Assignment Sample on Mathematics & Business Finance

TASK 1

a. Pound Value of loan at the start of the loan period

The use of the formula in the process evaluates the equation at an annual interest rate ($200m* 1.1) Dollar to pound. Hence, the evaluation of the pound value occurred at the starting period of the loan at £220000000.

b. Pound Value of the loan at the end of the loan period

For the evaluation of the end period of pound value occurred at £320,000,000, through using the formula at = [($200m*0.125*4) +£220000000]. Therefore, it is presented that £320,000,000, is required for the end period of the pound value.

c. Evaluation of the Nominal Dollar Value of the Loan

The recognition of Beta Capital is the application of the formula for the evaluation of the nominal dollar value (1.2) of the loan divided by the loan amount (£320,000,000). Hence, the evaluation is presented as £320,000,000/1.2, resulting in $266,666,666.7. Therefore, the evaluation represented that at a fixed position of Sigma, its forward exchange rate occurred Betra capital at $ 266,666,666.7, at the end of the loan period for 1.2 dollars for the respective pound value.

d. Exchange Rate Circumstances

The above calculation at the determination of the forward rate exchange at the situation of Beta is not fixed at the presence of the value existence that would increase in only case the rate of exchange that may also increase. Furthermore, it can be measured that the enhancement of the dollar value to the pound value then the determination of loan value refers to indicating the pound will also enhance. Hence, in the case of the loan value that would enhance simultaneously.

e. Forward Exchange Rate

The situation of Beta is not fixed at its “forward exchange rate”, therefore the exchange rate at the circumstances that the valuation of actual loan value position would stare down falling (Wang, and Zhu, 2022, pg.03). This is the reason that it has been determined behind the declining value of the pound.

f. Identification of two situations

It is presented that the beta value which is less than 1.0 means that the presence of security at the theoretical value the less volatile compared to the market situation. Moreover, including the stock variance in the portfolio process makes it less risky compared to the same portfolio without the stock. Therefore, the presented anticipated situation of the loan return of Beta is discussed below.

Default Risk: In this situation, it is observed that the pound value of the loan has fallen at the end period of the default risk that is present in the situation (Kim, and Choi, 2019, pg.03). Therefore, in the presented situation most probably the occurrence of the newly commenced situation falls in the business failing to pay off the number of loans, in that case, Sigma may have been in the position to bear the risk.

Risk of information: In another situation, recognized that the pound value of the loan has become fall at the end period of the loan creating default risk (Swandewi, and Purnawati, 2021, pg.04). Hence, the situation presenting the situation of inflation refers to enhancing the situation during the tenure at the pound value of the presented loan at the assumed value at the end of the tenure situation.

TASK 2

a. Calculation of percentage changes

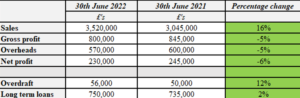

Figure 1: Percentage Fluctuation

(Sources: Self-Created)

The above figure has shown that the company has increased income as well as decreased expenses. Based on this analysis, it is stated that the performance of the company is improved.

b. Advice to Magpie based on the percentage fluctuation

The above figure represents the fluctuations in the percentages value at the values of the changes on a yearly basis. Hence, it is recognized the determined valuation of sales occurred at 16% as changes in the compared value £3520000 and £3045000 for the respective year 2022, and 2021. Furthermore, the representation of the gross profit valuation at the percentage’s changes occurred at -5%, representing low performances in the business of Magpie. Furthermore, the reduction in the profitability margins at -6% indicates a decline in the business efficiency, and cost has been increased. Therefore, the overall analysis indicates that the business has declined its profitability, and efficiency performance. Hence, it is recommended to Magpie that at the interpretation, and the actual consequences required improving the sales performances of the business at the solution to the situation.

c. Calculation of cost for a typical basket

i. A year ago

156.3/ (1+0.103)

=156.3/1.103

=£141.70

Therefore, the evaluation presented that the government has released the retailed price index which calculated the cost of that typical basket a year ago value occurred at £141.70. Hence, due to the presence of inflation, the actual cost occurred at the typical basket that refers enhanced from £141.70 to £156.30.

ii. One Month ago

At the determination of the inflation rate for the period of 1 month occurred at 0.820%, process the evaluation by implementing the formula which is = (1 + 0.103) ^ (1/12) – 1.

After that the recognition of the cost of a typical basket at the period some month ago at

= [156.30/ (1+0.820%)]

=£155.03

TASK 3

a. Compilation of table by filling yellow marked cells

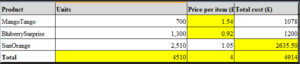

Figure 2: Total Cost Computation

(Sources: Self-Created)

b. Equivalent Price Determination

The recognition of the above Figure 2, it is presented the offers of the suppliers for the commodities, and the identical things at 45%, indicating the comparison of the overall price over the equivalent price that occurred at £2702.70.

The calculation of the overall equivalent price has been discussed below,

Equivalent Price= Overall price*(100%-45%)/100%

Equivalent Price= 4914*55%/100%

Equivalent Price= £2702.70

c. Expression analysis

(4p – 3r) (3p – 7r)

= 4p * (3p – 7r) – 3r * (3p – 7r)

= 12p2 – 28pr -9pr + 21r2

= 12p2 – 37pr + 21r2

= 12p2 + 21r2 – 37pr

d. Evaluation of Expression

16x3y2 – 4x2y3 + 12x2y

The evaluation of the determined greatest factor of the given equation at 4x2y,

Hence, the equation stands at 4x2y*(4xy-y2+3),

Therefore, dividing the evaluated expression by 2 binominals represented at the expression of [(ax + b)*(cx + d)].

TASK 4

a. Statics Calculation of the respective points

b. Application of COUNTIFS function

c. Histogram plot

d. Explanation of the computation

In this section represents the determination based on the figure 3,4, and 5, of the computation of a sample of 100 students, and the passing marks selected at 40%. Hence, the evaluation represents that 55 students are scored below 60% among the 100 students. Moreover, evaluation of the COUNTIFS function application presented that the total lowest limit presented at 30, and the upper limit at 40 answering the frequency at 15. The changes in the frequency represent the changes in the level of the markers.

TASK 5

a) Evaluation of the number of booking

it can be seen that the age group of the 30s seems to be involved highest over the booking of boarding parties with a percentile of 34. On the other hand, the Silver Sunsets tend to be involved in booking the service of northern lights at a level of 58%. Dolphin Splash was highly booked by mid-lifers.

b) Analysis of the popularity of different services

it can be seen that the highest booking services tend to be the northern lights which include 58% of the total involvements of 58% by silver sunsets (Argüelles, et al. 2022.p.14). The second most popular booking tends to be of dolphin splash which tends to be 99. The booking party tends to be the lowest at a level of 40.

c) Overall percentage of booking by services

Therefore, the overall percentage of booking of different services is evaluated with the help of the pie chart. Therefore, it can be seen that the largest number of bookings was done as per the services of northern lights at a level of 43%. The booking of dolphin splash was recorded to be 41% and 16% booking was done for the Boarding party.

d) Interpretation of the result

The overall analysis of the above charts and graphs evaluated for the analysis of the number of bookings shows the involvement of different service booking by the customers. As per the analysis, it can be seen that the highest booking tends to be done by the N northern lights tour with a total number of bookings of 103 (Forero-Acosta and Roncancio-Rodríguez, 2023.p.15). On the other side, the second most popular booking service tends to be recorded by Dolphin Splash with a total number of bookings to be 99 which tends to be 41% and bookings tend to only 40 by the Boarding parties which shows a level of 17/% of the bookings.

As per the concern of the age group factor of the cruise services, high level of booking tends to involve under 30 groups for booking of the Boarding party. The highest number of bookings of Dolphin Splash teds to depended over Mid lifers being involved at a level of 48 and the booking of northern lights mainly depended over silver sunset which shows a valuation of 58%

TASK 6

a) Evaluation of the number of cars manufactured by BMW

The evaluation of the number of cars manufactured by BMW tends to be done with the help COUNTIF function which gives the result of 72. Therefore, BMW tends to manufacture 72 cars

b) Determination of the number of Toyota cars sold in Japan

The calculation of the number of cars has been done by the application of the COUNTIFS formula. Therefore, 6 cars have been sold by Toyota in Japan.

c) Determination of body type using XLOOKUP

The body type as per the evaluation of XLOOKUP function, BMW t tends to be manufacturing the model of Z which is a sports compact / roadster car.

d) Determination of production years for ATS models VLOOKUP function

As per the application of the VLOOKUP function, it can be said thet the manufacturing of ATS tends to be in the year 2012 to 2019 by Ford (Murray, 2022.p.16)

TASK 7

a) Evaluation of the final value of an investment

the calculation of the final valuation of the investments. They are mainly calculated on the basis of the annual interest rate, the number of years compounded as well as the level of investments. The annual interest rate was 3.27% and the number of compounded years tends to be 5 (Carvalho, et al. 2023.p.19). The present value of the investment was £85000. Therefore, the future value of the investments was evaluated by applying the formula of Future value. The value tends to be -£453718.85. This means the value if the investments tend to result in negative valuation.

b) Calculation of the original amount of investment

the calculation of the original valuation of the investments. They are mainly calculated on the basis of the present value of the investments, interest rate, the number of years as well as compounding frequency. The interest rate was 3.10% and the compounding frequency tends to be 1. The present value of the investment was £37245 and the number of years to be considered was 8 years (Gerken, Sander, and Krekel, 2022.p.18). Therefore, the future value of the investments was evaluated as per the compound interest tends to be -£294525.83.

c) Calculation of the average annual rate of interest

the calculation of the rate of interest of the investments. The investment amount tends to be 35000 whereas the number of years was 10. The present valuation of the value of the investment tends to be 64555. Therefore, the rate of interest was evaluated to be 5%.

TASK 8

a) Calculation of IRR

the valuation of IRR based on two different discounting factors that tend to be 3.5% as well as 6%. The initial investments of the project tend to be 700000. The IRR tends to be evaluated as per the 3.5% discounting factors which result in the value of 3% on the other side as per the level of a discounting factor of 6%, the IRR tends to be 1%. This shows the discounting rate of 3.5% tends to be more profitable for the investment as it may provide a higher level of internal return from the investment.

b) Rechecking the calculated values of IRR

IRR (-700000: 214374.788)

IRR (-700000: 194855.0412)

c) Acceptability if the project

As per the provided information of investments process it can be seen that the investments tend to be heaving hurdle rate of 6.5%. On the other hand, the valuation of IRR tends to be calculated as per the rate of 3.5% as well as 6% of discounting factors tends to be 3% and 1%. Therefore, as per the overall analysis it can be said that acceptance of the project tends to be risky as the level of hurdles tends to be higher than the IRR evaluated in the project

d) Advantages and disadvantages of IRR

Advantages

- The method is easy to use and understand.

Disadvantages

- The size of the project is ignored in the programe

c) Description

As per the different benefits obtained by t application of the NPV methods, it can be said that the methods tend to be more effective as compared to the Simple payback period (Yan and Zhang, 2022.p.17). As the method is considered to be taking the value of time. value of money as well which tends to be more accurate as well as realistic in analysing text\return level of the values of the investments. On the other side, the payback period tends to avoid the above-mentioned factors in the valuation of the future return of the investments.

The brief determination of the NPV and Payback period evaluation presents that Simran Plc is required to improve its car manufacturing business by opening a new production plant in Scotland by investing an initial amount of £20500000 for 5 years. As per the recognition of NPV, it occurred at £20,200,000.22, which is not acceptable as the value is the lowest return (Abuk, G.M. and Rumbino, 2020, pg.04). On the other hand, the payback period represents that the initial investment of the project is covered within 7 years and 5 months which is over the investment period of 5 years. Therefore, it is recommended to Simran Plc, not to accept the project.

Reference list

Argüelles, C.A., Esteban, I., Hostert, M., Kelly, K.J., Kopp, J., Machado, P.A., Martinez-Soler, I. and Perez-Gonzalez, Y.F., (2022). MicroBooNE and the ν e Interpretation of the MiniBooNE Low-Energy Excess. Physical Review Letters, 128(24), p.241802.

Carvalho, C., Ishikura, L.M., Silva, I.B., Arruda, M.M., dos Santos, T.L.G. and Cutait, R.G., (2023). Evaluation of companies (Magazine Luiza SA) and investments in the E-commerce area during the Covid-19 pandemic period. Technium Social Sciences Journal, 41(1), pp.130-146.

Forero-Acosta, A.Y. and Roncancio-Rodríguez, L.F., (2023). Interpretation of the results of the oculomotor, positional and caloric test of the videonistagmography. Documentary review. Acta de Otorrinolaringología & Cirugía de Cabeza y Cuello, 50(4), pp.310-319.

Gerken, M., Sander, J. and Krekel, C., (2022). Visualising iron gall ink underdrawings in sixteenth century paintings in-situ by micro-XRF scanning (MA-XRF) and LED-excited IRR (LEDE-IRR). Heritage Science, 10(1), pp.1-16.

Kim, S.T. and Choi, B., (2019). Price risk management and capital structure of oil and gas project companies: Difference between upstream and downstream industries. Energy economics, 83, pp.361-374.

Murray, A., (2022). The Infamous VLOOKUP Function. In Advanced Excel Formulas: Unleashing Brilliance with Excel Formulas (pp. 329-372). Berkeley, CA: Apress.

Wang, H. and Zhu, J., (2022). Investigation on transition of RMB forward exchange rate pricing mechanism based on error correction model with structural mutation. International Journal of Financial Engineering, 9(03), p.2250006.

Yan, R. and Zhang, Y., (2022, March). The Introduction of NPV and IRR. In 2022 7th International Conference on Financial Innovation and Economic Development (ICFIED 2022) (pp. 1472-1476). Atlantis Press.

Know more about UniqueSubmission’s other writing services:

I’ve become an eager follower of this stellar website over the past week. The owner clearly pours passion into serving up top-notch content that wows readers. I applaud their dedication and hope they keep up the ace work!