Corporate & Financial Accounting

The key objective of this report is to develop the understanding in concern of corporate and financial accounting framework that is essential for the Australian corporate to follow it. In the present time, the effective financial framework is the requirement of the Australian corporation to manage the information of the company.

In addition, this report study also discusses the regulations related to financial accounting as well as reporting. In this way, Australian Accounting Standard Broad (AASB) also contributes within the global accounting standards-setting process that is determined in this report study.

Furthermore, in this report, four public limited companies that listed in ASX, are selected for completion of this report study in concern of owner’s equity. This report also focuses on the changes within each equity items of selected firms over the past four years. At the same time, a comparative analysis of debt and equity position of the selected companies is also done in this.

In concern of corporate regulations, the financial accounting is a broad area that includes the summary, analysis, and reporting of the financial accounting within the organization.

For this, the accounting books are maintained by the organizations in respect to preparing the financial statements for organizational employees, its suppliers, investors, shareholders, banks and government agencies also.

In this way, the company’s stakeholders use the financial information to make important decisions as well as strategies related to finance and non-finance areas.

In support to this, Leuz and Wysocki (2016) mention that the corporate regulations in financial accounting are essential as it provides the reliable direction, governing laws, and control with approved regulations over the accounting in the corporation.

The organizational financial statements cover the huge amount of accounting information that is significant for its stakeholders. In addition, a financial report records the cash flows, liabilities, assets, and equity of the owners. This is important to analyze each account that is connected with the organization.

On this basis, it can be mentioned that corporation regulations must be regulated by the financial statements as well as reports of organizations. There is also a need of the financial manager to release the information related to financial statements of the business in order to help the shareholders to make important decisions related to their investment as well as business growth.

At the same time, Dehaan et al., (2013) depict that the financial information of the company should not be disclosed through any person individually within the public because disclosed information can create the several issues for the business.

But the finance manager of the company has the right to disclose the information on the requirement of the stakeholders within the organization as well as outside the organization.

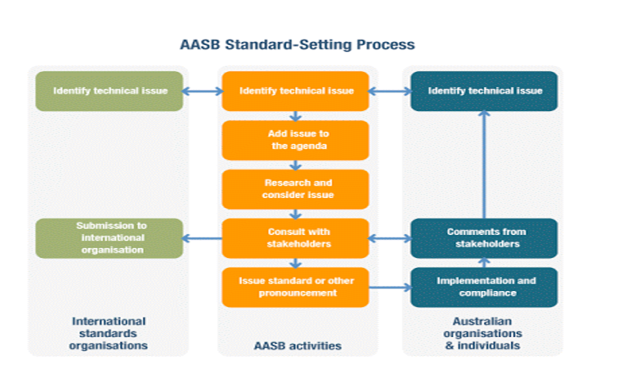

On the basis of Zeff (2012) research study, the Australian Accounting Standard Board is beneficial for the process of global accounting standard-setting because of effective collaboration with IASB (International Accounting Standards Board).

Accordingly, AASB develops the strategic directives and oversight of FRC first, after that identifies and analyzes the technical issues. Moreover, AASB is defined as the government agency which initiates in the contribution towards build up a single set of standards related to accounting in order to adopt internationally under the ASIC (Australian Securities and Investments Commission Act 2001).

In this way, AASB also helps to analyze and consider the issues and it also contributes to the research of IASB. In this regards, the standard-setting process is defined below in concern of taking part in global accounting

(Source at: http://aasbprocess.blogspot.com/2013/12/understand-accounting-standard-setting.html)

After reviewing the standard-setting process, it is determined that the FRC strategic directives & oversights are needed by the AASB for its policies and practices. As per this process, it is considered it defines that how the issues are identified and how to resolve them within the limited time period.

With the help of this process, it is easy to ensure that essential changes to IFRS may be implemented expeditiously. In this way, it is essential to communicate these changes to the Australian constitution (Zeff, 2012).

In support of this, IFRS is set by IASB in order to offer the global accounting standards. At the same time, some countries of IASB are identified which are involved in research of new standards for accounting as well as reform the existing standards (Chua et al., 2012).

In this way, the member countries of IASB adopt the effective standards which are appropriate for finding the specific outcomes. Due to this, the member countries of IASB need not follow the IFRS. Thus, the main objective of developing the global accounting standards is to organize the same business practices within the businesses as well as counties.

These standards are essential because they contain the variety of principles and regulations in respect to record the financial transactions which are important and valuable for the company or business.

Discussion about the changes in each item of equity for the firms over the past four years

In relation to owners equity, Jefferson et al. (2017) state that generally, a firm includes several items associated with equity in its financial statements. These items are share capital, retained earnings, reserves and non-controlling interest etc.

In this way, the equity of the owners which includes preference shares as well as equity shares, are reflected through the ordinary shares. In addition, the reserves are also included in owners’ equity that is considered as the surplus amount after settling all the income as well as expenses in the financial statements.

In owners’ equity, the retained earnings are also known as retained profit that represents the corporate income or profit which remains within the company after distributing the dividend to its shareholders (Ajide and Aderemi, 2014). At the same time, the proportion of subsidiary firms’ stock is considered as non-controlling interest because it is not owned through the parent company.

In concern of changes in owners equity, the banking and finance industry is chosen in this report. These four selected banks and financial companies that are also used for comparative analysis are as given below:

- ASX Limited

- AMP Limited

- Commonwealth Bank of Australia

- Bank of Queensland Limited

ASX Limited

In this way, the changes in each item of the equity for the ASX Limited over the past four years are as follows:

| 2017 | 2016 | 2015 | 2014 | 2013 | |||

| Owner’s Equity | |||||||

| Ordinary share capital | 3,027 | 3,027 | 3,027 | 3,027 | 2,746 | ||

| Reserves | 259 | 220 | 206 | 162.8 | 148 | ||

| Retained profits | 622 | 577 | 526.3 | 480.9 | 428 | ||

| Total Shareholders’ Equity | 3,908 | 3,824 | 3,760 | 3,671 | 3,322 | ||

| % Change | 2.20% | 1.70% | 2.42% | 10.51% | |||

On the basis of the above table, it is identified that the company’s equity was 10.51% in 2014 whereas it declined in next year as 2.42% in 2015. In a similar manner, the equity of the owners was 1.70% in 2016 as well as 2.20% in 2017. This defines that there was no major change in owner equity last three years (ASX Limited. 2018).

AMP Limited

| 2017 | 2016 | 2015 | 2014 | 2013 | |

| Owner’s Equity | |||||

| Contributed equity | 9,376 | 9,619 | 9,566 | 9,508 | 9602 |

| Reserves | -2,010 | -1,972 | -1,866 | -1,888 | -1973 |

| Retained profits | -164 | -185 | 819 | 566 | 461 |

| Total Shareholders’ Equity | 7,202 | 7,462 | 8,519 | 8,186 | 8090 |

| Non-controlling interests | 81 | 79 | 376 | 199 | 110 |

| Total equity of shareholders of AMP Limited and non-controlling interests | 7,283 | 7,541 | 8,895 | 8,385 | 8200 |

| % change | -3.42% | -15.22% | 6.08% | 2.26% | 0.00% |

In the case of AMP limited, from the above data, it is mentioned that owners equity was 2.26% in 2014. At the same time, the owner’s equity in 2015 was 6.08% that was increased in comparison to 2014 (AMP Limited. 2018).

In addition, it also increased as it was 15.22% in 2016 whereas the owner’s equity declined in 2017 by -3.42%. This was a major change in owners equity (AMP Limited. 2018).

Commonwealth Bank of Australia

| 2017 | 2016 | 2015 | 2014 | 2013 | |

| Owner’s Equity | |||||

| Ordinary share capital | 34,971 | 33,845 | 27,619 | 27,036 | 26,323 |

| Other equity instruments | 0 | 939 | 939 | 939 | |

| Reserves | 1869 | 2,734 | 2345 | 2009 | 1,333 |

| Retained profits | 26330 | 23,435 | 21340 | 18827 | 16,405 |

| Non-controlling interests | 546 | 550 | 562 | 537 | 537 |

| Total Shareholders’ Equity | 63716 | 60,564 | 52805 | 49348 | 45537 |

| % Change | 5% | 15% | 7% | 8% |

After analyzing CBA’s data in above table, it can be defined that the owner’s equity of commonwealth bank had been increasing from 2014 to 2016 as it was 8% in 2014 while is declined with by 1% only as it was 7% in 2015.

After this, the major change was measured in 2016 as its owner’s equity was 15% that means it increased by 8%. Apart from this, owners equity declined by 10% as it was 5% in 2017 that is considered a major change in equity (Commonwealth Bank of Australia 2018).

Bank of Queensland Limited

| 2017 | 2016 | 2015 | 2014 | 2013 | |

| Owner’s Equity | |||||

| Ordinary share capital | 3,360 | 3,243 | 3,122 | 3,021 | 2,563 |

| Reserves | 57 | 33 | 90 | 114 | 111 |

| Retained profits | 371 | 311 | 257 | 206 | 144 |

| Total Shareholders’ Equity | 3,788 | 3,587 | 3,469 | 3,341 | 2,818 |

| % Change | 6% | 3% | 4% | 19% |

Above the table with the data of Queensland bank represents that its owner’s equity was highest in 2014 as it was 19% but after this, it rapidly changed with a major difference. In this way, the owner’s equity was 4% in 2015 but at the same time, it declined by 1% as it was 3% in 2016 (Bank of Queensland Limited. 2018). In oppose to this, some increment was noticed in 2017 as it was 6% in 2017 that means it creased by 3%.

A comparative analysis of the debt and equity position of the four firms

The below table presents a comparative analysis of the selected four listed companies in the Australian securities exchange in terms of the debt and equity position and respective share in percent computed from the data collected for the year 2017.

| Company | Debt $M | Equity | Ratio | Total capital | % of the debt | % of the equity |

| Bank of Queensland | 47,870 | 3,788 | 12.64 | 51,658 | 92.7% | 7.3% |

| Commonwealth Bank of Australia | 912658 | 63716 | 14.32 | 9,76,374 | 93.5% | 6.5% |

| ASX Limited | 4.1 | 86 | 0.05 | 90 | 4.6% | 95.4% |

| AMP Limited | 1,40,802 | 7,283 | 19.33 | 1,48,085 | 95.1% | 4.9% |

It can be compared that the ASX limited has the highest percentage of equity over other companies which has a lower percent share of equity. It is also analyzed that the equity has high value than debt in ASX limited.

This is not the case with other companies which highlights that they are based on debt. It can be observed that for Bank of Queensland, the debt at the end of the reporting period in 2017 is accounted for $47,870m while the equity is $3788, therefore, the share of equity percent is low and debt percent is higher.

Similar is the case for Commonwealth Bank of Australia and AMP Limited where the debt value is higher than the equity which increases the percent of debt share.

It is also analyzed that due to the higher value of debt against equity the ratio value is more for Commonwealth Bank of Australia, Bank of Queensland and AMP Limited. Also, the ratio value is less for ASX Limited as debt has lower value against the equity in the year 2017. Thus, a lower percent of the debt for ASX limited that means the company has a strong equity position in the year 2017.

It can be summed up that the owner equity includes capital balance in the beginning and capital balance in ending of a reporting period, profit, total comprehensive income and dividends paid were analyzed for a period of four years for public listed companies in Australian securities exchange.

The comparative analysis of debt and equity position highlighted that out of four companies, only ASX limited has a sturdy equity position while others are based on debt.

Ajide, F.M. and Aderemi, A.A., 2014. The effects of corporate social responsibility activity disclosure on corporate profitability: Empirical evidence from Nigerian commercial banks. IOSR Journal of Economics and Finance (IOSRJEF), 2(6), pp.17-25.

AMP Limited. 2018. 2015 Annual Report. [Online] available at: https://shareholder.anz.com/sites/default/files/2015_annual_report.pdf (Accessed on: 26 Sep, 2018).

AMP Limited. 2018. 2017 Annual Report. [Online] available at: https://corporate.amp.com.au/content/dam/corporate/shareholdercentre/files/reports/2018/Investor_and_annual_reports/2017_annual_report_20_march_2018.pdf (Accessed on: 26 Sep, 2018).

ASX Limited. 2018. Annual Report 2017. [Online] Available at: https://www.asx.com.au/documents/investor-relations/AnnualReport2017.pdf. (Accesses: 26 Sep, 2018)

Bank of Queensland Limited. 2018. 2015 Annual Report. [Online] available at: https://www.boq.com.au/content/dam/boq/files/reports/annual-report/annual-report-2015.pdf (Accessed on: 26 Sep, 2018).

Bank of Queensland Limited. 2018. 2017 Annual Report. [Online] available at: https://www.boq.com.au/content/dam/boq/files/reports/annual-report/annual-report-2017.pdf (Accessed on: 26 Sep, 2018).

Chua, Y.L., Cheong, C.S. and Gould, G., 2012. The impact of mandatory IFRS adoption on accounting quality: Evidence from Australia. Journal of International accounting research, 11(1), pp.119-146.

Commonwealth Bank of Australia 2018. 2016 Annual Report. [Online] available at: https://www.commbank.com.au/content/dam/commbank/about-us/shareholders/pdfs/annual-reports/2016_Annual_Report_to_Shareholders_15_August_2016.pdf (Accessed on: 26 Sep, 2018).

Dehaan, E., Hodge, F. and Shevlin, T., 2013. Does voluntary adoption of a clawback provision improve financial reporting quality?. Contemporary Accounting Research, 30(3), pp.1027-1062.

Jefferson, T., Austen, S., Ong, R., Haffner, M.E. and Wood, G.A., 2017. Housing equity withdrawal: Perceptions of obstacles among older Australian home owners and associated service providers. Journal of Social Policy, 46(3), pp.623-642.

Leuz, C. and Wysocki, P.D., 2016. The economics of disclosure and financial reporting regulation: Evidence and suggestions for future research. Journal of Accounting Research, 54(2), pp.525-622.

Zeff, S.A., 2012. The Evolution of the IASC into the IASB, and the Challenges it Faces. The accounting review, 87(3), pp.807-837.