BMG704(86968) Assignment Sample – Department of Global Business and Enterprise 2022

Introduction

International finance environment (IFE) witnessed effective fluctuations in its module during issues in monetary policies and rigidity into the government regulating schemes. In this regard, it was observed as necessary to make certain modifications and developments to the IFE strategies. Keeping in mind, IFE started to make foreign exchange swaps which played a vital role to generate stability into its operational procedures.

Enhancements of certain developments in IFE helps to minimize threatening risk management issues, associated with the global financial marketing policies. Different finance sources and dividend policies of an organization seem to be affected by risk management factors. In this report, the financial performance of British American Tobacco (BAT) will be summarized to observe strengths and weaknesses of its business policies and marketing strategies.

Developments in the international finance environment (IFE)

Growth in money and equity markets

Positive fluctuation in IFE helps to stabilize policies related to money markets and extends funding procedures into organization marketing schemes. Changes in funding of financial market schemes observed in interbank lending schemes have a positive effect. In this regard, there was a positive change and significant growth in Benchmark Credit Swap (CDS).

As opined by Aziz et al. (2021), international financial factors have been positively impacted by the changes in the marketing factors and specifications of business policies. On the other hand, it has been observed that finance, macroeconomic issues, and investment policies tend to be increased in cooperation with development in IFE.

Along with the growth of international money market, certain growth in foreign markets and government schemes was observed. Rigidity to geographical location factor and barriers to entry in other countries minimized as well as enhancement of business opportunities seen in IFE.

Implementation of short-term investment rates

Application of short-term investment rates facilitates in generating advanced economic performances along with recession along financial and trading opportunities have observed here. Minimization of funds rate to 0.25 percent was a great initiative taken by IFE for developing international financial position (Globaldata.com, 2021).

As expressed by Ogbuji et al. (2020), the economic growth of a country is related to growth of money and capital market of that country as it tends to make positive changes in the operational and financial perspectives. Main operational refinancing rates have been reduced by 1.25% which generates a reduction in foreign market rates and economic liquidity of a country (Globaldata.com, 2021). Foreign market rates and classification of the marketing factors get impacted in a positive flow of financing factors.

A decrease in the outstanding amount by greater than 26% was a major positive change notified by development in IFE.

Impact of changes in IFE on BAT

British American Tobacco (BAT) has to export its key products to other countries to enhance its financial performance and make positive intentions into the business techniques. Relaxation of foreign exchange rates and marketing strategies have reduced barriers to a business. In addition, it can be observed that certain barriers related to non-tariff customs have been reduced due to the growth of the business perspectives and increased in the financial viability.

As narrated by Watson et al. (2018), growth in the international business strategies may help to make positive growth of the operational procedures and financial viability into the business strategies of an organization. Moreover, growth of components of financial position has positively impacted financial business procedures of BAT.

Foreign rate of exchange and international regulating system are considered as two most effective factors related to the promotion of the financial business structure and financial operational projection. Development in IFE helps to stabilize financial marketing factors and operational procedures which may be helpful for the operational procedures for the operational business and marketing classification tools to generate viability into the business projections.

BAT can be able to freely enter and exit into the foreign markets and there will not be financial rigidity in the operating procedures and business strategy. As narrated by Tolliver (2020), market growth drivers are positively affected by an increase in national growth factors and business techniques. On the other hand, it can be assured that international market and currency convertibility techniques have become more valid and flexible based on the growth of the operational procedures.

A business that helps with strategic marketing techniques and business issues. Collection of proper resources and business material is considered as a great strategic factor in the marketing development of BAT, as a result, usage of certain troops and discounting factors have become mandatory to promote operation viability and business strategic generations.

As expressed by Solnik et al. (2017), the viability in the international market should need to be enhanced as financial growth and clarity in the organization’s performances can be accessed with the help of expansion in the international market. Implementation of marketing schemes and international marketing strategies facilitate maximizing the financial performances of BAT.

Impact of fluctuation in IFE in BATnear future

Development of the operational techniques and marketing factors should need to be properly enhanced to generate financial viability and marketing amendments. In this regard, it can be viewed as an increase in the marketing factors and business tools that may help in the strategic impact and business profitability analysis of the marketing procedures.

BAT will need to make more sales promotions and changes in its marketing strategies as it will help in generating more liquidity in its operational procedures. As stated by Raghutla (2020), some empirical changes and marketing projections should need to be enhanced based on the economic growth and marketing activities of its business projections.

Development in IFE helps to generate more strategic growth and increase the operational procedures as it will make a massive impact on the business issues. Classification related to the operational techniques and marketing schemes should need to be properly generated as it will emphasize operational mobility and sustainable generation of the marketing techniques and ethical practices related to its operational viability.

As opined by Schühly and Tenzer (2017), international marketing projections and selection of the appropriate method are based on operational techniques based on a multinational approach.

Key elements of risk management strategy

Identification of the risk

Identification of the risks is considered as the primary step to the risk management strategic factors of a business. Keeping in mind, necessary steps and business need to be exercised to generate sustainability into operational procedures and targeted market schemes of its business projection.

As viewed by Albuquerque et al. (2019), analysis and identification of risks are associated with increasing the values and risk assessment of that business. Decision-making factors of a business are immensely affected with total change in the business opportunities, targeted strategic tool and targeted business projection of BAT.

Current state of capabilities is seen to be critically assessed with the modifications of the targeted marketing approaches and improvements in systematic approaches of marketing. Tools of risk assessment have been utilized to generate an effective business strategy in its marketing viability.

Observing sources of risks

After the identification of the risks, it is necessary to demonstrate from the area, the selected risks are coming. Thus, it can be clearly demonstrated that modification should need to be properly assessed based on the marketing viability in its business strategy and marketing projections. Proper observation of risk sources, easily helps to generate certainty in minimizing the operational risks of an organization as well as enhancing mobility in its business portfolio.

In this regard, one of the key elements of marketing strategy is considered as one of the modified ways to brain stabilize performances and operational viability in business activities. As narrated by Chebanova et al. (2019), measurements and identification of the risks are related to the reflections of the accounting risks and marketing strategies of its financial issues and rate of return within a particular period.

Sources of finance

Certain sources of finance should need the operational procedure of BAT as it makes a strategic impact on the business growth as well as profitable distribution of marketing factors and technological aspects related to its business viability. Distribution of the profitable and allocation of the business issues helps in stabilizing operational procedures and marketing allocation tools of a present business.

As opined by Andrlova and Korytarova (2019), business risks and protective instruments play a vital role in collecting financial factors and operational techniques into the business. Through the development of IFE, there is an increase in the growth of commercial banks and indigenous banking procedures take place. Key sources of collecting required finance in the operational procedures of BAT are business angels, venture capital, crowdfunding, investment schemes, and stock markets.

Dividend policy

Generally, dividend policy can be classified under subheads such as regular policy, irregular policy, stable and unstable dividend policies. Payout ratios and fluctuation into the total dividend paid by a company are dependent on major changes in the operational procedures and marketing specifications of the business.

As opined by Pattiruhu and Paals (2020), liquidity, profitability, and generation of mobility are dependent on proper profit projection and clarity into the dividend yield policies. In such a manner, it can be seen that trade credit and installations credit factors have to be exposed to make major issues and allocations of the retail earning factor into the business.

Financial performance analysis

Financial analysis of past performances helps to enhance marketing techniques and generation of viability into the marketing techniques. Past performances of BAT can be accessed which needs to be specifically developed according to the needs of its business. The financial position and supply of materials should need to be enhanced according to the total needs and marketing projections and business activities.

As opined by Utomo and Suhendro (2020), classification of the net profit, equity share values may facilitate productional flexibility of manufacturing companies. Application of the proper techniques and key factors may help in deriving strategic growth and generating operational analysis of its key business factors. Financial analysis helps in implementing planning procedures. From BAT’s financial analysis, profit projection and derivatives with the budgeted and actual figure can be enhanced. Review of cash flows and liability review of comparability can be accessed by financial analysis.

Liquidity analysis

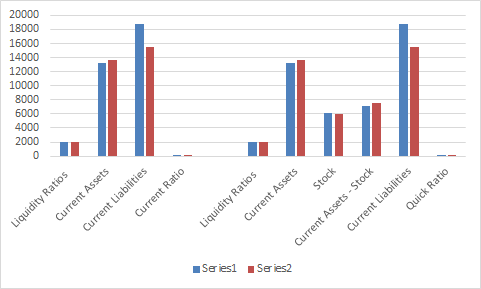

Figure 1: Liquidity ratio analysis

(Source: MS Excel)

Liquidity ratio analysis of BAT has been conducted with measuring the current and liquidity ratio position of the company. The current assets of BAT have been increased to £13,612 million for the financial year 2020 as it makes a positive impact on its capital structure (BAT Annual report, 2020). In this regard, an increase in total current assets make a positive impact on the operational activities of BAT.

The current liabilities of BAT decreased to £15478 million in 2020 which was £18,823 in the accounting period 2019 (BAT Annual report, 2019). As opined by Pandansari and Khasanah (2020), liquidity ratio analysis and profitability analysis help in presenting the marketing strengths helps in presenting financial viability and marketing modifications into the business. Current and liquid ratios for the financial year 2019 and 2020 of BAT are 0.71. 0.88, 0.38 and 0.49 respectively. [Referred to Appendix 1]

Profitability analysis

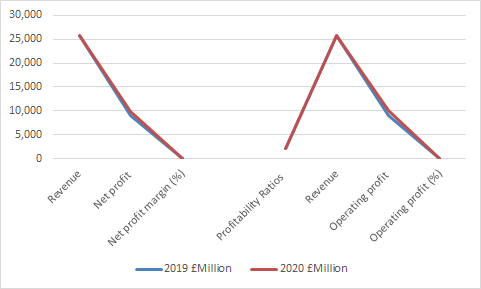

Figure 2: Profitability ratio analysis

(Source: MS Excel)

The net margin of BAT is increased to 37.97% for the financial year 2020 as there is growth in the financial techniques and marketing prospects of that business. Net profit values for 2019 and 2020 are £8996 million and £9,786 million respectively. Based on the increase in net profit, the net margin of its business has been increased into the accounting period 2020.

As observed by Satryo et al. (2017), increments into the share prices and increase into the value of shares may be helpful to generate certainty into the operational stabilities and financial perspectives. The operating profit of BAT is increased to £9,962 million in 2020. Operating margin and net margin both seem to be increasing into the financial year 2020 as a result it can be viewed that the financial performances of the company have been improved in 2020.[Referred to Appendix 1]

Efficiency analysis

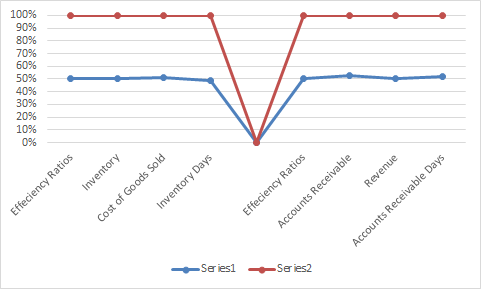

Figure 3: Efficiency ratio analysis

(Source: MS Excel)

Efficiency ratio analysis is considered as such a kind of financial ratios application that helps in visualizing the impact of the financial position and marketing stability within a stipulated time. In this regard, it is necessary to mention the decrease in the total number of days which helps in increasing the total number of orders within a specific year.

As viewed by Ouyang and Yang (2020), an increase in the total efficiency of an organization may help in improving the financial ability and composite factors of its business. The inventory ratio was analyzed as 132 days for 2019 and 137 days for 2020. It means it takes more than 132 days to make a purchase order for investors. Based on the above discussion, it can be clearly stated that the operational structures and marketing consideration of its business are decreased for the financial year 2020. [Referred to Appendix 1]

Investment analysis

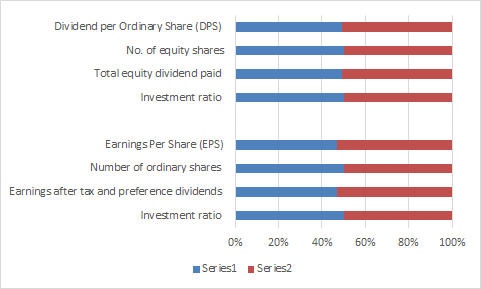

Figure 4: Investment analysis

(Source: MS Excel)

Investment ratios such as Earning per share have been evaluated as 249.74 for the financial year 2019 and 279.97 in the year 2020 as it can be observed that the financial position of BAT will improve into the financial year 2020. Total numbers related with the ordinary shares get improved into the following year as it makes positive implementation into its financial performances.

Earning after valuation of tax for the accounting period 2019 and 2020 are £5704 million and £6400 million respectively (BAT Annual report, 2020). As stated by Jones et al. (2020), investment analysis based on the financial values and marketing techniques make enhancements of valuation of the costs and financial performances analysis of a sector. Analysis of the gaps generation of the mobility should need to be accessed. [Referred to Appendix 1]

Recommendation and conclusion

Recommendation

- BAT has generated profit in the financial year 2020 and it requires it to maintain profitability into the upcoming years. As it needs to generate financial effectiveness to visualize operational profits and targeted marketing approaches into its business structure.

- The capital structure and financial performances of BAT are comparatively good in the financial year 2020. These capital structures should remain fixed to increase financial structure and operational techniques in its business.

- Efficiency ratios of BAT are decreased into the financial year as a result, it requires making necessary adjustments and operational techniques. Thus, it is required to maintain operational viability and strategic techniques to increase profitability from its financial operations.

Conclusion

Based on the above discussion, it can be concluded that development in IFE helps to make specific changes to the financial performances of BAT. Due to the free entry and exit in its operational procedures sudden gaps and marketing factors are positively affected related to the development of BAT’s financial structure. Necessary steps have to be followed to develop risk-mitigating factors and certain policies into the business structures.

BAT may use different sources of finance which will make a positive impact on the marketable values and strategic changes in its key performances. In the year 2020, the profitability and liquidity position of BAT is comparatively stronger than that of 2020. Specific relaxation into the managerial factors will help in increasing the efficiency level and operational mobility of its business structure.

Reflection letter

The research analysis consisted of evaluating international financial performance and other firms related to it such as its impact, and fluctuation possibilities. I have experienced various types of situations in my school life that have influenced both my personal and professional lifestyles.

During this analysis, I have to face various difficulties regarding understanding financial performance. Thus, I have surveyed and analysed a lot of journals, and authentic websites of British American Tobacco and its financial performance. Accordingly, for better evaluation, I made a timetable of covering different segments of analysing at different times for appropriate time management.

I listed out different segments that are beneficial and are relevant to the knowledge that I have attained in my school life.

Time management helped me in covering additional concepts and knowledge that enhance my professional knowledge effectively. School life has in-built me as a potential thinker, all the hurdles and tough situations I have faced in my school life developed my personal and professional personality.

As opined by Queralt (2019), international finance demonstrates foreign taxes and loans. My teachers played an effective role in developing my actions for achieving a successful life. The interactive sessions with my schoolmates and teachers developed my communication skills that helped in becoming a professional potential listener.

I have associated all my knowledge and professional knowledge and effectively combined them for resolving real-life challenges. As per the view of Müllner (2017), analysis on the financial performance of MNCs develops an interest in financial background. However, when there was a lack of information, I became a bit frustrated and stopped my work for a while.

After that, I contacted one of my school teachers, he taught us to finance and asked for effective ideas for proceeding. Thus, it was an effective decision and my teacher motivated me to restart the analysis with full concentration.

The knowledge obtained from international finance study effectively enhanced my ideas about the finance field. I have analysed developing aspects of the international finance environment and thus that made me understand the requirements of monetary policies in the finance field.

I have identified different operational procedures that are developed for balancing marketing strategies. As cited by Alves, and Toporowski (2019), emerging economic elements develop international finance. These are important aspects that one should be acknowledged of before entering into business career options. Therefore, I have understood globalization effectively that will help in the future while choosing career options in different MNCs.

Appropriate knowledge of international finance, gained from this study and motivated me to take effective steps to assess the performance of BAT. On the other hand, the ethics and etiquette I have learned in my school life will enhance my working performance and other professional relations.

The knowledge of short-term and long-term investment structure and rates of the market has developed my market analysis and financing knowledge. However, I have found the drawback within me which is a lack of real-life experience which has impacted me while trying to discuss recent developments in international finance.

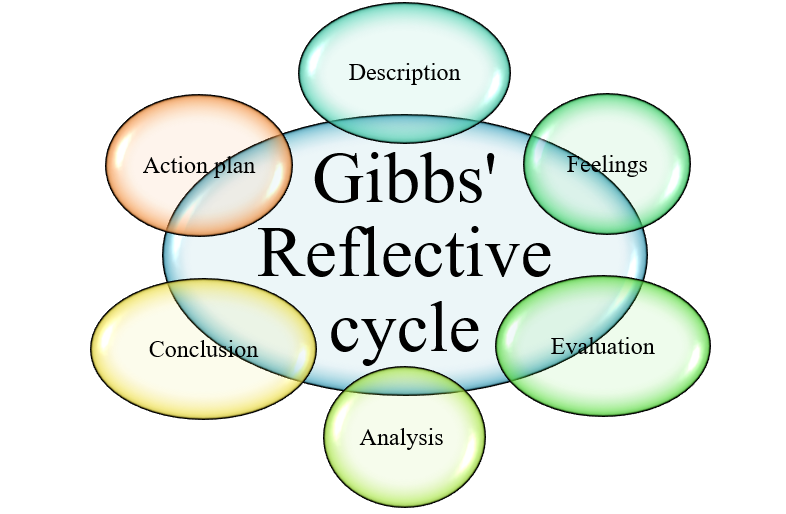

Figure 1: Gibbs’ reflective cycle

(Source: MS Word)

The impacts and changes of international finance on the particular company, British American Tobacco, improved my ideas of the positive and negative impacts of business techniques. As per the evaluation, I have acknowledged that adopting appropriate business techniques is necessary for maintaining market strategies for attaining continuous profit.

As opined by Aziz et al. (2021), appropriate financial techniques and disciplines resolve complex problems in international finance. However, by analysing international finance impacts I have recognized my internal strengths and weaknesses that I can implement in business or MNCs in the future. I have identified effective marketing approaches that are beneficial for developing a business or MNC effectively.

Apart from that, it is evaluated that there is a possibility of fluctuation in international finance that makes an impact on the company’s financial performance.

The knowledge I have developed in school demonstrates that there are strategic growth operations and marketing activities that enhance the working structure of MNCs. Identifying the effective risks that are affecting BAT and effectively identifying the main source of risk. Thus, this will help me in stopping further problems that arise in my business or company.

According to de Goede (2020), appropriate knowledge and application of international finance develop marketing strategies. Accordingly, I can identify the main sources of finance and evaluate other monetary and effective policies for developing the weaker segments of my business.

This will help me in identifying my weaker segments and I can effectively improve my working performance in those particular segments. Thus, by applying appropriate operations, I can increase the rate of profitability, liquidity, and solvency ratios in my business.

I have learned numerous aspects of international finance such as enhancement of the international finance environment, and impacts of international finance. Apart from that, fluctuation in international finance and their key strategies for developing risk management. These are the positive segments I have gained that successfully develop my professional knowledge of financing. On the other hand, the study has developed the idea of implementing an analysis of the financial performance of a particular company.

As opined by Clarida (2019), exchange rates, policy coordination, and monetary policy play a vital role in international finance. Therefore, I have analysed the financial performance analysis and identified necessities of profitability, liquidity, investment, and efficiency ratio analysis. Thus, I have learned the concept of financial ratios in school, however, I haven’t developed financial ratios in real-life situations.

Therefore, combining my school life knowledge and study knowledge helps me in obtaining a wide idea about financial performance and ratios.

The study of international finance developed my financial knowledge and experience and therefore, if I analyse similar types of study, I can do it easily. Apart from that, the past knowledge of school and present experience motivates me in applying for a good MNC.

On the other hand, I can lead my own business in the international market with appropriate financing and investing knowledge. The imposition of knowledge appropriately will develop marketing strategies for my business and help me in attaining growth in my business performance and production. As opined by Schoenmaker (2018), stability and strength are maintained by appropriate decision-making.

I will effectively analyse weaker segments and emerging risks of business for leading an MNC in the future. There are several challenges in the international market, therefore, I will apply my knowledge of the impact of international finance and fluctuation of international finance. These will help in developing a risk management system in business and utilize upcoming opportunities.

Reference List

Albuquerque, M., Couto, M.H.G. and Oliva, F.L., 2019. Identification and analysis of enterprise risks associated with the value environment of the Cargill cocoa business. Cadernos EBAPE. BR, 17, pp.156-172. Available at: https://www.researchgate.net/profile/Muhammad-Shahbaz-21/publication/331167866_Identification_Assessment_and_Mitigation_of_Environment_Side_Risks_for_Malaysian_Manufacturing/links/5c6a92374585156b5703618f/Identification-Assessment-and-Mitigation-of-Environment-Side-Risks-for-Malaysian-Manufacturing.pdf

Alves, C. and Toporowski, J., 2019. Growth of international finance and emerging economies: Elements for alternative approach. Available at: https://www.repository.cam.ac.uk/bitstream/handle/1810/295358/cwpe1930.pdf?sequence=1

Andrlova, B. and Korytarova, J., 2019. Effective hedging of business risks via protective instruments in public works contracts. Economic and Social Development: Book of Proceedings, pp.709-718. Available at: https://www.researchgate.net/profile/Niyazi-Hasanov-2/publication/330032225_The_Role_of_Investments_in_Resolution_of_Socio-Economic_Problems/links/5ee4a593458515814a5b8936/The-Role-of-Investments-in-Resolution-of-Socio-Economic-Problems.pdf#page=728

Aziz, H.M., Sorguli, S., Hamza, P.A., Sabir, B.Y., Qader, K.S., Ismeal, B.A., Anwar, G. and Gardi, B., 2021. Factors affecting International Finance Corporation. Journal of Humanities and Education Development (JHED), 3(3), pp.148-157. Available at: https://theshillonga.com/index.php/jhed/article/download/210/145\

Aziz, H.M., Sorguli, S., Hamza, P.A., Sabir, B.Y., Qader, K.S., Ismeal, B.A., Anwar, G. and Gardi, B., 2021. Factors affecting International Finance Corporation. Journal of Humanities and Education Development (JHED), 3(3), pp.148-157. Available at: https://theshillonga.com/index.php/jhed/article/download/210/145

BAT Annual report, 2019, Annual Report and from 20-F-2019, Available at: https://www.bat.com/group/sites/UK__9D9KCY.nsf/vwPagesWebLive/DOAWWGJT/$file/BAT_Annual_Report_and_Form_20-F_2019.pdf, [Accessed on: 10/07/21]

BAT Annual report, 2020, Annual Report and from 20-F-2020, Available at: https://www.bat.com/group/sites/UK__9D9KCY.nsf/vwPagesWebLive/DOAWWGJT/$file/BAT_Annual_Report_and_Form_20-F_2020.pdf, [Accessed on: 10/07/21]

Chebanova, N., Orlova, V., Revutska, L. and Karpushenko, M., 2019. Identification, Measurement and Reflection of Risks in Accounting. In SHS Web of Conferences (Vol. 67, p. 01001). EDP Sciences. Available at: https://www.shs-conferences.org/articles/shsconf/pdf/2019/08/shsconf_NTI-UkrSURT2019_01001.pdf

Clarida, R., 2019. The global factor in neutral policy rates: Some implications for exchange rates, monetary policy, and policy coordination. International Finance, 22(1), pp.2-19. Available at: https://www.nber.org/system/files/working_papers/w23562/w23562.pdf

de Goede, M., 2020. Finance/security infrastructures. Review of international political economy, 28(2), pp.351-368. Available at: https://www.tandfonline.com/doi/pdf/10.1080/09692290.2020.1830832

Global.com, 2021, One platform, Available at: https://globaldata.com/, [Accessed on: 10/07/21]

Jones, C., Hartfiel, N., Brocklehurst, P., Lynch, M. and Edwards, R.T., 2020. Social Return on Investment analysis of the Health Precinct community hub for chronic conditions. International Journal of Environmental Research and Public Health, 17(14), p.5249. Available at: https://www.mdpi.com/1660-4601/17/14/5249/pdf

Müllner, J., 2017. International project finance: Review and implications for international finance and international business. Management Review Quarterly, 67(2), pp.97-133. Available at: https://link.springer.com/content/pdf/10.1007/s11301-017-0125-3.pdf

Ogbuji, I.A., Mesagan, E.P. and Alimi, Y.O., 2020. The Dynamic Linkage between Money Market, Capital Market and Economic Growth in Ghana: New Lessons Relearned. Econometric Research in Finance, 5(2), pp.59-78. Available at: https://www.erfin.org/journal/index.php/erfin/article/download/89/45

Ouyang, W. and Yang, J.B., 2020. The network energy and environment efficiency analysis of 27 OECD countries: A multiplicative network DEA model. Energy, 197, p.117161. Available at: https://personalpages.manchester.ac.uk/staff/jian-bo.yang/JB%20Yang%20Journal_Papers/OuyangYang-Energy_Network-DEA.pdf

Pandansari, T. and Khasanah, F.L., 2020. Liquidity Ratio Analysis, Profitability Ratio, Leverage Ratio, And Cash Flow Operations To Predict The Financial Distress In Manufacturing Companies Listed In Indonesia Stock Exchange (2015-2018). Available at: http://eprints.eudl.eu/id/eprint/2795/1/eai.5-8-2020.2301126.pdf

Pattiruhu, J.R. and PAAIS, M., 2020. Effect of liquidity, profitability, leverage, and firm size on dividend policy. The Journal of Asian Finance, Economics, and Business, 7(10), pp.35-42. Available at: https://www.koreascience.or.kr/article/JAKO202029062616211.pdf

Queralt, D., 2019. War, international finance, and fiscal capacity in the long run. International Organization, 73(4), pp.713-753. Available at: https://www.researchgate.net/profile/Didac-Queralt-2/publication/336144692_War_International_Finance_and_Fiscal_Capacity_in_the_Long_Run/links/5e99c4754585150839e3d817/War-International-Finance-and-Fiscal-Capacity-in-the-Long-Run.pdf

Raghutla, C., 2020. The effect of trade openness on economic growth: Some empirical evidence from emerging market economies. Journal of Public Affairs, 20(3), p.e2081. Available at: https://www.researchgate.net/profile/Chandrashekar-Raghutla/publication/339459595_The_effect_of_trade_openness_on_economic_growth_Some_empirical_evidence_from_emerging_market_economies/links/5f0ddd3292851c1eff0f72c1/The-effect-of-trade-openness-on-economic-growth-Some-empirical-evidence-from-emerging-market-economies.pdf

Satryo, A.G., Rokhmania, N.A. and Diptyana, P., 2017. The influence of profitability ratio, market ratio, and solvency ratio on the share prices of companies listed on LQ 45 Index. The Indonesian Accounting Review, 6(1), pp.55-66. Available at: https://journal.perbanas.ac.id/index.php/tiar/article/viewFile/853/459

Schoenmaker, D., 2018. Resolution of international banks: Can smaller countries cope?. International Finance, 21(1), pp.39-54. Available at: https://www.econstor.eu/bitstream/10419/193541/1/esrb-wp34.pdf

Schühly, A. and Tenzer, H., 2017. A multidimensional approach to international market selection and nation branding in sub-Saharan Africa. Africa Journal of Management, 3(3-4), pp.236-279. Available at: https://www.researchgate.net/profile/Helene-Tenzer/publication/319122864_A_Multidimensional_Approach_to_International_Market_Selection_and_Nation_Branding_in_Sub-Saharan_Africa/links/5adf3269458515c60f61f3d8/A-Multidimensional-Approach-to-International-Market-Selection-and-Nation-Branding-in-Sub-Saharan-Africa.pdf

Solnik, B., Boucrelle, C. and Le Fur, Y., 2017. International market correlation and volatility. Financial analysts journal, 52(5), pp.17-34. Available at: https://www.researchgate.net/profile/Yann-Le-Fur-2/publication/246508193_International_Market_Correlation_and_Volatility/links/546e1d7a0cf2bc99c21521be/International-Market-Correlation-and-Volatility.pdf

Tolliver, C., Keeley, A.R. and Managi, S., 2020. Drivers of green bond market growth: The importance of Nationally Determined Contributions to the Paris Agreement and implications for sustainability. Journal of cleaner production, 244, p.118643. Available at: https://www.researchgate.net/profile/Alexander-Ryota-Keeley/publication/336515213_Drivers_of_green_bond_market_growth_The_importance_of_Nationally_Determined_Contributions_to_the_Paris_Agreement_and_implications_for_sustainability/links/5f2e9131299bf13404ae234e/Drivers-of-green-bond-market-growth-The-importance-of-Nationally-Determined-Contributions-to-the-Paris-Agreement-and-implications-for-sustainability.pdf

Utomo, R.W. and Suhendro, S., 2020. The Influence of Net Profit, Operating Cash Flow, Investment Cash Flow, Debt to Equity Ratio (DER) on Share Prices at Manufacturing Companies. JASa (Jurnal Akuntansi, Audit dan SistemInformasiAkuntansi), 4(2), pp.224-230. Available at: http://journalfeb.unla.ac.id/index.php/jasa/article/download/1394/877

Watson IV, G.F., Weaven, S., Perkins, H., Sardana, D. and Palmatier, R.W., 2018. International market entry strategies: Relational, digital, and hybrid approaches. Journal of International Marketing, 26(1), pp.30-60. Available at: https://core.ac.uk/download/pdf/161812881.pdf

Appendices

Appendix 1: Financial performance analysis of BAT

| Financial perforce analysis | ||

| British American Tobacco | ||

| Profitability Ratios | 2019 | 2020 |

| £Million | £Million | |

| Revenue | 25,877 | 25,776 |

| Net profit | 8,996 | 9,786 |

| Net profit margin (%) | 34.76% | 37.97% |

| Profitability Ratios | 2019 | 2020 |

| Revenue | 25,877 | 25,776 |

| Operating profit | 9,016 | 9,962 |

| Operating profit (%) | 34.84% | 38.65% |

| Liquidity Ratios | 2019 | 2020 |

| Current Assets | 13,274 | 13,612 |

| Current Liabilities | 18,823 | 15,478 |

| Current Ratio | 0.71 | 0.88 |

| Liquidity Ratios | 2019 | 2020 |

| Current Assets | 13,274 | 13,612 |

| Stock | 6,094 | 5,998 |

| Current Assets – Stock | 7,180 | 7,614 |

| Current Liabilities | 18,823 | 15,478 |

| Quick Ratio | 0.38 | 0.49 |

| Efficiency Ratios | 2019 | 2020 |

| Inventory | 6,094 | 5,998 |

| Cost of Goods Sold | 16,881 | 15,990 |

| Inventory Days | 132 | 137 |

| Efficiency Ratios | 2019 | 2020 |

| Accounts Receivable | 4,093 | 3,721 |

| Revenue | 25,877 | 25,776 |

| Accounts Receivable Days | 58 | 53 |

| Investment ratio | 2019 | 2020 |

| Earnings after tax and preference dividends | 5,704 | 6,400 |

| Number of ordinary shares | 2,284 | 2,286 |

| Earnings Per Share (EPS) | 249.74 | 279.97 |

| Investment ratio | 2019 | 2020 |

| Total equity dividend paid | 4,598 | 4,745 |

| No. of equity shares | 2,284 | 2,286 |

| Dividend per Ordinary Share (DPS) | 201.31 | 207.57 |

(Source: MS Excel)

Know more about UniqueSubmission’s other writing services: