LD7164 International Financial and Contractual Management Assignment Sample

Introduction

International contract management could be determined as the surveillance and the execution of a project contract for the ideal of augmenting financial and operational reduction and execution to the risk, incorporating persuading acquisitions against the contracts to assure selected suppliers are used, rates followed to and discounts and settled the rebates. International contract management is the aspect of a necessary thing as generally,

it appears it is another portion of the method of sourcing that could produce multiple privileges for the organization. International financial management is known as finance based on international standards. It is the management of the finance in cross border business circumstances which are making and trading money by using foreign currency.

The international activities in the context of financing help the organizations to connect to the cross border dealing along with the international business partners suppliers, consumers and lenders etc. it is utilized by the non-profit organization and government organizations.

Pre-project

The life cycle in respect of the project management is generally broken down into 4 stages: initiation, execution, planning and also closer. All these stages create a path that the project from starting to finish the project. To successfully implement a project, pointed out the actual business requirement, and various issues and brainstorm paths that the group could meet these requirements to solve these kinds of issues or measure this opportunity.

Over the top, it also figures out that the objective of the organization measures ether the project is identified and feasible the major deliverables for this project (Challoumis, 2018). The financial appraisal is a method that is utilized to check the use of this proposed project by calculating the value of net cash flows that outcome from its utilization. The financial appraisals vary from appraisals in respect of the economy in the range of its investigation, the level of impacts methodology and analysis.

The financial appraisal in construction is the most significant and also the earliest phase of the construction project planning project procedure. There are four appraisal techniques such as accounting rate of return, payback period, discounted cash flow, and sensitive and investment risk analysis. As the organization has a huge number of capital invested to roll out manufacturing units in India, hence it is required the economic aspects of the company and financial or social project appraisal.

Critical evaluation

As the organization wants to expand their business all over the world its needs to very important the company perfectly utilized the pre-project plan. There are four stages that which the company perfectly implemented the project plan. There are a few factors the company must focus on as the company’s main aim is to implement properly the pre-project plan.

There are a few factors such as the economic plan, cost management plan and financial management plan. The cost management plan is the crucial part as if it is not controlled properly there for the company faces Hughes losses and the project could face various issues. The factor that is influenced by the cost management that is discussed below:

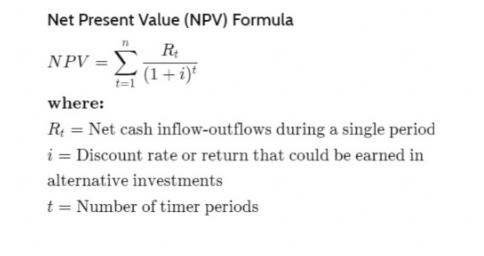

Net present value

The NPV is the difference between the PV of cash inflows and the PV of cash outflows during the project periods. The NPV is mainly used for investing and capital budgeting planning to analyze the investment profitability.

Figure 2: NPV

(Source: investopedi.com)

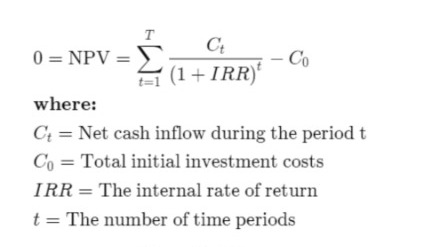

IRR

The IRR is a metric used in the analysis that is based on financials to estimate the potential profitability of the project. The IRR is a rate that is based on the discount that creates the NPV of cash flow same as zero in a DCF analysis.

Figure 3: IRR

(Source: investopedi.com)

ARR

The annual percentage return of investment relies on the prelims expanses of the project. The ARR is a law that reflects the rate of returns on investment. The ARR law classified revenue of average assets by project initial investment to derive return or ratio except for lifetime project.

Figure 4: ARR

(Source: investopedia.com)

In this project consider NPV, to estimate the project cost in the pre-stage of the project. In the project execution section, the project manager should consider the IRR and ARR techniques to understand the project situation. Through this process, the project manager controls the project.

In the post-project segment, the project manager considered to analysis the whole project and also tallies the pre and post-project situation. The project manager must use the techniques NPV for the betterment of the project as it supports the whole project procedure, by using the NPV formula the manager can estimate the whole project budget as the project budget work as the whole project framework.

The project manager can utilize the valuable time and also utilized the time to enhance the project efficiency. In-project duration project insight the whole project’s current value through the NPV. In the project execution stage where have already completed the maximum part of the project, the project manager getsan insight into the project situation by calculating the ARR and IRR techniques. Both techniques help to insight the project’s current situation.

Project execution

Project execution is a significant aspect in respect of the development of a project. This mostly focuses on some factors such as project implementation techniques and methods of the project that use in this project to successfully complete the project.

Create a team that helps to analyses the whole project and find out the actual issues that would have during the project execution (Scheltema, 2019). The organization gave a contract to construct a manufacturing unit to build a proper palace where everyone has good facilities such as well road transportation, all resources are easily supplied. To the successfully complete a project needs some steps mentioned below:

Create task

As the already discussed the task in the above section, is to fulfil all requirements needs, and create a team that main work is to gather data or information about the various perspective such as economic, financial, social and legal procedures. By selecting the stakeholder or sponsor that backs the project and also forecasts the return on investments hence the stakeholders could assurance about their investments (Mirzaee et al. 2022).

The team also helps to identify the risk factor and to submit the reports to the higher authority for better decisions about this project. The team might be conducting a bid function where the multiple bidders attempt this bid function and the team take a decision that which candidate is suitable for contracting the whole project. The team ensure that all the requirements must be fulfilled and the project work must be going on smoothly without any hindrance.

Setup duration

Every project has a specific duration as there is involve lots of money; hence it must important that the research team and the contracting company must be focused on the project duration. It needs a perfect prediction after calculating all the factors that involve in this project (Manzo et al. 2019). The lengthy project duration could increase the project cost and that is not favorable for any project. The contractual organization can help with some software that is available in the market for better prediction of the project duration.

Assign tasks to a team

To properly execute the project needs perfectly divided a worked and build a special team for every unit of the project. Every team has the expertise as per the units of work. Every team connected strong and cooperation with each team member. As each work is related to other works in this context communication play a vital role.

The project is divided into multiple parts such as one team focused on all kinds of resource-related issues and other teams seeing the design-related work (Keonget al. 2019). And a team that involves surveillance that the all the team worked properly or not and in any of the sections the team finds out any gap the team trying to find out the path that the issues resolved.

Surveillance progress

The project surveillance is the most important thing, through this procedure higher authorities understand whether the project going on the right path or not. The higher authority takes decisions by using this report that generates the project tract report. Big projects generate everyday tract reports.

Communication regularly

Communication plays a vital role, as in a project every factor is related to other factors. In a project after the end of one section, it is going to another section for processing. Hence only through the reports or data of the previous section, do others segments start their work by depending on the previous data. In this context, communication plays a vital role.

Involve the external stakeholders

To complete successfully a project, one needs to engage the external stakeholders. Successfully stakeholder involvement involves adopting a project approach for each stakeholder. Pointed out the stakeholder is how often and the reasons that the project ought to engage them and also pointed out the desired outcome from this engagement.

Net present value

Through the NPV, the project manager understands the project situation and through the NPV technique, the project manager can tally the pre-project situation to the project execution position. Through the NPV techniques, the project managercreates a future path and this future path supports the future decision.

ARR technique

This technique helps to project execution periods’ average revenue by investing an initial amount that is injected into the project. Through this technique understand the value of time that spend on the project. Through these techniques, the project manager can take an important decision about the project as to how much more money needs to inject into this project and how to reduce the project budget.

IRR technique

Through these techniques, the project manager can project initial expenses and discounted project cash inflows during the project execution. The IRR technique ensures that all the cash that inject into the project must be sufficient and through this technique, the project manager speculates the total project remaining budget.

Post project analysis

The purpose of the PPE is to check the effectiveness of the project in respect of the project benefit as bold the economical appraisal. It also helped compared panned benefits and costs along with the real benefits and costs to permit an assessment of the overall value of the project (Morozova et al. 2020).

It also identified specific features of the project that have impacted the project benefits whether negatively or positively and also suggested that advanced projects could then be derived. The post-project analysis reveals the opportunities for enhancing the project’s produced benefits whether the organization were planned after or duration implementation and suggests the actions need to achieve its optimization. There are incorporating some activities that are followed in these activities:

- Conduct a gap analysis

- Measure ether the project mission was achieved.

- Measure the satisfaction of stakeholders.

- Measure the benefits and project cost.

- Pointed out areas for the project’s future development

- Pointed out the lesson that learns during the project’s previous phase.

To successfully implement a project need to very important that focus on the above section, already discussed. There are various sections such as economical aspects, financial aspects and social aspects. Every country has its own economic benefits and barriers, the organization must predict the future and as per the risk, the organization must take action to maximum mitigate the risk. Through this project the organization’s impact on the country’s internal economy such as gross domestic product, unemployment issues and other economic factors (Robinson, 2020).

The financial factors also impact the organization. To succeed the organization first need to raise the fund and distribute it as per the project needs. The project needs a heavy budget. And the company required huge capital for the investments hence the company mostly convinced internal and external stakeholders. Business communication plays a vital role in the transmission of the message, not the message itself.

To successfully implement need proper strategies. The strategies could be involved internal and external project factors. The entire project involved a manufacturing plan and organizational factors. After successfully completing the manufacturing building structure, the organization next plans to install a manufacturing machine that helps with raw materials processing to make finished goods.

The procuring manufacturing machine is an important part of set manufacturing units. For implementation, any project needs to follow a specific path it’s called contracting budgeting, where a contractor forecast the project implementation procedures and as per the project weightage predicts the contracting budget. The international activities in the context of financing help the organizations to connect to the cross border dealing along with the international business partners suppliers, consumers and lenders etc.

it is utilized by the non-profit organization and government organizations. After the forecasting, all aspects of the organization ensure the time duration of the project. The project duration must be ended within time. The time duration must be followed by the national approach as it involves investment as the time duration extent could be increased the organization’s liabilities.

After the analysis above section, finding out the project’s weakness and discussing each team member to deal with the risk and if it is possible to mitigate it completely. The projects must be met with the project cost estimate before starting the project it’s called project budgeting. The organization always tried that the project never overtakes the project cost budgeting.

Conclusion

All aspects of the manufacturing units must be installed within time duration and the operation must be starting within the time duration. The project manager must be generated a weekly report that works as evidence of the project development report and gives the perfect scenario in front of the board of directors of the organization. The economic environment is a realm of economics that researches the financial impact on environmental policies.

The environment economists perform research to measure the empirical effects of policies in respect of the environmental economy. It helps governments plan proper environmental analysis and policies that the merit and effect of proposed policies.The core theory underpinning the economics of environmental is that environmental amenities have value and also there is the cost to growth in the context of economics that are not responsible in traditional models.

For implementation, any project needs to follow a specific path it’s called contracting budgeting, where a contractor forecast the project implementation procedures and as per the project weightage predicts the contracting budget. The international activities in the context of financing help the organizations to connect to the cross border dealing along with the international business partners suppliers, consumers and lenders etc.

it is utilized by the non-profit organization and government organizations. The last thing that must remember for every stakeholder involved in the project implementation project.

Reference list

Journal

Abad-Segura, E. and González-Zamar, M.D., 2020. Global research trends in financial transactions. Mathematics, 8(4), p.614.

Alzoubi, E.S.S., 2018. Audit quality, debt financing, and earnings management: Evidence from Jordan. Journal of International Accounting, Auditing and Taxation, 30, pp.69-84.

Askim, J., Bjurstrøm, K.H. and Kjærvik, J., 2019. Quasi-contractual ministerial steering of state agencies: Its intensity, modes, and how agency characteristics matter. International Public Management Journal, 22(3), pp.470-498.

Bashynska, I., Sokhatska, O., Stepanova, T.V., Malanchuk, M., Rybianets, S. and Sobol, O., 2019. Modelling the risks of international trade contracts.

Benítez-Ávila, C., Hartmann, A., Dewulf, G. and Henseler, J., 2018. Interplay of relational and contractual governance in public-private partnerships: The mediating role of relational norms, trust and partners’ contribution. International journal of project management, 36(3), pp.429-443.

Borio, C.E., Farag, M. and Tarashev, N.A., 2020. Post-crisis international financial regulatory reforms: a primer.

Challoumis, C., 2018. The Role of Risk to the International Controlled Transactions. Annals of the University Dunarea de Jos of Galati: Fascicle: I, Economics & Applied Informatics, 24(3).

Chyrva, O.H., Chvertko, L.A., Chyrva, H.O., Melnychuk, Y. and Berbets, V.V., 2019. The role of management in the financial independence of the region. Tem Journal, 8(2), pp.201-206.

Davradakis, E. and Santos, R., 2019. Blockchain, FinTechs and their relevance for international financial institutions (No. 2019/01). EIB Working Papers.

Hilali, A., Charoenngam, C. and Barman, A., 2019. Barriers in contractual scope management of international development projects in Afghanistan. Engineering, Construction and Architectural Management.

Keong, O.C., Pengb, L.S. and Lengc, L.W., 2019. The impact of international financial reporting standards (IFRS) on accounting quality in Malaysia. Journal of Accounting and Finance in Emerging Economies, 5(1), pp.93-104.

Manzo, A.G., Disputes over Global Financial Governance in the Field of Sovereign Debt Restructurings: Contractual or Statutory Approach?.

Mirzaee, A.M., Hosseini, M.R., Martek, I., Rahnamayiezekavat, P. and Arashpour, M., 2022. Mitigation of contractual breaches in international construction joint ventures under conditions of absent legal recourse: case studies from Iran. Engineering, Construction and Architectural Management.

Mishchenko, S., Naumenkova, S., Mishchenko, V. and Dorofeiev, D., 2021. Innovation risk management in financial institutions. Investment Management and Financial Innovations, 18(1), pp.191-203.

Morozova, T., Akhmadeev, R., Lehoux, L., Yumashev, A.V., Meshkova, G.V. and Lukiyanova, M., 2020. Crypto asset assessment models in financial reporting content typologies. Entrepreneurship and Sustainability Issues, 7(3), p.2196.

Moșteanu, N.R., 2019. International Financial Markets face to face with Artificial Intelligence and Digital Era. Theoretical & Applied Economics, 26(3).

Narziev, O., 2021. The Perspectives Of The Establishment Of International Financial Centers In Uzbekistan And The Implementation Of English Law. Turkish Journal of Computer and Mathematics Education (TURCOMAT), 12(4), pp.1104-1108.

Nwaobia, A.N., Kwarbai, J. and Olajumoke, J., 2019. Earnings management and corporate survival of listed manufacturing companies in Nigeria. International journal of development and sustainability, 8(2), pp.97-115.

Osadchy, E.A., Akhmetshin, E.M., Amirova, E.F., Bochkareva, T.N., Gazizyanova, Y. and Yumashev, A.V., 2018. Financial statements of a company as an information base for decision-making in a transforming economy.

Robinson, T.R., 2020. International financial statement analysis. John Wiley & Sons.

Saka, A.B. and Chan, D.W., 2020. Knowledge, skills and functionalities requirements for quantity surveyors in building information modelling (BIM) work environment: an international Delphi study. Architectural Engineering and Design Management, 16(3), pp.227-246.

Scheltema, M., 2019. The mismatch between human rights policies and contract law: Improving contractual mechanisms to advance human rights compliance in supply chains. In Accountability, International Business Operations, and the Law (pp. 259-278). Routledge.

Segal, M. and Naik, G., 2019. The expected impact of the implementation of International Financial Reporting Standard (IFRS) 16–Leases. Journal of Economic and Financial Sciences, 12(1), pp.1-12.

Sharma, S. and Gupta, A.K., 2019. Risk identification and management in construction projects: Literature review. International Journal of Humanities, Arts and Social Sciences, 5(6), pp.224-231.

Vovk, V., Zhezherun, Y., Bilovodska, O., Babenko, V. and Biriukova, A., 2020. Financial Monitoring in the bank as a market instrument in the conditions of innovative development and digitalization of economy: management and legal aspects of the risk-based approach.

Yasser, S. and Soliman, M., 2018. The effect of audit quality on earnings management in developing countries: The case of Egypt. International Research Journal of Applied Finance, 9(4), pp.216-231.

Know more about UniqueSubmission’s other writing services:

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.com/sl/register-person?ref=V2H9AFPY

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://accounts.binance.com/pt-PT/register?ref=IQY5TET4