Assignment Sample on Mathematics & Business Finance

Inroduction

Task 1

a. Value at Pound of the loan at the starting period

The evaluation of the value dollar value in pound value at the starting period of the loan at a loan tenure occurred at £220,000,000. Hence, the value is calculated by multiplication of value at $200 million through 1.1.

b. Pound value of the loan at the end of the loan period

The evaluation of the pound value loan at the end of the loan period is recognized at £320,000,000, at ending loan tenure (Cascarinoet al. 2022, pg.05). Hence, the value is calculated by multiplying $200 million by 0.125 and 4, therefore, the outcome value will be added to £220,000,000.

c. Evaluation of the nominal value at dollar for the loan at Beta Capital

The determination of the dollar value of $200 million has been computed by using the functioning process the value £320,000,000 by 1.2. Hence, in based on the resulting value, which is determined at the loan valuation occurred at £266,666,666.7. Thus, the further identification that has been computed at a sigma fixes the value of the rate of forward exchange after the actual loan that would be occurred at £266,666,666.7.

d. Discussion of the forward exchange rate, when the actual loan value goes up

The resulting accumulated interpretation refers to determining the forward exchange rate which is not fixed due to fluctuation in the exchange rate process on a loan value. Hence, the Beta value may not fix at its forward exchange rates compared to loan value that would enhance at the rate due to increasing dollar value to the pound value. Therefore, the increasing value of the pound is the value of the dollar at increasing values.

e. Discussion of the forward exchange rate, when the actual loan value goes down

The presence of numerous factors that influence the exchange rates that may include the economic performance of a country, the outlook for capital flows, interest rates at differential sectors, and capital flows (Ilzetzki, Reinhart, and Rogoff, 2020). An exchange rate of the currency a typically determined by the weakness, and strength of the process to the underlying economy is presented. Therefore, it is observed that during the period of the forward exchange rate, a declining amount of loan may reduce the increase in the loan amount which indicates the exchanged forward exchange rate.

f. Evaluation of two situations for the return on beta loan

Operating Leverage

It refers to changes in economic earning values before interest, and tax, that have the ability to make changes in the companies with more volatility in the term of asset management (Alzoubiet al. 2020, pg.03). Therefore, the higher operating lease in the firm may be risky presently or future basis, and their stock with higher beta value.

Financial Leverage

It basically refers to describing the debt portion that has the financial structure of a company at a specific period. It helps to show the requirement of debt in a accompany that has to be taken during the period of running a business. Therefore, having more debt faces greater risk in the business or company. Thus, growth in the value of financial leverage refers to indicates higher or increasing financial risk in a business (Douma, and Weedon, 2019, pg.02). Hence, this will impact the performance of the beta of a stock of a company by increasing the beta value as well.

Task 2

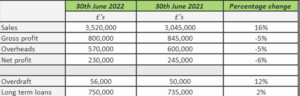

a. Calculation of percentage change

Figure 1: Quantification Changes in Percentage

(Source: Self-Created)

b. Recommendation to Magpie

Based on the provided information it is evaluated that the decision has been made on the provided loan at most probably occurred after a long period of time doing a good analysis of the details (Bordo, and Levy, 2021, pg.01). Furthermore, it is also recognized whether the loan was granted process to the client named Magpie by Penguin Banking or not. Moreover, the analysis refers to providing details knowledge through a table at the evaluation of GP, which has increased but the percentages of net profit have been decreased by 5 to 6%. Therefore, the determination of decreasing value in the profitability margin indicateslow performances in the management or efficiency, and also in the section of the enlargement in the price. Hence, the analysis also introducing that the provided condition of an overdraft which has been increased by 12% at overall consideration is a major issue for borrowers in borrowing loans. The overall situation represents that the interpreted results recommended to Magpie that it is important to analyze the actual result of borrowing a loan before taking any decision.

c. Computation of the cost of the basket

(i) One year ago

The evaluation of the cost of the basket by dividing £156.30 by (1+0.103), which represents weekly costs divided by the inflation of 10.3%. The implication of the formula referred to resulting a determined stands at £141.70, which recognized significant changes in the process of enhancement of the cost of the typical basket of food. Therefore, the resulting value occurred at £141.70 which is lower compared to the weekly cost.

(ii) One month ago

The accumulation of knowledge and details based on the opined is recognized the situation based on the assumptions that occurred by using the evaluation formula at (1 + 0.103) (1/12) – 1, recognized at 0.820%. Therefore, the indicated value that one month ago the cost of a typical food basket at the evaluation occurred at £155.03. Hence, the actual cost of one month ago of the evaluation occurred at by determining £156.30 through (1+0.820%)

Task 3

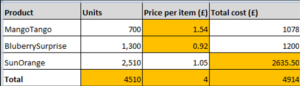

a. Evaluation of provided data of Table

Figure 2: Evaluation of provided data of table

(Source: Self-developed)

b. computation of the price equivalent provided by the supplier

The provided data is interpreted as the inference of identical different commodities by a supplier at a rate of evaluated by 45%, which is comparatively low than the actual prevailing cost, which is settled by the supermarket. Hence, the recognition of the equivalent price of the Chinese supplier would occur at £2702.70. Therefore, the equivalence of price a further evaluated bymultiplication of the whole price at (100%-45%), the resulted value will dividedby 100% for calculated valuation.

c. Evaluation of the provided information

“(4p – 3r)(3p – 7r)”

“= 4p * (3p – 7r) – 3r * (3p – 7r)”

“= 12p2 – 28pr -9pr + 21r2”

“= 12p2 – 37pr + 21r2”

“= 12p2 + 21r2 – 37pr”

d. Factorising

“16x3y2 – 4x2y3 + 12x2y”

The given equation is further factorized by taking the greatest common factor which is identified to be 4x2y

At the present, 4x2y(4xy – y2 + 3)

thus, the “actual equation” is

“4xy – y2 + 3 = 4xy – 1y – 3y + 3”

= “y(4x – 1) – 3(4x – 1)”

= “(y – 3)(4x – 1)”

So the equation is “4x2y(y – 3)(4x – 1)”.

Task 4

a)Excel functionality

| Computation of the statistical values | |||

| i | highest mark | 89 | MAX(B2:B101) |

| ii | lowest mark | 30 | MIN(B2:B101) |

| iii | range of marks | 59 | E3-E4 |

| iv | mode of the sample | 56 | MODE(B2:B101) |

| v | median of the sample | 57 | MEDIAN(B2:B101) |

| vi | mean of the sample | 57.65 | AVERAGE(B2:B101) |

| vii | standard deviation of the sample | 16.17103971 | STDEV(B2:B101) |

Table 1: Evaluation of the statistical value by implementing the Excel function

(Source: Ms-Excel)

b)Count if

| Implication of COUNTIFS function | |||

| Lower limit | Upper Limit | Frequency | Formula |

| 30 | 40 | 15 | COUNTIFS($B$2:$B$101,”>30″,$B$2:$B$101,”<40″) |

| 40 | 50 | 18 | COUNTIFS($B$2:$B$101,”>40″,$B$2:$B$101,”<50″) |

| 50 | 60 | 22 | COUNTIFS($B$2:$B$101,”>50″,$B$2:$B$101,”<60″) |

| 60 | 70 | 18 | COUNTIFS($B$2:$B$101,”>60.5″,$B$2:$B$101,”<70.5″) |

| 70 | 80 | 14 | COUNTIFS($B$2:$B$101,”>70″,$B$2:$B$101,”<80″) |

| 80 | 90 | 13 | COUNTIFS($B$2:$B$101,”>80″,$B$2:$B$101,”<90″) |

| Total | 100 | SUM(F13:F18) | |

Table 2: Aggregation of data into the suitable frequency interval of 10

(Source: Ms-Excel)

c) Histogram

d) Analysis for the head of the programme

It is clear from the exam’s assigned results that there were a total of 100 marks and that a total of 100 students took the test. Excel’s “COUNTIFS function” function can be used to calculate the number of students who had to obtain the exam’s targeted grade because passing requires a score of 60 or higher. This allowed the code “= COUNTIF (B2:B101,”>59″)” to be used and the result is 45 students. So the “head of the program” should be concerned as also most half of the student is below the 60%.

Task 5

A) Stacked bar chart (Vertical)

B) Clustered bar chart (horizontal)

C) Pie chart

For the pie chart first, some calculation has to be done in order to develop pie-chart that is as follows:

| Tourist age group | Type of service booking | ||

| Boarding Party | Dolphin Splash | Northern Lights | |

| Under 30s | 34 | 16 | 25 |

| Mid Lifers | 5 | 48 | 20 |

| Silver Sunsets | 1 | 35 | 58 |

| Total | 40 | 99 | 103 |

| Total | 17% | 41% | 43% |

| Formula for the percentage | (40/242)*100 | (99/242)*101 | (103/242)*102 |

Table 3: calculation for Pie chart

(Source: Ms-Excel)

By doing the above calculation the pie chart is been made that would help to analyze the type of service booking that is more dominating. It is seen that northern light has a better performance among the three.

d) Data and chart analysis

It is suggested that the Northern Lights tour be considered the most well-liked service among the three categories of services based on the study of the stacked bar chart. According to the data, the “Northern Lights” trip is the most well-liked of the three based on the greater rate of reservations than the other two. The number of reservations for the “Northern Lights” trip is calculated to be 45%, while 32% of reservations are made for “Dolphin Splash” and 26% are made for the Boarding Party. According to subsequent data, the below 30 age crowd is the best market for “South Pacific cruises”. This is because the age group under 30 makes a greater proportion of reservations. It is also seen that the Silver Sunsets age crowd has completed 94 bookings, as opposed to the Mid-Lifers age group’s 73.

Regarding the general “interpretation and analysis”, it is noted that the “Cruise Company” should continue to concentrate on the “marketing of Northern Lights services”, as well as “Dolphin Splash”, in order to easily increase the company’s revenue and profit margin. In addition, it has been stated and determined that the cruise line ought to highlight reservations made by the “Silver Sunsets” age set for the Northern Lights service and the Mid-Lifers age crowd for the Dolphin Splash service.

Task- 6

A) COUNTIF function

In order to find the number of car that is been manufactured by BMW from the provided data countif function is been used. So, the formula that is been used is “=COUNTIF (A3:A139, “=BMW”)” and the answer that is computed is 72. So, 72 cars are of BMW model.

B) COUNTIF function

In order to find the number of cars that is been manufactured by Toyota and are sold by Japan from the provided data countifs function is been used. So, the formula that is been used is “COUNTIFS (A3:A139, “=Toyota”G3:G139, “=only Japan”)” and the answer that is computed is 6. So, 6 cars are made by Toyota and are only sold in Japan.

C) XLOOKUP function

To find that body type Z4 that are manufactured by BMW, VLOOKUP function is been used so the result that is been computed is:

| Model | Body Type | Formula |

| Z4 | Sports compact / roadster car | VLOOKUP(I7, B3:G139,3,0) |

D) VLOOKUP function

To find that body type ATS that are manufactured by Ford, VLOOKUP function is been used so the result that is been computed is:

| Model | Production years | Formula |

| ATS | 2012-2019 | VLOOKUP (I9, B5:G141,4,0) |

Task- 7

A) Computation of the final value for Rohit

| Computation of the final value of the investment | ||

| Description | Argument | Value |

| Annual Interest Rate | Rate | 3.27% |

| No of compounded years | n/per | 5 |

| Investment | PV | £ 85,000.00 |

| Future value | -£ 453,718.85 | |

Table 4: Computation of the final value for Rohit

(Source: MS-Excel)

B) Amount that was invested

| Computation of the original value of the investment | |

| Present value | £ 37,245.00 |

| Interest rate | 3.10% |

| Number of years | 8 |

| Compounding frequency | 1 |

| Future value using compound interest | -£ 294,525.83 |

Table 5: Evaluation of the Amount that was invested

(Source: MS-Excel)

C) Computation of “annual rate of interest”

| Computation of rate of interest | |

| Investment | 35000 |

| Year | 10 |

| amount | 64555 |

| Rate of interest | 5% |

Table 6: Computation of “annual rate of interest”

(Source: MS-Excel)

Task 8

A) Computation of “Internal Rate of return (IRR)”

- I) when the discount rate is 3.5%

| Discounting rate 3.5% | Present value @ 3.5% discount | Discounting rate 6% |

| 0.01 | -700,000 | 1 |

| 0.965 | 144927.5362 | 0.94 |

| 0.931225 | 275385.6566 | 0.8836 |

| 0.898632125 | 126271.9788 | 0.830584 |

| 0.867180001 | 214374.788 | 0.780749 |

| 3% | ||

| Formula | IRR (D2:D6) | |

Table 7: Computation of IRR when discounting rate is 3.5%

(Source: MS-Excel)

- ii) When discount rate is 6%

| Discounting rate 6% | Present value @ 6% discount |

| 1 | -700000 |

| 0.94 | 141509.434 |

| 0.8836 | 262548.9498 |

| 0.830584 | 117546.6996 |

| 0.780749 | 194855.0412 |

| 1% | |

| Formula | IRR (F2:F6) |

Table 8: Computation of IRR when discounting rate is 6%

(Source: MS-Excel)

B) Values of IRR through MS-Excel

“IRR (-700000: 214374.788)”

“IRR (-700000: 194855.0412)”

C) Hurdle rate evaluation

The provided rate of the barrier is recognized as the minimal rate, which additional aids in the examination and examination of the “project or investment proposal”, according to further analysis and acquired information. In other words, the hurdle rate is useful in determining if an investment proposal will be advantageous to the trade form (Yan and Zhang, 2022, p.08). According to additional information, it is advised that if the “hurdle rate” is higher than the “rate of internal return”, it indicates that the company may suffer a loss if the project is approved. Additionally, according to the total computation, the IRR is estimated to be between 1% and 3% at two alternative discount rates. Moreover, the “hurdle rate” according to the case scenario is determined to be 6.5%. As a result, it can be claimed that accepting the project is highly dangerous because the hurdle’s rate is higher than the IRR’s evaluated rate (Liu, 2022, p. 08). Therefore, it is suggested to “Birkbeck Ltd” that accepting the plan could result in the company suffering a loss in the near future.

D) Merits and demerits of IRR

Merits

Unlike other method IRR considers the time value of the money that helps to get a more accurate answer (Arjunan, 2022, p. 32).

Demerits

He size of the investment is not been considered in the IRR so, even the project that has a huge size is treated same (Qi et al. 2022, p. 712).

Task 9

A) NPV computation

| Calculation of NPV | |||

| Year | Cash flow | Discounting rate | Present value |

| 0 | -£ 20,500,000.00 | 1.00 | -£ 20,500,000.00 |

| 1 | £ 12,500,000.00 | 0.92 | £ 11,467,889.91 |

| 2 | £ 12,500,000.00 | 0.84 | £ 10,520,999.92 |

| 3 | £ 12,500,000.00 | 0.77 | £ 9,652,293.50 |

| 4 | £ 12,500,000.00 | 0.71 | £ 8,855,315.14 |

| 5 | £ 12,500,000.00 | 0.65 | £ 8,124,142.33 |

| Total present value | £ 299,999.78 | ||

| Initial investment | -£ 20,500,000.00 | ||

| Net Present Value | -£ 20,200,000.22 | ||

Table 10: NPV Computation

(Source: Self-developed)

B) working out of Payback Period

| Payback period | |||

| Year | Cash flow | Cumulative cash flow | |

| 0 | -£ 20,500,000.00 | -£ 20,500,000.00 | |

| 1 | £ 12,500,000.00 | £ 12,500,000.00 | |

| 2 | £ 12,500,000.00 | £ 25,000,000.00 | |

| 3 | £ 12,500,000.00 | £ 37,500,000.00 | |

| 4 | £ 12,500,000.00 | £ 50,000,000.00 | |

| 5 | £ 12,500,000.00 | £ 62,500,000.00 | |

| Payback period | 2.64 | ||

| 2 years 6 months | |||

Table 11: payback period

(Source: Self-developed)

C) Implementing the technique of NPV

supplementaryunderstanding and analysis have led to the conclusion that the key methods for determining whether accepting the project proposal is advantageous or not are NPV and a Simple period of payback (Dai et al. 2022, p.08). Additionally, NPV contrastamong the two is a common “investment appraisal method”. Furthermore, it is found that choosing the NPV technique over PBP has two advantages: first, it yields the most accurate results. The fact that NPV uses and takes into account cash flow values is another advantage of the metric (Tan et al. 2022, p. 1005). However, it should be mentioned that PBP is still regarded as one of the most useful and important strategies for calculating the advantages of an investment proposal because it is the quickest and easiest to use when compared to other methods (Abdurofiet al. 2021, p. 116).

Reference list

Alzoubi, H., Alshurideh, M., Kurdi, B. and Inairat, M.J.U.S.C.M., 2020. Do perceived service value, quality, price fairness and service recovery shape customer satisfaction and delight? A practical study in the service telecommunication context. Uncertain Supply Chain Management, 8(3), pp.579-588.

Arjunan, K., 2022. A New Method to Estimate NPV and IRR from the Capital Amortization Schedule and the Advantages of the New Method. Australasian Accounting, Business and Finance Journal, 16(6), pp.23-44.

Bordo, M.D. and Levy, M.D., (2021). Do enlarged fiscal deficits cause inflation? The historical record. Economic Affairs, 41(1), pp.59-83.

Cascarino, G., Gallo, R., Palazzo, F. and Sette, E., 2022. Public guarantees and credit additionality during the Covid-19 pandemic. Bank of Italy Temi di Discussione (Working Paper) No, 1369.

Dai, H., Li, N., Wang, Y. And Zhao, X., 2022, March. The Analysis of Three Main Investment Criteria: NPV IRR and Payback Period. In 2022 7th International Conference on Financial Innovation and Economic Development (ICFIED 2022) (pp. 185-189). Atlantis Press.

Douma, J.C. and Weedon, J.T., (2019). Analyzing continuous proportions in ecology and evolution: A practical introduction to beta and Dirichlet regression. Methods in Ecology and Evolution, 10(9), pp.1412-1430.

Ilzetzki, E., Reinhart, C.M. and Rogoff, K.S., (2020). Will the secular decline in exchange rate and inflation volatility survive COVID-19? (No. w28108). National Bureau of Economic Research.

Qi, J., Wang, Y. And Xu, Y., 2022, December. Research on Project Investment: Methods of NPV, IRR and MIRR. In 2022 International Conference on mathematical statistics and economic analysis (MSEA 2022) (pp. 710-715). Atlantis Press.

Tan, Q., Chen, Y., Wang, X. And Zeng, Z., 2022, December. Studies on the Modifications and Applications of the Net Present Value and Internal Rate of Return. In 2022 6th International Seminar on Education, Management and Social Sciences (ISEMSS 2022) (pp. 1001-1009). Atlantis Press.

Yan, R. And Zhang, Y., 2022, March. The Introduction of NPV and IRR. In 2022 7th International Conference on Financial Innovation and Economic Development (ICFIED 2022) (pp. 1472-1476). Atlantis Press.

Know more about UniqueSubmission’s other writing services: