HA3011 Advanced Financial Accounting Assignment Sample

Here’s the best sample of HA3011 Advanced Financial Accounting Assignment, written by the expert.

Introduction

The key objective of this report is to discuss the advanced financial accounting and its different aspects under an organization as to how financial accounting is done in an organization in order to manage its accounts. In this manner, Spark Infrastructure is one of the best options for accomplishing this research report ineffective way. In addition, the discussion about the accounting concept used by the company is included. At the same time, the conceptual framework, and the issue of the measurements are also examined under this study. In the end, this report also contains the fundaments qualitative characteristics of the company.

Background of the Company

Spark Infrastructure is identified as the company listed in the Australian Securities Exchanges in 2005 in Sydney, Australia and it also has the investment under infrastructure assets. In addition, a company has its main operation is to invest in quality infrastructure along with the focus on the Australian electricity networks. Due to its effectiveness in investment, most of the efficient assets in Australia have been considered by the Australian Regulator to the investments of Spark Infrastructure (Spark Infrastructure, 2019). At the same time, the company also provides an efficient combination of the cash generation capability in concern of present and the values creation opportunity in concern of the future. In this manner, it can be mentioned that its main aim is “to deliver long term value to Security holders through our quality portfolio of utility style assets”. Moreover, the company’s key person is Rick Francis who is its MR and the CEO as well.

Define the Accounting Concepts

While concerns the financial accounting, it is identified that on the foundation of the few basic concepts, the accounting principles are developed. In this way, these are the too basic concepts and due to this, most of the persons do not think about it while preparing the financial statements (Kieso et al., 2016). It is already cleared that these concepts are defined as the self-evident. In oppose to these accounting concepts, some theorists and accounting researchers mentioned that currently presented accounting concepts are wrong or these should be changed as per the emerging needs in financial accounting.

Apart from above, some beliefs that in order to understand the accounting as it exists today, it is essential to understand the underlying concepts which are used in organizations currently (Jollands and Quinn, 2017). In this manner, the basic accounting concepts which are adopted by Spark Infrastructure under the organization are defined below:

- Entity Concepts

Under this accounting concept, it is assumed that while concerns about the company financial statements as well as other accounting information of the company are needed to be considered because as per this concept, the entity has its separate identity from its owner. In this way, the company’s financial condition in terms of changes is expressed under the analysis of the company’s transactions that involve various expenses and revenue (Aziz and Ahmad, 2018). In a similar manner, Spark Infrastructure also follows these accounting concepts and due to this, it keeps its all the transactions separate from its owner so that accurate financial condition can be measured of the company.

- Going Concern Concept

As per this accounting concept, it is supposed that a business is continuing within its operations while the absence of the evidence to the contrary. Due to the connected performance of the entity, it is formulated by financial accosting through presuming that entity will continue its operations in respect of the long period of time in further years (Kamp et al., 2016). At this concern, it is examined that Spark Infrastructure also adopts this concept as because of this concept, the company uses the historical cost in order to evaluate different things under the business.

- Accounting Period Concept

This accounting concept defines that a company’s financial statements reflect the information of the company’s economic activities in respect of a specified period which is smaller than the organization’s life. Usually, the time period is similar to the length to facilitate comparison. In this similar manner, Spark Infrastructure adopts this concept with more criticalness so that it can identify its financial position in comparison to other companies in this same field for the specific time period.

- Dual Aspect Concept

The concept of dual accounting is based on the heart of the whole accounting process as the financial events are recorded by the accountant under the accounting books in concern of the wealth of the particular organization (Bedford and Ziegler, 2016). As per this concept, two main things are reflected by the accounting system under the organization and these things are the source of wealth and the form it takes. In this way, Spark Infrastructure follows this concept by adopting this, it can easily identify all the expenses and the revenues under the business.

- Realization or Recognition Concept

This concept is particularly used to reflect the amount of revenue which must be identified from provided sales. With the help of this realization concept, accountants determine that the specific amount has been earned under the business so that this amount can be considered while measuring the revenue of the company, recorded and reported it under the financial reports (Clikeman, 2018). Moreover, Spark Infrastructure also considers this concept under its financial accounting while finalizing the actual amount of revenue by selling its good and d services.

Thus, after discussing accounting concepts, it can be mentioned that Spark Infrastructure also adopts these accounting concepts with more focus so that it can identify the actual financial position of its business.

Discuss the Conceptual Framework and the Issue of Measurement

Conceptual Framework

While analyzing the conceptual framework, it is examined that financial accounting conceptual framework is the system that contains the set of various ideas and purposes that lead to the creation of different rules and standards which are more reliable. Moreover, for financial accounting under the business, these rules and standards help to define the nature and the functions of them (Macve, 2015). Although, these set of rules and standards reveal the financial accounting and statement limits. In this way, Spark Infrastructure also adopts this financial accounting conceptual framework under its business by its manager in order to prepare its accounting books with more accuracy and effectiveness. In a similar manner, the main objectives of Spark Infrastructure to develop its accounting conceptual framework are:

- To implement the standards of accounting

- To give the fundamental principles for organizational accounting

- To resolve the disputes in concern of accounting by providing the basis

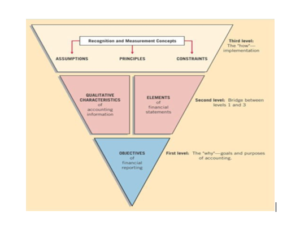

There are three levels under the conceptual framework that is considered under Spark Infrastructure and these different levels describe the set of different rules and standards which are as below:

First Level: Financial Accounting Objectives

Under the organization, the primary users of financial reporting are the organization’s potential and the existing investors, lenders, and creditors for the general purpose. In this way, it is determined that these primary users of the financial reporting use it for making the investment decisions for buying shares, bonds, and selling as well as debt the instruments, selling the loans, distributing the right of voting on, other form of credit and making the management decisions for the use of economic resources under the organization by Spark Infrastructure (Kieso et al., 2016). In this manner, the changes under the economic resources as well as claims and financial performance, etc are identified as the economic resources of Spark Infrastructure.

Second Level: Qualitative Characteristics of the Accounting Information and the Financial Statement’s Elements

The second level of the conceptual framework is identified as the bridge between level 1 and level2. This level identifies the qualitative characteristics of the useful financial reporting which are essential to identify the different type of information related to the company such as Spark Infrastructure. In this way, this information is quite beneficial for its users for making financial decisions on the basis of the company’s financial reports (Henderson et al., 2015). By applying these qualitative characteristics under financial reporting, Spark Infrastructure can be helpful for its shareholders.

At the same time, while discussing the elements of the financial statements, it is determined that there are few elements such as liabilities, assets, investment, shares, equity, expenses and incomes that are included company’s financial statements while measuring its financial position under the market (Cooper, 2015). These financial elements are determined as general groupings of the line items defined under the financial statements and the key objective of these elements to reflect the accurate financial condition of the company. In this manner, Spark Infrastructure considers these all the financial elements so that its stakeholders can find its actual position.

Third Level: Recognition and Measurement of Concepts

It is determined as the last level of the conceptual framework in which different concepts are considered related to Spark Infrastructure. As per this, the key objective of this is to implement the first level. In this manner, these various concepts are helpful to examine that when and how the financial elements should be recognized, measured and reported with the help of accounting system (Magnan et al., 2015). According to this conceptual framework of Spark Infrastructure, it adopts some important accounting concepts like monetary until assumption, going concern assumption, and the business entry assumption, etc for managing organizational operations.

Issues of Measurement

In the context of accounting measurement, it is the evaluation of economic and financial activities in terms of money, hours and the other units. In a similar manner, according to the current business changes, the accounting measurement’s part diagram of Spark Infrastructure has shifted. In this way, there have been different steps away from the historical costs in respect of fair value (Mitchell et al., 2015). In addition, it is done with the help of further controversial approach of the measurement under Spark Infrastructure. AT the same time, some key resources related to this controversy are defined which are as follows:

- The decisions of measurements are influenced by politics.

- Subjective nature of the estimates which are included in determining the fair value under which no active market in respect of an item.

- The role of management assumption and the judgment helps to develop the accounting information which is the resource of a high level of manipulation (Melnyk, 2018).

- Unpredictability under the assessment techniques is adopted by the entities.

- Variability under the measurement approaches that are used for the same and similar assets.

- Discretion and the subjectivity are involved under the identification of the important values (Kieso et al., 2016).

Examine the Fundamental Qualitative Characteristics – Understanding of Relevance and Representational Faithfulness

Financial statements are quite effective for the stakeholders of the company as they reflect some qualitative characteristics such as Understanding of Relevance and Representational Faithfulness (Herath and Albarqi, 2017). In this concern, it is determined that by these characteristics, it is easy for Spark Infrastructure to attract its shareholders towards the company. Moreover, these fundamental qualitative characteristics are defined below:

Understanding of Relevance

In respect of understanding of relevance, if the company’s financial information has the efficiency to influence the decision of its investors as well as its shareholders then it can be mentioned that the company’s financial information is quite relevant and it reflects the actual facts of the company. In addition, while making the decision of investing the funds under a particular organization, the investors need to look out the company’s stock efficiency first with a holistic perspective (Mbobo and Ekpo, 2016). In this manner, the company’s financial information can be found at its personal websites by its investors. Moreover, from the perspective of Spark Infrastructure, it is determined that the company’s financial information adds more values that are important while making the financial decisions by considering the past, present and the future information.

Representational Faithfulness

In a similar manner to above, it is important for the companies that their financial information should contain the faithful representation that can be ensured by preparing the financial statements with more accuracy so that the actual picture of the company can be seen by its investors. In this manner, the characteristic of Representational Faithfulness is defined in the three terms. First one is complete that means include all the organizational transactions under the statements. The second one is natural that means financial information must be free from the bias (Yurisandi and Puspitasari, 2015). Similarly, the third one is error-free information that means an organization’s financial information should be error free. These all the terms must be considered while preparing the financial statement so that it can be considered that all the information of the company contains the representational faithfulness with the completely natural facts.

Conclusion

On the basis of above defined facts, it can be concluded that Spark Infrastructure adopts the financial accounting in its organization by different manner as company finds the important financial information from its accounting that is quite effective for its stakeholders because they rely on the financial information provided by the organization in order to create their investment and other important decisions. In this manner, the accounting concepts are more important for Spark Infrastructure as these provide it some specific guidelines at the time of preparing its accounting books.

References

Aziz, N.M.A. and Ahmad, F.A., 2018. Islamic Green Accounting Concepts for Safeguarding Sustainable Growth in the Islamic Management Institutions. International Journal of Academic Research in Business and Social Sciences, 8(5), pp.830-847.

Bedford, N.M. and Ziegler, R.E., 2016. The contributions of AC Littleton to accounting thought and practice. Memorial Articles for 20th Century American Accounting Leaders, 49, p.219.

Clikeman, P.M., 2018. North Pole Car Wash: A Teaching Case Demonstrating The Advantages Of Accrual Basis Accounting. Journal of Business Case Studies (Online), 14(3), p.17.

Cooper, C., 2015. Accounting for the fictitious: a Marxist contribution to understanding accounting’s roles in the financial crisis. Critical Perspectives on Accounting, 30, pp.63-82.

Henderson, S., Peirson, G., Herbohn, K. and Howieson, B., 2015. Issues in financial accounting. AU: Pearson Higher Education.

Herath, S.K. and Albarqi, N., 2017. Financial reporting quality: A literature review. International Business Management and Commerce, 2(2).

Jollands, S. and Quinn, M., 2017. Politicising the sustaining of water supply in Ireland–the role of accounting concepts. Accounting, Auditing & Accountability Journal, 30(1), pp.164-190.

Kamp, A., Morandi, F. and Østergård, H., 2016. Development of concepts for human labour accounting in Emergy Assessment and other Environmental Sustainability Assessment methods. Ecological indicators, 60, pp.884-892.

Kieso, D.E., Weygandt, J.J. and Warfield, T.D., 2016. Intermediate Accounting, Binder Ready Version. US: John Wiley & Sons.

Macve, R., 2015. A Conceptual Framework for Financial Accounting and Reporting: Vision, Tool, Or Threat?. UK: Routledge.

Magnan, M., Menini, A. and Parbonetti, A., 2015. Fair value accounting: information or confusion for financial markets?. Review of Accounting Studies, 20(1), pp.559-591.

Mbobo, M.E. and Ekpo, N.B., 2016. Operationalising the qualitative characteristics of financial reporting. International Journal of Finance and Accounting, 5(4), pp.184-192.

Melnyk, O., 2018. Accounting for Profit or Loss from the Initial Recognition and Measurement of Biological Assets. Accounting and Finance, (3), pp.60-68.

Mitchell, R.K., Van Buren III, H.J., Greenwood, M. and Freeman, R.E., 2015. Stakeholder inclusion and accounting for stakeholders. Journal of Management Studies, 52(7), pp.851-877.

Spark Infrastructure, 2019. About the company. [Online] Available at: https://www.sparkinfrastructure.com/. (Accessed: 31st May, 2019)

Yurisandi, T. and Puspitasari, E., 2015. Financial Reporting Quality-Before and After IFRS Adoption Using NiCE Qualitative Characteristics Measurement. Procedia-Social and Behavioral Sciences, 211, pp.644-652.

________________________________________________________________________________

Know more about UniqueSubmission’s other writing services: