BU7206 Corporate Finance Assignment Sample

Introduction

Kingfisher Plc is a multinational company of retail of Great Britain and the headquarters of the company are situated in London. The regional offices of the company seem to spread across Poland.

France, Romania, along with United Kingdom. Currently, the company is in possession of around 1300 stores in around nine nations, and the brands of the company include Castorama, B&Q, Screwfix, and Brico Depot. Kingfisher is also considered to be listed on the stock exchange of London, along with being a constituent of the FTSE 100 Index.

Objective of the report

The main objective of the report is to perform the financial analysis of kingfisher company. The FTSE (financial times stock exchange) also regarded as the FTSE Russell Group is a financial organization of Britain, which seems to be specializing in providing the offerings of index for the financial markets on a global basis.

The stock exchange of London is considered to be owning the FTSE Russell Group. Moreover, it is also considered to be owning the Millennium IT, Borsa Italiana, along with other brands of the finance.

Performance Evaluation

Kingfisher Plc is a company of home improvement supplying products of home improvement, along with the services with the help of a network of stores of retail, along with other channels situated in United Kingdom and the entire continental Europe. The segments of the company include Ireland, United Kingdom, Poland, France as well as other International.

Currently, the organization seems to be operating under the banners of the retail. Screwfix involves in supplying tools for trade, kitchens, electric, plumbing and bathrooms. B&Q is a retailer of garden centre and home improvement in the United Kingdom. T

Key performance Indicators

Gross Profit Margin

The stores of Castorama involves in offering products that are renovated and DIY. Moreover, Koctas currently is a retailer of home improvement in Turkey (Baker,2021). http://BU7206 Corporate Finance Assignment Sampleit is considered to be offering a range of categories of product starting from decorating the materials of building to both outdoor and garden.

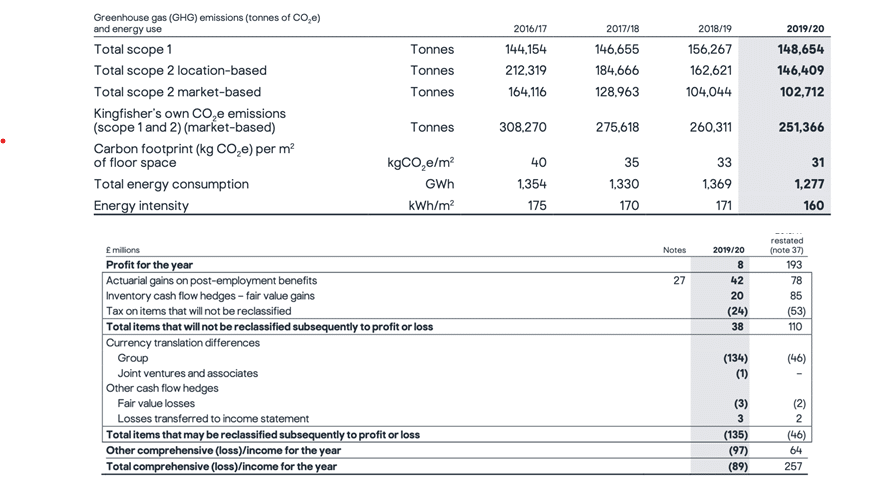

Year on year revenues of around 7.21% from 11.51 billion to around 12.34 billion, whereas the net income seemed to have improved from 7,300% from 8 million to 592 million (Farag,2021).http://BU7206 Corporate Finance Assignment Sample

(Source: Kingfisher.com )

So far in the third quarter of September, the company has seen specific sales decline by approximately 0.6 percent when compared to the same period in 2020, despite the fact that it is still considered to be operating in a number of European countries, and sales were not as strong as those in the United Kingdom. (2019) defines formalised

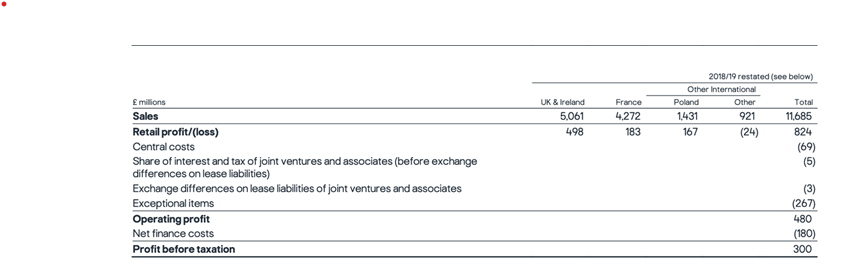

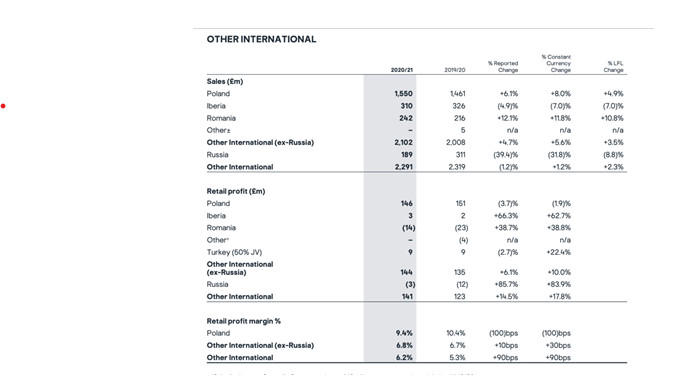

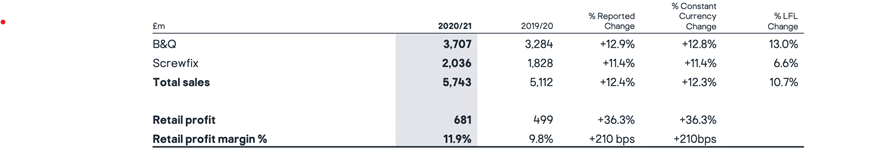

Among the standouts was France, which saw its retail profit more than double, from 11 to 129 million pounds. On the other hand, Poland saw its profit drop by half, while the country of Romania saw its loss shrink from 11 to 6 million pounds, making it the worst performer.

While the company is expected to report a drop in total sales during the second half, the specific figure has been lowered from approximately 5.5 percent to approximately 3.7 percent.

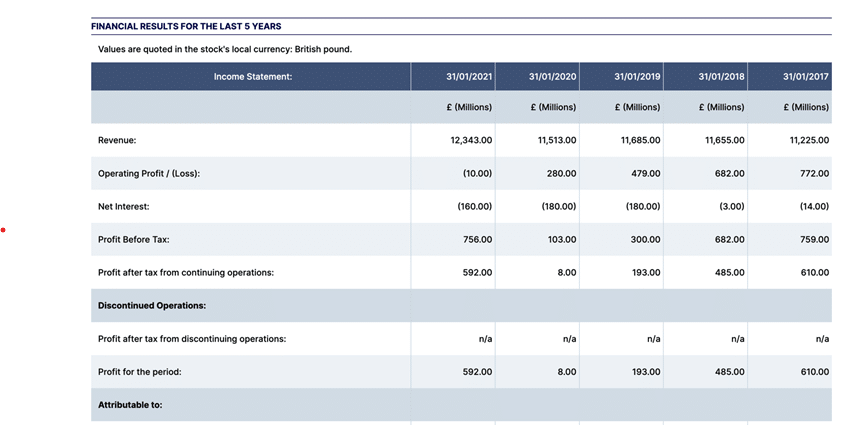

Five-year performance

(Source: Kingfisher.com )

According to consensus projections, a full-year profit of operations of approximately 1.1 billion pounds can be expected, an increase over the previous year’s profit of 946 million pounds. In addition to warning investors about potential risks, it is possible that buybacks are being offered to keep investors interested in the organisation (Silva,2019).http://BU7206 Corporate Finance Assignment Sample

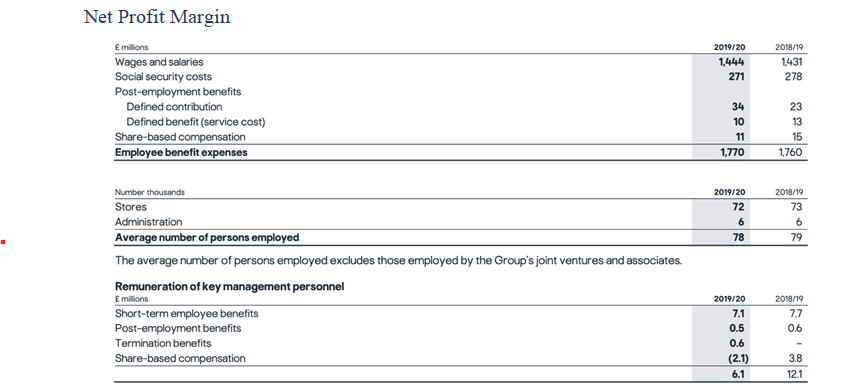

Net Profit Margin

(Source: Kingfisher.com )

The strong profits and sales of Kingfisher Plc in the first 6 months of 2021 could not be considered a surprise to any person who has been standing in line for getting into a B&Q. as per the company, the specific level of the demand is also considered to be online.

Along with owning Screwfix, Kingfisher is now seeming to be working on the expansion of the reach to the outlets inside the supermarkets of ASDA, speeding up the deliveries done online along with relaunching the brand focused on trade.

Working Capital\

Inventory Turnover

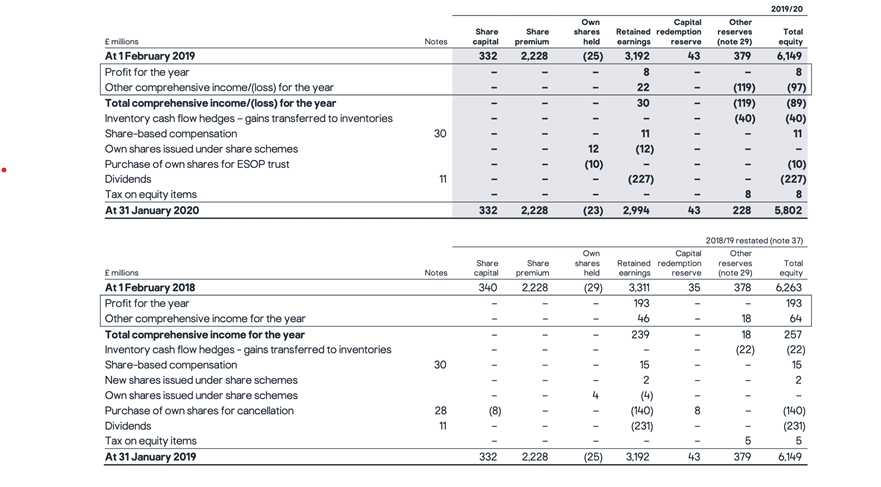

(Source: Kingfisher.com )

The company’s adjusted profit estimate for the full year appears to be ranging from 910 million pounds to 950 million pounds, as opposed to 785 million pounds for 2020 and 544 millions for 2019. (Hawash,2019).http://BU7206 Corporate Finance Assignment Sample

According to Kingfisher Plc, the business was experiencing higher than average cost price inflation as a result of raw material and freight costs, as well as a significant strain on the supply chain as a result of the issues with Asian ports and Covid-19, though the company claimed that it had avoided the majority of the major issues with stock.

Current ratio

(Source: Kingfisher.com )

As a result of the increased demand, the profit of operation was estimated to be 50% of 747 million pounds, with the interim dividend increasing from 2.75p in 2020 to about 3.8p in 2021. In the opinion of the company’s chief executive officer, Thierry Garnier, the increased dividend terms are expected to coincide with the organization’s apparent involvement in the priority of growth initiatives.

As stated by the company’s CEO, the primary factors that are propelling Kingfisher beyond the present DIY craze include people spending more time working from home, the urgency of new people advocating DIY, as well as the need for greener houses and a healthy housing market. In addition to the increased dividend, Kingfisher appeared to have launched a share buyback programme worth 300 billion pounds.

Dividend Policy

The dividends are considered to be the specific ways in which the organizations seem to be organizing the earnings to the shareholders. When an organization is considered to be paying a dividend, every share of the stocks of the company that is owned helps in entitling to a specific payment of dividend.

Capital can be accepted as dividends, along with additional shares of the stock or any kind of warrants for buying stock. Both public and private organizations are considered to be paying dividends, however, not every company seems to be offering them and no laws can be in requirement of paying the dividends of the shareholders.

Net finance costs of £160 million (2019/20: £173 million) consists principally of interest on IFRS 16 lease liabilities.

Net finance costs decreased by 6.2%, largely due to lower lease liabilities.

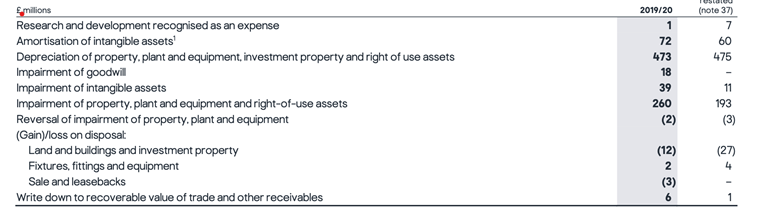

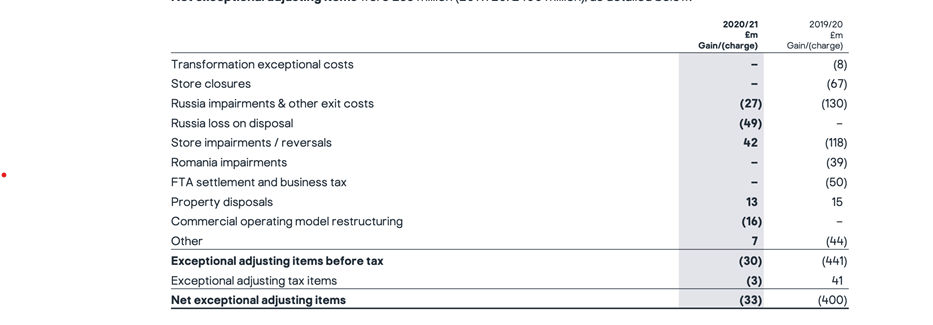

Net exceptional adjusting items were £33 million (2019/20: £400 million), as detailed below:

(Source: Kingfisher.com )

If an organization seems to be choosing to pay the dividends, they might be distributed annually, quarterly as well as monthly. The special dividends are considered to be paid on a irregular basis.

Even the organizations that do pay the dividends, not every shareholder gets the opportunity of receiving them on equal basis. The next dividend of Kingfisher Plc is expected for going ex in the 3 months and for making the payment in 4 months. The previous dividend of Kingfisher Plc was considered to be 3.8 p and it seemed to have gone 5 months, and was paid prior to the 4 months.

There is availability of usually a couple of dividends in a single year and the cover of the dividend is around 2.1

current dividend policy

Kingfisher Plc is considered paying every dividend of cash through direct payment to the bank accounts of the shareholder. Shareholders who have not yet been notified with the computer share, registrar, of the preferred option of the payment should be done without any kind of delay.

It has to be noted that this does not impact the specific shareholders who do not have subscription plan of the dividend in Kingfisher. There is availability of options in terms of payment along with displaying the DRIP. The last dividend paid by Kingfisher on 7th of October, 2021 was 0.038 pounds, and the last payable date was 12th of November, 2021 through cash dividend (Aras,2018). http://BU7206 Corporate Finance Assignment Sample

The cash dividend is the specific distribution of the money and funds paid to the holders of stock generally as a segment of the current earnings of the corporation along with profits that are accumulated.

The dividends through cash are paid directly in money, in opposition to being paid as the dividend of the stock or other form of value. The board of directors must have declarations regarding the issue of every dividend along with deciding of the payment of the dividend should remain the same or go through some changes.

Investors of long-term who are in need of maximizing their achievements can help in reinvesting the dividends. Most of the brokers seem to be offering a choice of reinvesting the cash dividends and accepting them. Cash dividends are considered to be the common way for the organizations for returning the capital to the shareholders in the form of periodic payments of cash, usually on a quarter basis; however, some of the stocks might make the payments of the bonuses on a annual, monthly, or a semi-annual basis.

Though several firms seem to be paying the dividends regularly, there is availability of special dividends of cash, which are distributed to the shareholders after a specific non-recurring event inclusive of the legal settlements as well as borrowing the money at large, one-time distributions of cash.

Every company is involved in the establishment of the policy of the dividend along with having periodic assessment if any dividend cut and increase the warranted. The dividends of the cash are paid on a basis of per-share.

Evaluation of the implications

The board of directors of the company makes announcements of a cash dividend on the date of declaration entailing the payment of a specific money amount per common share. After the specific, notification, there is establishment of the record date that is on the date on which the firm helps in determining the shareholders on record that are in eligibility for receiving the payment. Moreover, the stock exchanges and no other proper securities seem to be determining the organizations on an ex-dividend date that is typically a couple of days prior to the date of record (Any investor buying the common shares prior to the date of ex-dividend is considered to be entitled to the announcement of the dividend of the cash.

If there is decline of the profits, there is a possibility that the policy of the dividend can be postponed to the better times (De Matos, J2018).http://BU7206 Corporate Finance Assignment Sample With the declaration of the dividend by the corporation, it is considered to be the debits of the retained earnings along with crediting a liability account called the payable dividend.

On the date of payment, the company is considered to be reversing the dividend that is payable with the entry of the debit as well as the credit of the cash account for the respective outflow of the cash (Dang,2018). http://BU7206 Corporate Finance Assignment SampleThe cash dividends do not seem to be impacting the income statement of the company.

However, there is availability of a shrink of the equity of the shareholder of the company, along with the balance of the cash by the same amount. Firms must be reporting the dividend of the cash as the payments in the activity of the finance section of the statement of cash flow.

The easiest way of comparing the dividends of cash across the nations is for looking at the dividend yields of trailing for 12-month that are computed as the dividends of the company per share for most recent period of 12 months by the current price of the stock. The specific standardization helps in standardizing the measure of the dividends of the cash concerning the price of the share in common (Gillan,2019).http://BU7206 Corporate Finance Assignment Sample

Capital Structure and Working Capital

Every company is in requirement of the sources of the finance both in debt as well as in equity. The balance of the debt to the equity is considered to be significant along with the requirement for enough capital for effective operations. Debt can be considered a faster source for larger sums and higher levels of debt helping in the reduction of the weighted average in terms of the capital cost.

However, debt can get increased in terms of the risk of payment. Money that is borrowed is in requirement of being repaid along with the interest. If the company is in possession of the bad year of the sales, this can help in the determination of the ability of the company for repaying the debt.

The specific alternative is the equity in the form of shares that can be a better option as the shareholders are considered to be the last for receiving their capital back. Banks are considered to be getting repaid much earlier than the shareholders.

Market share

Though shares might seem to be quite less risky, the company is still in possession of a cost that is the return rate, which can be impacted by the risks within the business. Issuing more shares shall help in the effective reduction of the control of the company (Bazdresch,2018).http://BU7206 Corporate Finance Assignment Sample The weighted average cost of capital can help in the determination of the factor of discount for the projects, the wealth of the shareholder and the value of the customer as well.

Accounts of the weighted average cost of capital is considered to be providing the finance. The equity cost can be in calculation with the help of two methods, one is considered to be using the growth model of the dividend and the other seems to be using the asset of the capital in terms of the model of pricing.

This helps in allowing the estimation of the information. The calculations of the market value help in providing the realistic results in comparison of the value of the book. The same is considered to be applied to the debt.

(Source: Kingfisher.com )

Capital structure

Kingfisher Plc is considered to be the leader of the market of both Europe and United Kingdom are in requirement of acknowledging the structure of the capital along with having constant reassessment of the strategy of finance. There have been evaluations of the capital structure of the Kingfisher Plc compared with the sector of two specific methods.

The first method is the gearing of the capital that involves in discussing both the limitations as well as the benefits of the different formula in comparison to the level to gear up against the specific sector. The second method cam be the weighted average cost of the capital that seems to be providing the explanation for the various method in terms of calculation.

There can be difficulty in the capital structure for the Kingfisher Plc and there is availability of numerous methods, which can be of use for working out the gearing of the capital. It is considered to be very tough to state the specific kind of formula helps in the production of the most realistic outcome.

Long term investments

One method is considered to be the debt of long-term characterised by the funds of the shareholder. The debt weighted to the finance is not in provision as it only seems to be showing the specific amount of the debt of long-term as a certain equity percentage.

The gearing of the Kingfisher involves the specific method in qual to the 40% of the section of calculations. A formula that is in common use in gearing the debt over long-term is the funds of the shareholder plus the debt for longer-term. The specific method helps in informing the users regarding the weighting, along with the provision of the limitations. When an organization is involved in the current borrowings, like the overdrafts or loans from banks, the amount to a fair percentage of the debt getting ignored.

Debt Analysis

The debt for a shorter term is still a source of finance that is in requirement of being repaid. The ratio of the Kingfisher seemed to have shown around 28.5% as per the calculations done. The method that is in broader use and is mostly preferred in terms of gearing the accounts for every borrowing.

Therefore, the borrowings on a short-term and long-term are inclusive of the bank loans as well as the notes on short terms. The formula of the all borrowings is considered to be divided the by the funds of the shareholders and the all borrowings as well.

(Source: Kingfisher.com )

The current borrowings of Kingfisher is considered to be including the loans from bank, overdraft, along with the leases of the finance totalling of around 389 million pounds plus the borrowings that is non-current, loans from bank, notes of medium-term and the leases of the finance with a total of around 1907 million pounds equalling to the 2296 million pounds.

The funds of the shareholders are considered to be found within the annual report by taking the liabilities along with the minority of the interest from the entire assets. For Kingfisher, this is considered to be equalling to around 4783 million pounds. The capital gearing of the Kingfisher is hence, 2296/ (2296+4783) =32%. Other liabilities inclusive of the deferred tax as well as the provisions, have not been included within the calculations as they are not the specific means of finance, as well as liabilities.

(Source: Kingfisher.com )

Loans and borrowers

Kingfisher is respectively low geared with around 32% of the borrowings of the finance. This is considered to be showing that Kingfisher is mostly financed through the shareholders. In the current economy, if the recession is taken into consideration, Kingfisher Plc seems to be having a medium to higher levels in terms of risk of business.

It is theorized due to the assumption issued by the company in terms of the less debt (Aras,2018).http://BU7206 Corporate Finance Assignment Sample There is minimization of the risk of finance as there is availability of less risk chance that Kingfisher does not have the money for repaying its debt.

However, the equity of the shareholder still seems to be having the risk of repayment since there is availability of possibility of being the last to the return of the money if any organization is bankrupt. Risks of finance that are involved are considered to be affecting the cost of capital as the business were considered to be holding more chance of debt along with increase in the bankruptcy. Hence, the shareholders are in requirement of a greater amount of return.

Potential Acquisition

NeedHelp is considered to be the potential acquisition Kingfisher Plc. NeedHelp is taken into consideration as an innovative online platform of B2B2C, which seems to be connecting the customers in requirement of help for improvement of homes, both online as well as in-store through vetted tradespeople who are professional along with other skilled experts.

The acquisitions help in representing the significant phase in the direction of the key priorities of Kingfisher under the recent announcement made by the company in terms of the strategy powered by Kingfisher, for building a mobile first experience of the customer oriented with service.

Guillaume founded NeedHelp in the year 2014 in France, who continued to be the chief executive for leading the team and growing the business as well. Though most of the business is currently in France, NeedHelp also helps in operating in Switzerland and has made some recent expansions into Belgium, Germany, Netherlands and Austria.

Through the help of the architecture, Needhelp already helps in providing of the services to the customers in more than 500 physical stores inclusive of the French business of the Kingfisher, Brico Depot and Castorama, along with the growth of the number of leading the retailers of the home retailer. NeedHelp is growing with rapidity, and the organization has been tripling both the revenue as well as the GMV each year since it got launched.

With more and more people seeking the improvement of their homes since the beginning of the pandemic of Covid-19, the demand of the NeedHelp has been accelerating with the monthly revenue doubling after the first period of the lockdown.

(Source: Kingfisher.com )

The strong growth of NeedHelp is considered to be driven by the higher differentiation of the proposition. It helps in providing the customers with the options of service from a range of channels inclusive of the stores of the retail partners, the e-commerce sites of the retail partners and from its own specific site.

Unlike the marketplace of the service aiming for the provision of a directory of the jobbers or the tradespeople, the organization helps in focusing over the specialist skills in requirement for the improvement of the home.

The most popular projects for home improvement seemed to have offered through NeedHelp are the installations of kitchen, flooring, painting, as well as renovations of bathroom. Other jobs that seem to be inclusive of the future assemble, gardening along with as well as moving the furniture.

Conclusion

Currently, the company is in possession of around 1300 stores in around nine nations, and the brands of the company include Castorama, B&Q, Screwfix, and Brico Depot. Kingfisher is also considered to be listed on the stock exchange of London, along with being a constituent of the FTSE 100 Index.

The FTSE (financial times stock exchange) also regarded as the FTSE Russell Group is a financial organization of Britain, which seems to be specializing in providing the offerings of index for the financial markets on a global basis. Any investor buying the common shares prior to the date of ex-dividend is considered to be entitled to the announcement of the dividend of the cash.

The higher terms of dividend are considered to be coming at the same time as the organization seems to be involved in the prioritization of the growth as per the CEO, Thierry Garnier.

According to the chief, the major themes carrying Kingfisher beyond the current rush of DIY seems to be including people spending more time working from home, the urgency of the new people encouraging DIY, along with the requirement of greener homes, as well as a strong market of housing. Over the top of the higher dividend, Kingfisher seemed to have announced a buyback program of 300 billion pounds share.

In the quarter of September, so far, the company has seen specific sales coming off by around 0.6% in comparison to 2020, though it is still considered to be operating numerous countries of Europe, and sales were not as strong as the United Kingdom. If there is decline of the profits, there is a possibility that the policy of the dividend can be postponed to the better times.

With the declaration of the dividend by the corporation, it is considered to be the debits of the retained earnings along with crediting a liability account called the payable dividend.

On the date of payment, the company is considered to be reversing the dividend that is payable with the entry of the debit as well as the credit of the cash account for the respective outflow of the cash.

The cash dividends do not seem to be impacting the income statement of the company. However, there is availability of a shrink of the equity of the shareholder of the company, along with the balance of the cash by the same amount. Firms must be reporting the dividend of the cash as the payments in the activity of the finance section of the statement of cash flow.

Reference

Aras, G., & Yildirim, F. M. (2018). The impact of corporate finance decisions on market value in emerging markets. International Journal of Productivity and Performance Management.

Baker, H. K., Kumar, S., & Pattnaik, D. (2021). Twenty-five years of the journal of corporate finance: a scientometric analysis. Journal of Corporate Finance, 66, 101572.

Bazdresch, S., Kahn, R. J., & Whited, T. M. (2018). Estimating and testing dynamic corporate finance models. The Review of Financial Studies, 31(1), 322-361.

Berg, T., Reisinger, M., & Streitz, D. (2021). Spillover effects in empirical corporate finance. Journal of Financial Economics, 142(3), 1109-1127.

Brealey, R. A., Myers, S. C., Allen, F., & Mohanty, P. (2018). Principles of corporate finance, 12/e (Vol. 12). McGraw-Hill Education.

Cloyne, J., Ferreira, C., Froemel, M., & Surico, P. (2018). Monetary policy, corporate finance and investment (No. w25366). National Bureau of Economic Research.

Dang, C., Li, Z. F., & Yang, C. (2018). Measuring firm size in empirical corporate finance. Journal of banking & finance, 86, 159-176.

De Matos, J. A. (2018). Theoretical foundations of corporate finance. Princeton University Press.

Eka, H. (2018). Corporate finance and firm value in the Indonesian manufacturing companies. Business Studies, 11(2), 113-127.

Farag, H., & Johan, S. (2021). How alternative finance informs central themes in corporate finance. Journal of Corporate Finance, 67, 101879.

Gillan, S. L., Koch, A., & Starks, L. T. (2021). Firms and social responsibility: A review of ESG and CSR research in corporate finance. Journal of Corporate Finance, 66, 101889.

Hawash, R., & Stephen, S. A. K. (2019). Where Are All the Female Finance Majors? An Examination of Gender and Performance in Undergraduate Corporate Finance. Journal of Higher Education Theory & Practice, 19(8).