Assignment Sample on International Marketing and Brand Management

Introduction

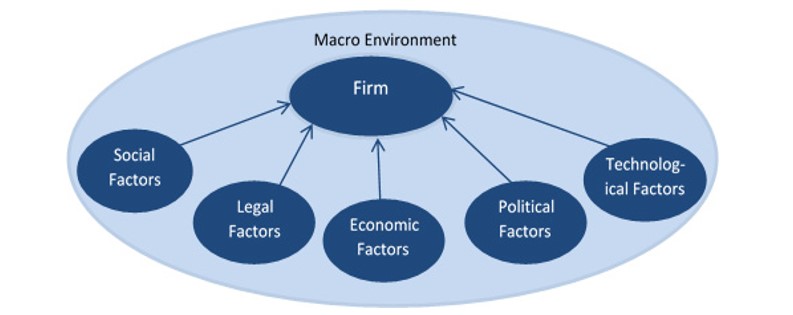

The report is focused on managing international markets and brands by achieving greater profits. In this perspective, different international marketing strategies and market entry modes will be discussed. The country chosen for completing the research is The Royal Dutch Shell Group that evolved from Shell Transport and Trading and the Royal Dutch Petroleum Company merged in 1907. The company operates in more than 90 countries and aims at providing better energy solutions to meet the demands of customers (Who are we- Shell, 2020). They also have a museum to maintain a healthy relationship with its customers. Their brand portfolio states that the company invests in different companies to develop and find disruptive business models and leading technologies in the area of interest. After that, the report analyses the international marketing strategy and potential market that the company must expand its business. The SLEPT analysis is used to monitor the external market environment so they can access the best option.

Furthermore, different market entry modes in the international market such as franchising, buy a company, joint venture, and partnering will be discussed (Hilmersson et.al. 2021). After that, the report also aims at analysing the different strategies for market entry. The market selected for expanding the business in India and the products served will be renewable energy sources. The company needs to adopt an adaptation strategy as it will help in the modifying product as per the demands of the customer. Finally, the company must select points of differentiation (POD) approach because it comes with numerous benefits.

Part 1) Brand Analysis

1. Brand Introduction

A shell is a global group of petrochemical and energy companies employing about 86000 employees and operating in more than 70 countries. The company is operating in the UK since 1897. They primarily believe that their operations are the major part of the business success. The company is evolved when Shell Transport and Trading and Royal Dutch Petroleum Company merged in 1907 and now known by the name of Royal Dutch Shell Group. They invest most of the time and energy to build a strong brand image (Who are we- Shell, 2020). The company believes that it is their most valuable and largest asset that helps in enhancing trust and loyalty among customers. Using their meaningful action and memorable storytelling helps them stay connected with its customer in the changing market environment. The company constantly innovate their services so they can evolve in the modern developed world. Music also plays a crucial role in their audio and visual communication and also includes collaborations with many singers.

In 2015, Shell launched “Sound of Shell” brand music and sonic signature that helps in capturing the value of Shell. The Sound of Shell offers an opportunity to tell the customer about the company using music (van Beurden, 2017). In their holistic brand management, they take steps to preserve, protect and celebrate their heritage. The company also has a Shell Heritage Art collection at the National Mortar Museum.

2. Brand Portfolio / Availability

The brand portfolio of Shell describes the country they are operating along with the elements they serve. Their primary vision is to do the right things and their visual identity helps in bringing the culture of innovation and describes the way they handle difficulties so they can deliver the energy required by people to sustain and power their lives. They also provide training related to brand designing. The company offers services that include power, resources, multi-industry solutions, fuels and mobility, funds/incubators, and seed investments (Kumar, 2019). Their business operations are segregated into four parts that include Upstream, Downstream, Integrated Gas, and renewable and energy solutions i.e. new energies.

The upstream organisation maintains the operations related to extraction and exploration of natural gas, natural gas liquids, and crude oil. It also manages the responsibility of transporting oil and gas and maintains the infrastructure that needs to be delivered to the market. Their integrated gas organisation manages operations related to LNG and producing gas-to-liquid fuels and other products (What we do- Shell, 2020). On the other hand, renewable energy and solutions work on finding new solutions in commercial ways to meet the requirements of their customers. Finally, Downstream provides a retail service station every day and serves about 30 million customers.

They invest in different companies to develop and find disruptive business models and leading technologies in the area of interest. The brand portfolio map of Shell describes the companies all around the world they have invested in (Our Portfolio, 2021). It can be seen that the company constantly invest and develops product and services that meet the evolving needs of energy so people can live their life.

3. Brand Elements

The company preserves its brand heritage by remembering from where it came. The Company maintains holistic brand management by taking steps so they can preserve, celebrate and protect their heritage. In this concern, the company has Shell Heritage Art Collection where they have the finest collection of vintage motorcycles, cars, and motoring memorabilia in the entire world (History of the shell brand, 2021). The museum also has lorry bills and early postcards from the 1920s, motoring guides from the 1930s, and these are used to connect with their customers. The company also has a Shell Heritage Archive that has temperature controlled environment so they can store and handle heritage materials. Shell museum of brand celebrates the most loved brands from the past 150 years.

Furthermore, the Shell logo has changed many times starting from realistic pectin to scallop shell, and now has a simplified shape with red and yellow colour. The colour in the Shell logo first appeared when the construction of its first service stations in California (UNCU and ÇALIŞIR, 2019). The brand selected Spanish colours to create an emotional brand. Initially, the logo appeared with the brand name at its bottom but now the brand has become so famous that it doesn’t have a brand name.

Along with that, Shell also invests in different companies after analysing their innovations and development for meeting future needs. They primarily invest in the companies that provide the best and new solutions for providing energy and making the lives of people better (Durugbo and Amankwah‐Amoah, 2019). Finally, the company also works for generating renewable energy for the sake of enhanced sustainability.

4. Brand Equity (Keller’s CBBE model)

Keller’s Brand equity model is the Customer-Based Brand Equity (CBBE) model and the major concept is to build a strong brand it is essential to shape the customer’s thinking and feeling about the organisation’s product. Having strong brand equity enhances the purchase of the product served by the company. The model segregates the model into four parts. These segregations are described below:

Step1- Brand Identity: It is essential to create brand awareness among customers so they know about the product served by the company (Qiao and Wang, 2017). Shell has a great brand salience and serves 30 million customers at their service stations.

Step2- Brand Meaning: To communicate and identify the brand means and reason it stands out. Shell’s primary motive is to provide energy to every people so they can meet their demands of life. Other than that, they develop new energies so renewable energy can be developed.

Step3- Brand Response: The customer responses on the product served by the organisation are categorise in this step. Shell constantly focuses on evolving with innovation so they can enhance customer satisfaction and they maintain their heritage so customer relationship can be maintained (What we do- Shell, 2020).

Step4- Brand resonance: It is the most difficult step to reach in the brand equity pyramid and has been divide into four parts that include behavioural loyalty, sense of community, active engagement, and attitudinal attachment. The brand resonance of Shell is high as its customers are highly satisfied with its products and the company continuously brings innovation to meet future needs.

5. Brand Mantra

Their vision is to create a difference through their people. The company has a team of dedicated employees that value their customers and enhances sustainable development. Royal Dutch Shell Group has a mission of distributing petrochemical and energy products to market safely by providing innovative services. On the other hand, Shell Lubricants has come with a new motto stating that “Anything is possible, together”. The company follows proper values and works with integrity, honesty, and respect for people (Mägar and Faustino, 2018). Other than that, the company believes in bringing advancements in technology so they can offer new energies such as renewable energy so their sustainability can be enhanced. Their powering progress project aims at accelerating the transition of their business to net-zero emission. The project aims at offering more and cleaner energy solutions.

Part 2) International Market Analysis

Shell currently operates in more than 90 countries and they need to enhance their business operation so they can achieve greater revenues. In this context, the company must increase their globalisation even using entry into a new market or expanding into the market they are currently operating. The previous innovations and expansion of the Royal Dutch Shell group were highly successful and they must increase their international business operations (Liang et.al. 2017). Based on the brand portfolio of Shell, the company must expand its market in countries by developing new products and services. Along with that, the company must think of expanding its market in India, Germany, and Africa. The company operates in these regions but they can expand their product ranges so they can meet the market requirements. It enables the great opportunity for Shell to enhance their market operations.

1. SLEPT analyses of 3 culturally distinct markets which the brand could potentially enter

SLEPT analysis of India:

The Royal Dutch Shell Group can enter the market of India by providing them a renewable source of energy. The economic growth of the country has declined due to the pandemic outbreak and it increases the rate of poverty. Other than that, many regions in India don’t get a proper supply of electricity. Regions such as Uttar Pradesh, Himachal Pradesh, and Uttarakhand have shortages of electricity and their demands are not fulfilled properly. The company can offer renewable energy projects to India and can provide them electricity in these regions (Pickl, 2019). To analyse the external environment SLEPT analysis is done so the company can work on the projects effectively. SLEPT stands for Social, Legal, Economic, Political, and Technological.

Furthermore, an increase in the population of India can impact the business environment and it will also increase the consumption of energy. By implementing projects for providing renewable sources of energy can put a positive impact on the environment and provides electricity to the region that doesn’t have proper electricity for meeting their daily needs (Simões, 2020). Other than that, an increase in population also enhances the unemployment rate for older workers. The company can also provide employment benefits for older people. It can help them in increasing their sustainability and profitability. On the other hand, new legal rules are implemented in India as the country is currently facing major environmental pollution. Providing renewable energy can help them in entering the market easily.

The economic growth has been adversely affected by the Covid-19 pandemic and providing renewable energy sources at a low price can help in meeting the demands adequately (PESTLE Analysis of India, 2019). Privatization is increasing and from this company can achieve greater benefits in the political environment. Other than that, using technological factors the company can reach different sectors suffering from electricity shortages.

SLEPT analysis of Germany:

Germany is the largest gas importer and most of its gas comes from Norway, Netherland, Russia through Nord Stream. The country is known for its largest consumption power of natural gas in Europe 2019 (Bissiri et.al. 2019). It is a great opportunity for increasing their service stations in Germany to enhance its profitability. The company is aiming at producing aviation fuel and naphtha made from renewable power and crops to increase the electrolysis plant that produces fossil-free hydrogen. The country is planning to reduce the consumption of crude oil. It is a great opportunity for the company to increase its business operations in Germany.

Germany has high economic, technological and educational advancements and it is the best opportunity for Shell to take advantage. The company can hire talented and skilled employees from Germany to work on its project and enhance their productivity (Perera, 2017). Other than that, people living there are from diverse culture and thinks that citizen welfare is its primary goal. It would be great for a company to enhance its workforce diversity. The legal factor of Germany is very great as it promotes the development of business ventures by foreign investors as well as citizens. It is an excellent destination for investors to make investments. In this perspective, Shell can expand their business in Germany. The economy of Germany is ranked as 4th largest in the entire world. The shell can take advantage of it and can provide the facilities at expensive rates.

Germany has a politically stable environment but the Brexit was responsible for causing a favourable amount of disturbance in the political environment of the country. It can be a drawback for the company to expand its business. On the other hand, Germany is known for its innovation and advancements in technology and science (Achinas et.al. 2019). This factor can increase the level of threat for the company as many other companies will be operating there and the market competition will be increased.

SLEPT analysis of Africa:

Africa can become the first country to ratify a carbon-free energy transition with both socio-economic and geopolitical relevant factors. Other than that, the major source of electricity in sub-Saharan-Africa is oil products, coal and hydropower (Dioha and Kumar, 2020). The Royal Dutch Shell Group can buy a share or invest in companies that are producing huge carbon-free energy transitions. Other than that, they can also collaborate with them and negotiate to have joint ventures. It will help the company in improving its brand portfolio, revenue streams, and profitability.

The poverty and unemployment rate in Africa is so high that affects the buying power of people negatively. Concerning this, the company can help the individuals by providing employment and enables a great lifestyle for these people. Labour laws of Africa are very much similar to the UK and it can be beneficial for the company to expand their business operations (Frue, 2016). The currency of Africa is low and has a weak economy so expanding the business into Africa can be dangerous. Other than that, Africa has a politically unstable environment and it can be challenging for foreign investors to deal with that.

2. Competitor analyses for each market

India has been ranked 4th in wind power, 5th in renewable power installed, and 5th in solar power. Looking at these stats, it can be depicted that the market competitiveness for supplying renewable energy will be very high. Other than that, renewable energy will be observed for 55% of the entire installed power capacity by 2030 (Sawhney, 2021). Shell needs to analyse the market that doesn’t have renewable power plants as it will be beneficial for the company.

Furthermore, Germany will also have a tough competitive market as it is the world’s largest importer of oil and gas. The company has to develop aviation fuel and naphtha made from renewable power and crops to increase the electrolysis plant that produces fossil-free hydrogen. It can be valuable for the company to expand in the German market (Lytvyn et.al. 2018). Africa is the first developer of carbon-free energy transitions and investing in large companies can be highly beneficial for Shell. It will also help them in making their brand portfolio attractive.

Part 3) Strategy for Market Entry

1. Selection and justification of new international market to enter

After analysing the competitiveness of the market internationally, it can be seen that Shell must develop a renewable energy power plant project in India in the regions where there are electricity shortages. The primary reason for selecting India is the economic growth of the country is being declined due to the Covid-19 pandemic and Shell can take advantage of this factor. The company can offer deals at lower prices than other competitors and because of its brand reputation, the deal will be signed (Watson IV et.al. 2018). After getting a huge customer base they can increase their prices.

Furthermore, providing electricity using solar panels, wind energy, and power plants is sustainable and will reduce the environmental impacts the country is currently facing. Providing renewable energy to many regions can help the country in reducing electricity consumption. It will directly reduce the use of water as a huge amount of water is required in generating electricity. Concerning this, the company can also provide energy to some poor regions that can’t afford electricity. It will help them in meeting their sustainable development goals.

The Royal Dutch Shell Group must analyse the market structure appropriately so they can keep the price lower as compare to its other competitors and they can also provide renewable energy to commercial industries as the electricity consumption is high in the industrial regions (Onoz and Giachetti, 2021). On the other hand, the privatization in India is increasing and it can be advantageous for the company to choose a wise market entry strategy. It will be beneficial for Shell to collaborate with some companies that are already providing renewable energy and giving them new energy solutions can help build the joint venture.

2. Recommended market entry strategy

Market entry strategy is defined as the delivery method or planned distribution of goods and services to a new target market (Hilmersson et.al. 2021). The company can monitor different market entry strategies and can choose the strategy as per the market competitiveness. Some of the recommended market entry strategies are discussed below:

Partnering: The Company can collaborate and partner with India’s top power producers and renewable energy companies (Wu and Wang, 2021). The establishment of these companies can be highly beneficial for Shell to enhance its business operations. In this market entry strategy, the company can offer new renewable energy project plans to these companies and convince them to have a partnership. The well-established companies from India include Adani Group, NTPC, Tata Power, and others. Partnering with these companies can be valuable for Shell to earn greater profits.

Joint ventures: The Royal Dutch Shell Group can open a joint venture with already established project plans in India. It enables an opportunity for the company to identify the targeted customers that suffer from electricity shortages. This will be beneficial for the company as the investment will be reduced and they can earn profit.

Buy a company: They can make investments in buying a well-established power plant company as it can help them in meeting the customers. The company has to maintain its services by bringing innovation and new energies to the market. Shell needs to sell products and services at lower rates so the customer base can be improved.

Franchising: It will be the best option for the company to extend its market in India as the company is well-established and known by millions of people in the world. Starting the company outside international borders with their name is known as franchising (Adeola et.al. 2018). In this entry strategy, the company can start operations and establish its products and services.

3. Recommendations for standardisation or Adaption (Marketing mix framework)

Adaption means modifying the product as per the demands of customers from the local market. In standardisation, products are not modified and sold to customers as they are in their local markets (Rao-Nicholson and Khan, 2017). In this approach, the company thinks that one size fits all. In the context of the above discussion, Shell must use an adaption approach to meet the demands. They can achieve this by bringing innovation to their product and modifying them as per the needs of their targeted customers. International marketing mix activities include various steps and the company can adopt adaption using this marketing mix. Different activities are described below:

- The first step is to analyse the potential markets so the company can monitor the demands and can modify the product. As per the analysis the potential market is chosen and the services that need to be delivered. In this perspective, the Indian market is selected to meet the demands of customers that are facing electricity shortages.

- The second step is to develop products and services as per the demand analysed. In this concern, the company needs to develop renewable energy using the lower price manufacturing process as they need to serve the product at a lower price in comparison with its market competitors.

- After that, a market distribution strategy will be selected to ensure that all the targeted customers are getting delivered with their required products (Mandler al. 2021). It has been recommended that the company must select franchising or joint venture entry mode.

- The fourth step is to establish an advertising strategy so the customers get aware of their products and services. In this context, the company must use social networking sites to know about customer demands and keep them aware of the products and services delivered.

- The final step is to set a price so that customers can afford it and a profit rate can be achieved. The targeted customers are from regions that are suffering from electricity shortage so they have to keep the prices low to attract massive customers.

4. Intended Points of Parity (POP) and Points of Differentiation (POD)

Intended points of parity mean the product offerings by a company that is similar to other competitors and can be easily imitable. On the other hand, points of differentiation mean offering a product that is different from their competitors (Keller and Brexendorf, 2019). Differentiation strategy will help the company in generating greater profits if the customer gets addicted to it. They will buy products and services from them as there is no market substitute available. In case of points of parity, the buying power of buyers will be high as they have numerous substitutes and they will switch easily from one company’s product to other. The Royal Dutch Shell group must adopt points of differentiation (POD) strategy as the company is the market leader.

Furthermore, entering the Indian market with renewable energy products requires product differentiation to a great extent as the company will face tough competition from their rivalries such as Adani Group, NTPC, Tata Power, and others. For reducing the market competitiveness they need to offer product that is different from products offered by other competitors so more customers get attracted to it (Points-of-difference (POD) and Points-of-parity (POP), 2020). Other than that, different customers have diverse demands and based on that they need to bring modification constantly so the satisfaction of customers can be increased continuously. It will also impact the loyalty of customers positively. POD also helps the company in competing in the targeted market where they offer different products already.

It has been recommended that this approach can help the company in providing a higher rate of economic benefits that is good for the economic growth of the company as well. It will also help Shell in achieving a greater profit rate by offering a different product that is not available in the market (Sorin et.al. 2018). The POD is also capable of promoting brand loyalty and enhances brand reputation. Other than that, this strategy will also help the company in achieving its mission and vision statement.

Conclusion

It has been concluded from the report that it is essential to analyse the international market before entering into a new market. The report is focused on monitoring the products and services delivered by the Royal Dutch Shell Group. The company operates in more than 90 countries and employing about 860,000 people. The primary mission of the company is to deliver services and products so the demands related to energy consumption can be met. The brand believes in bringing innovations to deliver renewable energy to different sections of the country. Other than that, the concept of entering into the international market is analysed using three different countries. Using the SLEPT analysis the eternal market environment is monitored so the market has chosen can give greater benefits.

Furthermore, the market selected is India and the company must aim at delivering renewable energy to the regions where electricity shortages are there. It will help the company in acquiring great customers as they don’t have any electricity. Other than that, competitive market analysis is done so the market competitiveness can be identified. The company faces tough competition in the Indian market from rivalries such as Adani Group, TATA Power, NTPC, and many more. In this perspective, the company must use the strategy of Point of differentiation (POD) and adaptation to modify the products and services as per the demand of customers.

References

Books and Journals

Achinas, S., Horjus, J., Achinas, V. and Euverink, G.J.W., (2019). A PESTLE analysis of biofuels energy industry in Europe. Sustainability, 11(21), p.5981.

Adeola, O., Boso, N. and Adeniji, J., (2018). Bridging institutional distance: an emerging market entry strategy for multinational enterprises. In Emerging Issues in Global Marketing (pp. 205-230). Springer, Cham.

Bissiri, M., Reis, I.F., Figueiredo, N.C. and da Silva, P.P., (2019). An econometric analysis of the drivers for residential heating consumption in the UK and Germany. Journal of cleaner production, 228, pp.557-569.

Durugbo, C. and Amankwah‐Amoah, J., (2019). Global sustainability under uncertainty: How do multinationals craft regulatory policies?. Corporate Social Responsibility and Environmental Management, 26(6), pp.1500-1516.

Hanna, K. and Hurmelinna-Laukkanen, P., (2019). Managing the energy transition in established organizations towards a low-carbon future–case Royal Dutch Shell.

Hilmersson, M., Johanson, M., Lundberg, H. and Papaioannou, S., (2021). Serendipitous opportunities, entry strategy and knowledge in firms’ foreign market entry. International Marketing Review.

Keller, K.L. and Brexendorf, T.O., (2019). Strategic Brand Management Process. In Handbuch Markenführung (pp. 155-175). Springer Gabler, Wiesbaden.

Kumar, B.R., (2019). Acquisitions by Royal Dutch Shell. In Wealth Creation in the World’s Largest Mergers and Acquisitions (pp. 147-153). Springer, Cham.

Liang, J., Xie, E. and Redding, K.S., (2017). The international market for corporate control and high-valuation cross-border acquisitions: Exploring trends and patterns. International Journal of Law and Management.

Lytvyn, V., Oborska, O., Vysotska, V., Dosyn, D. and Demchuk, A., (2018). Ontology using for decision making in a competitive environment. Computational linguistics and intelligent systems (2), 2018, pp.17-27.

Mägar, R. and Faustino, A., (2018). STRATEGIC PLAN FOR ROYAL DUTCH SHELL PLC.

Mandler, T., Sezen, B., Chen, J. and Özsomer, A., (2021). Performance consequences of marketing standardization/adaptation: A systematic literature review and future research agenda. Journal of Business Research, 125, pp.416-435.

Onoz, E. and Giachetti, C., (2021). Will Rivals Enter or Wait Outside when Faced with Litigation Risk? Patent Litigation in Complex Product Industries and International Market Entry. Strategic Organization, p.1476127021998258.

Perera, R., (2017). The PESTLE analysis. Nerdynaut.

Pickl, M.J., (2019). The renewable energy strategies of oil majors–From oil to energy?. Energy Strategy Reviews, 26, p.100370.

Qiao, L. and Wang, H., (2017, September). Building a Strong Customer-brand Relationship From CBBE. In International Conference on Transformations and Innovations in Management (ICTIM 2017) (pp. 501-507). Atlantis Press.

Rao-Nicholson, R. and Khan, Z., (2017). Standardization versus adaptation of global marketing strategies in emerging market cross-border acquisitions. International Marketing Review.

Sawhney, A., (2021). Striving towards a circular economy: climate policy and renewable energy in India. Clean Technologies and Environmental Policy, 23(2), pp.491-499.

Simões, E.N., (2020). A decision support system application module-for PESTLE analysis-competitive intelligence algorithm (Doctoral dissertation).

Sorin, E., Bobo, L. and Pinson, P., (2018). Consensus-based approach to peer-to-peer electricity markets with product differentiation. IEEE Transactions on Power Systems, 34(2), pp.994-1004.

UNCU, G. and ÇALIŞIR, G., (2019). FROM PAST TO PRESENT; EVOLUTION OF THE LOGOS: APPLE, SHELL & COCA COLA CASES. Social Sciences, 14(5), pp.2623-2640.

van Beurden, B., (2017). Royal Dutch Shell in a Changing World: Navigating Uncertainty. In Evolving Business Models (pp. 195-207). Springer, Cham.

Watson IV, G.F., Weaven, S., Perkins, H., Sardana, D. and Palmatier, R.W., (2018). International market entry strategies: Relational, digital, and hybrid approaches. Journal of International Marketing, 26(1), pp.30-60.

Wu, Y. and Wang, S., (2021). Sustainable Market Entry Strategy under a Supply Chain Environment. Sustainability, 13(6), p.3046.

Online

Evolution of Shell. (2018). [Online]. Accessed through: <https://www.biokemia.fi/Shell_Evolution_Logo.htm>

Frue. K. (2016). PESTLE Analysis of South Africa. [Online]. Accessed through: <https://pestleanalysis.com/pestle-analysis-of-south-africa/>

Graham. C. (2021). [Online]. Accessed through: <https://www.logodesignlove.com/shell-logo-design-evolution#:~:text=Since%20first%20appearing%20in%20the,simplified%20shape%20with%20distinctive%20colours.&text=Both%20the%20word%20%E2%80%9CShell%E2%80%9D%20and,founders)%20by%20another%20interested%20party.>

History of the shell brand. (2021). [Online]. Accessed through: <https://www.shell.co.uk/about-us/history-of-the-shell-brand.html>

Keller’s Brand Equity Model. (2020). [Online]. Accessed through: <https://www.mindtools.com/pages/article/keller-brand-equity-model.htm>

Our Portfolio. (2021). [Online]. Accessed through: <https://www.shell.com/energy-and-innovation/new-energies/shell-ventures/portfolio.html>

PESTLE Analysis of India. (2019). [Online]. Accessed through: <https://pestleanalysis.com/pestle-analysis-india/>

Points-of-difference (POD) and Points-of-parity (POP). (2020). [Online]. Accessed through: <https://www.marketingstudyguide.com/study-notes-for-points-of-difference-pod-and-points-of-parity-pop/>

SLEPT Analysis. (2018). [Online]. Accessed through: <https://www.mbaskool.com/business-concepts/marketing-and-strategy-terms/8377-slept-analysis.html>

What we do- Shell. (2020). [Online]. Accessed through: <https://www.shell.com/about-us/what-we-do.html>

Who are we- Shell. (2020). [Online]. Accessed through: <https://www.shell.co.uk/about-us/who-we-are.html>

Know more about UniqueSubmission’s other writing services: