Business Expansion For UK Manufacturing Organisation In Mainland Europe In June 2022:The case of Aggregated Telecom, UK

Introduction

Agmet Ltd has been operating in the UK market as a chemical products manufacturer. The company is headquartered in Birmingham. The journey of Agmet was started in 1980 as the company initiated trading on the British market. The organisation is listed as voluntary liquidation with their main line of business activity reflecting manufacturing of chemical products. In accordance with the latest financial standings of the organisation, it was notified that the company generated a turnover of £ 16 million during 2018 (Global Database, 2021). At the same time, Agmet was able to ensure a gross profit of £ 5 million (Global Database, 2021).

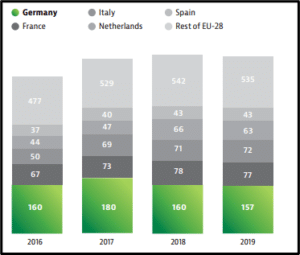

Germany has been selected as the host country for the organisation. For expanding business, Germany is suitable for Agmet as it has significant spending power and a very innovative climate with highly skilled workers. Germany has seen a huge growth in the chemical manufacturing sector with attractive market statistics. In 2019, the revenue of the chemical manufacturing industry of Germany amounted to 157 billion Euros. Thus, this assignment will lead to reasons for expansion with significant factors, which will help in the business growth. Additionally, the study will provide a beneficial mode of entry and set of recommendations for the organisation.

Reason for expansion

The chemical manufacturing industry of Germany is contributing to the economic growth of the country, as the country is the fourth largest player after the United States, Japan and China with high productivity rate. The workforce of the country is very innovative and excellent. Moreover, if Agmet Limited expands their business in Germany this will benefit their organisation with huge profits and brand value. Expanding the business internationally will help the organisation in their business growth and success of the firm (He et al. 2019). This will lead to the economic sustainability of the organisation with advancement of the chemical manufacturing sector. Business expansion will help in learning creative and innovation in the business market. In addition, majorly it will flourish the brand value to another level. Taking business to the global market not only helps the business and organisation but it also makes the employees more intellectual with a clear vision of goal to achieve.

Factors

Business growth

Distinctive opportunities of business growth can be assumed for Agmet in case of expanding into the German market. While serving as a chemical manufacturer, Agmet might obtain inclusive access to the German chemical manufacturing industry. A highly skilled workforce can be notified across the German chemical manufacturing sector. This skilled workforce defines distinctive opportunities for ensuring business growth from the perspective of Agmet where the skills and knowledge level of employees might be helpful for the company. Moreover, the company could also achieve distinctive local market knowledge by referring to this skilled workforce from the chemical sector, which can drive the organization’s business growth furthermore.

The German chemical industry accounted for 27 % of the entire chemical industrial revenue generated across the European region (Gtai, 2021). Moreover, the distinctive growth rate of average chemical industrial revenue can also be notified across the German market. The period between 1960 to 2020 has experienced 4.8 % average chemical revenue growth in Germany (Gtai, 2021). Attractive opportunities of research and development can also be certified for the German chemical market. During 2019, 4.4 billion Euro was invested by the German chemical manufacturers for research and development purposes excluding pharmaceuticals (Gtai, 2021). Concerning the aforementioned statistics, distinctive opportunities of business growth can be certified for Agmet with regards to the increasing market growth.

Figure 1: Chemical industry revenue in Europe

(Source: Gtai, 2021)

Germany is also notified to undertake the fourth leading spot across the globe in chemical manufacturing. Moreover, the German chemical industry is also accounted as the leading industry across Europe. In this concern, the above-mentioned figure demonstrates distinctive growth of the German chemical market, which has successfully passed other countries’ chemical industry revenue. With this attractive market consumption volume, Agmet might be able to enhance their business growth. Moreover, the German market also accounts for more than one fourth of the entire European chemical market revenu, which has recognised the industry as the largest across the continent (Gtai, 2021). With this distinctive industrial reputation, Agmet might be able to seek the chances of achieving attractive business growth while expanding their services in Germany.

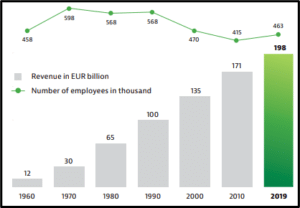

Agmet is a chemical manufacturer. In this regard, the German chemical sector growth can also be largely grabbed by the company with successful business expansion. Increasing growth can be suspected from the perspective of the German chemical manufacturing market with a rising proportion of employee development. For instance, it was notified that the number of employees internet serving across German chemical sector had been 463,000 during 2019, which also came up from 415,000 during 2010 (Gtai, 2021). With increasing preference of chemical services, Agmet might also look forward to enhancing their business growth under the shape of considering business expansion in the German market.

As a result of these, distinctive opportunities of enlarging business feasibility can be suspected from the perspective of Agmet where the wider German chemical market might be associated with the products and offerings of the company. Apparently, the German chemical market is already notified to include a range of competitors such as Bayer AG, Henkel AG and others (Research Germany, 2021). With increasing possibility of obtaining business growth, Aggregated Telecom might be able to achieve competitive advantage by competing with the existing market rivals in Germany.

Economic sustainability

The German telecommunication industry has been observed to operate with distinctive financial sustainability and feasibility, which discloses the industrial effectiveness of maintaining further growth. For example, the context of the growth in chemical industry revenue can be undertaken into the discussion.

Figure 2: Chemical industry revenue in Germany from 1960 to 2019

(Source: Gtai, 2021)

The German chemical manufacturing sector was able to maintain distinctive stability in its revenue generation across the last two decades. Despite having gradual fluctuation in revenue generation, the above-mentioned figure illustrates financial stability and growth of the industry. It has been noticed that the German chemical sector generated 171 billion Euro revenue during 2010 that grew up to a fair extent (Gtai, 2021). Despite having the unfavourable consequences of ongoing covid-19 pandemic, the German chemical sector was also able to obtain 208.4 billion Euros in revenue during 2020 (Statista, 2021). This attribute might motivate Agmet to suspect the industrial accountability in front of the wider German chemical market. Based on this factor, the company might think about business expansion in Germany.

Apart from that, the products and offerings of Agmet have also disclosed increasing preferences towards innovation and advancement. In this aspect, the German chemical sector has been observed to experience attractive growth over the chemical exporting services. During 2019, the German chemical industry was notified to obtain an export value of 118 billion Euro (Germany Works, 2021). Despite having the toxic impact of the ongoing coronavirus outbreak, the countrywide chemical manufacturing services were able to maintain decent market volume.

On the other hand, Germany has witnessed decent growth in market share achievement. During 2019, the German chemical industry was able to obtain a global market share of 9.1 % (Germany Works, 2021). In this concern, the service infrastructure of Agmet discloses efficient compatibility with the German chemical market, which might drive the company towards its business expansion in Germany. Apparent consequences can also be observed through the German mobile market. During 2019, Germany accounted for the second largest global exporter of chemical products (Germany Works, 2021). These attractive financial standings define enormous opportunities for ensuring economic sustainability from the perspective of Aggregated Telecom by mitigating the market demand in Germany.

On the contrary, the German chemical manufacturing market is also expected to witness strong growth over the upcoming future. In this concern, rising export statistics can be noticed across the country, which has been adding a greater value to enhance the credibility of the chemical manufacturing market.

The above-mentioned evaluation disclosed distinctive opportunities for Agmet concerning the maintenance of economic sustainability by mitigating the market requirements and industrial demands in Germany. From this standpoint, the aspects of industrial economic sustainability and increasing users can be suspected as a direct influential factor behind the decision of business expansion for Agmet in Germany.

Technological advancement

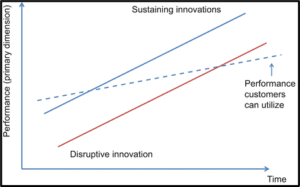

Figure 3: Disruptive innovation theory

(Source: Christensen et al. 2018)

Enormous technological advancement can be noticed in the German telecommunication market. In this aspect, greater preference for the disruptive innovation theory can be considered. The theory defines to offer better products and services with an intention to defend the business of the incumbents as compared with the existing market rivals (Reinhardt and Gurtner, 2018). This attribute might be encouraging for Agmet to enlarge their service accountability concerning the association of innovative and advanced technologies while expanding their services across Germany.

It was noticed that research and innovation is largely emphasized across the German chemical market as an integral part of ensuring constant innovation. In accordance with the world economic forum, it can be stated that Germany has undertaken the fifth spot as the best regions for innovation followed by Switzerland, USA, Japan, Finland and Israel (Koester, 2015). The innovation capability of Germany is largely dependent upon the obtaining of most modern chemical and process engineering technologies. The combination of high quality research institutions and close cooperation between science and industry has been playing a beneficial role to enlarge the chemical manufacturing industrial value chain attributes. For instance, the context of investment for research and development purposes can be considered in Germany which has been increasing in a drastic manner. As per the foreign direct investment report 2019 of Germany trade and invest, the foreign companies have preferred large investments with 18% in information and communication technology and software (Centurion Lgplus, 2021). The capital of Germany, Berlin has been developed as a leading European centre of technological innovation with a rapidly growing startup culture. Distinctive support would be provided by the regulatory authorities in Germany with an intention to enlarge the chemical manufacturing industrial market dynamics, which might play a major role in terms of success in adopting business growth.

On the other hand, Germany has also paid attention to empowering technological advancement as an integral part of obtaining future growth. For example, the forecast made by the international consultancy firm Deloitte can be considered, which expects that the German technology sector turnover might increase by 20% by 2022 (Centurion Lgplus, 2021). This is also equivalent to the increment of 280 billion Euros. Increasing preferences of artificial intelligence and analytics, industry 4.0 technologies and internet of things, big data applications and others are playing a leading role to enlarge the technological advancement through the German manufacturing industry. Rapid consideration of digitalisation in Germany is also supportive of this concern. A close and direct association can be certified from the German technology sector with the mechanical engineering and other industries. Due to this concern, the chemical manufacturing organisations operating across Germany might be immensely beneficial in terms of achieving distinctive technological advancement with the rapid technological growth throughout the country. With a start-up rate of around 6.2 % during 2019, the German technology industry is expected to achieve distinctive future growth, which is also a support team for the chemical manufacturing operations (Centurion Lgplus, 2021).

With the growing industrial demand and rising digitisation, the chemical manufacturing market of Germany is also expecting to approach innovative solutions for mitigating industrial demands. In this aspect, Agmet might be succinctly encouraged to expand in Germany concerning enormous technological advancement and thereby ensuring business profitability.

Brand recognition

The German chemical manufacturing sector is notified to achieve distinctive customer retention and loyalty by providing innovative technological advanced services. Moreover, increasing usage of advanced technologies are playing a leading role to define the unique value proposition of the industry. From this standpoint, the German chemical manufacturing market can be expected to ensure distinctive brand awareness with the inclusion of industry 4.0 technologies, big data and others.

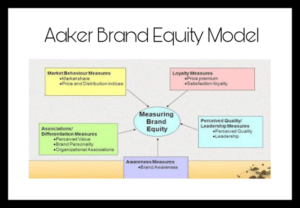

This attribute might emerge as an indirect influential factor behind encouraging Agmet to expand their services in Germany. Serving as an SME in the UK, Agmet has been looking forward to outline attractive brand image for ensuring increasing customer attraction and profitability. In this regard, the brand equity model of Aaker can be considered, which identifies relational components of brand equity such as brand loyalty, brand awareness, perceived quality, brand association and relational proprietary assets (Vasileva and Vasileva, 2017).

Figure 4: Aaker’s brand equity model

(Source: Vasileva and Vasileva, 2017)

From the perspective of Agmet, brand loyalty could be ensured by adopting innovative technological advancement like artificial intelligence and others existing across the German technology market (Centurion Lgplus, 2021).

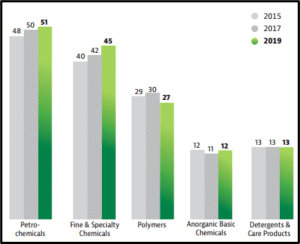

Figure 5: Germany chemical industry market segmentation by revenues

(Source: Gati, 2021)

The above-mentioned figure illustrates the chemical industrial market segmentation in Germany in the form of generating revenues. In this aspect, Agmet can pay attention to serve across one of the mentioned chemical industries such as petrochemicals, polymers and inorganic basic chemicals, fine and speciality chemicals and others (Gtai, 2021).

This diverse service portfolio might also encourage the organisation to consider business expansion in Germany concerning the brand image of the German Telecom industry. This attribute can also provide an attractive brand image to the company with increasing profit.

Recommended mode of entry

The market entry strategies are very important to prosper in the host market (Adeola and Boso, 2018). For Agmet, the below mentioned market entry strategies will work for the business expansion.

Joint Venture: In a new market where the business has to be expanded, creating partnership with other host companies is one of the preferable market strategies. By creating an alliance, the company can get hold of the mastery of its partner’s local knowledge, infrastructure and reputation, which can help in the rapid expansion of the business (Killing, 2017). Creating a partnership with the top chemical manufacturing companies can help the organisation to move forward in the business. Having a backup in an unknown country is much more helpful than doing it alone (Pedada et al. 2021). Partnership helps in developing the brand image among the customers and creating new ones for the organisation.

Licensing: Licensing refers to the legal rights, which are given to the organisation. In Licensing, there are two companies involved, one is the licensor, and the other one is the licensee who wants to expand business in another country (Cabaleiro-Cerviño and Burcharth, 2020). The licensor company gives rights to the licensee by granting the use of their intellectual property for a time being. Under licensing, the company can sell products under the brand name of the licensor. For Agmet, this market entry strategy will work more than Joint venture because licensing is more quick and simpler. In Joint Venture there might be a question that arises whether the other companies will agree on the partnership or not, whereas in Licensing there is no such thing, just an amount to be paid for the grants, which are accessible to the licensee company (Chen, 2017). It helps the company to do business without any risk and requires very less capital. Licensing can help the organisation to succeed over the tariff barriers and borders for expansion.

However, the consideration of improving brand image can be successfully ensured by the organisation through licensing mode of entry. It can also enlarge the organisational resources availability as an integral part of maintaining service flexibility in Germany.

Conclusion and recommendation

Based on the overall study, it is evident that expansion of Agmet Limited will be beneficial if they set up their business in Germany. There is a colossal business growth in the chemical manufacturing sector as the country has been experiencing rapid growth of the industry throughout the last decades. The German chemical market is improving day after day. The economic sustainability of the country is to effectively maintain its growth with the help of various industries and one such industry is chemical manufacturing. In the German market, there is a huge advancement of technological innovation. Big data, industry 4.0 technologies are adopted by the country as an integral part of ensuring other industrial growth. Hence, the expansion of Agmet Limited in Germany will flourish their business with advancement of technology and self-sustainability in the global market.

For ensuring successful business growth with consistent profit of Agmet Limited in Germany, some set of recommendation is provided below:

- Agmet Limited needs to develop their technological creativity according to the German market demands

- The organisation should have a clear vision of the goal to achieve in the host country to maintain its position in the market

- The organisation has to develop their management program for ensuring all the objectives are meeting their requirements

- The organisation has to change their strategy to retain in the global market as long as possible without any loss

References

Adeola, O., Boso, N. and Adeniji, J., 2018. Bridging institutional distance: an emerging market entry strategy for multinational enterprises. In Emerging Issues in Global Marketing (pp. 205-230). Springer, Cham.

Cabaleiro-Cerviño, G. and Burcharth, A., 2020. Licensing agreements as signals of innovation: When do they impact market value?. Technovation, 98, p.102175.

Centurion Lgplus, 2021. Investing in Germany – The Technology Sector at a Glance. [Online]. Available at: <https://centurionlgplus.com/investing-technology-sector-germany/ [Accessed 19 July 2021]

Chen, C.S., 2017. Endogenous market structure and technology licensing. The Japanese Economic Review, 68(1), pp.115-130.

Christensen, C.M., McDonald, R., Altman, E.J. and Palmer, J.E., 2018. Disruptive innovation: An intellectual history and directions for future research. Journal of Management Studies, 55(7), pp.1043-1078.

Ekinci, Y., 2018, June. A model of consumer based brand equity for holiday destinations. In 8th advances in hospitality and tourism marketing and management (AHTMM) conference (p. 830).

Germany Works, 2021. Leading the industry in Europe and beyond. [Online]. Available at: <https://germanyworks.com/branch/chemical-industry/#opportunities> [Accessed 19 July 2021]

Global Database, 2021. AGMET LIMITED VOLUNTARY LIQUIDATION. [Online]. Available at: <https://uk.globaldatabase.com/company/agmet-limited [Accessed 19 July 2021]

Gtai, 2021. The chemical industry in Germany. [Online. Available at: <https://www.gtai.de/resource/blob/64542/121894962e5bfeb883a79d3ec6ae44d7/industry-overview-chemical-industry-in-germany-en-data.pdf> [Accessed 19 July 2021]

He, G., Marginson, D. and Dai, X., 2019. Do voluntary disclosures of product and business expansion plans impact analyst coverage and forecasts?. Accounting and Business Research, 49(7), pp.785-817.

Killing, J.P., 2017. How to make a global joint venture work. In International Business (pp. 321-328). Routledge.

Koester, V., 2015. German Process Industry and Innovation. [Online]. Available at: <https://www.chemistryviews.org/details/ezine/8060351/German_Process_Industry_and_Innovation.html> [Accessed 19 July 2021]

Pedada, K., Padigar, M., Sinha, A. and Dass, M., 2021. Developed market partner’s relative control and the termination likelihood of an international joint venture in an emerging market. Journal of Business Research, 135, pp.295-303.

Reinhardt, R. and Gurtner, S., 2018. The overlooked role of embeddedness in disruptive innovation theory. Technological Forecasting and Social Change, 132, pp.268-283.

Research Germany, 2021. Top 600 Chemistry Companies Germany – List of the Largest Chemical Companies. [Online]. Available at: <https://www.researchgermany.com/product/top-chemistry-companies-germany-list-of-the-largest-chemical-companies/> [Accessed 19 July 2021]

Statista, 2021. Manufacturing: Chemicals in Germany 2020. [Online]. Available at: <https://www.statista.com/study/46570/manufacturing-chemicals-in-germany/#:~:text=The%20high%20export%20quota%20makes,industry%20is%20%E2%82%AC208.4%20billion.> [Accessed 19 July 2021]

Vasileva, I.V. and Vasileva, T.N., 2017. Brand equity management on the example of the Aaker model. Modern Science, (5-1), pp.102-107.

Know more about UniqueSubmission’s other writing services: