Machine Learning Assignment Sample

Introduction and problem identification

Machine Learning can be defined as an utilization and development of the computer systems, which are capable of learning and adapting without any explicit instructions. It is done by using algorithms and models of statistics to analyses and draw some kind of inferences from data patterns. Machine Learning can be utilized to solve any institutional or organizational problem. Here machine learning will be used for solving the problem of money laundering and the example of Standard Chartered Bank will be utilized.

Review and justify machine-learning techniques

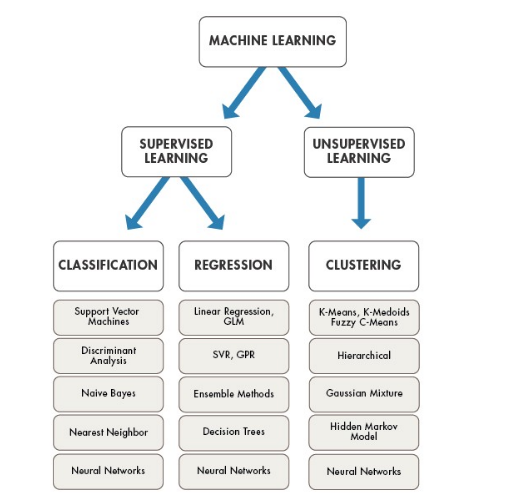

One of the most utilized machine learning methods of the financial industry is supervised learning. This is because this kind of learning can help in analyzing historical data and after that, it becomes easier to identify financial risks associated with business firms and the individuals. On the other hand, unsupervised learning is utilized by the e-commerce industry largely. Unsupervised learning mainly makes a machine capable of exploring considerably large data sets (IBM, 2022). After initial exploration, the machine mainly tends to identify the hidden patterns that help in connecting various variables.

Figure 1: Machine learning

Under the category of supervised machine learning method, learning classification algorithm technique is mostly utilized due to its simple nature. Classification algorithms can help in explaining and predicting a particular class value. Classification is an important component for many machine learning applications although it is specially used for financial Institutions. For example classification algorithms can help in predicting if a transaction is authorized or not. The two classes of this case can be considered as “yes” and “no”. Classification algorithms are not at all limited to only two classes and can be utilized for classifying different items or data sets into large numbers of diverse categories (IBM, 2022). Under the category of unsupervised machine learning method, clustering algorithms can be considered. This technique is mainly utilized in the business application at the time of segmenting large data sets.

Machine learning technique suitable for the problem

Standard Chartered Bank was fined an amount of 102 million Euros by the Financial Conduct Authority for the breaches of anti-money laundering that involves shortcoming in its controls of Counter Terrorism Finance in Middle East (The Guardian, 2022). It can be considered as the second largest fine imposed by the government of the UK for the failures of anti-money laundering. This organization can use machine learning to enhance the approaches of anti-money laundering through improving the process of consumer verification and detecting any kind of anomalies in the behavior’s of customers. It makes the procedures of KYC and CDD efficient and effective (Fineksus, 2022).

Classification algorithm under the supervised machine learning method can be utilized by Standard Chartered Bank to deal with the information or large amount of data gathered from open data sources social networks and public access. The ease of dealing with different categories of class within the classification algorithm can be helpful for the bank to identify a person who is eligible for financial transactions according to their records or data (Hussain et al. 2020). The different classes can be programmed into the classification algorithm and the people can be classified according to their activities whether it is illegal or legal. Therefore, transactions can be done with the authentic or legal customers in this manner for avoiding any kind of regulatory breach for the failure of anti-money laundering like the case of Standard Chartered Bank.

Problems or challenges with the solution

The issue of classification algorithms is data preparations, which involves the pre-processing stages that can be applied to the classification data. The pre-processing steps are feature selection, data transformation and data cleaning. A professional applying classification algorithm can face challenges in data cleaning which involves the process of reducing noise and handling the missing values. The other issue faced by the financial organizations while dealing with classification algorithm is that it becomes out of synchronization with the constantly evolving regulations of compliance (Forbes, 2022). The ever-changing regulations can make professionals change the programming within the classification algorithm constantly, which delays the implementation of anti- money laundering activities.

Conclusion

It can be concluded that the money laundering issue has made many financial or e- commerce platforms face challenges and had to pay a huge amount of fine to the regulatory authority. Classification algorithms under the category of supervised machine learning method can be utilised for anti-money laundering.

References

Fineksus, 2022. Machine Learning (ML) in Anti-Money Laundering (AML). [Online]Available at:<https://fineksus.com/machine-learning-ml-in-anti-money-laundering aml/#:~:text=The%20use%20of%20machine%20learning,and%20CDD%20procedures%20more%20efficient> [Accessed 6th March 2022]

Forbes, 2022. These Four Challenges In Adopting Machine Learning Can Lower Your ROI And Sabotage Success. [Online] Available at: <https://www.forbes.com/sites/forbestechcouncil/2021/08/31/these-four-challenges-in-adopting-machine-learning-can-lower-your-roi-and-sabotage-success/?sh=62b23c8847c4> [Accessed 6th March 2022]

IBM, 2022. Machine Learning. [Online] Available at: <https://www.ibm.com/in-en/cloud/learn/machine-learning> [Accessed 6th March 2022]

The Guardian, 2022. Standard Chartered fined $1.1bn for money-laundering and sanctions breaches. [Online] Available at: <https://www.theguardian.com/business/2019/apr/09/standard-chartered-fined-money-laundering-sanctions-breaches> [Accessed 6th March 2022]

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services: