BSS064-6 Leading and Managing Organizational Resources Assignment Sample

1.0.Introduction

The complexity and need for productivity have led to the developing hybrid mode, a new form of organizational approach to work. Hybrid mode is considered as a form of organization that combines functional and product based structures (Huang, et al., 2017). Under the concept, employees are needed to involve with various projects and report to different managers under the hybrid based organizational structure. Along with this, flexibility in performing job is also considered as a key element of hybrid mode based work. Under the hybrid mode, sustainable leadership is considered to be important in managing the operation management and enhancing productivity, performance and profit. Sustainable leadership is important in hybrid mode as the management of functions becomes difficult under the form of organizational structure. This report focuses on the HSBC case study to analyze the hybrid mode of organizational structure in the company alongside the organizational structure, corporate governance, and leadership. Based on the analysis, areas for improvement in operation for HSBC and its potential impact on productivity and performance have also been developed in the report.

2.0. Analysis of HSBC’s main challenges

2.1. Leadership challenges

The business of HSBC in the market of Europe has faced major issues with profitability and performance until 2020. Ineffective leadership as well as incapability to develop strategies are found to be the main reason for the issues. It has led the company to terminate CEO John Flint in 2019. John Flint had been the CEO of HSBC for 18 long years. But recent challenges have enforced the organization to change its CEO (Forbes, 2019). The requirement of cultural, strategic, operational approaches has been the major factor for the company to fire the CEO and adopt new approaches. In place of John Flint, Mark Tucker had been recruited by the company in the role of CEO. The challenges with leadership have been continued in HSBC leads to the change of leadership in 2020 too. The CEO for Europe James Emmett has been replaced by Nuno Matos. While a new role has been created for overseeing the operations in Europe, the Middle East, Latin America, Canada, North Africa, and Turkey (HSBC, 2021). Stephen Moss has been recruited for the post of overseeing from his existing post of group head of strategy. In regards to analyzing the leadership turmoil situation of HSBC between 2019 and 2020, the situational leadership theory can be considered. According to the leadership theory, situational variables play an important in leadership rather than the leadership style (Meier, 2016). Based on the leadership theory, it can be said that the termination of John Flint and James Emmett has been influenced by situational variables. Both the leaders have been worked in the company for a long term with successful approaches. However, the need for change in the organization to come out from traditional approaches has been the situation in HSBC. Along with this, the political pressure of replacing the CEO has also been an external situational factor that enforced HSBC to terminate the leaders (Theguardian, 2019).

2.2. Corporate governance challenges

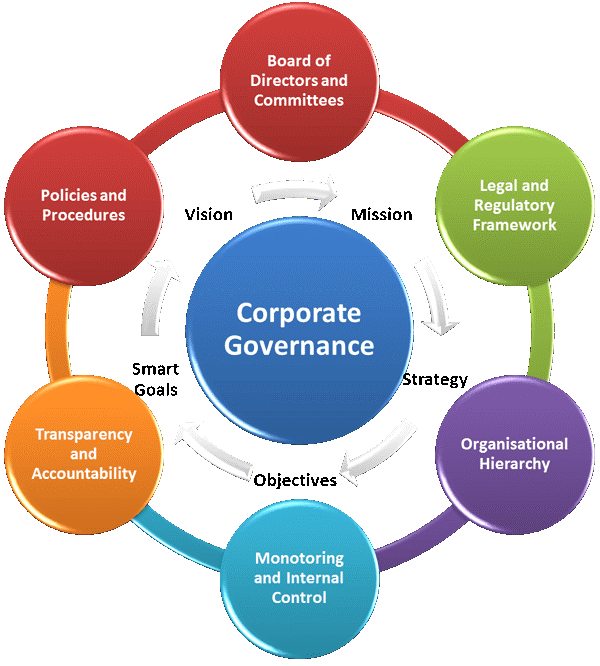

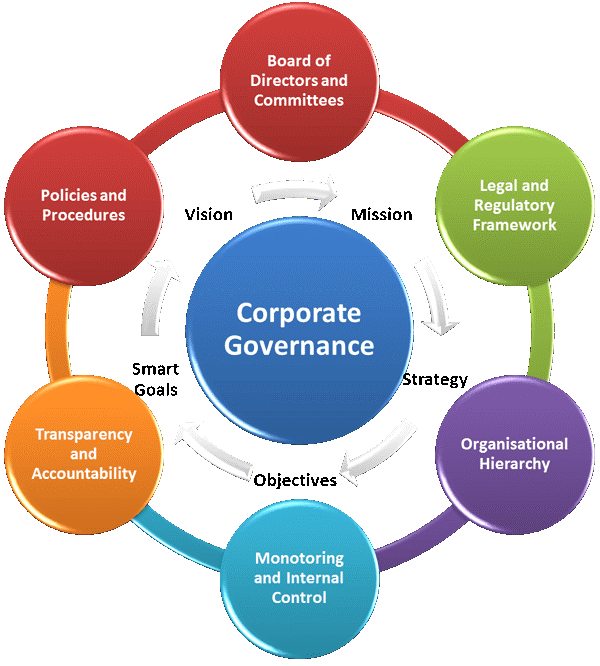

Figure 1: Corporate Governance Source: (Armitage, et al., 2017)

The hierarchical structure and corporate governance of HSBC are also considered to be going through challenges. In September 2021, the organization has announced a change in its management system to develop a leadership framework that can accelerate transformation as well as growth in business. The major reason for making changes in the structure and corporate governance is to eliminate the hierarchical structure where hundreds of managers involve in work with their personal leadership approaches. Considering the changes in the hierarchical structure of HSBC and the management system, it can be said that the function of the organization becomes difficult due to the complicated structure. Communication and collaboration are the major concerns regarding the complicated structure of management (Armitage, et al., 2017). Thus, the issue in decision making is quite common in HSBC that leads to an impact on the performance and profitability of the company. Theoretically, it is also claimed that effective corporate governance involves the dedicated focus over the CEO, senior management, and directors for working with their responsibilities. Under such an approach, long term organizational goals become easier to adopt by organizations. In this regard, it can be said that the presence of several managers and complicated organizational structure has made it difficult to manage effective corporate governance with proper allocation of roles and responsibilities.

2.3. Organizational change challenges

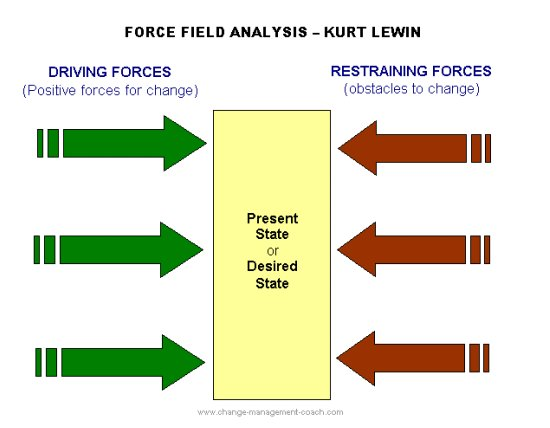

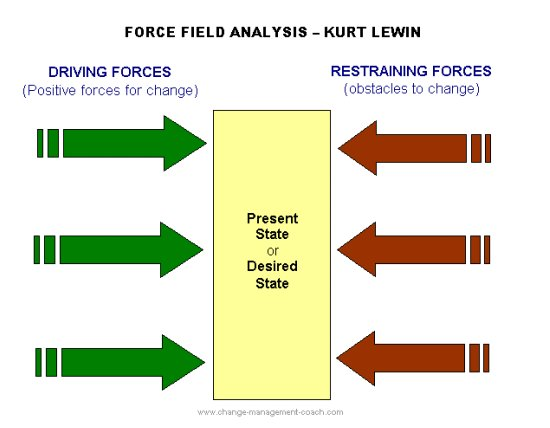

Figure 2: Lewin’s Force Field Analysis Source: (Burnes & Bargal, 2017)

Organizational change is the approach of an organization to make alterations in their dimensions of business such as technology, strategy, policies, procedures culture. Organizational change is considered to be a difficult approach to undertake in organizations (Suddaby & Foster, 2017). It requires focusing on numerous areas to control the implementation of the change management plan. It is evident from the case study of HSBC that the bank has been undergone a restructuring across its global businesses. In order to analyze the change management challenges in HSBC, Lewin’s force field analysis can be considered. Lewin’s force field analysis involves two dimensions which are driving forces and restraining forces (Burnes & Bargal, 2017). Driving forces are the factors that influence a change in organizations. Whereas, restraining forces involve resisting the change management approaches to be implemented. Considering the restraining forces, it can be said that the restructuring will cause thousands of job cuts as well as a demotion of employees and managers. In this scenario, termination of employees at large numbers as well as a demotion of managers is restraining the company to implement the change. This is because the protest of employees as well as mental stability to provide effective productivity are the major reasons behind it. While the change is assured to not cause any pay cut for the staff even after demotion in their work role which is considered to be a driving force behind the change. Another driving force for the company to implement the change is effective wealth management under the restructuring process.

2.4. Hybrid working mode

Expense is a major challenge in the business of HSBC as the company face issue with its expenses for the business operation. This factor has enforced the company to adopt a hybrid mode of work. Under the approach, the organization focuses on business operation under the work from the home approach. The hybrid mode of business is focused to consider for reducing the property footprint over the upcoming years. Along with this, other changes in the company involve working two employees at a desk, a reduction of 40% of office spaces (Theguardian, 2019). Massive financial loss for the company by £6.3 billion GBP in the ongoing year is also a major reason that influenced the organization to adopt the approach. In this regard, it can be said that the expenses, as well as environmental impact through office footprint, are the major issues that enforce HSBC to adopt the hybrid model of work.

3.0. Evaluation of improving the operation management and enhance productivity and performance

3.1. Areas to consider for improvement in operation management

Based on the case study, it is evident that HSBC has faced a major issue with its profit from the market of Europe in comparison to the Asian market. Changes in leadership, as well as restructuring of the organization, are the major factors that have impacted the business of HSBC. Owing to this reason, profit and performance of the company have majorly been impacted. In this regard, HSBC needs to focus on the improvement in certain areas of operation management. The major areas to consider by HSBC are training, prioritizing the employees, development of customer service, implementing a proper review process (Wolniak, 2020). With such an approach, HSBC can improve the state of productivity and performance inside the business. Training is required in the organization to allocate roles and responsibilities to the employees following the implementation of change management. With training, employees can have an understanding of their new roles and responsibilities. While prioritizing the employees and providing support to them through monetary or internal recognition can help in motivating the staff to perform at their best level. Other than this, the areas for improvement in operation management involve technology and automation, staff productivity, process cost, and channel optimization.

With the focus on these areas, HSBC can improve the state of production. In the contemporary era of business technology and automation have become common and important for businesses. With the use of automation and technology, HSBC can replace the traditional techniques adopted for operation management. For example, improvement of security and transparency through fraud detection as well as prevention in payment can be effective for HSBC to implement automation (Forbes, 2019). It would help in making a decision based on technology along with the reduction of major issues. Along with this, the implementation of technology and automation can also help the organization to increase its staff productivity. This is because technology and automation simplify the organizational approach of managing production by increasing the production rate. Under the approach of increasing staff productivity, HSBC is also required to focus on the area of performance management. With the performance management approach, the employees’ ability to execute tasks becomes easy to understand and explore. HSBC management can also understand the ability of their employees and make the decision for motivation through monetary or internal recognition.

3.2. The potential impact of improvement in operation management to enhance productivity and performance

With the improvement of operation management areas, HSBC can enhance the productivity rate as well as the performance of the company. Improvement in the area of operation management, can help in increasing productivity as well as a performance by increasing the organizational capabilities along with the productivity of employees. With the influence of technology, HSBC can simplify its decision making process and reduce the chance of errors in the decision made by humans. Due to the presence of a complicated organizational structure and corporate governance framework, the decision making in HSBC is quite difficult (Zhang, et al., 2019). It creates difficulty in terms of collaboration and communication among the employees and managers. Thus, the incorporation of technology and automation in the company can help in improving the efficacy of operation management. Further, the performance management approach in HSBC can separately be impacted over the staff productivity and performance. This is because the performance management approach in organizations is quite related to employee motivation and the identification of weaknesses in the working approaches of employees. In this regard, the potential impact of the performance management approach in HSBC can help in understanding the efficacy of employees and strategies can be formulated to deal with the challenges (Suddaby & Foster, 2017). Further, the organization is also focused to adopt a hybrid work mode for organizational growth. For this purpose, HSBC is highly required to adopt a performance management approach. This is because the company focuses on adopting work from a home approach where monitoring of the employees is quite difficult. This is why HSBC needs to focus on adopting a proper performance management approach that can help in tracking the work performance of staff under the work from the home approach.

4.0. Conclusion

It is concluded by analyzing the operation management in HSBC that the company has faced major loss in its business operation across the European market. Although, the Asian market of HSBC has shown progress in the business European market has caused major financial loss. The organization’s European subsidiary has faced issues with leadership, complicated corporate governance and hierarchical structure, change management. The issues are considerable for HSBC as it directly impacted operation and productivity management. Owing to this reason, certain areas have been suggested to the company for improving operation management. The suggested areas for improvement in the business of HSBC involve training and performance management framework implications.

5.0. Recommendations

With the consideration of analysis performed on the HSBC case study, a number of issues have been identified in the company. Based on the identified issues certain suggestions or recommendations are to be given to the company in this section. The major areas of challenge in HSBC involve leadership changes, complicated hierarchical and corporate governance structure, adoption to change management as well as hybrid work mode. In this regard, it can be said that the company must focus on building a new leadership strategy under the leadership of new leaders. The leadership strategy in HSBC should be focused on sustainable approaches. Under the sustainable approach, HSBC needs to focus on the reduction of its cost as well as the benefits of employees. With such an approach, the organization can bring stability to the perform as well as recover a certain amount from the loss faced in the European market. Along with this, it is also evident that employee protest is also a major issue with the potential change management approach to be implemented in HSBC. In this regard, the organization needs to develop an effective communication strategy for interacting with the employees. The employees must be ensured of compensation so that their mindset and motivation does not get low in a short time. Another challenge involved in the business of HSBC is based on the adoption of a hybrid work mode. Under the working mode, it is quite difficult for companies to evaluate employee performance through monitoring. Although cost cutting becomes easier for organizations with the consideration of hybrid work mode. For this purpose, the company must focus on monitoring employees through observation over their time of work. The organization can also be involved in providing deadlines or specific tasks to employees for understanding their capabilities.

6.0. References

Armitage, S., Hou, W., Sarkar, S. & Talaulicar, T., 2017. Corporate governance challenges in emerging economies. Corporate Governance: An International Review, Forthcoming, 1(1), p. 1.

Forbes, 2019. Why HSBC CEO John Flint Got Fired: Poor Future Fit With His New Boss. [Online]

Available at: https://www.forbes.com/sites/georgebradt/2019/08/05/why-hsbc-ceo-john-flint-got-fired-poor-future-fit-with-his-new-boss/?sh=4bff87e07e11 [Accessed 05 March 2022].

HSBC, 2021. HSBC Holdings plc Senior management changes. [Online]

Available at: https://www.hsbc.com/news-and-media/media-releases/2021/senior-management-changes [Accessed 05 March 2022].

Huang, J., Pan, S. & Liu, J., 2017. Boundary permeability and online–offline hybrid organization: A case study of Suning, China. Information & Management, 54(3), pp. 304-316.

Meier, D., 2016. Situational leadership theory as a foundation for a blended learning framework. Journal of Education and Practice, 7(10), pp. 25-30.

Suddaby, R. & Foster, W., 2017. History and organizational change. Journal of management, 43(1), pp. 19-38.

Theguardian, 2019. HSBC boss John Flint resigns ‘by mutual agreement’. [Online]

Available at: https://www.theguardian.com/business/2019/aug/05/hsbc-boss-john-flint-resigns-by-mutual-agreement [Accessed 05 March 2022].

Wolniak, R., 2020. Main functions of operation management. Production Engineering Archives, 26(1), pp. 11-14.

Zhang, W., Wang, J. & Lin, Y., 2019. Integrated design and operation management for enterprise systems. Enterprise Information Systems, 13(4), pp. 424-429.

7.0. Bibliography

Aguilera, R.V., Marano, V. and Haxhi, I., 2019. International corporate governance: A review and opportunities for future research. Journal of International Business Studies, 50(4), pp.457-498.

Armitage, S., Hou, W., Sarkar, S. & Talaulicar, T., 2017. Corporate governance challenges in emerging economies. Corporate Governance: An International Review, Forthcoming, 1(1), p. 1.

Burnes, B. & Bargal, D., 2017. Kurt Lewin: 70 years on. Journal of Change Management, 17(2), pp. 91-100.

Choudhry, M., 2018. An introduction to banking: principles, strategy and risk management. John Wiley & Sons.

Forbes, 2019. Why HSBC CEO John Flint Got Fired: Poor Future Fit With His New Boss. [Online] Available at: https://www.forbes.com/sites/georgebradt/2019/08/05/why-hsbc-ceo-john-flint-got-fired-poor-future-fit-with-his-new-boss/?sh=4bff87e07e11 [Accessed 05 March 2022].

HSBC, 2021. HSBC Holdings plc Senior management changes. [Online] Available at: https://www.hsbc.com/news-and-media/media-releases/2021/senior-management-changes [Accessed 05 March 2022].

Huang, J., Pan, S. & Liu, J., 2017. Boundary permeability and online–offline hybrid organization: A case study of Suning, China. Information & Management, 54(3), pp. 304-316.

Meier, D., 2016. Situational leadership theory as a foundation for a blended learning framework. Journal of Education and Practice, 7(10), pp. 25-30.

Suddaby, R. & Foster, W., 2017. History and organizational change. Journal of management, 43(1), pp. 19-38.

Theguardian, 2019. HSBC boss John Flint resigns ‘by mutual agreement’. [Online] Available at: https://www.theguardian.com/business/2019/aug/05/hsbc-boss-john-flint-resigns-by-mutual-agreement [Accessed 05 March 2022].

Wolniak, R., 2020. Main functions of operation management. Production Engineering Archives, 26(1), pp. 11-14.

Zaman, R., Jain, T., Samara, G. and Jamali, D., 2020. Corporate governance meets corporate social responsibility: Mapping the interface. Business & Society, p.0007650320973415.

Zéman, Z., 2019. New dimensions of internal controls in banking after the GFC. Economic Annals-XXI, 176, pp.38-48.

Zhang, W., Wang, J. & Lin, Y., 2019. Integrated design and operation management for enterprise systems. Enterprise Information Systems, 13(4), pp. 424-429.

8.0. Appendices

Figure 1: Corporate Governance Source: (Armitage, et al., 2017)

Figure 2: Lewin’s Force Field Analysis Source: (Burnes & Bargal, 2017)