MAR042-6 Business Dissertation Sample

Module code and Title: MAR042-6 Business Dissertation Sample

1. Introduction

1.1Background

In the UK, retail banking helps customers to effectively manage their money, deposit money and achieve access to credit in a secure way. Macroeconomics is the part of economics that examines “economy-wide phenomena” such as economic growth, price level, “gross domestic product (GDP)”, and rate of inflation. In retail banking, the different types of management include employee management, wealth management, monitoring mortgage, loan and saving accounts and maiant6ins the safety of money.

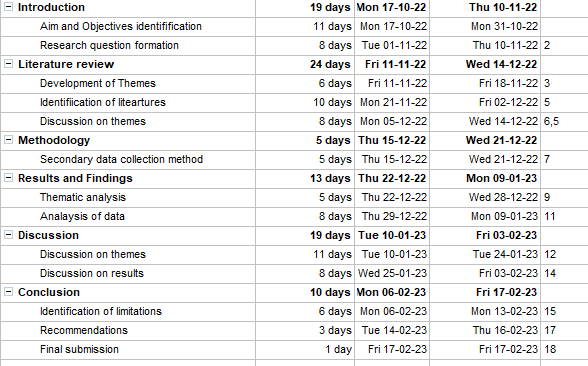

Figure 1.1: The number of banks in the UK (Source: Statista.com, 2022)

Figure 1.1: The number of banks in the UK (Source: Statista.com, 2022)

In the year 2022, a total of 357 “Monetary Financial Institutions (MFI)” operated in the UK (Statista.com, 2022).

1.2 Rationale

Retail banking helps in the different perspectives that include “asset management”, “liquidity management”, “capital management” and “liability management” (García-Ruiz and Vasta, 2021). Different researchers have highlighted the use of microeconomic concepts for analysing the different attributes related to the banking sectors. However, the managerial aspects related to this retail business in the UK context have not been unveiled yet (Ahmed et al. 2020).

Over the passage of time, advancements in technologies have brought changes in managerial behaviour and other services in different industrial sectors (Ananda et al. 2020). Thus, an in-depth analysis of their particular areas has been presented in this research to understand the exact role of retail banking services in the UK context.

1.3 Aim and Objective

Aim

The aim of the research is to analyze the importance of retail banking by using the macroeconomic approach.

Objective

- To analyze the dynamic evolution in retail banking services of the UK with the technological degradation.

- To understand the microeconomic aspects of retail banking and its importance for maintaining financial stability in England.

- To analyze the way online banking and advanced technology help the retail banking to give proper services

1.4 Research question

- What is the importance of the adoption of technology in the banking sectors of the UK?

- How does the macroeconomic approach help to measure the safety of the economy in the UK’s banking sector?

- How does retail banking can overcome business issues and gives proper services to customers?

2. Literature review

2.1 Conceptual framework

Figure 2.2: Conceptual framework (Source: Self-developed)

Figure 2.2: Conceptual framework (Source: Self-developed)

2.2 Theoretical overviews

“Classical microeconomic theory” can be useful here for determining the role of retail banking in the UK. This theory can further establish proper wealth distribution and equitable incomes for the benefit of society (CARSON, 2019). Here, the implementation of this theory can be beneficial in understanding the usefulness of retail banking in broader aspects concerning the economic condition of the UK. This theory has been developed by Adam Smith and has since then been regarded as basic fundamentals of economics.

“Fractional reserve theory”, is another important theory that can be useful in this aspect. As per this theory, an authentic banking system can create money collectively and the banks are only required to hold a specific portion of the money of the customer and free the rest of the amounts (Shihadeh, 2023). This theory can successfully stimulate the money supply. Application of this theory can also be beneficial for understanding the basic fundamentals of banking systems in this study.

2.3 Microeconomics factors, affecting the performance of retail banking.

Banks are considered an important fundamental of the economy as they maintain and encourage the development of the different economic sectors. As per the opinion of Huang, (2021), microeconomics is concerned with different single factors rather than a collective approach and it also creates a significant impact on the individual decision.

Different microeconomic factors such as “supply and demand”, regulations, taxes, “Gross domestic product (GDP)”, and interest rates play significant impacts on the performance of retail banking by helping in predicting potential price rise and hence regulating the modification of demand and supply.

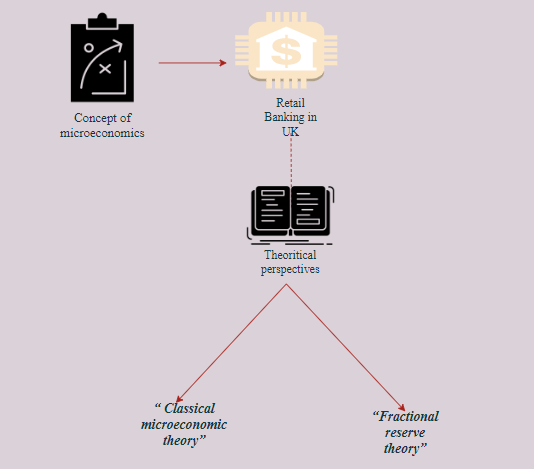

Figure 2.1 Basic supply and demand curve of microeconomics (Source: Socialsci.libretexts.org, 2021).

Figure 2.1 Basic supply and demand curve of microeconomics (Source: Socialsci.libretexts.org, 2021).

From the above-mentioned supply and demand curve of microeconomics, an idea has been gained regarding how an increased demand leads to a price rise.

3. Methodology

3.1 Research Methodology

As opined by Rashid et al. (2020), a “secondary data collection method” has been used to measure the relationship between the “financial performance” of banks and customer loyalty. This method helps to investigate the different aspects and the finding shows that banks give good services to customers. In this research, a “secondary data collection method” will be used to analyse the effective role of retail banking. In this research, the information will be collected from “Google scholar” and websites and appropriate articles will be chosen.

A “deductive research approach” will be used that help to critically analyze the research topic by using the previous and present information. A “descriptive research design” will be used in this research that helps to collect valid information. In terms of data analysis, “thematic analysis” will be used that help to effectively analyze the research objectives and fulfill all the criteria of the research.

3.2 Ethical issues

In this research, all the ethics will be followed to overcome ethical issues. In order to maintain the privacy of the data and to overcome security issues the “data protection act of 2017” will be (Ctp.co.uk, 2022). In this research, the “Copyright Act of 1956” will be followed to overcome unwanted “copyright issues” (Legislation.gov.uk, 2022). In this case, the proper citation will be maintained to overcome data privacy issues.

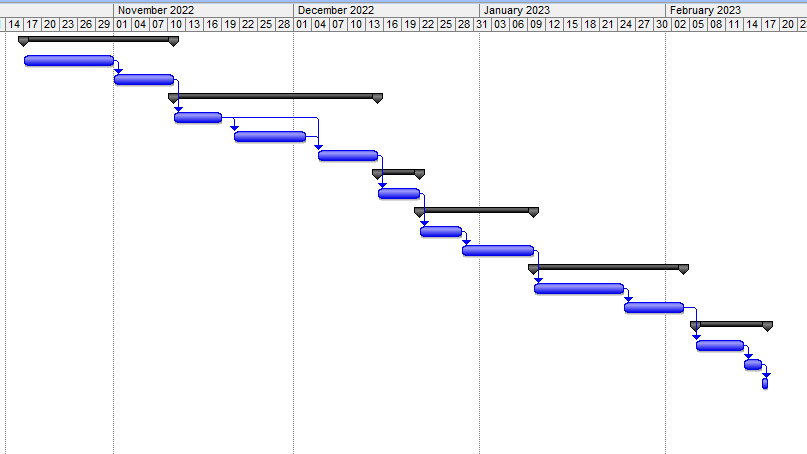

3.3 Time plan

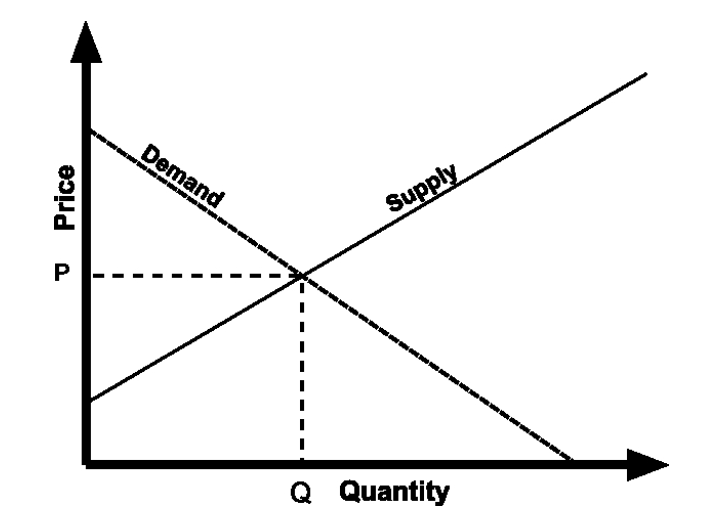

A total of five months is required to successfully complete the overall task, with starting dates of 17.10.2022 to 17.02.2023.

Figure 3.1: Time plan (Source: Self-developed)

Figure 3.1: Time plan (Source: Self-developed)

4. Potential outcomes

| Objectives | Potential outcomes |

| Objective 1 | It is expected that this research will give a collaborative idea regarding the working procedure of retail banking in the UK. Apart from that, the security aspects from the side of this type of banking will also be addressed by this study. Along with that, an idea will also be given regarding how this concept of retail banking can be beneficial for the local people. |

| Objective 2 | It is expected that this study will also give a comprehensive idea regarding the impact of different microeconomic factors on the working process of retail banks. Apart from that, the impact of microeconomics will also be discussed in a broader aspect considering the economics of the UK. |

| Objective 3 | The concept of retail banking will be given along with mentioning the working process of the banks. Different improvement factors will also be discussed here for the betterment of the retail banking sector. Along with that, the potential risk factors will also be discussed. The security aspects of people’s assets and the money kept in the retail bank will be evaluated here in this research |

Table 4.1: Potential outcome of the research objectives (Source: Self-developed)

5. References

Ahmed, S., Bangassa, K. and Akbar, S., 2020. A study on trust restoration efforts in the UK retail banking industry. The British Accounting Review, 52(1), p.100871.https://doi.org/10.1016/j.bar.2019.100871.

Ananda, S., Devesh, S. and Al Lawati, A.M., 2020. What factors drive the adoption of digital banking? An empirical study from the perspective of Omani retail banking. Journal of Financial Services Marketing, 25(1), pp.14-24. https://doi.org/10.1057/s41264-020-00072-y

CARSON, S.A., 2019. Andrew W. Lo, Adaptive Markets: Financial Evolution at the Speed of Thought. Journal of Economic and Social Thought, 6(2), pp.128-131.https://doi.org/10.1111/j.1540-6261.1993.tb04702.x

Ctp.co.uk (2022). UK GDPR & Data Security Online Training. Available at: https://www.ctp.co.uk/product/data-protection-e-learning/?gclid=CjwKCAjww8mWBhABEiwAl6-2RV9xliawFMc8pvNQI35Jk1puD8sco8VlLluVnHnqHCbfDMk-pm443BoCmF4QAvD_BwE. . Accessed on 14.10.2022.

García-Ruiz, J.L. and Vasta, M., 2021. Financing firms: Beyond the dichotomy between banks and markets. Business History, 63(6), pp.877-891. https://doi.org/10.1080/00076791.2020.1767600

Huang, C., 2021, January. Research on the Innovative Teaching Mode of Microeconomics Based on OBE Concept. In International Conference on Decision Science & Management (pp. 249-256). Springer, Singapore.DOI: 10.1007/978-981-16-2502-2_26.

Legislation.gov.uk (2022). Copyright Act 1956. Available at: https://www.legislation.gov.uk/ukpga/1956/74/contents/enacted. Accessed on 14.10.2022

Rashid, M.H.U., Nurunnabi, M., Rahman, M. and Masud, M.A.K., 2020. Exploring the relationship between customer loyalty and financial performance of banks: Customer open innovation perspective. Journal of Open Innovation: Technology, Market, and Complexity, 6(4), p.108. http://dx.doi.org/10.3390/joitmc6040108.

Shihadeh, F.H., 2023. The Links Between Banking Theories and Financial Inclusion: A Theoretical Framework. In International Conference on Business and Technology (pp. 251-257). Springer, Cham.DOI: 10.1007/978-3-031-08084-5_19

Socialsci.libretexts.org (2021). Differences Between Macroeconomics and Microeconomics. Available from https://socialsci.libretexts.org/Bookshelves/Economics/Book%3A_Economics_(Boundless)/1%3A_Principles_of_Economics/1.6%3A_Differences_Between_Macroeconomics_and_Microeconomics. Accessed on 14.10.2022.

Statista.com (2022). Number of banks operating in the UK 2022, by country of origin. Available from https://www.statista.com/statistics/870166/number-of-banks-operating-in-the-uk-by-country-of-residence/. Accessed on 14.10.2022.

Know more about UniqueSubmission’s other writing services: