BSS064-6 Leading and Managing Organizational Resources Assignment Sample

CRITICALLY ANALYSIS OF HSBC ITS HYBRID WORKING MODEL AND SUSTAINABLE LEADERSHIP

Introduction

The alterations in regulations and policies all over the globe have influenced organizations to restructure their business model. Due to the disturbances in the political environment and due to Covid-19, hybrid modes of working have been found suitable for different industries. Therefore, it can be stated that hybrid working facilities provided to the employees have been useful for their income growth along with the profitability of the organization itself (Johannes et al. 2018). Organizations all over the world are trying to restructure their business model due to the losses suffered and to eradicate any possibility of pay cuts for the employees. A detailed understanding about the sustainable leadership initiatives for improvement in operation management along with enhancing productivity and performance has been provided in this report. On the other hand, the different challenges associated with the business model of HSBC have been signified in this report along with the issues faced by it.

Case background

Figure 1: HSBC logo

(Source: HSBC, 2022)

The case study on HSBC has shed light on the company’s operations in a global context focusing on the achievement of sustainability in the banking sector. The leadership and management in the banking sector have been focused upon helping to shed light on sustainable leadership, its importance and prevalence in the banking sector (HSBC, 2022). Moving further the case study has reflected how even after being one of the largest banks in the global context HSBC has been facing losses at different ends. These issues thus summarized in the case study have reflected the lack of proper leadership and management which influenced the organization to adopt a hybrid working model (Wilson and Spezzati, 2020).

The case study has also reflected how the company has made changes in some of its branches like Argentine where 100 days of intensive activity and training was provided to approximately 6,000 employees to achieve a change in the organizational culture. Adding to that it has also been seen that HSBC is facing a number of challenges that significantly threatens its exciting position in the market. These challenges include complicated corporate governance, restructuring of the organization in the global context, and the adoption of a global hybrid working model (Singh Deo, 2009). The presence of these challenges poses a significant threat to the company’s position in the market. Thus, the adoption of proper sustainable leadership is the need of the hour.

Issues HSBC is currently facing

Increasing amount of losses in different sectors

In the global banking market in which the organisation operates they faced significantly higher losses. Only the securities services branch of the organisation was the one to achieve a positive figure in terms of revenue. Such losses in the organisation’s performance had increased significantly previous 2019, especially in the Asian market that is responsible for the generation of the majority of its profits. However, in the European division of the organisation faced a significantly higher loss of $914 million in a span of 9 months until September 2019. The organization’s South American division has also been facing several issues due to a training session involving approximately 6,000 employees undertaken by the organisation.

Top leadership shake up

There was a shake up in top leadership of HSBC Holdings PLC. Many leaders were in the race to become the permanent boss of the company. Nuno Matos is a close Lieutenant of the acting chief executive officer Noell Quinn in HSBC who is in the front row to become the permanent Boss of this company. Quinn has been managing HSBC since last August when John Flint was replaced by him. On the other hand, Stephen Moss and James Emmett were also in the running to become boss of the company. The sudden replacement of John Flint and the race to become permanent boss of the company led to confusion within the management of HSBC Holdings PLC (Wilson. and Spezzati, 2020).

Complicated corporate governance

The corporate governance adopted by the organisation which utilizes a hierarchical approach of managing the workforce has also been identified as highly challenging in the present business environment. In order to mitigate this issue, the organisation has decided to alter the roles of several managers of the organisation who would see a change in their current position. These individuals might be reallocated to different divisions of the organisation (Battistella, 2020). Therefore such restructuring and reorganising the human resources has created a complicated environment and has also significantly reduced the morale of the workforce. The presence of such conditions within the company requires to be handled in an effective manner so that it does not affect the productivity and efficiency of the employees who work under these managers

Restructuring of the organisation in the global context

Apart from changing and shifting other roles of managers the organisation also decided to adopt global restructuring as a part of mitigating their existing issues present within the human resource management and leadership (Wilson. and Spezzati, 2020). In the global context, restructuring can lose the support of different entities and organisations which are part of their outsourcing section. On the other hand, restructuring the business firm can lead to alteration of the own regulations which may not get aligned with the banking or financial regulations of different countries.

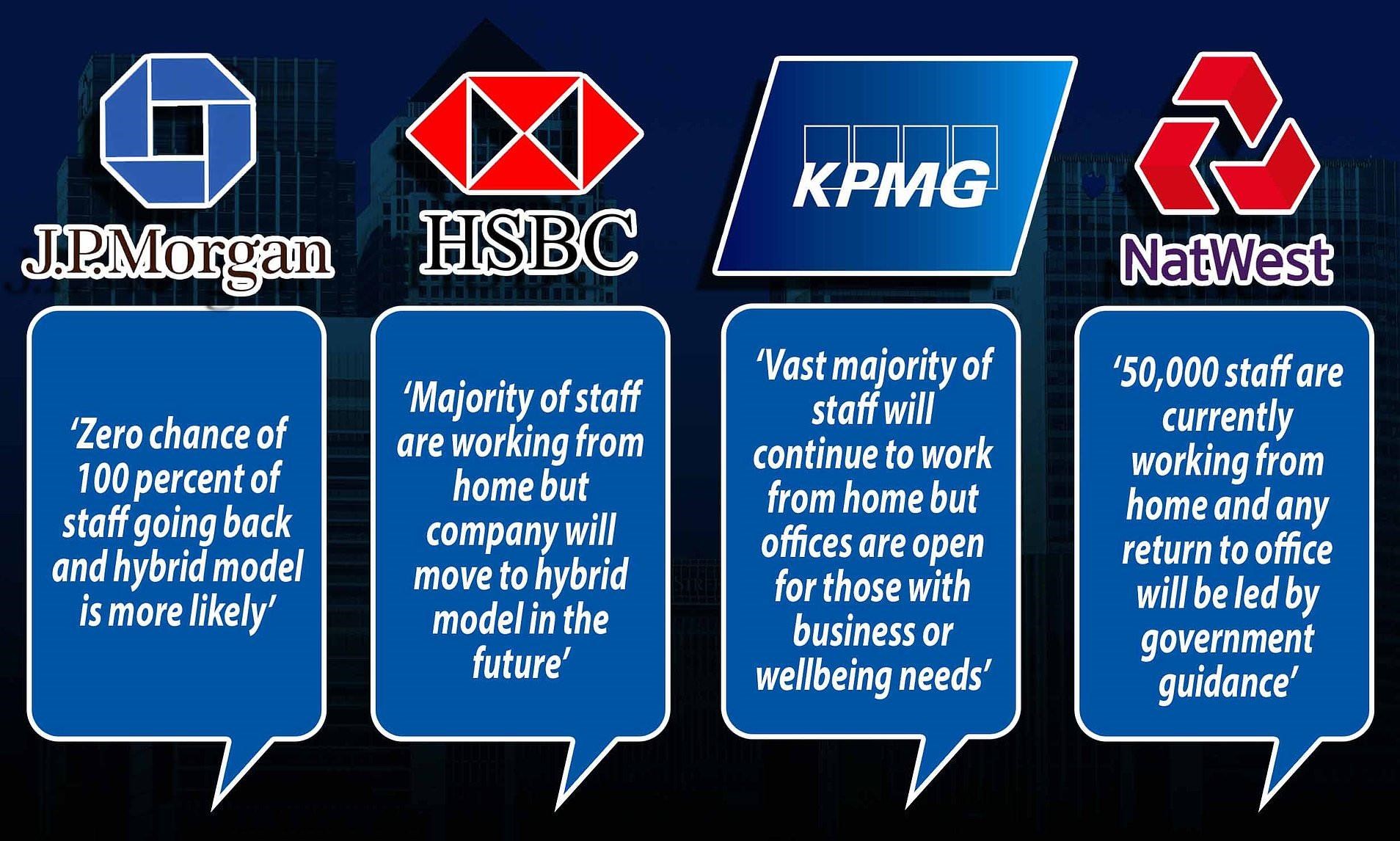

Adoption of a global hybrid working model

The organisation also aimed to utilise the hybrid working model as a permanent part of its organisational structure however this also requires a significant amount of investment. Nonetheless, in order to achieve this objective successfully, the organisation aims to utilise a cost-cutting method to minimise the impact of dropping revenue (Losada and Bajer, 2009). The hybrid working model would allow the organisation to utilise a large proportion of the workforce to work from home and remotely which would significantly reduce operational costs.

Sustainable leadership initiatives

Figure 2: HSBC hybrid culture

(Source: Feehan, 2021)

Restructuring the workspace of the organisations can be termed as the sustainable leadership initiative of HSBC. On the other hand, it should be noted that after suffering losses over the last 18 months from its influential market, the organisation tried to restructure its business model and switched to the hybrid mode of working. It has tried to cut the investments by allowing 40% of the employees to work from home (Ganderson, 2020). It has benefitted the employees as due to Covid-19, they suffered from income shortages and alternative shift of hybrid working has helped them to save the cost of transportation to reach the office. It has also removed their fear of getting affected by Covid-19 disease. The sustainable leadership initiatives have been prominent within the workforce through the approach of making no alterations in the contractual agreements between the authority and the employees. The leaders have been helpful to all the employees even if they are working from home or from the office.

No changes to the contractual agreement of the employees have influenced their mentality about the authority of HSBC. It has made the employees think that the organisation is thinking for their well-being along with earning profit to compensate for the loss. The complications have been removed by the organisation’s authority by redesigning the culture on leadership priority of the workspace. The cutting down of office spaces has cut down the investment of the bank. This has eradicated the scope of pay cuts for the employees.

Fiedler’s Contingency Theory

Fiedler’s Contingency Theory of leadership is fitted in this case. It is because the leaders understood the requirements of the present situation and acted accordingly. Stephen Moss has tried to provide mental stability to the employees in this difficult situation along with cutting unnecessary investments done by the company. During the pandemic, employees are tense about the low income which has been eradicated by the efforts from the leaders about the contractual agreements. This has increased the work productivity of the employees highly (Zhukovska et al. 2021).

Operations management

The operations management of the organisation is one of the most important aspects that can be improved with the help of sustainable leadership. Leaders of the organisation that have adopted sustainable leadership can utilise activities such as goal setting, identification of opportunities that can help in the workforce to improve its overall productivity and helped HSBC to improve its services and competitive position in the global market (Andri et al. 2021). Sustainable leadership can also increase recognition and provide rewards to employees which can have a significant impact on operations management. Operations management of the organisation can also benefit from effective resource management strategies adopted by the leaders. Resource management strategies adopted by leaders especially involving human resources allow the development of a team that can actively achieve the objectives necessary to be achieved (Guhr et al. 2019).

Theory X and Y

Drawing upon the implications of theories X and Y it can be stated that theory X reflects an organisational culture that is more authoritarian while Y is more liberal. Hence aligning this with the case of HSBC it can be stated that a more liberal and open front culture needs to be adopted in the organisation (Abdullahi et al. 2020). This can increase the productivity of the employees while alos ensuring that are contributing enough to achieve their given objectives. This can be an effective way to enhance the existing operations of the company. Moreover, adopting such management and operational capability would also allow the organisation to increase

Operations management within the organisation can also benefit from the adoption of sustainable leadership as sustainable leadership aims to improve the working condition and develop a positive working culture within the company (Top et al. 2020). Positive working culture is essential for employees working in the banking sector especially since HSBC has decided to adopt a permanent hybrid working model. Hybrid working models can face several issues and in this regard sustainable leadership would require to ensure that the communication level between the teams and the managers responsible for handling them is significantly high. Moreover, another aspect that can allow sustainable leadership to benefit the operations management within HSBC is the inclusion of a diverse workforce.

Enhancing productivity and financial performance

In the sector of banking, new standards and code of conduct have promoted corporate accountability requirements for transparency and the need for managing the environment and society. The different subsidiaries of HSBC have different cultures. It has faced a loss of 9% in the adjusted profit at the end of 2019 which is 4.1 billion dollars from the previous year which was 5.9 billion dollars (Lahkani et al. 2020). In the last 18 months, HSBC faced different problems in the main Asian market which can be considered as the main profit generator of HSBC. It was mainly due to the sudden changing of leaderships of the organisation that affected the business in Europe, the Middle East and Latin America. The branches of HSBC in the Asian market also faced huge problems due to the shakeup of leadership.

The issues were decreasing the productivity of the employees due to the diverse variety of leadership. The complicated management system of HSBC has damaged employee productivity highly. This is the reason why the bank is facing high financial losses. Therefore the bank is trying to accelerate the transformation by the creation of a simple leadership framework. No contractual changes associated with employee benefits will take place due to the transformations. This type of leadership initiative will be helpful for maintaining sustainability within the organisation. This will lead to the removal of problems associated with income shortage for the employees. HSBC tried to implement a hybrid working model in order to proceed with its cost-cutting program. It can be considered as one of the latest organizations that embraced hybrid working with proper planning to make it a useful model for all the banks worldwide (Sibanda et al. 2020). The financial loss of HSBC has influenced them to reduce its space in the office by 40%. It enabled the staff to work from their home as well as in the office.

Alternative shifts are provided to the staff for maintaining sustainable leadership. On the other hand, it should be noted that after the covid-19, HSBC made a decision of enhancing the hybrid model of working in order to eradicate their loss and get aligned with the issue of income shortage for the employees. This model can be considered for enhancing the productivity of the employees as the banks were shutting down many of their branches which caused fear among the employees relating to their job cuts (Kingshott et al. 2018). Therefore providing work from home facilities to 40% of the employees has removed their fear of losing their jobs and has enhanced their productivity. The employees thought that the bank was trying to focus on their issues or problems along with maintaining its own profitability.

The previous losses faced by the bank has forced them to change the leader which caused confusion among the employees. This issue has been solved by the organisation by keeping the contractual agreements of the employees unchanged in spite of the change in leadership (Thaker et al. 2019). This enhanced the productivity and performance of the employees as they were sure that the bank would provide them with benefits in emergency situations. It has tried to compensate for the financial loss due to Covid-19 and the previous alterations of leadership suddenly along with the complicated management style by giving more focus on the flexible work from home facility to the employees. This has solved the problem of income shortage within the employees along with the high investment made by the bank authority for office spaces. The target for space reduction was reached by the HSBC Bank and gained an increase in profitability.

Recommendations

During the present condition of the organisation, several losses and a number of recommendations can be provided aimed towards improving the facilitation of sustainable leadership.

Communication

It would be essential for the management of the organisation to develop a proper line of communication that can help in connecting the different members working in a team with the managers as well as the hierarchy. Moreover, communication can reduce the chances of internal conflicts and minimise misalignment between teams working on a comm objective.

Positive leadership

Positive leadership needs to be developed within the organization which can help in achieving positive responses and better productivity from the workforce. This can also help in facilitating better performance from employees working in different departments of HSBC, especially in the Asian division of HSBC

Achieving transparency

Achieving transparency is another major aspect that can help HSBC needs to incorporate to maximise the effectiveness of the workforce and achieve productivity.

Conclusion

It can be concluded that the flexible working shifts in the hybrid mode have affected the income of the employees positively along with their mental state. It can be stated that the organisation has tried to provide proper facilities to the employees even if they are working from homes such as providing them with detailed information about a particular project or a transformation that will take place. A number of issues have been faced by HSBC due to the periodic changes in its structure. Efforts have been given by the authority to change their leadership model in order to compensate for the loss suffered previously. The organisation has allowed work from home facilities for 40% of the employees which has helped them to compensate their loss and removed the chances of reducing the income of the employees highly. It can be said that the business firm has tried to get a proper idea about the hybrid model of working from the other organisations of the banking industry during the emergency situation of covid-19.

References

Abdullahi, A.Z., Anarfo, E.B. and Anyigba, H., 2020. The impact of leadership style on organizational citizenship behavior: does leaders’ emotional intelligence play a moderating role?. Journal of Management Development.

Andri, B., Darti, D., Haris, A., Wulantari, R.A., Meifilina, A. and Yusriadi, Y., 2021. The influence of leadership and incentives on nurse performance through motivation in the inpatient room of the Makassar general hospital Labuang Baji. In Proceedings of the International Conference on Industrial Engineering and Operations Management (pp. 3689-3695).

Battistella, P. .2020. ‘HSBC profits slump, plans restructuring’, Global Investor, p. N.PAG.

Feehan, K., 2021. Will WFH go on forever? Firms say they’ll look at ‘hybrid models’ instead of sending all workers back to the office after Canary Wharf chief revealed ‘gradual’ return to desks will start from March 29. [Online]. Available from: https://www.dailymail.co.uk/news/article-9311487/The-beginning-END-Canary-Wharf-chief-says-gradual-return-desks-start-March-29.html [Accessed on 28th February 2022]

Flanagan, T. and Purnanandam, A., 2019. Why do banks hide losses?. Available at SSRN 3329953.

Ganderson, J., 2020. To change banks or bankers? Systemic political (in) action and post-crisis banking reform in the UK and the Netherlands. Business and Politics, 22(1), pp.196-223.

Guhr, N., Lebek, B. and Breitner, M.H., 2019. The impact of leadership on employees’ intended information security behaviour: An examination of the full‐range leadership theory. Information Systems Journal, 29(2), pp.340-362.

Hendershott, T., Zhang, X., Zhao, J.L. and Zheng, Z., 2021. FinTech as a game changer: Overview of research frontiers. Information Systems Research, 32(1), pp.1-17.

HSBC, 2022. About the company. [Online]. Available from: https://www.hsbc.com/who-we-are/our-history [Accessed on 28th February 2022]

Johannes, R., Dedy, D. and Muksin, A., 2018. The Preparation of Banking Industry in Implementing IFRS 9 Financial Instruments (A Case Study of HSBC Holdings Plc Listed on London Stock Exchange of Year 2015–2017). International Journal of Economics and Financial Issues, 8(6), pp.124-136.

Kingshott, R.P., Sharma, P. and Chung, H.F., 2018. The impact of relational versus technological resources on e-loyalty: A comparative study between local, national and foreign branded banks. Industrial marketing management, 72, pp.48-58.

Lahkani, M.J., Wang, S., Urbański, M. and Egorova, M., 2020. Sustainable B2B E-commerce and blockchain-based supply chain finance. Sustainability, 12(10), p.3968.

Losada, A. and Bajer, J. 2009. ‘How we transformed our culture in 100 days: the story behind an intensive culture change program at HSBC Argentina’, Strategic HR Review, 8(5), pp. 18–22. doi: 10.1108/14754390910976799.

McHugh, N., Baker, R. and Donaldson, C., 2019. Microcredit for enterprise in the UK as an ‘alternative’economic space. Geoforum, 100, pp.80-88.

Sibanda, W., Ndiweni, E., Boulkeroua, M., Echchabi, A. and Ndlovu, T., 2020. Digital technology disruption on bank business models. International Journal of Business Performance Management, 21(1-2), pp.184-213.

Singh Deo, A. N. 2009. ‘Gender Diversity and Leadership Inclusion: The Keys to Workplace Success’, Vikalpa: The Journal for Decision Makers, 34(4), pp. 102–106.

Thaker, M.T., Kanan, H. and Sakaran, C., 2019. Discussion on islamic finance and small medium enterprises’ financial accessibility. Al-Iqtishad J. Ilmu Ekon. Syariah, 11(2), pp.303-340.

Top, C., Abdullah, B.M.S. and Faraj, A.H.M., 2020. Transformational leadership impact on employees performance. Eurasian Journal of Management & Social Sciences, 1(1), pp.49-59.

Wilson, H. and Spezzati, S. 2020. ‘HSBC Overhauls European Management Ahead of Major Review’, Bloomberg.com, p. N.PAG.

Wu, J. and Tran, N.K., 2018. Application of blockchain technology in sustainable energy systems: An overview. Sustainability, 10(9), p.3067.

Zhukovska, V., Piatnytska, G., Raksha, N., Lukashova, L. and Salimon, O., 2021. HR-manager: Prospects for Employment in the Labor Markets. In SHS Web of Conferences (Vol. 111, p. 01011). EDP Sciences.

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services: