MBB7008M Finance for Decision Making

Introduction

This report has been made to analyze the overall operational performance of “Pedaltrain Limited” dependent on “breakeven analysis”, “pricing method”, and “margin safety”. This study has been going to seek the components which highlight the ABC analysis importance, and also discuss the significant role of costing models; as well as how it assists the overhead expenses of the company will have been further explained. Primarily, the difference between “activity-based costing” and “absorption costing” has been delivered. The demerits in the process of budgeting the company regarding its other financial performance have also measures that are offered in association with a few recommended strategies. The estimation of the company’s market, its “production cost”, and the “competitors’ strategies” have also been explained.

Company Overview

Figure 1: Logo of the company

(Source: pedaltrain.com, 2023)

The provided company “Pedaltrain Ltd” is based in the UK market and operates as a private firm. In the year 2017, this company was established by “Johnny Miller” (pedaltrain.com, 2023). The company serves “high-tech stationary exercise cycles” and it has huge demand among cycling enthusiasts and high-grade athletes. The company has the aim or target to deliver “high-quality” creative products to obtain worldwide Goodwill and fame.

A. “Break Even point” and safety margin Analysis

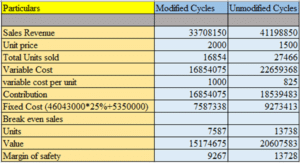

Figure 2: Computation of “Break Even point” and “margin of safety”

(Source: Self-made)

Assumptions

- The reflection of sales is a 5% growth.

- “Variable cost” is computed depending on the percentage of the price of selling for modified products and unmodified products.

- The total administration cost and cost of sales seem to be fixed at 25%.

- The “fixed cost” has been divided depending on the percentage of sales of the unmodified and modified products.

Breakeven

“Break-even” point which defines the level of production at which the “total revenue” is relevant to the “total cost” resulting in no loss and no profit, (Jones et al, 2020, p. 4041). The point of break-even reverses that output units which when produced generate that level of revenue that can sufficiently fulfill the overall production cost. In addition, any productions over break-even units are able to create profit considering any production under break-even would result in the loss.

In the above-shown figure, it can be noticed that “Pedaltrain Limited” is required to generate a “total sales revenue” of GBP “20607583 from 13728” output units from “unmodified cycles” and GBP “15174675 from 7587” output units from “modified cycles” to extend the level of break-even throughout the financial year. This designates that any diminishing revenue of sales under GBP 15174675 from “modifies cycles” and GBP 20607583 from “unmodified cycles” may be the reason for the outcome of the loss for the mentioned company and vice versa. Hence, if the selling capacity and production of the entity decline under 13738 units for “unmodified bicycles” and 7587 units for “modified bicycles”, or if each unit selling price of “unmodified bicycles” declines below £1500, and for “modified bicycles” decline under £2000, the company would seem to begin to sustain a loss. Hence, it can be prominent that if the output of production and total sales revenue survive constant for the time duration of a longer period, it would further result in the company’s loss because of the currency value element and inflation element.

Safety margin

The safety margin is another opinion in “marginal costing” where the difference between break-even volume and actual volume is recognized. This level is known as the level of safety for an organizational entity. As it has been previously stated, “breakeven units” reverse the sales volume which generates the revenue amount which can help to cover the overall production cost and outcomes in neither loss nor profit, (Andreau et al, 2019, p. 150). Now, the exact sales level units show whether the entity is operating below break even or above breakeven. In this case, the actual sales of “Pedaltrain Limited” are over the break-even point, it indicates the company has already fulfilled its overall production cost and any extra units would be able to create only profit. On the other point of view, if the organization operates under the breakeven points which means, all production costs are not yet covered. So, because the safety margin specified the variation “actual and breakeven” output, a greater safety margin shows a profit at a higher level and a better placement for the company. In case of that, the safety margin is positive and higher which means that the company is selling and producing more output and ignoring the breakeven point and with per extra unit of output, the profit percentage would increase as cost only consists of variable cost since fixed cost has earlier been covered up.

B. Applicability of change of “Activity Based Costing” from “Absorption Costing”

Nowadays the procedure of production has become very complex. There is a huge range of unit costs related to each process of production, (Avinash et al, 2020, p. 2330). This assembled comparison of cost and control of cost is more complex. Such as, in the above figure, the “variable cost” has been excluded on the presumption of the percentage of sales mix to both unmodified cycles and modified cycles. It fails to notice the labor hours that may affect the per-unit cost in a few other paths. Furthermore, it is a basic demerit of “absorption costing” that it declined to offer a correct reverse of the earning of the firm as fixed costs are determined as “product cost” and not covered in the time period in which it has been sustained. So, as a matter of fact, it does not offer the accurate profitability position of the “product” that creates the “product mix” and “pricing” decision though, (Xia et al, 2021, p. 267).

On the contrary, ABC analyzes smooth management by offering information on cost linking to individual services and products depending on “individual cost drivers”. Therefore, contingent on ABC costing, decisions connected to “pricing, performance, product mix, and process” are easy to handle. Under “ABC costing” economics related to the procedure of manufacturing can be truly considered as it separates costs depending on cost drivers and activities.

C. Role of “incremental budgeting” in improving employee motivation

In the condition of “Pedaltrain Ltd”, it can be noticed that the entity approves cost control measures and incremental budgeting in a proper way and employees need to follow the measures of cost control to create a performance complex for them. It further affects the quality standard in another way. Sometimes, issues of teamwork occur between employees and managers. Incremental “budgeting” itself has few native demerits, (Finger et al, 2019, p. 314). They notice the efficiency of the “current” procedure only and decline to notice the outcome wastes in front of the “current” procedure. Quality, innovativeness, control and continuous improvement are not examined.

Nonetheless, incremental “budgeting” can be manifest to be fruitful for employee motivation if the approach of “bottom-up” can be noticed. Each level of management needs to consist in the process of budgeting as the level of lower management can efficiently discuss the cons and pros of difference as they relate to the area of function, (Ortynsky, Marshall, and Mou, 2021, p. 80). When employees are engaged in the process of budgeting, they keenly accept striving to perform and budget within it. There is a need for a committee of the budget that helps to control the procedure of budgeting and assemble the execution “departmental-wise”.

D. Pricing Analysis

Product cost

| Total “per unit cost” of “unmodified cycle” | Fixed cost Variable cost | 9273413+22659368/27466 | 1163 |

| Total “per unit cost” of “modified cycle” | Fixed cost Variable cost | 7587338+16854075/16854 | 1450 |

Table 1: Production cost for “Pedaltrain Ltd”

(Source: Self-created)

The upward cost determined has been created according to absorption costing that requires to be converted to “ABC costing” since of the cons and pros explained above. ABC is longer accurate for “cost computation techniques” which would assist in better pricing of the “products”.

Competitive strategy

“Pedaltrain Ltd” has taken an essential strategy where “unmodified products” pricing is low, whereas “modified products” pricing is high, with no deal in quality. Their products are unique, innovative and customized (Majeed et al, 2022, p. 178). Their aim consumers are “serious cycling enthusiastic and high-grade athletes”. They further have copyright for their brand that delivered them a competitive significant advantage.

Competitor behavior

“Pedaltrain Ltd” is running in a market that is highly competitive with Nordictract and Peloton as its competitors. Both companies offer affordable competitive prices of the product and profit unique features too. It can be noticed by the case study that “Nordictrace” has a high product price whereas the Pelton and Pedaltrain are low.

Non-value-added duties

“Pedaltrain Ltd” has done “non-value-added” duties at 8% of the total available time. Hence, the organization requires shifting its techniques of costing from “Absorption” to “ABC”. “Zero-based” budgeting and strategy may assist in lowering activities of non-value-added. The “price-demand” theory must be noticed with the “cost-plus” pricing strategy, (Danso et al, 2019, p. 886).

E. Demerits of financial performance measures and recommendations

Financial performance calculated budgeting, ratio analysis, costing etc alone based on historical data, that bound the true overview of the recent situation. External factors like currency value change, change in demand, inflation, and government taxation rule and regulations are neglected. They are estimated from a short-term consideration. In some case, there are fast changes in the “accounting standard” “financial reporting”and “principle governing accounting” that leads to inappropriate outcomes. It declines to reverse seasonality. Because financial data are adopted from financial statements and connected vouchers and documents, any wrong data therein may negatively affect the measure of financial performance.

Recommendations

| Internal Business Process

● The efficient procedure of production ● Overall quality management ● Saving of environment and waste management |

Customer Perspective

● After-sales service ● High-quality assurance ● Higher customer satisfaction ● Enhance in demand for services and products. |

| Growth and Learning

● Development and training facilities for employees. ● Satisfaction of employees ● Motivation and growth of employees |

Financial perspective

● Optimum sales mix ● Revenue enhancement ● Cost reduction ● Enhance liquidity position |

Table 2: BSC for Pedaltrain Ltd

(Source: Self-created)

Hence, a balanced scorecard or BSC can be fruitful for “Pedaltrain Ltd” as it offers a multidimensional assignment of measure of performance which consists of both non-financial as well as financial perspectives. To achieve a “360-degree” round control based on the performance of the organization’s effectiveness, BSC requires to be established.

Conclusion

Therefore, it can be concluded, which is a major focus on the “financial performance” measure won’t offer strategic management paths to expand the “operational performance” of the company. It is of very much essential to accept some non-financial as well as financial measures to deliver 360 management of the procedure of the organization. Hence, according to the above explanation, it can be explained, that the use of “ABC cost control techniques”, “Performance pyramid” and “preparation of BSC” may assume the organization expanding efficiency along with cost control and performance of employees.

References

Journals

Andreau, O., Pessard, E., Koutiri, I., Penot, J.D., Dupuy, C., Saintier, N. And Peyre, P., (2019). A competition between the contour and hatching zones on the high cycle fatigue behaviour of a 316L stainless steel: Analyzed using X-ray computed tomography. Materials Science and Engineering: A, 757, pp.146-159.

Avinash, C., Gore, N., Shriniwas, A., Gaurang, J. And Manoranjan, P., (2020). Choice crossing behaviour model for Safety Margin of pedestrian at mid-blocks in India. Transportation research procedia, 48, pp.2329-2342.

Danso, A., Adomako, S., Amankwah‐Amoah, J., Owusu‐Agyei, S. And Konadu, R., (2019). Environmental sustainability orientation, competitive strategy and financial performance. Business Strategy and the Environment, 28(5), pp.885-895.

Finger, R., Swinton, S.M., El Benni, N. And Walter, A., (2019). Precision farming at the nexus of agricultural production and the environment. Annual Review of Resource Economics, 11, pp.313-335.

Jones, C.A., Pensado, A.R., Clark, M., Ivanco, M., Judd, E., Klovstad, J. And Reeves, D.M., (2020). Cost breakeven analysis of lunar In-Situ propellant production for human missions to the Moon and Mars. In ASCEND 2020 (p. 4041).

Majeed, A.H., Kosov, M., Fiume, R., Kuznetsov, N., Vasyunina, M. And Semin, A., (2022). Improving the Efficiency of Budgeting in Industrial Enterprise: The case of Russia, Italy, and the Middle East. Emerging Science Journal, 7(1), pp.177-189.

Ortynsky, S., Marshall, J. And Mou, H., (2021). Budget practices in Canada’s K‐12 education sector: Incremental, performance, or productivity budgeting?.Canadian Public Administration, 64(1), pp.74-98.

Xia, T., Shi, G., Si, G., Du, S. And Xi, L., (2021). Energy-oriented joint optimization of machine maintenance and tool replacement in sustainable manufacturing. Journal of Manufacturing Systems, 59, pp.261-271.

Websites

Pedaltrain.com, (2023). About us. Available at: https://pedaltrain.com/ [Accessed on: 20/06/2023]