RBP020L062H Financial Performance Management Assignment Sample

Module code and Title: RBP020L062H Financial Performance Management Assignment Sample

1. Introduction

The role of managing financial performance is essential for maintaining the type of activities and business performance. It can be seen that the need for different types of equations requires different formulations. In this report, the role of financial and non-financial performance of British airways is considered as Company A (British airways.com, 2022).

As a competitor, Virgin Atlantic Airways is being considered so that a detailed overview can be considered of Company B. In order to provide financial importance ratio analysis is going to be shown. Under non-financial roles integrated reporting and balanced scorecards are going to be portrayed. The main objective is to portray how the health of a company can be analyzed for its improvement.

Overview of the chosen and competitor company

In 2019 British Airways completed 100 years of flying services. On 25th August 1919, this was the first company that had started its operation as a civil airline which had also provided service during world-war 1. The company was formed by the British government so that the national airlines can be managed. British Airways is subdivided into two parts one is British Overseas Airways Corporation and the other is British European Airways.

As a competitor Company B that is Virgin Atlantic Airways had established in 1984 and is also known as Virgin Atlantic Airways co-founded by “Randolph Fields and Alan Shelley”. Currently, this company is considered a major competitor of British airways. It is considered the largest airline as it had acquired a market share of over 19.5%. That means one-fifth of the market share works under company A.

2. Financial Performance using Ratio Analysis

The financial performance of a domestic and global level organisation is a core pillar and strategic tool which supports enhancing growth as well as market position through considering different investment strategies. In this study paper, airline industries such as British Airways and VIRGIN ATLANTIC are selected to evaluate financial performance efficiency levels, which help them develop different strategies to compare their competitors and acquire better positions in global airline industries.

As opined by Atrill et al. (2018), it is necessary for any organisation to consider different financial and non-financial techniques such as efficiency level improvement techniques for its financial performance and operation in future business. Therefore, financial performance is evaluated through a ratio analysis technique for two years, such as 2020 and 2019.

Profitability

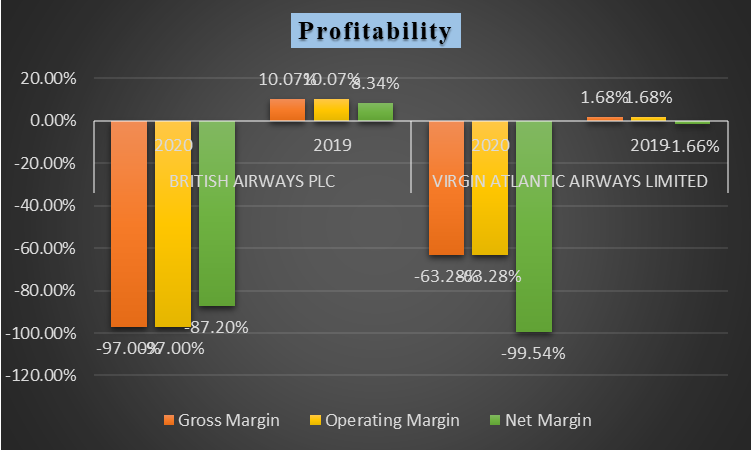

Profit is the primary motivating component for any organisation while their operator business at the domestic and global level as the profitability of any industry has support to enhance its growth and financial activity across the countries at the global level. As stated by Berk and DeMarzo (2017), therefore analysis of British Airways’ profitability for two years such as 2020 to 2019 in comparison with VIRGIN ATLANTIC’ performance for these two years.

It is observed that the gross margin and net margin of British Airways will exist at 10% and 8% in 2019 which will decrease to negative 97% and 87% in 2020. The loss of British Airways is more incomplete with VIRGIN ATLANTIC’s loss at 63% and 99% of gross margin and margin in 2020. VIRGIN ATLANTIC has a low profit as compared with the profitability of British Airways in 2019.

Figure 1: Profitability of VIRGIN ATLANTIC (Source: Self-created)

Figure 1: Profitability of VIRGIN ATLANTIC (Source: Self-created)

It is analysed from the above figures that VIRGIN ATLANTIC is required to implement effective marketing segmentation as well as business strategy such as digital advertisement, and better service to its customers to acquire better profitability in the future financial year as compared with financial performance in the financial year of 2020. As stated by Baxter (2019), nevertheless, VIRGIN ATLANTIC has suffered from massive challenges such as continuously losing consumer engagement as well as losing the interest of investors in the organisation.

Liquidity

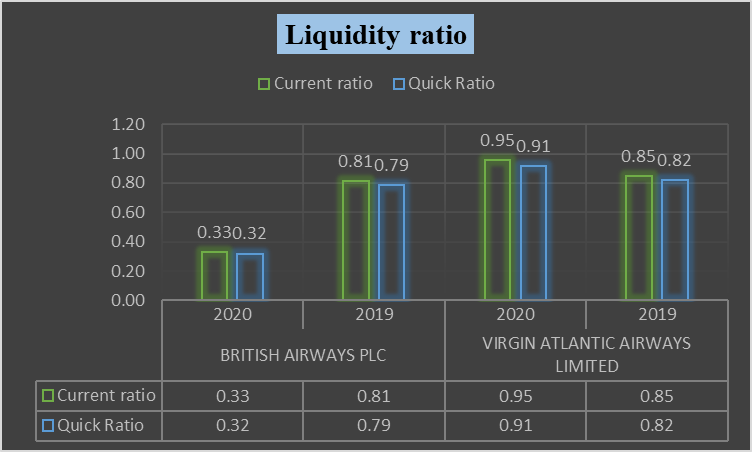

The liquidity of any organisation has to support organisations to develop better relationships with different types of external stakeholders such as creditors and investors. As argued by Busco et al. (2019), an organisation having high liquidity has more capability to settle different types of dues and liabilities within a period. Therefore, analysis of the liquidity of both VIRGIN ATLANTIC British Airways and VIRGIN ATLANTIC is as follows.

Figure 2: Liquidities of VIRGIN ATLANTIC (Source: Self-created)

Figure 2: Liquidities of VIRGIN ATLANTIC (Source: Self-created)

It has been observed from the above figure that the ratio of British airways exists at 0.81 in 2019 which is reduced to the value of 0.33 in 2020 due to low profitability as well as cash inflow. Besides that, its competitor’s VIRGIN ATLANTIC is able to maintain an optimum level of liquidity in 2019 and 2020 through an increased current ratio from 0.85 to a value of 0.95 in 2020.

Apart from this, the quick ratio of British airways is 0.79 and 0.32 in 2019 and 2020 which is low compared with values of 0.82 and 0.91 in 2019 and 2020 of VIRGIN ATLANTIC. As stated by Kim and Son (2021), therefore it is necessary for British Airways to focus on increased revenue of the business for increased cash inflow. As a result, VIRGIN ATLANTIC has been able to improve its quick and current ratio which is a key motivating factor for different investors as well as lenders to the organisation.

Efficiency

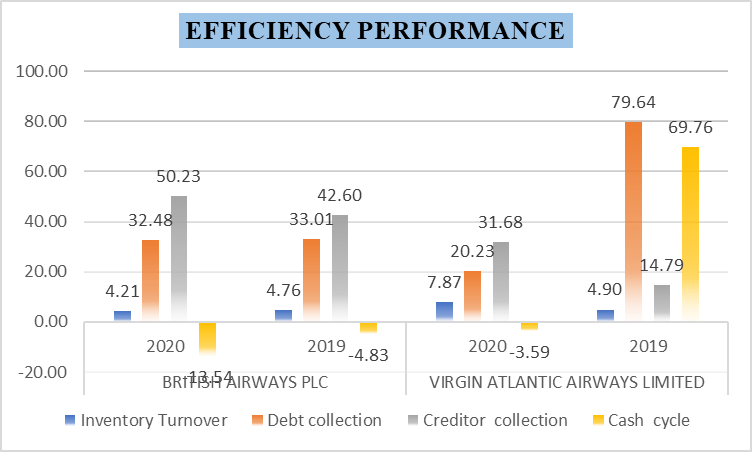

The efficiency of any VIRGIN ATLANTIC has played an important role to boost its profit margin as well as productivity. These two factors profitability and productivity must be considered by a domestic and global base organisation to sustain its financial performance as well as explore business other locations through investing more in development and growth. Inventory turnover days of British Airways exist at 4.76 days in 2019 which is increased to 4.2 days in 2020.

The inventory turnover days are low in comparison with VIRGIN ATLANTIC’ inventory turnover days at 4.9 days and 7.87 days in 2019 and 2020. Apart from this, cash conversion cycles play an important role to increase liquidity as well as convert its working capital into liquid cash. The cash cycle period of British Airways will exist at 4.83 days in 2019 which is increased to 13.54 days which will exist in 2019 and 2020.

In response, VIRGIN ATLANTIC has maintained a gas ratio of 69.76 days in 2019 which is reduced to 3.59 days in 2020. As opined by Arjomandi et al. (2018), therefore it is observed that British Airways has a low period to convert its working capital into cash which is a strength of British Airways as well as These steps may be increased liquidity in an organisation and give a positive impact on different external stakeholders.

Figure 3: Efficiency of VIRGIN ATLANTIC (Source: Self-Created)

Figure 3: Efficiency of VIRGIN ATLANTIC (Source: Self-Created)

Apart from this, it is suggested to British Airways that they have focused on reducing the cash conversion cycle to 5 to 10 days which is an ideal cash conversion cycle. As opined by Paul (2020), this cycle also supports VIRGIN ATLANTIC in increasing the satisfaction level of different stakeholders such as customers and suppliers that are provided to the organisation after a certain interval of period.

Apart from this, the inventory turnover distributor will exist between 10 to 15 days which is a support organisation to reduce its inventory management cost by reducing holding costs and inventory acquisition costs.

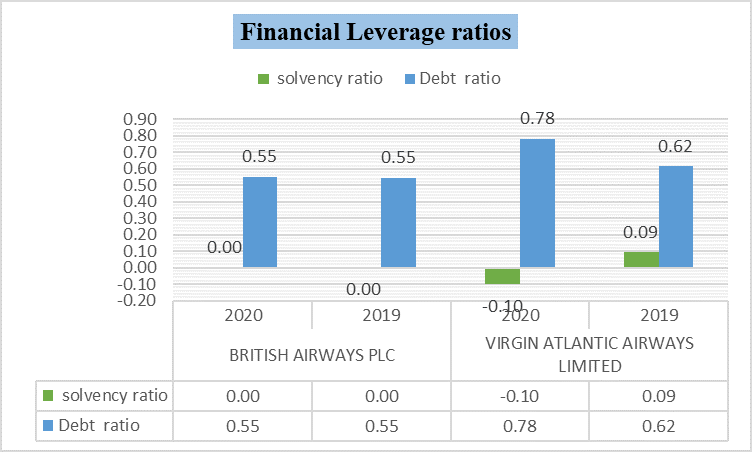

Financial leverage

Financial leverage is a core indicator of an organisation’s working capital structure as well as a combination of debt and equity which are key sources of financing for any domestic or global MNC organisation. To analyse the organisational working capital of British Airways and VIRGIN ATLANTIC there are took financial leverage components such as solvency and debt ratio have been selected.

Figure 4: Financial leverage of VIRGIN ATLANTIC (Source: Self-created)

Figure 4: Financial leverage of VIRGIN ATLANTIC (Source: Self-created)

The figures are sufficient to indicate the working structure of British Airways and its core competitor VIRGIN ATLANTIC. The debt ratio of VIRGIN ATLANTIC exists at 0.55 for both financial years such as 2019 and 2020. Apart from the solvency received by VIRGIN ATLANTIC, it will exist at 0.1 in 2019 in 2020 which should be maintained below 20% which is an ideal solvency ratio and give a positive impact on different interests and landers that are engaged in the organisation’s investment activity from the past few decades.

On the other hand, VIRGIN ATLANTIC will be used at 0.62 in 2019 and 0.7 in 2020. Apart from this, the solvency VIRGIN ATLANTIC will also exist at 0.09and 0.10 in 2019 and 2020. As stated by Parameswaran (2018), here it is observed that VIRGIN ATLANTIC has easily maintained below 20% solvency ratio which is the strength of VIRGIN ATLANTIC and gives a positive impact on its financial performance of VIRGIN ATLANTIC.

4. Integrated Reporting

Integrated report refers to development of strategy and technique for the innovation of operating systems as well as management methods to implement the latest techniques and tools at different levels of the organisation. Besides that, this reporting technique has given a positive impact on the “commercial, social and environmental” of an organisation in which they have performed business operations.

As opined by Ghosh (2019), the integrated report has supported any organisation to enhance communication levels by introducing the latest tools and technology through considering corporate governance issues supported by employees to operate each operation and activity effectively. In current times each organisation needs to focus on considering better communication with different levels of mistake holders either external or internal to introduce effective management as well as coordination between them. The benefits of an integrated report are as follows

Enhance the value of organisation: the value of any business is based more on the faith of external stakeholders as well as the relationship and satisfaction of stakeholders. Therefore, an integrated report has support to consider different issues and challenges from which consumers and investors are suffering.

As stated by Ellibeş and Candan (2021), in pandemic situations, different business organisations such as the service industry have suffered from massive issues due to the implementation of the remote working system.

At that time the organisation required effective digital communication to abate conflict as well as enhance the satisfaction level of different stakeholders either external or internal. This is possible through effective communication as well as the use of technology and tools for communication. Thus, the integrated report may be supported by British Airways to develop effective communication as well as a social image among external stakeholders.

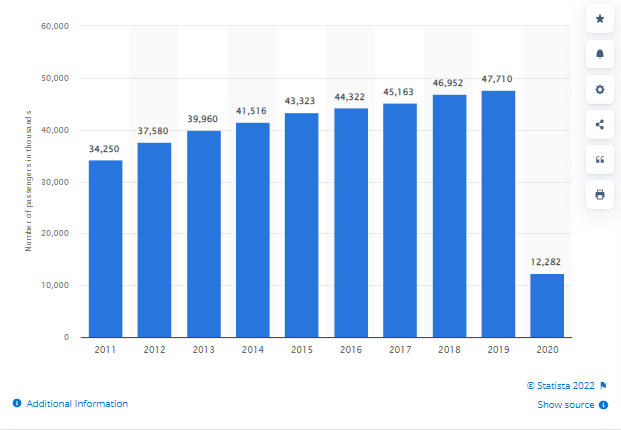

As of the current time, 30,555 employees are engaged in an organisation which is low compared with 2019’s employee engagement of 37,631. Besides that, the number of active passengers has increased continuously since 2011 from 3425 02 values to 47710 in 2019. Nevertheless, VIRGIN ATLANTIC has suffered from very low consumer engagement in 2020 which is 12282 due in 2020. This indicates that VIRGIN ATLANTIC suffered from words stakeholder engagement which impacts observed in a number of active consumers through the environmental issues as well as the strategy of British Airways.

Figure 5: Active consumers of British Airways (Source: Statista.com, 2022)

Figure 5: Active consumers of British Airways (Source: Statista.com, 2022)

Develop coordination between existing and new working environment: The integrated report has mainly supported any business to promote the latest technology as well as toll. which has been suitable to increase its productivity as well as efficiency level through better communication. On the other hand, an organisation needs to develop proper coordination between two working environments while renovating to get optimum benefits of the new working environment.

As opined by Verboten (2018), that is possible through effective communication as well as avoiding conflict between different levels of employees and stakeholders while wanting to manage its operations. Thus, it has been observed that integration has different benefits and advantages which should be considered by British Airways in order to overcome current challenges and worst conditions such as low profitability and liquidity.

These are the main reasons for this issue of the Covid-19 pandemic and the reduced number of active consumers due to the worst condition of business activities at a global level.

- Balance scorecard

It is considered a system of management that is used for understanding the internal as well as the external business of the company. The learning and growth of the company can be determined with the help of a balanced scorecard. In the case of a balanced scorecard, four different factors are considered that are customer’s perspective, financial data, business process and learning growth.

This also helps to improve the alignment of organisational structure with the strategic objective (Cosmulese et al. 2019). Improving the course of activities can help to maintain the type of activities for better activation of industries.

Financial perspective

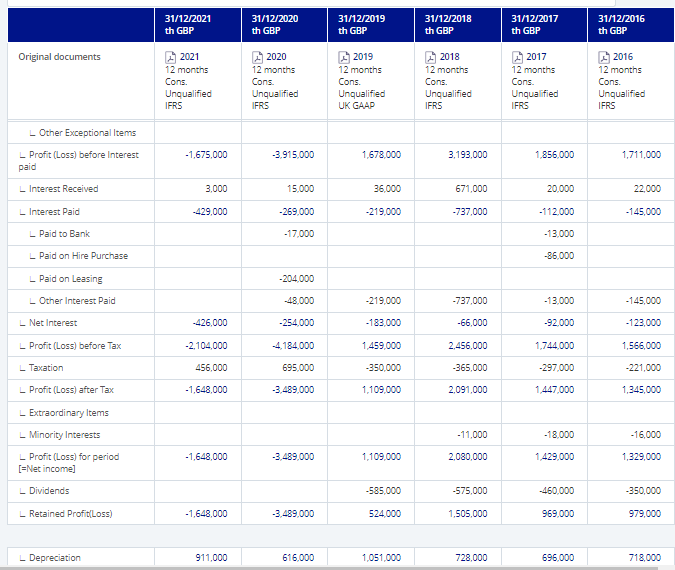

- The profitability of British Airways had reduced from 10.07% to -97.10% which suggests that the margin of gross profit needs to be increased. In the case of net profit, it can be seen that the value had again dropped from 8.34% to -87.20% (Barnabè et al. 2019). This was because the profitability of the company had reduced from £ 1109000 to £ -3489000.

- In terms of maintaining the asset balance, it can be seen that the liabilities of the company are comparatively more than £ 6342000 in 2020 compared to the asset which is £ 2093000. This resulted in a ratio of 0.33 and impacted the asset side which means clearing the expenses can be challenging for British airways.

- In terms of quick ratio, the formulation of business activities can bring business maximization and also articulate business ventures. The need of maintaining different forms of business activities can bring formulation of the business (La Torre et al. 2019). The recovery of the debtors is noticed from 4.76 days to 4.21 days. This means that the recovery of money is essential for business activities.

- Estimating the type of business activity can bring efficiency in terms of financial leverage. The debt ratio of the company has also reduced its function, which will bring asset maximization (Navarrete-Oyarce et al. 2021). The need of mitigating the course of action can bring business activities and thus it is essential for bringing the business activities.

Customer’s perspective

- In the United Kingdom, British Airways is considered a symbol of status for most of its users. The customers are satisfied with the services that the company provides. Over the century the company had created an image in such a way that it is well known for its performance and customer service.

- The airline covers 200 destinations and its frequency of flying comes under the top category. The company has also introduced mobile services so that their airline becomes more convenient. British Airways had always followed this objective of the company comes first. It is a journey to create a better and sustainable future and its estimated that it has also focused on carbon emission.

- The marketing of these airways is done with the help of billboards, television advertisements and newspapers. The company had focused on maintaining authenticity and always focused on maintaining a minimalistic approach. The ticket booking is done to maintain a convenient approach.

- British airways are convenient as it provides facilities such as single class cabins for all their aircraft. Apart from that, detailing the services enhances the quality and experience of the customers. After providing all sorts of services the company had strategically fixed its pricing to £25.

- In terms of pricing strategy, the company had kept its pricing low so that people can get comfortability within a budget. The company had always focussed on maintaining the type of activities in such a way so that other airlines are not able to compete with the pricing and services.

Business process

- It comes under a premium segment where the services to the customers are good. It maintained a profit margin of 12-15%. As a business strategy, the inflight services of the company are enhanced in such a way that the role of business activities can be maintained. Services such as boarding Wifi and in-seat power differentiate this airline from the rest.

- It is considered a public company that has maintained its operation like a private company. It also estimated the role of different airlines that had helped them to estimate the role and development of business activities (Syahdanet al. 2018). There are different types of objectives that British airways have to consider so that business activities can be maintained.

- Its stakeholders include employees, customers and investors. The airline follows certain rules and objectives that include creativity, diversity and open-mindedness for the business actions (Debnath, 2018). It can also be seen that the business activities of the company can establish the role and development of business actions and the steps that need to be considered for business maintenance.

- The type of responsibility can be created for estimating the type of business actions and the role and development of business activities can articulate the situation of the company. Maintaining a sense of responsibility can also be part of business actions and responsibility.

Learning and growth

- Growth and development are considered as one the important aspects of this company. In 2021 British Airways arranged a training module for 46000 employees. 6000 among them work outside the nation. In terms of learning it is considered the first company that had successfully introduced scheduled services for international travelers.

- The training module is considered in such a way that different types of measures are taken from the end of the company. The training module of the company focused on the collection of services that are involved in the growth of business activities. It can also be seen that building business activities can improve the maximization of business action.

- There are different types of services that involve the type of activities which involve different courses of action. Involving the business activities can improve business activities which will develop business activities. Maintaining the type of business activities can improve articulation. Matrix of maintaining both programs can impact the growth curve and also stimulate other business activities.

- The company has focused on maintaining the type of activities so that the business culture can be maintained. Though it is older than a century it has always stepped out of its comfort zone and tried something that is different. Articulating the type of activities that British airways had performed had helped the company to maintain its course of action.

- The company had also made a duty-free sales system so that the cabin crew could use this facility. Maintaining this type of activity can grow the type of business activities. The maintenance for the type of business organisation can bring developed products which can help to enhance the type of activity.

Integrated reporting

Creation of value

It can be seen that an integrated report is a mixture of both financial and non-financial data. This creates confusion in terms of value creation. It can also be seen that there are different types of business activities which have helped to bring the curse of business action (Serpeninova, 2022).In case, If the creation of value is also essential and the terms of activities. In the case of British Airways, it has improved its course of activities so that the business action gets improved.

Connectivity issues

It is considered a mode of communication for both departments. This resulted in misinterpretation of data. It can also be seen there are different types of issues that are needed to be implemented so that business activities can be maintained (Ashok and Abhishek, 2019). If the connectivity issue of British airways can be mitigated then the types of action can be maintained.

Completeness and reliability

Dependency on integrated reporting can involve the type of actions and the role of maintaining different types of activities can matriculate the course of action. If the information is not taken appropriately then it can create challenges for the organisation. Involving the course of action can also bring challenges to the company (Utomo et al. 2021). Maintaining business activities also influence the course of business activities. Thus involving a challenging situation can also estimate business action.

Issues in Materiality

Historical resources are required for estimating the course of making integrated reporting. The data may not be accurate or it can also involve business activities (Mateş and Irimuş, 2020). This involves different forms of business activities and articulating these activities can also bring business ventures.

5. Conclusions

It has been concluded that British Airways has suffered from the worst financial conditions due to the Covid-19 pandemic and increasing competition in the airline industry. On the other hand, it has been noticed that both industries are currently facing issues to sustain their financial performance due to low revenue in 2020 and 2019 after the commitment of lockdown in different countries as well as the shutdown of business activity at different businesses locations throughout the global level.

Therefore, this report also consists of a reanalysis for 2019 and 2020 and it is observed that VIRGIN ATLANTIC is having more losses and low revenue in 2020 in comparison with 2019 business performance. Apart from this, British Airways should be considered an integrated report, as well as balance, is a card we support to enhance the better relationship with different level and different types of stakeholders in order to maintain profitability as same in their previous year such as 2017 and 2018 when VIRGIN ATLANTIC has to get up to on the level of profitability in the business life.

Reference

Books

Arjomandi, A., Dakpo, K.H. and Seufert, J.H., 2018. Have Asian airlines caught up with European Airlines? A by-production efficiency analysis. Transportation Research Part A: Policy and Practice, 116, pp.389-403.

Ashok, M.L. and Abhishek N, D., 2019. Role of XBRL in Promoting the Integrated Reporting in Indian Scenario. Dr. Ashoka M L., & Abhishek, (2019), pp.25-33.

Atrill, P., McLaney, E.J. (2018). Management Accounting for Decision Makers. Pearson.

Barnabè, F., Giorgino, M.C. and Kunc, M., 2019. Visualizing and managing value creation through integrated reporting practices: a dynamic resource-based perspective. Journal of Management and Governance, 23(2), pp.537-575.

Baxter, G., 2019. Capturing and Delivering Value in the Trans-Atlantic Air Travel Market: The Case of the Air France-KLM, Delta Air Lines, and Virgin Atlantic Airways Strategic Joint Venture. MAD-Magazine of Aviation Development, 7(1), pp.17-37.

Berk, J., DeMarzo, P. (2017). Corporate Finance (3rd ed.), Chapter 2. Pearson.

Busco, C., Malafronte, I., Pereira, J., Starita, M. (2019). The Determinants of Companies’ Levels of Integration: Does One Size Fit All? The British Accounting Review, 51(3), 277-298.

Cosmulese, C.G., Socoliuc, M., Ciubotariu, M.S., Mihaila, S. and Grosu, V., 2019. An empirical analysis of stakeholders’ expectations and integrated reporting quality. Economic research-Ekonomskaistraživanja, 32(1), pp.3963-3986.

Debnath, A., Roy, J., Chatterjee, K. and Kar, S., 2018. Measuring corporate social responsibility based on fuzzy analytic networking process-based balance scorecard model. International journal of information technology & decision making, 17(04), pp.1203-1235.

Ellibeş, E. and Candan, G., 2021. Financial Performance Evaluation of Airline Companies with Fuzzy AHP and Grey Relational Analysis Methods. Ekoist: Journal of Econometrics and Statistics, (34), pp.37-56.

Ghosh, S., 2019. Integrated reporting in India: research findings and insights. In Integrated Reporting (pp. 365-386). Springer, Cham.

Journals

Kim, H. and Son, J., 2021. Analyzing the environmental efficiency of global airlines by continent for sustainability. Sustainability, 13(3), p.1571.

La Torre, M., Bernardi, C., Guthrie, J. and Dumay, J., 2019. Integrated reporting and integrating thinking: Practical challenges. In Challenges in managing sustainable business (pp. 25-54). Palgrave Macmillan, Cham.

Mateş, D. and Irimuş, R.M., 2020. Reporting In Time Of Pandemic: Will Integrated Reporting Become A Must?. Annales Universitatis Apulensis: Series Oeconomica, 22(2), pp.88-96.

Navarrete-Oyarce, J., Gallegos, J.A., Moraga-Flores, H. and Gallizo, J.L., 2021. Integrated reporting as an academic research concept in the area of business. Sustainability, 13(14), p.7741.

Parameswaran, K., 2018. Does First Class Make Sense for Airlines?. Studia Humana, 7(2), pp.31-44.

Paul, J.P., 2020. Pandemics and Airline Industry–A Case Study. Management, 7(S1), pp.110-14.

Serpeninova, Y., 2022. Integrated reporting: bibliometric landscape. Public Policy and Accounting, (1 (4)), pp.23-31.

Syahdan, S.A., Munawaroh, R.S. and Akbar, M., 2018. Balance Scorecard Implementation in Public Sector Organization, A Problem?. International Journal of Accounting, Finance, and Economics, 1(1), pp.1-6.

Utomo, S.D., Machmuddah, Z. and Hapsari, D.I., 2021. The Role of Manager Compensation and Integrated Reporting in Company Value: Indonesia vs. Singapore. Economies, 9(4), p.142.

Vermooten, J., 2018. Options for the restructuring of state ownership of South African Airways. Journal of Transport and Supply Chain Management, 12(1), pp.1-15.

Websites

Statista.com, 2022; Number of passengers traveling with British Airways and its subsidiaries from 2011 to 2020(in 1,000) Available at: https://www.statista.com/statistics/734311/british-airways-passenger-figures/ [Accessed on 1 July 2022]

Fame.bvdinfo.com, 2022; Financial statement of with British Airways Available at: https://fame.bvdinfo.com/version2022628/fame/1/Companies/report/Index?format=_standard&BookSection=PROFITANDLOSS&seq=0 [Accessed on 1 July 2022]

Iairgroup.com, 2022; annual report of with British Airways Available at: https://www.iairgroup.com/~/media/Files/I/IAG/annual-reports/ba/en/british-airways-plc-annual-report-and-accounts-2020.pdf [Accessed on 1 July 2022]

Virginatlantic.com, 2022; Financial information of of with VIRGIN ATLANTIC AIRWAYS LIMITED Available at: https://www.virginatlantic.com/in/en?cm_mmc=10.15.00.17.12.00.142&gclid=CjwKCAjw_ISWBhBkEiwAdqxb9u-bQy96wUvHVFi5kjxlY8ErmryDM1pFJMsbIKINLXXD_5HQUm0C_hoCXkMQAvD_BwE&gclsrc=aw.ds [ Accessed on 1 July 2022]

Appendices

Appendix 1: Ratio analysis

| Ratio Name | Formula | Variable | BRITISH AIRWAYS PLC | VIRGIN ATLANTIC AIRWAYS LIMITED | ||

| 2020 | 2019 | 2020 | 2019 | |||

| Profitability | ||||||

| Gross profit margin | Gross Profit x 100 Total Revenue |

Gross profit | -£ 3,881,000 | £ 1,338,000 | -£ 549,300,000 | £ 49,300,000 |

| Total Revenue | £ 4,001,000 | £ 13,290,000 | £ 868,000,000 | £ 2,927,100,000 | ||

| Gross Margin | -97.00% | 10.07% | -63.28% | 1.68% | ||

| Operating profit margin | Operating Profit x 100 Total Revenue |

Operating profit | -£ 3,881,000 | £ 1,338,000 | -£ 549,300,000 | £ 49,300,000 |

| Total Revenue | £ 4,001,000 | £ 13,290,000 | £ 868,000,000 | £ 2,927,100,000 | ||

| Operating Margin | -97.00% | 10.07% | -63.28% | 1.68% | ||

| Net profit margin | Net Profit x 100 Total Revenue |

Net profit | -£ 3,489,000 | £ 1,109,000 | -£ 864,000,000 | -£ 48,500,000 |

| Total Revenue | £ 4,001,000 | £ 13,290,000 | £ 868,000,000 | £ 2,927,100,000 | ||

| Net Margin | -87.20% | 8.34% | -99.54% | -1.66% | ||

| Liquidity ratio | Formula | Variable | BRITISH AIRWAYS | BP Plc | ||

| 2020 | 2019 | 2020 | 2019 | |||

| Current Ratio | Current Asset Current Liabilities |

Current Asset | £ 2,093,000 | £ 4,720,000 | £ 736,900,000 | £ 1,146,800,000 |

| Current Liabilities | £ 6,342,000 | £ 5,801,000 | £ 773,400,000 | £ 1,351,600,000 | ||

| Current ratio | 0.33 | 0.81 | 0.95 | 0.85 | ||

| Quick Ratio (Acid | (Current Asset – inventories) Current Liabilities |

Current Asset | £ 2,093,000 | £ 4,720,000 | £ 736,900,000 | £ 1,146,800,000 |

| Inventories | £ 73,000 | £ 156,000 | £ 30,300,000 | £ 38,800,000 | ||

| Current Liabilities | £ 6,342,000 | £ 5,801,000 | £ 773,400,000 | £ 1,351,600,000 | ||

| Quick Ratio | 0.32 | 0.79 | 0.91 | 0.82 | ||

| Efficiency Performance | Formula | Variable | BRITISH AIRWAYS | BP Plc | ||

| 2020 | 2019 | 2020 | 2019 | |||

| Inventory Turnover days | Inventory*365 Cost of goods |

Inventory | £ 73,000 | £ 156,000 | £ 30,300,000 | £ 38,800,000 |

| Cost of goods sold | £ 6,329,000 | £ 11,961,000 | £ 1,405,400,000 | £ 2,890,600,000 | ||

| Inventory Turnover | 4.21 | 4.76 | 7.87 | 4.90 | ||

| Debt collection period | Debtors*365 Sales |

Debtors | £ 356,000 | £ 1,202,000 | £ 48,100,000 | £ 638,700,000 |

| sales | £ 4,001,000 | £ 13,290,000 | £ 868,000,000 | £ 2,927,100,000 | ||

| Debt collection | 32.48 | 33.01 | 20.23 | 79.64 | ||

| Creditor collection period | Creditor *365 Sales |

Creditor | £ 871,000 | £ 1,396,000 | £ 122,000,000 | £ 117,100,000 |

| Credirt purchase | £ 6,329,000 | £ 11,961,000 | £ 1,405,400,000 | £ 2,890,600,000 | ||

| Creditor collection | 50.23 | 42.60 | 31.68 | 14.79 | ||

| cash conversation cycle | Inventory days+ Debtors days -creditor days | Cash cycle | -13.54 | -4.83 | -3.59 | 69.76 |

| Financial Leverage ratios | Formula | Variable | BRITISH AIRWAYS | BP Plc | ||

| 2020 | 2019 | 2020 | 2019 | |||

| Solvency ratio | net profit after tax + depriciation short-term + long-term liability |

net profit after tax + depriciation | £ 14,616 | -£ 16,906 | -£ 341,400,000 | £ 315,900,000 |

| short-term + long-term liability | £ 15,972,000 | £ 14,510,000 | £ 3,392,100,000 | £ 3,428,500,000 | ||

| solvency ratio | 0.00 | 0.00 | -0.10 | 0.09 | ||

| Debt Ratio | Total debt Total Assets |

Total debt | £ 9,819,000 | £ 8,787,000 | £ 2,479,600,000 | £ 2,220,000,000 |

| Total assets | £ 17,764,000 | £ 16,077,000 | £ 3,167,100,000 | £ 3,588,300,000 | ||

| Debt ratio | 0.55 | 0.55 | 0.78 | 0.62 | ||

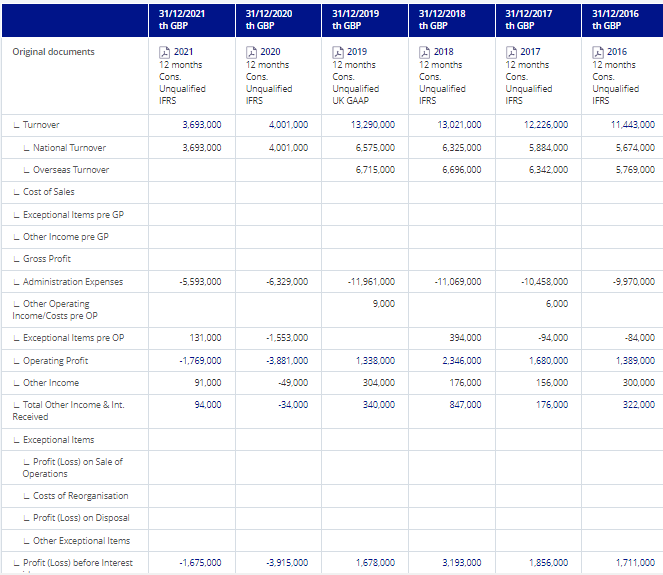

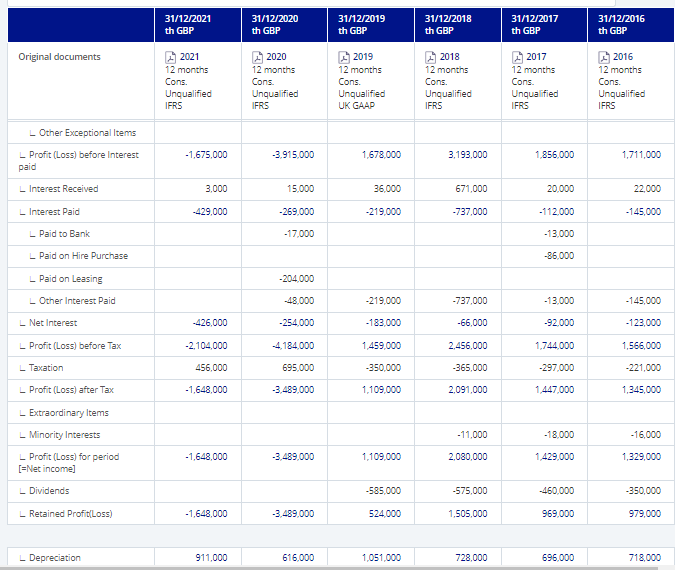

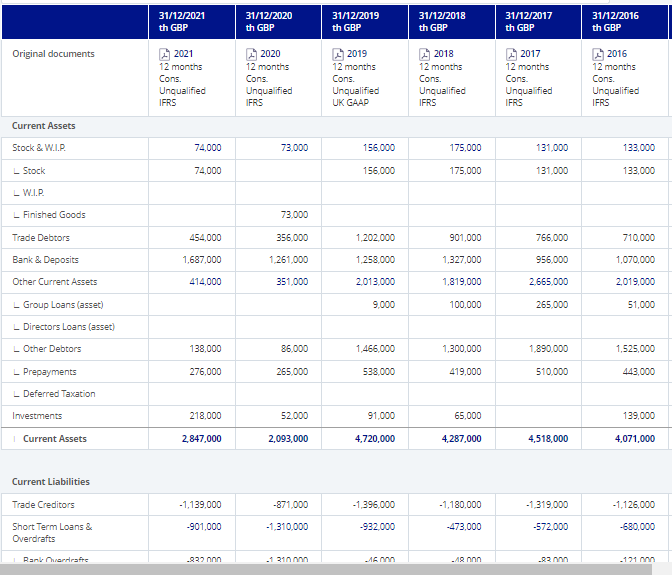

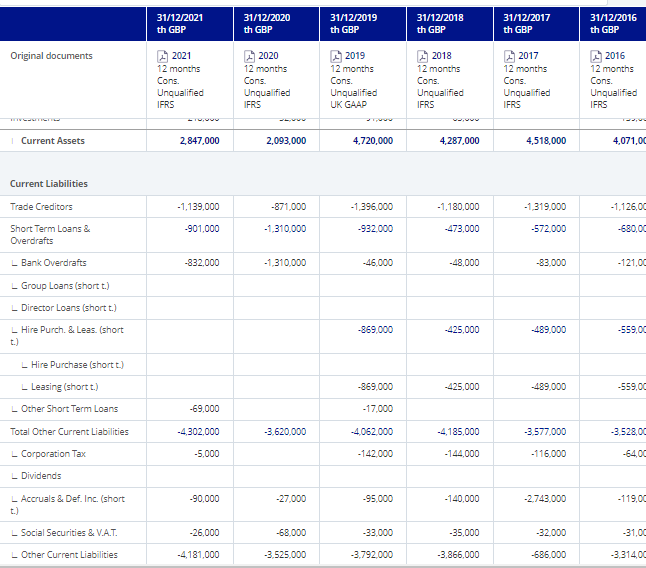

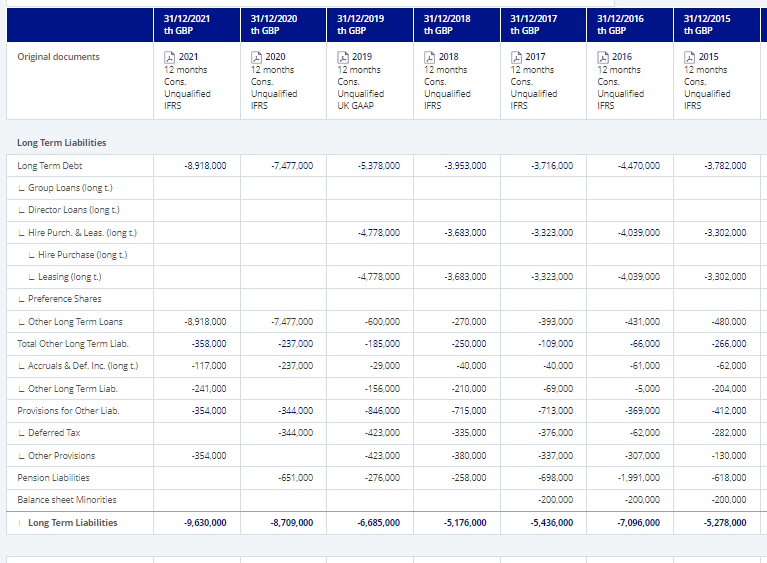

Appendix 2: Income statement (Source: Fame.bvdinfo.com, 2022)

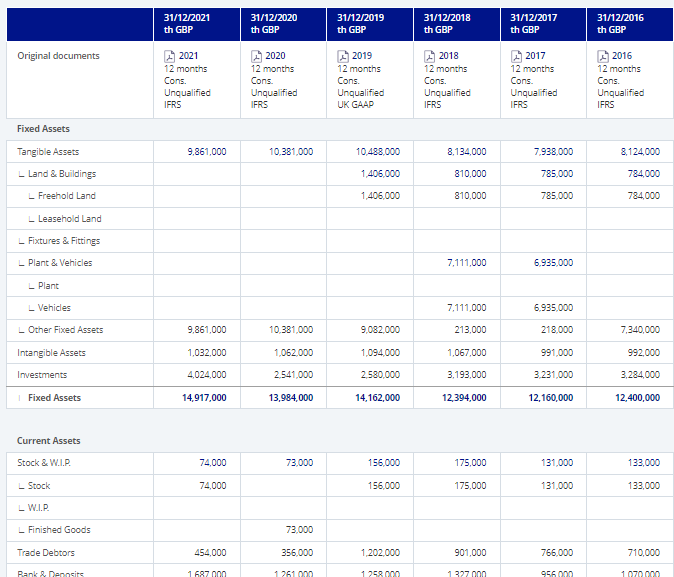

Appendix 3: Balance sheet (Source: Fame.bvdinfo.com, 2022)

Know more about UniqueSubmission’s other writing services: