Assignment Sample on Global Market Analysing and Marketing Strategy

1. Introduction

Selection of an effective and efficient market entry mode assists in entering into a new market effectively. The report aims to discuss to analyse the market of China for justifying the reasons behind the selection of the market. Along with this, an effective “market entry approach” and marketing strategy for launching the fragrances from Arran in the marketplace of China will be discussed. There is a requirement for an effective “market entry technique” to develop the presence of the product in the new market. Therefore, macro and micro analyses of China will be presented for suggesting effective marketing strategies and techniques on the basis of the present market condition.

2. Choice of the country

Macro analysis of China

| Factors | Description of PESTE factors | Impact on Country Choice |

| Political and Legal | ● The “People’s Republic of China” operates as a socialist republic under the control of a “single party”, the “Chinese Communist Party (CCP)”.

● In the year 2021, the political stability index value of China is -0.48 points (bti-project.org, 2023). ● China enjoys favourable trading connections with the majority of the other major countries. ● A “progressive tax rate” with 5 levels will be applied to corporate income (worldwide-tax.com, 2023). ● The two main laws for regulating occupational health and safety in China are the “Occupational Disease Prevention Law” and the “Safe Production Law”. ● Customers are entitled to return goods or ask the company owner to perform repairs or swap them if the products or services they are receiving do not satisfy quality standards (Zhou et al. 2022). |

Moderate |

| Economical | ● With a nominal GDP of almost “US$18.321 trillion in 2022”, China will have the “second-largest economy” in the world behind the United States (tradingeconomics.com, 2023).

● Average annual inflation rate of China in 2022 was about 2.0 percent higher than the year before (statista.com, 2023). ● The cash rate was fixed at 2.75% pa in February 2023. ● “1 USD = 6.8307 CNY Mar 23, 2023 13:25 UTC” (currency-converter.org.uk. 2023). ● From 1990 and 2022, the average yearly “per capita disposable income” of Chinese households (in yuan) ● All businesses in China are subject to the “Chinese Business Tax”, sometimes known as the “Corporate Income Tax (CIT)”. It is assessed at a 25% rate on business earnings (tradingeconomics.com, 2023). |

High |

| Social-Culture | ● In 2022, the population growth of China decreased to 1.412 billion, following many years of sluggish growth (statista.com, 2023).

● This is about a 0.6% decrease in the Chinese population growth in the year 2022. ● Around 68.2 percent of the context of the overall population in this nation in 2022 was in “working age range of 15 to 64 years old”, in accordance with the citizenry’s age demographics. Over the age of 65, retirees composed around 14.9% of the overall population (statista.com, 2023). ● Consumers of China, who have always been strong savers, increased their commitment in 2022 to saving rather than spending their money. ● The emergence of “Gen Z” brings about a fresh transformation in the market due to their tremendous readiness to embrace novel ideas. |

Moderate |

| Technological | ● Emerging technologies in China are “Artificial intelligence”, self-driving cars, quantum technology, smart city “infrastructure, biotechnology”, “sophisticated materials”, and manufacturing (gravitasgroup.com.hk, 2023).

● The services sector, manufacturing, technology, and agriculture are some of the primary businesses and fields fuelling the growth of China. ● The growth of the IT market in China will decrease, going from 9.7% in 2021 to 8.2% in 2022 (tradingeconomics.com, 2022). ● The major two innovation waves in China are Deep Science innovation wave and Digital Age innovation wave. |

High |

| Ecological | ● The total rate of consumption of “renewable energy” was set to rise to “1 billion tonnes of standard coal equivalent (tce)” by June 2022 from 0.68 billion tce in 2020, and the percentage of non-fossil fuel power consumption was anticipated to rise to 20% by coming years (2025) from 15.9% in 2020, that could assist decrease carbon dioxide emissions (iea.org, 2022).

● Around 100 businesses on the countrywide emissions trading scheme have been penalised by the Ministry of “Ecology and Environment (MEE)” for noncompliance (china-briefing.com, 2023). ● With effect “from 8 February 2022”, the MEE has published new disclosure regulations (Rules) requiring domestic enterprises to provide a wide range of environmental indicators on an annualized basis. ● “Plan for the Reform of the Legal Disclosure System of Environmental Information” |

Low |

Table 1: Macro analysis of China

Micro analysis of China

| Micro factors | Description of Micro factors | Impact on country choice |

| Market size | By 2021, cosmetic chemicals sales in China were above US$ 21 billion. In 2023, the “Beauty & Personal Care industry” would produce almost “US$59.06 billion” in the context of revenue. The business market is expected to expand by 5.41% annually (“CAGR 2023-2027”). The segment of “Personal Care” will include a market value of almost “US$25.52 billion” in 2023 (made-in-china.com, 2022). | Positive |

| Market growth | The market is anticipated to increase by 4.7% year over the year starting in 2022, reaching US$ 22 billion (statista.com, 2023). By 2032, total sales of cosmetic compounds are projected to reach US$ 39.4 billion, increasing by around 1.8 times. More than 30% of demand in the mentioned country is for cosmetics ingredients for beauty and hair care products. In addition, the industry for personal grooming compounds is anticipated to “grow at a CAGR of more than 5%” annually during the projected period. | Positive |

| Intensity of competition | The level of competition in the personal care industry of China is moderate, which can have a significant positive impact on Arran. The market is growing which can increase the level of competition in future (ideas.repec.org, 2022). | Negative |

| Porters five forces | Threat of entry

The majority of Chinese citizens have discovered business prospects as the personal care market in their nation has grown incrementally over the past several years, resulting in a greater number of competitors (Isabelle et al. 2020). The competitiveness of the existing competitor There is a huge number of personal care companies in China because of which the level of competition among business firms is also very high. Substitute threat In the business market of China, the demand for personal care products is changing which creates a high chance of substitutes for existing companies. Buyers’ bargaining ability The number of personal care companies in China is huge, and because of the customers have the ability to choose products and services according to their needs (Al-Baldawi et al. 2019). This increases the bargaining power of buyers in the personal care industry of China. The supplier bargaining ability The availability of raw materials for personal care products in the business market of China is very high which offers organizations to select effective suppliers for their business operations because of which the bargaining power of suppliers is low. |

● Threat of entry– High

● The competitiveness of the existing competitor– Moderate ● Substitute threat– High ● Buyers’ bargaining ability-High ● The supplier bargaining ability-Low

|

| Consumers | Customer demands for products of personal care are driving the rise of three primary ingredient subcategories in the market in China such as “Natural and Premium Ingredients”, “Mild Antimicrobials” and “Colour Cosmetic Ingredients” (trade.gov, 2023). | Positive |

| Distribution intermediaries | Online sales are becoming the primary source of income for personal care companies competing in the Chinese cosmetics industry. Even with the technologically aware “Chinese Gen-Z”, “short-video platforms” and brand-owned channels ranked second and third, respectively, in terms of how frequently consumers in China made purchases of skincare and cosmetics in 2020 (trade.gov, 2023). | Positive |

Table 2: Micro analysis

3. Choice of market entry mode

Arran has developed its strong presence in the market of Scotland and the quality along with a variety of goods and services provided by this organization has assisted in developing the number of consumers. In the segment of launching its product in the market of China, the organization can use the mode of “Joint venture (JV)”.

| Benefits of “Joint Venture” | “Academic reference” |

| ● Significantly profitable

● Provides access to native expertise, resources, and business networks that minimize risk vulnerability within the destination nation. ● JV models may provide these advantages, allowing international subsidiaries to profit alongside regional partners.

|

Li et al. (2020) |

| ● It can help in building a strong base of consumers within a short period

● JV can be effective for acquiring local knowledge |

Dow et al. (2020) |

Table 3: Benefits of joint venture

JVs are commercial ventures that involve multiple individuals or organizations for a particular period of time. Unless both parties choose to continue their collaboration, the initiative usually ends once these goals are achieved. The legal agreement that both sides of a JV enter into regulates the business. As stated by Chan et al. (2022), the contract details the responsibilities in the context of both parties associated with how profits, as well as damages, would be divided, including their rights and duties. The usage of JV by Arran in the context of entering into the market of China can be effective as it can help the organization in developing a strong base of consumers within a short period, development of popularity, and awareness among consumers regarding the qualities of fragrances. Along with this, it can assist the organization in accessing “distribution networks” and developing the rate of profitability in China.

4. Recommendations on marketing strategy

4.1 Target Audience

| Base of segmentation | Targeting segmentation in the context of consumers | |

| “Geographic factors” | Density | “Urban and Rural” |

| Region | Shanghai | |

| “Demographic factors” | “Social status” | “Lower middle class”, “working class”, “Middle class” and “upper class”. |

| Gender | Female and male | |

| Age | Almost 14 years to about 60 years age | |

| Income | Low-income range to moderate and high-income scale | |

| “Behavioural factors” | “Benefits sought” | Cost advantages, variance, along with sustainability |

| “Occasions” | Regular | |

| “Psychographic factors” | “Personality” | easy-going |

| “Lifestyle” | “Healthy Lifestyle”, “Nomadic Lifestyle”, traditionalists, | |

Table 4: Target consumers

Before creating plans and strategies, the organization’s management must comprehend the demands and wants of businesses. Given that the company’s suggested product is fragrances, its target market is defined as being between the ages of 14 to almost 60 (statista.com, 2023). It can aid in increasing sales and fostering sustainability in the organization’s working procedures. The correct identification and analysis of consumer demands can aid in maximizing company opportunities and achieving corporate goals. Shanghai will be the target market for the suggested item because a larger portion of these markets requires products of sustainable qualities and high quality (Xiao, 2019). In order to manage customer satisfaction, Arran offers a broad range of services. After identifying the marketing variables, buyer demands, and organizational capabilities, effective management and segmentation strategies were developed, which helped to increase the number of stores and customers.

As stated by Soni et al. (2020), an organization’s ability to introduce creative ideas for the production of new products to increase the number of existing consumers and draw in new ones has been aided by an advantageous connection with providers and efficient communication among the firms’ stakeholders. The intended age, social status, gender, and income ranges in the demographic factors segment can aid in boosting product sales and developing an effective brand in specific markets. Strong brand awareness can benefit the company’s ability to compete and grow its revenue. In the retail sector, increasing product quality is essential for controlling customer satisfaction levels and gaining insight into their opinions on the creation of new goods and services.

4.2 Positioning

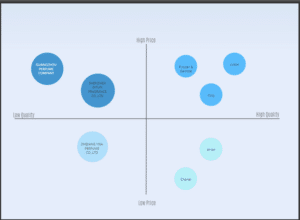

The consumers of China can get an effective range of variation in the context of fragrances at low costs as compared to the competitors of Arran. The “unique selling proposition (USP)” of this company would be “the ethical replacement for luxury fragrances”. As opined by Saqib (2020), effective understanding based on the needs and expectations of consumers can help Arran in providing effective services as compared to its competitors. The larger segment of consumers in China demands “Floral and fruity scents” in the segment of fragrances. The strapline of the goods will be “a perfect perfume for every mood” which would be translated into the Chinese language in China. The competitors in China such as Chanel, Coty, “Procter & Gamble”, LVMH, “SHENZHEN DITUN FRAGRANCE CO., LTD”, “ZHEJIANG YISA PERFUME CO., LTD.” and “GUANGZHOU PERFUME COMPANY” provide different goods and services in the context of personal care (arranchemical.ie, 2023). On the basis of “Hofstede score”, China scores almost 20, making it a “highly collectivist society” where individuals often place the requirements of the group “before their own”. It has effectively influenced in the development of promotional and distribution strategies. In the segment of distribution, Arran will use retailers and distributors in China to develop the sales and market value of this company.

Perceptual map

Figure 1: Perceptual mapping

4.3 Product strategy

The business market of China is highly competitive in the personal care industry. Therefore, in order to gain competitive advantages and expand its business operation in China market, Arran can use a differentiation products strategy in this business operation. The focus of this approach is on how the product of an organization stands out in the marketplace (Liang and Xiangmin, 2020). The USP of a product is determined by a number of variables. The qualities that set the product apart from others on the market could include the usage of premium materials for luxury. According to Danso et al. (2019), using a strategy of distinction, an organization may identify its goods and make them more appealing to buyers. This strategy can help Arran to make different and unique products from the firms already present in China market.

4.4 Pricing Strategy

| Factors | Impact on pricing strategy |

| Tariffs | Arran has to pay additional custom tax or tariffs on imports into China. |

| Costs | The availability of raw materials in the market of China reduces overall operating cost of Arran. |

| Political/economic | Exchange rate and government regulation of China will also be uncontrollable variables in the business market (Jiang and Kim, 2020). The change in tax rate can have a negative impact on the operating profit of Arran. |

| Consumer ability to pay | The target market will be prepared to pay a good price for premium products and services as the discretionary spending power of the consumer is set to rise. |

Table 5: Pricing

Therefore, Arran should use a demand pricing strategy in the business marketplace of China to expand its business operations. As per the opinion of Choi et al. (2020), “demand pricing strategy” helps an organization in enhancing its profit margins according to growing demands. In addition, it also helps in providing better customer services and enhances the satisfaction level of the customers. This can help in expanding the brand image of the firm in the business marketplace of China.

4.5 Distribution Strategy

In this segment, the usage of “Intensive distribution” technique can be used to develop sales as well as awareness among consumers. The selection of an effective distribution strategy is required to develop the sales of this organization in the market of China. As stated by Scarpi and Scarpi, (2020), the usage of this “distribution technique” can be effective for the development of fragrances by developing the presence of the product in different locations in the context of the targeted market. This strategy can be effective in fulfilling the needs and expectations of consumers (Melkonyan et al. 2020). There is a requirement for effective fulfilment of the needs of consumers in order to maintain the retention rate of consumers. The activities of developing the presence of products in different locations can be helpful in increasing awareness and developing the demand for fragrances produced by Arran in the marketplace of China.

4.6 Promotional Strategy

Businesses use promotional strategies as a tool to market, promote, and sell their products. A business decides on its approach to advertising based on a variety of variables, involving the factors associated with product type, budget for marketing, and customer demographics. As stated by Amin and Priansah (2019), the usage of “marketing communication mix” can be effective for developing effective awareness among consumers associated with the services and goods delivered by an organization. “Social media advertising” can help the company in developing sales in different locations in China.

| Factors | Impact |

| “Socio-cultural difference” | |

| Habits of media | There is the presence of several sites associated with “social media” for instance Tencent QQ, WeChat, “Xiao HongShu” and “Zhihu”. Almost “573 million” people in China are using “Sina Weibo” (studycli.org, 2022). |

| Multiple languages | In a country with 1.4 billion people, China has 302 distinct living dialects. To place that in context on a global scale, an astounding almost 20% of people speak Chinese as their first language (asianabsolute.co.uk, 2022). |

| Involvement of goods | The company can involve different products in the development of advertisements |

| “Legal and regulatory” | |

| Advertisement regulations | In the development of advertisement, the organization should focus on the acts of “FTC Act”, “Advertising Law of the People’s Republic of China (Advertising Law), 2015” (adchina.io, 2022). |

| “Economic- competitive differences” | |

| Competitors | The competitors of this organization include “Chanel, LVMH, Coty, and Procter & Gamble”. These organizations are using both digital as well as traditional marketing techniques. Therefore, the organization should focus on the development of unique content to attract consumers. The organization should focus on the services of “SHENZHEN DITUN FRAGRANCE CO., LTD”, “ZHEJIANG YISA PERFUME CO., LTD.” and “GUANGZHOU PERFUME COMPANY” (arranchemical.ie, 2023). |

| “Economic- competitive differences” | |

| Availability of media | “Central Propaganda Department of the CCP” is the major association in charge of “regulating the country’s media”, that is firmly under the CCP’s stringent control. The CCP is in charge of the biggest media outlets, including “People’s Daily”, “China Central Television” as well as “Xinhua News Agency” (adchina.io, 2022). Over 3,300 neighbourhood, regional, and nationwide television networks are available. |

Table 6: Factors associated with promotion

5. Conclusion

The report has evaluated the micro and macro environment of China. Arran can effectively launch the goods of fragrances in the market of China with the use of JV. This entering mode can help this organization in developing market value and building an effective base of consumers. Effective promotional efforts that are focused on the qualities and benefits of the suggested goods are necessary. It may help in effectively raising consumer knowledge of the products as well as fragrances. Wide service selection and reasonable pricing help businesses increase their market capitalization and gain competitive benefits in the business marketplace of China.

Reference list

adchina.io, 2022. The Massive Guide to China Advertising Regulations. Available at: https://www.adchina.io/china-advertising-regulations/#:~:text=In%20contrast%20to%20advertising%20in,version%20of%20a%20particular%20product. [Accessed on 26/03/2023]

Al-Baldawi, I.A., Mohammed, A.A., Mutar, Z.H., Abdullah, S.R.S., Jasim, S.S. and Almansoory, A.F., 2021. Application of phytotechnology in alleviating pharmaceuticals and personal care products (PPCPs) in wastewater: Source, impacts, treatment, mechanisms, fate, and SWOT analysis. Journal of Cleaner Production, 319, p.128584.

Amin, M. and Priansah, P., 2019. Marketing communication strategy to improve tourism potential. Budapest International Research and Critics Institute-Journal (BIRCI-Journal), 2(4), pp.160-166.

arranchemical.ie, 2023. Manufacturer of products for specialised chemical & industrial applications. Available at: https://arranchemical.ie/ [Accessed on 26/03/2023]

asianabsolute.co.uk, 2022. How Many Languages are Spoken in China? Available at: https://asianabsolute.co.uk/blog/2018/04/24/languages-spoken-in-china/ [Accessed on 26/03/2023]

bti-project.org, 2023. China Country Report 2022. Available at: https://bti-project.org/en/reports/country-report/CHN [Accessed on 26/03/2023]

Chan, A.P., Tetteh, M.O. and Nani, G., 2022. Drivers for international construction joint ventures adoption: a systematic literature review. International Journal of Construction Management, 22(8), pp.1571-1583.

china-briefing.com, 2023. China ESG Reporting – New Measures on Disclosure of Enterprise Environmental Information. Available at: https://www.china-briefing.com/news/china-esg-reporting-disclosing-enterprise-environmental-information/ [Accessed on 26/03/2023]

Choi, T.M., Guo, S., Liu, N. and Shi, X., 2020. Optimal pricing in on-demand-service-platform-operations with hired agents and risk-sensitive customers in the blockchain era. European Journal of Operational Research, 284(3), pp.1031-1042.

currency-converter.org.uk. 2023. CNY INR Historical Exchange Rate. Available at: https://www.currency-converter.org.uk/currency-rates/historical/table/CNY-INR.html [Accessed on 26/03/2023]

Danso, A., Adomako, S., Amankwah‐Amoah, J., Owusu‐Agyei, S. and Konadu, R., 2019. Environmental sustainability orientation, competitive strategy and financial performance. Business Strategy and the Environment, 28(5), pp.885-895.

Dow, D., Baack, D. and Parente, R., 2020. The role of psychic distance in entry mode decisions: Magnifying the threat of opportunism or increasing the need for local knowledge?. Global Strategy Journal, 10(2), pp.309-334.

gravitasgroup.com.hk, 2023. The Top Tech Trends in China for 2022. Available at: https://www.gravitasgroup.com.hk/blog/2022/06/the-top-tech-trends-in-china-for-2022 [Accessed on 26/03/2023]

ideas.repec.org, 2022. Intensity of competition in China: profitability dynamics of Chinese listed companies. Available at: https://ideas.repec.org/a/taf/apbizr/v16y2010i3p461-481.html [Accessed on 26/03/2023]

iea.org, 2022. Renewables increased their share of power generation in 2021 despite record growth in electricity demand and droughts affecting hydropower generation. Available at: https://www.iea.org/reports/renewable-electricity [Accessed on 26/03/2023]

Isabelle, D., Horak, K., McKinnon, S. and Palumbo, C., 2020. Is Porter’s Five Forces Framework Still Relevant? A study of the capital/labour intensity continuum via mining and IT industries. Technology Innovation Management Review, 10(6).

Jiang, F. and Kim, K.A., 2020. Corporate governance in China: A survey. Review of Finance, 24(4), pp.733-772.

Li, A., Burmester, B. and Zámborský, P., 2020. Subnational differences and entry mode performance: Multinationals in east and west China. Journal of Management & Organization, 26(4), pp.426-444.

Liang, J. and Xiangmin, H., 2020. Optimal Pricing and Product Differentiation Strategy under Different Price Leadership. Management Review, 32(5), p.205.

made-in-china.com, 2022. Cosmetic Chemical. Available at: https://www.made-in-china.com/products-search/hot-china-products/Cosmetic_Chemical.html [Accessed on 26/03/2023]

marketingtochina.com, 2022. Advertising in China – The Most Effective Strategies. Available at: https://marketingtochina.com/advertising-china/ [Accessed on 26/03/2023]

Melkonyan, A., Gruchmann, T., Lohmar, F., Kamath, V. and Spinler, S., 2020. Sustainability assessment of last-mile logistics and distribution strategies: The case of local food networks. International Journal of Production Economics, 228, p.107746.

Saqib, N., 2020. Positioning–a literature review. PSU Research Review, 5(2), pp.141-169.

Scarpi, D. and Scarpi, D., 2020. Hedonism and Utilitarianism in Intensive Distribution. Hedonism, Utilitarianism, and Consumer Behavior: Exploring the Consequences of Customer Orientation, pp.105-118.

Soni, N., Sharma, E.K., Singh, N. and Kapoor, A., 2020. Artificial intelligence in business: from research and innovation to market deployment. Procedia Computer Science, 167, pp.2200-2210.

statista.com, 2023. Age distribution in China 2012-2022. Available at: https://www.statista.com/statistics/270163/age-distribution-in-china/#:~:text=According%20to%20the%20age%20distribution,percent%20of%20the%20total%20population. [Accessed on 26/03/2023]

statista.com, 2023. Beauty & Personal Care – China. Available at: https://www.statista.com/outlook/cmo/beauty-personal-care/china#:~:text=The%20market’s%20largest%20segment%20is,k%20are%20generated%20in%202023. [Accessed on 26/03/2023]

statista.com, 2023. Monthly inflation rate in China from February 2021 to February 2023. Available at: https://www.statista.com/statistics/271667/monthly-inflation-rate-in-china/#:~:text=In%20February%202023%2C%20the%20monthly,at%202.0%20percent%20in%202022. [Accessed on 26/03/2023]

statista.com, 2023. Population growth in China from 2000 to 2022. Available at: https://www.statista.com/statistics/270129/population-growth-in-china/ [Accessed on 26/03/2023]

studycli.org, 2022. Chinese Society: A Study in Contrasts. Available at: https://studycli.org/chinese-culture/chinese-society/ [Accessed on 26/03/2023]

trade.gov, 2023. Distribution and Sales Channels. Available at: https://www.trade.gov/country-commercial-guides/china-distribution-and-sales-channels [Accessed on 26/03/2023]

tradingeconomics.com, 2022. China GDP Annual Growth Rate. Available at: https://tradingeconomics.com/china/gdp-growth-annual [Accessed on 26/03/2023]

tradingeconomics.com, 2023. Gross Domestic Product (GDP) in China. Available at: https://tradingeconomics.com/china/gdp [Accessed on 26/03/2023]

worldwide-tax.com, 2023. China Taxes. Available at: https://www.worldwide-tax.com/china/china-taxes.asp#:~:text=China%20Taxes,-Home%2FChina%20Taxes&text=As%20at%202022%2C%20an%20individual’s,corporate%20tax%20in%20certain%20regions. [Accessed on 26/03/2023]

Xiao, X., 2019. Linear marketplaces upon fixation line of Shanghai: a case study of Hongzhu Market. Linear marketplaces upon fixation line of Shanghai: a case study of Hongzhu Market, pp.34-43.

Zhou, L., Xue, P., Zhang, Y., Wei, F., Zhou, J., Wang, S., Hu, Y., Lou, X. and Zou, H., 2022. Occupational health risk assessment methods in China: A scoping review. Frontiers in Public Health, 10.

Know more about UniqueSubmission’s other writing services: