GEEN 1016 Strategy and Management Assignment Sample

Introduction

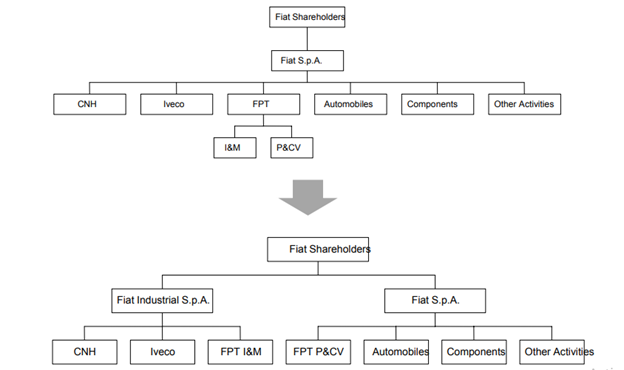

Strategic management is the system of creating goals, objectives, and procedures that help to make the organization or company more competitive. Strategic management is the identification and description of the strategies that the manage4rs carry out to reach the better performance of the employees. Strategic management defines as the bundle of decisions in acts that is the manager undertakes and decides the outcomes of the performance of the organization. The study is based on the Fiat industry which is the value of the spinoff. The study is going to investigate the groups of Fiat for splitting up the constituent companies that are able to assess the performance of the organization. In addition, the reflection of the pros and cons of the industry and explanation of the diversification discount is determined in the study.

Question 1

Options have been taken by Fiat group for Capital Goods

The group of the company Fiat gains the approval of the shareholders to spin off the business of the industry. The automobile unit of the company Fiat moved in the hopes of the company leading the stock market. In order to give the economic growth of the company, the management needs the continuous use of the soar (Handayani et al. 2018). The group of the company views the two halves of the positive whole of the market. The group of the company has separate entities that finally solve with the diversification strategy. The investors said that the length of speculation about the potential values of the company realized the splitting up of the company.

The management groups of the company deal with companies in the US that provide the right way to raise the stake. Fiat Company announced the spin-off of the car manufacturer that makes through agriculture and marine equipment. The issues of the workplace consider the increasing the risk of the company for the performance of the market (Hui et al. 2020). The Fiat car manufacturing industry makes the capital goods market a separate sector for the development of the business. The components of capital goods of the company are valued within the groups of the company. The company needs to make the decision for the operation of the two-sector for measures the performance of the business.

Figure 1: Fiat capital goods sales

(Source: Statista.com, 2022)

Fiat takes the decision for separating the capital goods that view as the industrial business as valuable research for the business. The cost development of the company is at the low-profit level. The company needs to take some new tools and technology for the development of the business market (Khan, 2019). The technology is able to provide satisfaction to the customers as well as deliver goods within time. Fiat needs to control the business market with plans the improvement the sales of agricultural equipment in the tracks. The company needs to compare the loss of the products and construction and the farming equipment company. The separate groups of the company make the development of the business market and increase the annual revenue.

Options have been taken by Fiat group for Automobile

The automobile business of the company Fiat has many competitors in the marketplace such as Lancia, Alfa Romeo, Maserati, etc. The market shows the business industry as valuable as the development of the cost of the production. The statistical regression of the model of the business can be applied to predict the outcomes of the automobile industry of the company (Koh et al. 2020). The different kinds of business with the various capital needs of the customer are fulfilled by the management of the company. Fiat prepares for the outright with the combination of the performance of the company. The company separates the two parts of the business that helps to develop the business.

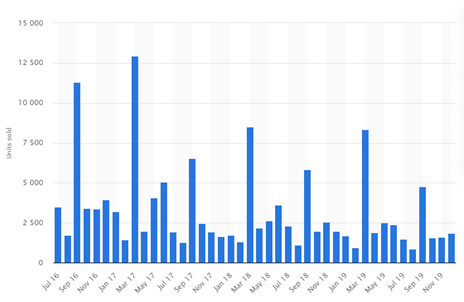

Figure 2: Fiat car sales

(Source: Statista.com, 2022)

The car sales of the company Fiat is the most appreciated business that ranks at the top of the business. Fait care sales experience a positive trend from the year 2013 to 2017. The car brand drops its sales rate volume between the years 2018 to 2020 (Refer to Appendix 2). According to the record of the annual sales for 2020, the company increases its unit of sales by 211000 (Statista.com, 2022). The Italian market is the most important market for the company Fiat in the year 2019. Through diesel and petrol-fueled vehicles, cars still dominate the market of the country. The government introduced electronic car sales for the customer with financial incentives in 2019. The hydrogen fuel vehicles have arrived on the scene and are similar to show the early signs of the development of the business markets of the company.

The outcomes of the company share a higher percentage of the sales of automobiles in the market. The spin-off of the company Fiat provides the results in the business profile that compare with the present combination of the group of Fiat. The issues of energy crisis and the climate change of the company automobile have received a large range of attention from the customer (Li et al. 2019). The groups of the company want to increase the business market and sale rate. The spinoff of the car manufacturing industry considers the debt and cash allocation in the new products of the company.

Question 2

Diversification is the act that existing the entity of branching out into new business opportunities of the company. The corporate restriction strategy is able to the entity enter the new market segment that already operates. The decision about diversification can find a challenging decision for the entity as the lead of the extraordinary rewards with the risks of the market. The existing impacts of the cities worldwide with the potential energy of the future of Fiat are important (Atanga, 2020). The strategic diversity of the company helps to grow the business, make sure the maximum utilization of the existing resources of the company. In order to get knowledge of the concept of strategic diversification, the company needs to look at its advantage and disadvantages of the company.

Pros of the diversification strategy

The economic changes of the company are spending the patterns of the people of the world. The diversifying of the number of industries or the product or services of the company can help to create the balance of the entity during the ups and downs. The business of the company Fiat is managed through the economic condition that presents the 2010 results to the financial community. The strategic management conducts at the municipal or the household level of the company (Bahçelioğlu et al. 2020). According to my thinking, all the companies of the world operate the capital goods better for the products that transfer the new groups of the company.

The diversification strategy is the main part of the business development for the company Fiat. The pros of the diversification strategy are the economic changes in the workplace. The company Fiat introduces the products and services of the company in the market for the development of the business. The strategic management related with the best outcomes of the business that develop the municipal and household level of the organization. Diversification management gives satisfaction to the desired objectives by compromising the system of the performance of the organization (Bukar and Tan, 2019). The strategy of the diversification helps to find the way of development of the products of the company. Diversification helps to motivate the employees in the workplace to manage the business.

Cons of the diversification strategy

The diversification of the Fiat car manufacturing industry involves the profit-making parts of the company. According to my knowledge, diversification loses the saving of the limited investment in the specific segment of the business (Refer to Appendix 1). Multiple sources of energy offer high productivity out the significance of the degree of the energy in the contract of the productivity (Chien et al. 2021). The mismanagement of the diversification ambition can lead Fiat over the expansion of the new directors. All the old and new sectors of the entity suffer from a lack of resources and attention to the sources.

Apart from these, it can be said that if a company aims at excessive ambitious strategies then it can end upto focusing on too many directions. It will eventually lead to loose the aims of the company. The large range of the diversified company is not able to respond to the changes in the markets. The focus on the operations makes the limited innovation in the entity. The business management needs information about the internal and external environment of the design and the implementation of the diversification strategy (Eker and Eker, 2019). I think that the strategy of diversification enters a new market segment which is the demand of the management of the Fiat Company. The lack of expertise in the new field can prove a setback for the entity. According to my opinion, it can be seen that Fiat is a well-diversified company. However, too much of diversification can lead the company’s performance and response to the market.

Question 3

The main two reasons behind the diversification discount are “high agency cost; another is the cost inefficiency”. The reason for diversification is to increase the capacity of the organization. The diversification strategies of the company use to expand the operations of the business company. The business groups of the company add the services, products, markets, or stages of the production to develop the business market. All fees required with answering to opposing parties’ claims are included in agency fees while investigating and resolving disputes. This cost is referred to as “agency risk.” Agency fees are unavoidable in any business where the owners do not have total control. The purpose of the diversification of the company allows the company Fiat to enter the lines of the business that is different from the current operations. The satisfactory limitations of the long battery charging time, improve the operating efficiency extend the business market (Liu et al. 2019). The main reason for the diversification is the increased capabilities of the organization. The diversified firm’s trade at the discount relates to a similar segment of the Fiat Company.

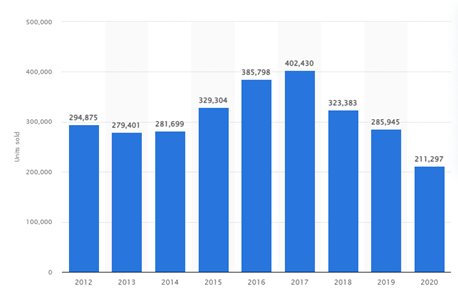

Figure 3: Diversity Discount

(Source: Self-developed)

Resources

Diversified firms trade at the discount relative to the worth of the company for the production of automobiles. The total values of the diversified firms are less than the sum of the diversified parts of the company such as Automobiles and capital goods. The domain of the industry evolves with the rapid growth of the business in the different revolutions of the industry (Omri et al. 2020). The empirical evidence exists in demonstrating the discount of the company based on the common sense of the management. The company considers electronic power as the virtual role in the diversification discount with the development of the quality of the products in the market (Sitharthan et al. 2019). The total value of the diversification discount of the firms provides the results as the value. The resources of the company have the empirical evidence that exist in the workplace to demonstrate the business with the total values of the diversification.

Managerial motives

The company Fiat measures the performance of the two sectors as the different parts of the diversity. The system of the diversification discount measures the difficulty of concentrating on the physical examination and review of the products (Tietjens et al. 2019). The managerial motives are associated with the bad manners of the managers in the workplace. The company measures the performance of the business for the development of the research. The diversification discounts are the clarification of the different sectors of the company. The traditional vehicles in the world bring the issues of oil consumption that emission of greenhouse gas and global warming (Wang et al. 2020). The market scope, economical power, and financial conditions of the two sectors of Fiat determine the discount of diversification.

Incentives

The different business needs the different skills that are set through the management of the Fiat Company in the business market. The management of the company focuses on renewable energy of the company which addresses the growth of the energy demand of the company (Wang et al. 2019). The incentives of the workers help to develop the process of production and motivate them to develop the business in the marketplace. The incentives of the diversification discount involve the tax income, low performance of the business. The knowledge of the company management strategy helps to organize the development strategy of the business of the company (Yoshikuni and Albertin, 2020). The certain cash flow and the risk of the firms are included in the reasons for the diversification discounts.

Conclusion

The study determines the strategic management for the company Fiat that helps to develop the market segment of the company. The study investigates the groups of the company Fiat for separating the constituent of the companies of the world. The team of the company is able to assess the performance of the products of the company in the market. The main business of the Fiat Company is Capital goods and the automobile on an individual basis. The study also determines the reflection of the pros and cons of the diversification strategies of the company. The diversification strategy of the company is an important part of the company entering the new segment of the market. The possible reasons for explaining the discount of the diversification strategy of the company Fiat discusses in the study. Diversification is the act that operates the corporate strategy for the business that helps to introduce the products in the market.

References

Websites

Statista.com, 2022. Number of Fiat cars sold in Italy from 2012 to 2020. Available at: https://www.statista.com/statistics/416645/fiat-car-sales-in-italy/[Accessed On: 29th March 2022]

Statista.com, 2022. Fiat car sales in the United Kingdom (UK) from July 2016 to December 2019. Available at: https://www.statista.com/statistics/385354/fiat-car-sales-in-the-united-kingdom/[ Accessed On: 29th March 2022]

Journals

Atanga, R.A., 2020. The role of local community leaders in flood disaster risk management strategy making in Accra. International journal of disaster risk reduction, 43, p.101358.

Bahçelioğlu, E., Buğdaycı, E.S., Doğan, N.B., Şimşek, N., Kaya, S.Ö. and Alp, E., 2020. Integrated solid waste management strategy of a large campus: A comprehensive study on METU campus, Turkey. Journal of Cleaner Production, 265, p.121715.

Bukar, A.L. and Tan, C.W., 2019. A review on stand-alone photovoltaic-wind energy system with fuel cell: System optimization and energy management strategy. Journal of cleaner production, 221, pp.73-88.

Chien, F., Kamran, H.W., Albashar, G. and Iqbal, W., 2021. Dynamic planning, conversion, and management strategy of different renewable energy sources: a sustainable solution for severe energy crises in emerging economies. International Journal of Hydrogen Energy, 46(11), pp.7745-7758.

Eker, M. and Eker, S., 2019. Exploring the relationships between environmental uncertainty, business strategy and management control system on firm performance. Business and Economics Research Journal, 10(1), pp.115-130.

Handayani, I.G.A.K.R., Sulistiyono, A., Leonard, T., Gunardi, A. and Najicha, F.U., 2018. Environmental management strategy in mining activities in forest area accordance with the based justice in Indonesia. Journal of Legal, Ethical and Regulatory Issues, 21(2), pp.1-8.

Hui, J., Qing-Xin, K. and Hui-Min, W., 2020. COVID-19 prevention and control strategy: management of close contacts in Hangzhou City, China. Journal of Infection and Public Health, 13(6), p.897.

Khan, I., 2019. Energy-saving behaviour as a demand-side management strategy in the developing world: the case of Bangladesh. International Journal of Energy and Environmental Engineering, 10(4), pp.493-510.

Koh, E.H., Lee, E. and Lee, K.K., 2020. Application of geographically weighted regression models to predict spatial characteristics of nitrate contamination: Implications for an effective groundwater management strategy. Journal of Environmental Management, 268, p.110646.

Li, X., Wang, Y., Yang, D. and Chen, Z., 2019. Adaptive energy management strategy for fuel cell/battery hybrid vehicles using Pontryagin’s Minimal Principle. Journal of Power Sources, 440, p.227105.

Liu, Y., Li, J., Chen, Z., Qin, D. and Zhang, Y., 2019. Research on a multi-objective hierarchical prediction energy management strategy for range extended fuel cell vehicles. Journal of Power Sources, 429, pp.55-66.

Omri, N., Al Masry, Z., Mairot, N., Giampiccolo, S. and Zerhouni, N., 2020. Industrial data management strategy towards an SME-oriented PHM. Journal of Manufacturing Systems, 56, pp.23-36.

Sitharthan, R., Sundarabalan, C.K., Devabalaji, K.R., Yuvaraj, T. and Mohamed Imran, A., 2019. Automated power management strategy for wind power generation system using pitch angle controller. Measurement and Control, 52(3-4), pp.169-182.

, J.R., Claman, D., Kezirian, E.J., De Marco, T., Mirzayan, A., Sadroonri, B., Goldberg, A.N., Long, C., Gerstenfeld, E.P. and Yeghiazarians, Y., 2019. Obstructive sleep apnea in cardiovascular disease: a review of the literature and proposed multidisciplinary clinical management strategy. Journal of the American Heart Association, 8(1), p.e010440.

Wang, T., Li, Q., Wang, X., Qiu, Y., Liu, M., Meng, X., Li, J. and Chen, W., 2020. An optimized energy management strategy for fuel cell hybrid power system based on maximum efficiency range identification. Journal of Power Sources, 445, p.227333.

Wang, Y., Li, X., Wang, L. and Sun, Z., 2019. Multiple-grained velocity prediction and energy management strategy for hybrid propulsion systems. Journal of Energy Storage, 26, p.100950.

Yoshikuni, A.C. and Albertin, A.L., 2020. Leveraging firm performance through information technology strategic alignment and knowledge management strategy: an empirical study of IT-Business Value. International Journal of Research-GRANTHAALAYAH, 8(10), pp.304-318.

Appendices

Appendix 1:

Appendix 2: