International Strategic Management Individual Assignment Sample

1. Introduction

The present study has been focused on explaining the competitive environment of the carsharing industry and value-adding activities. Furthermore, it will describe the international entry mode, and the creating-shared value has described.

2. Task 1: Critically analysing the competitive environment

SEAT has been playing a significant role in Australia regarding introducing its carsharing company in Newcastle city. The city has a significant competitive market based on this industry, and the competitive environment of this industry has played a crucial role in the company’s performance.

| Porter five forces | |

| Threats of new entry (Weak) | ● Time and cost for any entry

● Knowledge ● Economic scale ● Technological advancement |

| Bargaining power of suppliers (Moderate) | ● Suppliers number

● Uniqueness in their supply ● Cost of changing |

| Bargaining power of customers (High) | ● Cost of changing

● Inflation rate ● Competitors availability ● Getting more than enough substitute |

| Threats of substitute (Weak) | ● Performance of substitute

● Cost management ● Presence of uniqueness |

| Competitive rivalry (High) | ● Presence of a vast number of competitors

● Difference between product ● Switching cost ● Customer loyalty program ● Quality differences |

Table 1: Porter Five forces

(Source: Designed by Learner)

Porter’s five forces

-

Threats of new entry (Weak)

Car sharing industry has been correctly modified with better strategies to provide rental cars to the customers for a short period. New entrants will require more knowledge about customer’s expectations and customer’s capacity to rent cars (Ahi et al. 2017). Therefore, new entrants will need to do a complete marketing analysis, requiring more time. As Bashir and Verma (2017) mentioned, continuous changes in the economic scale have played a significant role in providing an ups and down situation to industry as in case inflation rate is increased in the country, the industry will face a considerable loss in cost. This type of economic scale’s fluctuation ruins the new entrants’ corporate practices.

On the other hand, technological advancement has played a significant role as various technologies have been invented every year. Therefore new entrants will be required to implement it; however, cost will differ in that case (Batista et al. 2018). This kind of innovative technical fluctuation will not provide better circumstances to perform business for new entrants. Therefore, it will be impossible for the new entrants to take over the ongoing markets.

-

Bargaining power of suppliers (Moderate)

As a carsharing industry, the industry has various supplier types such as raw materials suppliers, fuel suppliers, and others can be influenced by any future situation and deny supply things for a specific carsharing company (Brendel et al. 2020). However, its power of influential characteristics has been described as moderate as in emerging-market suppliers number has been increased rapidly. Therefore, industry can grab any other alternative suppliers in case someone refurbished to supply.

Uniqueness in supplying methods has influential characteristics in the carsharing industry on which customers’ expectations can be met. Ferrantino and Koten (2019) stated that continuously ch be a cause of suppliers’ negotiating matters. Due to the increasing cost of raw materials and fuel, suppliers have to increase their costs (Geissdoerfer et al. 2018). It has partially influenced the customer’s budget, and it can be one reason for customer loss.

-

Bargaining power of customers (High)

Customers’ bargaining power has played an essential part in demotivating the industrial manner. Continuously changing costs can demotivate the customers, and they can look for an alternative. As per the view of Hansen et al. (2019), the country’s inflation rate and political interference have partially demotivated the industrial performances. As Joo (2017) mentioned, the Australian government can introduce any policies or increase living costs in the country. That will partially negotiate the customer’s thought process. Due to political interference or inflation rate, the industry may require an increase in cost, and middle-income-based customers may not be able to rent their cars (Kang and Na, 2020).

Therefore, losing customers can be observed as lowering the corporate performances of the industry.

Focus on the matter that customers can be lost due to increasing competition in the overseas markets (Ko, 2019). Getting more than enough substitutes for the carsharing industry can partially demotivate the business of this industry. As Koo et al. (2019) discussed, middle-income range to lower-income range-oriented customers is mainly incorporated with this industry as they cannot afford their cars or vehicles for roaming here and there.

-

Threats of substitute (Weak)

Mainly, this industry has public transport as a substitute for carsharing or CB booking systems present globally. Therefore, increasing the number of alternative options can be a significant risk for the industry as the customers can easily be motivated by the substitute’s performances (Mukherjee, 2018). Therefore, the industry has been conscientious while representing the floating systems or round trip.

Significant risk will be increased in the cost part of the industry. In case customers are noticed, the industry’s rental cost has been higher than other substitute options available in overseas markets such as public transport, governmental transport, transport offered from tourism, and others with hints of uniqueness in cost or vehicle rental discounts (Müller, 2019). It will partially hamper the performance of this industry.

-

Competitive rivalry (High)

In the overseas markets, there are a considerable number of competitors present. Therefore, the industry needs to offer considerable discounts to attract customers or lower the customers’ costs. As per the opinion of Porter and Kramer (2019), switching costs will not be entertained in the industrial practices as customers will be highly demotivated from the industry if its composting fluctuates much.

According to Schellenberg et al. (2018), quality is required to be more precise. The customers’ corporate social responsibility regarding taking care of the environment by utilizing biofuel in vehicles’ engines will attract customers. All that things are benign provided by the competitors, such as public transport awards within the country. Therefore, customers are highly influenced by such practices and motivated to stand for the competitors rather than this industry (Johnson et al. 2019).

3. Task 2: Internal value-adding activities

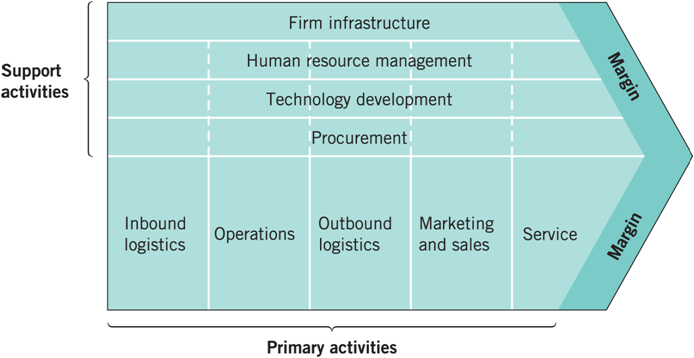

Internal value-adding services can be defined utilizing value-chain theory;

- Primary activities It is related to direct maintenance and support as well as meeting the customer’s expectations.

-

Inbound logistics

:This facility has been directly performed with suppliers’ connection with the company. SEAT has been trying to introduce its new vehicle Minimo in Newcastle’s market, an Australian market. In such means, raw materials such as vehicle’s parts, fuel, and other elements are required to be more precisely implemented in the vehicle’s parts (Ahi et al. 2017). It will help the company to reduce accidental risk and get customer’s preferences quickly. As Bashir and Verma (2017) cited, distributing all vehicles in the whole Newcastle’s markets will be performed in favor of this planning of entry mode. It will be easier for the people to order their ride from wherever they want in the city.

-

Operations

Prominent operational techniques will help the company to get customer’s attention. In such a manner, the company will be required to introduce mobile applications available for the people as it will be easy to order rental cars for the customers. As influenced by Koval et al. (2019), driver availability should be an operational option as many customers prefer drivers to drive their rental cars instead of them. By contrast, the company must introduce its car repairing employees who are readily available across the city if any emergency occurs and customers need help from the mechanic. It will help to meet customer’s expectations.

-

Outbound logistics

In this part, the company can store cars and collect vehicles from the various automobile companies. As per Batista et al. (2018), many customers have a requirement regarding particular branded cars. Therefore, the company should have the availability of various company’s cars along with their own. As per the view of Brendel et al. (2020), the company’s employees must have the technical knowledge and driving sense as it will help the company enhance its performance regarding business.

-

Marketing and sale

Marketing and sales are required to be more enhanced as marketing in a better manner can increase its activities. Management of this company’s operational activity department is required to gain marketing strategies such as customer’s choice, cost of competitors, and others (Ferrantino and Koten, 2019). It will enhance the service process of this company. Costing should be prominent and equal in all areas of the city in order to develop customer loyalty.

-

Services

Service is playing an essential role in increasing company’s performance. Employees must enhance their technical knowledge, and higher authorities should provide them training regarding new technological implementation (Geissdoerfer et al. 2018). Maintaining services in a better condition will help to gain more customers. Uniqueness in supplying methods has influential characteristics in the carsharing industry on which customers’ expectations can be met. Following this will help the customer, and linkage relation strongly binds with the company.

-

Figure 1: Value-chain

(Source:)

-

Supporting activities

It is based on supporting the primary activities by utilizing linkages.

-

Procurement

It is a linkage or relationship with a value-adding service for the company. Purchasing more vehicles will help to store more cougars and thus customers’ can rent many cars from the company. Finding appropriate vendors for renting the cars will increase relations with other parties, mainly linkages (Hansen et al. 2019). Therefore, it can partially help in increasing customer’s involvement and thus help to improve brand value.

-

Human Resources Management

The HR team of this company must recruit more employees based on technological knowledge. The team is required to train the employees in a better manner (Joo, 2017). An acceptable Hr practice will enhance the company’s performance in a better way.

-

Technological development

In case any technical advancement is introduced in the overseas market, the company should be able to implement it within the premises. Automation in the car manufacturing department will manufacture more cars within a short period (Kang and Na, 2020). Therefore, the company can obtain cars for huge customer requirements, which would provide them with an extra competitive edge to sustain their business in this competitive era.

-

Infrastructure

This company’s infrastructure is required to be more prominent, and the higher authorities are required to execute strategies for operational work (Ko, 2019). Employee’s salary, wages, company’s size, legal and administrative aspects should be carefully starred within the premises (Koo et al. 2019). Cost determination should be implemented appropriately within the company as it will help to attract customers.

-

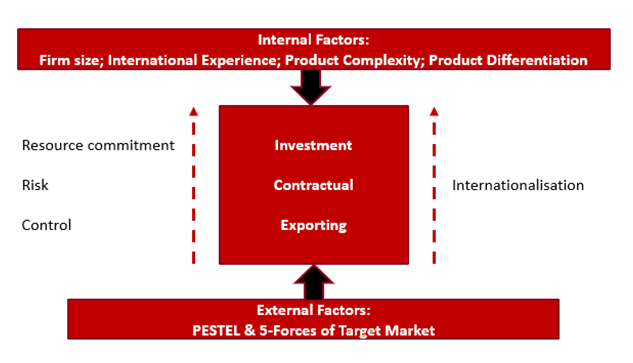

4. Task 3: Critically evaluate the various modes of entry and recommendation

The company can introduce Minimo to the overseas markets for achieving immense profits and the customer’s involvement. As per the view of Mukherjee (2018), mode of entry in the international market can be defined as six steps such as licensing, franchising, direct exporting, joint venture, strategic acquisitions, and foreign direct investment. Entering a foreign market requires a company to adopt a specific strategy that can ensure success. Business companies develop these strategies by analysing their intended market’s business environments and performing an internal analysis of company resources and capabilities. Three entry modes are available to SEAT in their current entry in New Castle, Australia, and these are a joint venture, acquisition, and Greenfield investment. According to Watch (2014), a company should choose a mode of entry through a thorough evaluation of business’s internal and external factors.

Figure 2:Factors Affecting Choice of Entry Mode

(Source: Watch, 2014)

Joint Venture

A joint venture is a mode of entry that requires direct investment by a company into a foreign market in collaboration with another local company. In this entry node, both local and external companies share their resources, investments, risks, and profits. Joint entry mode provides reduced levels of control to a company on its foreign operations. However, foreign companies can utilize a local company’s developed reputation to establish its business, which reduces levels of risk for business, and companies do not need to commit all of their resources and reduce business risk (Xie et al. 2018). SEAT can enter Australia by creating a joint venture in business with a local company that provides carsharing facilities to its customers. A joint venture such as this can be cooperated through exporting Minimό cars to Australia and incorporating them in business and setting up local manufacturing may not be required.

Acquisition

SEAT can consider acquiring a local carsharing company of New Castle, Australia, that provides business-to-customer services by purchasing the majority or entirety of this company’s shares. As can be understood from this business concept, this entry mode would require SEAT to invest a considerable amount of money. Acquisition would require SEAT to arrange an account for all the resources required for setting up and operating a business in Australia (Semeraro et al. 2020). Acquisition business involves huge risk factors as SEAT is a new foreign company in Australia, unaware of this new market’s trends. Setting up a local manufacturing facility would be essential for operating business properly in acquisition mode. Despite huge risks involved in this entry mode, it would allow a car-manufacturing company to earn greater profits compared to joint ventures upon successful adoption.

Greenfield Investment

Greenfield investment is a comparatively new business entry mode that provides business prospects and opportunities similar to foreign direct investments. This investment mode allows a foreign company to exert maximum control over its activities in a foreign land. Therefore, adopting this entry mode would allow SEAT to operate its activities in Australia with greater precision and provide better control. As cited by Simatupang et al. (2017), similar to acquisition mode of entry, greenfield investment requires a large amount of investment and involves more significant risk in business. However, such direct foreign business approaches are the most suitable modes of entry for large companies that have experience conducting foreign business and operating in the international market. SEAT would be required to set up local production factories and operational processes in Australia to implement Greenfield investment properly in their business.

Recommendation

Based on the above analysis and critical evaluation, it can be recommended that a joint venture would be the most suitable mode of entry for SEAT in case it entered the Australian market. There are several benefits a joint venture would provide over acquisition or Greenfield investment to this company. SEAT is a German car-manufacturing company that operates mainly over the business-to-business model and does not experience a car sharing business. Thus, a joint venture with another local business-to-consumer car sharing company, SEAT, would gain the opportunity to utilize this company’s industry experience and local resources.

Joint ventures may create lower business profits for SEAT compared to the other two entry modes discussed here. However, it would involve far lesser risk and would not need such huge investments and resource facilities. A joint venture business would enjoy requiring this company to set up local manufacturing units immediately and could be operated through exporting as well. Therefore, joint ventures can be deemed as the most appropriate mode of entry for a medium-sized car manufacturer such as SEAT that has limited international business experience.

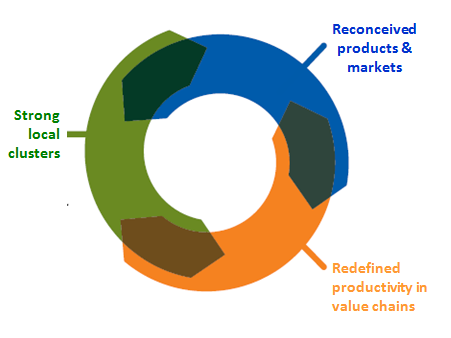

5. Task 4: Critical reflection on believing that SEAT supports CSV

The creation of shared value is an emerging concept in modern business literature related to sustainable business practices. Modern business consumers are becoming increasingly aware of the consequences of the products they consume and the processes involved in their preparation and operation (Yun et al. 2020). In this context, creating shared value (CSV) has become a popular business concept, which suggests that businesses should strive to create social values along with economic values. Many companies are modifying their production and manufacturing process and creating products that can benefit the local community along with increasing business revenue of company (Semeraro et al. 2020). CSV models allow businesses to attend to social and communal im[pacts of business along with its financial growth.

According to business literature, there are three main ways a company can create shared value and introduce modifications in business to create positive social impact.

Re-conceiving products and markets

This process involves re-conception of products by taking the needs of both local and international markets into consideration. In this approach, companies redesign and re-conceive their products to increase company revenue, meet customer demands, and improve its social implications. New and improved products can address relevant social issues and create improvements in the local community. Viverita (2019) stated it is considered an essential step in creating CSV, and business organizations adopt this approach most often.

Redefining value chain activities

Value chain activities and operations involved in the value chain of a company have significant social and economic impacts. Therefore it is critical for companies that aspire to create shared value to review and redefine the various activities in different levels of their value chain. Companies need to adopt this approach to create shared value, and this requires them to identify the different activities in their relevant industry that have social and environmental implications (Siamwalla, 2017). Proper identification and definition allow companies to modify value chain activities for creating more social and economic value.

Strengthening local clusters

Creating a robust local cluster involves shuttering knowledge gained by a company with its local community directly impacted by that company’s business operations. This strategy requires a company to share its improved technologies or capabilities with its local competitors to benefit the local community. Companies that intend to create actual shared value adopt activities that create knowledge among the local community.

Figure 3:Three Ways of Creating Shared Value

(Source: Porter and Kramer, 2019)

SEAT is a car-manufacturing company that is aspiring to introduce a new product, Minimό cars, in Australia through its new business venture of entering into the carsharing industry of Australia. Minimό is an electric car model that operates by electric batteries and does not utilize any non-renewable fuels such as petrol or diesel. This is a modern product designed to meet the demands of modern customers regarding environmental sustainability and conservation (Sinthupundaja and Kohda, 2019). Thus, it can be considered as an approach for an attempt by SET to create shared values through the first approach discussed above, which involves re-conceiving products to meet a new demand for customers. This product has provided sufficient economic value to this company by increasing company revenue and has addressed the social issue of fuel conservation, thus creating shared value successfully.

However, other approaches such as redefining value chain activities so that it creates environmental and social benefits or sharing their knowledge regarding electric vehicles with other competitors have not been observed among SEAT’s activities. A company that intends to create shared value as a part of its business priorities would focus on addressing these aspects of CSV and reinvention of products (Schellenberg et al. 2018). On the other hand, SEAT has focused its business activities on developing economic aspects of its business in its expansion to New Castle, Australia, and entering carsharing industry, which shows promising financial opportunities for business. Furthermore, this company has not taken any initiative to share its knowledge with local competitors and provide them with the technologies required for manufacturing electric cars, which would allow these companies to create electric cars.

This process would have enabled local car manufacturers to produce electrical cars at a mass production level. It may have allowed these companies to improve their business’s environmental aspects and create shared value as well. SEAT has not offered its knowledge of electric car manufacturing to local companies of Australia to improve environmental issues of the local community and create shared value. As mentioned by Schramm (2017), redefinition of value chain activities and shift of company production towards more sustained operations have not been displayed by this company either. Thus, it can be concluded that SEAT may not have reconceived its electrical cars intending to create shared value in business. Therefore, Minimό cars prepared by this company can be considered just another new invention undertaken by SEAT, rather than an attempt to create shared value.

References

Ahi, A., Baronchelli, G., Kuivalainen, O. and Piantoni, M., 2017. International market entry: how do small and medium-sized enterprises make decisions?. Journal of International Marketing, 25(1), pp.1-21.

Bashir, M. and Verma, R., 2017. Why business model innovation is the new competitive advantage. IUP Journal of Business Strategy, 14(1), p.7.

Batista, L., Bourlakis, M., Smart, P. and Maull, R., 2018. In search of a circular supply chain archetype–a content-analysis-based literature review. Production Planning & Control, 29(6), pp.438-451.

Brendel, A.B., Lichtenberg, S., Prinz, C. and Herrenkind, B., 2020. Increasing the Value of Shared Vehicles: Insights from an Implementation of User-Based Relocation in Station-Based One-Way Carsharing. Sustainability, 12(21), p.8800.

Ferrantino, M.J. and Koten, E.E., 2019. Understanding Supply Chain 4.0 and its potential impact on global value chains. GLOBAL VALUE CHAIN DEVELOPMENT REPORT 2019, p.103.

Geissdoerfer, M., Morioka, S.N., de Carvalho, M.M. and Evans, S., 2018. Business models and supply chains for the circular economy. Journal of cleaner production, 190, pp.712-721.

Hansen, C., Mena, C. and Aktas, E., 2019. The role of political risk in service offshoring entry mode decisions. International Journal of Production Research, 57(13), pp.4244-4260.

Joo, J.H., 2017. Motives for participating in sharing economy: Intentions to use car sharing services. The Journal of Distribution Science, 15(2), pp.21-26.

Kang, S. and Na, Y.K., 2020. Effects of strategy characteristics for sustainable competitive advantage in sharing economy businesses on creating shared value and performance. Sustainability, 12(4), p.1397.

Ko, S.J., 2019. The Differing Foreign Entry Mode Choices for Sales and Production Subsidiaries of Multinational Corporations in the Manufacturing Industry. Sustainability, 11(15), p.4089.

Koo, J., Baek, S. and Kim, S., 2019. The effect of personal value on CSV (creating shared value). Journal of Open Innovation: Technology, Market, and Complexity, 5(2), p.34.

Koval, V., Duginets, G., Plekhanova, O., Antonov, A. and Petrova, M., 2019. On the supranational and national level of global value chain management. Entrepreneurship and Sustainability issues, 6(4), p.1922.

Mukherjee, I., 2018. Applying Porter’s Five Force Framework in Emerging Markets—Issues and Recommendations. In Strategic Marketing Issues in Emerging Markets (pp. 307-316). Springer, Singapore.

Müller, J.M., 2019. Comparing Technology Acceptance for Autonomous Vehicles, Battery Electric Vehicles, and Car Sharing—A Study across Europe, China, and North America. Sustainability, 11(16), p.4333.

Porter, M.E. and Kramer, M.R., 2019. Creating shared value. In Managing sustainable business (pp. 323-346). Springer, Dordrecht.

Schellenberg, M., Harker, M.J. and Jafari, A., 2018. International market entry mode–a systematic literature review. Journal of Strategic Marketing, 26(7), pp.601-627.

Schramm, M., 2017. How the (business) world really works. Business metaphysics & “creating shared value”. In Creating Shared Value–Concepts, Experience, Criticism (pp. 81-117). Springer, Cham.

Semeraro, T., Aretano, R., Barca, A., Pomes, A., Del Giudice, C., Gatto, E., Lenucci, M., Buccolieri, R., Emmanuel, R., Gao, Z. and Scognamiglio, A., 2020. A conceptual framework to design green infrastructure: ecosystem services as an opportunity for creating shared value in ground photovoltaic systems. Land, 9(8), p.238.

Siamwalla, Y., 2017. THE USE OF DIGITAL CHANNELS SUPPORTING SME’s INTERNATIONAL BUSINESS COMPETENCE, INTERNATIONAL PERFORMANCE AND THEIR MODES OF ENTRY. Journal of Supply Chain Management: Research and Practice, 11(1), pp.1-19.

Simatupang, T.M., Piboonrungroj, P. and Williams, S.J., 2017. The emergence of value chain thinking. International Journal of value chain management, 8(1), pp.40-57.

Sinthupundaja, J. and Kohda, Y., 2019. Effects of corporate social responsibility and creating shared value on sustainability. In Green Business: Concepts, Methodologies, Tools, and Applications (pp. 1272-1284). IGI Global.

Viverita, Karinna1, 2019. “The Effects of Ownership Types, Concentration, and Foreign Banks’ Modes of Entry Risk-Taking Behaviour and Capital Ratio.” In SU-AFBE 2018: Proceedings of the 1st Sampoerna University-AFBE International Conference, SU-AFBE 2018, 6-7 December 2018, Jakarta Indonesia, p. 249. European Alliance for Innovation,.

Wach, K., 2014. Market entry modes for international businesses. E. Horská (Author), International Marketing: Writing and Beyond Visegrad Brothers, pp.135-147.

Xie, Y., Du, Y.F., Boadu, F. and Shi, X.Y., 2018. Executives’ assessments of evolutionary and leapfrog modes: An ambidexterity explanation logic. Sustainability, 10(8), p.2893.

Yun, J.J., Zhao, X., Wu, J., Yi, J.C., Park, K. and Jung, W., 2020. Business model, open innovation, and sustainability in car sharing industry—Comparing three economies. Sustainability, 12(5), p.1883.

Know more about UniqueSubmission’s other writing services: