BE553 Principles of International Marketing Sample

Introduction

The pandemic of covid-19 seems to be having adverse impact on several sectors in the global; scenario. It led to the sales decline, demand decline and others that created several difficulties for the companies to operate in the global scenario. MNEs (Multinational Enterprise) seem to be mostly affected by the pandemic and the companies are having global presence and decline in sales and revenue can impact the sustainability of the business.

In this respect, the current study will be analysing the impact and challenges faced by British Petroleum, a famous MNE of the oil and gas sector. Starting from an overview of the company, the study will be presenting the covid-19 impact on the company and industry further analysing the current trends within the domain after the pandemic. In addition to this, the study will also be presenting the factors leading to the changes within the marketing and internationalization strategies. Lastly, suitable recommendations will be suggested to tackle the impact of covid-19 on the business.

Overview of the company

British Petroleum (BP) is a famous MNE under the oil and gas sector operating since 1909 (British Petroleum, 2021). The company is headquartered within the domain of London, UK and has an international presence. In the current scenario, the company is known as BP Plc after it merged with Amoco back in 1998 (British Petroleum, 2021). The purpose of the company deals with reimagining energy for the people around the world (British Petroleum, 2021).

However, the goal of the company in the current scenario deals with the aspects of reaching Net Zero by the end of 2050 (British Petroleum, 2021). In this respect, the company aims at the reduction of the carbon usage from the operations carried out by the company. In addition to this, the services of the company also support the aspects of sustainability within the market so that they can be effective in meeting the needs of the customers in the future as they are meeting it in the current scenario.

International operations of the company deals with the production of hydrocarbon energy at an affordable range, further maintaining high safety and efficiency within the operations (British Petroleum, 2021). The vision of the company deals with becoming the leading producer of hydrocarbon business. However, the transition of the company in this respect deals with the transformation of the company to an integrated energy company from an international company of oil and gas.

The service of BP also includes trading, power generation, marketing and distribution, refining production and exploration (British Petroleum, 2021). Subsidiaries of BP include BPX Production Company, Aral, Castrol, and others. Through its operations, the company earned revenue of $37.867 billion as of 2021 that further is considered to be an increase of 44.18% from the previous year that is 2020 after the pandemic (Macrotrends, 2021). Henceforth, the company is operating successfully, further having an international presence.

Discussion

Challenges and impact of covid-19 on the company and the industry

Covid -19 created several challenges for the business to operate smoothly within the targeted markets. According to Esfandiari & Rezvani (2021), the prevalence of lockdown due to covid have restricted the amount of travel around the world that also lead to a challenging situation for the oil and gas sector within the world. In this respect, BP also faced certain challenges in its operations. One of the main challenges faced by BP is the management of workforce within the domain. In response to covid-19, the company has been observed to be cutting 10000 jobs (BBC News, 2021). As the company employs around 15000 people within the domain of the UK, therefore, cutting 10000 people from the UK segment seems to be a challenging situation for the organisation. The management of the shareholders of the company also seems to be a challenging situation as the company has to pay a $0.11 dividend per share (BBC News, 2021).

As a result of this, the company seems to be reporting its first loss of $5.7 billion within the decades of its operation (Bousso & Nasralla, 2021). Other than that, 20$ low volumes of sales and demand also were a challenging situation for the company after having a successful year of operations in 2019 (Bousso & Nasralla, 2021). It is because, Cortez & Johnston (2020) stated that low margin of employees is likely to decrease the level of production amount and also creates delay in delivering the targeted goals. Due to covid, the company also experienced a restricted demand on the refined products within the market. As a result of this, BP was also forced to be cutting its assets value by $6.5 billion (Ambrose, 2021). Other than that, followed by a loss of $4.9 billion, BP faced a huge loss in its non operating charges that depicts an amount of $18.1 billion for 2020 (Ambrose, 2021). Apart from that, challenges have also been faced by BP in its prices of Brent Crude that depict lower value than $20 for a single barrel. Lastly, due to a 5% tumble on the share price of the company to 254p as its equity, the company faced a debt of $40 billion in the same year (Ambrose, 2021). Henceforth, the company seemed to face huge challenges of covid 19 that impacted its operations adversely.

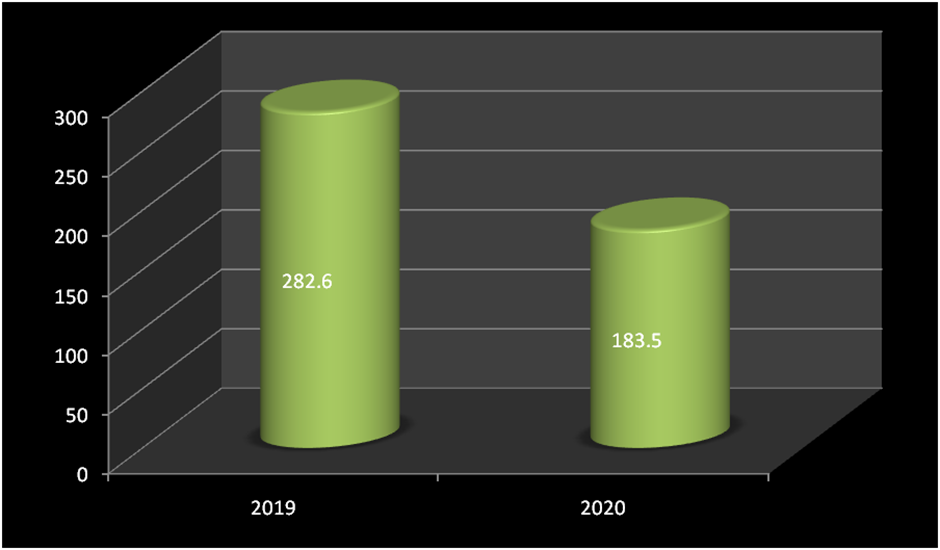

Figure 1: Revenue of BP (in $ billions)

(Source: Influenced by Macrotrends, 2021)

Based on the figure above it can be seen that the revenue of BP as of 2020 depicts $183.5 billion that is considered to be lower by 35.07% from 2019 (Macrotrends, 2021). It is because the revenue gained by the company as of 2019 depicts $282.616 billion (Macrotrends, 2021). This is considered to be a serious impact of the challenges faced by the company during the pandemic situation. On the other hand, the impact of covid situation on BP can also be measured through the gross profit aspects of the company. As of 2020, gross profit of BP reflects $28.270 billion that is considered to be declining by 43.11% from 2019 that further reflects a gross profit margin of $49.582 billion (Macrotrends, 2021)

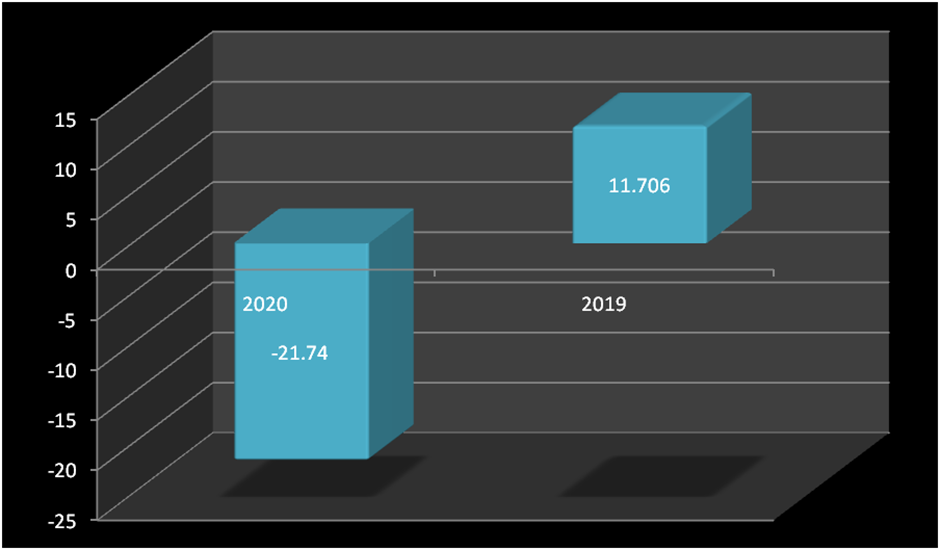

Figure 2: Operating loss of BP (in $ billions)

(Source: Influenced by Macrotrends, 2021)

Additionally, the company seems to be mostly impacted in the aspects of its operating loss. As of 2020, the operating loss of the company reflects -$21.74 billion that seems to be 285.72% less from 2019 as the operating system of 2019 depicted $11.706 billion (Macrotrends, 2021). In addition to this, the company also seems to be impacted in its asset value within the market. As of 2020, the asset value of the company reflects $267.654 billion that is further observed to be declining from 2019 by 9.33% further reflecting an asset value of $295.194 billion as of 2019 (Macrotrends, 2021) . Hence, the prevalence of covid-19 seems to create a huge impact on the operational domain of BP.

Figure 3: Brent crude price per barrel

(Source: BBC News, 2021)

The industry of oil and gas is observed to be experiencing third collapse in the aspects of its price and demand after its successful 12 years of operations due to covid. The industry seemed to be properly recovered after its second wave of loss (BBC News, 2021). However, the current situation depicted an unprecedented drop of the demand followed by a crisis of humanitarians that provided high supply shocks to the overall oil and gas sector globally (Barbosa et al., 2020). This further impacted the sector through the fall of revenue by 50% to 85% in 2020 (OECD, 2020).

Based on the figure above it can also be observed that the prices of Brent Crude decreased in 2020 further depicting a high crisis within the oil and gas sector globally. In addition to this, the global oil and gas sectors is highly impacted by the market share that resulted in $1830389.8 million as of 2020 that further is considered to be lower than 2019 that reflects a market share of $2892021.2 million (IBIS World, 2021). Henceforth, it can be stated that the prevalence of covid scenario is impacting the operational instances of the overall oil and gas sector.

Trends seen after the pandemic

The prevalence of covid-19 as can be depicted from the section above has created a huge impact on the operational domain of BP. In this respect, the company has been mobilising the ways of operations across the world with the help of three objectives. These include protecting the people of the company and the nation, supporting different communities further depicting the approach of working together and strengthening the finances so that the business can maintain high sustainability and meet the demands of the customers (British Petroleum, 2020). However, with the objectives, the company has also been taking certain actions to manage the covid situation within the domain. In this respect, one of the new trends of the company involves protecting the people that further includes changing the pattern shift of the employees in order to maintain social distancing aspects (British Petroleum, 2020). It also involves safe isolation, increasing the aspects of testing before entering the work premises alongside restricting full access to the workplace and others.

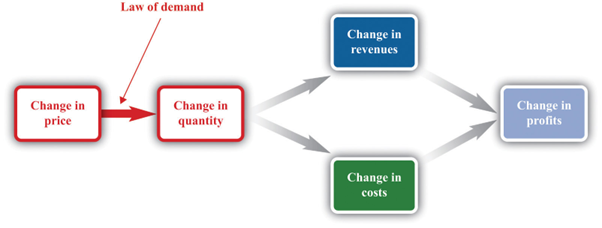

Figure 4: Model of revenue and sales

(Source: Cortez & Johnston, 2020)

Other than that, the company also deals with the boosting of the precaution of the staff alongside the people through the aspects of increased cleaning, protective equipment usage, and others. Other than that, the trends of the company also deal with the support of the community and strengthening the financial aspects of the company so that BP can be effective in meeting the future demand for the oil and gas and satisfy the customers within the domain. Besides that, low prices of the fuels have also been a new trend of the overall industry after the pandemic. It is because, as of previous year that is 2019, the price of a Brent crude barrel reflects $75, and the recent trends of the price of a barrel after the pandemic reflect $5 a barrel (British Petroleum, 2020). It is because, the price mainly depends on the demand within a market. As per Ritter & Pedersen (2020), low demand of a products and services tends to be reflects low prices while reflecting high quality of the products.

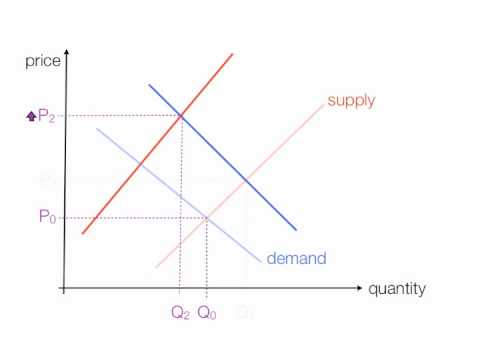

Figure 5: Theory of demand and supply

(Source: Ghalehkhondabi & Maihami, 2020)

Based on the theory of demand and supply, high demand reflects high supply while low demand reflects low supply. However, as argued by Crick & Crick (2020), high prices of the goods and services seem to be lowering the demand alongside the supply. In this respect, lowering the prices is done by BP and the overall oil and gas sector seems to be increasing the demand and supply further providing the company with the benefit of gaining high margins of revenue.

Henceforth, the current trends or the new normal of the company and industry after the pandemic reflects proper execution of the targets through maintaining the covid-19 standards while lowering the prices so that the demand rises and the company can effectively mitigate the losses faced during the pandemic situation.

External and internal factors driving changes within BP’s marketing and internationalization strategy

Internal alongside external factors seems to be serving as the key aspects of maintaining the marketing and internationalisation changes within the domain of BP after the pandemic situation. Supporting the communities seems to be one of the external factors that drive changes within the strategy of marketing and internationalisation within the domain of BP. The company donated $2 million to the Solidarity Response Fund of covid-19 in order to manage the international response of covid (Ghalehkhondabi & Maihami, 2020).

In addition to this, the company also deals with providing free fuels to the air ambulance and other emergency services within the domain of Spain, UK, Belgium, France, Germany and others (British Petroleum, 2020). This is also an external factor that contributed to the change in the strategy of internationalisation and marketing.

It is because, Dochev et al. (2019) depicted that providing free fuels is a strategy of promotion that will equally help the community in managing covid instances as well. In addition to this, the company is also providing free foods, high support to the taxi drivers, convenience goods, and others.

Moreover, the divestment program introduced by BP is also considered to be one of the internal factors leading to the changes within the marketing and internationalisation aspects of the company. By the end of 2020, the company invested $10 billion through the program of divestment (British Petroleum, 2020). Besides, the strategy of cost savings has also been implemented by the company due to the current pandemic of covid. In this respect, the company is expected to save $2.5 billion by the end of 2021 (British Petroleum, 2021).

Based on the stated instances it can be observed the current company is adopting the strategy of promotion by providing free fuel to several countries. This is helping the company to manage the covid instances around the world further creating high image and awareness globally. Contrary, the legal system is also influencing the operating domain of the company. In this respect, the Litigation Reform Act of 1995 reform in order to maintain the aspects of safe harbour also influenced the marketing and strategy of internationalisation within the domain of BP (British Petroleum, 2020). Henceforth, it can be stated that certain internal and external factors seem to be influencing the marketing alongside the internationalisation strategy of BP.

Conclusion and Recommendation

From the study above it can be concluded that prevalence of covid-19 scenarios have impacted most business organisations. BP is a famous MNE headquartered in the UK and operating successfully since 1908. Considering the scenario of BP, the company has been highly impacted by 10000 employee cut downs while having severe impact on the revenue and sales margin.

Loss of $5.7 billion faced by BP depicts its first loss in several years of successful operations. This also impacted on the revenue, assets and sales margin of the company that created high uncertainty in maintaining the level of sustainability within the domain. In addition to this, the new trend of the company includes lowering the price of the Brent crude to $55 a barrel from $75 per barrel. Other than that, the company is also following the trends of the covid-19 guideline further implementing high protective measures in executing the targeted goals.

However, the current issues faced by the company in terms of low prices of the products and services further resulting in low revenue can be assumed to be a result of low demand within the market due to travel restrictions. In this respect, the net zero aspects targeted by the company can be helpful in increasing the level of operations. Other than that, implementation of innovative values and technological instances within the operations will increase the speed and viability of production within the domain.

Moreover, the company can also implement training and development within the domain in order to develop the skills of the employees and increase the quality of the product and services; this will also be effective in increasing the demand and sales of the products within the market. Henceforth, through proper strategic instances, the company can be effective in managing the negative impact of covid on the business operations.

Reference list

Ambrose, J (2021) BP reports $5.7bn loss as Covid-19 pandemic hits oil demand, The Guardian, Online at: https://www.theguardian.com/business/2021/feb/02/bp-loss-covid-19-oil-demand Accessed 20 November 2021

Barbosa, F. Bresciani, G. Graham, P. Nyquist, S. & Yanosek, K (2020) Oil and gas after COVID-19: The day of reckoning or a new age of opportunity?, McKinsey& Company, Online at: https://www.mckinsey.com/industries/oil-and-gas/our-insights/oil-and-gas-after-covid-19-the-day-of-reckoning-or-a-new-age-of-opportunity Accessed 20 November 2021

BBC News (2021) BP to cut 10,000 jobs as virus hits demand for oil, BBC News, Online at: https://www.bbc.com/news/explainers-52966609 Accessed 20 November 2021

BBC News (2021) Coronavirus: Oil price collapses to lowest level for 18 years, BBC News, Online at: https://www.bbc.com/news/business-52089127 Accessed 20 November 2021

Bousso, R & Nasralla, S (2021) Covid-19 crisis: BP reports first loss in a decade after ‘brutal’ year, Business Standards, Online at: https://www.business-standard.com/article/international/covid-19-crisis-bp-reports-first-loss-in-a-decade-after-brutal-year-121020300063_1.html Accessed 20 November 2021

British Petroleum (2020) BP details COVID-19 response and provides market update, British Petroleum, Online at: https://www.bp.com/en/global/corporate/news-and-insights/press-releases/bp-details-covid19-response-and-provides-market-update.html Accessed 20 November 2021

British Petroleum (2020) COVID-19 BP response, British Petroleum, Online at: https://www.bp.com/en/global/corporate/news-and-insights/covid-19-bp-response.html Accessed 20 November 2021

British Petroleum (2020) Progressing strategy development, bp revises long-term price assumptions, reviews intangible assets and, as a result, expects non-cash impairments and write-offs, British Petroleum, Online at: https://www.bp.com/en/global/corporate/news-and-insights/press-releases/bp-revises-long-term-price-assumptions.html Accessed 20 November 2021

British Petroleum (2021) Aims, British Petroleum, Online at: https://www.bp.com/en/global/corporate/who-we-are/our-ambition/our-aims.html Accessed 20 November 2021

British Petroleum (2021) Ambition launch event, British Petroleum, Online at: https://www.bp.com/en/global/corporate/who-we-are/our-ambition/ambition-launch-event.html Accessed 20 November 2021

British Petroleum (2021) Production & operations, British Petroleum, Online at: https://www.bp.com/en/global/corporate/what-we-do/production-and-operations.html Accessed 20 November 2021

British Petroleum (2021) Purpose, British Petroleum, Online at: https://www.bp.com/en/global/corporate/who-we-are/our-purpose.html Accessed 20 November 2021

Cortez, R. M., & Johnston, W. J. (2020). The Coronavirus crisis in B2B settings: Crisis uniqueness and managerial implications based on social exchange theory. Industrial Marketing Management, 88, 125-135.

Crick, J. M., & Crick, D. (2020). Coopetition and COVID-19: Collaborative business-to-business marketing strategies in a pandemic crisis. Industrial Marketing Management, 88, 206-213.

Dochev, I. Seller, H. & Peters, I. (2019) Spatial aggregation and visualisation of urban heat demand using graph theory.: An example from Hamburg, Germany. International Journal of Sustainable Energy Planning and Management, 24.

Esfandiari, S & Rezvani, M. H (2021) An optimized content delivery approach based on demand–supply theory in disruption-tolerant networks. Telecommunication Systems, 76(2), 265-289.

Ghalehkhondabi, I. & Maihami, R. (2020) Sustainable municipal solid waste disposal supply chain analysis under price-sensitive demand: A game theory approach. Waste Management & Research, 38(3), 300-311.

IBIS World (2021) Global Oil & Gas Exploration & Production – Market Size 2005–2027, IBIS World, Online at: https://www.ibisworld.com/global/market-size/global-oil-gas-exploration-production/ Accessed 20 November 2021

Macrotrends (2021) BP Gross Profit 2006-2021 | BP, Macrotrends, Online at: https://www.macrotrends.net/stocks/charts/BP/bp/gross-profit Accessed 20 November 2021

Macrotrends (2021) BP Operating Income 2006-2021 | BP, Macrotrends, Online at: https://www.macrotrends.net/stocks/charts/BP/bp/operating-income Accessed 20 November 2021

Macrotrends (2021) BP Revenue 2006-2021 | BP, Macrotrends, Online at: https://www.macrotrends.net/stocks/charts/BP/bp/revenue Accessed 20 November 2021

Macrotrends (2021) BP Total Assets 2006-2021 | BP, Macrotrends, Online at: https://www.macrotrends.net/stocks/charts/BP/bp/total-assets Accessed 20 November 2021

OECD (2020) The impact of coronavirus (COVID-19) and the global oil price shock on the fiscal position of oil-exporting developing countries, OECD, Online at: https://www.oecd.org/coronavirus/policy-responses/the-impact-of-coronavirus-covid-19-and-the-global-oil-price-shock-on-the-fiscal-position-of-oil-exporting-developing-countries-8bafbd95/ Accessed 20 November 2021

Ritter, T., & Pedersen, C. L. (2020). Analyzing the impact of the coronavirus crisis on business models. Industrial Marketing Management, 88, 214-224.

Know more about UniqueSubmission’s other writing services:

I may need your help. I tried many ways but couldn’t solve it, but after reading your article, I think you have a way to help me. I’m looking forward for your reply. Thanks.