MOD007700 Uk Taxation and Auditing Assignment Sample

Introduction

Taxation refers to a fixed percentage that is charged by the tax authority of the government after a certain fixed income or revenue is generated by a different business organization or individual. Tax is main source of income for the government to manage all financial activities of the country and provide financial support to different sectors. Audit is an examination and inspection of different financial activities and its record in different forms to represent in front of the government for paid tax to the government and tax benefits. This report is based on an examination of audit reforms in the UK and identifies different types of issues faced by the government to improve the quality of the audit profession.

Evolution of social and economical results of audit reforms

Auditing is highly important for a government to solve the “social and economic” problems of a country. There needs to be reform in the audit process to improve the confidence of organisations and individuals. Audit reform refers to changing or modifying the old audit and tax process to attract more people and organisations to pay tax for the development of the country. There are different types of “social and economic results of any audit reforms.

Social consequences

Helps to collect more tax: Sometimes new audit reform help government to collect more amounts through imposed new tax rate to different bodies of industries and individuals also. The UK government introduced the “Income Tax Act 1842” in 1842 again reforms it and reduced the tax rate to 2.9% on the income of more than £150 (uk.practical law, 2021). The tax act is old and organisations are also finding a way through they not pay tax to government. The government has faced problems in developing countries due to not having sufficient finance. It is essential for the government to reform their audit process through large numbers of industries and individuals who want to pay tax for the development of the country. On the other hand, these steps of the government are taken under the “Peel’s income tax act”. Main objective of this tax audit is to engage more people in the taxation process.

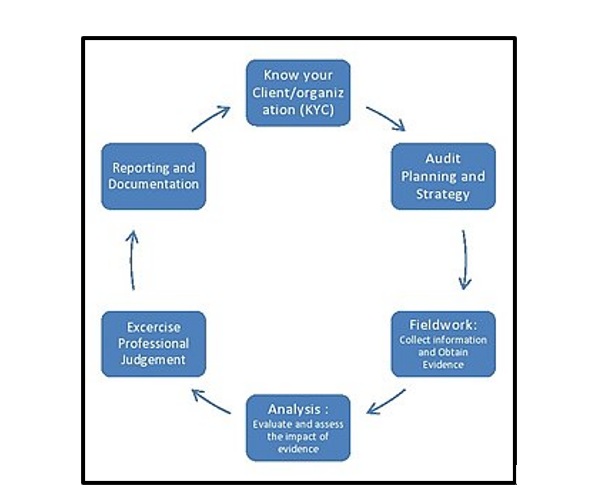

Figure 1: Social and economical results

(Source: Koval et al. 2019)

Reduce tax burden: tax burden plays a prime role to distract people from the taxation process and the government of any country has to face issues to collect tax. Old taxation process of the UK government gives a negative impact on different industry sectors as well as individuals. As opined by Koval et al. (2019) government of the UK is thinking of reforming its tax to introduce a new rate of tax act from 2015 as 25% on income of the corporate industry. This tax rate is reduced from the old tax rate of 30% (UK.practical law, 2021). The new tax reforms attract 24.5% more corporate industry to pay tax to the government.

Economical consequences

Improve profitability of industry as well as government: tax is one of main reasons to reduce profit of industries and improve income level of government. The old tax rate of the government that is charged was nearly 30 % in 2010 and it was reduced to 20%in 2015 through different actions that were conducted in the process of reforms. As stated by Alexandra, (2018) this reform of government plays a significant role to improve the profit of corporate industries and government also through engaging more industries in the process of tax paid.

Possible factor of audit reforms

Audit reform is a prime factor to change the economic condition of corporate industries as well as country economics. There are different positive factors of the new tax policy.

Tax relief: new tax policy supports different organisations to feel relief. New reforms allow different corporate sectors to pay 25% over their net income (law.ac.UK, 2021). The new tax relief is to support investment of £5.5 billion that is invested in more than 825 firms. Besides, it gives relief of £800 million.

Improve income level of individuals: people of UK have relief from new tax policy and paid 20%on the 1st£ 32, 010 incomes. Furthermore, the highest tax rate is 40%that is charged between incomes of “£ 32,011 to £ 150,000” (UK.practical law, 2021). The old tax rate for personal income is high as compared with the current tax rate and people also avoid paying tax. Old tax’s negative impact is seen in the income of the government. People of the UK are also involved in the new tax process and feel safe as they do not take any unethical process to save their income from the authority of the tax department. New tax rate has supported individuals to improve their income level by 2%.

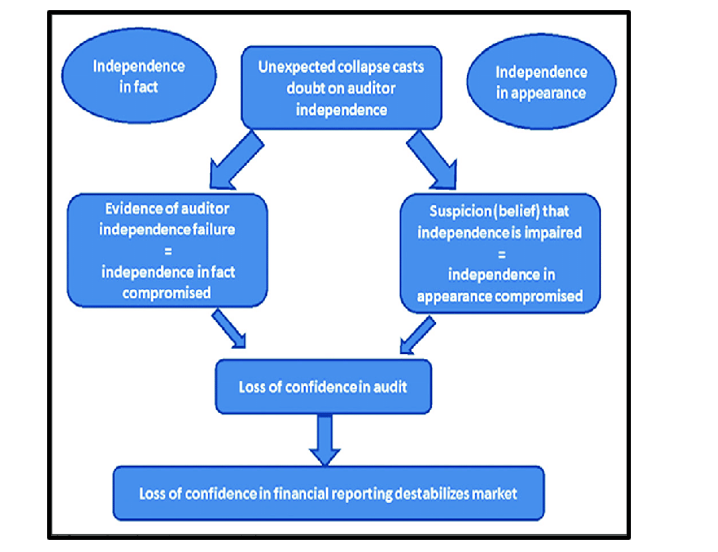

Figure 2: Possible factor

(Source: Kanakriyah, 2020)

Provide strong structure for the economy: the economy of any country depends on the income of the county and there are taxes as a prime resource to generate income for the country. New tax schemes must be developed through focus to attract more individuals in tax practices and paid tax honestly. As argued by Kanakriyah, (2020), it is a possible factor that the income level of the government is hiked nevertheless the government is able to collect tax from individuals lower as compared with previous amount tax paid. Besides, a high income of the government may support the government to develop a strong structure for the country that supports different sectors and horizontal development of the country. These steps of country also support to become world’s largest “foreign exchange market” UK has performed 40% currency exchange process is held in UK.

Reduce complexity of calculation: New method of tax calculation is simple as compared with old method to calculate the tax amount of industries and individuals to pay tax to the UK tax authority. The government is also considering the method of calculation while developing policy and rates for new audit reforms.

Practical issues faced by UK government to improve audit profession

Audit profession means independent checking of financial statements and the process of recording different transactions in books of accounts in a company. Audit profession is the support authority of the tax department to identify different taxable activities of industries and calculate accurate amounts of tax paid. There are different types of issues that arise when the government of any country reformed these tax rates and their process was imposed on income.

Objectivity and Independence: government of UK has faced issues to define objective of new tax policy such as generating high income for nation or improving income level of individuals. Objective of any practice must be defined. Neither the new scheme of tax is successful nor are people of the county interested in the new tax process. On the other hand, it must be observed by members of authority that the new process of tax calculation and process of imposed tax is must be simple. As opined by Unerman and Bebbington, (2018), the new reform that was introduced by the government in 2015 is simple for calculating corporate tax nevertheless personal tax calculation is complicated as compared to previous calculation.

Public interest: government must consider public interest while imposing a new tax scheme in the process of collecting income for the country through tax. New tax calculation process for personal tax is too complicated and general people easily understand the process of tax calculation and their interest may be lower. The government is also facing problems attracting people to pay taxes to the government.

Integrity: integrity is an important factor to launch any new scheme to collect tax from people. The government is also considered honest of people to launch new reformed tax schemes in the country. The new tax rate must be lower than the previous rate to attract new taxpayers and avoid activities if taxpayers such as hidden some income to reduce tax amount. Integrity supports any government to improve the audit profession through awareness of the benefits of tax payments.

Coordinating previous tax process: Government faces issue in coordinating the previous tax process. Besides the current tax, the process should be coordinated within previous tax schemes to carry out previous tax due of different industries and individuals. The government recently reforms “Income Tax Act 2007” and imposed a new tax rate for individual tax payments. Tax rate after reforms is 20%, 30%and 40% (parliament.UK, 2021). It is dependent on the income of individuals; nevertheless, the tax authority of the UK faces the issue of calculating the actual amount of tax paid.

Replace confidence through new audit reforms in capital market and financial statement

Audit reformed in capital market

Audit refresh plays a prime role to improve the performance of capital market as well as increased operation of the capital market through a simplified process of imposed normal tax rate in income that is generated from capital gain. As opined by Ojeka et al. (2017) capital market refers to a market where people are able to generate high income through investing in low amounts such as “income from lottery, puzzle games and gambling”. The new audit process of the UK government is to collect a high amount of tax. The current tax rate on capital gain is 28%. The current rate is decreased from the previous rate promoting capital gainers to pay is actual tax on income. Besides, it improves public trust to be involved in the capital market. The Auditing profession is also allowed to consider the cost of capital such as “interest on capital” while calculating corporate tax and other tax.

Audit reform also plays a significant role to improve the confidence of individuals who generate gain through different activities in the capital market and partners of a partnership organisation. The government is also focused on simply calculating tax on capital transactions and the process of monitoring different capital business activities. The new audit profession is to promote people to buy capital bound and other securities to support any organisation to access sufficient finance for business operation. The new process of auditing is to improve “Relevance and Reliability” of capital transactions in the capital market. Reliability of transactions is too important for identifying accuracy of capital gain.

Audit reformed financial statement

The financial statement consists of greater information on all financial activities of an organisation. It is an element to monitor and evaluate the actual income of an organisation. Normally an income statement is considered by the tax authority to calculate the taxable income of the company. New tax policy and reforms in tax is a support organisation to provide sufficient information about different sources of income. Besides, some other statement of an organisation is also considered by members to calculate actual income that is already entered in the income statement of the company. New tax policy is developed by focusing on the imposed simple percentage of tax on the income of industries that is 20% on net income of the company (lawcom.gov.uk, 2021). Besides, new regulations of auditing also provide authority to members of the tax department to analyze all financial statements other than income statements to identify some other income for calculating tax.

Conclusion

This report is a tax analysis and its impact on different stakeholders who are directly or indirectly engaged to pay tax to the government. New audit reforms are developed by the government to attract extra people in the process of tax payment. It is noticed that UK government is focused to reduce tax burden on different business organisations continuously and reforming this tax structure regularly on a yearly basis. It is identified from previous tax policies and current tax policy of the government. The government made nearly 30% rate in previous years and now reduced it to 20%. Besides, the government is also supporting their people to improve their income by 2%. Finally, it is discussed that without effective and strong taxation and auditing for better income generated from organisations and individuals as a professional tax. Besides, tax is also providing a wide range of income for the government.

Reference

Journals

Alexandra, J., 2018. Evolving governance and contested water reforms in Australia’s Murray Darling Basin. Water, 10(2), p.113. Available at: https://www.mdpi.com/2073-4441/10/2/113/pdf

Kanakriyah, R., 2020. Model to determine main factors used to measure audit fees. Academy of Accounting and Financial Studies Journal, 24(2), pp.1-13. Available at: https://www.researchgate.net/profile/Raed Kanakriyah/publication/340742733_MODEL_TO_DETERMINE_MAIN_FACTORS_USED_TO_MEASURE_AUDIT_FEES/links/5e9b86b6a6fdcca789245110/MODEL-TO-DETERMINE-MAIN-FACTORS-USED-TO-MEASURE-AUDIT-FEES.pdf

Koval, V., Nazarova, K., Hordopolov, V., Kopotiienko, T., Miniailo, V. and Diachenko, Y., 2019. Audit in the state economic security system. Management Theory and Studies for Rural Business and Infrastructure Development, 41(3), pp.419-430. Available at: https://ejournals.vdu.lt/index.php/mtsrbid/article/download/501/413

Ojeka, S., Iyoha, F.O., Ikpefan, O.A. and Osakwe, C., 2017. Does the reformed code of corporate governance 2011 enhance market performance of firms in Nigeria?. International Journal of Economic Perspectives, 11(1), pp.155-164. Available at: https://core.ac.uk/download/pdf/85162254.pdf

Unerman, J., Bebbington, J. and O’dwyer, B., 2018. Corporate reporting and accounting for externalities. Accounting and Business Research, 48(5), pp.497-522. Available at: https://www.tandfonline.com/doi/pdf/10.1080/00014788.2018.1470155

Websites

parliament.uk , 2021: Taxation Available at: https://www.parliament.uk/about/living-heritage/transformingsociety/private-lives/taxation/

law.ac.uk, 2021: Tax law Available at: https://www.law.ac.uk/employability/legal-practice-areas/tax-law/

lawcom.gov.uk, 2021: Taxation Available at: https://www.lawcom.gov.uk/project/taxation/

uk.practicallaw, 2021: tax act of UK Available at: https://uk.practicallaw.thomsonreuters.com/PLCCoreDocument/ViewDocument.html?comp=pluk&DocumentGuid=I6626334d63a911e598dc8b09b4f043e0&ViewType=FullText&HasDraftingNotes=False&ResearchReportViewMode=False&SessionScopeIsValid=True&IsCourtWireDocument=False&IsSuperPrivateDocument=False&IsPrivateDocument=False&ClientMatter=Cobalt.Website.Platform.Web.UserData.ClientMatter&AuthenticationStrength=0&IsMedLitStubDocument=False&IsOutOfPlanDocumentViewClicked=False&TransitionType=Default&ContextData=%28sc.Default%29&BillingContextData=%28sc.Default%29

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services: