BU L7 The Tourism and Hospitality Industries

Introduction

Background of Whitbread

Whitbread is one of the largest hotel brands based in the UK. This largest hotel industry operates about 840 hotels across the UK and Germany as well. In 1968, Whitbread was memorialized as an international brand through the bottling of beer and other alcoholic products. Whitbread has compiled more than 850 hotel facilities with full concessions and more than 82,000 rooms in different locations over the UK (Whitbread.co.uk, 2022). Along with that, in this company, more than 35,000 people have engaged as employees. COVID-19 has created undependable challenges for this company hence, using different strategies and effective support of shareholders and stakeholders it is able to keep its position fixed in the UK market segment. Whitbread has its overall business plan from the UK. Whitbread opened its first hotel in Germany, Frankfurt named “Premier Inn hotel” in the year 2016. The net income of this national company represented a sum of “£ (906.5) million” as per the record of 2021 (Whitbread.co.uk, 2022). [Referred to Appendix 1]

Aim

The main aim of this company is to provide effective services and facilities to their consumers at an affordable price in the competitive market segment. Removing all barriers, and providing meaningful work, skill and career development is the foremost aim of this company.

Objective

Customer satisfaction is one of the major objectives of the hospital and tourism industry. In the competitive market segment, consistent and exceptional facilities will help to create a positive effect on Caesar of overall organizational growth and accomplishment of organizational goals.

Critical discussion of the strategic position of the company

Comparison between current and future position

In this largest diversity, Whitbread is positioned at the top of the hospital industry. Worldwide this national company has a 3.5-star rating out of 5-star rating. The sustainable report of the company reported that this is one of the profitable companies to get a more heightened rate of return. As per the observations of Priem (2021), focusing on the development and best affordable services to their consumer this company has earned a position in a global context. A study report of Whitbread has demonstrated that this company’s pay range is approx “£7.83 per hour for a Front Desk Receptionist” accordingly; Whitbread is able to pay “£11.96 per hour for a Kitchen Supervisor”. Conducting this report, it can be said that the financial position of this company is quite strong and will be stronger in the near future. Convincing the support of investors and stakeholders has assisted Whitbread to determine an effective business strategy and capture a position in the UK market segment.

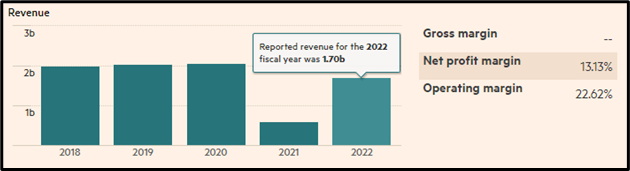

Figure 1: Revenue changes in 2022, from the fiscal year 2021

(Source: Whitbread.co.uk, 2022)

In the fiscal year of 2021, the total revenue of Whitbread was 588.09 million. Accordingly, Whitbread’s revenue report has reported a sum of 1.70 billion in 2022 (Whitbread.co.uk, 2022). Revenue blossoming has also permitted an increase in sales and reduced other goods’ expenditures. It can estimated that in the near future Whitbread will be able to breed more revenue by engaging considerable stakeholders and investors.

The financial performance of the company in the market

Financial performance is the effective factor that can be helped to make sure an investor is the company suit fitted for investment or not. As per the opinion of Hurry et al. (2022), financial analysis of the hospital industry basically depends on multiple factors like the activity of investors, the number of creditors, the activity of stakeholders in the business organization and past or present financial situation of the organization. The financial workforce and availability of skilled employees are one of the effective factors that should maintained by the hospital industry.

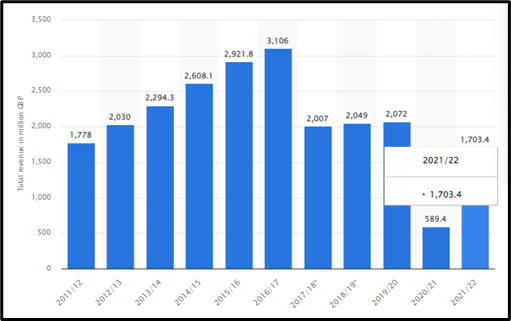

Figure 2: Annual revenue of Whitbread worldwide from 2011-2022

(Source: Statista.com, 2022)

The above statistical figures have demonstrated that Whitbread’s annual revenue has rapidly changed over multiple years, from 2012 to the current year. In the current year, Whitbread has shown an annual report of 1.7 billion British pounds (Statista.com, 2022). On the other hand, in the previous fiscal year, Whitbread was compiled with a sum of 589.4 million BP. Compared to the previous fiscal year Whitbread earned most of its revenue in 2017, around 3.1 billion British pounds (Statista.com, 2022).

Analysis of business practices of Whitbread

The uncommon ownership interchange pinnacle nourishes this company with a competitive benefit to overcome multiple challenging factors in the market segment and encourages Whitbread to evolve into one of the best hotel industries in the UK. Along with that, effective business practices and using different strategies have effectively assisted in developing an actuality in Germany. As per the observations of Köhler (2020), combined with other national hotel industries and inventory distribution has a significant role to deliver consistent services to its existing and new consumers.

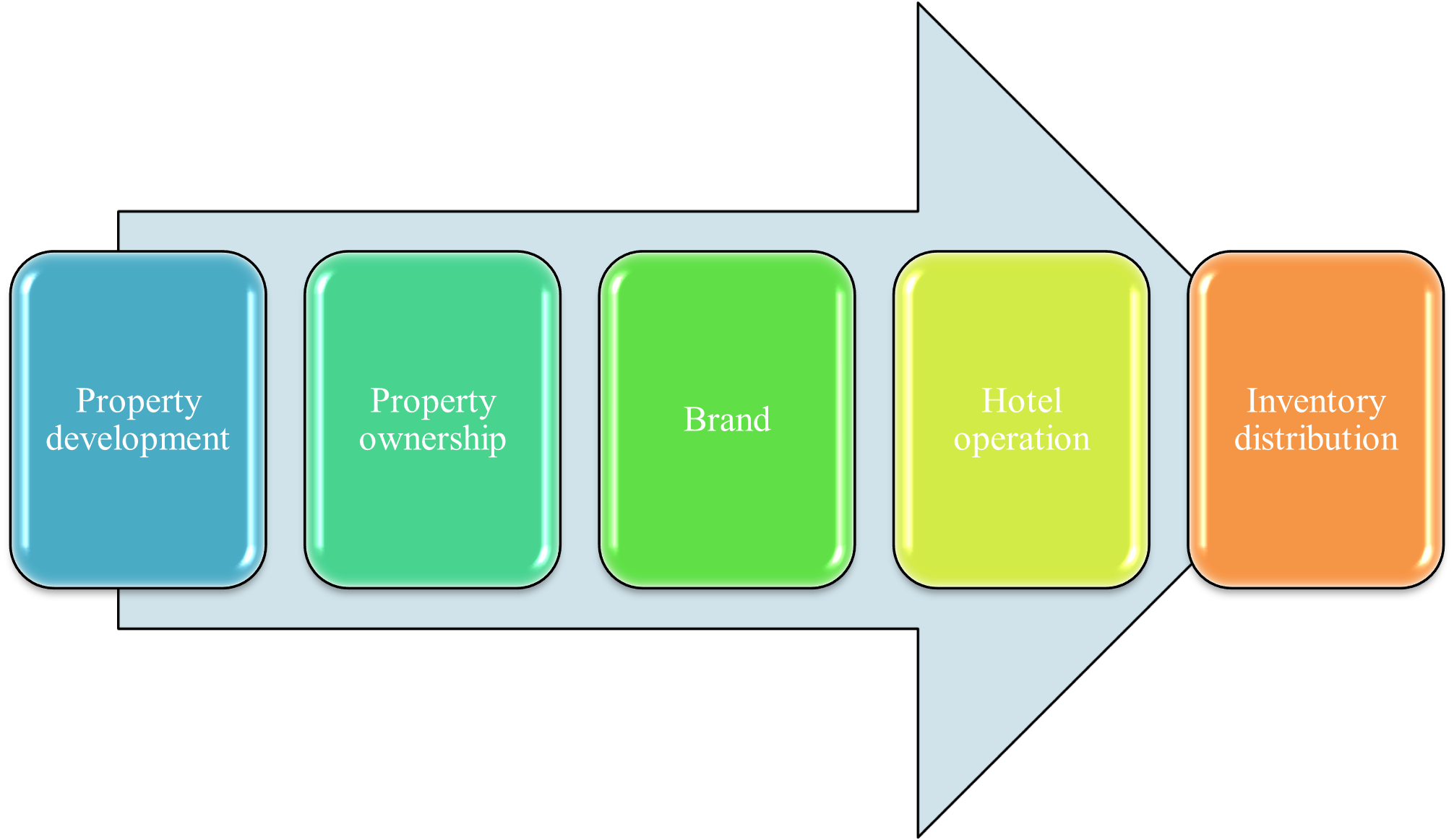

Figure 3: Hotel industry value chain

(Source: Influenced by Choi and Robertson, 2020)

The above value chain model is one of the effective strategies that has been used by Whitbread in the case of organizational conquest. The strongest business model and maintenance operation of other financial operations are quite different from other hotel industries. As per the opinion of Mazzucato (2019), marketing strategy and focus on the market also assisted Whitbread to grow more. The German market has the same attributes as the UK demand. Constructing the market more functional can be beneficial for Whitbread in case of worldwide expansion. On the other hand, the property backing model strategy is a successful business program that helps to increase business flexibility and increase the ability to invest.

Suggestions of investment

Investing is an essential part that can lead a business organization to take place in a global context. Support of a lot more investors and stakeholders can make an organization more stable from a financial future perspective. Before investing in a company, investors must have an idea about the background of the company, equities, sales revenue and other financial terms like assets and available debt in the market segment. As per the perspective of Myšková and Hájek (2019), a report of stock of a company represents the share of ownership of an individual in the company. Compared to previous activity and the overall function of Whitbread it can be justified that stable earnings and effective return on equity have influenced investors to invest more with safe return facilities in an accurate period.

Discussion

External analysis of Whitbread

| PESTLE | FACTORS | IMPACT |

| POLITICAL | ● High-rated stable government

● Low rate of interest facilities ● Values of a political index as of 2021 is 0.54 points (Gov.uk, 2022) |

A political factor of UK has created a positive effect on Whitbread to gain success |

| ECONOMIC | ● The GDP of UK is 3.19 lakh crores US dollars (2021)

● Consumer price index (CPI) of UK in 2022 is 81.97 points ● The corporate tax rate is 19% (Gov.uk, 2022) ● Captured position in the transnational context with 16.4% registered business organization |

Economic factors of UK are quite effective from other country |

| SOCIAL | ● Population of UK 6.73 crores in 2021 (Gov.uk, 2022)

● Modest life-leading fashion ● Practices of a multicultural ethnical group of individuals |

Positive impact of its multicultural society impacts |

| TECHNOLOGICAL | ● Utilization of machine understanding activity

● Robotic process of industrialisation ● Mobile computation |

Technological factors institute a positive impact in order to stable in the market of UK |

| LEGAL | ● Strict rules and regulations for wages and other vacations

● Employment act “1966 c 18” (Gov.uk, 2022) |

Legal rules have created a negative effect in UK |

| ENVIRONMENTAL | ● Rapid climate change

● Pollution rate is “329.58 CO2 (million tons) as per the record of 2020” (Gov.uk, 2022) |

Negative effects due to rapid changes of climate and environment |

Table 1: PESTLE analysis

(Source: Influenced by Cooper, 2020)

External environment and different effective factors of the UK have positively created an effect on the organizational growth of Whitbread. “Eat out to help out” is an effective scheme provided by the government of the UK that has assessed the hotel industry to grow more. As per the observations of Vallati and Grassi (2019), a stable government and low-interest rates are the major political factors in the UK. The low rate of tax and global position context of the UK has positively influenced Whitbread to grow more and more. Due to technological factors in the UK Whitbread is able to take a position all over the globe. On the other hand, consistent changes in the environment and other legal factors have created a negative impact on Whitbread’s growth and engagement of stakeholders and other communities.

Internal investigation of Whitbread

| STRENGTH | WEAKNESS |

| ● Innovative and effective services to consumers

● Cultural connection to subsidiary companies ● “Force for good” program boosting activity (Whitbread.co.uk, 2022) ● Effective business model and strategy |

● Low quality of marketing plan and strategy

● Management and staff engagement ● Non-cultural employee engagement ● Lack of confidence and culture |

| OPPORTUNITIES | THREATS |

| ● High rated and potential growth in a german market segment

● Engagement of quality staff ● Cost-effective services to existing and new consumers (Whitbread.co.uk, 2022) |

● Financial issue and lack of liquid cash

● Consolidated labour market (Whitbread.co.uk, 2022) ● Pristine of communication skill ● Poor staff engagement |

Table 2: SWOT analysis

(Source: Influenced by Almansoori et al. 2021)

The above table has demonstrated different types of strengths, weakness, threats and opportunities in the UK market segment. Whitbread is one of the strongest branding companies in the UK market. “The premier brand INN” is one of the largest hotels of Whitbread which has effectively helped to increase market share by 6% in 2020. As per the viewpoint of Wang and vom Hofe (2020), a high focus on investors and stakeholders is an effective strength. Accordingly, effective service facilities to their consumers are also considered a strength of Whitbread. Engagement for potential staff is marked as an opportunity for Whitbread. The hospital industry has to face different threats and challenging factors: financial issues and a lack of sufficient liquid cash facilities.

Financial analysis of Whitbread

Efficiency Ratio calculation considering Asset turnover and Inventories turnover

In the case of finding out the level of efficiency of this company, several pieces of data have been collected and analysed through Excel to find out an accurate report.

Asset turnover ratio = sales revenue / total asset

In 2020 the ratio was 0.20%, in 2021 it was 0.07% and in 2021 it was estimated at 0.08%. There were similar changes made compared to the previous year hence, it proved that the financial condition considering assets is quite perfect. [Referred to Appendix 2]

Liquidity ratio calculation of Whitbread considering current assets and liabilities in the market

Current ratio and quick ratio helped to get an idea about demarcating whether the company is capable of meeting all sorts of due and debt over the financial year.

Current ratio = current asset / current liability

Quick ratio = (Current Assets-Inventory) / Current Liabilities

Current ratio of Whitbread in 2020 was 1.31%, in 2021 it was 1.77% and in 2022 it is approx 1.18%. As cited by Di Tullio et al. (2019), changes compared to the previous fiscal year are quite similar and effective hence, the company is suit fitted for investment.

A quick ratio of Whitbread in 2020 was 1.29%, in 2021 it was 1.75% and in 2022 it is approx 1.83%. Changes in the ratio proved that the company has no liabilities over the market hence, it creates a positive effect and is favourable for investment. [Referred to Appendix 3]

Solvency ratio calculation considering shareholder equity and asset/expenses incurred by Whitbread

Interest expenses ratio and shareholder equity is calculated by considering EBIT and interest expenses.

Interest coverage ratio = (EBIT/Interest Expenses)

Interest coverage ratio of Whitbread in 2020 was 2.94%, in 2021 it was -5.55006502 and in 2022 it is 1.340151958. From this perspective, it can be said that this year the company has made accurate expenses as needed. [Referred to Appendix 4]

The strategic position of Whitbread in shade of ESG factors

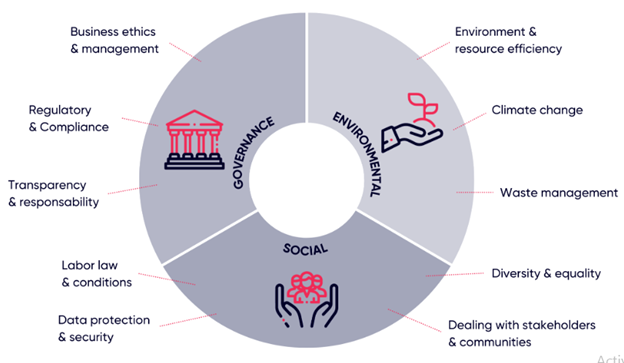

Figure 4: ESG guideline for Whitbread from an investor’s viewpoint

(Source: Influenced by Myšková and Hájek, 2019)

ESG characteristics stand for expanding the ability to apply non-financial; factors as part of their investigation process in case of remembering risk factors and growth possibilities of the hotel industry in a competitive market component. As per the observations of Jiang et al. (2020), ESG factors focused on the factors that include “Environment, social and governance”. These effective factors are administered to measure the sustainability and honorable consideration of a company. Environmental factors that deal with changes in environment, changing climate and waste management programs. Social factors deal with diversity & number of equity and sharing. Dealing with stakeholders and communities of investment makes a company able to assemble a lot of investors. Data protection and security to the stakeholder is quite an essential and demandable term in case of investment hence, an assured rate of return attracts investors.

Recommendation

An investor should judge the company before making an investment over there. Purchasing common equity and stock in a hotel industry totally depends on the performance of that industry in the previous fiscal year.

Recommendation 1

Showing effective care for consumers can lead the hotel industry to success. As per the opinion of Alkaabi and Nobanee (2019), great and effective care for employee’s increases job performance, as a result, consumers will be attracted through treatment.

Recommendation 2

Reckoning customers’ reviews and feedback and changes as per their demands and needs can create a positive impact on organizational growth. As per the suggestions of Roblek et al. (2020), victory in the hotel industry is constructed by assembling every struggle in order to provide exceptional benefits to the consumer.

Recommendation 3

Increased number of holding shares of the stakeholder is quite a beneficial strategy for assembling a lot of investors in a single phase. As per the opinion of Munteanu et al. (2020), “The Premier Inn and restaurant” provide the facilities to grab more than 30% of share facilities with a high rate of dividend.

Conclusion

This overall study paper was made based on the overall discussion of the Whitbread Company. Whitbread is one of the largest hotel industries based in the UK. The business was formed in multiple partnerships with “Samuel Whitbread, Godfrey and Thomas Shewell”. This company has announced more than 150 bedrooms in “Premier INN”, accordingly listed on “London stock exchange”. In this study report, different types of cultural factors and business practices have been demonstrated in-depth. Sales activity in different fiscal years was considered in this study paper. Financial performance in the UK market is quite effective and different from other similar companies. Multiple internal, external and financial analysis has been made through PESTLE and SWOT analysis. Conducting this research paper it can conclusively say that, in terms of operating marketing and leading competition Whitbread take a position in a global context. Market experts have also reported that Whitbread will acquire 65% of the business market in the UK hotel industry at the end of 2025.

References

Journals

Priem, R., 2021. An exploratory study on the impact of the COVID-19 confinement on the financial behavior of individual investors. Economics, Management, and Financial Markets, 16(3), pp.9-40. Available at: https://lirias.kuleuven.be/retrieve/630625 [Accessed on 9th November 2022]

Hurry, D., Miller, A.T. and Bowman, E.H., 2022. Calls on high-technology: Japanese exploration of venture capital investments in the United States. In Venture Capital (pp. 83-99). Routledge. Available at: https://www.academia.edu/download/51102502/smj.425013020220161229-23289-cg4qgf.pdf [Accessed on 9th November 2022]

Köhler, A., Ratzinger-Sakel, N. and Theis, J., 2020. The effects of key audit matters on the auditor’s report’s communicative value: Experimental evidence from investment professionals and non-professional investors. Accounting in Europe, 17(2), pp.105-128. Available at: https://portal.findresearcher.sdu.dk/files/172895306/Koehler_Ratzinger_Sakel_Theis_2020_accepted_manuscript.pdf [Accessed on 9th November 2022]

Choi, J.J. and Robertson, A.Z., 2020. What matters to individual investors? Evidence from the horse’s mouth. The Journal of Finance, 75(4), pp.1965-2020. Available at: https://www.nber.org/system/files/working_papers/w25019/w25019.pdf [Accessed on 9th November 2022]

Mazzucato, M., 2019. Governing missions in the European Union. Independent Expert Report. Available at: https://www.kowi.de/de/Portaldata/2/Resources/Horizon2020/mazzucato_report_2019.pdf[Accessed on 9th November 2022]

Myšková, R. and Hájek, P., 2019. Relationship between corporate social responsibility in corporate annual reports and financial performance of the US companies. Journal of International Studies, volume 12, issue: 1. Available at: https://dk.upce.cz/bitstream/handle/10195/75000/The_Relationship_Between_Corporate_Social_Responsibility_in_Corporate_Annual_Reports_and_Financial_Performance_of_U.S._Companies.pdf?sequence=1&isAllowed=y [Accessed on 9th November 2022]

Jiang, J., Liao, L., Wang, Z. and Xiang, H., 2020. Financial literacy and retail investors’ financial welfare: Evidence from mutual fund investment outcomes in China. Pacific-Basin Finance Journal, 59, p.101242. Available at: http://beike.xq18x.com/upload/default/20210601/87ce69c172105bfaee55dee7278f6ed2.pdf [Accessed on 9th November 2022]

Alkaabi, H. and Nobanee, H., 2019. A study on financial management in promoting sustainable business practices & development. Available at SSRN 3472415. Available at: https://www.researchgate.net/profile/Haitham-Nobanee/publication/336904296_A_Study_on_Financial_Management_in_Promoting_Sustainable_Business_Practices_Development/links/5f04471da6fdcc4ca452f938/A-Study-on-Financial-Management-in-Promoting-Sustainable-Business-Practices-Development.pdf [Accessed on 9th November 2022]

Roblek, V., Thorpe, O., Bach, M.P., Jerman, A. and Meško, M., 2020. The fourth industrial revolution and the sustainability practices: A comparative automated content analysis approach of theory and practice. Sustainability, 12(20), p.8497. Available at: https://www.mdpi.com/2071-1050/12/20/8497/pdf [Accessed on 9th November 2022]

Munteanu, A.I., Bibu, N., Nastase, M., Cristache, N. and Matis, C., 2020. Analysis of practices to increase the workforce agility and to develop a sustainable and competitive business. Sustainability, 12(9), p.3545. Available at: https://www.mdpi.com/2071-1050/12/9/3545/pdf [Accessed on 9th November 2022]

Di Tullio, P., Valentinetti, D., Nielsen, C. and Rea, M.A., 2019. In search of legitimacy: a semiotic analysis of business model disclosure practices. Meditari Accountancy Research, 28(5), pp.863-887. Available at: https://ricerca.unich.it/retrieve/e4233f18-ec02-2860-e053-6605fe0a460a/In%20search%20of%20legitimacy%20a%20semiotic%20analysis%20of%20BM%20disclosure%20practices_post%20print.pdf [Accessed on 9th November 2022]

Cooper, R.J., 2020. Pestle and mortal: the demise of community pharmacy in the UK. International Journal of Pharmacy Practice, 28(3), pp.205-206. https://academic.oup.com/ijpp/article-pdf/28/3/205/36596599/ijpp12635.pdf [Accessed on 9th November 2022]

Vallati, M. and Grassi, A., 2019, July. AI to Facilitate Legal Analysis in the PESTLE Context. In Proc. Emerging Technology Conference (EMiT) (pp. 66-68). Available at: https://www.researchgate.net/profile/Alessia-Grassi/publication/337186405_AI_to_Facilitate_Legal_Analysis_in_the_PESTLE_Context/links/5dca8d20a6fdcc57504122bd/AI-to-Facilitate-Legal-Analysis-in-the-PESTLE-Context.pdf [Accessed on 9th November 2022]

Almansoori, M.S., Almansoori, M.H., Almansoori, M.M., Almansoori, A.R., Alhammadi, A.A., Alnuaimi, S.M. and Nobanee, H., 2021. Financial analysis of Adnoc. Available at SSRN 3895246. Available at: https://www.researchgate.net/profile/Haitham-Nobanee/publication/353526356_Financial_Analysis_of_Adnoc/links/61019f661ca20f6f86e5ec49/Financial-Analysis-of-Adnoc.pdf [Accessed on 9th November 2022]

Wang, X. and vom Hofe, R., 2020. Financial analysis. In Selected Methods of Planning Analysis (pp. 173-223). Springer, Singapore. Available at: https://www.adb.org/sites/default/files/linked-documents/44318-013-uzb-fa.pdf [Accessed on 9th November 2022]

Websites

Whitbread.co.uk, 2022. Homepage of Whitbread. Available at: https://www.whitbread.co.uk/about-us/our-history/ [Accessed on 9th November 2022]

Statista.com, 2022. Annual revenue of Whitbread. worldwide from 2011-2022. Available at: https://www.statista.com/statistics/511372/total-revenue-whitbread-united-kingdom-uk/ [Accessed on 9th November 2022]

Gov.uk, 2022. Homepage of UK Government. Available at: https://www.gov.uk/ [Accessed on 9th November 2022].

Know more about UniqueSubmission’s other writing services: