Assignment Sample For BUS7B30 Financial Insights and Business Intelligence

1. Introduction

Fintech is the technology that helps customers and businesses with financial issues, and this allows any industry to maintain its financial services. Fintech helps in the financial services of businesses, and this technology allows them to evaluate the process of development. The study highlights various fintech solutions and focuses on certain fintech tools such as Blockchain, Cryptocurrency and Crowdfunding. The two selected fintech solutions help Sainsbury in developing its growth in the market. This study describes the solutions that Mobile payment and Crowdfunding may help Sainsbury in financing solutions. In addition, it enlightens the solutions that help in the investing and operating decisions of Sainsbury. Therefore, the study incorporates the solutions and decisions that may assist Sainsbury in developing its growth with the help of fintech solutions.(BUS7B30 Financial Insights and Business Intelligence Assignment Sample )

Fintech Solutions

Fintech is the term that indicates the assistance of financial services through its services to the customers as well as businesses. The payments get easier by using this tool, and this allows the business to sustain itself in the market (Hwang et al. 2021). In the present scenario, it is an important aspect to maintain sustainability by using technologies in the business. The technology does not only include the machines or tools for the improvement of the products or services; it indicates financial supports also. Fintech solutions help businesses in developing any businesses growth through their technology.

Many fintech solutions have been evaluated in the present days that help the businesses in the development. As per Hwang et al. (2021), the varieties of Fintech solutions are,

Crowdfunding Platforms

The platform of Crowdfunding allows the citizens to send or receive money from any other platforms that are incorporated with the transferring of the money. The businesses or customers may maintain their transactions in a safe and proper way that helps in transferring the money (Zhang et al. 2020). It also allows the businesses to pull resources from a specific source that helps them in funding. Illustrations of Crowdfunding are Kickstarter, GoFundMe and many more.

Cryptocurrency

Cryptocurrency is one of the useful fintech that helps businesses and customers on the transaction of amounts. This digital system helps the organisation or consumer to transfer money that does not rely upon the banks (Wątorek et al. 2021). The transactions are peer-to-peer transactions that help the user to send or receive money at anytime and anywhere. Examples of Cryptocurrency are Litecoin and Bitcoin.

Mobile Payments

Statista data shows that mobile payments in recent days have been increasing at a rapid rate, and the market of mobile payment is surpassing over one trillion dollars in 2019. According to Flavian et al. (2020), this shows that consumers are using various applications in payments utilising their smart phones. Venmo, AAPL is some of the examples of Mobile payments.

Robo-advising

Robo-advising is the digital system that helps the management of a company to evaluate their payments or transactions in a modern way. This technology helps to analyse the algorithm-based recommendations for the company and allows the management of portfolios (Capponi et al. 2021). The efficiency of the company’s production is increased, and the cost is lowered by using this app.

Budgeting Apps

The apps that help in evaluating the budgets of the companies are known as Budgeting apps. The companies used to gather information and write down their expenses and profits in the sheet and used to maintain the same by calculating in hand. According to Sari et al. (2021), these apps allow the companies to maintain their budgets in a proper way, and this helps them keep the record of accomplishment of spreadsheets throughout the year. The illustration of some Budgeting apps is INTU and Report Mini.

Blockchain

Blockchain is the fintech that helps the company from getting rid of hackers or fraudulent activists. Any companies are protected by blockchain technology, and this helps them to identify the hackers and keep the information or data of the companies protected. Blockchain keeps the records in the system in a safe way and thus reduce fraud (Syed et al. 2019). BlockVerify is an example of Blockchain.

2. Financing solution

Sainsbury is an organisation that deals with the largest chain of supermarkets in the UK, and the company deals with many financial issues in the processing of its functions. The organisation may follow Crowdfunding in its system of financial issues. As it is already discussed that Crowdfunding is the Fintech solution that helps in gathering money from various sources, Sainsbury can take the help from this tool as well (Biancone et al. 2019). The growth of the organisation depends on the process of the management and the way the company runs its business. Sainsbury is a company that deals with a large market, and the financial issues must be dealt with strict management.

The organisation is the largest supermarket chain in the UK, and the company helped the citizens of the nation during the pandemic, which took them in experiencing loss. As per the view of Baber (2021), the company need to take a proper decision regarding financial solutions and must gather resources from various sources. Sainsbury must expand its business in relation to meet the global market experiences. The company was introduced in 1869 that indicates that the organisation is an old organisation (Sainsburys.co.uk, 2020). It is noted that the company is the largest chain in the UK, but this is also to note that the company must focus on expanding its business across the border, which could be possible with the help of Crowdfunding.(BUS7B30 Financial Insights and Business Intelligence Assignment Sample )

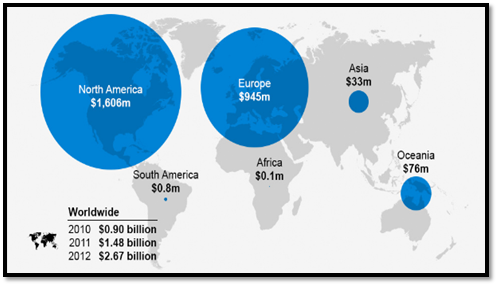

Figure 1: Global Crowdfunding rate

(Source: Statista.com, 2017)

Crowdfunding is the fintech tool that helps organisations to gather amounts from various sources that may help the company in their growth. A huge number of people helps the organisations in raising funds in venturing of a project or for some other reason. Sainsbury may get help from these sources in gathering funds and use the money in the development of the company. Nowadays, Crowdfunding is expanding its growth at a rapid speed and is becoming a trusted source of transferring money (Amuna, 2019). The major aspect of using Crowdfunding is that it helps in gathering amounts from any source. Global Crowdfunding is also increasing, and this is considered the best form of crowdsourcing and can be used as alternatives to all the transactions that take place in the organisation.

3. Investing decisions

The important aspect to developing the business is to make more investment for the company. The investment policy needs to take keeping in mind specific issues that may help the company to develop. In the absence of tracking major issues, the company may make a loss, and thus the investment will not help the company in its growth (Appiah et al. 2019). It is to maintain that the organisation is receiving profit in a way to make the investment is extremely necessary to consider. Otherwise, an only investment may take the organisation to experience a significant loss. The company must also focus on the trust that needs to maintain at the time of investing. Without trusting the source, the organisation cannot make the investment.

After evaluating investment policies, the company may make investments in order to maintain its sustainability in the market. It is pertinent to mention that more spending of money may help the organisation to make more money. Sainsbury is an organisation where the management is not able to take the decisions of the investment policies, and thus the company’s growth has been restrained in recent days (Sainsburys.co.uk, 2020). When it comes to the question of investing money in a proper source, Cryptocurrency is the best fintech tool that helps in investing resources (Moşteanu and Faccia, 2020). Investing is the other form of reaping the rewards for the company, and this may show results in the way of development.

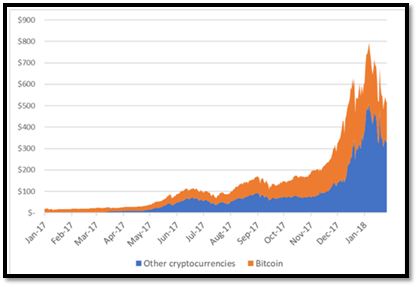

Cryptocurrency is the system that digitally supports the organisations’ transactions. This is a way that helps in the exchanges of amounts, and this allows peer-to-peer transactions. This helps the organisation to invest the payments to the investors through Cryptocurrency. The trusted aspect of Cryptocurrency is that this tool records the transaction of the organisation in the public ledger (Brummer and Yadav, 2018). The organisation may claim its transaction at any time by showing the public ledger if needed. The increase in using Cryptocurrency can be seen from the end of 2017 as people are now becoming aware of the technologies and their benefits. The organisation may choose the tool in order to invest and to make the development in a unique way.

Figure 2: Growth in Cryptocurrency

(Source: Brummer and Yadav, 2018)

The long-term financial goals of Sainsbury may be conducted in accordance to maintain the investment in a proper way. The company is in need of proper investments, and the management of Sainsbury must look into the matter. Cryptocurrency is the best tool of fintech that may help Sainsbury to make the investments, and this tool allows to keep the trust (Gryshova and Shestakovska, 2018). The system of Cryptocurrency is stored in the wallets that are digitally made. Bitcoin is the most used Cryptocurrency in the global market for transactions.

4. Operating decisions

Operating the business is the duty of the management in order to maintain the sustainability of the business. The management must look after the operations that need to evaluate for the development. The development of the organisation is dependent on focusing on some functions of the organisation (Gadwe and Sangode, 2019). The management of the operational team of an organisation is responsible for keeping track that supervises controls, and plans the manufacturing and production of the organisations’ products. The management is extremely important to look after the people, services and goods related to the organisations (Gadwe and Sangode, 2019). However, it is pertinent to mention here that the organisation must follow the management in the operational matter by trusting in fintech solutions as this may help the company more.

The importance of fintech solutions such as Blockchain and Robo-Advisory is very much visible in the recent markets. The organisations that are using fintech solutions are becoming the best manufacturers in the market. Sainsbury has a great management team that operates the systems of supervising, controlling and planning, but it is to note that the operations they are maintaining are not maintained by modern technologies (Sainsburys.co.uk, 2020). In the present scenario, modern technologies are of extreme importance in dealing with the operations of organisations. This is to maintain by the organisation to alternate the systems of the operational management team in order to develop the systems of the organisation.

Blockchain is the fintech tool that helps the organisation to stay protected from the hackers that may hack the data and information of the organisations. The recent scenario in the organisations is that the fraudulent activists are becoming active, and in the pandemic situation, it has become more active (Ahmad, 2018). Sainsbury also owns many personal data that may get hacked by hackers, which may stay protected by Blockchain. Blockchain is the trusted tool that has been applicable in recent days.

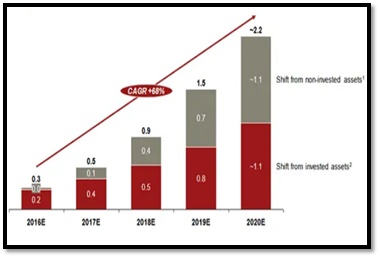

Figure 3: Growth of Robo-Advisory

(Source: Ahmad, 2018)

Robo-Advisory is the asset of fintech solutions that helps the company to maintain the establishment of algorithm-based recommendations for the organisation. The operation of the management of an organisation must maintain the efficiency of the organisation, and portfolio management must be maintained (Potdar and Pande, 2021). This is to note that the Robo-advisory is increasing at a rapid rate as the operating systems of the organisations are well maintained by the tool.

Conclusion

The study may be concluded by stating that the financial solutions and the operating and investing decisions are of extreme importance in maintaining the process of development by an organisation. It is seen in the study that Sainsbury may follow the Crowdfunding fintech tool in maintaining the financial issues faced by the organisation. Investing decisions of Sainsbury may be evaluated with the help of the Cryptocurrency system. Blockchain and Robo-Advisory are the tools that help Sainsbury in maintaining its operational functions. Therefore, it is pertinent to mention here that the fintech solutions are the most important aspect of regulating the functions of an organisation with their technologies.

References

Journals

Ahmad, Z.I., 2018. New Information Management Dimension in Blockchain. INTERNATIONAL JOURNAL OF ACADEMIC RESEARCH IN BUSINESS AND SOCIAL SCIENCES, 8(12).

Amuna, Y.A., 2019. Entrepreneurship, Crowdfunding Platforms and Sponsors Interaction. International Journal of Academic Management Science Research (IJAMSR), 3(1).

Appiah, M.K., Possumah, B.T., Ahmat, N. and Sanusi, N.A., 2019. Small and medium enterprise’s internal resources and investment decisions in Ghana: The resource-based approach. Economics & Sociology, 12(3), pp.37-53.

Baber, H., 2021. Financial Inclusion and Crowdfunding-A study of European Countries. Review of Applied Socio-Economic Research.

Biancone, P.P., Secinaro, S. and Kamal, M., 2019. Crowdfunding and Fintech: business model sharia compliant.

Brummer, C. and Yadav, Y., 2018. Fintech and the innovation trilemma. Geo. LJ, 107, p.235.

Capponi, A., Olafsson, S. and Zariphopoulou, T., 2021. Personalised robo-advising: Enhancing investment through client interaction. Management Science.

Flavian, C., Guinaliu, M. and Lu, Y., 2020. Mobile payments adoption–introducing mindfulness to better understand consumer behavior. International Journal of Bank Marketing.

Gadwe, M.P. and Sangode, P.B., 2019, Impact of Operations Management Activities on Operational Performance in Service Organisations.

Gryshova, I.Y. and Shestakovska, T.L., 2018. FinTech business and prospects of its development in the context of legalising the Cryptocurrency in Ukraine. Наукові записки Інституту законодавства Верховної Ради України, (5), pp.77-78.

Hwang, Y., Park, S. and Shin, N., 2021. Sustainable Development of a Mobile Payment Security Environment Using Fintech Solutions. Sustainability, 13(15), p.8375.

Moşteanu, N.R. and Faccia, A., 2020. Digital Systems and New Challenges of Financial Management–FinTech, XBRL, Blockchain and Cryptocurrencies. Quality-Access to Success Journal, 21(174), pp.159-166.

Potdar, A. and Pande, M., 2021, July. Comprehensive Analysis of Machine Learning Algorithms Used in Robo-Advisory Services. In Journal of Physics: Conference Series (Vol. 1964, No. 6, p. 062105). IOP Publishing.

Sari, D., Pradana, M., Nugraha, D.W. and Oktafani, F., 2021, February. Web-based Design of Financial Apps: Case of Kosan 54. In IOP Conference Series: Materials Science and Engineering (Vol. 1071, No. 1, p. 012020). IOP Publishing.

Syed, T.A., Alzahrani, A., Jan, S., Siddiqui, M.S., Nadeem, A. and Alghamdi, T., 2019. A comparative analysis of blockchain architecture and its applications: Problems and recommendations. IEEE access, 7, pp.176838-176869.

Wątorek, M., Drożdż, S., Kwapień, J., Minati, L., Oświęcimka, P. and Stanuszek, M., 2021. Multiscale characteristics of the emerging global cryptocurrency market. Physics Reports, 901, pp.1-82.

Zhang, Y., Tan, C.D., Sun, J. and Yang, Z., 2020. Why do people patronise donation-based crowdfunding platforms? An activity perspective of critical success factors. Computers in Human Behavior, 112, p.106470.

Websites

Sainsburys.co.uk, 2020, About Us, Available at: https://www.about.sainsburys.co.uk/about-us/our-business-strategy [Accessed on: 30th December 2021]

Statista.com, 2017, Global Crowdfunding Volume Reaches $2.7 Billion, Available at: https://www.statista.com/chart/1034/funds-raised-through-crowdfunding-in-2012/ [Accessed on: 30th December 2021]

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?