Business Report

Abstract

This business report is based on comparative analysis. The main aim of this report is to analyse the financial performance of two selected companies so that investment decision cab be taken. For this purpose, Cambria Automobiles Plc. and Pendragon Plc. firms are taken by the researcher in this study.Cambria Automobiles Plc. is taken as a primary company whereas Pendragon Plc. has taken as a comparator company. In this study, theoretical as well as financial analysis has taken place. For this purpose, SWOT as well as PESTEL analysis has taken place which has supported towards analyzing the entire industry outside the environment as well as the internal environment of the company. SWOT is analyzed separately for both the companies; however, as both the company is dealing in the same market so there is a same PESTEL environment for the firms which have helped to analyze the entire industry outside the environment. Additionally, financial discussion has also taken place in this business analysis report which has supported to analyze the two companies in the London stock exchange in the context of finance section.

This study has discussed the financial statement of both the firms while giving focus towards different analysis methods. It includes PESTLE, Porter’s five forces analysis and SWOT analyses as well as ratio analysis, vertical analysis and horizontal analysis which has supported towards giving the deep understanding regarding the research topic. Furthermore, on the basis of financial analysis of both companies, it is found that Cambria is more effective compared to Pendragon so investors should invest in Cambria.

This business report is based on comparative analysis. In this study, researcher has discussed regarding two companies of UK while taking one firm as a primary firm and other as a comparator company. For this purpose, Cambria Automobiles Plc. is taken as a primary company whereas Pendragon Plc. has taken as a comparator company. In this business analysis report, researcher has critically analyzed both the company while giving concern towards SWOT, PESTEL and many other financial tools and techniques which has supported to comparative analysis of the firms in an effective manner. In this business analysis report, researcher has given brief idea regarding the company background. Furthermore, literature review has supported to critically analyze the research topic on the basis of past findings. In like manner, this business analysis report analyzes the SWOT and PESTEL of the firms while studying the financial parameters.

This study has given focus towards various analyses (ratio analysis, vertical analysis and horizontal analysis) to analyze the financial statement of both the companies for the purpose of comparative analysis of Cambria Automobiles Plc. and Pendragon Plc. This business report has supported to give detailed understanding regarding the research topic while giving focus towards theoretical as well as practical aspect which has enabled the researcher to increase the relevancy of the research outcome. Moreover, theoretical data collection has supported to increase the relevancy of the study while correlating it with the findings (Cucchiella, & Rosa, 2015).

The Cambria Automobiles plc is a UK based fastest growing motor dealer. The company was set up in March 2006 as a retailer dealing in used and new cars, motorbikes and commercial vehicles. The company aims to build an autonomous motor dealership to represent luxury and premium segments in the United Kingdom. The group has more than 30 dealerships and deals in 17 vehicle brands such as Jaguar, Aston Martin, Ford, Land Rover, Honda, Renault, Mazda, Nissan, Volvo, etc. with around 47 franchises (Financial Times, 2017).

Cambria Automobiles Plc. is a motor dealer firm and it is engaged in the sale and also offers the servicing of motor vehicles. Thisfirm is engaged with the car vehicle sales while offering vehicle servicing and many other related services too. Cambria deals with offering the retailing services for new and used cars. It also offers the retailing services for commercial vehicles and motorbikes. Cambria operates on a dealership-by-dealership basis of approximately 30 sites and deals with over 50 dealer franchises (Financial Times, 2017). Its brand portfolio includes Abarth, Alfa Romeo, Aston Martin, Dacia, Ford, Fiat, Honda, Jaguar, Jeep, Land Rover, Mazda, Nissan, Renault, Seat, Triumph, Vauxhall and Volvo. Moreover, it also provides auxiliary service facility too. Additionally, it deals with finance and insurance facility too for the purpose of the execution of the transaction along with service plans which supports to maintain the vehicle (Financial Times, 2017).

The company works as an online retailer of new and used automobiles especially cars and motorbikes in the Nottingham, United Kingdom. The online retailer has around 276 franchises in the UK alone (Pendagron PLC., 2017). The company has franchised motor car dealerships in UK and USA and also offers the customers with after sales services, repairing and sells spare parts. The company operates in the USA under the brand name of Stratstone and Evans Halshaw. The retailer under the brand name of Chatfield deals in used and new trucks, commercial vehicles and after sales services. The company also have a well placed system of Web enabled dealer management system, Pinnacle providing software and services to dealers for bookkeeping, accounts, sales and marketing.

Pendragon Plc has become a public limited company in the year 1989during de-merge of the vehicle division of Williams Plc. During that time the operation has included 19 car dealerships which were dealing in specialist and luxury franchises. After that firm has enhanced its portfolio and has expanded its business considerably while focusing towards the series of new builds as well as acquisitions. At present firm is dealing in over 20 brands in the UK as well as in the USA (Pendagron PLC., 2017). This firm not only covers specialist but also volume brands. Firm has the largest representation is with Ford and Vauxhall in the UK market. This firm is specialist in offering the range from Ferrari to Mercedes-Benz to Harley-Davidson motorcycles (Pendagron PLC., 2017). Company has nationwide portfolio in the context of manufacturer partners while focusing towards its superior IT platform. This firm is highly focused towards value pricing and offers the products while focusing towards offering competitive advantage to the firm which and enables the firm to become the number one internet motor retailer (Pendagron PLC., 2017).

Critical Evaluation of Literature

In this section of the study, researcher has discussed the research topic on the basis of various past findings which has taken place regarding the research topic. This section will critically analyse the SWOT and PESTLE analysis as well as it will support to give understanding regarding ratioanalysis, vertical analysis and horizontal analysis to theoretically analyze these factors while giving deep idea regarding the research topic. This section contains huge focus to include the relevant research sources (Achimugu, et al., 2014). For the collection of secondary data various blogs, articles, newspapers, reports, etc. are referred by the researcher which has supported towards giving the deep understanding regarding the research topic.

SWOT analysis enables the firm to analyse the strengths, weaknesses, opportunities and threats of the firm. This analysis supports to offer structured planning method and enables to evaluate the organization, project or business venture on the basis of these four elements (Bull, et al., 2016). It enables to specify the objective of the business venture or project while identifying the internal and external factors of the firm. Strength and weakness are the internal elements whereas opportunities and threats are the external elements. This analysis supports to determine thefavourability and un-favourability of the internal and external towards achieving the organizational objectives (Hollensen, 2015).

SWOT Analysis

(Source: Hollensen, 2015)

SWOT Analysis is a useful technique for understanding the strengths and weaknesses while identifying the opportunities as well as threats that company has to face in the external environment. SWOT analysis majorly used for business context and it helps to carve a sustainable niche in the industry while utilizing it in a personal context. It enables the firm to identify the weaknesses and threats while evaluating the strengths and opportunities of the firm. It supports to design the organizational plans and strategies according to the situational requirement (Chen, Kim, & Yamaguchi, 2014). SWOT enables the firm to uncover the opportunities while understanding the weaknesses of the business which supports to manage and eliminate threats. SWOT framework enables to craft a strategy while distinguishing the firm from its competitors to increase the chances of success and long-term sustainability in the industry.

SWOT analysis is internal analysis which is company based. Due to this reason, in this business analysis report, two SWOT analyses has taken place for Cambria Automobiles Plc. and Pendragon Plc. which remained assistive to identify the strengths, weaknesses, opportunity and threat of both the firms.

PESTEL analysis is a framework which is used to analyse and monitor the macro-environmental factors in the context of the organisation. The result of which is used to identify threats and weaknesses which is used in a SWOT analysis. PESTEL analysis enables the firm to evaluate the political, environmental, social, technological, economic and legal analysis. This analysis gives consideration towards macro-environment (Lamas Leite, et al., 2017).

PESTEL Analysis

(Source: Lamas Leite, et al., 2017)

Political–While dealing in the industry, organizations need to focus towards various political factors such as employment laws, tax policies, trade restrictions, environmental regulations, political stability, tariffs, trade reforms, etc.(Song, Sun, & Jin, 2017).

Economic – The economic analysis includes interstate taxes, interest rates, economic growth, recession, inflation rate, embargoes, exchange rate, minimum wage, maximum working hours, wage rates, credit availability, financing availability, etc.(Song, Sun, & Jin, 2017).

Sociological-Sociological analysis takes into consideration all the activities which are taken place by the organization and its impact towards the community, society and the surrounding area. Sociological analysis includes cultural expectations, global warming, norms, healthy consciousness, population dynamics, career altitudes and much more(Song, Sun, & Jin, 2017).

Technological–Under this factor consideration towards the technology takes place. It is an important factor as technology gets outdated within a few months after its launch, so there is a need of updating the technology time to time according to the consumer need. This factor creates barriers to entry in certain markets and supports to take effective financial decisions (Song, Sun, & Jin, 2017).

Legal –Legal factor supports to take the consideration towards the legal factors related to employment, quotas, taxation, imports, exports, resources, etc.(Song, Sun, & Jin, 2017)

Environmental–Under this factor, organization needs to consider the ecological and environmental aspects while fulfilling the CSR (Corporate Social Responsibility). While focusing towards this perspective firm needs to give consideration towards economic, social and environmental perspectives. Under this perspective, firm gives consideration towards waste management, recycling, reuse, proper utilization of the resources, etc.(Song, Sun, & Jin, 2017).

PESTLE analysis is a simple and easy to understand tool. It supports to understand the business environment better while encouraging the development of strategic thinking. It supports to make the firm aware about the threats and challenges of the macro environment which enables the firm to take corrective actions to reduce the effect of future business threats (Lamas Leite, et al., 2017). It supports to spot new opportunities while exploiting them for the future context effectively.

In this research, PESTLE analysis remains assistive to identify the automobile industry in the UK market while focusing towards all the parameters of PESTLE analysis.

Uechi, et al. (2015) stated that ratio analysis plays vital role in assessing an entity on financial basis. It enables the removes the mystery which remains surrounding to the financial statements and supports to make it easier in the context of pinpointing the items to investigate it further. It is identified that without ratios, financial statements remains largely uninformative as ratio analysis enables the financial statements to interpret and to usefully applied for the purpose of satisfying the needs of the reader.

For instance, if there are four companies who are dealing in the same type of goods then the performance of four companies can be judged through ratio analysis. On the basis of gross profit and sales, it becomes able to determine the gross margin of the firm. It enables to analyze that which company gets the best profit and to evaluate the performance of the firms regarding the best as well as the worst performer. In support of this, Gigler, et al. (2014) depicted that the efficiency of the ratio analysis get affected by the timing of the end of the reporting period. Moreover, ratio efficiency is also affected through accounts receivable days and accounts payable days. Constructing the series of ratios support to bring the entire stakeholder group together while relating them with something that they find relevant which supports to do further investigation if necessary.

From the above table, it can be understood that there are different ratio category, i.e. profitability, liquidity, efficiency, shareholder and capital structure and there are different interest groups who show there interest in different categories.

It is identified that there are many ratios that can be utilized for the purpose of calculating the financial statements on the basis of interpretation. However for effective interpretation, it is essential to compare all the ratios in an adequate manner (Pierson, Hand, & Thompson, 2015). At the same time, it is identified that main comparators are with similar companies in the same sector that means to compare in the same industrial group. Moreover, there is a need of the comparisons with prior years while giving focus towards comparisons against the plan.

The profitability ratios remain focused towards the firm’s ability of generating the profit while giving concern towards adequate return on assets as well as equity. Due to this reason, most of the shareholders show there interest in this category (Uechi, et al., 2015). This ration enables to evaluate that how efficiently the firm uses its assets as well as how effectively it manages its operations too while answering the profitability of the business.

These ratios are helpful in getting the insight of a business and indicate the sufficiency and adequacy of profits of the firm. In addition, these ratios provide the understanding of the rate of return and help to make a comparative study with the industry and past performance. These ratios are also used by the banks and financial institutions to make lending decisions to the business. It is because these ratios are used to be ensured about the regular payments of interest and instalments. Investors also use these ratios to determine what return they will get after investment. In addition, these ratios are useful for the management to determine the lacking areas in their operations and make improvements. But at the same time, these ratios are based on earnings and investments that can be manipulated by the management through different accounting policies related to depreciation, inventory valuation, treatment of provisions, etc. In addition, there is possibility of errors due to different basis for computing profits and investments. These ratios are effective n terms of short-term profits rather than long term aspects. Along with this, this is not effective measure for financial position of the firm due to the influence of many extraneous and non-controllable factors.

Liquidity financial ratios determine the solvency of a company based on the assets and its liabilities. It enables towards working capital per dollar of sales and the current ratio. Liquidity ratio enables the firm to evaluate the resources available for the firm to use for the purpose of paying the bills, paying the staff members and many other payments (Kirklin, et al., 2013). This ratio is a powerful ratio which has supported even the powerful businesses to become bankrupt. These ratios are helpful to gauge the short-term financial strength of a company. Higher ratio indicates the stability of the firm to meet the short-term obligations. It is also effective to determine inventory mechanisms and optimize overhead costs. it also helps the management to determine efficiency in meeting the demands of creditor and identify the working capital management/requirement of the company. But at the same time, this ratio is based on the amount of current assets rather than quality of the asset that is not sufficient to determine the liquidity position. In addition, the consideration of inventory in calculation of this ratio leads to incorrect liquidity health of the firm. This ratio is not appropriate in different seasons due to showing high variations.

Efficiency ratio supports the management and the company to utilize the capital, while giving focus towards the cash conversion cycle for the purpose of pursuing of profit (Gigler, et al., 2014). The interest groups under this ratio are shareholders, potential purchasers and competitors. The efficiency ratio enables the firm to analyze the company while utilizing the assets and liabilities internally. Efficiency ratio supports to calculate the turnover of the receivables, while giving consideration towards the repayment of the liabilities.

There are basically five ratios which are calculated under shareholder ratios. These ratios are earnings per share (E.P.S), price/ Earnings (P/E) ratio, dividend per share, dividend yield and dividend covers (Kirklin, et al., 2013). This ratio supports to determine the shareholders interest in the context of company-wide liquidation. This ratio is calculated by dividing the number of total shareholders’ equity by total assets of the firm. It enables to represent the amount of assets regarding the shareholders residual claim. The figures are taken from the company balance sheet to calculate the ratio.

Shouman, El Shenawy, & Khattab (2016) stated that capital structure supports to identify the financing structure of the firm to overall operate the organizational function in the context of growth by giving concern towards different sources of funds. In the context of debt, it creates bond issues or long-term notes payable, however, equity is a common stock which offers preferred stock or retained earnings.

Porter five forces analysis helps an organization for analyzing the level of competition and business strategy development. The five forces are; threat of new entrants, threat of substitutes, bargaining power of customers, bargaining power of suppliers, and industry rivalry. Threat of new entrants force explains that how difficult it is for any of the firm or the competitor to enter the marketplace for the first time in the industry. A profitable market that generates greater outputs attracts new firms to enter the marketplace (David. & David, 2016). The barriers to entry are absolute cost advantage, economies of scale, brand equity, product differentiation, etc. Threat of substitutes force describes how easy it is for any customer to easily switch to any other competitive brand or its products & services (Enz, 2009).

The threat of substitutes is informed by quality depreciation, buyer switching costs, ease of substitution, quality depreciation, availability of closed substitute, etc. Bargaining power of customers force explains the power the customers have in affecting the price and quality (Dranove, et al., 2015). Customers are having more power when there are large numbers or sellers in the market or when it is easy for them to switch from one business’s products or services to another. Bargaining power of suppliers force explains how much of power is exercised by the suppliers in the marketplace. It makes it easy for them to have more power when they are few (Enz, 2009). They can charge huge for the unique resources. Where there are few substitutes these suppliers can be a source of power over the firm. Industry rivalry force describes the level of intense competition that exists in the marketplace currently. The rivalry competition is little when there are fewer businesses (Evans, Stonehouse and Campbell, 2012).

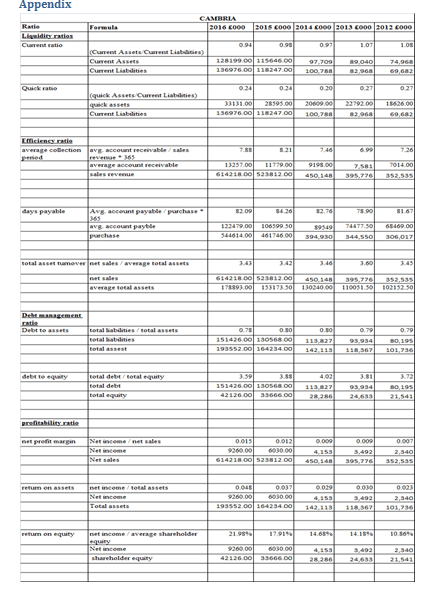

| CAMBRIA | ||||||

| Ratio | Formula | 2016 £000 | 2015 £000 | 2014 £000 | 2013 £000 | 2012 £000 |

| Liquidity ratios | ||||||

| Current ratio | (Current Assets/Current Liabilities) | 0.94 | 0.98 | 0.97 | 1.07 | 1.08 |

| Current Assets | 128199.00 | 115646.00 | 97,709 | 89,040 | 74,968 | |

| Current Liabilities | 136976.00 | 118247.00 | 1,00,788 | 82,968 | 69,682 | |

| Quick ratio | (Quick Assets/Current Liabilities) | 0.24 | 0.24 | 0.20 | 0.27 | 0.27 |

| Quick assets | 33131.00 | 28595.00 | 20609.00 | 22792.00 | 18626.00 | |

| Current Liabilities | 136976.00 | 118247.00 | 1,00,788 | 82,968 | 69,682 | |

| Efficiency ratio | ||||||

| Average collection period | Avg. account receivable / sales revenue * 365 | 7.88 | 8.21 | 7.46 | 6.99 | 7.26 |

| Average account receivable | 13257.00 | 11779.00 | 9198.00 | 7,581 | 7014.00 | |

| Sales revenue | 614218.00 | 523812.00 | 4,50,148 | 3,95,776 | 3,52,535 | |

| Days payable | Avg. account payable / purchase * 365 | 82.09 | 84.26 | 82.76 | 78.90 | 81.67 |

| Avg. account payble | 122479.00 | 106599.50 | 89549 | 74477.50 | 68469.00 | |

| Purchase | 544614.00 | 461746.00 | 3,94,930 | 3,44,550 | 3,06,017 | |

| Total asset turnover | Net sales / average total assets | 3.43 | 3.42 | 3.46 | 3.60 | 3.45 |

| Net sales | 614218.00 | 523812.00 | 4,50,148 | 3,95,776 | 3,52,535 | |

| Average total assets | 178893.00 | 153173.50 | 130240.00 | 110051.50 | 102152.50 | |

| Debt management ratio | ||||||

| Debt to assets | Total liabilities / total assets | 0.78 | 0.80 | 0.09 | 0.09 | 0.79 |

| Total liabilities | 151426.00 | 130568.00 | 13,039 | 10,766 | 80,195 | |

| Total assets | 193552.00 | 164234.00 | 1,42,113 | 1,18,367 | 1,01,736 | |

| Debt to equity | Total debt / total equity | 3.59 | 3.88 | 0.46 | 0.44 | 3.72 |

| Total debt | 151426.00 | 130568.00 | 13,039 | 10,766 | 80,195 | |

| Total equity | 42126.00 | 33666.00 | 28,286 | 24,633 | 21,541 | |

| Profitability ratio | ||||||

| Net profit margin | Net income / net sales | 0.02 | 0.01 | 0.01 | 0.01 | 0.01 |

| Net income | 9260.00 | 6030.00 | 4,153 | 3,492 | 2,340 | |

| Net sales | 614218.00 | 523812.00 | 4,50,148 | 3,95,776 | 3,52,535 | |

| Return on assets | Net income / total assets | 0.05 | 0.04 | 0.03 | 0.03 | 0.02 |

| Net income | 9260.00 | 6030.00 | 4,153 | 3,492 | 2,340 | |

| Total assets | 193552.00 | 164234.00 | 1,42,113 | 1,18,367 | 1,01,736 | |

| Return on equity | Net income / average Shareholder equity | 0.22 | 0.18 | 0.15 | 0.14 | 0.11 |

| Net income | 9260.00 | 6030.00 | 4,153 | 3,492 | 2,340 | |

| Shareholder equity | 42126.00 | 33666.00 | 28,286 | 24,633 | 21,541 | |

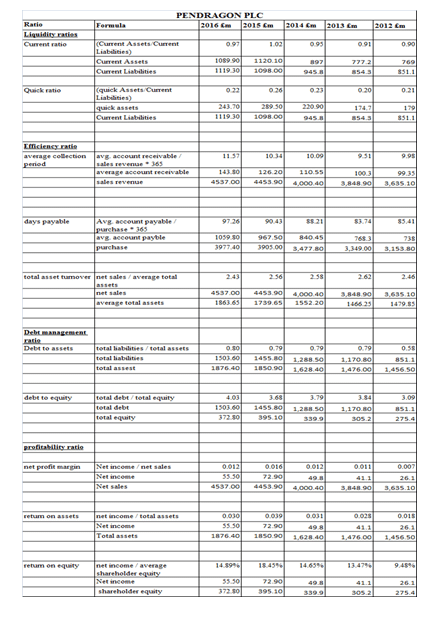

| PENDRAGON PLC | ||||||

| Ratio | Formula | 2016 £m | 2015 £m | 2014 £m | 2013 £m | 2012 £m |

| Liquidity ratios | ||||||

| Current ratio | (Current Assets/Current Liabilities) | 0.97 | 1.02 | 0.95 | 0.91 | 0.90 |

| Current Assets | 1089.90 | 1120.10 | 897 | 777.2 | 769 | |

| Current Liabilities | 1119.30 | 1098.00 | 945.8 | 854.3 | 851.1 | |

| Quick ratio | (Quick Assets/Current Liabilities) | 0.22 | 0.26 | |||

| Quick assets | 243.70 | 289.50 | 220.90 | 174.7 | 179 | |

| Current Liabilities | 1119.30 | 1098.00 | 945.8 | 854.3 | 851.1 | |

| Efficiency ratio | ||||||

| Average collection period | Avg. account receivable / Sales revenue * 365 | 11.57 | 10.34 | 10.09 | 9.51 | 9.98 |

| Average account receivable | 143.80 | 126.20 | 110.55 | 100.3 | 99.35 | |

| Sales revenue | 4537.00 | 4453.90 | 4,000.40 | 3,848.90 | 3,635.10 | |

| Days payable | Avg. account payable / purchase * 365 | 97.26 | 90.43 | 88.21 | 83.74 | 85.41 |

| Avg. account payble | 1059.80 | 967.50 | 840.45 | 768.3 | 738 | |

| purchase | 3977.40 | 3905.00 | 3,477.80 | 3,349.00 | 3,153.80 | |

| Total asset turnover | Net sales / average total assets | 2.43 | 2.56 | 2.58 | 2.62 | 2.46 |

| net sales | 4537.00 | 4453.90 | 4,000.40 | 3,848.90 | 3,635.10 | |

| Average total assets | 1863.65 | 1739.65 | 1552.20 | 1466.25 | 1479.85 | |

| Debt management ratio | ||||||

| Debt to assets | Total liabilities / total assets | 0.80 | 0.79 | 0.79 | 0.79 | 0.58 |

| Total liabilities | 1503.60 | 1455.80 | 1,288.50 | 1,170.80 | 851.1 | |

| Total assets | 1876.40 | 1850.90 | 1,628.40 | 1,476.00 | 1,456.50 | |

| Debt to equity | Total debt / total equity | 4.03 | 3.68 | 3.79 | 3.84 | 3.09 |

| Total debt | 1503.60 | 1455.80 | 1,288.50 | 1,170.80 | 851.1 | |

| Total equity | 372.80 | 395.10 | 339.9 | 305.2 | 275.4 | |

| Profitability ratio | ||||||

| Net profit margin | Net income / net sales | 0.01 | 0.02 | 0.01 | 0.01 | 0.01 |

| Net income | 55.50 | 72.90 | 49.8 | 41.1 | 26.1 | |

| Net sales | 4537.00 | 4453.90 | 4,000.40 | 3,848.90 | 3,635.10 | |

| Return on assets | Net income / total assets | 0.03 | 0.04 | 0.03 | 0.03 | 0.02 |

| Net income | 55.50 | 72.90 | 49.8 | 41.1 | 26.1 | |

| Total assets | 1876.40 | 1850.90 | 1,628.40 | 1,476.00 | 1,456.50 | |

| Return on equity | Net income / average Shareholder equity | 0.15 | 0.18 | 0.15 | 0.13 | 0.09 |

| Net income | 55.50 | 72.90 | 49.8 | 41.1 | 26.1 | |

| Shareholder equity | 372.80 | 395.10 | 339.9 | 305.2 | 275.4 | |

Interpretation of ratios

Liquidity Ratio

From the above discussion, it can be interpreted that ratio analysis is significant technique that evaluates the liquidity position of the company. In is identified that the liquidity position of the both companies are good because the current ration of are near the ideal current ratio. Cambria current ratio is recoded 0.94 in the financial year 2016. On the other hand, in the same time period, the current ratio for Pendragon is recoded .97. It shows that liquidity position of Pendragon is strong compared to Cambria. At the same, in the context of the quick ratio, it is found that there position of the company are worst because quick ratio of Cambria and Pendragon for 2016 are 0.24 and 0.22 respectively. It is because both companies have invested lots of money in the inventory. Due to this companies can face problem related to liquidity in the future in the context of paying their short term debt.

Efficiency Ratio

In the context of the efficiency ratio, it is found that the situation of Cambria is good compared to the Pendragon. It is because average collection period of Cambria is 7.88 in 2016 that is less than Pendragon 11.57 in same year. It shows that firm ability of collation the cash from debtors is good compared to Pendragon. In this, the last five years (2012-2016) average collection period were 7.88, 8.21, 7.46, 6.99 and7.26. At the same time, the average collection period for Pendragon was11.57, 10.34, 10.09, 9.51 and 9.98. It depicts that Cambria is performing well to obtain cash from debtors.

Furthermore, it is identified that in last five year, days payable ratio of Cambria was 82.09, 84.26, 82.76, 78.90 and 81.67 days. At the same time, day payable ratio of Pendragon was 97.26, 90.43, 88.21, 83.74 and 85.41. It also shows the ability of Cambria is good compared to Pendragon. On the other hand, total assets turnover ratio depict that Cambria is good to generate sale from its assets. It is because total assets turnover ratio is 3.43, 3.42 3.46 3.60 3.45 compared to Pendragon total assets turnover ratio is 2.43, 2.56, 2.58, 2.62 and 2.46. Hence, it can be said that efficiency position of Cambria is good compared to Pendragon.

Debt Management

Debt management ratio is also a significant part of financial ratio analysis. In this, it is found that debt assets ratio is almost equal for both companies. There are not much different between the both companies in the context of the debt to assets ratio. Cambria has 0.78, 0.80, 0.8, 0.79 and 0.79 debt to assets ratio and Pendragon has 0.80, 0.79, 0.79, 0.79 and 0.58 debt to assets. It shows that both companies are equal in debt to assets ratio. Beside of this, Cambria has 3.59 3.88 4.02 3.81 and 3.72 debt equity ratio in last five years. In the same time period, Pendragon has 4.03, 3.68, 3.79, 3.84 and 3.09 debt equity ratio. It depicts that debt management Cambria is good compared to Pendragon. Even though, there is not much difference in the debt and equity management (Gigler, et al. 2014). Therefore, it can be said that Cambria is in good position in the debt management.

Profitability Ratio

Profitability ratio shows the profitability position of the company. In this concern, net profit margin, return on assets and return on equity is analysed. Cambria has 0.015 net profit margins in the financial year 2016 while Pendragon has 0.012 net profit margins in 2016. It draws that Cambria has high profit margin compared to Pendragon due to reduction in operational costs and marketing costs. Additionally, return on assets determines that Cambria has 0.048, 0.037, 0.029, 0.030 and 0.023 in the last five years. On the other hand, Pendragon has 0.030, 0.039, 0.031, 0.028 and 0.018 return on assets ratio. It also defines that Cambria is also performing good here compared to Pendragon. Moreover, return on equity defines that Cambria has 21.98%, 17.91%, 14.68%, 14.18%, 10.86% profit on the equity. In compared of this, Pendragon has 14.89%, 18.45%, 14.65%, 13.47% and 9.48% profit on the equity. Thus, it can be said that Cambria is performing good in compared (Pentragon Cucchiella, et al. 2015)

Vertical analysis supports to analyse the financial statement which supports to analyse the major categories of accounts, i.e., liabilities and equities in a balance sheet. It supports to represent the proportion of the total account. Vertical analysis supports to analyse the financial statements in the context of percentage measure. Vertical analysis supports to manage the balance sheets, income statements and many other financial reports of businesses of different sizes which can be easily compared. It also enables to see relative annual changes easily within one business (Weygandt, Kimmel, & Kieso, 2015).Vertical analysis reports enable the finance department to line each item through the financial statement and support to represent the percentage of the statement through the main focus. Under the cash flow statement, each line item supports to express as a percentage of the total cash and cash equivalents in the context of the firm.

Vertical analysis is one of the popular methods of financial statement analysis which supports to show each item on a statement as a percentage basis. For conducting the vertical analysis of balance sheet, the total of assets as well as the total of liabilities and the stockholders’ equity is generally used for the purpose of base figures (Valickova, Havranek, & Horvath, 2015). All individual assets are taken as a total assets percentage. At the same time, current liabilities, long term debts as well as equities are taken as a percentage of the total liabilities and stockholders’ equity. Conducting the vertical analysis of income statement, company mostly utilizes the sales figure. Moreover, other components of income statement such as cost of sales, gross profit, income tax, operating expenses, net income etc. are also shown as a sales percentage (Weygandt, Kimmel, & Kieso, 2015).

The formula of computing vertical analysis is as follow:

Vertical analysis is an analytical approach which supports to present the Statement of financial performance in a manner as it enables to express them as a percentage of income. This enables the firm to offer the advantage of vertical analysis in the context of the balance sheets, income statements and other financial reports (Grant, 2016). This analysis is helpful for different business sizes to compare them easily. It also enables the firm to identify the relative annual changes within a business easily.

Vertical analysis is a technique of identifying the relationship between the items in the same financial statement while focusing towards the expression of the amounts according to the percentage of the total amount. In the context of balance sheet, cash and other assets support to reflect the total assets of the firm. Moreover, income statement enables to reflect the each expense in a percentage of the sales revenue (Grossmeier, et al., 2016). Vertical analysis enables the firm to line the item of a financial statement to represent the percentage of the statement. In the context of income statement each line item can be represent for the purpose of gross sales.

In the context of cash flow statement, vertical analysis allows the firm to represent the financial statement within a standard process in the industry. It supports to offer the snapshot for the company’s financial position through the line item. It is used by the organization for the purpose of easy comparison to the previous periods for timeline analysis which includes annual quarter as well as sequential quarter analysis. This analysis enables towards longer time period analysis such as for the time span of five years or three years. Vertical analysis supports to represent the financial statements while including line item percentages under the separate column (Siedlecki, 2014). Financial statement supports to including detailed vertical analysis so it is also known as common-size financial statements. Most of the companies use vertical analysis due to its effective interpretation which supports to provide greater detail of thefirm’s financial position. Common-size financial statements incorporate the comparative financial statements which also includes columns comparing each line item in the context of previously measured period (Shouman, , El Shenawy, & Khattab, 2016).

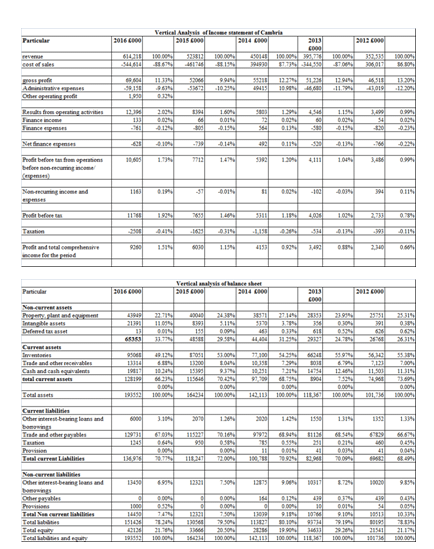

| Vertical Analysis of Income statement of Cambria | ||||||||||

| Particular | 2016 £000 | 2015 £000 | 2014 £000 | 2013 £000 | 2012 £000 | |||||

| Revenue | 6,14,218 | 100.00% | 523812 | 100.00% | 450148 | 100.00% | 3,95,776 | 100.00% | 3,52,535 | 100.00% |

| Cost of sales | -5,44,614 | -88.67% | -461746 | -88.15% | 394930 | 87.73% | -3,44,550 | -87.06% | 3,06,017 | 86.80% |

| Gross profit | 69,604 | 11.33% | 52066 | 9.94% | 55218 | 12.27% | 51,226 | 12.94% | 46,518 | 13.20% |

| Administrative expenses | -59,158 | -9.63% | -53672 | -10.25% | 49415 | 10.98% | -46,680 | -11.79% | -43,019 | -12.20% |

| Other operating profit | 1,950 | 0.32% | ||||||||

| Results from operating activities | 12,396 | 2.02% | 8394 | 1.60% | 5803 | 1.29% | 4,546 | 1.15% | 3,499 | 0.99% |

| Finance income | 133 | 0.02% | 66 | 0.01% | 72 | 0.02% | 60 | 0.02% | 54 | 0.02% |

| Finance expenses | -761 | -0.12% | -805 | -0.15% | 564 | 0.13% | -580 | -0.15% | -820 | -0.23% |

| Net finance expenses | -628 | -0.10% | -739 | -0.14% | 492 | 0.11% | -520 | -0.13% | -766 | -0.22% |

| Profit before tax from Operations before non-recurring Income/ (expenses) | 10,605 | 1.73% | 7712 | 1.47% | 5392 | 1.20% | 4,111 | 1.04% | 3,486 | 0.99% |

| Non-recurring income and expenses | 1163 | 0.19% | -57 | -0.01% | 81 | 0.02% | -102 | -0.03% | 394 | 0.11% |

| Profit before tax | 11768 | 1.92% | 7655 | 1.46% | 5311 | 1.18% | 4,026 | 1.02% | 2,733 | 0.78% |

| Taxation | -2508 | -0.41% | -1625 | -0.31% | -1,158 | -0.26% | -534 | -0.13% | -393 | -0.11% |

| Profit and total comprehensive income for the period | 9260 | 1.51% | 6030 | 1.15% | 4153 | 0.92% | 3,492 | 0.88% | 2,340 | 0.66% |

| Vertical analysis of balance sheet of Cambria | ||||||||||

| Particular | 2016 £000 | 2015 £000 | 2014 £000 | 2013 £000 | 2012 £000 | |||||

| Non-current assets | ||||||||||

| Property, plant and equipment | 43949 | 22.71% | 40040 | 24.38% | 38571 | 27.14% | 28353 | 23.95% | 25751 | 25.31% |

| Intangible assets | 21391 | 11.05% | 8393 | 5.11% | 5370 | 3.78% | 356 | 0.30% | 391 | 0.38% |

| Deferred tax asset | 13 | 0.01% | 155 | 0.09% | 463 | 0.33% | 618 | 0.52% | 626 | 0.62% |

| 65353 | 33.77% | 48588 | 29.58% | 44,404 | 31.25% | 29327 | 24.78% | 26768 | 26.31% | |

| Current assets | ||||||||||

| Inventories | 95068 | 49.12% | 87051 | 53.00% | 77,100 | 54.25% | 66248 | 55.97% | 56,342 | 55.38% |

| Trade and other receivables | 13314 | 6.88% | 13200 | 8.04% | 10,358 | 7.29% | 8038 | 6.79% | 7,123 | 7.00% |

| Cash and cash equivalents | 19817 | 10.24% | 15395 | 9.37% | 10,251 | 7.21% | 14754 | 12.46% | 11,503 | 11.31% |

| total current assets | 128199 | 66.23% | 115646 | 70.42% | 97,709 | 68.75% | 8904 | 7.52% | 74,968 | 73.69% |

| 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | ||||||

| Total assets | 193552 | 100.00% | 164234 | 100.00% | 1,42,113 | 100.00% | 1,18,367 | 100.00% | 1,01,736 | 100.00% |

| Current liabilities | ||||||||||

| Other interest-bearing loans and borrowings | 6000 | 3.10% | 2070 | 1.26% | 2020 | 1.42% | 1550 | 1.31% | 1352 | 1.33% |

| Trade and other payables | 129731 | 67.03% | 115227 | 70.16% | 97972 | 68.94% | 81126 | 68.54% | 67829 | 66.67% |

| Taxation | 1245 | 0.64% | 950 | 0.58% | 785 | 0.55% | 251 | 0.21% | 460 | 0.45% |

| Provision | 0.00% | 0.00% | 11 | 0.01% | 41 | 0.03% | 41 | 0.04% | ||

| Total current Liabilities | 1,36,976 | 70.77% | 1,18,247 | 72.00% | 1,00,788 | 70.92% | 82,968 | 70.09% | 69682 | 68.49% |

| Non-current liabilities | ||||||||||

| Other interest-bearing loans and borrowings | 13450 | 6.95% | 12321 | 7.50% | 12875 | 9.06% | 10317 | 8.72% | 10020 | 9.85% |

| Other payables | 0 | 0.00% | 0 | 0.00% | 164 | 0.12% | 439 | 0.37% | 439 | 0.43% |

| Provisions | 1000 | 0.52% | 0 | 0.00% | 0 | 0.00% | 10 | 0.01% | 54 | 0.05% |

| Total Non -current liabilities | 14450 | 7.47% | 12321 | 7.50% | 13039 | 9.18% | 10766 | 9.10% | 10513 | 10.33% |

| Total liabilities | 151426 | 78.24% | 130568 | 79.50% | 113827 | 80.10% | 93734 | 79.19% | 80195 | 78.83% |

| Total equity | 42126 | 21.76% | 33666 | 20.50% | 28286 | 19.90% | 34633 | 29.26% | 21541 | 21.17% |

| Total liabilities and equity | 193552 | 100.00% | 164234 | 100.00% | 1,42,113 | 100.00% | 1,18,367 | 100.00% | 101736 | 100.00% |

|

Vertical analysis of Balance sheet of Pendragon |

||||||||||

| Particular | 2016 £m | 2015 £m | 2014 £m | 2013 £m | 2012 £m | |||||

| Non-current assets | ||||||||||

| Property, plant and equipment | 405.3 | 21.60% | 352.7 | 19.06% | 312 | 19.16% | 295.7 | 20.03% | 290.3 | 19.93% |

| Goodwill | 356.5 | 19.00% | 360.8 | 19.49% | 365.4 | 22.44% | 365.4 | 24.76% | 368.2 | 25.28% |

| Other intangible assets | 5.7 | 0.30% | 5.8 | 0.31% | 6.1 | 0.37% | 5 | 0.34% | 4.4 | 0.30% |

| Investments | 0 | 0.00% | 0 | 0.00% | 24 | 1.47% | 10 | 0.68% | 0 | 0.00% |

| Deferred tax assets | 19 | 1.01% | 11.5 | 0.62% | 23.9 | 1.47% | 22.7 | 1.54% | 10.4 | 0.71% |

| Total non-current assets | 786.5 | 41.92% | 730.8 | 39.48% | 730.8 | 44.88% | 698.8 | 47.34% | 687.5 | 47.20% |

| Current assets | ||||||||||

| Inventories | 846.2 | 45.10% | 830.6 | 44.88% | 676.1 | 41.52% | 602.5 | 40.82% | 590 | 40.51% |

| Trade and other receivables | 153.1 | 8.16% | 134.5 | 7.27% | 117.9 | 7.24% | 103.2 | 6.99% | 97.4 | 6.69% |

| Cash and cash equivalents | 84 | 4.48% | 138.8 | 7.50% | 91.4 | 5.61% | 58.4 | 3.96% | 58 | 3.98% |

| Assets classified as held for sale | 6.6 | 0.35% | 16.2 | 0.88% | 11.6 | 0.71% | 13.1 | 0.89% | 23.6 | 1.62% |

| Total current assets | 1089.9 | 58.08% | 1120.1 | 60.52% | 897 | 55.08% | 777.2 | 52.66% | 769 | 52.80% |

| Total assets | 1876.4 | 100.00% | 1850.9 | 100.00% | 1628.4 | 100.00% | 1476 | 100.00% | 1456.5 | 100.00% |

| Current liabilities | ||||||||||

| Trade and other payables | 1068.7 | 56.95% | 1050.9 | 56.78% | 884.1 | 54.29% | 796.8 | 53.98% | 739.8 | 50.79% |

| Deferred income | 36.6 | 1.95% | 32.9 | 1.78% | 26.2 | 1.61% | 24.9 | 1.69% | 23 | 1.58% |

| Current tax payable | 7.8 | 0.42% | 9.9 | 0.53% | 33 | 2.03% | 30.5 | 2.07% | 25.5 | 1.75% |

| Provisions | 6.2 | 0.33% | 5 | 0.27% | 2.5 | 0.15% | 2.1 | 0.14% | 2.4 | 0.16% |

| Total current liabilities | 1119.3 | 59.65% | 1098 | 59.32% | 945.8 | 58.08% | 854.3 | 57.88% | 851.1 | 58.43% |

| Non-current liabilities | ||||||||||

| Interest bearing loans and borrowings | 175.7 | 9.36% | 218.4 | 11.80% | 200.2 | 12.29% | 198 | 13.41% | 228.2 | 15.67% |

| Trade and other payables | 48.8 | 2.60% | 41.6 | 2.25% | 31 | 1.90% | 28.3 | 1.92% | 23.7 | 1.63% |

| Deferred income | 50.4 | 2.69% | 50.1 | 2.71% | 41.6 | 2.55% | 43.1 | 2.92% | 44.8 | 3.08% |

| Retirement benefit obligations | 103.2 | 5.50% | 43.4 | 2.34% | 66.4 | 4.08% | 43.4 | 2.94% | 29.8 | 2.05% |

| Provisions | 6.2 | 0.33% | 4.3 | 0.23% | 3.5 | 0.21% | 3.7 | 0.25% | 3.5 | 0.24% |

| Total non-current liabilities | 384.3 | 20.48% | 357.8 | 19.33% | 342.7 | 21.05% | -316.5 | -21.44% | -330 | -22.66% |

| Total liabilities | 1503.6 | 80.13% | 1455.8 | 78.65% | 1288.5 | 79.13% | -1170.8 | -79.32% | -1181.1 | -81.09% |

| Total equity | 372.8 | 19.87% | 395.1 | 21.35% | 339.9 | 20.87% | 305.2 | 20.68% | 275.4 | 18.91% |

| Total liabilities and equity | 1876.4 | 100.00% | 1850.9 | 100.00% | 1628.4 | 100.00% | 1476 | 100.00% | 1456.5 | 100.00% |

|

Vertical analysis of Balance sheet of Pendragon |

||||||||||

| Particular | 2016 £m | 2015 £m | 2014 £m | 2013 £m | 2012 £m | |||||

| Non-current assets | ||||||||||

| Property, plant and equipment | 405.3 | 21.60% | 352.7 | 19.06% | 312 | 19.16% | 295.7 | 20.03% | 290.3 | 19.93% |

| Goodwill | 356.5 | 19.00% | 360.8 | 19.49% | 365.4 | 22.44% | 365.4 | 24.76% | 368.2 | 25.28% |

| Other intangible assets | 5.7 | 0.30% | 5.8 | 0.31% | 6.1 | 0.37% | 5 | 0.34% | 4.4 | 0.30% |

| Investments | 0 | 0.00% | 0 | 0.00% | 24 | 1.47% | 10 | 0.68% | 0 | 0.00% |

| Deferred tax assets | 19 | 1.01% | 11.5 | 0.62% | 23.9 | 1.47% | 22.7 | 1.54% | 10.4 | 0.71% |

| Total non-current assets | 786.5 | 41.92% | 730.8 | 39.48% | 730.8 | 44.88% | 698.8 | 47.34% | 687.5 | 47.20% |

| Current assets | ||||||||||

| Inventories | 846.2 | 45.10% | 830.6 | 44.88% | 676.1 | 41.52% | 602.5 | 40.82% | 590 | 40.51% |

| Trade and other receivables | 153.1 | 8.16% | 134.5 | 7.27% | 117.9 | 7.24% | 103.2 | 6.99% | 97.4 | 6.69% |

| Cash and cash equivalents | 84 | 4.48% | 138.8 | 7.50% | 91.4 | 5.61% | 58.4 | 3.96% | 58 | 3.98% |

| Assets classified as held for sale | 6.6 | 0.35% | 16.2 | 0.88% | 11.6 | 0.71% | 13.1 | 0.89% | 23.6 | 1.62% |

| Total current assets | 1089.9 | 58.08% | 1120.1 | 60.52% | 897 | 55.08% | 777.2 | 52.66% | 769 | 52.80% |

| Total assets | 1876.4 | 100.00% | 1850.9 | 100.00% | 1628.4 | 100.00% | 1476 | 100.00% | 1456.5 | 100.00% |

| Current liabilities | ||||||||||

| Trade and other payables | 1068.7 | 56.95% | 1050.9 | 56.78% | 884.1 | 54.29% | 796.8 | 53.98% | 739.8 | 50.79% |

| Deferred income | 36.6 | 1.95% | 32.9 | 1.78% | 26.2 | 1.61% | 24.9 | 1.69% | 23 | 1.58% |

| Current tax payable | 7.8 | 0.42% | 9.9 | 0.53% | 33 | 2.03% | 30.5 | 2.07% | 25.5 | 1.75% |

| Provisions | 6.2 | 0.33% | 5 | 0.27% | 2.5 | 0.15% | 2.1 | 0.14% | 2.4 | 0.16% |

| Total current liabilities | 1119.3 | 59.65% | 1098 | 59.32% | 945.8 | 58.08% | 854.3 | 57.88% | 851.1 | 58.43% |

| Non-current liabilities | ||||||||||

| Interest bearing loans and borrowings | 175.7 | 9.36% | 218.4 | 11.80% | 200.2 | 12.29% | 198 | 13.41% | 228.2 | 15.67% |

| Trade and other payables | 48.8 | 2.60% | 41.6 | 2.25% | 31 | 1.90% | 28.3 | 1.92% | 23.7 | 1.63% |

| Deferred income | 50.4 | 2.69% | 50.1 | 2.71% | 41.6 | 2.55% | 43.1 | 2.92% | 44.8 | 3.08% |

| Retirement benefit obligations | 103.2 | 5.50% | 43.4 | 2.34% | 66.4 | 4.08% | 43.4 | 2.94% | 29.8 | 2.05% |

| Provisions | 6.2 | 0.33% | 4.3 | 0.23% | 3.5 | 0.21% | 3.7 | 0.25% | 3.5 | 0.24% |

| Total non-current liabilities | 384.3 | 20.48% | 357.8 | 19.33% | 342.7 | 21.05% | -316.5 | -21.44% | -330 | -22.66% |

| Total liabilities | 1503.6 | 80.13% | 1455.8 | 78.65% | 1288.5 | 79.13% | -1170.8 | -79.32% | -1181.1 | -81.09% |

| Total equity | 372.8 | 19.87% | 395.1 | 21.35% | 339.9 | 20.87% | 305.2 | 20.68% | 275.4 | 18.91% |

| Total liabilities and equity | 1876.4 | 100.00% | 1850.9 | 100.00% | 1628.4 | 100.00% | 1476 | 100.00% | 1456.5 | 100.00% |

| Vertical analysis of Income Statement of Pendragon | ||||||||||

| Particular | 2016 £m | 2015 £m | 2014 £m | 2013 £m | 2012 £m | |||||

| Revenue | 4537 | 100.00% | 4453.9 | 100.00% | 4000.4 | 100.00% | 3848.9 | 100.00% | 3,635.10 | 100.00% |

| Cost of sales | 3977.4 | 87.67% | 3905 | 87.68% | 3477.8 | 86.94% | 3349 | 87.01% | 3,153.80 | 86.76% |

| Gross profit | 559.6 | 12.33% | 548.9 | 12.32% | 522.6 | 13.06% | 4999 | 129.88% | 481.3 | 13.24% |

| Operating expenses | 459.5 | 10.13% | 452.9 | 10.17% | 432.8 | 10.82% | 4224 | 109.75% | 413.8 | 11.38% |

| Operating profit before other income | 100.1 | 2.21% | 96.4 | 2.16% | 89.8 | 2.24% | 77.5 | 2.01% | 67.5 | 1.86% |

| Other income/expense | 0.3 | 0.01% | 25.3 | 0.57% | 7.4 | 0.18% | 0.3 | 0.01% | 0.4 | 0.01% |

| Operating profit | 100.4 | 2.21% | 121.7 | 2.73% | 97.2 | 2.43% | 77.2 | 2.01% | 67.9 | 1.87% |

| Finance expense | 27.4 | 0.60% | 43.2 | 0.97% | 33.1 | 0.83% | 42.6 | 1.11% | 36.3 | 1.00% |

| Finance income | 0 | 0.00% | 0.5 | 0.01% | 0.5 | 0.01% | 4.3 | 0.11% | 2.4 | 0.07% |

| Net finance costs | 27.4 | 0.60% | 42.7 | 0.96% | 32.6 | 0.81% | 38.3 | 1.00% | 33.9 | 0.93% |

| Profit before taxation | 73 | 1.61% | 79 | 1.77% | 64.6 | 1.61% | 38.90% | 0.01% | 34 | 0.94% |

| Income tax (expense) / credit | 17.5 | 0.39% | 6.1 | 0.14% | 14.8 | 0.37% | 2.20% | 0.00% | 7.9 | 0.22% |

| Profit for the year | 55.5 | 1.22% | 72.9 | 1.64% | 49.8 | 1.24% | 41.10% | 0.01% | 26.1 | 0.72% |

Horizontal analysis is based on analytical approach in which same item is compared between the time periods. It enables towards finite horizon forecasting of the financial statement. Horizontal analysis supports toutilize effective technique that enables to shows the changes in the corresponding financial statement in the period of time. It is a tool which remains highly assistive to evaluate the current trend. For the analysis purpose, the statements for two or more periods are used in the context of horizontal analysis(Legoux, et al., 2014). The earliest period supports to be used as a base period and enables to offer the items on the statements for all the later periods as compare to the items on the statements. Additionally, the changes can be seen in amount as well as in percentage.

For computing the changes, following formulas can be used:

Horizontal analysis assists the investors and analysts to evaluate the company growth in a particular time span. Moreover, horizontal analysis enables the firmto compare the company growth rates with the competitor firms for the purpose of comparative analysis in the context of industry. For instance, if it is identified that the revenue of the firm increased by 10% this past quarter, then it can be identified by utilizing the horizontal analysis as it enables the firm to use any item in company financials from revenues to EPS to compare the performance of various companies of a same industry(Pierson, Hand, & Thompson, 2015).

Achimugu, et al. (2014) depicted that the major difference between horizontal analysis and vertical analysis is that vertical analysis remains focused towards listing each item on a company’s financial statement in the separate column such as cost of goods sold, gross margin, etc. are listed as a percentage of sales. Horizontal analysis supports to offer the ratio as well as trend analysis which enables to work under the income statement. Both horizontal and vertical analyses remain assistive to compare the income statement accounts of the firms in dollars as well as in percentages.

In this business analysis report, these methods remain supportive to compare the financial statement of Cambria Automobiles Plc. and Pendragon Plc. These methods have supported to give detailed understanding regarding the comparison of the financial position of both the company.

| Particular | 2016 £000 | 2015 £000 | 2014 £000 | 2013 £000 | 2012 £000 | 2013 | 2014 | 2015 | 2016 |

| Revenue | 6,14,218 | 523812 | 450148 | 3,95,776 | 3,52,535 | 12.27% | 27.69% | 48.58% | 74.23% |

| Cost of sales | -5,44,614 | -461746 | 394930 | 3,44,550 | 3,06,017 | 12.59% | 29.05% | -250.89% | -277.97% |

| Gross profit | 69,604 | 52066 | 55218 | 51,226 | 46,518 | 10.12% | 18.70% | 11.93% | 49.63% |

| Administrative expenses | -59,158 | -53672 | 49415 | -46,680 | -43,019 | 8.51% | -214.87% | 24.76% | 37.52% |

| Other operating profit | 1,950 | 0 | |||||||

| Results from operating activities | 12,396 | 8394 | 5803 | 4,546 | 3,499 | 29.92% | 65.85% | 139.90% | 254.27% |

| Finance income | 133 | 66 | 72 | 60 | 54 | 11.11% | 33.33% | 22.22% | 146.30% |

| Finance expenses | -761 | -805 | 564 | -580 | -820 | -29.27% | -168.78% | -1.83% | -7.20% |

| Net finance expenses | -628 | -739 | 492 | -520 | -766 | -32.11% | -164.23% | -3.52% | -18.02% |

| Profit before tax from operations before non-recurring income/ (expenses) | 10,605 | 7712 | 5392 | 4,111 | 3,486 | 17.93% | 54.68% | 121.23% | 204.22% |

| Non-recurring income and expenses | 1163 | -57 | 81 | -102 | 394 | -125.89% | -79.44% | -114.47% | 195.18% |

| Profit before tax | 11768 | 7655 | 5311 | 4,026 | 2,733 | 47.31% | 94.33% | 180.10% | 330.59% |

| Taxation | -2508 | -1625 | -1,158 | -534 | -393 | 35.88% | 194.66% | 313.49% | 538.17% |

| Profit and total comprehensive income for the period | 9260 | 6030 | 4153 | 3,492 | 2,340 | 49.23% | 77.48% | 157.69% | 295.73% |

| Particular | 2016 £000 | 2015 £000 | 2014 £000 | 2013 £000 | 2012 £000 | 2013 | 2014 | 2015 | 2016 |

| Non-current assets | |||||||||

| Property, plant and equipment | 43949 | 40040 | 38571 | 28353 | 25751 | 10.10% | 49.78% | 55.49% | 70.67% |

| Intangible assets | 21391 | 8393 | 5370 | 356 | 391 | -8.95% | 1273.40% | 2046.55% | 5370.84% |

| Deferred tax asset | 13 | 155 | 463 | 618 | 626 | -1.28% | -26.04% | -75.24% | -97.92% |

| 65353 | 48588 | 44,404 | 29327 | 26768 | 9.56% | 65.88% | 81.52% | 144.15% | |

| Current assets | |||||||||

| Inventories | 95068 | 87051 | 77,100 | 66248 | 56,342 | 17.58% | 36.84% | 54.50% | 68.73% |

| Trade and other receivables | 13314 | 13200 | 10,358 | 8038 | 7,123 | 12.85% | 45.42% | 85.32% | 86.92% |

| Cash and cash equivalents | 19817 | 15395 | 10,251 | 14754 | 11,503 | 28.26% | -10.88% | 33.83% | 72.28% |

| Total current assets | 128199 | 115646 | 97,709 | 8904 | 74,968 | -88.12% | 30.33% | 54.26% | 71.00% |

| Total assets | 193552 | 164234 | 1,42,113 | 1,18,367 | 1,01,736 | 16.35% | 39.69% | 61.43% | 90.25% |

| Current liabilities | |||||||||

| Other interest-bearing loans and borrowings | 6000 | 2070 | 2020 | 1550 | 1352 | 14.64% | 49.41% | 53.11% | 343.79% |

| Trade and other payables | 129731 | 115227 | 97972 | 81126 | 67829 | 19.60% | 44.44% | 69.88% | 91.26% |

| Taxation | 1245 | 950 | 785 | 251 | 460 | -45.43% | 70.65% | 106.52% | 170.65% |

| Provision | 11 | 41 | 41 | 0.00% | -73.17% | -100.00% | -100.00% | ||

| Total current Liabilities | 1,36,976 | 1,18,247 | 1,00,788 | 82,968 | 69682 | 19.07% | 44.64% | 69.70% | 96.57% |

| Non-current liabilities | |||||||||

| Other interest-bearing loans and borrowings | 13450 | 12321 | 12875 | 10317 | 10020 | 2.96% | 28.49% | 22.96% | 34.23% |

| Other payables | 0 | 0 | 164 | 439 | 439 | 0.00% | -62.64% | -100.00% | -100.00% |

| Provisions | 1000 | 0 | 0 | 10 | 54 | -81.48% | -100.00% | -100.00% | 1751.85% |

| Total Non current liabilities | 14450 | 12321 | 13039 | 10766 | 10513 | 2.41% | 24.03% | 17.20% | 37.45% |

| Total liabilities | 151426 | 130568 | 113827 | 93734 | 80195 | 16.88% | 41.94% | 62.81% | 88.82% |

| Total equity | 42126 | 33666 | 28286 | 34633 | 21541 | 60.78% | 31.31% | 56.29% | 95.56% |

| Total liabilities and equity | 193552 | 164234 | 1,42,113 | 1,18,367 | 101736 | 16.35% | 39.69% | 61.43% | 90.25% |

| Particular | 2016 £m | 2015 £m | 2014 £m | 2013 £m | 2012 £m | 2013 | 20104 | 2015 | 2016 |

| Non-current assets | |||||||||

| Property, plant and equipment | 405.3 | 352.7 | 312 | 295.7 | 290.3 | 1.86% | 7.48% | 21.50% | 39.61% |

| Goodwill | 356.5 | 360.8 | 365.4 | 365.4 | 368.2 | -0.76% | -0.76% | -2.01% | -3.18% |

| Other intangible assets | 5.7 | 5.8 | 6.1 | 5 | 4.4 | 13.64% | 38.64% | 31.82% | 29.55% |

| Investments | 0 | 0 | 24 | 10 | 0 | ||||

| Deferred tax assets | 19 | 11.5 | 23.9 | 22.7 | 10.4 | 118.27% | 129.81% | 10.58% | 82.69% |

| Total non-current assets | 786.5 | 730.8 | 730.8 | 698.8 | 687.5 | 1.64% | 6.30% | 6.30% | 14.40% |

| Current assets | |||||||||

| Inventories | 846.2 | 830.6 | 676.1 | 602.5 | 590 | 2.12% | 14.59% | 40.78% | 43.42% |

| Trade and other receivables | 153.1 | 134.5 | 117.9 | 103.2 | 97.4 | 5.95% | 21.05% | 38.09% | 57.19% |

| Cash and cash equivalents | 84 | 138.8 | 91.4 | 58.4 | 58 | 0.69% | 57.59% | 139.31% | 44.83% |

| Assets classified as held for sale | 6.6 | 16.2 | 11.6 | 13.1 | 23.6 | -44.49% | -50.85% | -31.36% | -72.03% |

| Total current assets | 1089.9 | 1120.1 | 897 | 777.2 | 769 | 1.07% | 16.64% | 45.66% | 41.73% |

| Total assets | 1876.4 | 1850.9 | 1628.4 | 1476 | 1456.5 | 1.34% | 11.80% | 27.08% | 28.83% |

| Current liabilities | |||||||||

| Trade and other payables | 1068.7 | 1050.9 | 884.1 | 796.8 | 739.8 | 7.70% | 19.51% | 42.05% | 44.46% |

| Deferred income | 36.6 | 32.9 | 26.2 | 24.9 | 23 | 8.26% | 13.91% | 43.04% | 59.13% |

| Current tax payable | 7.8 | 9.9 | 33 | 30.5 | 25.5 | 19.61% | 29.41% | -61.18% | -69.41% |

| Provisions | 6.2 | 5 | 2.5 | 2.1 | 2.4 | -12.50% | 4.17% | 108.33% | 158.33% |

| Total current liabilities | 1119.3 | 1098 | 945.8 | 854.3 | 851.1 | 0.38% | 11.13% | 29.01% | 31.51% |

| Non-current liabilities | |||||||||

| Interest bearing loans and borrowings | 175.7 | 218.4 | 200.2 | 198 | 228.2 | -13.23% | -12.27% | -4.29% | -23.01% |

| Trade and other payables | 48.8 | 41.6 | 31 | 28.3 | 23.7 | 19.41% | 30.80% | 75.53% | 105.91% |

| Deferred income | 50.4 | 50.1 | 41.6 | 43.1 | 44.8 | -3.79% | -7.14% | 11.83% | 12.50% |

| Retirement benefit obligations | 103.2 | 43.4 | 66.4 | 43.4 | 29.8 | 45.64% | 122.82% | 45.64% | 246.31% |

| Provisions | 6.2 | 4.3 | 3.5 | 3.7 | 3.5 | 5.71% | 0.00% | 22.86% | 77.14% |

| Total non-current liabilities | 384.3 | 357.8 | 342.7 | -316.5 | -330 | -4.09% | -203.85% | -208.42% | -216.45% |

| Total liabilities | 1503.6 | 1455.8 | 1288.5 | -1170.8 | -1181.1 | -0.87% | -209.09% | -223.26% | -227.31% |

| Total equity | 372.8 | 395.1 | 339.9 | 305.2 | 275.4 | 10.82% | 23.42% | 43.46% | 35.37% |

| Total liabilities and equity | 1876.4 | 1850.9 | 1628.4 | 1476 | 1456.5 | 1.34% | 11.80% | 27.08% | 28.83% |

| Particular | 2016 £m | 2015 £m | 2014 £m | 2013 £m | 2012 £m | 2013 | 2014 | 2015 | 2016 |

| Revenue | 4537 | 4453.9 | 4000.4 | 3848.9 | 3,635.10 | 5.88% | 10.05% | 22.52% | 24.81% |

| Cost of sales | 3977.4 | 3905 | 3477.8 | 3349 | 3,153.80 | 6.19% | 10.27% | 23.82% | 26.11% |

| Gross profit | 559.6 | 548.9 | 522.6 | 4999 | 481.3 | 938.65% | 8.58% | 14.05% | 16.27% |

| Operating expenses | 459.5 | 452.9 | 432.8 | 4224 | 413.8 | 920.78% | 4.59% | 9.45% | 11.04% |

| Operating profit before other income | 100.1 | 96.4 | 89.8 | 77.5 | 67.5 | 14.81% | 33.04% | 42.81% | 48.30% |

| Other income | 0.3 | 25.3 | 7.4 | 0.3 | 0.4 | -25.00% | 1750.00% | 6225.00% | -25.00% |

| Operating profit | 100.4 | 121.7 | 97.2 | 77.2 | 67.9 | 13.70% | 43.15% | 79.23% | 47.86% |

| Finance expense | 27.4 | 43.2 | 33.1 | 42.6 | 36.3 | 17.36% | -8.82% | 19.01% | -24.52% |

| Finance income | 0 | 0.5 | 0.5 | 4.3 | 2.4 | 79.17% | -79.17% | -79.17% | -100.00% |

| Net finance costs | 27.4 | 42.7 | 32.6 | 38.3 | 33.9 | 12.98% | -3.83% | 25.96% | -19.17% |

| Profit before taxation | 73 | 79 | 64.6 | 38.90% | 34 | -98.86% | 90.00% | 132.35% | 114.71% |

| Income tax (expense) / credit | 17.5 | 6.1 | 14.8 | 2.20% | 7.9 | -99.72% | 87.34% | -22.78% | 121.52% |

| Profit for the year | 55.5 | 72.9 | 49.8 | 41.10% | 26.1 | -98.43% | 90.80% | 179.31% | 112.64% |

Interpretation of Vertical analysis and horizontal analysis

The vertical analysis of balance sheet of Pendragon shows that in 2016, the total current asset of the company is 58.08% and non- current assets is 41.92%. It means that company has invested more in the more in the current assets. On the other hand, vertical analysis of balance sheet of Cambria depicts that company has invested 33.77% in the non -current liabilities and 66.23% in the current liabilities. It shows that both companies have invested more in current assets compared non-current assets. Beside of this horizontal analysis shows that Cambria total assets have been increase 90.25% from 2012. At the same time, its total liabilities increased 88.82% during this period. In compared of this, Pendragon total liabilities have increased 28.83% in last five years from 2012 while its liabilities increased 27.31%. It depicts Cambria is growing more effectively (Weygandt, et al. 2015).

Vertical analysis of income statement of Cambria depicts that cost of sales of the company has increased of the company from 2012. It is because cost of sales is measured 88.67% of the total sales that was 86.80% in 2012. But at the same time, it is also found that net profit also increased of the company because it is found by 1.51% in 2016 that was 0.66% in 2012. On the other hand, in the context of Pendragon, it is found that cost of sales increased also increased here. In 2012, cost of sales was 86.76% and in 2016, it is 87.67%. Situation is also same in the context of net profit (Sharma &Mehra, 2016). It is also recoded high compared to 2012 because that time, it was 0.72% and in 2016 is recorded by 1.22% of sales revenue.

Trend analysis supports towards offering technical analysis which enables to predict the future movement of a stock based in the context of past data. This analysis focuses towards what has happened in the past which supports to give the idea to the traders of what will happen in the future. It is the extensive practice of collecting the information by attempting the spot of pattern (Sharma, &Mehra, 2016). Market trend supports to offer a perceived tendency of financial markets which enables to move in a particular direction. These trends can be classified as a long term frames. It enables to offer primary for medium time frames and secondary for short time frames. Trend analysis supports to analyse the financial statement for the longer period which assists to analyse the trend (Cucchiella, D’Adamo, &Gastaldi, 2015). Based on trend analysis, it can be stated that there is an increasing trend in liquidity, efficiency, debt management and profitability of Cambria as compared to Pendragon.

Political: The political factors such as government policies and restrictions, political framework, safety and standard and tax structure of a nation control the automobile industry. The government in the UK is supporting the automobile industry for the hybrid vehicle for less emission and energy-efficiency (Grünig, &Morschett, 2017). However, the government poses strict rules for automobile production and high tax charge for high CO2 emissions and non-compliance with regulations.

Economical: The fluctuations in the exchange rate, recession, rise in prices of raw material for automobile production, rise in petrol prices, high interest rate are economic factors influencing the automobile retail industry. The increase in global income has a positive influence for the automobile retailers in terms of increase demands for used and new vehicles. However, the inflation In UK has caused prices of automobiles to rise further. The rise in petrol (gas) prices lower the demands for vehicles. (Kapogiannis, Gaterell, &Oulasoglou, 2015) argue that the increase in fuel efficient vehicles in the UK did not negatively impact the demands for vehicles with high petrol prices.

Social: The change in demographics and buying pattern along with cultural change are some of the social factors influence the automobile industry. The changing demographics like more number of individuals in family demands for the spacious car and look for safety aspects whereas sporty and business individuals look for sport and luxurious cars respectively. Moreover, the buying pattern of the individual is affected due to economic downturns in the economy (Lamas Leite, et al., 2017). The change in customer preference and demands for energy efficient vehicle or eco-friendly automobiles have provided an opportunity for the automobile manufacturers in the UK for high market growth. However, the higher cost is associated with production and for research and development activities for automobile manufacturers to comply with quality aspects and safety standards and to meet the political and environmental regulations.

Technological: The technological innovation and advancement are one of the most crucial factors for the growth of automobile industry in the UK. Technology is greatly linked to reducing cost in the production of new designs, automation, supply chain management, eco-friendly vehicles, and energy vehicles for car manufacturers. The e-commerce opportunities for online retailers are contributing the growth of automobile industry in the UK (Song, Sun, & Jin, 2017). The technological advancements provided the automobile manufacturers such as Toyota, Volkswagen, BMW, etc. have discovered new ways of reducing green house gas emission, improving the battery efficiency, developing rechargeable batteries and different fuel systems for eco-friendly and energy vehicles in the UK.

Environmental: The automobile industry is one of the major environment polluter (specifically air pollution). The increase in public awareness regarding the environmental issue has put immense pressure on the UK car manufacturers to develop energy efficient and cars with low CO2 emissions (Kapogiannis, Gaterell, &Oulasoglou, 2015). The government as a commitment towards the environment have posed several regulations for the automobile industry to adhere to environmental policies. However, to address the environmental concerns and reduce the green house gas emission the UK car manufactures are transforming existing technology into energy vehicles.

Legal: The UK government is supporting the development of energy vehicles in compliance with quality and safety standards,gas emission laws, environmental regulations and labour laws. It is important for the automobile manufactures to meet the legal obligations to avoid high tax charge, environmental fines and to enhance the company image in the social system (Grünig, &Morschett, 2017).

The PESTLE analysis enables the firm to evaluate the automobile industry of the UK market which has supported to analyse the industry for both the firms.

In relation to the UK automobile industry, there is less threats of new entrants because it is troublesome for the new firms to enter in automobile industry. The new entrants need to spend more in production and R&D to manufacture the automobiles. Apart from this, they also need to follow rules and regulations and face legal formalities and complexities (Rawlinson & Wells, 2016). In addition, brand position of the existing firms such as like Ford, Toyota, Honda, etc. and economies of scale also create challenges and issues for the new entrants.

On the other hand, there is high bargaining power of suppliers because they supply specific parts of the vehicles and bargain for their products. They supply different parts like breaking system, cooling system, steel, electrical system, engine, fuel supply system, etc. The most of the suppliers are from China due to their cost effectiveness. However, the brands can bargain with suppliers and make better relationship with them (Law, 2017). In addition, there is moderate bargaining power in the UK automobile industry as car buyers have bargaining power but the firms also charge the special prices for customized features.

There is also moderate threat of substitutes as people start to buy the cars which consume less fuel when oil price increases. Apart from this, there is also an increasing trend of e-vehicles in the market as it is crucial for the firms to invest in technologies to make their vehicles more fuel efficient. There is high rivalry in the industry that causes high competition for Cambria and Pendragon (Maxcy, 2017). Several automobile firms from Germany and US are operating their business successfully in the UK market that provides their vehicles in different varieties, models, and prices with differences features (Bailey & De Propris, 2014).

Comparative Analysis of two companies

The SWOT model provides an analytical framework for the analysis of company strengths, weaknesses, opportunities and threats to determine the intrinsic and extrinsic factors and the critical issues are favourable and unfavourable for its existing and future business operations (Chen, Kim, & Yamaguchi, 2014).

The swot analysis of Cambria Automobiles plc is presented below:

| Strength | Weakness |

| · Experience and competent workforce

· Strong experience in capturing new car market · High goodwill in the market · Power of huge investment · Dealing with reputed firms · Skilled workforce · Barriers of market entry

|

· Changes in pricing policy made by manufacturer brand partners

· Low margins · Varying margin on the selling new vehicles (Yuan, 2013) · Less brand portfolio |

| Opportunity | Threat |

| · Increase on purchasing power customers

· High growth in emerging markets (Bull, et al., 2016) · Acquisitions · Increase the revenue and profits in after sales services · Increase in web-based presence · Opportunity of growing Economy · New products and services · growth rates and profitability · Increase in the trend of diversified markets

|

· Competition for online and offline retailers

· Volatility in the car markets (new and used) · Laws relating to gas emission and safety standards · the global economy downturn · Rise in interest rates · Development of new technologies and hybrid technologies |

The swot analysis of Pendragon plc is presented below:

| Strength | Weakness |

| · Good presence on domestic market with 218 retail points in UK and USA

· Strong online retailer (Hollensen, 2015) · High market growth rate with £4,537.0m revenue and £559.6m (+4.9% from previous year) gross profit in 2016 · Large assortment of used vehicles (good choices to customer base) · High growth rate · Domestic market |

· Less focus on future productivity

· Less advanced technology · Less competitive strategy · Future productivity

|

| Opportunity | Threat |

| · Growth of global economy

· Investment through venture capital · To seek acquisitions · High growth rate and profitability in global markets · High focus towards digital marketing · Opprtunity of growing economy and venture capital · Increase in the trend of global markets |

· Increase in competition can lead to lower productivity (Yuan, 2013)

· Government regulations of different countries · Economic downturns or recession · Rise in labor costs · Changes in external business factors can pose business risks (Bull, et al., 2016) |

This study has supported to understand the strengths, weaknesses, opportunities and threats of both the companies and has supported to do comparative analysis. From the above comparison it can be identified that there are few dissimilarities between both the firms however there are few similarities too. This SWOT analysis has assisted to give clear picture of both the firms.

This SWOT Analysis has supported to provide a comprehensive insight of both the firms which has supported towards analysing the firm on the basis of corporate strategy as well as business and financial structure (Chen, Kim, & Yamaguchi, 2014).

Current Dilemmas and Future Strategies

There are several dilemmas in current market of the UK automobile sector. There is high competition for the firms which are operating in the industry. The presence of competition is causing reduction in market share and decline in profits. For this, it is crucial for the firms to make future strategies by focusing on research and innovation to compete effectively. This strategy can be helpful for the firms to differentiate their products and get competitive advantage in the market. There is also volatility in the car markets. In addition, Pendragon is performing lower than Cambria as there is need to focus on current strategies to improve financial position, company needs to manage its inventory and improve cash position through proper credit and supplier policy that can be helpful for the firm to manage cash and strengthen the liquidity position (Rawlinson & Wells, 2016).

Focus on differentiation in products may be helpful to achieve high growth in the market to compete with other firms successfully. Apart from this, there is also a dilemma related to compliance with laws relating to gas emission and safety standards. It will be more crucial for the firms to comply with these laws and regulations to avoid legal issues and successfully operate the business in the domestic as well as international markets (Law, 2017). In addition, there is also impact of the global economy downturn and rise in interest rates on the production causing reduction in operational efficiency.

The firms need to identify the ways that could be helpful to reduce the operational costs and get competitive advantage in the market. Moreover, there is also a dilemma related to development of new technologies and hybrid technologies. It is because the customers also prefer e-vehicles due to rising environmental concerns (Maxcy, 2017). Therefore, it becomes also necessary for the firms to consider these technologies to develop such vehicles that could be helpful to reduce the carbon footprint and meet the current and future requirements of the customers.

From the above discussion, it can be concluded that investors should invest on Cambria because its financial performance is better compared to Pendragon’s. It is recommended on the basis of financial analysis of the both companies. In this, ratio analysis depicts that Cambria is looking well compared to Pendragon in liquidity, efficiency, debt management and profitability. Along with this, vertical and horizontal analysis also depicts that Cambria is also good in the context of various accounts. These all things suggest that investors should invest on Cambria, it will provides good return to them.

Achimugu, P., Selamat, A., Ibrahim, R., &Mahrin, M. N. R. (2014).A systematic literature review of software requirements prioritization research.Information and software technology, 56(6), 568-585.

Bailey, D., & De Propris, L. (2014). Manufacturing reshoring and its limits: the UK automotive case. Cambridge Journal of Regions, Economy and Society, 7(3), 379-395.

Bull, J. W., Jobstvogt, N., Böhnke-Henrichs, A., Mascarenhas, A., Sitas, N., Baulcomb, C., …& Carter-Silk, E. (2016). Strengths, weaknesses, opportunities and threats: A SWOT analysis of the ecosystem services framework. Ecosystem services, 17, 99-111.

Chen, W. M., Kim, H., & Yamaguchi, H. (2014). Renewable energy in eastern Asia: Renewable energy policy review and comparative SWOT analysis for promoting renewable energy in Japan, South Korea, and Taiwan. Energy Policy, 74, 319-329.

Cucchiella, F., & Rosa, P. (2015). End-of-Life of used photovoltaic modules: A financial analysis. Renewable and Sustainable Energy Reviews, 47, 552-561.

Cucchiella, F., D’Adamo, I., &Gastaldi, M. (2015).Financial analysis for investment and policy decisions in the renewable energy sector.Clean Technologies and Environmental Policy, 17(4), 887-904.

David, F. & David, F. R. (2016) Strategic Management: A Competitive Advantage Approach, Concepts and Cases.

Dranove, D., Besanko, D., Shanley, M., & Schaefer, M. (2015) Economics of Strategy. UK: Wiley Global Education.

Enz, A. C. (2009) Hospitality Strategic Management: Concept and Cases. New Jersey: Haboken.

Evans, N., Stonehouse, G. and Campbell, D. (2012) Strategic Management for Travel and Tourism. UK: Routledge.

Financial Times (2017). Cambridge Automobiles PLC. [Online] available at: https://markets.ft.com/data/equities/tearsheet/profile?s=CAMB:LSE (Accessed at: 10 June 2017).

Gigler, F., Kanodia, C., Sapra, H., &Venugopalan, R. (2014). How Frequent Financial Reporting Can Cause Managerial Short‐Termism: An Analysis of the Costs and Benefits of Increasing Reporting Frequency. Journal of Accounting Research, 52(2), 357-387.

Grant, R. M. (2016). Contemporary strategy analysis: Text and cases edition. John Wiley & Sons.

Grossmeier, J., Fabius, R., Flynn, J. P., Noeldner, S. P., Fabius, D., Goetzel, R. Z., & Anderson, D. R. (2016). Linking workplace health promotion best practices and organizational financial performance: tracking market performance of companies with highest scores on the HERO scorecard. Journal of occupational and environmental medicine, 58(1), 16-23.

Grünig, R., &Morschett, D. (2017).Determining the Target Markets.In Developing International Strategies (pp. 85-104).Springer Berlin Heidelberg.

Hollensen, S. (2015).Marketing management: A relationship approach. Pearson Education.

Hollensen, S. (2015).Marketing management: A relationship approach. Pearson Education.

Kapogiannis, G., Gaterell, M., &Oulasoglou, E. (2015).Identifying uncertainties toward sustainable projects.Procedia Engineering, 118, 1077-1085.

Kirklin, J. K., Naftel, D. C., Kormos, R. L., Stevenson, L. W., Pagani, F. D., Miller, M. A., … & Young, J. B. (2013). Fifth INTERMACS annual report: risk factor analysis from more than 6,000 mechanical circulatory support patients. The Journal of heart and lung transplantation, 32(2), 141-156.

Lamas Leite, J. G., de Brito Mello, L. C. B., Longo, O. C., & Cruz, E. P. (2017). Using Analytic Hierarchy Process to Optimize PESTEL Scenario Analysis Tool in Huge Construction Projects.In Applied Mechanics and Materials (Vol. 865, pp. 707-712).Trans Tech Publications.

Law, C. M. (2017). Restructuring the global automobile industry. Taylor & Francis.

Legoux, R., Leger, P. M., Robert, J., & Boyer, M. (2014). Confirmation biases in the financial analysis of IT investments. Journal of the Association for Information Systems, 15(1), 33.

Maxcy, G. (2017). The motor industry. Taylor & Francis.

Pendagron PLC. (2017). The UKs Leading Automotive Retailer. [Online] available at: http://www.pendragonplc.com/ (Accessed at: 10 June 2017).

Pierson, K., Hand, M. L., & Thompson, F. (2015). The Government Finance Database: A Common Resource for Quantitative Research in Public Financial Analysis. PloS one, 10(6), e0130119.

Rawlinson, M., & Wells, P. (2016). The new European automobile industry. Springer.

Sharma, A., &Mehra, A. (2016). Financial analysis based sectoral portfolio optimization under second order stochastic dominance. Annals of Operations Research, 1-27.

Shouman, E. R., El Shenawy, E. T., &Khattab, N. M. (2016). Market financial analysis and cost performance for photovoltaic technology through international and national perspective with case study for Egypt. Renewable and Sustainable Energy Reviews, 57, 540-549.

Siedlecki, R. (2014). Forecasting company financial distress using the gradient measurement of development and S-curve.Procedia Economics and Finance, 12, 597-606.

Song, J., Sun, Y., & Jin, L. (2017).PESTEL analysis of the development of the waste-to-energy incineration industry in China.Renewable and Sustainable Energy Reviews, 80, 276-289.

Uechi, L., Akutsu, T., Stanley, H. E., Marcus, A. J., &Kenett, D. Y. (2015).Sector dominance ratio analysis of financial markets.Physica A: Statistical Mechanics and its Applications, 421, 488-509.

Valickova, P., Havranek, T., & Horvath, R. (2015). Financial Development and Economic Growth: A Meta‐Analysis. Journal of Economic Surveys, 29(3), 506-526.

Weygandt, J. J., Kimmel, P. D., &Kieso, D. E. (2015).Financial & Managerial Accounting.John Wiley & Sons.

Yuan, H. (2013). A SWOT analysis of successful construction waste management.Journal of Cleaner Production, 39, 1-8.

.