the Airbnb platform; in addition, all communication is conducted electronically and with someone who “manages” the Airbnb unit rather than with someone who owns or lives in it.

Institutions that place a high value on the human aspect (such as cheery check-in personnel or helpful concierges) generate more positive sentiments in their clients, which results in stronger brand loyalty among those who continue to utilise the organisation. Although we are living in an age of unprecedented brand proliferation, it is still vital to consider the highly technological, highly personalised experience that hotel brands seek to create when establishing new product or service offerings (Oe2021).

It is vital to do further research from the viewpoint of someone who is unfamiliar with the subject matter under consideration. A public petition for Airbnb to be taxed and regulated was filed in 2016 by the American Hotel & Lodging Association (AH&LA), after years of denial that the service was a rival to the hotel sector. Since the hotel lobby and other community organisations began exerting political influence on the governments of their respective countries, both in the United States and around the globe, it has only been a few years. On the other hand, this is a tendency that is increasing. According to the academics Nieuwland and van Melik, short-term rental authorities in 12 European and American cities have exercised little or no control over their operations to yet, despite the fact that they are regulated by law. They carried out their investigation in attempt to learn the truth about the situation (2018).

It is claimed that Airbnb’s growth has had a bigger influence on neighbourhoods and communities than the levelling of the playing field with hotels that has come as a consequence of the company’s expansion in terms of competitiveness, which has occurred as a result of Airbnb’s expansion (Nguyen,2021). On the legal front, there have been a number of barriers encountered in the legalisation of the peer-to-peer economy, particularly when it comes to its implementation. According to New York City’s Multiple Dwelling Law, renting an apartment for less than 30 days is against the law, provided the landlord plans to utilise the unit for his or her own personal purposes. While “entire homes” are defined as properties that do not have a live-in host in principle, according to the firm, there are still “entire houses” accessible on Airbnb in New York City, despite the fact that they are characterised as properties that do not have a live-in host (Curtis2020).

Recommendations

One cannot exaggerate the significance of a company’s customer loyalty programme, and it is even more difficult to emphasise how critical it is to the overall success of a company’s customer loyalty programme. For loyalty programmes to go beyond programmatic levels and fully personalise the brand experience for each individual guest, predictive analytics, visitor history, social media, and other marketing data sources must be leveraged in concert with other data sources. The integration of game-like aspects into loyalty programmes is essential for them to stay relevant in today’s era of rapid gratification (Neuts,2021).

According to the hotel industry, as part of its goal to compete in the home sharing market, it intends to ultimately integrate platform business models at the corporate level rather than only at the level of individual brands in order to scale. In spite of the fact that Accor bought Onefinestay, Marriott has partnered with Hostmaker to build Tribute Portfolio Homes, which is an example of this kind of relationship. As a consequence, since its beginning, the alliance has expanded to include four more European locations (Fox, 2018).

Conclusion

It is understandable that organic brand growth is a key component of the new Accor Jo & Joe brand, and that the new brand is intended to be analogous to the sharing economy within the confines of a traditional hotel room, which is similar to the sharing economy outside the confines of a traditional hotel room. Incorporating the sharing economy ethos into a hotel by establishing a “Airbnb floor,” which would be the polar opposite of a hotel’s club floor in that it would not include housekeeping or other hotel amenities and would, as a result, be marketed at a lower price, would be an additional more innovative and risky method of infusing it into the hotel. In light of the fact that hotel brands are increasingly acting as “branded marketplaces” for lodging rather than just as manufacturers of hotel rooms, it is feasible that selling hotel rooms on other accommodation platforms may prove to be profitable in the long term. Bed and breakfasts and boutique hotels are offered via the Expedia Affiliate Network, while hotel rooms are available through the company’s Airbnb platform, which offers a more diverse selection of accommodations.

References

Alrawadieh, Z., Guttentag, D., Cifci, M.A. and Cetin, G., 2020. Budget and midrange hotel managers’ perceptions of and responses to Airbnb: evidence from Istanbul. International Journal of Contemporary Hospitality Management.

Anwar, S.T., 2018. Growing global in the sharing economy: Lessons from Uber and Airbnb. Global Business and Organizational Excellence, 37(6), pp.59-68.

Congel, S., Clark, K. and Cizeau, M., 2019. How Three Millennials Revolutionized a Global Industry.

Curtis, S.K. and Mont, O., 2020. Sharing economy business models for sustainability. Journal of Cleaner Production, 266, p.121519.

de Paula, C.M., Zuppo, C.P.I. and Francisco, E.R., 2020, October. Pricing strategy on AirBnb based on the Spatial Influence of Touristic Attractions in New York. In CLAV 2020.

Doggrell, K., 2020. Checking Out: What the Rise of the Sharing Economy Means for the Future of the Hotel Industry. Bloomsbury Publishing.

Hoffman, R. and Yeh, C., 2018. Blitzscaling: The lightning-fast path to building massively valuable companies. Currency.

Neuts, B., Kourtit, K. and Nijkamp, P., 2021. Space Invaders? The Role of Airbnb in the Touristification of Urban Neighbourhoods. In Tourism and Regional Science (pp. 103-125). Springer, Singapore.

Nguyen, T.T.N., 2020. Business Plan-Travelholic Oy-An Online Travel Agency for Tour Operator in Vietnamese Market.

Oe, H., 2021. The innovative organisation of Airbnb: Business model innovation and holacracy to enhance innovative business behaviour coping with the impact of the COVID-19. International Journal of Business Innovation and Research.

Strømmen-Bakhtiar, A. and Vinogradov, E., 2019. The effects of Airbnb on hotels in Norway. Society and Economy, 41(1), pp.87-105.

Sutherland, I. and Kiatkawsin, K., 2020. Determinants of guest experience in Airbnb: a topic modeling approach using LDA. Sustainability, 12(8), p.3402.

Vieira, K.C., Pinto, G.A., Sugano, J.Y., Carvalho, E.G. and Grutzmann, A.A., 2021. Does Network Effect Have an Influence on the Acceptance of Airbnb?. Global Business Review, p.0972150920988654.

Wisker, Z.L., Kadirov, D. and Bone, C., 2019. Modelling P2P Airbnb online host advertising effectiveness: the role of emotional appeal information completeness creativity and social responsibility. International Journal of Culture, Tourism and Hospitality Research

Know more about UniqueSubmission’s other writing services: