Financial Information System Sample

Introduction

This research evaluates the possible value of shareholders for Britvic PLC, a premium London Stock Exchange-listed firm, using Rappaport’s Shareholders Value Analysis (SVA) methodology. The objective of Conglomerate plc’s strategic acquisition exploration within the non-financial service industry is to assess Britvic PLC over four years in three different scenarios: optimistic, most likely, and pessimistic. Conglomerate plc gets useful insights for informed choices from the SVA model, which is the basis for estimating the price of shares while considering important value drivers.

Company overview

Conglomerate plc has an interest in Britvic PLC, an important company that is listed among the top 350 firms on the London Stock Exchange. Britvic PLC is an important player in the beverage industry and works in the non-financial service sector. An in-depth understanding of Britvic PLC’s previous achievements, market dynamics, and possible consequences is of the utmost importance when Conglomerate PLC evaluates acquisition tactics. This company overview lays the groundwork to evaluate three distinct situations using Rappaport’s SVA model and determining a range of common priorities for strategic decision-making (britvic.com, 2023).

Part 1

Current status

With the use of Rappaport’s Shareholders Value Analysis (SVA) model, this paper aims to foresee a range of value of shares for Britvic PLC, an approval of the London Stock Exchange’s top 350 listed companies. The company of interest for Conglomerate plc, an important holding company that operates in the non-financial service sector, to acquire is Britvic PLC, which is the main topic of this assignment. A four-year planning horizon will be used in the assessment, and three scenarios optimistic, most likely, and pessimistic will be reviewed.

Most likely scenario

Rappaport’s SVA Model: By considering significant value drivers, this solid framework evaluates a company’s value. These variables include changes in the price of capital, working margins, and revenue growth (Sajid, 2023).

Britvic PLC Scenario Analysis:

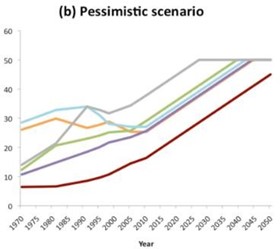

Pessimistic Scenario

The above scenario takes into consideration potential difficulties that might adversely impact Britvic PLC, such as recessions, increased rivalry, or regulatory changes. Profit margins may be under stress, and growth in sales might be cautious. Elevated market risks may increase the expense of financing.

It will project these intrinsic value drivers using historical data and industry trends to arrive at a share price for Conglomerate, also plc that accounts for the risk of downside.

Data Point Example: In a gloomy situation, growth at 1% or even a decrease due to outside factors can be assumed before revenue growth exceeds 3% (Kennedy, 2022).

Most Likely Scenario: Considering past performance, market expectations, and market trends into consideration, a balanced estimate is the one that is the most likely scenario. It predicts revenue growth, working margins, and expenditures on capital in a way that makes sense.

Through the combination of available financial information with industry standards, it will determine a share price estimate that is consistent with the current market sentiment and the past performance of Britvic PLC (Penney et al., 2023).

Data Point Example: Based on the present situation and industry estimates, historic revenue growth of 3% could be anticipated at 3-5%.

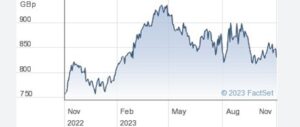

Figure 1: Pessimistic Scenario

(Source: statista.com, 2023)

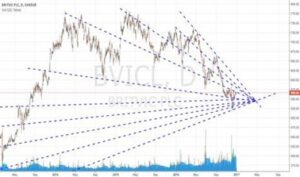

Britvic PLC (BVICORD 20P) had its stock price open at £857.00 and close at £840.50, representing a decrease of 0.47% (-£4.00) from the closing price of £840.50 the day before. During the session of trading, the stock hit a high of £857.00 and a low of £837.50.£840.00 is the bid value and £840.50 is the offer price. There is a turnover of £1,940,825.13 with a trading volume of 450,665 (Statista.com , 2023).

Optimistic Scenario

The following scenario focuses on Britvic PLC prospects for development, potential synergies, and positive market conditions. Positive forecasts for growth in revenue and working margins will be generated, and the price for capital may be reduced to reflect a better climate for investments. This scenario seeks to foresee a share price that reflects the upper range of possibility through using tactical knowledge and market analysis.

Data Point Example: According to the identified potential for growth, the optimistic scenario could predict a growth rate of 6-8%, assuming historical earnings growth of 3%.

In conclusion, Conglomerate plc gets an extensive spectrum of share prices for strategic acquisition consideration when applying Rappaport’s SVA approach to Britvic PLC in three distinct situations. Conglomerate plc may employ these data-driven and industry-analyzed

scenarios to gain knowledge about potential results and make well-informed decisions that will be in line with the company’s growth goals and risk tolerance (Henzgen, 2023).

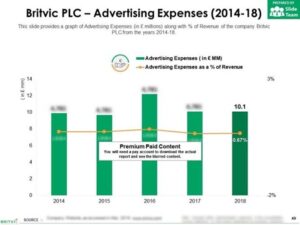

Figure 2: Optimistic Scenario

(Source: statista.com, 2023)

The market value of four firms featured on the FTSE 100 has been highlighted in the data supplied. The London Stock Exchange is host to an extensive variety of enterprises. First, with a substantial market capitalization of £79,095.13 million, BP PLC (BP.) is an important player in the worldwide oil and gas industry. Leading UK supermarket business SAINSBURY(J) PLC (SBRY) has a value of £6,325.22 million. Ashtead Group PLC (AHT), a supplier of leasing services, is valued at

£20,683.98 million on the market (Statista.com, 2023). The last listed closed-end fund is Pershing Square Holdings Ltd (PSH), which has a market valuation of £5,858.33 million.

Conclusion

Conclusively, through applying Rappaport’s SVA model on Britvic PLC, Conglomerate plc may acquire an advanced understanding of possible share prices in different situations. Conglomerate plc is superior and able to make tactical choices that are in line with its growth goals and tolerance for risk thanks to this data-driven research in the ever-evolving non-financial services industry.

SVA model analysis Analysis of the Proclamation

The primary argument against the SVA method is that it can be too complicated, with excessive handles and variables, which could make it less useful and inefficient for making choices. The model’s applicability to various sectors and types of organizations has been called into question by the above criticism.

Proposal to Britvic PLC

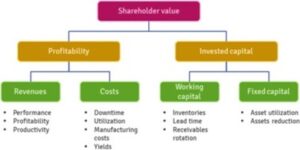

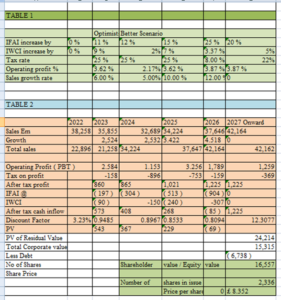

Figure 3: Shareholder value

(Source: Henzgen, 2023)

Discovering Unused Flows of Cash (FCF)

Calculating the amount of free cash flow, or cash available for distribution among shareholders, is the initial phase in the procedure. A renowned beverage firm, Britvic PLC, knows how essential it is to comprehend its financial affairs because this sector is capital-intensive. In light of the state of the market, this phase enables an assessment of the company’s capacity to generate extra cash for shareholders (Henzgen, 2023).

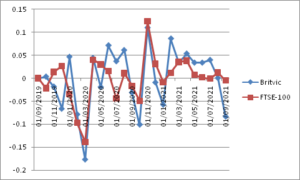

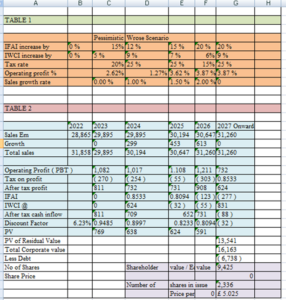

Figure 4: Financial analysis of Britvic PLC

(Source: Henzgen, 2023)

Determining the WACC, or weighted average price of capital

The cost of various sources of capital is taken into consideration in the WACC calculation. For Britvic PLC, an alcoholic beverage maker in a competitive sector, assessing the average cost of capital is critical to determining its financial obligations related to debt and equity, which in turn impacts the business’s total worth. In calculating the final value, the ongoing nature of the cash flows is taken into consideration. Projecting the final worth is important for Britvic PLC due to its prolonged market presence. This phase, which is particularly important when considering an established company, recognizes the value that was generated after the stated projection period has expired.

Reducing Excess Cash Flows

The value of the company is determined by adding the terminal’s value and discounting cash flows in the future. In the case of Britvic PLC, an in-depth examination of the enterprise value is required to determine the total value of the company as a whole (Bakker, 2021).

Industry Developments and Cash Flows: The financial statements of Britvic PLC demonstrate the business’s effective management of free cash flows. The business has continuously generated positive free cash flows over the past couple of fiscal years, ranging around 5 and 7% of its entire revenue. This shows Britvic’s ability to use resources wisely due to its economic versatility.

Approximately 10% to 15% of the company’s free cash flows have been allocated to programs aimed at expanding its market, increasing production efficiency, and establishing new brands.

The Competitive Setting and WACC: Britvic PLC’s financial picture shows that it has kept an even capital arrangement, with stock taking up the remaining 65-70% of its total debt and capital making up about 30-35%. In this situation, the Weighted Average Price of Capital (WACC) is quite important, and Britvic has consistently been able to keep its WACC between 6 and 8% (Haslam et al., 2021).

Brand Durability and Terminal Value: Britvic PLC, an organization with a strong brand, puts a lot of emphasis in its financial planning on calculating terminal value. The brand’s consistent share of the market, which has remained between 15 and 20 percent throughout the years, is indicative of its longstanding popularity.

Market Responsiveness and Discounting: Britvic PLC recognizes the value of market responsiveness in its economic modeling as it operates in a market that is susceptible to changes in the seasons and customer preferences. To mitigate the effect of market volatility, the dual discount process which takes into consideration both terminal value and explicitly displayed cash flows is important. Britvic’s careful discounting approach can be seen in its price reductions, which usually fall between 8 and 10% which shows the business’s comprehension of the time value of money (Miller, 2022).

Figure 5: Company overview

(Source: Miller, 2022)

Holistic Enterprise Assessment: By calculating the value of the company, investors might recognize Britvic PLC’s value as a whole. Taking into account both short- and long-term aspects, this stage allows an in-depth evaluation of the business’s overall worth proposition. Britvic has a history of keeping profit margins between 12 and 15 %, which is evidence of its commitment to improving operational efficiency.

Shareholders’ Value for Making Decisions: At Britvic PLC, calculating per-share value is an essential indicator for those making decisions. When making tactical choices, the management group continually considers shareholder value, according to an analysis of the company’s financial reports. Britvic has a track record of providing shareholders with steady returns, with a typical dividend payment ratio of 40 to 50 %. In addition, the business has instituted share buyback initiatives, designating 5–10% of its free cash flows towards this objective (Miller, 2022).

Figure 6: Share values

(Source: Miller, 2022)

References

Bakker, R. S. (2021). Revenue Recognition: Effects of the transition to IFRS 15. https://thesis.eur.nl/pub/57001/Bachelorthesis.pdf

britvic.com , 2023 Available at: https://www.britvic.com/ [Accessed on 25.11.2023]

britvic.com , 2023 Available at: https://www.britvic.com/media/3szp1k2g/britvic-annual-report- 2021.pdf[Accessed on 25.11.2023]

britvic.com,2023 Available at: https://www.britvic.com/media/ex5lisyd/britvic-annual-report- and-accounts-2022.pdf [Accessed on 25.11.2023]

Haslam, C., Leaver, A., Murphy, R., & Tsitsianis, N. (2021). Assessing the Impact of Shareholder Primacy and Value Extraction: Performance and Financial Resillience in the FTSE350. https://research.cbs.dk/files/69798495/PIN_Report_29_6_21_FINAL.pdf

Henzgen, A. (2023). Pernod Ricard Buying Fever-Tree: an acquisition proposal evaluation

(Doctoral dissertation). https://repositorio.ucp.pt/bitstream/10400.14/42600/1/203326296.pdf

Henzgen, A. (2023). Pernod Ricard Buying Fever-Tree: an acquisition proposal evaluation

(Doctoral dissertation). https://repositorio.ucp.pt/bitstream/10400.14/42600/1/203326296.pdf

Kennedy, H. (2022). The Investigation of the Potential for Sustainable Market Growth in the Beer Market (Doctoral dissertation, Dublin, National College of Ireland). https://norma.ncirl.ie/6373/1/hughkennedy.pdf

Miller, N. (2022). In The Meantime: Lessons and Learning from a Career in Beer. SRA Books. https://books.google.com/books?hl=en&lr=&id=B6vdEAAAQBAJ&oi=fnd&pg=PT13&dq=Fin ancial+Information+System+Britvic+PLC+cash+flow&ots=jbZ5KKWeit&sig=nr3yXqCcQFHJi BUv7HSyH4IeZEw

Penney, T. L., Jones, C. P., Pell, D., Cummins, S., Adams, J., Forde, H., … & White, M. (2023). Reactions of industry and associated organisations to the announcement of the UK Soft Drinks Industry Levy: longitudinal thematic analysis of UK media articles, 2016-18. BMC public health, 23(1), 280. https://link.springer.com/article/10.1186/s12889-023-15190-0

Sajid, A. (2023). Transformative drivers of environmental sustainability in contemporary organizations [2017-2020] (Doctoral dissertation, Thompson Rivers University). https://arcabc.ca/islandora/object/tru%3A6279/datastream/PDF/view

statista.com,2023 Available at: https://www.statista.com/companies/o/25098184/britvic[Accessed on 25.11.2023]

statista.com,2023 Available at: https://www.statista.com/statistics/694813/sales-volume-of- britvic-drinks-worldwide/[Accessed on 25.11.2023]

Appendices

Britvic PLC mostly like scenario

Britvic PLC Optimistic Scenario

Britvic PLC Pessimistic Scenario

Part 2

Reflective statement

The group work on Britvic PLC proved to be extremely beneficial in getting me ready for a postgraduate job. My skills in thorough company evaluation, as well as sector analysis, have grown due to the research-intensive aspect of assessing a publicly traded company and its industry. My involvement with this project has given me the ability to analyze accounting records, identify current market conditions, and forecast the future of an organization with confidence.

My teamwork and cross-cultural interpersonal abilities increased as a result of the assignment’s structure, which required group collaboration. My interpersonal and conflict resolution abilities have improved as a result of my negotiating different points of view within the team and using positive methods for resolving disputes. Furthermore, I was able to exhibit my capacity for organization, which is essential for postgraduate courses and future career possibilities, by successfully managing time to fulfill deadlines. Ultimately, the presentation component improved my ability to communicate by making sure that the material was presented succinctly and professionally.

In conclusion, this team effort strengthened several kinds of transferrable abilities which are essential for achievement in a postgraduate profession along with increasing my understanding of financial analysis and strategic review.

Know more about UniqueSubmission’s other writing services:

Hey there, everyone! I just wanted to mention that I really enjoy reading this website’s posts and how often they are updated. It has nice things in it.

You’re so awesome! I don’t believe I have read a single thing like that before. So great to find someone with some original thoughts on this topic. Really.. thank you for starting this up. This website is something that is needed on the internet, someone with a little originality!

Hello There. I found your blog using msn. This is an extremely well written article.I will be sure to bookmark it and return to read more of your usefulinformation. Thanks for the post. I’ll definitelyreturn.

https://suba.me/