MSc Management Global Strategy and Sustainability Assignment Sample 2023

Part A- Report

Introduction

In the competitive business world of the contemporary age, every organization is attempting to sustain itself alongside the competition and simultaneously acquire the maximum amount of financial gain possible. Therefore, in this report, the effective strategies a company may undertake to survive within the arena of global business and the way they may maintain their sustainability will be discussed critically by emphasizing Tesla.

Task 1- Internal and external environment

Internal and external environment of Tesla using relevant models

External environment (PESTLE)

Political

Tesla is an American company which has flourished in the global market quite successfully and the economic condition of the country has helped the company to flourish well in the global market effectively. Moreover, Tesla has been able to provide a low-interest loan of 465 million dollars and the United States government has provided 7500 dollars with the tax credit for managing the electric vehicles of the company (Refer to appendix 2).

Economical

The economical condition of the company is quite good as the company’s total liabilities sum up to 30.5 billion dollars between the years 2020 to 2021 has helped the company to progress well in the global competitive market (Refer to appendix 3).

Social

The management of the customers of the company is good as it helps in retaining the customers quite well by providing innovative benefits for the customers to put the customers into the company.

Technological

The company with the help of innovative technology management helps manage Artificial Intelligence (AI) as it helps in managing the change of the processes of the organisation effectively (Zarifiset al., 2019). Tesla has to implement certain device management such as designing error rather than driver error to understand the error of the product of the company and helps in understanding the capabilities the products have in real-life situations (Banks et al., 2018).

Legal

The company has to make an effective business plan in managing both external and internal problems for understanding the improvements the organisation may make by managing battery manufacturing and other solar panel utilisation for the development of the products of the company by implementing policies for managing the employees of the company.

Environmental

Tesla also maintains good environmental and sustainability management of the company that has helped in brand management of the company in the global arena. Therefore, the company has good access to various facilities as it helps in improving the financial performance of the company to understand the carbon emissions from the vehicles.

Internal Environment (SWOT Analysis)

| Strengths | Weaknesses |

| Tesla’s sales department has made the strategic market segmentation, which is evident from the company’s investment in the Model 3 has an affordable price structure of $35,000

|

Lower finance focuses led Tesla to lose the price of the shares by 22% in the early years, where there has been a loss accounting for $2.25 billion |

| Opportunities | Threats |

| Tesla has a better competitive strategy as such Elon Musk, the Chief Executive officer (CEO) created investment in solar panels in 2015 along with collaboration with Solar City

|

Insufficient market entry strategy into China, with a strong resilience from the Chinese government on pollution, hence reducing sales |

Table 1: SWOT Analysis

(Source: Self-created)

The strengths of the company include innovative management which is seen in the manufacturing of the electric cars which has helped the company to flourish well in the global competitive market. The company tries to understand the way the company may manage the challenges faced by the company and by managing the choices and promotion of the brand management quite well (Valentin, 2019).

The company’s increase in the global sales in the market helps in developing good opportunities that help in developing a better business market for the electric car company for Tesla (Li et al., 2021). The company does face certain threats due to the fluctuations of the material prices of the company which disrupts the working of the company into a problematic situation.

Discussing the three most critical factors emerging through the analysis

Tesla is a huge company and the company’s innovative management and the implementation of various innovative policies and strategies hashelped the company to progress well in the market. Furthermore, the three most critical factors which have helped the company sustain itself are the innovative technology, healthy networks and vertical integration that has helped the company to flourish well.

Understanding the competitive advantage of Tesla and evaluating the competitive advantage

Tesla’s management is sufficiently wise to understand the importance of brand socialisation, which allows the company to create hyped awareness and follow a $0 budget system, thus letting the brand followers increase.

Moreover, the competitive advantage of the company may be recognised from Tesla taking the market opportunity by not making the patent of the technology of the company exclusive, thus letting it motivate other brands to follow the company. Tesla has gained significant market share by collaborating with Tencent in the valuation of $1.8 billion and lowering operating costs in Shanghai.

Task 2- Strategy in a global environment

Analysing relevant models for the organisation on entering the foreign markets

The organisations have to manage well by understanding various models such as direct selling, franchising, joint ventures, acquisitions, market penetration and Foreign Direct Investment (FDI) that helps the companies to expand successfully in the foreign markets.

Direct selling helps in managing the global brands to reach the consumers through various retail channels whereas franchising helps in providing licensing for the company to come in terms of an agreement to expand in the market.

Moreover, joint ventures help in combining with other organisations to progress in the market by understanding the FDI as it helps to expand the company well and even acquisitions incertaincases helped in gaining potential customers from the market.

Evaluation of Tesla’s expanding motives into the foreign markets that help in impacting the overall company’s strategy

Tesla tries to understand the growth strategy of the company by managing the revenue of the company quite well and it helps the company to flourish in the global competitive market situation effectively. Moreover, the company by transitioning to electric vehicles has helped in supporting sustainable energy and also developing innovative technologies that it helps in storing the energy for the future (Matthews et al., 2020).

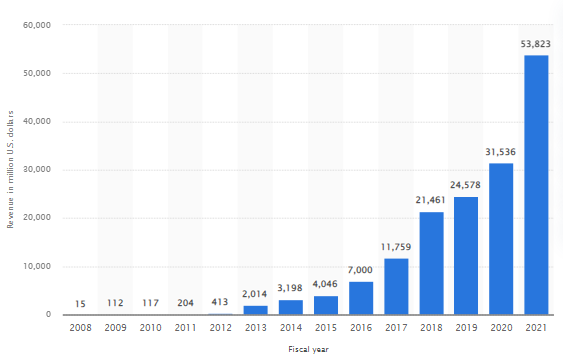

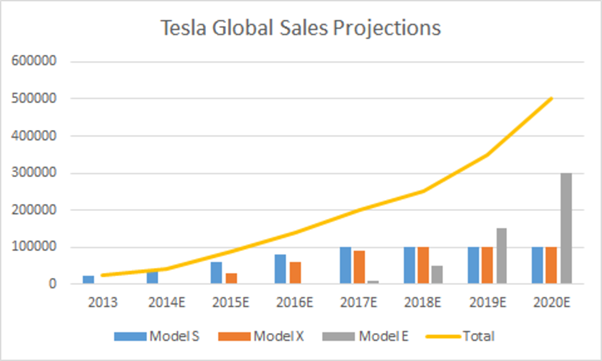

Thus, the revenue growth of the company became possible with the help of the world spread selling of vehicles and the manufacturing and sales of vehicles depend highly on the demand of the customers (Statista. 2022).

Figure 1: Growth of revenue of Tesla

(Source: Statista. 2022)

The company also follows ownership and various types of expansion strategies with the help of implementing strategies such as direct selling, Certified Pre-owned Program (CPO), strategic positioning of stores and galleries, local responsiveness and related diversification which helps the company to progress well.

The company’s innovative design of the batteries helps the company to make better investments that help in high operating cash by managing electric vehicles by reducing the cost of the batteries quite well (Liu, 2021). The cost of the vehicles is quite high and so the company has to make sure that the market segmentation is done well so that it helps the company to gain good profits from the market.

Thus, the business growth of the company depends highly on the opportunities the company gets and the deals the company does with other companieshelp in gathering better customers (Lugtu Jr, 2019). The market expansion of Tesla has been profitable in many ways, where the company has secured regional empowerment by creating deals with the company of Tencent at a 5% stakeholder share value.

This has made Tesla the company to attain a business evolution in Asia, which followed Tesla’s entry vision into China, reducing the tax margin by 25%. Tesla however has the plan of creating a vast expansion of Gigafactory in various areas and taking the market opportunity of China’s growing market for electric automobiles.

Recommendations for different strategies for Tesla

The desired recommendation for Tesla is on the management of the high prices the company and the company has to manage the prices well so that it helps the company to keep its position in the market. The company’s dynamic employees help in skilled management in the case of technology as it helps the company to flourish well (Gayathri and Kumari, 2019).

Thus, the company has to understand the quality and reliability of the company and it helps the company to manage the market share of the company effectively (Agnihotri and Bhattacharya, 2022).

The recommendations have to be valuable for the company so that the company may work well with the help of managing the competition within the market by expanding and understanding the competition well.

Furthermore, the dynamic competition of the company by managing the effective competition and by understanding the mobility of the company with the help of technological innovation quite well (Ferreira, 2019).

The company has to understand well to implement environmental sustenance through the help of electric vehicles and the company has managed well to maintain the sustainability by managing the working of the environment quite well. Therefore, the success of the company depends on the penetration pricing of the company by analysing the transition process that helps in managing the value of the products of the company quite well (Ding and He, 2022).

Task 3- Corporate Strategy

Horizontal integration

Aspect of horizontal integration is a growth strategy that companies use to gain a competitive advantage by acquiring a company that may be operating within a similar field of business.

In the context of Tesla, it has come to light that the company has acquired several organizations such as Maxwell Technologies as this is quite a significant move for the company to attain their mission of helping the world to transition toward sustainable energy (Refer to Appendix 4).

Therefore, this specific approach taken by the company indicates that by acquiring a company that works within a similar field as Tesla, the company is attempting to grow its business and it is an integral part of its corporate strategy. Not only organizations, the company also hired several experienced engineers who had previously worked in organizations such as Audi, Jaguar and more to ensure that the company may build the best electric vehicles (Perkins and Murmann, 2018).

Vertical integration

The concept of vertical integration, on the other hand, refers to the concept of extending the operations of a firm within the supply chain of the company. Such a corporate strategy implies that an organization is more likely to transfer its outsourced operations to in-house activities and manufacture the required items within its faculties.

In the case of Tesla, the vertical integration of the organization is something that many automotive companies want to follow since Tesla is known for manufacturing the parts of their cars in their one manufacturing facility. Elon Musk, the founder of Tesla has been determined to build a company that is vertically integrated and for that, the individual bought a German automation factory in 2016 (Teece, 2018).

Such an approach enables the company to be less reliant on third parties and that further helps the organization to reduce its production cost too. According to research, as a result of the business model of the company, Tesla did not have to compete with others within the sector and developed a marketplace named Blue Ocean that made the competition irrelevant (Ahmad and Khan, 2019).

Outsourcing or strategic alliances

In addition to, horizontal and vertical integration, outsourcing and strategic alliance are also one of the corporate strategies that companies use to sustain within the competitive race. In the event of Tesla’s operational activities, it has already been mentioned that the company does not outsource its production, meaning Tesla does not give any third-party organization to manufacture their products.

By obtaining such a corporate strategy the company may save a substantial amount of manufacturing costs and as has been mentioned before, strategies similar to these help the company in maintaining its sustainability effectively. Research has also suggested that the company attempts to build in-house production for the company to ensure that the organization has superior vertical integration as it helps to reduce the dependency on the suppliers (Sathish and Weenk, 2019).

In the event of strategic alliances, it needs to be mentioned that the company has collaborated under some circumstances for the benefit of the business such as Tesla’s collaboration with Samsung to make a chop for their next-generation cars (Reuters.com. 2022).

The strategies acquired by the company have helped it to become the largest producer of cars by value and the company has also been able to surpass the combined corporate value of Ford and GM by charging a specific price within a niche market of target consumers (Cooke, 2020).

Figure 2: Growth of Tesla vs Ford

(Source: Cooke, 2020)

Recommendations on the way Tesla may be able to improve the company’s profitability

From the above-mentioned discussion, it has been established that Tesla’s adopted strategies have helped the corporation to become quite profitable, however, there are still some international markets in which Tesla has failed to leave its footprint.

Therefore, one of the most significant recommendations in this context is that the company needs to reduce its prices and target a bigger market compared than only focusing on a niche market as previously mentioned.

On the other hand, the company should also invest in different products meaning that the company should diversify its product range and start manufacturing different vehicles such as electric bikes, cars and more as that way more consumers may feel compelled to purchase Tesla vehicles.

Task 4- Corporate Social Responsibility (CSR) and Ethics

Theoretical models and theories in evaluating Tesla’s CSR strategy

Tesla’s main mission is the creation of a two-fold business model that affects the consumer as well as the environment. The company aimed to make electric vehicles and technology available to the whole population and Tesla used patents in the way to contribute to the affordability and the availability of the electric vehicles (Akakpoet al., 2019).

The CSR strategy of Tesla incorporates the stakeholder group to be led by the communities and also to follow the consumers, investors, and employees (Tesla. 2022). The main aim of Tesla is to build the safest cars for the consumers and also to make the production process in the company safe for the employees.

The CSR strategy in Tesla indicates the profit-making which is not the main business objective, however, the CSR strategies promote the responsibility of the business standards by maintaining the sourcing of the raw materials responsibly (Danciu, 2018).

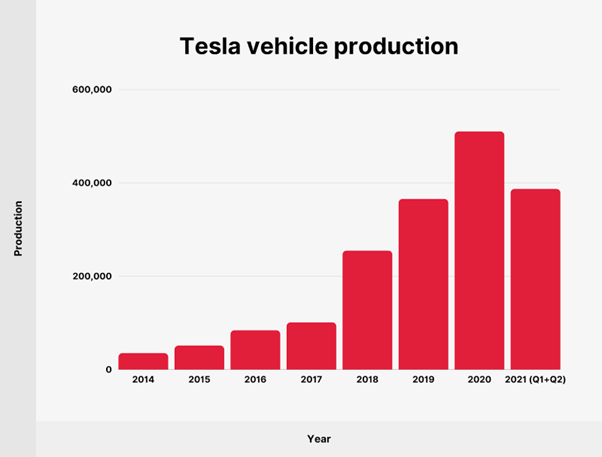

Figure 3: Tesla’s CSR strategy implemented sales growth

(Source: Danciu, 2018)

According to Carroll’s pyramid of CSR of a company, Tesla has to encompass the economic responsibility that is bringing the products o the market in an affordable range for every structure of consumers to enjoy. Moreover, the legal and ethical may of sourcing and the legal responsibility of maintaining the laws and regulations in the production has to be maintained.

And lastly, the CSR strategy of Tesla in alignment with Caroll’s theory has to bring what is desired by society and the consumers to gain business success. The CSR strategy of Tesla focuses on caring for the employees and the consumers and also encourages the communities to participate in the process of transferring sustainable energy for future use.

The CSR strategy also extends to the company spending the revenue on researching outcomes and maintaining the Code of Conduct for the suppliers and supply chain to deliver safer products and make the process harmless. The Triple bottom line theory applied in Tesla’s CSR strategies aligns with the measurement of the corporate profit in the business to the sustainable development of the company.

The social and environmental strategies that are maintained in Tesla by the CSR strategies help in measuring the social and environmental responsibility according to the triple bottom line theory (Gurzawska, 2020).

Figure 4: Tesla’s vehicle production increases with social and environmental responsibility in CSR strategy

(Source:Gurzawska,2020)

Ethical issues faced by Tesla

In Tesla, one of the main ethical issues that were faced was that of the employee injury and Tesla also has been misreporting the injuries at the factory along with wrong labelling of injuries in the workplace. Additionally, Tesla has received complaints about workplace harassment and racial discrimination in the workplace despite the company claiming to be following anti-discrimination in the functioning of the company. Tesla claimed that the energy stations may be net energy positive and implied the use of carbon-neutral electricity.

However, the claims were never confirmed by the company about the amount of renewable energy that the company uses and the number of energy stations that are net energy. The safe Autopilot drive assistance system had some issues and along with that, the vehicles were proven to be less safe with the autopilot assistance on.

An ethical issue that was brought forward by the former employees in the company was that energy services were not provided to the employees under symptoms that were faced the employees such as dizziness, and chest pains despite being associated with physically demanding tasks (Refer to Appendix-4).

Recommendations on ethical issues

- The company should focus on creating a safe working environment for the workers to avoid the occurrence of any accidental incidents that may ruin the brand image of the company.

- Additionally, the company should become more transparent concerning all their operational activities such as the amount of renewable energy the company uses.

- Tesla should be more focused on maintaining the quality of their cars and do several quality checks before launching a vehicle in the market.

Conclusion

Finally, it may be concluded that the corporate strategies acquired by Tesla have helped the company to become one of the most profitable electric-car manufacturing companies. Tesla is fundamentally known to be a vertically integrated company and believes in the concept of in-house production of its cars. However, there have been some ethical issues associated with their operational activities that the company needs to rectify to maintain its corporate image.

References

Agnihotri, A. and Bhattacharya, S., 2022. Tesla Innovation and Growth at the Cost of Quality?. SAGE Publications: SAGE Business Cases Originals.

Ahmad, S. and Khan, M., 2019. Tesla: Disruptor or Sustaining Innovator. Journal of Case Research, 10(1).

Ahmed, B., Taddia, G. and Michele, D.M., 2022. Environmental impact analysis of Lithium extraction activity and Li-Ion batteries recycling.

Ajitha, P.V. and Nagra, A., 2021. An Overview of Artificial Intelligence in Automobile Industry–A Case Study on Tesla Cars. Solid State Technology, 64(2), pp.503-512.

Akakpo, A., Gyasi, E.A., Oduro, B. and Akpabot, S., 2019. Foresight, organization policies and management strategies in electric vehicle technology advances at tesla. In Futures Thinking and Organizational Policy (pp. 57-69). Palgrave Macmillan, Cham.

Banks, V.A., Plant, K.L. and Stanton, N.A., 2018. Driver error or designer error: Using the Perceptual Cycle Model to explore the circumstances surrounding the fatal Tesla crash on 7th May 2016. Safety science, 108, pp.278-285.

Cooke, P., 2020. Gigafactory logistics in space and time: Tesla’s fourth gigafactory and its rivals. Sustainability, 12(5), p.2044.

Danciu, V., 2018. The Changing Focus of Green Marketing: From Ecological to Sustainable Marketing (III). Romanian Economic Journal, 21(68), pp.121-144.

Ding, J. and He, Y., 2022, April. Tesla Pricing Strategy Analysis: Take Model 3 as an Example. In 2022 7th International Conference on Social Sciences and Economic Development (ICSSED 2022) (pp. 1010-1014). Atlantis Press.

Ferreira, M.B.D.C., 2019. Tesla and the electric vehicle market in 2018 (Doctoral dissertation).

Gayathri, S. and Kumari, D.A., 2019. Electric Vehicles-An Introduction of the Tesla for Strategy and Leadership. International Journal of Recent Technology and Engineering, 8.

Gurzawska, A., 2020. 3 Strategic responsible innovation management (StRIM). Assessment of Responsible Innovation, p.63.

Li, Y., Lin, J. and Xu, S., 2021, September. Analysis of Tesla’s Business Model: A Comparison with Toyota. In 2021 International Conference on Financial Management and Economic Transition (FMET 2021) (pp. 30-39). Atlantis Press.

Liu, S., 2021, March. Competition and valuation: a case study of Tesla Motors. In IOP Conference Series: Earth and Environmental Science (Vol. 692, No. 2, p. 022103). IOP Publishing.

Lugtu Jr, R.C., 2019. Tesla: Testing a Business Model at its (R) Evolutionary Best (Doctoral dissertation, DE LA SALLE UNIVERSITY-MANILA).

Matthews, T., Hirve, M., Pan, Y., Dang, D., Rawar, E. and Daim, T.U., 2020. Tesla Energy. In Innovation Management in the Intelligent World (pp. 233-249). Springer, Cham.

Niet, I.A., Dekker, R. and van Est, R., 2020. Seeking public values of digital energy platforms. Science, Technology, & Human Values, p.01622439211054430.

Perkins, G. and Murmann, J.P., 2018. What does the success of Tesla mean for the future dynamics in the global automobile sector?. Management and Organization Review, 14(3), pp.471-480.

Reuters.com. 2022. [online] Available at: <https://www.reuters.com/business/autos-transportation/samsung-talks-with-tesla-make-next-gen-self-driving-chips-korea-economic-daily-2021-09-23/> [Accessed 9 June 2022].

Sathish, S. and Weenk, E., 2019. Case Study of Tesla.

Statista. 2022. Tesla’s turnover 2008-2018 | Statista. [online] Available at: <https://www.statista.com/statistics/272120/revenue-of-tesla/> [Accessed 9 June 2022].

Teece, D.J., 2018. Tesla and the reshaping of the auto industry. Management and Organization Review, 14(3), pp.501-512.

Tesla. 2022. Tesla. [online] Available at: <https://www.tesla.com/> [Accessed 9 June 2022].

Tesla. 2022. Tesla. [online] Available at: <https://www.tesla.com/> [Accessed 9 June 2022].

Valentin, M., 2019. The Tesla Way: The disruptive strategies and models of Teslism. Kogan Page Publishers.

Zarifis, A., Holland, C.P. and Milne, A., 2019. Evaluating the impact of AI on insurance: The four emerging AI-and data-driven business models. Emerald Open Research, 1, p.15.

Self-assessment

Task 1

I have analysed the internal and external environment of Tesla with the help of SWOT and PESTLE analysis respectively and it has helped me to understand well that the way the influence of the political scenario of the USA has helped the country to gain good economic and financial costs effectively.

I also have understood that the organisation has been able to manage the technological innovation by managing the AI technology and by introducing the electric cars into the society which helps the company to manage the environment quite well.

Furthermore, I also have taken into consideration the strengths and weaknesses of the company to understand well by managing the brand and by managing the pricing strategies of the company effectively.

The opportunities which I have come across about the company in the case of global sales management and diversification of business and the threats management of the company becomes possible with the help of mitigating the competition of the organisation.

Task 2

I have understood that the company tried to maintain effective business plans and innovation management as it helps the company to progress well and it helps in understanding the markets to penetrate with the help of effective strategies.

Moreover, I also have analysed that the company to retain customers have to manage the prices well and in expanding in the global markets the company should take up acquisitions and joint ventures for better market revenue.

I have to have understood that the company has to look after the competition in the market and has to incorporate effective strategies for the growth and development of the company by managing the effective strategies of the company quite well.

I have been able to analyse that Tesla has been able to successfully expand the business in the foreign markets with the help of joint ventures, direct selling, franchising and branding which has helped the business to flourish well.

Task 3

I have analysed Tesla’s corporate strategy by understanding the kind of strategy Tesla follows which is vertical integration more than horizontal integration which has helped the business to flourish so well.

Additionally, the outsourcing procedure of the companies is quite good which has helped the company to expand the business by managing the operational activities by managing strategic alliances of the organisation which I have analysed with the help of collaboration with other organisations effectively.

I too think that the company has to focus on each product as it helps in managing the profitability management of the organisation quite well. The enterprises have adopted strategies which I think have been helpful for the company by managing the consumers’ demand as it helps the company to expand well in the global market and also it helps the organisation to progress well.

Task 4

I think the CSR strategy of the company has to be maintained quite well so that it helps Tesla to maintain a two-fold business model by managing the affordability and availability of the electric vehicles within the market to fulfil the demands and even help in keeping the environment clean.

Furthermore, I have analysed the CSR strategy of the company with the help of Carrolls’ CSR model which helps in understanding the code of conduct of the company by managing the revenue collection of the company effectively. I understood that the company has to manage the ethical issues so that it helps in managing the carbon neutrality of the company to safeguard the environment and it helps in quality management of the company quite well.

Thus, I have understood that Tesla by managing the operational activities helps in managing the renewable energy of the organisation and it helps in avoiding any kind of accidental situation within the company and also of customers.

Appendices

Appendix 1

Slide 1: Agenda

- Tesla’s agenda for the upcoming years is the introduction of new vehicle models

- Roboaxis are said to be brought to the market by Tesla for the future use of the consumers

- Improving Autobidder and the Virtual power plant (Nietet al., 2020)

The main agenda for Tesla is breaking away from the competitive market to bring new and innovative vehicle models to the consumers. Innovations are brought into the market by Tesla for the future use of the consumers along with maintaining the sustainable development of the company and the environment with the help of Roboaxis technology.

The Autobidder and the Virtual power plant improvements are planned to increase efficiency (Nietet al., 2020).

Slide 2: Analyzing and evaluating the people aspect of Tesla

- Accelerating the world’s transition to sustainable energy

- Focusing on employee compensation and maintaining diversity and equity ( 2022)

- Enhancing community engagement

Tesla has been able to invite people from exceptional backgrounds to join the company’s mission to accelerate the world’s transition to sustainable energy. Moreover, the notion of diversity and equity is maintained in the employee structure of the company which consists of about 62% of underrepresented groups (Tesla. 2022).

Drastic changes in compensation and the increased level of employee satisfaction have also resulted in employee retention. After the Covid-19 Pandemic, Tesla has focused on expanding the measures to enhance community engagement.

Slide 3: Analyzing and evaluating the profit aspect of Tesla

- Tesla has made a record with the high prices

- Tesla sold cars and energy products without counting the sale of emission credits

- Model Y’s success brought a boost in the company’s profit (Ajithaet al., 2021)

Tesla is able to make records in bringing profit despite having competitors in the same industry in the market. Tesla was able to gain profit without even calculating the carbon emission being given out by the sold cars which also led to sustainability maintenance in the environment.

The model 3 and model Y compact Sedan dominated Tesla’s sales and were able to bring $101 million in profit revenue (Ajithaet al., 2021).

Slide 4: Analysis of the Planet aspect in Tesla

- The utilisation of renewable energy throughout the operations

- Keeping supply chain emissions in check (Tesla. 2022)

- Materials which are possible for recycling are recycled in the company (Ahmed et al., 2022)

In Tesla, the renewable energy resources are maintained through the operations of the production and the manufacturing of the vehicles in the factories. The company is able to recycle the products which are recyclable, including lithium battery production, to maintain sustainable development and have a positive impact on the Plant (Ahmed et al., 2022).

Supply chain sustainability is also maintained by the company’s CSR to check the ethical resourcing to maintain sustainable development in the whole process ((Tesla. 2022).

Slide 5: Key interest of Chief Executive Officer (CEO) for future sustainable development

- Development of the best technology to capture Carbon dioxide

- Solar Powered roof shingles

- Plans for the adoption of solar panels at home

The CEO of Tesla has shown interest in bringing out a technology that may help in the capture of carbon dioxide from the environment as well as the factories of production to bring plant sustainability. In addition to that, the CEO has shown the future of using f solar-powered roofs in electric vehicles to lower battery manufacturing in the company.

Elon Musk the CEO of Tesla has a vision of pushing the people of the planet toward the usage of solar panels at home to decrease the emission of carbon dioxide in day to day lives.

Slide 6: Recommendations

- Expansion of the operations in the foreign market

- Diversification of the supply chain management to reduce the impact of the supply chain issues

- Increase in investments in employee compensations and better treatment to avoid lawsuits

Tesla as a company may be able to retain the position in the market by expanding the operations at a global level and increasing the supply chain group at the same time.

The diversification of the supply chain may help in decreasing the load over the existing supply chain companies, thus leading to more sustainable resourcing. Additionally, the investments may be increased in the employee compensation and the employees may be treated better to enhance employee satisfaction.

Slide 7: Self Assessment

- I have been able to analyse that Tesla’s agenda is fixed through introduction of new models for coming years

- I have also noticed that Tesla have focused on employee engagement to help in company growth

- I have gained knowledge about Tesla’s plan to store and use Solar energy in the plants and for next generation use

- I have learned that Tesla have made efforts in storing CO2 to accelerate towards sustainability

I have been able to analyse that Tesla’s agenda is fixed through introduction of new models for coming years. I have also noticed that Tesla have focused on employee engagement to help in company growth. I have gained knowledge about Tesla’s plan to store and use solar energy in the plants and for next generation use. I have learned that Tesla have made efforts in storing CO2 to accelerate towards sustainability.

Appendix 2

https://teslaresearchproject.weebly.com/internal-external-analysis.html

Appendix 3

Appendix-4

https://www.cnbc.com/2019/02/04/tesla-to-but-maxwell-technologies-for-4point75-a-share.html

Appendix 5

https://www.cliffsnotes.com/tutors-problems/Business-Other/36277045-THIS-IS-BUSINESS-ETHICS-In-what-ways-does-Tesla-address-the/