MGT703 Strategic Management Assignment Sample

Here’s the best sample of MGT703 Strategic Management Assignment, written by the expert.

Introduction

The main purpose of this report is to strategically analysis the firm’s strategic management system efficiently. LIDL Company is chosen organization for analyzing and evaluating the current growth strategy and performance in today’s highly competitive environment. This report will focus on identify the current growth strategy that business uses for attaining organizational goals and objectives efficiently (Borland et al., 2016). In addition, this report will evaluate the current growth strategy on the basis of external environment, need for innovation and by using different useful framework respectively. Further, some changes will also be recommended to the company that will help the firm in attaining the higher level of growth performance efficiently. However, this report will simply help in identifying the threats and opportunities related to innovation in core business.

Company Background

LIDL is a German based well-known grocery stores and supermarket that offers varieties of products & services to the customers efficiently and effectively. The company established its business in Neckarsulm Germany supermarket industry in 1930 by introducing a new concept of discount retail products & services to German based consumers. LIDL is focusing towards offering the customer with varieties of products at a low and affordable price and also in best quality (Lidl, 2018). The company is operating over 10000 stores across United States and Europe. The main competitor of the company in discounted supermarket or hypermarket industry is Aldi in different market location as well as market in United States too. The target market of LIDL Company is whole market (anyone) because it provides cheaper groceries to the customers who influence the buying decision of the people who prefer and satisfy with LIDL over other competitors firms i.e., ALDI, Tesco, D-Mart, Mark & Spencer, etc While expanding the business, company faced various challenges that affected business performance to a large extent.

Identify LIDL’s Current Growth Strategy

Describe the current strategy for the core business

Currently, LIDL is using the low price growth strategy i.e., cost leadership strategy. This strategy focuses on providing the customer with high quality of products at a low cost. Currently, the company strategy for LIDL is dependable on the fresh products offering with the improvement in the setup. Generally, customers look for best quality of the products and services in today’s diversified market and tough competition (Clegg et al., 2015). The company efficiency is based on the input and outputs where it operates its business by reducing the costs and saving the time, space, energy and effort respectively. In addition, Lidl also uses the approach to elaborate the additional services and the promotions of the products and services in an efficient manner.

Business Model

LIDL Business Model is very effective for achieving high growth performance for that business model is divided into three core values such as consistency, simplicity and responsibility. There is high need to maintain the consistency in the working culture and environment of the organization which help in leading the reliability and helped company (LIDL) to position its brand name in competitive environment (Glauner, 2016). In addition, the simplicity in the business functioning creates a huge impact on the LIDL business performance and growth. Moreover, the company value is also raised with the support of its stakeholders, employees, customers and other respective parties with whom company deals with efficiently (Rosenbaum-Elliott et al., 2015). The company value is maintained by paying its employees well which increases their efficiency to work harder and focus more on raising customer satisfaction level.

Identify resources and capabilities

VRIO Framework is an effective way to evaluate the competitive advantage of an organization on the basis of resources and capabilities. In concern to this, VRIO framework is also applied by LIDL Store Ltd. that helps in determining the value of the low pricing supermarket that allows the customer to change their buying decisions. In LIDL, there is rarity found which is related to industry rivalry (Bălan, 2015). On the other side, the limitability of LIDL is difficult because of different nature of organization as it focus on providing limited branded products. The organizing of LIDL is something which allows the operational manager to adapt input for attaining a better output and capture the large market share (Jenkins and Williamson, 2015). While studying, it is identified that brand name and business efficiency help in achieving the competitive advantage easily and efficiently. The resources and capabilities of LIDL involve financial resources, technological resources, organizational resources and human resources. Thus, these all resources and capabilities help in overcoming the strategic problems efficiently.

Evaluate the Current Growth Strategy

Identify the need for innovation

In every organization, there is always a need to develop or grow the business through innovative idea respectively. For this, proper industry analysis is required to be done in order to identify the innovative opportunity that enhances business growth and development. SWOT analysis help in identifying the strength, weakness and opportunity and threat for the company LIDL as well as requirements respectively:

| Strengths

· Strong customer base and brand image · Limited quality of product range · Attain cost efficiency by offering wide range of owned products (Yoder et al., 2016) · High buying power · Unique organizational operational system |

Weaknesses

· Lack of product differentiation · Lower name of brand · Few well trained staff · Lesser advertisement |

| Opportunities

· Increase market penetration · Geographical expansion · Implement new technological system to improve customer experience (Grünig and Kühn, 2015) · Use diversification method efficiently · Develop strong relationship |

Threats

· Limited usage of new technology · Globalization is a major factor that develop competition in future · Organization culture get affected with business expansion · Online shopping |

Examine the external environment

PESTEL Analysis

| Political factor | LIDL company is operating its business efficiently in this highly competitive environment by opening new stores all around UK. While studying, it is found that LIDL performance is highly influenced with the political condition of different countries. The government of different companies is focused towards employment legislation and food safety & subsidy (Grünig and Kühn, 2018). In respect to this, LIDL focuses on employing a large number of elder and disabled workers and students by offering lower wage rate. |

| Economic factor | The economic factor of UK country is very strong and effective in order to avoid the situation related to recession as seen in year 2008. Economic factors of the country helped LIDL to influence the demand, price, cost and profit efficiently. The economic factor such as inflation rate, GDP growth rate creates a huge influence over the company’s performance. |

| Socio-cultural factor | The socio-cultural trend worldwide are changing very drastically similarly like a fashion trend because now customers demand for more organic food products, branded products (Kotler et al., 2015). In UK market, customer demand products in bulk which is due to the change in social environment. |

| Technological factor | Nowadays, customers want more convenient and high tech experience while purchasing a product or service. The technology plays a significant role in bringing cost effectiveness and enhances the customer experience. Technological factor is considered effective for the company growth because this help the development of many products which are offered by company to customers (Marcilla, 2014). There are different technologies Lidl utilizes in the store are Wireless devices, intelligent scale, self-check-out machine and electronic shelf labeling and so on. |

| Environmental factor | Environmental factor also create influence over the growth of the company and its performance such as exhaustive cultivation and mismanagement while resource extraction. These factors affect the sustainable consumption of goods and production efficiently and effectively. |

| Legal factor | There are different legal policies and regulations that need to be considered by the retail firm which operating business in large market space. At the same time, labeling law is one of most important law that needs to be adopted by LIDL in order to maintain customer loyalty. |

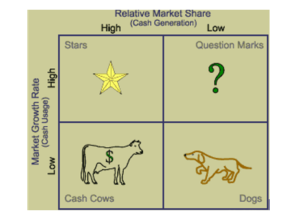

Evaluate industry attractiveness and competitive position by using BCG Matrix

In order to evaluate the LIDL current positive in this competitive business environment, there is need to firstly examine the company current strategies and approaches (Palia et al., 2014). In regards to this, BCG matrix will undertakes for identifying the company competitive position in the market. This matrix is divided into the two areas such as relative market share and market growth etc. However, market growth serves as a proxy for industry attractiveness while market share serve as a proxy for competitive advantage (Nippa et al., 2011). The BCG matrix is further divided into four categories such as dogs, question marks, stars and cash cow etc. This area defines that company current status in the market.

Dogs: Dogs define the low market share and low growth and this means that company not generating any type of cash.

Question marks: Question marks shows the rapid growth but by consuming lot of money. At the same time, there is low market share due to which they do not generate much cash. It results in large net cash consumption (Udo-Imeh et al., 2012).

Stars: Stars indicates the generation of large amount of cash because of high market share. Similarly, high market growth exists due to the different portfolio investment.

Cash cow: As leaders have arrived at the maturity stage then return on assets is greater than the market share (Untiedt et al., 2012). Thus this generates more cash as compare to consumption.

On the basis of BCG matrix, LIDL is at the question mark stage as company has low market share due to less recognition. But it has high market growth because firm focuses on the higher quality product with affordable price. Thus, such actions show that the company has high opportunity to grow but it lacks in attracting the market share.

In concern to this stage, the LIDL current strategy is to focus on the limited range of product by making changes in price policy (Massa and Testa, 2012). This strategy may help the company to become the cost leader as it plans to provide the quality product at affordable price. Thus, this process allows the company to achieve the position of star in the BCG matrix.

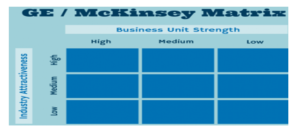

Evaluate the MACS (Market Activated Corporate Strategy

The market activated corporate strategy includes the GE McKinsey Matrix in regards to evaluate the market attractiveness and business strength (Hampl & Loock, 2013).

This matrix shows the company ability to attract the consumers with the business strength. This dimension assists in determining the attractiveness of the market by analyzing the benefits when company enters into the industry (Thompson et al., 2012). In regards to this, it is found that LIDL has achieves the success with the entry into this industry as it attracts the customers through its current strategy. Likewise, company focuses on the limited product by using the penetration strategy. This practice allows to cutting down the cost that’s help in saving maximum spending. Besides that, the strategy of expansion of retail base includes the petrol price and the liquor tends to also provide benefit to company (Stensson et al., 2015). The price changing policy is another tactic that is the company biggest strength. This practice attracts the LIDL Company to enter into this segment market. Moreover, LIDLs lean model is also proves to be strength as this step help the company to offer the quality products to its emerging segment of white collar customers and develop the favorable shopping experience for target market.

3.6 Evaluate Resourcing

The resources and capabilities are the biggest aspect for the company in regards to achieve the competitive advantage. Likewise, the LIDL resources include the opening hours, product differentiation and reputation in offering better services to customers. The above analysis clearly indicates that the company is properly uses its resources. Likewise, company invests in limited range of product by lowering the cost. This practices makes the company cost leader and then it is continued to be maintained. Moreover, company also use the capability in a effective manner as it concentrates on the selling of selected range for the exclusive brands rather than spending the money on the customer loyalty programs (Palia et al., 2014). Thus, this strategy of company shows the optimum utilization of resources. On the basis of study, it is analyzed that LIDLs has properly managed the resources by using its capability.

Recommend the changes that result into high growth performance

For betterment of LIDL, the recommendations are based on development of reputation and goodwill of the company by focusing on maintaining the globalizing pricing. Lidl Store ltd. is recommended to focus more on diversification by selling diversifying the products in three different ways such as: selling more organic products, existing states with more stores and new regions like Western & South Australia and New Zealand. At the same time, Lidl should focus on adopting institutional marketing in which they should open their store inside commercial building and hospital in order to reach the large numbers of customer (Laffy and Walters, 2016). Thus, this marketing strategy will help in attracting more customers in future. Moreover, LIDL must encourage its customer to use more of reusable bags so that environmental factors get less affected.

On the other side, it will also be recommended that company should provide the bare bones which will somewhere improve the shopping experience of the customers. The other recommendation will help in adding the value in the company performance i.e., through selling on-trend merchandise with an effective crafter discounted model. This will ultimately help the company to smartly expand its market and by selling more selected house brands and merchandise should cater health conscious shopper by providing them private brands mainly gluten free natural products. On the other hand, it can be recommended to the company that it must provide its service online i.e., through e-commerce business retailing (Grant et al., 2014). This way would reduce the cost of central distribution and allow the LIDL to expand the customer satisfaction and market share By adopting all these recommended changes, it will become easier for the LIDL to achieve the higher level of growth performance and will develop the business to next leading market position.

Conclusion

From the above study, it can be concluded that in today’s competitive environment, LIDL is efficiently operating its business by providing customer with the varieties of products and services. This report also helped in analyzing the external environment for identifying the innovative opportunities and threats of the company (LIDL Ltd.). While studying, it is also identified that LIDL is another hard core discounter business in the Australian market which is threat for LIDL but at the same time, geographical expansion of business is an opportunity for the firm too.

While evaluating the current innovative strategy, BCG matrix framework helped in identifying the company is operating successfully by offering products at low cost and only limited branded products. In addition, LIDL Company need to focuses more on reviewing its growth strategy in order to maintain and sustain its market position in the competitive environment. Currently, LDLI is focusing on offering limited branded and organic products by bring a change in the pricing policy. Further, LIDL should reconsider all recommendations in order to attain the high growth performance efficiently and effectively. Thus, overall report helped in conducting in-depth analysis related to current strategy and performance of LIDL.

References

LIDL. 2018. About Us. [Online] Available at: https://www.lidl.com/ (Accessed: 15th June, 2018).

Borland, H., Ambrosini, V., Lindgreen, A. and Vanhamme, J., 2016. Building theory at the intersection of ecological sustainability and strategic management. Journal of Business Ethics, pp.1-15.

Bălan, C., 2015. INVESTING IN MARKETING IN TIMES OF RECESSION. Quality-Access to Success, 16.

Clegg, S.R., Kornberger, M. and Pitsis, T., 2015. Managing and organizations: An introduction to theory and practice. Sage.

Glauner, F., 2016. Future Viability, Business Models, and Values: Strategy, Business Management and Economy in Disruptive Markets. Springer.

Grant et al., 2014. Contemporary StrategicManagement: An Australian Perspective, 2nd edn, USA: Wiley.

Grünig, R. and Kühn, R., 2015. Preparing the Strategy Planning Project. InThe Strategy Planning Process (pp. 67-75). Springer Berlin Heidelberg.

Grünig, R. and Kühn, R., 2018. The strategy planning process: Analyses, options, projects. USA: Springer.

Hampl, N., & Loock, M. (2013). Sustainable development in retailing: What is the impact on store choice?. Business Strategy and the Environment, 22(3), 202-216.

Jenkins, W. and Williamson, D., 2015. Strategic management and business analysis. Routledge.

Kotler, P., Burton, S., Deans, K., Brown, L. and Armstrong, G., 2015.Marketing. Pearson Higher Education AU.

Laffy, D. and Walters, D., 2016. Managing Retail Productivity and Profitability. Springer.

Marcilla, L.B., 2014. Business analysis for Wal-Mart, a grocery retail chain, and improvement proposals (Doctoral dissertation).

Massa, S. and Testa, S., 2012. The role of ideology in brand strategy: the case of a food retail company in Italy. International Journal of Retail & Distribution Management, 40(2), pp.109-127.

Nippa, M., Pidun, U. and Rubner, H., 2011. Corporate portfolio management: Appraising four decades of academic research. The Academy of Management Perspectives, 25(4), pp.50-66.

Palia, A.P., De Ryck, J. and Mak, W.K., 2014. Interactive Online Strategic Market Planning With the Web-Based Boston Consulting Group (BCG) Matrix Graphics Package. Developments in Business Simulation and Experiential Learning, 29.

Rosenbaum-Elliott, R., Percy, L., Elliott, R.H. and Pervan, S., 2015. Strategic brand management. Oxford University Press, USA.

Stensson, D., Strömberg, A. and Alfredsson, J., 2015. The Effects of Repositioning as a process of Rebranding in terms of Brand Equity, Corporate Identity, and Brand Image: A case study on Lidl.

Thompson, C., Clarke, G., Clarke, M. and Stillwell, J., 2012. Modelling the future opportunities for deep discount food retailing in the UK. The International Review of Retail, Distribution and Consumer Research, 22(2), pp.143-170.

Udo-Imeh, P.T., Edet, W.E. and Anani, R.B., 2012. Portfolio analysis models: a review. European Journal of Business and Management, 4(18), pp.101-117.

Untiedt, R., Nippa, M. and Pidun, U., 2012. Corporate portfolio analysis tools revisited: Assessing causes that may explain their scholarly disdain. International Journal of Management Reviews, 14(3), pp.263-279.

Yoder, S., Visich, J.K. and Rustambekov, E., 2016. Lessons learned from international expansion failures and successes. Business Horizons, 59(2), pp.233-243.

________________________________________________________________________________

Know more about UniqueSubmission’s other writing services: