HA1022 Principals of Financial Markets Assignment Sample

Executive Summary

The main aim of this study is to execute a fundamental analysis of two different firms. In this, it includes the top-down analysis and bottom-up analysis for Woolworth’s supermarkets and Coles supermarkets in the Australia. In top-down analysis, it is defined that there is a mixed impact on the selected businesses of economic conditions of Australia. On the other hand, the bottom-up analysis of the selected organisations is also identified to measure the performance of the companies. In addition, it is suggested to both the organisations that there is a need of effective cash management system as well as better marketing strategies to enhance the business performance.

Introduction

It is an important think for the business organisation to identify the factors that can influence the business due to high competition and dynamic business environment. In order to highlight the influencing factors, an organisation can use the fundamental analysis that plays a significant role in the success of the business. In concern to this, Woolworths and Coles are the major organisation in the retail industry that are selected for the fundamental analysis as well as identify their performance in the market.

Woolworths and Coles supermarkets are the two large organisations in the Australian supermarket or in the retail sector of Australia. Both the organisations covers more than 80% market of the Australia as well as both has more than 200,000 employees. The mission of Coles is offer real values to all the customers by reducing the price with improve the quality of the services and easier delivery for batter shopping experiences. On the other hand, the mission statement of Woolworths shows where the firm want to be the heart of the community by providing loving items for kids, home and kitchen.

Top-Down analysis

The economic conditions and policies of a country impacts on the public as well as businesses, so, it is necessary for the country to manger them in an effective manner. The performance levels of the different organisations in a country are identified by the use of different parameters and indicators. But in concern to Australia, the retail and grocery store organisations are affected by the several parameters (Weil, 2012). The business of Woolworths and Coles supermarkets are influenced by several indicators of the economy like inflation rate, GDP, interest rate, exchange rate, etc. At the same time, in the Australian market, the business firms are allowed to operate the business at global level with any restriction because the Australia has free economy. In addition, there are several government policies are followed by the government like fiscal policy, EXIM and monetary policy. All these policies directly and indirectly impacts on Woolworths and Coles business in order to make decisions related with capital budgeting, financial management, investment, etc.

At the same time, according to the research of Wahlen et al., (2010), it is identified that the consumer buying patterns and purchasing power is the most effective areas of the economic condition of a country with impacting on the businesses also. Whereas, the economic growth of the country is also an influencing factor that also helps the business to grow the businesses in the retail sector. Moreover, the international economy also affects the businesses of the Australian organisation. In this, the economic slowdown and meltdown in the global level also affected to the Australian people where they become highly price sensitive. Thus, it can be said that the changes in economic fundamentals will impact the performance of Woolworths and Coles with overall retail industry.

There are some economic fundamental in concern with Australia business environment that that influences on the performance of the company. These are given as below:

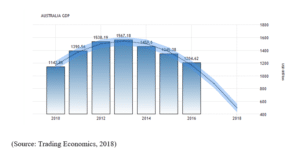

GDP of Australia

On the basis of graph 1, it can be said that the GDP in Australia has significant growth in the last 8 years mostly in the financial year 2013 that was 1567.18 USD Billion but after this it is rapidly decreasing. Additionally, it is expected that the future GDP will be decreased but in the year 2016 the GDP was more than 1200 USD Billion that was accurate as per the expectations.

GDP growth rate of Australia

On the other hand, as per graph 2, it is also identified that the GDP growth rate of Australia has dynamic growth rate such as in the second quarter of 2016, there was 1% growth rate whereas in fourth quarter of 2016, it declined with -0.2%. The graph of GDP growth rate is also defines that now it is showing average growth rate of GDP and it is constantly declining from several years. In addition, it is also identified that the decline in GDP can impact the sales and profit of businesses due to adverse impact of consumer confidence level.

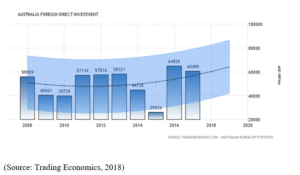

The foreign direct investment is another economic parameter:

FDI in Australia

As per the above graph, it is depicted that the FDI of Australia in the financial year 2017 was reported as 60499 AUD Million and it is forecasted that it will be slightly increase in the next financial years in FDI in Australia. This increasing trend in FDI of Australia will provide a positive impact on the business firms (Porter and Norton, 2012). It is because the foreign companies will invest more for the retail industry that will enhance the availability of resources in the retail market. Whereas, the foreign organisations also increases the competition in the retail industry that also negatively affects on the performance of the businesses.

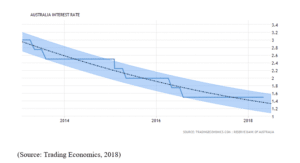

Australia Interest Rate

Apart from this, the interest rate also pays an essential role to impact on the performance of business through impacting to the decisions related with investment and finance. The below graph represents the interest rate for Australia:

On the basis of above graph, it is determined that the interest rate in Australia in current situation is 1.5%. It is decreasing continuously but the economist expects that it will increase up in future with 1.6% because of the static pattern of the interest rate. In order to improve the performance of the Australian businesses, the government focuses on the low interest rate strategy (Graham and Smart, 2011). It is identified that the lower interest rate is helpful strategy for the retail sector businesses because it increases the availability of money for enhancing the sale of retail and grocery items. At the same time, the organisation need not to provide the product and services at less financial cost and it will be helpful to increases the profitability. On the other hand, the Australian public can get the advantage of decreased interest rate to set own retail business that can reduce the demand of the organisation.

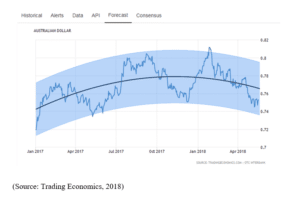

Exchange rate

The below graph represents the exchange rate of Australian dollars in respect of USD:

From the above graph, it is identified that the present exchange rate of AUD is 0.76 that is much affective for the business environment of the country. In addition, it is also defined that Australian exchange rate has a dynamic culture that may affect the performance of Woolworths and Coles (Coles supermarkets, 2018). In the current technological environment, the retail products are delivered by the both companies in the international market that is affected by the exchange rate. So both the organisations should increase their appreciation in AUD to increase the profitability.

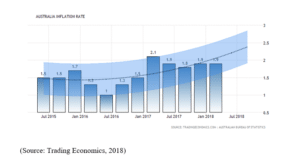

Inflation rate

The below graph is representing the inflation rate of Australia:

The present inflation rate is under the set limit and identified that it is 1.9. This inflection rate is showing increasing trend where the price of the product and services in the retail will enhance with a fast speed. It can affect the business of Woolworths and Coles because the purchasing power of the people can reduce due to increasing rate of inflation. The decline in sales of retail sector product will also reduce the profitability and revenue of Woolworths and Coles.

Bottom-Up analysis

In order to analyse the bottom-up analysis retail sector industry of the Australia, different key performance measures are identified for Woolworths Supermarkets and Coles Supermarkets. The below table are show the bottom-up analysis of both the organisations:

Woolworths Supermarkets

| Performance measures | 2016 | 2017 | 2018 (E) |

| Earnings per share | -0.98 AUD | 1.19 AUD | 1.34 AUD |

| Dividends per share | 0.77 AUD | 0.84 AUD | 0.93 AUD |

| Net Gearing (%) | 3.90% | 4.76% | 4.46% |

| Net Profit Margin (%) | -2.05% | 2.76% | 2.91% |

| Return on Equity (%) | 15.8% | 21.4% | 16,8% |

(Source: InvestSmart, 2018)

Coles Supermarkets

| Performance measures | 2016 | 2017 | 2018 (E) |

| Earnings per share | 36.2c | 254.7c | 260c |

| Dividends per share | 1.86c | 2.23c | 2.85c |

| Net Gearing (%) | 8% | 4.8% | 6% |

| Net Profit Margin (%) | 4% | 4.3% | |

| Return on Equity (%) | 11.5% | 12.3% |

(Source: InvestSmart, 2018)

Earnings per share (EPS)

The EPS ratio point outs the profit portion for the available shareholders or t it is an income of the outstanding share. As per the perspective of shareholders, it must be more to provide good profitability (Cumming and Johan, 2016). It is because the stock values and dividend payments in an organisation are depended on the EPS. The higher EPS shows the good financial strength of the firm as well as it provides high reliability for future investments.

As per the above tables, it can be said that EPS for Woolworths increased from 2016 to 2018 with a considerable margin. As same, Coles also has also increased their EPS in the same years but it has high increment then Woolworths EPS. It is indicating that the both the firms are in the profitable situation as comparison of other competitors in the industry. Coles is more attractive for the shareholders because it has more increment in the EPS in the estimated years.

Dividends per share (DPS)

DPS is that a part of net profit which is declared for distribution by the organisation for its outstanding shareholder. As same EPS, it is also expected to be higher to enhance the profitability on the investment for its shareholders. The performance measurement table defines that there is a continuous increment in the DPS of the both firm. But, in concern to this, Coles is providing higher amount as dividend to its investors and shareholders as comparison of other competitors.

Net Gearing

Net gearing ratio is a proportion of the total debt in respect of total shareholder’s capital. The net gearing ratio is helpful for a firm to measure the capital structure in order to determine the relativeness of liability and equity. As per the given table, the net gearing of Woolworths is continually increasing, but in concern of Coles, it is showing dynamic where it decreased in the year 2017 but increased in 2018. So, it can be said that Coles is facing problem to increase the money in the business.

Net Profit Margin

This ratio provides the profit of the firm in an appropriate percentage against the sales. It is expected by the firm that it should be high in order to show the ability of management for generating adequate profits to enhance the investors of the firm (Harvie and Van Hoa, 2016). According to above table, it can be said that the net profit margin for both firms are increasing from 2016 to 2018.

Return on Equity

The overall profitability of the firm can be measure by the use of return on equity in respect of invested money. Additionally, this measure should also be higher to provide high return on the investment to attract the investors. As per the given performance table, it is identified that the ROE of Coles is increasing but Woolworth’s ROE is providing variable outcomes but both are positive.

Summary and recommendation

On the basis of the above fundamental analysis, it can be concluded that the economic conditions of Australia are providing mix response to the selected companies. As per the top-down analysis, is identified that the GDP growth rate and GDP can reduce the opportunities for both the organisation that are selected. In addition, the economic environment of the Australia provides the opportunity to both the organisation but it may also create some problems for the same countries to enhance the performance. On the other hand, it is also concluded that the top-down analysis has summarised the performance of the both organisations. In which, it is identified that both the firms are performing better in concern to earning per share, profit margin and return on equity. Moreover, it is also identified that Coles must focus on the net gearing to enhance the attraction of the investors. The adoption of better cash management will be helpful for the company to pay out the interest expense.

References

Coles supermarkets (2018) Australia. [Online] Available at: https://www.coles.com.au/ (Accessed: 17 May 2018)

Cumming, D., and Johan, S. (2016) Venture’s economic impact in Australia. The Journal of Technology Transfer, 41(1), 25-59.

Graham, J. and Smart, S.B. (2011) Introduction to Corporate Finance. USA: Cengage Learning.

Harvie, C., and Van Hoa, T. (2016) The causes and impact of the Asian financial crisis. UK: Springer.

InvestSmart (2018) Company Financials – Coles Group Limited. [Online] Available at https://www.investsmart.com.au/shares/asx-cgj/coles-group-limited (Accessed: 17 May 2018)

InvestSmart (2018) Company Financials – Woolworths Group Limited [Online] Available at https://www.investsmart.com.au/shares/asx-wow/woolworths-group-limited/financials (Accessed: 17 May 2018)

Porter, G. and Norton, C. (2012) Financial Accounting: The Impact on Decision Makers Financial Accounting Series. USA: Cengage Learning.

Trading Economics (2018) Australia. [Online] Available at https://tradingeconomics.com/australia/indicators (Accessed: 17 May 2018)

Trading Economics (2018) Australia. [Online] Available at https://tradingeconomics.com/australia/inflation-cpi/forecast (Accessed: 17 May 2018)

Wahlen, J., Baginski, S. and Bradshaw, M. (2010) Financial Reporting, Financial Statement Analysis and Valuation: A Strategic Perspective. USA: Cengage Learning.

Weil, R.L. (2012) Financial Accounting: An Introduction to Concepts, Methods and Uses. USA: Cengage Learning.

Woolworth’s supermarkets (2018) [Online] Available at: https://www.woolworths.com.au/ (Accessed: 17 May 2018)

____________________________________

Know more about UniqueSubmission’s other writing services:

____________________________________________