MGT5STR Case Study Assignment Sample

Here’s the best sample of MGT5STR Case Study Assignment, written by the expert.

Introduction

This report is focus on the discussion of Crypto currency and case analysis of Bitcoin. The Crypto Currency Bitcoin an electronic cash system peer to peer model article is given by (Satoshi Nakamoto, 2011) is discussed elaborately. Crypto currency is exchange of electronic cash in digital media is same as Rupees, Euros, pounds and Dollars. These are brought to global culture to provide safe and secured digital cash exchange with impeccable ethics of digital currency (Hackett, 2017).

The aim of this is to provide global outlook of digital currency market. The world crypto currency markets are forecasted it has ample growth in 2025.It amble growth is because of increasing in Novel and continuous techniques in payment by big protruding companies across global (Tom, 2017).

The report object is to provide global outlook of 3 crypto currencies in which Bitcoin is must. It analyses and provides information about external environment factors through PESTLE and PORTERS 5 Force model. Resource and capabilities of crypto currency transaction volume in small home user and larger companies are clearly portrayed. The finding of this report people across global high preference through digital transaction but they are feared because of hacking and pirated actions by fraudulent system setup (patrick, 2017).

Background to the case

According to the case study (Satoshi Nakamoto, 2011) the electronic cash transaction can be done directly between two individuals without lending hands for the support and involvement of other financial companies or institutions. These are redesigned with help of digital signature concepts with add-ons of impeccable trust and avoid overspending to the third parties. Based on the case study (Satoshi Nakamoto, 2011) digital coin is a row of sequential digital signature it always carrier two data pervious transaction hash value and present owners public key.

Reference of this case (Satoshi Nakamoto, 2011) they have redesigned and implemented the system to provide high level trust and to neglect over spending to financial third parties. The strategies behind this implementation are adaptation of “centralized authority control for trust factor”. The author has framed “Mint model” to enhance the performance of the system.

The author has presented the effective solution in which the system will take information about per hash time stamp value. It is operated based on centralised serve with timestamps mechanisms. Decision making confronting and priorities can be automatically solve by proof of work system. Node slack time is controlled to avoid confronting in block transmission time by allocating single vote for both IP addresses and CPUs used (perez, 2015).

To skip the node which has length time it adopts the following steps in the network plan and action in the system.

- New transaction broadcaster in separate nodes.

- Blocks store all new transaction information.

- Confronting finding and solving by proof of work.

- Confronting and finding are reflected in all nodes.

- Validity of block for the acceptance of any nodes.

- Hash values of blocks are exposed.

To extend the power and CPU processing unique centralised model has been used to free from greedy attacker. To enhance determinants of honesty in all nodes and avoid inflation incentive methods are used. Memory disk which can store nearly 80 bytes of bocks for every 10 minutes transaction by using tree method “Merkle model”. Per year it needs space of around 4 MB. In the current scenario is 1GB growth rate for every year (Patterson, 2015). Centralised model provides support of fabricated transaction, novel and continues payment, safe, secured independent, unrivalled validity and impeccable verification. Values Merging and splitting between the two parties provides platform to handle the electronic coins independently (Tom, 2017). To enhance trust and security acknowledgment will reflect on both the side. This system provides additional security and privacy with effective firewalls. For instance, it can be used in stock exchange platform for getting multiple input and output transaction. 0.1% chance for the occurrence of problem (Patterson, 2015).

PESTLE analysis of the case

The PESTLE analysis for global crypto currency have been done

Political factor:

- Crypto currency implementation and usage is not controlled or stopped by any economy government bodies. Government bodies totally depend on the financial sectors.

- Banks in china, Russia are severely barred because of non-acceptance of crypto currency.

- US, UK, EU are the economies highly supporting bit coins. Latin people are more in spending bit coins.

- Private parties are highly enjoying this opportunity(Aitken, 2017).

Economical factor:

- More over 89,000 merchants were using crypto currency.

- Global market prediction is that GDP will rises 0.075% from $77.5 trillion with capitalisation increase up to 5.5 dollar billion.

- Monetary policies help to sustain and 20 billion of Bitcoin users across global.

- It has 15 million circulations of crypto currency(Hackett, 2017).

Social- Cultural factor:

- People driving towards to virtual trading practice because of anonymity, planning for future generation saving, etc.

- Awareness and usage is less(Aitken, 2017).

- To attract more customers merchants are playing with their preference of virtual payment and using crypto currency(Patterson, 2015).

Technological Factor:

- Every business in the competing world it runs towards technological aspects.

- Block chain of crypto currency are having exponential growth and in leveraged(Hackett, 2017).

- Global public ledger depicts

- Computational power rises when demand grows for crypto currency.

- Adverse effect because it emits co2 using of carbon prints expected 2 tons emission.

- Use high electricity and coal to cope up operation

Legal factor:

- Hinder of coins are generally decentralized in any economic rules and regulation policies(Hackett, 2017).

- Developed economies like US, UK, EU are implementing strong regulation by partnering with block chain private alliance.

3.1 Numeric data of crypto currency values and trends

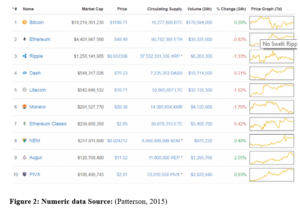

After the PESTLE analysis, digital currency like Bitcoin, Ethereum, Ripple, Dash are the top stream in business financial market. It is forecasted to rise 4.9% in the next 5-10 year of population (patrick, 2017). Numeric data of Bitcoin, Ethereum, Ripple, Dash values and trend are compared by pricing graphs are show below. In which bit coin occupies first place in the global market value with $1180 and next position by Etherium nearly 48.5$ and third position by ripple with nearly 40.5$.

Porters Five force Model

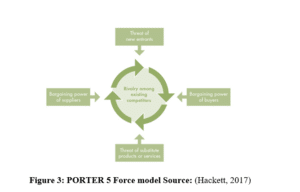

The crypto currencies are anti-social for youth and it has advanced technological block chain alliance. In the current scenario the crypto currency growth was drastic there is high rivalry between competitor and heavy competition (patrick, 2017). The competitors in the battle field are

- Bitfinex,

- BitFury Group,

- Bitstamp,

- Ripple,

- Litecoin,

- OKEX Fintech Company,

- Coinbase,

- ZEB IT Service.

Threat of new entrants and substitutes are very high most protuberant organisation is in the chain of crypto currency. For Instance, Obama administration leads to bring more partnership with private alliance of crypto currency. Various block chain alliance in US market are entered (Hackett, 2017).

Resource & capabilities required to mine the crypto currency by small home users and large commercial factories

The cost of the crypto currency shows that they have good future ahead in the market. According to (coinmarketcap, 2017), the top crypto currency and their value are as follows

- Bitcoin – Market cap is $101,443,113,608 and the price is 6097.50

- Ethereum- Market cap is $28,431,101,111 and the price is 298.55

- Ripple – Market cap is $7,901,893,876 and the price is 0.205076

- Bitcoin Cash – Market cap is $5,402,107,387 and the price is 323.33

Crypto currency has more negativity surrounding than positive. This unexplored nature of currency made the investors and government to concern about its safety and vulnerability to threat. It also changes the control over the money from the central bank to the common man.

- According to (Reiff, 2017) openness allows vulnerabilities to that system. I.e. Ripple, one of the crypto currency which core remains highly liquid: researchers at Purdue University found that the currency system allows attack on certain nodes.

- As the Crypto currency is much new than the currency system existed, the major issue it is facing is that “Crypto currency” is volatile. This fluctuation in price makes it hard for the business or customers to use it as a payment system. The speculators in this system make it more of an investment system.

- According to (Bohannon, 2016) Criminal usage of crypto currencies are more in number as Ross Ulbricht, is sentenced to life after found that he created the Silk Road; which is a Bitcoin market facilitates $1billion illegal drugs sales(blockchain, 2017). These become possible as the Bitcoin one of the crypto currency is something of address where it is seized that Silk Road 30,000 currency and auctioned it for $20 million by US government.

Many companies started to accept Bitcoin as the payment currency include wordpress.com, Subway, Microsoft, Paypal, okCupid, Wikipedia, Steam, piratebay, Bloomberg.com, etc, With the 320,322 transactions per day on 21st Oct, 2017 (blockchain, 2017) stats that n number of individuals is using crypto currency.

Conclusion

Crypto currencies are becoming much stronger as there is no control by banks or gold reserve etc. But on the other hand the volatile and individual usage can cause some adverse effects on the law enforcement (Patterson, 2015). As it is an infant stage of crypto currency, it needs a longer run to go further in development. Governments such as China, American, Russian and the Venezuelan although had jailing the miners, It needs further development in technologies.

Bibliography

Aitken, R. (2017, April 12). Cryptocurrency Boom Predicted By Bitcoin Market Data CEO Confirmed, Trend ‘Set To Continue’. Market moves , 20 (2), pp. 4-10.

blockchain. (2017, October 21). Retrieved from blockchain: https://blockchain.info/charts

Bohannon, J. (2016, March). Why criminals can’t hide behind Bitcoin. Retrieved from sciencemag: http://www.sciencemag.org/news/2016/03/why-criminals-cant-hide-behind-bitcoin

coindesk. (2017). Bitcoin USD price. Retrieved oct 20, 2017, from www.coindesk.com: https://www.coindesk.com/price/

coinmarketcap. (2017). Cryptocurrency Market Capitalizations. Retrieved oct 20, 2017, from coinmarketcap.com: https://coinmarketcap.com/all/views/all/

Hackett, R. (2017). 7 Cryptocurrency Predictions From the Experts. chicago: fortune.com.

patrick. (2017). ANALYZING CRYPTOCURRENCY MARKETS USING PYTHON. US: patricktriest.com.

Patterson. (2015). Bitcoin: A New Global Economy. blog.bitpay.com.

perez. (2015, oct 24). .coindesk. Retrieved oct 11, 2017, from www.coindesk.com: http://www.coindesk.com/european-exchanges-react-to-bitcoin-vat-exemption/

Reiff, N. (2017, June). What is the Biggest Security Threat to Ripple Cryptocurrency? Retrieved from Investopedia: http://www.investopedia.com/news/what-biggest-security-threat-ripple-cryptocurrency/

Satoshi Nakamoto. (2011). bitcoin. Retrieved 0ct 11, 2017, from /bitcoin.org: https://bitcoin.org/bitcoin.pdf

Tom. (2017). China and Japan are largely responsible for cryptocurrency’s success. US: businessinsider.

________________________________________________________________________________

Know more about UniqueSubmission’s other writing services: