ECON11026 Assignment Sample : Discuss the current macroeconomic environment in Australia whilst critically evaluating the role of fiscal policy as a stabilisation tool.

Here’s the best sample of ECON11026 Assignment : Discuss the current macroeconomic environment in Australia whilst critically evaluating the role of fiscal policy as a stabilisation tool.

Introduction

Macroeconomics explains the behavior of aggregate economy and different aspects like GDP, inflation, national income, growth rate, unemployment etc are evaluated in macroeconomics (Nkoro & Uko, 2017). On the other hand, fiscal policy explains the way government moderates its taxation and spending levels to manage the economy of the country (Bianchi & Ilut, 2017). The consideration of macroeconomic environment and fiscal policy are required for this essay because since the third quarter of 2018, the economy of Australia has plummeted down at a rapid rate (Abc.net.au, 2019). Macroeconomic factors such as GDP, inflation, national income, growth rate, unemployment etc are the main reason behind it. While, with the application of fiscal policy, Australian Government might stabilise its economy but it has its own limitations. This essay outlines Australia’s Current economic environment, stage of business cycle, macroeconomic goals, fiscal policy and its objectives and types, operation of the multiplier process, latest proposal related to tax cuts, forecasted budget surplus and limitations of fiscal policy.

Discussion

Australia’s Current economic environment

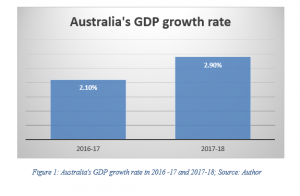

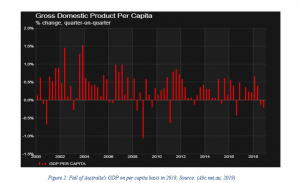

Australia has seen a prolific economic growth over the years as suggested by the proliferation of GDP in 2016 – 17 and 2017 – 18 by 2.1 % and 2.9 % respectively (Austrade.gov.au, 2018). During the time period of 2019 and 2023, it is expected to surpass many advanced economy. Since 1991 – 92 to till the beginning of 2018, an average growth rate of 3.2 % was observed in the economy of Australia. But the recent development have led to growing concerns over Australian’s economy. The two halves of 2018 presented a contrasting outcome for the economy of Australia. As during the first half of 2018, the economy rose at 3.8 % which is above average annualised rate but the second half showed a significant nosedive with the annualised rate fallen to 0.9 % (Deloitte, 2019). During the second half of 2018, Australia’s economy has taken a downward trajectory as the GDP plummeted down on per capita basis in the last two quarters (Abc.net.au, 2019).

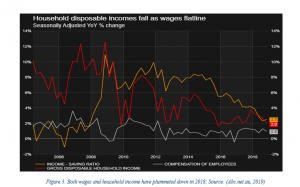

This dramatic fall of Australia’s economy is due to wide array of factors such as ongoing global slowdown, emphasizing on only two biggest markets of Australia – Melbourne and Sydney, increased house price losses which started to create a housing bubble and drop in household consumption growth. The other reasons which have slowed down Australia’s GDP are low wages, high debts and lesser job opportunities (Abc.net.au, 2018). Underperforming manufacturing sector of Australia has grown to be a serious issue as it also resulted in 99,000 job losses during the five year span to 2013 (Industry.gov.au, 2015).

Exploring stage of business cycle on the basis of current economic indicators

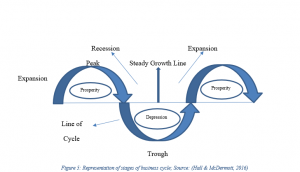

Business cycles are normally discussed as the period wherein there is a boom in the economic activities of a nation and in the following period, a collapse can be expected in the economic activities (Hall & McDermott, 2016). These ups and downs in the economic activities can be illustrated as the phases or stages of business cycle.

The stages of the business cycle can be more elaborated as shown in the figure below. Prosperity and depression are the two most significant stages of business cycle whereas expansion, trough, peak, recession and recovery are the crucial intermediary stages of business cycle (Hall & McDermott, 2016).

Based on the latest economic indicators such as underperforming Australia’s manufacturing sector, low wages, high debts, lesser job opportunities, ongoing global slowdown, household consumption growth and increased house price losses, the economy of Australia is entering into the stage of recession. All these economic indicators have pushed the economy on a downward spiral curve as GDP on per capita basis has drastically fallen in the end of 2018 and in this calendar year (Abc.net.au, 2019).

Macroeconomic goals

Macroeconomic goals are formulated by every nation in order to ensure long – term economic success (Nkoro & Uko, 2017). Basically there are five macroeconomic goals and they are non – inflationary growth, low inflation, low unemployment, equitable spreading of income and steady balance of payments. Non – inflationary growth explains the sustainable and steady economy growth that the country is expected to have over long –term. Australia had seen an astounding growth rate from 1991 – 1992 to first six month of 2018 but since then the GDP has sharply fallen. The income tax offset by government to seek the favour of low and middle level of earners prior federal election has a profound impact on the economy of Australia (Theguardian, 2019). Therefore, Australia needs to ensure that their macroeconomic goals are sound enough to deal with these issues. The other significant macroeconomic goal is low inflation rate which is highly beneficial for the growth of economy. Low inflation allows consumers to buy products and services as waiting would lead to rise in cost of the products or services. Borrowing money also becomes more appealing during low inflation rate as the interest rates are also low during this period. Most of the governments like to keep the inflation rate at 2 %. Australia’s inflation rate flattened to 1.4 % in the first quarter of 2019 as compared to the 1.8 % in the last quarter of 2018 (Abc.net.au, 2019). This drop of inflation rate would make the consumers purchase less products or services as they tend to have this perception the prices are not going to change. This less spending by consumers would slowdown the growth of economy. With interest rates still being put on hold, it is going to seriously impact the inflation rate and economy of Australia. Therefore, Australian government needs to ensure that inflation rate should be close to 2 % and higher taxes should be granted, as part of the macroeconomic goals.

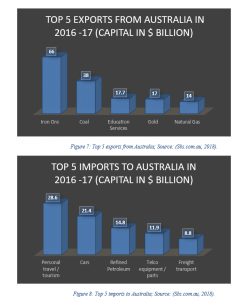

Unemployment has a become a major issue in Australia as the unemployment rate has surpassed 5.1 % in November, 2018 despite in excess of 37,000 jobs created in this month only (Abc.net.au, 2018). Hence, as part of their macroeconomic goals Australia need to ensure that unemployment rate can be mitigated. Equitable spreading of income highlights that the gap between poor and rich is considerably small. There is a prominent income inequality in Australia as this inequality becomes more significant due to higher prices of affordable houses, slow growth of wages and high household debt. The weekly income of the top 20 % household is almost 3.5 times higher the weekly income of the bottom 20 % household (Theconversation, 2017). In order to achieve the macroeconomic goals, Australian government needs to trim down this inequality. Steady balance of payments suggest that there should be balance between country’s imports and exports. The top 5 trading partners of Australia in 2016 -17 were China, USA, Japan, South Korea and UK. The top 5 exports from Australia were iron ore, coal, education services, gold and natural gas in 2016 -17 (Sbs.com.au, 2018). The top 5 imports to Australia in 2016 -17 were travel and tourism, cars, refined petroleum, telco equipment and freight transport.

Figure 6 and Figure 7 explains that there was a huge difference between imports and exports of Australia. Hence, in order to set a steady balance of payments between imports and exports of Australia, government needs to restructure the trade policies.

Explain fiscal policy and its objective. Elaborate different kinds of fiscal policy with the help of diagrams. Describe how the fiscal policy impact aggregate demand.

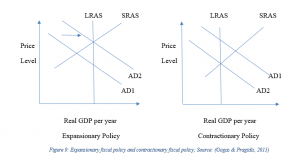

Fiscal policy is the only aspect of macroeconomic policy that is governed by the government (Bianchi & Ilut, 2017). It acts as an instrument for steadying the fluctuations that occur within the economic activities of the nation. It ensures change in the government spending, government borrowing and forms of taxes levied. Fiscal policy has 8 objectives and they are full unemployment, price stability, optimal use of resources, growth of economic development, fair spreading of wealth and income, economic stability, promoting investment and capital formation. There are basically three types of fiscal policy and they are neutral, contractionary and expansionary. Neutral fiscal policy is applicable only when an equilibrium economy is observed as the spending of the government is funded by revenues generated by taxes. Contractionary fiscal policy is normally applied to dampen the economic growth especially in the case of growing inflation and thus to mitigate it, taxes need to be raised and spending of the buyers are cut (Gogas & Pragidis, 2015). Expansionary fiscal policy are framed to stimulate the economic growth and are normally used at times of low employment or in case of stages such as recession and depression of the business cycle. This fiscal policy ensures that government focuses on lowering taxes and spending money. Expansionary policy moves the aggregate demand (AD) curve towards right as it mitigates the taxes and surges the government spending whereas contractionary policy moves the AD curve towards left which comprises of increase in taxation and reduction of government spending.

Fiscal policy impacts the aggregate demand on the basis of changes in government taxation and spending (Serrano & Summa, 2015). As taxation and spending by government impact household income and employment which eventually influence the buyer’s investment and spending.

Illustrate how the multiplier process operates with respect to the Australia’s proposed infrastructure spending.

As part of the proposed infrastructure investment program, Australian government is going to invest $ 100 billion over the next 10 years starting from 2019 – 20 (Infrastructure.gov.au, 2019). So, this would mean $ 100 billion would be invested into the development of Australian economy as many firms and contractors would be directly benefitted. This would create more jobs, more jobs and higher profits for the people of Australia. Therefore, multiplier effect process is going to be very strong and it is going to impact the GDP of Australia in a positive and massive way. With $ 100 billion investment from Australian government, it would set off a chain reaction of investment and expenses. The multiplier process operates as such when the injection of need of services and products meets the streamline flow of income for new and better infrastructure, it would lead to higher level of spending. This would eventually results in higher employment and output and the size of multiplier would like to become more prominent.

Examine the latest proposals related to tax cut and supply – side economics effects of tax reforms.

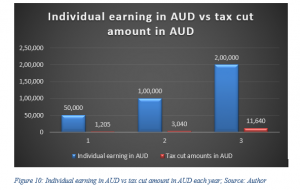

The latest proposal related to tax cuts in Australia was proposed in 2018 budget. The tax brackets are flattened and the rates are lowered to 30 % (Theguardian, 2019). This ensures that an individual earning $ 50,000 would face a total tax cut amount of $ 1,205 each year. For an individual earning $100,000, the total tax pay cut would be $3,040 and for an amount of $ 200,000 and excess, the total tax pay cut would be $ 11,640.

Supply – side economics is explained as the macroeconomic theory which points out that growth in economy is mainly due to mitigating regulation and reducing taxation. This is going to benefits the consumers as there would be more supply of goods at lower cost and eventually would lead to higher employment. As the latest tax cut proposal in Australia has taken drastic measures to decrease the tax rates, it would help the economy to come out the state of recession on per capita basis to prosperity stage of business cycle.

Examine the forecasted budget surplus as stated by Federal Government and its impact on the macroeconomy.

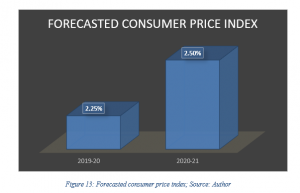

The Australian Government declares the 2019 – 20 federal budget with forecasts such as $ 7.1 billion of forecasts budget surplus in 2019 – 20, $ 11 billion of forecasts budget surplus in 2020 – 21, expected growth rate in GDP at 2.75 % in both financial year 2019 – 20 and 2020 – 21, expected consumer price index (CPI) at 2.25 % in the current year and 2.5 % in next financial year and suggest tax cut amount of $ 150 billion (Fxstreet, 2019). With forecasted budget surplus of $ 7 billion in 2019 – 20 and $ 11 billion in 2020 – 21, the Federal Government would have huge capital in hand to facilitate spending on its people. Similarly, the forecasted growth rate of GDP is expected to touch 2.75 % in both financial year 2019 – 20 and 2020 – 21. This would be higher than the current annual growth rate of 2.3 % (Ft, 2019). This growth in GDP and tax cut of $ 150 billion would influence the consumer to spend more and eventually stabilise the economic slowdown, thus explaining its impact on macroeconomy.

Constraints of using fiscal policy while steadying the economy.

Fiscal policy is used to circumvent recession and avoid inflation. But it presents many constraints while steadying the economy and they are poor information, time lags, impact on public spending, discontinuation due to tax cuts, budget deficit, consideration of other factors in aggregate demand, dependent on multiplier effect and crowding out (Coady & Gupta, 2012). Poor information or wrong forecast from the government can lead to wrong execution of fiscal policy and this might lead to inflation. Time lags while spending by the government into the economy has a serious repercussion as normally spending plans are developed once in a year. Impact of spending on public services is observed when government mitigates spending to reduce inflationary pressure. Surging taxes to mitigate aggregate demand might lead to discontinuation to work and drop in productivity. Surge in budget deficit is created by expansionary fiscal policy and it might lead to crowding out which is reduction of private sector’s size. As the multiplier process increases with more spending and investment, any saving by the consumers would halt the multiplier process and effectiveness of the fiscal policy. While executing fiscal policy, consideration of other factors in aggregate demand needs to be taken care of, factors such as consumer confidence instead of high taxes might be the reason behind less spending.

Conclusion

This essay highlights the latest macroeconomic trends in Australia and also elaborates the significance of fiscal policy as the stabilisation tool. The second half in 2018 showed that the economy of Australia took a downward spiral curve with the annualised rate fallen to 0.9 %. Factors such as high debts, lesser job opportunities, underperforming Australia’s manufacturing sector, low wages, ongoing global slowdown, household consumption growth and increased house price losses are the reason behind the economic meltdown in Australia. Five macroeconomic goals that needs to be considered by Australia are low inflation, low unemployment, non – inflationary growth, equitable spreading of income and steady balance of payments. Expansionary policy moves the AD curve towards right whereas contractionary policy moves the AD curve towards left. Multiplier process would increase the employment and higher growth of GDP. Tax cut and growth in GDP would have its influence on macroeconomy.

References

Abc.net.au. (2018). Low wages, high debts and housing bubble threaten the Australian economy in 2018. Retrieved June 01, 2019, from Abc.net.au: https://www.abc.net.au/news/2018-01-04/australian-economy-threatened-by-low-wages-high-debts-bubble/9286048

Abc.net.au. (2018). Unemployment edges higher as more people look for work. Retrieved June 01, 2019, from Abc.net.au: https://www.abc.net.au/news/2018-12-20/jobs-labour-market-abs-november/10638408

Abc.net.au. (2019). Australia’s economy just entered recession on a per capita basis. Retrieved June 01, 2019, from Abc.net.au: https://www.abc.net.au/news/2019-03-06/gdp-q4-2018/10874592

Abc.net.au. (2019). Reserve Bank leaves interest rates on hold but odds of cut soon remain high. Retrieved June 01, 2019, from Abc.net.au: https://www.abc.net.au/news/2019-05-07/reserve-bank-leaves-cash-rate-on-hold-at-record-low/11087986

Austrade.gov.au. (2018). 2017-18 GDP growth rate of 2.9% confirms the resilience of our economy. Retrieved June 01, 2019, from Austrade.gov.au: https://www.austrade.gov.au/news/economic-analysis/2017-18-gdp-growth-rate-of-2-9-per-cent-confirms-the-resilience-of-our-economy

Bianchi, F., & Ilut, C. (2017). Monetary/fiscal policy mix and agents’ beliefs. Review of economic Dynamics, 26(1), 113-139, DOI: 10.3386/w20194.

Coady, D., & Gupta, M. (2012). Income inequality and fiscal policy (1st ed.). NY: International Monetary Fund, ISBN: 9781513567754.

Deloitte. (2019). Australia Economy is a tale of two halves. Retrieved June 01, 2019, from Deloitte: https://www2.deloitte.com/insights/us/en/economy/asia-pacific/australia-economic-outlook.html

Ft. (2019). Australia GDP growth misses expectations. Retrieved June 01, 2019, from Financial Times: https://www.ft.com/content/e8d2c05c-3fa2-11e9-b896-fe36ec32aece

Fxstreet. (2019). Australian Govt forecasts return to budget surplus in 2019/20 after 12 years in deficit. Retrieved June 01, 2019, from Fxstreet: https://www.fxstreet.com/news/australian-govt-forecasts-return-to-budget-surplus-in-2019-20-after-12-years-in-deficit-201904020845

Gogas, P., & Pragidis, I. (2015). Are there asymmetries in fiscal policy shocks? Journal of Economic Studies, 42(2), 303-321, doi: 10.1108/JES-04-2013-0059.

Hall, V., & McDermott, C. (2016). Recessions and recoveries in New Zealand’s post-Second World War business cycles. New Zealand Economic Papers, 50(3), 261-280, doi: 10.1080/00779954.2015.1129358.

Industry.gov.au. (2015). Regional impacts of the accelerated decline of the manufacturing sector in Australia. Retrieved June 01, 2019, from Industry.gov.au: https://www.industry.gov.au/data-and-publications/staff-research-papers/regional-impacts-of-the-accelerated-decline-of-the-manufacturing-sector-in-australia

Infrastructure.gov.au. (2019). Infrastructure Investment Program. Retrieved June 01, 2019, from Australian Government Department of Infrastructure, Transport, Cities and Regional Development: https://investment.infrastructure.gov.au/

Nkoro, E., & Uko, A. (2017). Macroeconomic Stabilization Goal, Policy And Instruments. International Journal of Finance & Banking Studies, 6(6), 16-28, doi: 10.1080/23311975.2016.1154283.

Sbs.com.au. (2018). Australia’s trade explained: Top imports, exports and trading partners. Retrieved June 01, 2019, from Sbs.com.au: https://www.sbs.com.au/news/australia-s-trade-explained-top-imports-exports-and-trading-partners

Serrano, F., & Summa, R. (2015). Aggregate demand and the slowdown of Brazilian economic growth in 2011-2014. Nova Economia, 25(1), 803-833, doi: 10.1590/0103-6351/3549.

Theconversation. (2017). What income inequality looks like across Australia. Retrieved June 01, 2019, from The Conversation: https://theconversation.com/what-income-inequality-looks-like-across-australia-80069

Theguardian. (2019). Coalition budget woos low and middle-income earners with $19.5bn tax cuts. Retrieved June 01, 2019, from The Guardian: https://www.theguardian.com/australia-news/2019/apr/02/coalition-federal-budget-2019-woos-low-and-middle-income-earners-with-195bn-tax-cuts-in-budget

Know more about UniqueSubmission’s other writing services: