BSS064-6 Leading and Managing Organisational Resources Assignment Sample

Module code and Title: BSS064-6 Leading and Managing Organisational Resources Assignment Sample

Introduction

Leading and management of the resources in an organisation may be stated as the integrated approach that is taken to assess the relationship that is developed in terms of operations management, finances and information system to gain a competitive advantage in the global market. In terms of assessing, and managing the resources, the company has to undertake a detailed analysis of the concept of economic, technological and human resources to accomplish the goal that is anticipated for the longer run.

The business authorities have to include expertise to help identify the business excellence, and labour system with effective domain and knowledge put into exercise. This report is a detailed analysis of the change management process and resource management system better suitable for WeWork which has faced issues in management leading to financial and employee structure loss.

The purpose of this report is to guide the company in utilising the theory of change management model to measure the success level of the change process and gain the development of the desired organisational culture to bring productivity and performance in the business market. Through the detailed analysis done in this report, WeWork may be able to gain a clear understanding of the implementation of resource and operations management systems to evaluate risks in the long run.

The company of WeWork has been chosen as the company to be studied in this case study, as the company has been co-founded by Adam Neumann and Miguel McCelvey in the year 2010, set in the central place of the United States of America (USA). The company of WeWork had been operating in New York for a considerably longer period, and now there are almost 528 different locations in which the organisation operates, in 29 nations having almost 38% of the global fortune ranking (WeWork. 2022).

The report is concerned with the examination of corporate governance and studying the basic entrepreneurial issues that WeWork had been facing in recent times, with a strong focus on the financial performance of the company. The vision of WeWork had been to embrace the shift in work and culture and bring in a global pursuit for more flexible and adaptable commitments to the stakeholders, and have a rich community creation (WeWork. 2022).

Sometimes, it may be investigated as the way the company of WeWork is succeeding in the current market, where the power of creation makes way and further helps the company to gain better stakeholders, such as WeWork Manhattan (Bates et al., 2019).

Identification of the major challenges that WeWork is facing

Financial loss and a great decline in the annual earnings

The performance of the company had been too low and quite poor in recent periods, as the suffering of a net loss of $803 million to the company had been a financial shock as per the given case study. Moreover, in WeWork, the target valuation had not been feasible and it had fallen from $47 billion to $30 billion in a short time, which created a loss in the company’s financial future.

WeWork needs to create a model of risk assessment and hence find the financially vulnerable regions on which the economy needs to work better, which have been addressed in the next research evidence. A recent research paper has applied the regression model to estimate the negative financial situation and create a more definitive financial model of risk analysis, finding it to be quite a successful analysis (Valaskova et al., 2018).

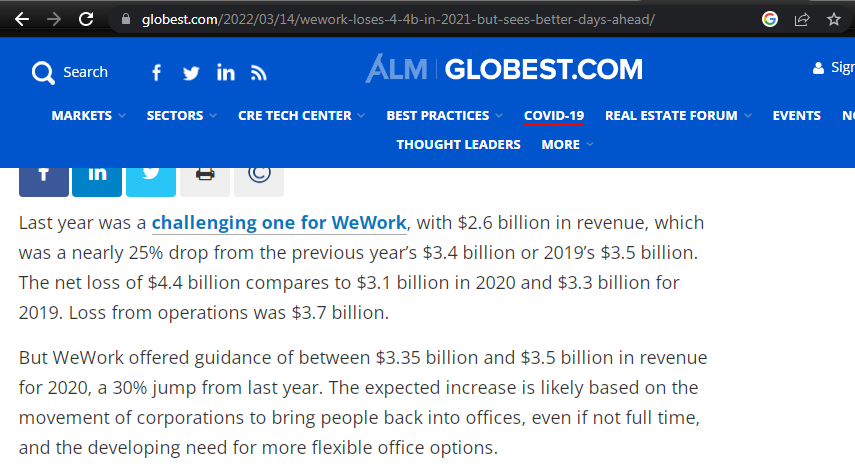

In 2021 the company of WeWork had lost almost a high proportion of financial loss culminating in $4.4 billion and every year a certain proportion of the revenue had been dropping off, making the future of the company quite static and poor. The net loss had been around $3 billion, which is the average measure of WeWork passing through each corporate year because as compared to 2019, the loss in 2020 had increased by $1.5 billion (Refer to Appendix 1).

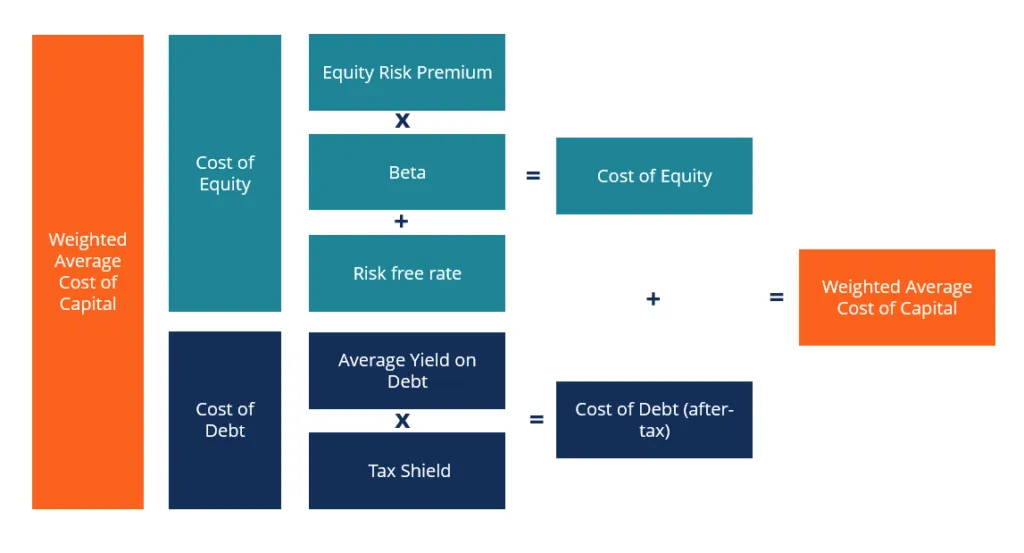

There are different models of risk assessment and financial performance tools to measure and understand the overall bard scenario to be precise, where the cost of capital returns and the investment returns need to be estimated, which WeWork needs to practise (Shad et al., 2019).

Figure 1: Measurement diagram for the cost of capital and equity returns (Source: Shad et al., 2019)

Figure 1: Measurement diagram for the cost of capital and equity returns (Source: Shad et al., 2019)

Moreover, the financial condition of WeWork had been so low due to certain aspects of the paper that needs to discuss, such as the lower credit of the company which had been much low. In the United States of America (USA), company of WeWork had been occupying 0.5% of the entire market position regarding the other companies, which had been financially quite harsh for the organisation (Refer to Appendix 1). The total partnership proportion had been lower and the brand equity of the organisation due to various interrelated complex issues had fallen, which needs to be noted.

Employee layoff and loss of human resources with a leadership issue

In the year 2019, the company of WeWork had been getting off to reduce the employee count by almost 5,000 due to a contingent situation, which clearly states that the company had a poor financial operation and lacked clarity on employee retention. In reality, the company had reduced the employment margin, not being able to keep up with the financial loss, where the alone reduction had been almost 2,400 people and that had seen the co-founder resign from the company’s operations.

The reduction had been severe, and a close to 20% decrease in the people being employed in WeWork, as after the reduction the company stood at a limited people count, weakening the corporate structure. It had been quite hard for the company to offer this decision and get to the saturation point where almost a certain proportion of the poodle had been given an exit door, letting the global employee be affected.

There are many sustained drawbacks to job loss and most of the people associated with the system of losing the job have been exposed to the issue of a labour market that is suffering from the frictional unemployment scenario (Jarosch, 2021).

The situation had been closely related to the resignation of the co-founder of the company, Adam Neumann following the IPO delay and the loss in the share value transmission, which had led the company to get to a dark corner and not thrive much. Additionally, the leadership had been so imbalanced that the subsidiary co-founders and major stakeholders resigned from WeWork, leaving the company orphaned financially and in leadership as per the case study.

There had been several questions on the poor IPO structure that had been the major problem after Adam Neumann had resigned from the company and the company lost the global valuation from $47 million to $7 million in days (Borgenicht, 2020). The leadership of WeWork since then had been suffering the IPO issues and although Softbank had liquidated most of the financial assets of the company, there are examining leadership issues which the company needs to care about.

Restructuring and cost optimisation challenges

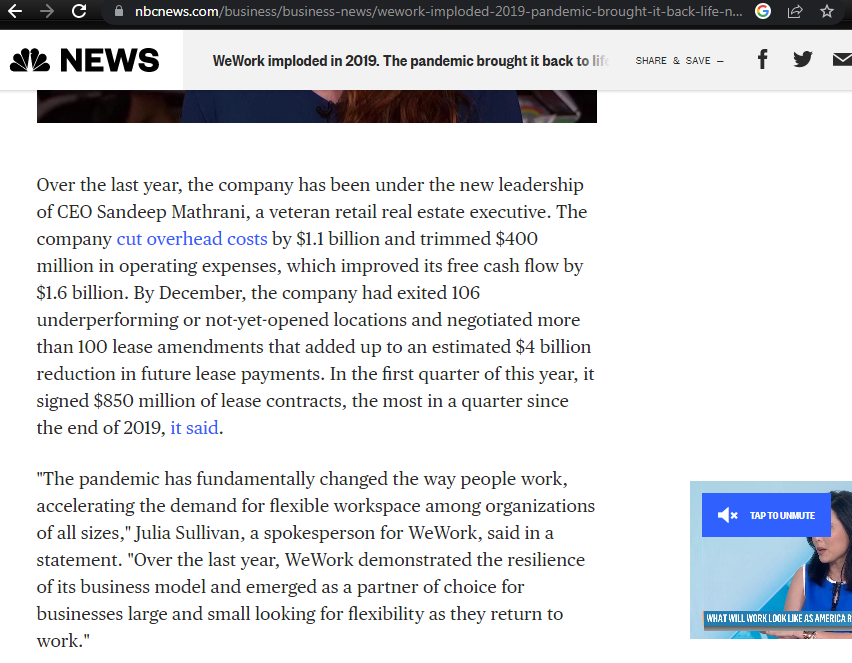

Optimising the overall cost and managing the feasibility for the firm to run had been a challenge for WeWork for quite a long period, to say. As per the given case study, the new Chief executive Officer, Sandeep Matharani, the operations and the falling situation of the company had been the biggest challenge regarding the restructuring and maintaining a cost balance.

In 2019, the company of WeWork faced the decision of not being in equilibrium with the different employees and not being sufficiently flexible with the different issues that may allow the company to survive the corporate holocaust. There had been different cost-cutting initiatives taken by the corporation in the fall of 2019, as the IPO reality of the company had been threatened by the firm’s investors and there had been losses worth billions of dollars.

The cost optimization as done by WeWork had been almost $1 billion and there had been renegotiations on at least 100 platforms taken on lease, which had threatened the company’s security (Refer to Appendix 2).

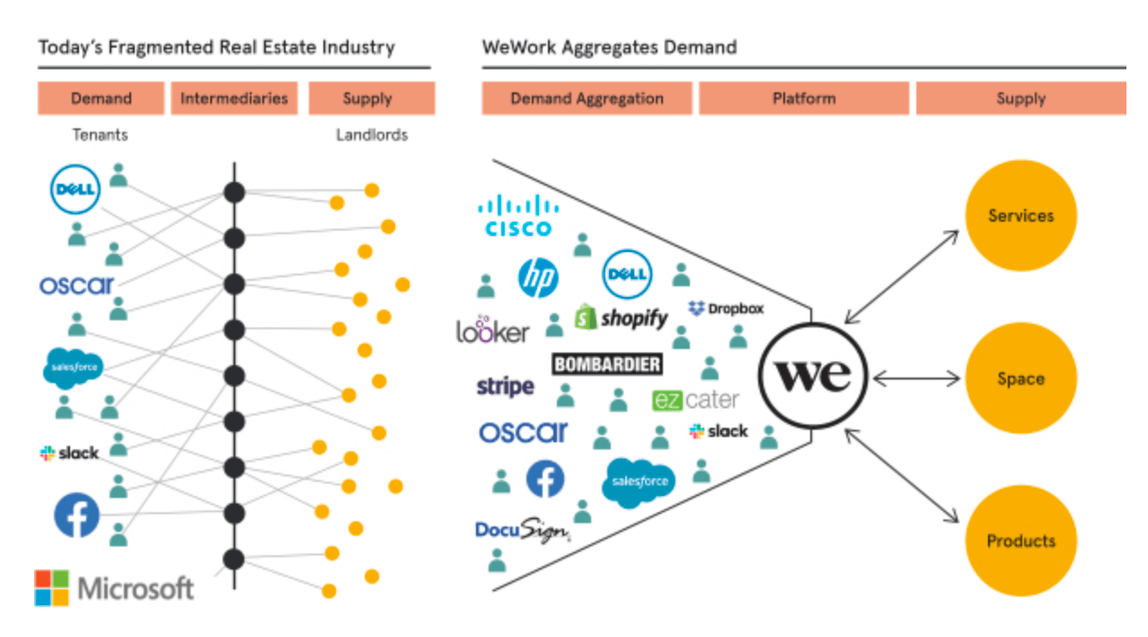

The economic response that WeWork faced in the early periods of 2019 is directly related to the resignation of the Co-founder of the company, as the concept of equity in payment, has been released by the organisation. The concept of WeWork had been examined by a research journal as the space renting and leasing platform that has contract-based network development and forms better communities (Aronoff, 2017).

Figure 2: Mechanism of functioning of WeWork (Source: Aronoff, 2017)

Figure 2: Mechanism of functioning of WeWork (Source: Aronoff, 2017)

The restricting of the organisation and the creation of employee trust had been one of the most important tasks of WeWork after the company had detracted and making contracts with new property deals had almost been the stormy stage of the company as per the case study. The excessive cost had been received and turned off from the operating cost expenses of the company, and there had been a more speedy trial that the new CEO of WeWork had followed.

Internal management of resources

Sometimes, the merger and acquisition of the established company had been observed, as there are certain aspects that the company of WeWork had taken care of to return to any maturity stage. In the case of WeWork, the merger with the company of BowX Acquisition Corporation had been quite famous and this had been one of the key strategies that WeWork had done for better performance as acknowledged by research papers to be diverse (Christofi et al., 2017).

As per the case study, it had been found that the corporate growth of the company of WeWork had been steadily increasing, especially after the merger with BowX Acquisition Corporation on a public scale. In the internal management of the resources, the issue of a company without many financial resources had been the most rated challenge for WeWork, and that had led the company to shorten its name to “We” and trade in the share market (NBCUniversal News Group. 2022).

In addition to that, the closure of the financial operations for WeWork had been around $1.3 billion where the equity support had been provided to the company by Cushman & Wakefield. The support that the company had expected to manage the internal sources had been provided by SoftBank and it had got to speed up in the process of gaining a high commercial pursuit (WeWork. 2022).

Resource management and productivity enhancement with performance increment

Resource management improves by focusing on people and finance

Financial Resources

According to the case study, WeWork has faced a decline in financial performance with a target valuation of about $47 billion in previous years, getting low as $ 20 billion as its target valuation and $30 billion for its Initial Public offering (IPO) and in the US in 2022 net loss of about $504 million. The company may have made improvements in financial performance deficits by the implementation of Henry Fayol’s administrative theory to make improvements in operations management and gain a better understanding of accounting with concerns leading to costs, profitability and ensuring optimum use of finances.

The company may have utilised the input of Business Analytics and Data-Driven resource planning which may have led to the company gaining quality information and empirical finances benefitting both the people and finance (Akhtar et al., 2019). The change in the resource planning process and change process may have helped WeWork in the development of decision-making capabilities to enhance the power of WeWork to designate the finances to bring an influx of revenue to the company and eliminate the issue of the financial crisis.

Technological Resources

WeWork has faced issues in resource management which is a reason for the development of the company in various spaces on the global market that led to communication issues as a result of cost-cutting strategies taken up by the Chief Executive Officer (CEO) Sandeep Mathrani. The company may have benefited from the implementation of innovation and technological advancements in Deep Reinforcement Learning (DRL) to utilise intelligent innovations in making resource management consistent with the people and stakeholder activities through priority-based core network slicing (Li et al., 2018).

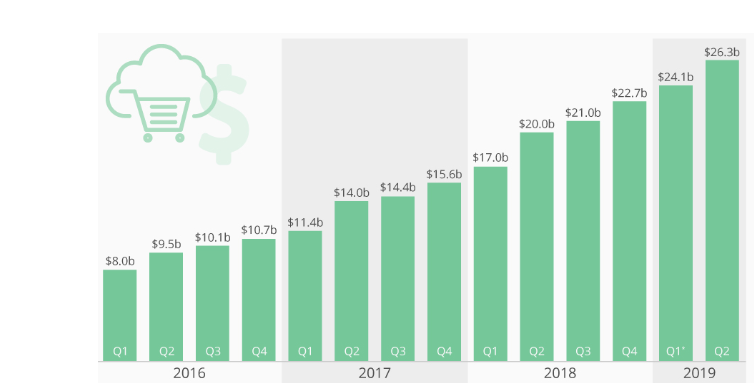

Furthermore, the implementation of technological resources such as Artificial Intelligence (AI) and the Internet of Things (IoT) may have provided WeWork with increasing efficiency in resource management helping in the development of new policy formulation. The implementation of technological advancements such as IT and Cloud Computing in the resource management system of the company also provided the company with flexible work models in improving smart and efficient organisational change to eliminate risks of future crises (Taghipour et al., 2020).

Figure 3: Increase in revenue of business companies through the implementation of Cloud Computing (Source: Taghipour et al., 2020)

Figure 3: Increase in revenue of business companies through the implementation of Cloud Computing (Source: Taghipour et al., 2020)

Human Resources

WeWork has announced its acquisition with BowX Acquisition Corp. for the special purpose of adhering to the stakeholder’s needs to be fulfilled by the organisation in blending physical and digital processes to support the company’s real estate product along with the idea to develop into a tech-savvy company to effective management employees and office space. However, the efficiency of Corporate Governance and leadership of the company has shaken up leading to issues faced in human resource management.

The company may have implemented the performance management theory of Elton Mayo’s Human relations theory to gain an understanding of the requirements of the stakeholders and employees for effective resource management and bring productivity in the given market (Omodan et al., 2020). The use of an effective decision-making process by higher authorities may lead to formulating satisfaction of the stakeholders and the employees in bringing productivity in operations.

Productivity and performance improvement by focusing on people and finance

Operational management through Business Analytics and Data-driven to improve productivity

Many businesses have recognised the value of building a data-driven organisational culture that has led to smoothening of the process of dealing with massive volumes of data, analytics and algorithms. WeWork may have utilised data-driven techniques and Big Data analytics to improve the business’s core operational and production tasks. Furthermore, the use of Big Data analytics and data-driven may have potentially led to an increase in operational efficiencies and cost savings which may also lead to an improvement in business value among the target consumers and stakeholders (Camilleri, 2020).

The utilisation of Big Data Analytics has become crucial for the operations management system in the business market environment which has led companies such as WeWork in identifying the strengths, and weaknesses in the major functionalities to remain relevant among stakeholders and the market. The company may have benefited from the implementation of data-driven techs and Big Data Analytics to help in revenue management, inventory management and risk analysis providing improvement in productivity and performance among people and bringing finances (Choi et al., 2018).

Figure 4: Use of Data-Driven and Big Data Analytics in businesses (Source: Choi et al., 2018)

Figure 4: Use of Data-Driven and Big Data Analytics in businesses (Source: Choi et al., 2018)

Effective Decision-making process to improve the performance of the employees.

The input of high authority’s capabilities on decision-making for the benefit of employee performance may have led to an increase in WeWork’s productivity and performance improvements in the given market. It is stated that a positive relationship is formed in an organisation through the implementation of effective decision-making abilities of the leader and reflects upon the employee’s flexibility in the work setting leading to increased productivity in the business and personal performance of the employee (Diamantidis and Chatzoglou, 2018).

The implementation of employee commitment may also be increased by the CEO of WeWork which may have been utilised to avoid the vacancy issues for higher posts in the company which has led to disruption in organisational performance.

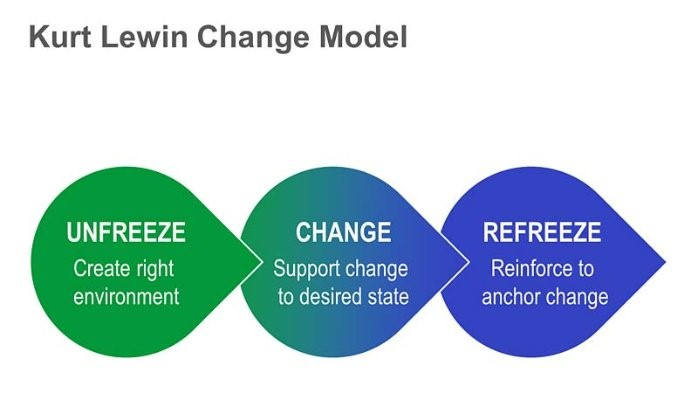

Managing the change through Lewin’s Change model

The elements of disruption in the organisation regarding Human resources, resource management and analysing the impact of performance and productivity by the employee’s structure, WeWork may have utilised the completion of Lewin’s Change model in the process of gaining optimal operational management. In delivering the change management process to gain productivity and increase employee Lewin’s Model, the step of Unfreeze may have been implemented where the higher authorities of the company may have utilised politics and power in guiding the employee structure with changes innate operational function (Etareri, 2022).

Figure 5: Lewin’s Change Management Model (Source: Etareri, 2022)

Figure 5: Lewin’s Change Management Model (Source: Etareri, 2022)

Then WeWork may have managed the change through the process of implementation of the theory in supporting the change based on the desired amount required to gain the productivity and performance level anticipated among the employees and operational management. The analysis of refreezing may be implemented by the company, where the authorities may have to reinforce the system of change in the organisational culture to help in the success level of the change management system and optimise the organisational functions in the long run (Genugten, 2022).

The utilisation of Lewin’s Change management model may help WeWork in optimising the desired changes in the organisational functions through a guided structure and also monitor effectively the steps involved in the changes. Moreover, the use of the model may be implemented to gain a better understanding of the steps that are required to be taken in the long run over the emergence of similar risks in terms of financial, management and performance structure.

Integrated with leadership initiatives for productivity improvement.

There are different ways by which the leadership may improve employee productivity and cause continuous development within the entire corporation, in a short period. In addition to this, the focus has been assigned to the direct ways by which leadership may improve the productivity of WeWork and cause an exclusive difference in work culture.

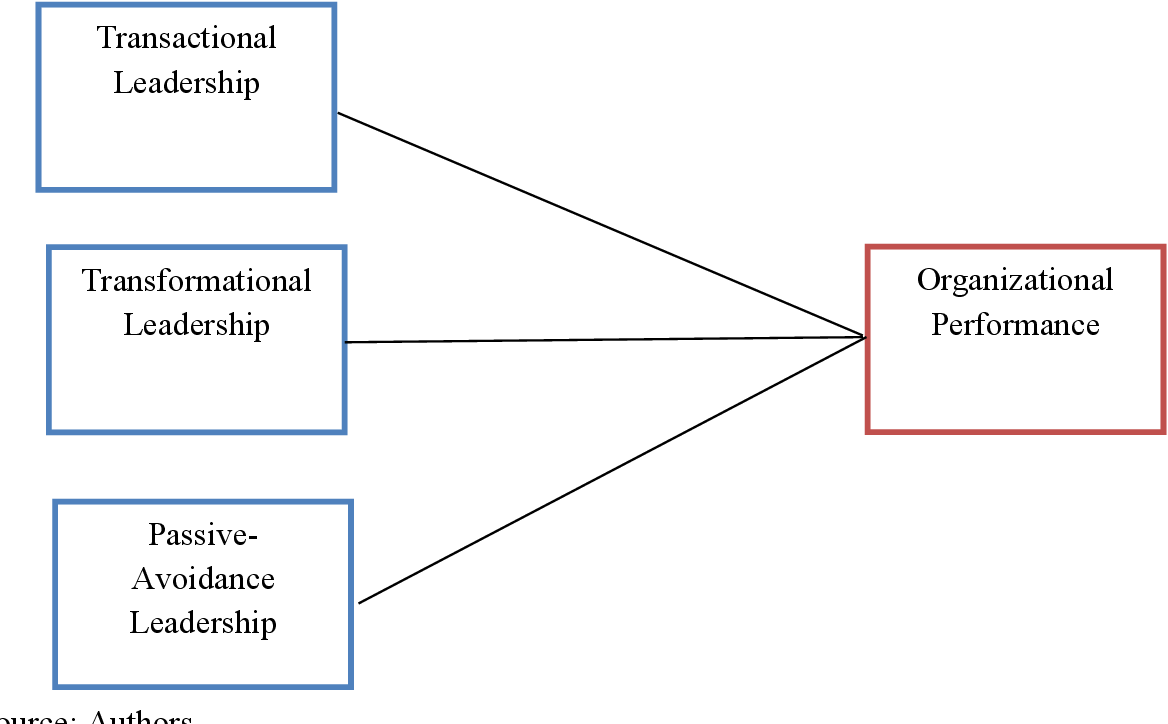

The system of leadership that is practised more often within the business organisation is the direct determinant of the impact that may be assigned on the business structure, to relate it with the organisational well-being. The most common power that the leadership exerts on the entire organisation is that the different leadership styles are always gravitated towards the creation of a team spirit and operate to achieve a unified goal (Al Khajeh, 2018).

Figure 6: Leadership affecting organisational performance (Source: Al Khajeh, 2018)

Figure 6: Leadership affecting organisational performance (Source: Al Khajeh, 2018)

As per the given case study, the leader of WeWork, when Adam Neumann resigned, the entire system of leadership had toppled and a new form of leadership had been developed. As the new CEO, Sandeep Mathrani had been positioned, the leadership change that had occurred may be thought of as the change in the management structure of the company and create new corporate governance.

Conclusions and Recommendations

Conclusions

From the above conclusion, it may be concluded that the corporate governance of WeWork had been quite poor and financially starving because of the intermittent complexities that have surfaced in the organisational perimeter. It may be summarised that there are varied effects of corporate governance on the operation of a business, and according to academic references, the first impacts may be discussed. There is a range of research papers that have established the relationship between corporate governance and the financial performance of business organisations for a longer period (Delima and Ragel, 2017).

The resultant remark that has come up regarding the corporate governance of the organisation is that the impact of the activity of the business organisation is directly impacted by corporate governance. Concluding from above, the sustainable development at the corporation of WeWork has been considered better after Adam Neumann had resigned and was replaced by a new CEO, also considering the different stakeholders interested in the operations of WeWork.

The financial stability of WeWork had been doubted because of the reason that the company had met a severe financial issue and had almost fallen to the verge of a large monetary collapse after 2019, concluding a reiterating cause and issue of a financial gap. The gap had been so large as analysed above, that WeWork had to reduce the operational cost by almost $1.5 billion and the 40% declining cost had been the reason for a slowdown in the operational efficiency of the company.

The interest of the different stakeholders such as the suppliers and the midrange stakeholders had been affected by the company’s decision to not disclose the IPO position as concluded from above, and this shows that WeWork needs to consider various aspects further.

Recommendations

There are different recommendations that WeWork may follow to let the financial eclipse of the corporation be revived and get to the point of sustainability for a longer period

- WeWork after the change and merger with BowX Acquisition Corporation needs to introduce a better model of managerial change and create a system of better evolution within the organisational structure through training, workshops and employee group summits. Different research papers are of the opinion that the business model that is relevant to the change produced needs to be explained, as Customer Relationship Management (CRM) is one of the most useful models that WeWork needs to redesign after the merger (Harmon, 2019).

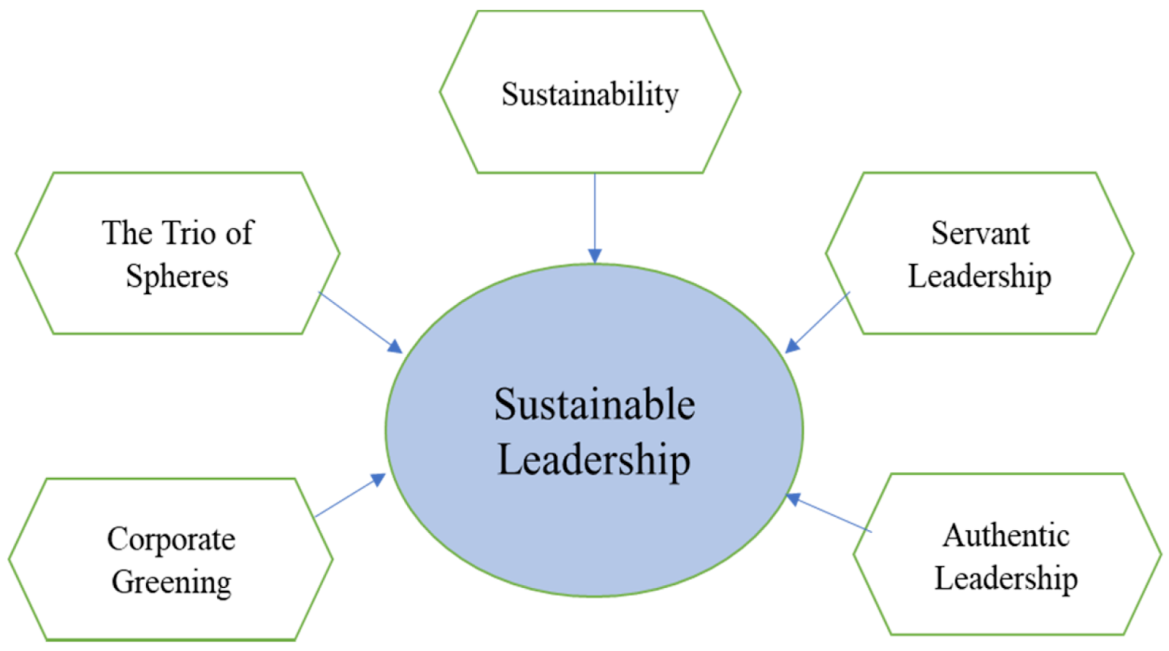

- Sustainable leadership which allows the cooperation of WeWork to survive in the long run may be re-emphasized, as it is a framework of leadership that most business corporations find useful to implement. Here, the concept of sustainable leadership is appropriate to mention because the style of leadership is directly related to Corporate Social Responsibility and hence positively affects the organisational performance (Wiengarten et al., 2017).

Figure 7: Sustainable leadership (Source: Wiengarten et al., 2017)

Figure 7: Sustainable leadership (Source: Wiengarten et al., 2017)

- WeWork needs a better financial management and risk assessment team for the rest of the life cycle of the company, and this is possible if the company recruits experienced management teams from other companies. The transition shock that the employees have faced after being transferred or being terminated from WeWork is great, and WeWork needs to address that by a tool of performance assessment or providing psychological assistance.

References

Akhtar, P., Frynas, J.G., Mellahi, K. and Ullah, S., 2019. Big data‐savvy teams’ skills, big data‐driven actions and business performance. British Journal of Management, 30(2), pp.252-271.

Al Khajeh, E.H., 2018. Impact of leadership styles on organizational performance. Journal of Human Resources Management Research, 2018, pp.1-10.

Aronoff, K., 2017. Thank God It’s Monday. Dissent, 64(1), pp.55-63.

Bates, L.K., Zwick, A., Spicer, Z., Kerzhner, T., Kim, A.J., Baber, A., Green, J.W. and Moulden, D.T., 2019. Gigs, side hustles, freelance: What work means in the platform economy city/Blight or remedy: Understanding ridehailing’s role in the precarious “gig economy”/Labour, gender and making rent with Airbnb/The gentrification of ‘sharing’: From bandit cab to ride share tech/The ‘sharing economy’? Precarious labor in neoliberal cities/Where is economic development in the platform city?/Shared economy: WeWork or We Work together. Planning Theory & Practice, 20(3), pp.423-446.

Borgenicht, N., 2020. Can WeWork Survive Its Botched IPO?. In SAGE Business Cases. SAGE Publications: SAGE Business Cases Originals.

Camilleri, M.A., 2020. The use of data-driven technologies for customer-centric marketing. International Journal of Big Data Management, 1(1), pp.50-63.

Choi, T.M., Wallace, S.W. and Wang, Y., 2018. Big data analytics in operations management. Production and Operations Management, 27(10), pp.1868-1883.

Christofi, M., Leonidou, E. and Vrontis, D., 2017. Marketing research on mergers and acquisitions: a systematic review and future directions. International Marketing Review.

Delima, V.J. and Ragel, V.R., 2017. Impact of corporate governance on organizational performance. International Journal of Engineering Research and General Science, 5(5).

Diamantidis, A.D. and Chatzoglou, P., 2018. Factors affecting employee performance: an empirical approach. International Journal of Productivity and Performance Management.

Etareri, L., 2022. An Analysis Framework of Change Management.

Genugten, A., 2022. Facilitating Sustainable Organisational Change: A Case-Study in Sustainability Assessment Models.

Harmon, P., 2019. Business process change: a business process management guide for managers and process professionals. Morgan Kaufmann.

Jarosch, G., 2021. Searching for job security and the consequences of job loss (No. w28481). National Bureau of Economic Research.

Li, R., Zhao, Z., Sun, Q., Chih-Lin, I., Yang, C., Chen, X., Zhao, M. and Zhang, H., 2018. Deep reinforcement learning for resource management in network slicing. IEEE Access, 6, pp.74429-74441.

NBCUniversal News Group. 2022. WeWork imploded in 2019. the pandemic brought it back to life. NBCNews.com. Retrieved November 1, 2022, from https://www.nbcnews.com/business/business-news/wework-imploded-2019-pandemic-brought-it-back-life-n1267957

Omodan, B.I., Tsotetsi, C.T. and Dube, B., 2020. Analysis of human relations theory of management: A quest to re-enact people’s management towards peace in university system. SA Journal of Human Resource Management, 18, p.10.

Shad, M.K., Lai, F.W., Fatt, C.L., Klemeš, J.J. and Bokhari, A., 2019. Integrating sustainability reporting into enterprise risk management and its relationship with business performance: A conceptual framework. Journal of Cleaner production, 208, pp.415-425.

Taghipour, M., Soofi, M.E., Mahboobi, M. and Abdi, J., 2020. Application of cloud computing in system management in order to control the process. Management, 3(3), pp.34-55.

Valaskova, K., Kliestik, T., Svabova, L. and Adamko, P., 2018. Financial risk measurement and prediction modelling for sustainable development of business entities using regression analysis. Sustainability, 10(7), p.2144.

WeWork. 2022. Office Space and Workspace Solutions. WeWork. Retrieved November 1, 2022, from https://www.wework.com/

Wiengarten, F., Lo, C.K. and Lam, J.Y., 2017. How does sustainability leadership affect firm performance? The choices associated with appointing a chief officer of corporate social responsibility. Journal of business ethics, 140(3), pp.477-493.

Appendices

Appendix 1

https://www.globest.com/2022/03/14/wework-loses-4-4b-in-2021-but-sees-better-days-ahead/

https://www.globest.com/2022/03/14/wework-loses-4-4b-in-2021-but-sees-better-days-ahead/

Appendix 2

Know more about UniqueSubmission’s other writing services:

Güzel aydınlatıcı makale için teşekkürler daha iyisi samda kayısı umarım faydalı çalışmalarınızın devamı gelir.