S2LBS Assignment Sample – CORPORATE STRATEGY 2022

Introduction

Strategic analysis of the different factors and elements that are associated with an organisation is needed as it helps in bringing about better decision making for different areas like financial area and market share area. For bringing about better sustainable competitive advantage, important steps and strategies are often taken into consideration by the management team of an organisation to make some significant difference.

This study tries to focus on CEMEX and its different strategic analysis that helps in better decision making process and brings about better competitive advantage for the organisation. Furthermore it also involves a proper recommendation that is going to be beneficial for CEMEX.

Strategic decision making

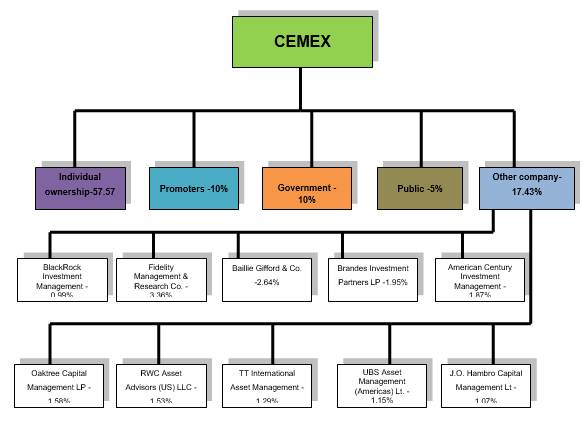

Figure 1: Shareholders structure

(Source: Created by author)

Different organisations have different kinds of shareholders structure as the amount of shareholding between different important areas of the organisation is different for varied organisations. Based on the ideas of Chanias et al. (2019), the strategic decision making process of any organisation depends on the amount of stakeholders present for an organisation and the important areas of concern for the different stakeholders present.

The different stakeholders present for the concerned organisation that is CEMEX depends on the new shareholder structure that is being put forward by the management team of the organisation with respect to the shares hold by various stakeholders. From the new shareholders structure present for the organisation it can be effectively observed that a larger amount of shares are individually owned by the concerned organisation.

This provides a better strategic position for the organisation to take its own decisions without any kind of influence or hassle.

The organisational environment as well as the framework used in CEMEX effectively in managed and properly categorised as for the shareholders seen within the organisation.

Identified in the findings of Tworek et al. (2019), the organisational environment often takes into consideration the external environment of the organisation as well as some important internal elements such as strength of the organisation to a large extent. The new shareholder structure that is presented by the concerned organisation brings forward a better analysis of the external environment so that better strategic options and steps can be taken by the management team.

Other than this it is also observed that the promoters tend to take 10% of the shareholding of CEMEX, therefore, important decisions are required to be taken into consideration for the promoters as well.

Different other organisations are seen to have a significant amount of share of the concerned organisation and therefore significant and strategic decisions are taken by the management team of CEMEX. As mentioned by Goranova et al. (2017), keeping in mind the strategic decision taken for the case of share holding by another organisation for any particular company is essential as it often says about the different strategic decisions taken by the shareholding companies.

This helps in bringing about better IPOs and FPOs for the organisation. Furthermore, Government and public also have some significant share within the concerned organisation therefore strategic decision making is often done by the management as capital generation can be possible from these two areas.

Therefore the new shareholder structure that is presented by the concerned organisation is going effectively well with the organisational environment as well as framework. Other than this it is also observed that the new shareholder structure is helping in bringing about better operations and innovative strategic direction for the organisation.

Three dimensional strategic analyses

1. Financial strength

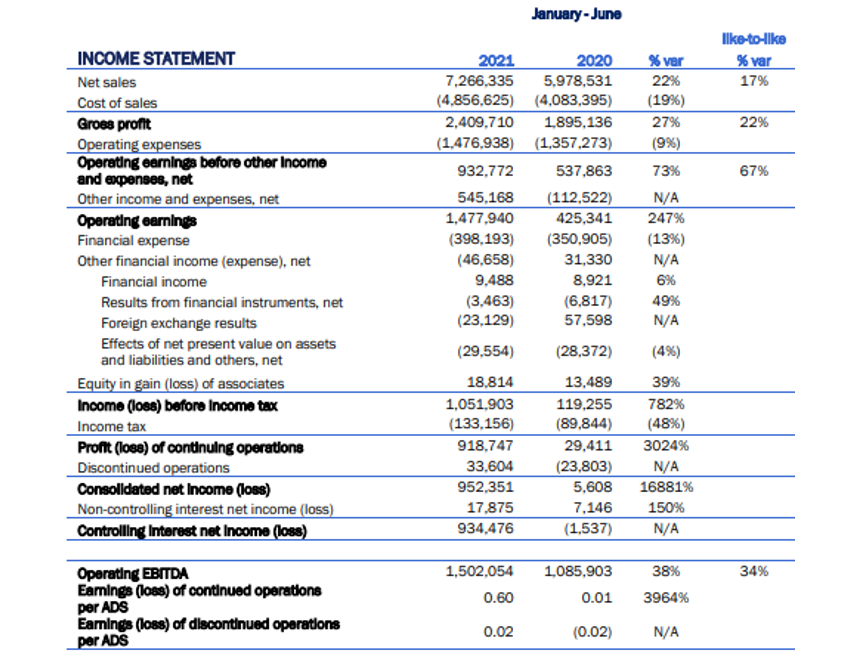

Figure 2: Income statement of CEMEX in Q1 and Q2 2021

(Source: Cemex.com, 2021)

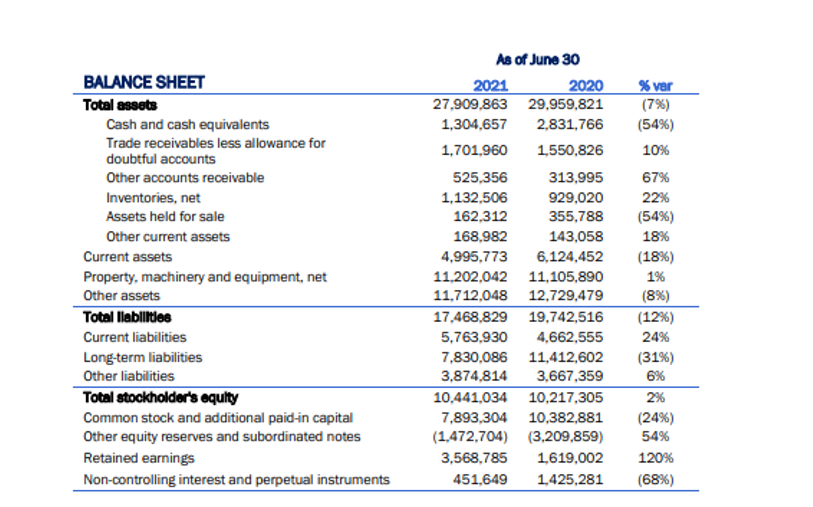

Figure 3: Balance Sheet of CEMEX

(Source: Cemex.com, 2021)

CEMEX is believed to have a stronger financial strength in the competitive market of Mexico, UK and other operational areas. As stated by Lata (2020), important information about the financial status of an organisation can be obtained from the difference annual report provided by different organisations in their concerned official website.

For the case of the concerned organisation a basic understanding about the financial strength is obtained from the annual report provided in the official website of CEMEX. Some of the important information is provided such as the net sales cost of sales as well as gross profit that is being obtained by the concerned organisation giving a comparison of 2021 and 2020.

From the income statement it can be effectively said that the concerned organisation has made some gross profit from 2020 to 2021 as in 2020 the gross profit is seen to be 1,895,136 and in 2021 the gross profit is 2,409,710 (Cemex.com, 2021). More than double profit is being encountered and obtained by the concerned organisation because of the different strategic decisions taken by the management team and understanding of the important information that are related to market share and market strength.

The balance sheet that is provided by the organisation provides a basic understanding of the important areas such as assets and liabilities and equity that is involved with CEMEX in the recent year. As highlighted by Huo et al. (2018), the balance sheet provides a basic understanding about important areas such as assets liability that is seen within an organisation so that proper and effective financial decisions can be taken by the management team.

Similar is the case for the concerned organisation as the balance sheet that is provided provides a broader and present understanding of the assets and liabilities as well as equity that is associated with the organisation. From the balance sheet it can be effectively says that the liability of the organisation is seen to be decreased as in 2020 the liability of CEMEX is seen to be 19,742,516 where has in 2021 the liability has decreased and it is seen to be 17,468,829 (Cemex.com, 2021).

6% variation can be observed for the case of liability within the organisation that might be beneficial for the organisation for a longer run.

A proper analysis of the important areas of finance in an organisation helps in bringing about a better strategic decision making process and helps in building better strategies for the organisation.

As opined by Kori et al. (2020), a proper understanding of some of the important elements within the financial arena of an organisation helps in bringing about better strategy for the business expansion process as well as bringing about better and innovative changes within the process of the organisation.

For the case of CEMEX it can be effectively said that the financial strength of the organisation is high as all the important strategic duration taking for the case of financial areas are effectively considered and keeping in mind all the important operation areas.

2. Relative market share

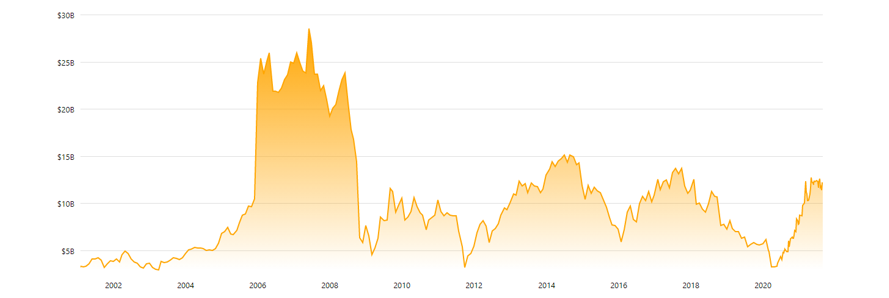

Figure 4: Market capitalisation history of CEMEX from 2001 to 2021

(Source: Forbes.com, 2021)

CEMEX is considered to be one of the well known organisations for building materials and it is providing different kinds of innovative products and services to its customers in its headquarter as well as in other countries that it is operating. According to Pineiro-Chousa et al. (2018), market share is also known as market capitalization that can be termed as a specific value of a particular publicly listed company in a competitive market.

It is mainly calculated by multiplying the different share prices with the amount of the difference in outstanding shares of a company. The market share of the market capitalisation of the concerned organisation in 2021 is $12.15 billion and it is considered to be in the rank of 1405th of the most valuable companies in the world (Forbes.com, 2021).

The relative market share of the organisation is higher as compared to the other building material providing organisation present in the competitive market of Mexico, UK or any other operating countries.

From the graph it can be effectively said that the market capitalisation of the concerned organisation is seen and its preposition in 2007 and after that it has relevantly decreased its market capitalisation. As influenced by Mjomba (2017), market capitalisation often varies as per the business operations in different countries and of the different strategic decisions taken by a particular organisation by its management team.

Similar is the case for CEMEX, when the significant Rise of the overall market capitalisation seen in 2007 might have included some important strategic decisions and strategic Alliance with other organisations. In 2021 it is observed that it has recently increased its market capitalization from 2020 and has brought about some significant changes in the overall business operations.

From the above analysis it can be effectively said that the market capitalisation of the market share that is seen for the case of CEMEX is relevantly higher than the other building material organisation present in the competitive market. A proper analysis of the important competitors present in the market helps in taking strategic decisions regarding market share of an organisation (Alderighi, 2020).

CEMEX has made some significant strategic decisions such as expanding its business incorporating some innovative processes within its business and better customer service has helped in bringing about relevant market share in different competitive markets of its operation.

3. Relative market strength

Market strength of CEMEX is considered to be higher as it has made a successful record in developing and bringing about new products to its targeted customers. Maintaining a strong brand portfolio is another important strength that helps the organisation in bringing about better market strength.

Based on the ideas of Todeschini et al. (2017), a relevant and strong distribution network often helps in bringing about a better distribution channel and helps in penetrating other competitive markets. For the case of CEMEX it is observed that a strong distribution channel or network is seen for some years that help in bringing about better potential in the market with reliable distribution channels.

Different kinds of automation of varied activities can be observed that helps in maintaining a consistency in the quality of the different products and services provided by the concerned organisation. This helps in strengthening the overall market strength of CEMEX in the recent time.

In addition to this it is seen that CEMEX is highly successful in its go to market strategies for the different products and services that are offered to its targeted customers in the competitive market. As influenced by Sivam et al. (2019), understanding the relevant strategies of maintaining a successful track is essential in strengthening the overall market of a particular organisation.

For the case of the concerned organisation it is observed that it has a successful track record of a better as well as appreciation that helps in strengthening the overall market strength full stop other than this it is also observed that the technological advancement used by the organisation in different operations have bring about some reliable suppliers for the organisation that has subsequently strength and the overall market strength.

Using different high skilled labours for doing the different business operations can help in increasing the overall reputation of the organisation in the competitive market.

As highlighted by Goos (2018), involving high skill labours and including better training and development courses and programs for the employees helps in doing all the important operations in a lesser duration of time without any kind of errors in it full stop this specific strategy is used by CEMEX for dealing with the different operation and bringing about better strategies for innovative operation.

This helps in making a better reputation for the concerned organisation in the competitive market and helps in better acquisition and merger in the market. This subsequently helps in increasing and strengthening the overall market of CEMEX.

Process innovation

CEMEX is seen to bring about some innovation in its business process so that better business operations can be done without any kind of issue or hassle. Based on the ideas of Khan et al. (2017), improvement in the management process is something that is often taken into consideration by the management team of any organisation.

This is mainly considered as it helps in bringing out better strategy and leadership approaches that are going to be beneficial for the organisation in taking some effective decision making process. For the case of the concerned organisation some changes in the management team are being made that help in resolving the issue of delivery process of the product to the targeted customers.

This has made some relevant changes in the overall working of the organisation and brought some overall profit and changes in the overall working of the employees.

In addition to this, another important process innovation that is seen for the case of CEMEX is that it has brought about a new IT department for its organisation for forecasting the different demands of the products in the competitive market.

As mentioned by Rumetna et al. (2020), forecasting the demands of the products or services offered by an organisation is essential as it helps the company to produce more of its products as for the demand of the target customers. This is taken into consideration by the different higher authorities present in CEMEX and the involvement of new IT departments and building separate ongoing operations is done.

This brought about some significant innovation in the business process as most of the work is done with the help of IT along with some accounting programs to check for its financial status.

Innovation in the use of technological advancement is also observed for the case of the concerned organisation as it helps in better installation of the logistics systems. Innovation is often made in the different processes of an organisation and they are mainly done with the help of different kinds of technological advancements within an organisation (Božič and Dimovski, 2019).

CEMEX is seen to use Dynamic Synchronisation of Operations which is one of the logistics systems installed in the concerned organisation and uses GPS technology for the delivery process of the different products and help in controlling them from the control centre. This is one of the important and relevant process innovations that is used by the organisation to deal with its different products and maintain a better delivery of the products and services to the targeted customers.

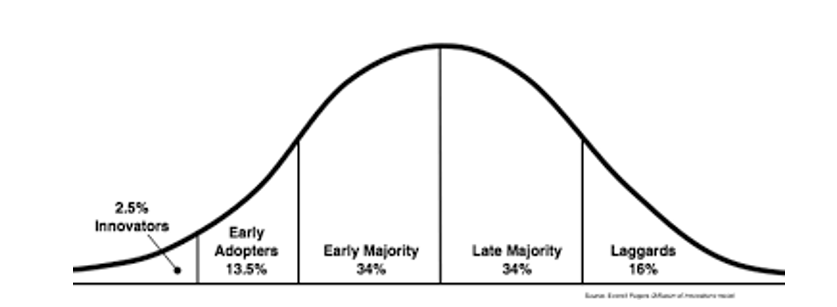

Figure 4: Roger’s innovation diffusion theory

(Source: Influenced by Marak et al. 2019)

Important process innovations are often considered by various organisations as it helps in making all the business operations in a smooth manner and lesser error within the business process. According to Lund et al. (2020), Roger’s innovation diffusion theory is one of the theories that is often used by different organisations that helps in bringing about better innovation that is mainly communicated with the help of different important channels in a proper system.

The concerned organisation for improving its overall process might go for Roger’s innovation diffusion model so that it is able to bring about some important changes in its business process with the help of important communication with management and the other stakeholders with the help of important channels.

Sustaining competitive advantage

CEMEX is one of the well known organisations that provides quality building materials to its targeted customers and tends to have better business strategy that brings about better competitive advantage for the organisation. As influenced by Baiochi et al. (2019), It is seen that having a better analysis of the different competitors present in the competitive market and understanding the different technological advancement in the surrounding is essential for an organisation.

This is mainly because it helps in bringing about a better strategic decision making process and helps in improving the overall business operations. CEMEX seems to focus more on its goal business that is the production of cement as well as increasing the overall value proposition of the organisation with the help of better flexibility.

All these are effectively done by the organisation so that better competitive advantage can be created with the help of fostering better sustainable development in the competitive market.

CEMEX is seen to strengthen its capital investment structure so that it is able to regain its flexibility in terms of financial aspects. As stated by Yüksel et al. (2019), having a proper knowledge of the different financial elements of an organisation and strengthening the overall capital investment helps in bringing about better financial strength for an organisation.

For a better financial position of an organisation better negotiation with the investors and suppliers as well as other stakeholders as something that is commonly done by the management team of an organisation. For enhancing the overall competitive advantage it is observed that CEMEX uses various strategic decision making policies for the case of financial upliftment.

This helps in sustaining the overall competitive advantage and it is seen that it is rightly doing so.

CEMEX has involved some technological advancement in its different process that is bringing better opportunities and scope for the organisation in recent times. One of the examples of the technological advancement that has been used by the concerned organisation is the use of GPS technology for detecting its delivery truck so that it can track its movement and also control from the control centre.

Based on the ideas of Reim et al. (2020), technological advancements that are used in different industries tend to provide them with different kinds of profits in the revenue as well as help in bringing forward better scope and opportunities for the organisation with lesser mistakes.

Similar is the case for CEMEX as it uses different kinds of technological advancement in its business operations so that it is able to bring forward better products and higher quality Services to its targeted customers and deliver them within a specified duration of time.

In the competitive market it is observed that the different other construction organisations are bringing about different kinds of products and services that are sustainable in nature and are in higher demand. As highlighted by Lozano (2018), more organisations are going for different times of sustainable products and services that help in attracting more customers and are also eco friendly in nature. CEMEX aims to bring about some sustainable building solutions for the targeted customers and helps in bringing about a low carbon economy.

This helps in bringing about a better position in the competitive market for CEMEX and helps in increasing the overall profit percentage. It tries to match up with the different trends and drivers of the market and bring about some new technological trends in its process so that it can match up the competitive market as well as reduce carbon in the environment.

Therefore, it can be effectively said that the different steps that are taken by the concerned organisation keeping in account competitive advantage in the competitive market is positive and creates a positive space for the concerned organisation in the market.

Conclusion

A proper analysis of the different areas of a business is necessary to bring about better strategic decision making that will help to provide better scope for a particular organisation. CEMEX which is an all well known organisation of building materials is seen to have a better strategic decision making process and have a proper financial strength along with a better market share.

The market strength of the organisation is also seen to be high as the market capitalisation of the organisation has increased in the past few years. Different kinds of process innovation can be observed for the concerned organisation and among them the use of technological advancement is notable. Different steps and strategies are taken into consideration that will help in uplifting the overall competitive advantage for the organisation.

Some relevant recommendation is provided after a proper analysis of the different areas of CEMEX so that the organisation might change some of its operation to bring about better revenue and profit from the competitive market.

Recommendation

- CEMEX can go for arbitrage which is sometimes called location advantage that will involve sourcing from countries with lesser cost. This will bring about low weighted to the different value ratio of important products of the concerned organisation and will be helpful in better International cooperation.

- Expansion of business can be one of the important strategies where diversification in a geographical manner can be made that will help in recovering some of the weak areas. It can be considered North Africa, South Asia, India and the Middle East for its expansion.

- Divesting of its assets can be one of the strategic recommendations for CEMEX as it will help in reducing the overall net depth of the organisation which is often considered as one of the priorities of CEMEX. This is going to be helpful for the company as it will bring about better financial strength for the organisation.

Reference List

Alderighi, S., (2020). Cross-listing in the European ETP market. Economics Bulletin, 40(1), pp.35-40.

Baiochi, S.V.F., Severgnini, E., Batista, M.J., Abbas, K. and Marques, K.C.M., (2019). Competitors’ cost analysis: a study with companies of the Brazilian sugarcane industry. Contaduría y administración, 64(2), pp.0-0.

Božič, K. and Dimovski, V., (2019). Business intelligence and analytics for value creation: The role of absorptive capacity. International journal of information management, 46, pp.93-103.

Cemex.com (2021). Second Quarter Results 2021. Available at: https://www.cemex.com/documents/20143/52736797/CXING21-1.pdf/2828b679-43cb-ca28-90ba-062fc80969bc?t=1619690629880 [Accessed on 30th August 2021]

Chanias, S., Myers, M.D. and Hess, T., (2019). Digital transformation strategy making in pre-digital organizations: The case of a financial services provider. The Journal of Strategic Information Systems, 28(1), pp.17-33.

Forbes.com (2021). CEMEX. Available at: https://www.forbes.com/companies/cemex/?sh=355e2a35121c [Accessed on 30th August 2021]

Goos, M., (2018). The impact of technological progress on labour markets: policy challenges. Oxford review of economic policy, 34(3), pp.362-375.

Goranova, M.L., Priem, R.L., Ndofor, H.A. and Trahms, C.A., (2017). Is there a “Dark Side” to Monitoring? B oard and Shareholder Monitoring Effects on M&A Performance Extremeness. Strategic Management Journal, 38(11), pp.2285-2297.

Huo, T., Ren, H., Zhang, X., Cai, W., Feng, W., Zhou, N. and Wang, X., (2018). China’s energy consumption in the building sector: A Statistical Yearbook-Energy Balance Sheet based splitting method. Journal of cleaner production, 185, pp.665-679.

Khan, A.A., Keung, J.W. and Abdullah-Al-Wadud, M., (2017). SPIIMM: toward a model for software process improvement implementation and management in global software development. IEEE Access, 5, pp.13720-13741.

Kori, B.W., Muathe, S.M. and Maina, S.M., (2020). Financial and Non-Financial Measures in Evaluating Performance: The Role of Strategic Intelligence in the Context of Commercial Banks in Kenya. International Business Research, 13(10), pp.130-130.

Lata, P., (2020). The influences of participatory management and corporate governance on the reduction of financial information asymmetry: Evidence from Thailand. The Journal of Asian Finance, Economics, and Business, 7(11), pp.853-866.

Lozano, R., (2018). Sustainable business models: Providing a more holistic perspective. Business Strategy and the Environment, 27(8), pp.1159-1166.

Lund, B.D., Omame, I., Tijani, S. and Agbaji, D., (2020). Perceptions toward Artificial Intelligence among Academic Library Employees and Alignment with the Diffusion of Innovations’ Adopter Categories. College & Research Libraries, 81(5), p.865.

Marak, Z.R., Tiwari, A. and Tiwari, S., (2019). Adoption of 3D printing technology: an innovation diffusion theory perspective. International Journal of Innovation, 7(1), pp.87-103.

Mjomba, M., (2017). The effects of macroeconomic variables on the market capitalisation of listed companies in Kenya. International Journal of Finance and Accounting, 2(1), pp.58-83.

Pineiro-Chousa, J., Vizcaíno-González, M. and Caby, J., (2018). Linking market capitalisation and voting pattern in corporate meetings. Economic research-Ekonomska istraživanja, 31(1), pp.376-385.

Reim, W., Åström, J. and Eriksson, O., (2020). Implementation of Artificial Intelligence (AI): a roadmap for business model innovation. AI, 1(2), pp.180-191.

Rumetna, M., Renny, E.E. and Lina, T.N., (2020). Designing an Information System for Inventory Forecasting:(Case Study: Samsung Partner Plaza, Sorong City). International Journal of Advances in Data and Information Systems, 1(2), pp.80-88.

Sivam, A., Dieguez, T., Ferreira, L.P. and Silva, F.J., (2019). Key settings for successful open innovation arena. Journal of Computational Design and Engineering, 6(4), pp.507-515.

Todeschini, B.V., Cortimiglia, M.N., Callegaro-de-Menezes, D. and Ghezzi, A., (2017). Innovative and sustainable business models in the fashion industry: Entrepreneurial drivers, opportunities, and challenges. Business Horizons, 60(6), pp.759-770.

Tworek, K., Walecka-Jankowska, K. and Zgrzywa-Ziemak, A., (2019). Towards organisational simplexity—a simple structure in a complex environment. Engineering Management in Production and Services, 11(4), pp.15-78.

Yüksel, S., Dinçer, H. and Meral, Y., (2019). Financial analysis of international energy trade: a strategic outlook for EU-15. Energies, 12(3), p.431.

Know more about UniqueSubmission’s other writing services: