Dissertation or Applied Business Project Assignment Sample

RESEARCH PROPOSAL ON THE IMPACT OF BREXIT ON THE FOREIGN INVESTMENT IN UK

1. Introduction

1.1 Research Background

Amendment of Brexit by British Government in January 2020 had created a financial and operational impact on domestic and international trading and commercial activities of United Kingdom. Fluctuations observed in excise duties and foreign investment activities, had obstructed industrial sectors in UK to acquire higher profit margins across domestic or international markets (Driffield & Karolos 2019). Commercial disparity occurring between European Union (EU) and UK had negatively impacted major financial operations involving “Foreign Direct Investments”, thereby resulting in an economic downfall during Brexit. The concept of FDI can be stated as investments conducted by foreign countries for developing new subsidiary organizations, acquiring local organizations or expanding operations of existing organizations (Driffield &Karoglou, 2019). Incorporation of Brexit in 2020 was considered to be a major economic and geo-political hindrance in reducing FDI rates.

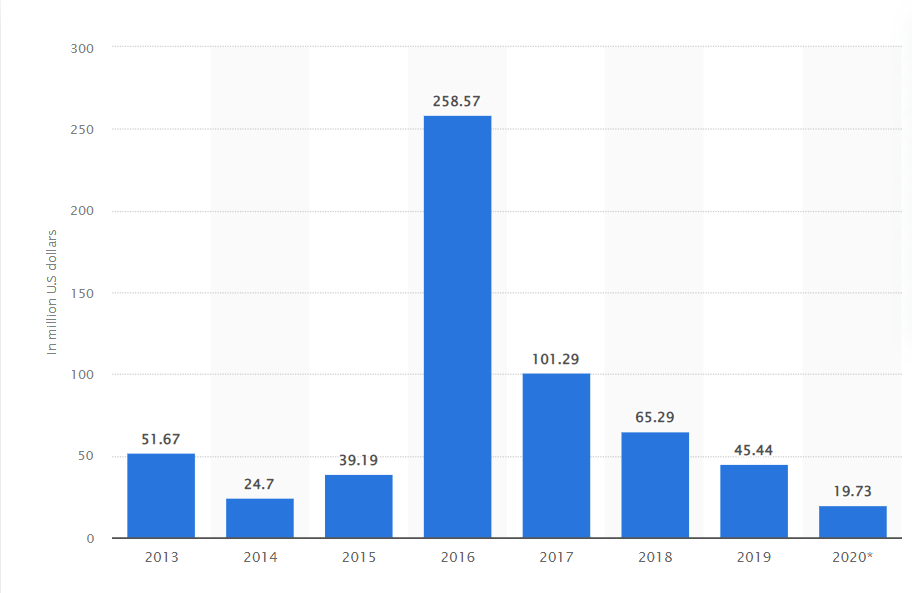

Figure 1: FDI Inward flows in UK from 2013 to 2020

(Source: STATISTA, 2021)

A statistical analysis of total Foreign Direct Investment (FDI) flows within UK economy was conducted by evaluating data from 2013 to 2020. Commemorative ratio analysis had identified that FDI inflow in UK stood at $258.57 million, which had gradually declined to $19.73 million in 2020 (STATISTA, 2021). It was analysed that amendment of Brexit in 2020 had resulted in creation of a single market economy, excluding major foreign direct investors such as Germany, France and Italy. The context of economic decline observed in UK due to Brexit, will be analysed in this study, primarily highlighting impact of chosen political decisions on FDI inflows.

1.2 Problem Statement

Legal amendment of Brexit in 2020 was considered as a major political decision undertaken by UK government, creating disparities in trading relations with other EU nations. As per the views of Noja et al. (2021), more than 50% of UK’s FDI are contributed by European nations involving France, Italy, Germany and Switzerland, followed by 55% of private sector organisations dominated by EU multinational organisations. It was analysed that incorporation of Brexit had enhanced commercial feuds between EU nations and UK, thereby reducing inward flows of FDI previously conducted for existing multinational companies. Noja et al. (2021) explained that an enhancement of excise duties by 5.6% from 2018 to 2029 had simultaneously caused a decline of total FDI by 22% in first quarter of 2021, thereby reducing £2200 per household. An explanation can be derived from this analysis that reduction of FDI rates had created a negative impact on corporate businesses and multinational commercial units functioning in domestic market of UK.

1.3 Research Rationale

Evaluation of Brexit and its impact of British FDI system will provide assistance in analysing economic influence of a major political decision in modern day scenario. This study holds significance in understanding concept of Brexit and involvement with EU membership, which would assist in interlinking FDI with national income ratios. Analysis of FDI strategies by UK government and future trade agreements involved in mitigating economic disparity, will assist in interconnecting economic phenomena with social, political and corporate aspects.

2. Outline of the Research Project

2.1 Aim

The following dissertation study is aimed at understanding the impact rendered by Brexit on foreign investment in United Kingdom (UK).

2.2 Objectives

- To assess the individual concept of Brexit for UK and the European Union (EU).

- To examine the effect of EU membership on foreign investment in UK.

- To analyse the impact generated by changes in foreign direct investment (FDI) on incomes of UK.

- To identify the foreign investment strategies that are adopted by UK government as a response to Brexit.

- To investigate future trade agreements maintained in UK as a response to Brexit.

- To bring about feasible recommendations for foreign investment in UK for mitigating Brexit-based challenges.

2.3 Questions

- What is the individual concept of Brexit for UK and the European Union (EU)?

- What are the foreign investment strategies that are adopted by UK government as a response to Brexit?

First Research question as presented in the above section direct towards understanding concept of Brexit in respect to UK and EU. Second research question determines in understanding how UK government had adopted foreign investment strategies as a response to Brexit. The above two questions were proposed in this study, in terms of understanding how Brexit had generated a positive or negative impact of British foreign investment decisions.

3. Key Literature Review

3.1 Concept of Brexit

Brexit is considered to be one of the significant political decisions undertaken by British Government, impacting socio-economic, geo-political and organisational relations with European Union. As proposed by Hobolt et al. (2021), UK’s EU referendum passed in 2016 had proposed the notion of Britain leaving EU membership, thereby deriving the colloquial term “Brexit” signifying “British Exit”. Pre-incorporation of Brexit had infused a sense of political and economic tension among EU nations and UK, hinting discrepancies in international trading and commercial practices prevalent across European nations. As observed by Hobolt et al. (2021), amendment of Brexit in January 2020 had satisfied the idea of economic disruption, by showcasing a downfall of FDI trends by 28% in first quarter of 2021. Disputes arising across EU and British trading centres had, due to an inclining trend in excise duties and VAT, had resulted in lowering of foreign trading activities for UK. On the other hand, it was observed that causes of vote in favour of Brexit had involved enhancing domestic economic resilience of Britain (Hobolt et al. 2021). Presence of economic objectives involving trading independence and autonomous business decisions in corporate sector had facilitated legal incorporation.

3.2 Effect of EU Membership on Foreign Investment

Amendment of Brexit in January 2020 was identified to be a significant approach in strengthening single market operation within domestic economic structure of Britain. According to Welfens and Baier (2018), lower FDI inflows across Bank of England in pre Brexit era signified that in long run approximately 50% of foreign direct investors in England had decided to withdraw asset allocations across European nations. Dispute arising within Bilateral Trade Agreements was considered to cause negative impact on lessening FDI inflows, thereby enhancing risks of bankruptcy for Bank of England. On the other hand, it was explained that single market membership of UK after Brexit would strengthen trade openness among Britain and OECD countries (Welfens&Baier, 2018). Involvement of Bilateral Trading agreements with OECD nations such as Australia in post Brexit period would enable Britain to recover from economic recession faced after termination of EU membership. It was analysed that termination of EU membership during Brexit may initially reduce FDI inflows from European states, however it would simultaneously act as a positive influencer in market expansion across Australia, Japan, Ghana and New Zealand.

3.3 Impact of Changes in FDI on UK Incomes

Incorporation of Brexit was considered to be a major economic setback for UK and industrial sectors or nations dependent on FDI inflow and outflow prior to this political decision. As per the views of Vaitilingam (2021), a survey of European and British economists had confirmed that national income associated with private sector organisations would tend to fall by 86%, thereby leading to an economic recession which may extend to 2030. An Economist review obtained in 2021 had confirmed that due to higher trading costs arriving after Brexit, international trade in UK would likely to receive negative trade volumes. Consistent trend of lower trading ratios from 4% to 6% would create an adverse impact on multinational industrial and commercial sectors operating in the domestic economy (Vaitilingam, 2021). Gradual shift towards single market economy of UK in European industrial sector, was initially considered to be a pessimistic decision undertaken by economic and political leaders, in terms of satisfying previously existing internal feuds.

Exposure of higher and new external trading rules on UK economy was identified to cause disruptions in individual weekly earnings ratios in British labour market and employability sector. According to Griffith et al. (2021), statistical analysis conducted in 2021 for identifying an individual worker’s response to “anti-nate exposure” and “response inclusive exposure”, which determined impact of FDI fluctuations in national income of UK. It was identified that “ex-ante exposure” was considered to have increased from 0% in first quarter of 2021 to 2% in December 2021. Griffith et al. (2021) explained that ex-ante exposure signified the potential returns of security in business organisations, whereas responsive inclusive exposure was referred to participative or decision making activities. Statistical analysis had confirmed that response inclusive exposure in British labour market had declined from 2% to 1.5% in 2021, thereby indicating that economic and political fluctuations during Brexit had negatively impacted and decreased trading decisions in labour markets of UK.

3.4 Foreign Investment strategies adopted by UK Government

3.4.1 Increasing share of Global Value Chains (GVC)

Advent of globalisation in twentieth and twenty-first centuries had brought forward growth opportunities for multinational companies towards performing foreign investments. As per the views of De Marchi and Alford (2021), in terms of enhancing foreign market relations, British Government had started to strengthen Global Value Chains (GVC) across global buyers and global factories. An explanation provided by this author said functional upgrading of GVC entails UK’s ability to shift towards more value added activities and indulge into advanced full package supply across international markets. Incorporation of “International Labour Organisation” (ILO) across British multinational organisations had focused on enhancing labour capital and employability ratios across operating units (De Marchi& Alford, 2021). Extensive GVC participation across developing nations such as India, South Africa and Indonesia had assisted Britain to maintain a strong hold of subsidiary markets, thereby acting as a second largest MNC corporator after USA.

3.4.2 Upgrading State Policies

Inward investment and restructuring job structure across domestic industrial, commercial and corporate sectors would assist British Government in improving internal resistance towards fluctuating economic and political conditions arising after incorporation of Brexit. As proposed by Baileyet al. (2019) FDI recipients across UK primarily consist of large multinational organisations concentrated across automotive and e-commerce enterprises. Incorporation of Brexit had disrupted inward flow of FDI from EU nations, thereby reducing investment returns in existing MNC enterprises. In terms of achieving internal resistance across existing international corporate firms, UK government had invested approximately £170 million in first quarter of 2021 (Bailey et al. 2019). Upgradation of international state policies had involved introduction of “Job Based Approach” focused on enhancing internal dependency of British labour market, thereby improving resilience and adaptability towards external economic and political changes.

3.5 Future Trade Agreements in UK

Trade Agreements conducted across UK after incorporation of Brexit in January 2020 had focused on strengthening domestic resilience and improving independent decision making system. International trade deal involving “UK-New Zealand” deal was incorporated on 20th October 2020, strengthening GDP growth by 0.2% at the first quarter of 2021 (BBC, 2021). Incorporation of UK-New Zealand Trading deal was considered as a significant step towards expanding trading centres in the southern hemisphere, thereby providing growth opportunities in enhancing agricultural aspects. However, it was analysed that UK-Australian Trade Deal commenced on 15th June 2020 had been identified to have cost undercut in trading activities through cheaper importing prices, thereby negatively affecting employability in international trading markets (BBC, 2021). In terms of addressing negative employability impact, British Government had confirmed that UK-Australian Deal would provide economic protection for Australian farmers, through incorporation of tariff free agricultural imports first in 15 years.

3.6 Theoretical Perspectives

3.6.1 Investment Development Path Theory

Economic development targeted by British Government after incorporation of Brexit in January 2020 had experienced drastic fluctuations after sudden emergence of Covid-19 pandemic in 2020. As observed by Paul and Feliciano-Cestero (2021), global economic decline caused by Covid-19 pandemic in 2020 had resulted in importation of several economic theories and ideas for improving internal resistance and enhancing foreign trading activities during post pandemic period. In terms of enhancing international trading resilience, concepts involving “Investment Development Path Theory” can be proposed for UK government. As proposed by Paul and Feliciano-Cestero (2021), investment development path theory developed by John Dunning in 1981 had emphasised on highlighting five consecutive stages associated with traditional line of development indicating growth of GNP. Analysis of IDP theory had derived an explanation that initial stages of development involving stage 1 to stage 3 would showcase decline of investment value. However, later stages of investment involving stage 4 and 5 would likely experience an inclination towards higher and stable return of investment (Paul & Feliciano-Cestero, 2021). Implementation of IDP theory for improving inward FDI flows in UK economy would enable British corporate organisations in understanding initial and later stages in development. Interconnection established between final and later developmental stages would assist in formation of FDI strategies as per market requirements.

4. Adopted Methodology

4.1 Research Paradigms

The following research study will account for application of the research onion tool for development of a robust research framework. Saunders et al. (2019) asserted that research onion engages in pictorial explanation of diverse aspects of research work for coming up with a sound research design. This will guide the researcher through the requisite steps for designing a research outline that can address all the framed questions. It is directed at making use of a “cross-sectional” time horizon rather than a longitudinal one for collecting required data at a single point in time. Research design caters to “exploratory, descriptive and conclusive” forms.

Given this research study assessing the individual concept of Brexit in UK and the European Union (EU), this study will intend to make use of a “descriptive” design. This will foster scope for this study in collecting a range of information for making a flexible design and describing characteristics of the involved variables (Al-Ababneh, 2020). Gleaned from the research philosophical positions of “positivism, pragmatism, interpretivism, postmodernism and realism” and point of view addressing “ontology, epistemology and axiology”, this study will integrate an “ontological interpretivism” philosophy. According to Saunders et al. (2019), “ontological interpretivism” fosters scope for assessing multiple interpretations, meanings and realities for addressing a research context. This will help gather richer and newer opinions and insights regarding the effect of EU membership on foreign investment in UK.

Research approach involves classification into “deductive, inductive and abductive” based on theory validation or development or modification. Al-Ababneh (2020) posited that it is significantly essential to align research philosophy with approach and design. In this regard, an “inductive” approach will be used for judging conclusions to be supported by observations regarding identifying the foreign investment strategies that are adopted by UK government as a response to Brexit. From the research strategies of “experimental research, survey, case study, grounded theory, ethnography, action research and archival research”, this study will use the “archival research” strategy in terms of stored statistical data for analysing the impact generated by changes in foreign direct investment (FDI) on incomes of UK. Application of “archival research” will cater to holism, contextuality and robustness of the study (Das et al., 2018). Besides, this research work will account for a “mono method” choice in terms of making use of a single form of collecting data.

Individual paradigms involving “Interpretivisim Philosophy”, “Inductive Approach” and “Archival Research Strategy” will hold significance in gathering existing sources of information available regarding Brexit and UK foreign investments. Consideration of existing concepts will assist in analysing strengths and drawbacks of previous policies and derive new recommendations for future improvement.

4.2 Data Gathering Process

Collection of data for addressing research questions can be grouped into “primary and secondary” based on sources and “qualitative and quantitative” depending on nature. Highlighted through the “mono method” choice and the need for investigating future trade agreements maintained in UK as a response to Brexit, this study will opt for “secondary qualitative” data. However, it will have the possible risk of a gap in accomplishing coherent foundations and empirical inference owing to a lack of triangulation (Dzwigol, 2020). Data gathering will account for credible academic sources from trusted databases like “Springer, ResearchGate and Google Scholar”. It will cater to using a range of books and authentic articles like statistical reports from official websites like “.org”, “.uk”, “.co” among others. Potential keywords will be used with the application of Boolean operators for refining and expanding the search process. This study will also involve a host of inclusion and exclusion aspects for choosing credible and desired sources.

4.3 Data Analysis Process

Analysis of gathered data can be done through “thematic analysis and statistical inference” based on the type of data collected. Concerning the collection of “secondary qualitative” data for this research, “thematic analysis” will be incorporated. Labra et al. (2018) opined that a comprehensive description relevant to a phenomenon need addressing a systematic review of identified themes. Hence, leveraging a “thematic analysis” will help in the formulation of broad themes regarding the need for bringing about feasible recommendations for foreign investment in UK for mitigating Brexit-based challenges.

4.4 Ethical Considerations

A foremost ethical undertaking for this study will be compliance with the ethical policies of the concerned academic Institute or University. Following the application of secondary data collection and analysis, this study will assure proper citation and in texting of the sources for promoting mutual trust. This will also address avoidance of data nuances and any plagiarism conduct for catering to credibility, reliability and validity of the interpretations to be made. It will also ensure adherence to the “Copyright, Designs and Patents Act 1988 (c. 48)” concerning layout and outcomes of the analysis.

5. Conclusion and Expected Outcomes

The following proposal has obtained that Brexit has brought about a significant negative impact on inward foreign investment in UK. Besides a fall in FDI inflows, the occurrence of Brexit is expected to cause damage to UK on grounds of productivity and yield reduced real incomes. Given this context, the following study will foster scope for having an in-depth understanding of the diverse angles of this EU membership that is impacting UK functions and strategic measures looked for by this nation. Application of a robust methodology will help this study address these research factors and account for reliability and validity. Although triangulation can be a risk factor, the researcher will ensure to use of credible and authentic sources for the interpretation of outcomes. Given this research subject to be of immense research reference, the research could entail a gap in required contexts in absence of primary data concerning Brexit in UK.

Reference List

Al-Ababneh, M.M., (2020). Linking ontology, epistemology and research methodology. Science & Philosophy, 8(1), 75-91. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3708935

Bailey, D., Driffield, N., &Kispeter, E. (2019). Brexit, foreign investment and employment: some implications for industrial policy?.Contemporary Social Science, 14(2), 174-188. https://www.tandfonline.com/doi/abs/10.1080/21582041.2019.1566563

BBC.COM (2021). Brexit: What trade deals has the UK done so far?.https://www.bbc.com/news/uk-47213842#:~:text=After%20Brexit%20happened%20on%2031%20January%202020%2C%20the,deal%20came%20into%20force%20on%201%20January%202021.

Das, R., Jain, K. K., & Mishra, S. K. (2018). Archival research: A neglected method in organisation studies. Benchmarking: An International Journal, 25(1), 138-155. https://www.emerald.com/insight/content/doi/10.1108/BIJ-08-2016-0123/full/html

De Marchi, V., & Alford, M. (2021). State policies and upgrading in global value chains: A systematic literature review. Journal of International Business Policy, 1-24. https://link.springer.com/article/10.1057/s42214-021-00107-8

Driffield, N., &Karoglou, M. (2019). Brexit and foreign investment in the UK. Journal of the Royal Statistical Society: Series A (Statistics in Society), 182(2), 559-582. https://rss.onlinelibrary.wiley.com/doi/abs/10.1111/rssa.12417

Dzwigol, H. (2020). Methodological and empirical platform of triangulation in strategic management. Academy of Strategic Management Journal, 19(4), 1-8. https://search.proquest.com/openview/3fcfdabe3dc8cf95b9ccc37e75613f7d/1?pq-origsite=gscholar&cbl=38745

Griffith, R., Levell, P., & Norris Keiller, A. (2021). Potential Consequences of Post‐Brexit Trade Barriers for Earnings Inequality in the UK. Economica, 88(352), 839-862. https://onlinelibrary.wiley.com/doi/abs/10.1111/ecca.12381

Hobolt, S. B., Leeper, T. J., & Tilley, J. (2021). Divided by the vote: Affective polarization in the wake of the Brexit referendum. British Journal of Political Science, 51(4), 1476-1493. https://www.cambridge.org/core/journals/british-journal-of-political-science/article/divided-by-the-vote-affective-polarization-in-the-wake-of-the-brexit-referendum/2393143858C3FA161AF795269A65B900

Labra, O., Castro, C., Wright, R., &Chamblas, I. (2020). Thematic analysis in social work: A case study. Global Social Work-Cutting Edge Issues and Critical Reflections, 1-20. https://books.google.com/books?hl=en&lr=&id=UBT8DwAAQBAJ&oi=fnd&pg=PA183&dq=importance+of+thematic+analysis+in+research&ots=ARiTCCQ5EM&sig=UYQr0h53447skn7vtjf5e_XO6pc

Melnikovas, A., (2018). Towards an explicit research methodology: Adapting research onion model for future studies. Journal of Futures Studies, 23(2), 29-44. http://journals.mountaintopuniversity.edu.ng/Research%20Methodology/03-Melnikovas-Onion-Research-Model.pdf

Noja, G. G., Cristea, M. S., &Yüksel, A. (2021). Brexit spillovers through international trade and foreign investment: empirical evidence from EU-27 and the UK. Panoeconomicus, 68(5), 653-680. http://panoeconomicus.org/index.php/jorunal/article/view/1153

Paul, J., & Feliciano-Cestero, M. M. (2021). Five decades of research on foreign direct investment by MNEs: An overview and research agenda. Journal of business research, 124, 800-812. https://www.sciencedirect.com/science/article/pii/S0148296320302332

Saunders, M., Thornhill, A. and Lewis, P. (2019). Methods for Business Students (8th edition). Pearson Education: London.

Statista.com (2021). Value of foreign direct investment (FDI) inward flows in the United Kingdom (UK) from 2013 to 2020. https://www.statista.com/statistics/935245/value-of-foreign-direct-investment-inward-flows-in-united-kingdom/

Vaitilingam, R. (2021). After Brexit: the impacts on the UK and EU economies by 2030. LSE Business Review. http://eprints.lse.ac.uk/108693/

Welfens, P. J., & Baier, F. J. (2018). BREXIT and foreign direct investment: Key issues and new empirical findings. International Journal of Financial Studies, 6(2), 46. https://www.mdpi.com/2227-7072/6/2/46

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services: