HR7003 The Pankras Express Café Sample

Task A

Key objectives of budgeting

Formation of business structure

Budgeting is considered an important technique that will help in developing financial position and operational sustainability and developing a financial structure of a company. Classification of total expenses under different factors such as fixed, variable, and operational expenses is said to be one of the vital prospects of budgeting.

As argued by Downes et al. (2017), proper performance management and development into the financial performances make a specific impact in developing finance in its operational techniques. Estimation of the appropriate structure and financial developments into the business strategies are considered as the two most important objectives of a budgeting process.

Prediction about the cash flows

Appropriate prediction of the cash flows and strategic evaluation of the sustainable policies make a proper impact and adequate increment into the organization’s performances. In this regard, it can be said that financial cash flow projection can be adequately implemented as it helps in justifying operational projections through budgeting analysis.

Development of the business structure and proper evaluation of the financial performance can be accessed through implementing the budgeting analysis of the business. As stated by Hagan et al. (2020), the impact of budgeting can be estimated based on justifying the financial performances of an institution.

The development of sustainable strategies and projection of the operational stability can be improved to make specific growth and operational improvements into the business. Budgeting helps in formulating gap analysis between the current and previous year financial performances.

Impact of budgeting procedure within Pankras Express Cafe

The application of robust budgeting systems can help in visualizing operational deficiencies and strategic deficiencies in the business. Pankras Express Cafe is associated with producing meals for the tourists and local citizens of the UK (As per case study). Implementation of the budgeting strategies will help in increasing its profitability and proper visitation of the financial prospects may help in uplifting the business value of Pankras Expressing Cafe.

As argued by Kurniawan and Sanapiah (2021), estimation of the effectiveness of a business and justification of its key activities enhances the budgeting opportunities of the business. In this regard, it can be viewed that there are financial deficiencies regarding the marketing strategies and improvements in its operational projection. Effective usage of money can be properly implemented as budgeting policies and financial practices have to be properly implemented to increase operational viability into the business projections.

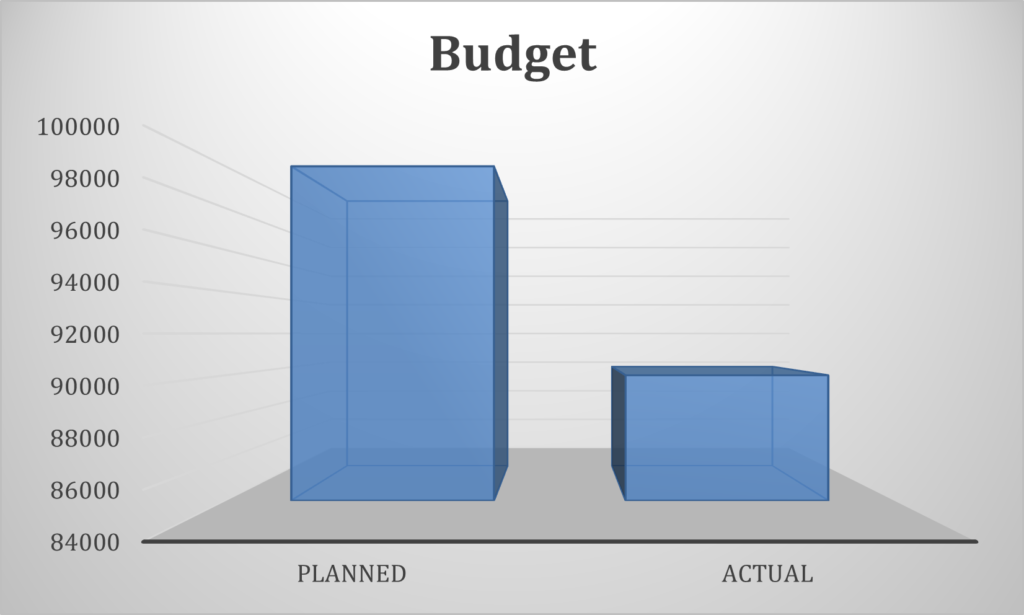

Figure 1: Planned and Actual budget

(Source: MS Excel)

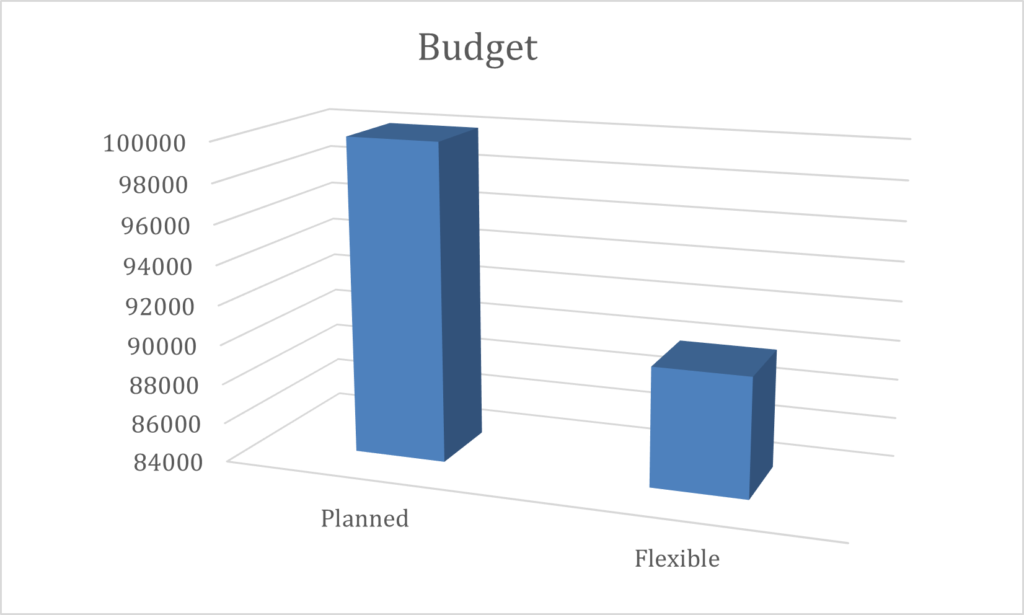

Figure 2: Planned and flexible budget

(Source: MS Excel)

Adaptation of the robust budgeting system within Pankras Express Cafe associate with generating operational increment and development of the financial structure in its business operation. Determination of the justified approach and operational development in its financial system can be adequately maintained by implementing a budgeting system in its operational viability.

As criticized by Martí (2019), performance management tools and marketing strategies have to be maintained to make improvements to the justified policies and operational developments in its marketing techniques.

Justification of the strategic activities and operational prediction into the marketing activities and classification of business issues may help in developing its business techniques. In this regard, it can be demonstrated that adaptation of the marketing prospects and implementation of budgeting strategies will facilitate in establishing a strategic marketing projection in Pankras Express Cafe.

Task B

Revenue and expenditure variance report of Pankras Express Café

| Planning | Actual | Variance | Variance (%) | Impact | |

| 20000 | 18000 | -2000 | -10% | Unfavorable | |

| Revenue (5.00q) | 100000 | 90000 | -10000 | -10% | Unfavorable |

| Raw materials (2.50q) | 50000 | 45000 | -5000 | -10% | unfavorable |

| Utilities (2500 + 0.05q) | 3500 | 3400 | -100 | -3% | unfavorable |

| Wages (5500 + 0.25q) | 10500 | 10000 | -500 | -5% | unfavorable |

| Facilities Rent | 5000 | 5500 | 500 | 10% | Favorable |

| Insurance | 2800 | 3200 | 400 | 14% | Favorable |

| Fuel | 2500 | 2800 | 300 | 12% | Favorable |

| Total cost | 74300 | 69900 | -4400 | -6% | Unfavorable |

| Net operating income | 25700 | 20100 | -5600 | -22% | Unfavorable |

Table 1: Revenue and expenditure variance report of Pankras Express Cafe

(Source: MS Excel)

Evaluation of the variance report of Pankras Express Cafe has been strategically furnished to make specific implementation into the operational strategies. Accumulation of the financial report can be used to make justification and financial valuation of its business. Based on the variance report, it can be estimated that there is a difference between the actual planning and budgeting techniques observed which can be treated as the weakness of Pankras Express Cafe in its financial structure.

As opined by Zimmermann (2017), evaluation of the business techniques and managerial perspectives of a business can be properly evaluated as it helps in evaluating the financial performance of a company. Determination of financial viability and operational projections of the financial data of Pankras Express Cafe helped in developing targeted financial approaches of Pankras Express Cafe.

| Planning

Budget 20000 units |

Flexible Budget 18000 units | |

| Revenue | 100000 | 90000 |

| Raw materials | 50000 | 45000 |

| Utilities | 3500 | 3400 |

| Wages | 10500 | 10500 |

| Facilities Rent | 5000 | 5000 |

| Insurance | 2800 | 2800 |

| Fuel | 2500 | 2500 |

| Total cost | 74300 | 69200 |

| Net operating income | 25700 | 20800 |

Table 2: Flexible budget for Pankras Express Café

(Source: MS Excel)

Flexible budget has been analysed in this paper to show the adjustment of revenue and planning budget for Express café. It has shown in above table that flexible budget change due to change in variable cost and remaining same due to fixed cost of the organisation. Based on the consideration of flexible budget it has been found that the net operating income should ne 20,800 while the actual is 20,100.

Task C

Strengths and weakness of Pankras Express Cafe

The operating income of Pankras Express Cafe has been evaluated as £20,100 for the month of June 2021 (as per the case study). In this regard, it can be viewed that the classification of the business approach into different perspectives may help in developing financial validity and sustainable business performances in its marketing activities.

Adequate viability into the business techniques and classifications of the expenses derived those variable expenses of Pankras Express Cafe were lower than its estimated total variable expense. As narrated by Sonmez et al. (2018), evaluation of the financial performance and evaluation of its financial techniques can help in developing financial viability and strategic growth into the business. On the other hand, it can be developed that a decrease in the total sales will reduce the total operational services of Pankras Express Cafe.

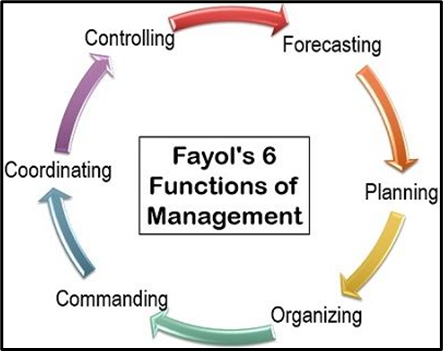

Figure 3: Fayol’s management theory

(Source: Hussain et al. 2019)

Fayol’s theory of management may be applied within Pankras Express Cafe as it can help in ascertaining the financial value and operational projection of its business techniques. Productive analysis of marketing techniques and classification of the business tools have been strategically implemented in forming financial development in its business operation.

Further, variable report analysis states that overall operational expenses regarding insurance, fuel, and factory rent have been showing a positive in its business operation. As opined by Berber et al. (2020), instrumental tools and marketing technique need to be evaluated as it helps in deriving financial values in its operational channels.

In addition, it can be opined that a decrease in the total expense makes a negative impact on the operational projection and strategical estimation in its financial systems.

Task D

Explanation of profitability and sustainability

Profitability

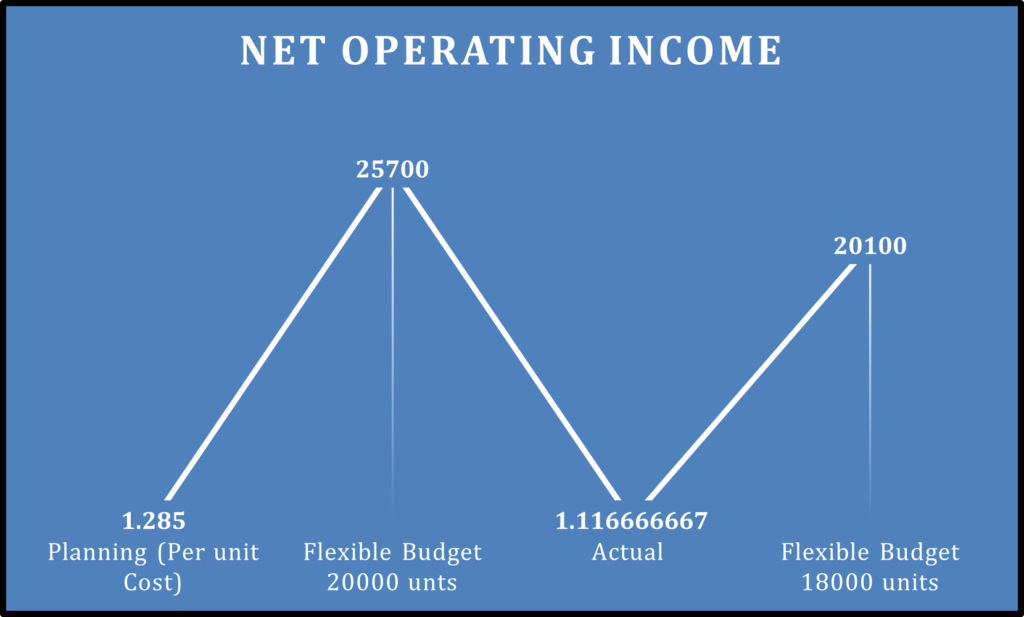

Figure 4: Net operating income of Pankras Express Cafe in June, 2021

(Source: MS Excel)

The profitability of a business is said to be related to the total profit of a business as profitability is not denoting the actual amount of profits. Further, it can be demonstrated that the profitability of a business can be demonstrated by using metrics that may be used in determining the scope of generating profit in relation to the total volume of the profit related to its financial activities.

The organizational efficiency and financial performances of a company can be derived based on evaluating its financial structure and operational projection in its business perspectives. As narrated by Zhichkin et al. (2020), improvisation into the financial policies and operational validation in its target marketing policies can be improved as there is strategic impact and financial generation of the marginal activities in its business viability.

Estimation of the marketing approaches and classification of the financial data may help in improving its financial performance.

Sustainability

Financial performances and business approaches can be strategically implemented based on sustainability performances within a company’s financial performance. Long term value of a company should need to be evaluated based on increasing financial performance and operational validity into the business. Target marketing policies and strategic development into the business should need to be developed to make improvements to the operational perspective of a business.

As expressed by Martínez et al. (2019), the financial development of a business is related to increasing sustainability and growth of that business. In this regard, it can be developed that the organizational performance of a business can be properly estimated through maintaining sustainability factors in its operational projections. The relativity of generating sustainability of a business can be observed as there is specific tool and marketing justification in its financial operations.

Certain measures are required to be adapted within Pankras Express Cafe

Overall profitability and sustainability of Pankras Express Cafe can be implemented based on reducing total operational costs of its company along with increasing sales volume of the business. The productivity and sustainability of Pankras Express Cafe can be improved by generating potential changes in the financial structure and operational mobility of the company.

Based on the financial report, it can be discussed that the total operating income of Pankras Express Cafe is facing deficiency in generating estimated operating profit in its business. Hence, it can be viewed those strategic techniques should need to be applied as it will help in generating sustainability in its business operations.

Currency price rates and generating sustainability may help in improving the financial structure of the company. In this regard, specific tools and marketing approaches such as inventory maximization, reduction of the overheads, growth maximization, and many others have to be marinated by Pankras Express Cafe to increase profitability in its business operations.

In addition, it can be viewed that sales promotion will be developed as one of the strategic ways which will help in the accumulation of estimated profit in its financial projections. On the other hand, modification of the financial strategies may help in increasing sustainability as well as improving the profitability of Pankras Express Cafe.

Reference list

Berber, A., Harding, N. and Mughal, F., 2020. Instrumentality and influence of Fayol’s doctrine: history, politics and emotions in two post-war settings. Business History, pp.1-14. Available at: https://www.researchgate.net/profile/Nancy-Harding/publication/343742639_Instrumentality_and_influence_of_Fayol’s_doctrine_history_politics_and_emotions_in_two_post-war_settings/links/5fc7923792851c00f8453e51/Instrumentality-and-influence-of-Fayols-doctrine-history-politics-and-emotions-in-two-post-war-settings.pdf

Downes, R., Moretti, D. and Nicol, S., 2017. Budgeting and performance in the European Union: A review by the OECD in the context of EU budget focused on results. OECD journal on Budgeting, 17(1), pp.1-60. Available at: https://ems.uniza.sk/wp-content/uploads/2019/03/EMS_1_2018_5_Emerling_Wojcik-Jurkiewicz.pdf

Hussain, N., HAQUE, A.U. and Baloch, A., 2019. Management Theories: The Contribution of Contemporary Management Theorists in Tackling Contemporary Management Challenges. Journal of Yaşar University, 14, pp.156-169. Available at: https://dergipark.org.tr/en/download/article-file/900585

Kurniawan, W. and Sanapiah, A.A., 2021. How BPS-Statistics Indonesia to Handle The Effectiveness of Information System of Public Budgeting Management?. Jurnal IlmiahAdministrasiPublik, 7(1), pp.30-40. Available at: https://jiap.ub.ac.id/index.php/jiap/article/download/1166/1484

Martí, C., 2019. Performance Budgeting and Medium-Term Expenditure Frameworks: A Comparison in OECD Central Governments. Journal of Comparative Policy Analysis: Research and Practice, 21(4), pp.313-331. Available at: https://zaguan.unizar.es/record/84315/files/texto_completo.pdf

Martínez-Martínez, A., Cegarra-Navarro, J.G., Garcia-Perez, A. and Wensley, A., 2019. Knowledge agents as drivers of environmental sustainability and business performance in the hospitality sector. Tourism Management, 70, pp.381-389. Available at: https://www.researchgate.net/profile/Juan-Cegarra/publication/328190782_Knowledge_agents_as_drivers_of_environmental_sustainability_and_business_performance_in_the_hospitality_sector/links/6092718292851c490fb743bd/Knowledge-agents-as-drivers-of-environmental-sustainability-and-business-performance-in-the-hospitality-sector.pdf

O’Hagan, A., MacRae, C., O’Connor, C.H. and Teedon, P., 2020. Participatory budgeting, community engagement and impact on public services in Scotland. Public Money & Management, 40(6), pp.446-456. Available at: https://www.researchgate.net/profile/Angela-Ohagan/publication/336867542_Participatory_budgeting_community_engagement_and_impact_on_public_services_in_Scotland/links/5e7b939ea6fdcc139c017bbf/Participatory-budgeting-community-engagement-and-impact-on-public-services-in-Scotland.pdf

Sonmez, C., Ozgovde, A. and Ersoy, C., 2018. Edgecloudsim: An environment for performance evaluation of edge computing systems. Transactions on Emerging Telecommunications Technologies, 29(11), p.e3493. Available at: https://scholar.archive.org/work/uiolxyzaarhbzni272nvnidwee/access/wayback/https://www.researchgate.net/profile/Atay_Ozgovde/publication/317067647_EdgeCloudSim_An_Environment_for_Performance_Evaluation_of_Edge_Computing_Systems/links/5925e39b458515e3d4537990/EdgeCloudSim-An-Environment-for-Performance-Evaluation-of-Edge-Computing-Systems.pdf

Zhichkin, K., Nosov, V., Zhichkina, L., Zhenzhebir, V. and Rubtsova, S., 2020. The agricultural crops production profitability in modern conditions. In E3S Web of Conferences (Vol. 175, p. 13008). EDP Sciences. Available at: https://www.e3s-conferences.org/articles/e3sconf/pdf/2020/35/e3sconf_interagromash2020_13008.pdf

Zimmermann, A., 2017, September. Modelling and performance evaluation with timenet 4.4. In International conference on quantitative evaluation of systems (pp. 300-303). Springer, Cham. Available at: https://www.tu-ilmenau.de/fileadmin/Bereiche/IA/sse/Pubilcations/2017/TimeNET-QEST2017.pdf