Impact of Australian government activities on tobacco smoking ratio in Australia

The prevalence of tobacco smoking is high across the globe which is majorly responsible for non-communicable disease and mortality of more than 100 million in the 20th century.

The World Health Assembly to reduce the prevalence and hazards of smoking has put immense pressure on the governments to avoid more than 200 million deaths by 2025 from tobacco.

The Australian government has steps to reduce prevalence of smoking activities through tobacco policy reform and antismoking activities. The report presents the topic of impact of government activities on the ratio of tobacco smoking in context of Australia.

The report includes research background, research aim and research questions, review of literature, research methodology followed by findings to provide evidence of impact of Australian government activities on smoking ratio and discussion and finally conclusion based on the analysis.

To reduce the prevalence the Australian government has increased the price of tobacco, invested in anti-smoking ad campaigns and changed the packaging of tobacco packets. Despite the fact that Australian government has initiated anti-smoking activities and policy reforms, tobacco smoking is still an ongoing concern for underage/adolescents, youth and adults in adults in Australia.

One of main influencers is advertisements that affect the decisions of minor or youth for smoking to try new things out of fun and curiosity. However, the survey by Australian Institute of Health and Welfare (AIHW) found there is a significant reduction in the percentage of percentage of daily smokers especially adolescents from 2007(16.6%) to 2013 (12.8%) in Australia (AIHW, 2017).

There is little study towards the exploring the relationship between the anti-smoking activities and its impact on reducing the smoking ratio. It is essential to explore how effective are the government anti-smoking activities to reduce the smoking ratio in Australian population.

Thus, there is need to understand the reason behind the reduction in smoking prevalence to direct the efforts towards the activities that are proving successful and creating high impact on the reducing the tobacco smoking level in Australia to inspire the initiative and focus to reduce smoking ratio at global level.

Research aim and Research questionsThe main aim of the research is to find and conclude that whether government activities are helping to reduce the smoking level in Australia in context to:

Research questions

To what extent government activities are reducing the tobacco smoking ratio in Australia?

To identify if there is any relationship between variables like price rise of tobacco, money spent on anti-smoking ads campaign, changes in tobacco packaging and smoking ratio of Australians population since last 10 to 15 years?

To evaluate whether the evidence of Australian government anti-smoking activities is helpful to reduce tobacco smoking ratio?

Since 2002, there have been reforms in the tobacco policies with intention to discourage the use of tobacco smoking. One of the earlier government interventions was to raise the tobacco taxes to discourage its use and to lessen the impact of its health consequences.

Several studies were done on to explore the relationship between the increase in taxes and reduction of tobacco use. Callison and Kaestner (2014) found that tobacco excise tax proved to be an effective strategy to reduce its consumption level and lessen the prevalence of mortality and other health related effects in mostly low to middle income population.

Brennan et al. (2017) verifies that increase in taxes of tobacco increase the tobacco price hence it prevents the potential consumers to buy thus, having a positive on the youth and low income population.

The author states the increase in price to be an effective tobacco control strategy by government. Similarly, Leas et al. (2015) state increased price of tobacco has a direct influence on the public health improvements.

The author also discuss that the increase in government revenues by tobacco taxes can be also invested in health promotions and anti-smoking campaigns. However, Callison and Kaestner (2014) argue that increased tobacco tax can impact the economic effect of a nation.

In 1997, the government tobacco control through taxes based on weight was introduced through National Tobacco Campaign (NTC) in Australia. According to Durkin et al. (2012), during the period of NTC there was a significant reduction in tobacco consumption of larger pack formats but a shift from heavy premium brand to value and budget brands which were of lighter weight.

In the study of Dunlop et al. (2011), the findings reveal that the impact of the raised tobacco tax was short-term smoking cessation in Australia. Another aspect of government initiatives is towards the impact of anti-smoking media campaigns to discourage smoking behavior.

In Australia, National Warning against Smoking campaign began in 1972 and continued till 1975. This initial national campaign on the smoking theme using posters and anti-smoking messages and slogans was reported to be at a cost of $500,000 per annum (Creighton et al., 2015).

Under this campaign, printed cardboards signs with no smoking requests were distributed to the public without any cost. However, the impact of campaign was not evaluated and there is not much evidence to study the impact this anti-smoking campaigns on reducing smoking and on general public smoking habits.

The finding of Liu and Tan (2009) reveal a positive relationship between the ad campaigns to reduce the prevalence of smoking among youth and adults and potential consumers.

The author found that anti-smoking media campaigns induce the motivation to quit smoking and discourage the smoking intention among youth thus, leading towards reduction in smoking.

Similarly, Leas et al. (2015) viewed anti-tobacco advertisements that depicting intuitive and personal messages have a positive impact on the smoking cessation in youth and adults.

It can be noted that the studies point that the investments in ad campaigns impacts the individual behavior that result in prevention of youth intentions, avoid initiation, reduce daily consumption and leads to short to mid-term cessation among the smokers.

Additionally, Thrasher et al. (2014) studied the impact of changes in tobacco packaging on the smoking pattern in Australia. The finding reveals that plain packaging lead to short term changes in the quitting related individual behavior in adult smokers in Australia.

The researcher makes use of secondary method of data collection. The secondary data collection method is to collect data that is already available publically which is researched by other researcher.

This data collected from secondary sources will provide a framework for this research study to explore the research questions. The secondary data provides a validation of research findings. In this study, the secondary data is collected through review of literature and from Australia bureau of statistics, Australian government websites and other Australian news websites.

Data analysis refers to the process of managing, identification and evaluation of the collected data to explore the results relevant to research questions.

Price rise of tobacco

| Year | Adults 18 years and over | 15-17 year olds |

| 1995 | 23.8% | |

| 2001-02 | 22.4% | |

| 2011-12 | 16.1% | 4.2% |

| 2014-15 | 14.5% (Approx 2.6 million adults) | 2.7% |

Table 1: Reduction of daily smokers from year 1995 to 2015

This table highlights the decrease in trend of daily smokers from 18 years and above since the last two decades and around 1.5 percent decrease in four years in15 to17 years’ age group.

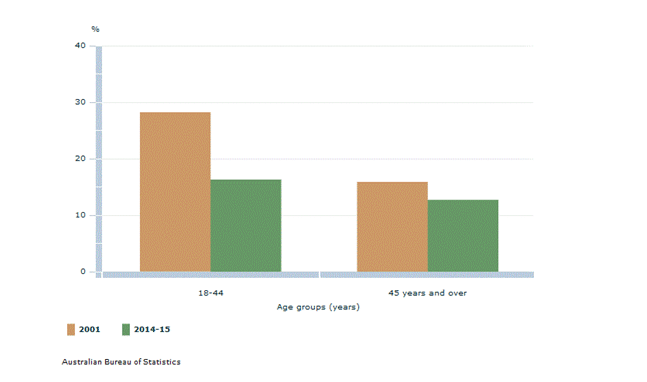

| Year | 18-44 years | 45 years and over |

| 2001 | 28.2 % | 15.9% |

| 2014-2015 | 16.3 % | 12.7% |

Table 2 : Rate of Daily smoking in two age categories

Figure 1 Rate of Daily smoking in two age categories (ABS, 2015)

The above figure shows the daily smokers rates in two age categories from 18 to 44 years and 45 years and more from the time period of 2001 to 2015(ABS, 2015). It can be observed that in both the age groups there has been a considerable decrease in daily smoking rates to certain extent.

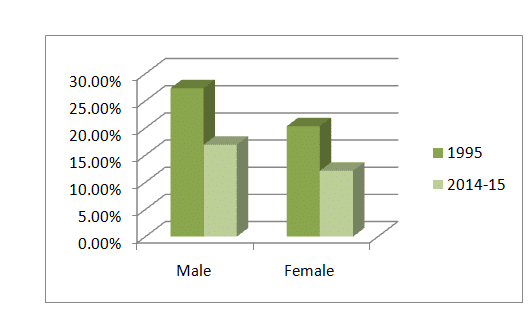

| Daily smokers | Male | Female |

| 1995 | 27.3% | 20.3% |

| 2014-2015 | 16.9% | 12.1% |

Table 3: Gender Comparison in daily smoking pattern since 2001

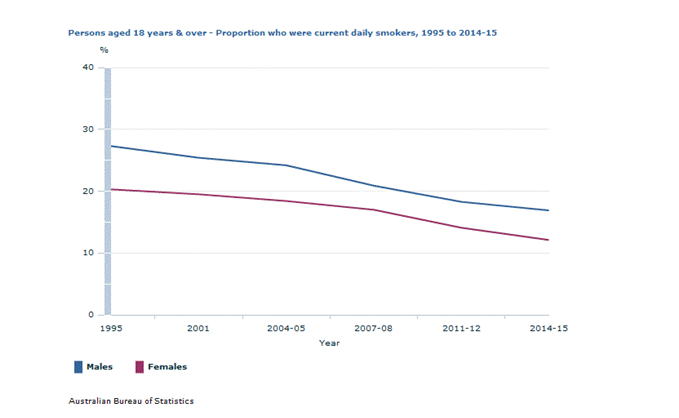

The table/figure depicts that prevalence of smoking in male is more as compared to women. However, the table also depicts a substantial reduction in smoking from both the genders from 2001 onwards. The below graph depicts decreases in trend of daily smoking rates across different age groups from both male and females from year 1995 to 2014-15.

Figure 2 Source(s): National Health Survey: First Results, 2014-15 (ABS, 2015)

| Increase in Excise | Before 2010 | 2010 |

| Cigarettes | $0.2622 per stick | $0.32775 per stick |

| Loose leaf tobacco | $327.77 per kilogram | $409.71 per kilogram |

Table 4: Increase in excise of tobacco products in 2010

This table indicates that the rise in excise of tobacco products led to increase in excise by around by 25 per cent in 2010. This is estimated to rise by $2.16 per pack of 30 cigarettes in 2010 (Parliament of Australia, 2017).

Figure 3 Source: Australian Bureau of Statistics

The figure also highlights the relationship between the tobacco prices and the consumption of tobacco products in Australia till year 2010-11. The declining trend in tobacco consumption is continuing since last few decades in the nation.

Money spent on Advertisement campaign for anti-smoking activities

| Funding Trend | Year 1996 | Year 1998 | Year 2001 |

| Tobacco control campaign | 26 % per adult | 55% per adult | 49 % per adult |

Table 5: Funding for tobacco-control programs in Australia

The table above highlights the increase in funding by 29 percent in two years and a decrease in funding by 6 percent by year 2001. The increase from 26 percent to 55 percent is contributed to the initiation of National Tobacco campaign in July 1997 till 2000.

| Investment | Contribution from Australian Government | Contribution from states and territories and NGO organizations | Total Funding for the

National Tobacco campaign in 3 years |

| 1997 to 2000 | Around $7 million ( 1997-98)

Around $2.18 million (1999-2000) |

Around $3.29 million | More than $12 million |

Table 6: Funding for National Tobacco campaign from a period 1997 to 2000

The above figure reveals the average expenditure of media campaigns in relation to the prevalence of smoking in minor age group from12 to 15 years and 16 to 17 years.

The spending on the anti-smoking and tobacco control activities is showing a decreasing trend in consumption of tobacco in minor or teenagers under both age categories. It can be observed that from period 1996 to 1999 shows a high media expenditure owing to the National Tobacco Campaign in year 1997.

The contribution of the Australian government contributed around $4.5 million on advertising in the initial five months of National Tobacco campaign activity.

During the campaign period, the figure shows a major drop in smoking prevalence among the teenagers. According to Durkin et al. (2012), the smoking rate among teenagers dropped from 23.5% (mid-1997) to 20.4% (2000) during NTC activities.

Changes in tobacco packaging

| Tobacco Plain Packaging enforcement | 1 December 2012 | For all Tobacco products to be sold and supplied in Australia |

| Health warnings (compulsory requirements) | – | Tobacco packaging- at least 75 per cent of the front

Cigarette packaging- 90 per cent of the back Other tobacco products- at least 75 per cent of the back (Liberman, 2013) |

The above table highlights the smoking frequency of daily smokers which are 18 years or above in Australia (The Cancer Council, 2017).

It can be noted that there is a slight drop in the smoking rate from a period between 2010 to 2013; thus, to a certain extent this can be attributed to the regulation of plain packaging with health warning and images of body parts as consequences of smoking apart from the increased in tax excise in 2010 and other tobacco control campaign.

The price factor of the tobacco products is of immense value concerning the public health.

From the above analysis, it is clear that the price of tobacco is an important indication for the existing consumer as well as potential buyers like youth and under age groups decision for the consumption of tobacco for smoking.

The custom duty and tax excise on tobacco products increases in 1999 and 2010 led to decrease in the prevalence of smoking in Australian population. The evidence from the above analysis highlights that a 5 to 10 percent increased in prices of tobacco has the potential to reduce the use of tobacco smoking to drop by approx 1.5 to 8 percent.

It can also be understood that variation in prices of tobacco can cause adult smokers to a shift from premium cigarette brands to value or budget brands in Australia.

The evidence supports the finding for the rise in price through increase of excise in tobacco products in 2010 led to reduction in affordability as well as prevalence of tobacco smoking products in different age group and for both male and female.

The figures above highlights a positive relationship between the affordability factors which is based on prices of tobacco products and its consumption which is quite clear from the data from 1995 to 2015.

There has been decline in its consumption with the rise in custom duty and excise leading to high tax revenue for government and an increase in price of per pack in different age categories and male and female daily smoking rates.

Considering the increased government spending on the anti-smoking campaigns it can be observed that anti-smoking campaigns played an important role in Australian economy to reduce the smoking prevalence to a greater extent during the campaign period.

The figure above provides evidence to observe reduced smoking occurrences in teenagers during the National Tobacco campaign as the activities targeted age group from 18 to 24 years.

This also indicate that the increase in Australian government expenditure for anti-smoking campaign around 75 percent of total spent on advertising in this campaign activities was successful as there was major reduction in smoking frequency among Australian teenagers.

Moreover, it can be noted that the drop in smoking rate from 23.5 to 20.4 in teenagers during the campaign period is not fully contributed to the anti-smoking campaigns alone as there were other tobacco policy reforms such a rise in tobacco taxes that also gave added contribution to reduce the smoking prevalence in Australian public.

Also, it can be observed that there is a positive relationship between anti-smoking campaign measures for cresting awareness and campaign response to reduce the audience interest to discourage tobacco smoking.

From the findings of the changes in the packaging of tobacco products especially cigarettes from the beginning of 2013, there was a downturn observed in the smoking prevalence in Australian adults.

However, this decline in smoking prevalence is a combine effort of regulation for plain packaging, tobacco control activities, legislative concerning tobacco advertising and restrictions on smoking in several places (Wilson et al., 2012) and excise on tobacco increase by 25 percent in 2010.

Thus, there is no direct relationship observed for the changes in tobacco packaging and smoking rates. This requires more evaluation and evidence regarding packaging changes impact on smoking behavior and consumption to reach valid conclusion.

However, the finding indicates an indirect relationship as during the shift in packaging there has been a decline in smoking frequency observed in both male and females in Australia.

From the above findings, it is observed that it is necessary that the government need to continue its combined efforts to reduce the smoking prevalence among adults and youth and increased health promotions.

It is suggested that there is need to develop a more supportive environment to discourage the use and attempts of tobacco smoking. The pricing policies, taxation also require a monitoring of restriction on advertisements to implement the regulations on tobacco promotions.

It is also suggested to develop smoke-free public places by developing a robust public health approach (World Health Organization, 2015). The government can focus on providing more health services to help addiction and tobacco dependent people to encourage quitting tobacco and cigarette smoking.

From the above analysis and discussion, it can be summarized that Australia is experiencing a declining trend in the smoking rate due to combined effects on government initiatives towards the control of tobacco smoking.

The anti-smoking campaigns have been effective to raise awareness among minor, teenagers and adults in Australia to discourage the tobacco smoking. These have contributed to decline the smoking rate in both male and female population.

Since last two decades, the efforts of the government has been towards targeting the teenagers as well as adult smokers to make aware of the negative consequences of passive smoking through warning and anti-smoking campaign and which led to changes in tobacco products packaging.

The analysis indicates a positive and direct relationship with increase in price of tobacco products due to increase in excise and increase government and organizational spending on ads campaign and smoking ratio.

These government measure have been a positively impact to reduce the smoking rate in Australian population. On the other hand, it can be concluded that there was an indirect and positive relationship between the changes in tobacco packaging and smoking rate.

Australian Bureau of Statistics (ABS). (2015). SMOKING. Retrieved from: http://www.abs.gov.au/ausstats/[email protected]/Lookup/by%20Subject/4364.0.55.001~2014-15~Main%20Features~Smoking~24

Australian Institute of Health and Welfare (AIHW). (2017). Tobacco smoking. Retrieved from: www.aihw.gov.au/reports/biomedical-risk-factors/risk-factors-to-health/contents/tobacco-smoking

Brennan, E., Gibson, L. A., Kybert-Momjian, A., Liu, J., & Hornik, R. C. (2017). Promising themes for antismoking campaigns targeting youth and young adults. Tobacco Regulatory Science, 3(1), 29-46.

Callison, K., & Kaestner, R. (2014). Do higher tobacco taxes reduce adult smoking? New evidence of the effect of recent cigarette tax increases on adult smoking. Economic Inquiry, 52(1), 155-172.

Creighton, N., Perez, D., & Cotter, T. (2015). Smoking-attributable cancer mortality in NSW, Australia, 1972-2008. Public Health Res Pract, 25(3), e2531530.

Dunlop, S. M., Cotter, T. F., & Perez, D. A. (2011). Impact of the 2010 tobacco tax increase in Australia on short-term smoking cessation: a continuous tracking survey. Med J Aust, 195(8), 469-72.

Durkin, S., Brennan, E., & Wakefield, M. (2012). Mass media campaigns to promote smoking cessation among adults: an integrative review. Tobacco control, 21(2), 127-138.

Leas, E. C., Myers, M. G., Strong, D. R., Hofstetter, C. R., & Al-Delaimy, W. K. (2015). Recall of anti-tobacco advertisements and effects on quitting behavior: results from the California smokers cohort. American journal of public health, 105(2), e90-e97.

Liberman, J. (2013). Plainly constitutional: the upholding of plain tobacco packaging by the High Court of Australia. American journal of law & medicine, 39(2-3), 361-381.

Liu, H., & Tan, W. (2009). The Effect of Anti-Smoking Media Campaign on Smoking Behavior: The California Experience. Annals of Economics & Finance, 10(1).

Parliament of Australia. (2017).Health – Tobacco excise increase. Retrieved from: http://www.aph.gov.au/About_Parliament/Parliamentary_Departments/Parliamentary_Library/pubs/rp/BudgetReview201011/HealthTobaccoExcise

The Cancer Council.(2017). Tobacco in Australia. Facts and Issues. Retrieved from: http://www.tobaccoinaustralia.org.au/1-3-prevalence-of-smoking-adults

Thrasher, J. F., Osman, A., Moodie, C., Hammond, D., Bansal-Travers, M., Cummings, K. M., & Hardin, J. (2014). Promoting cessation resources through cigarette package warning labels: a longitudinal survey with adult smokers in Canada, Australia and Mexico. Tobacco control, tobaccocontrol-2014.

Wilson, L. M., Avila Tang, E., Chander, G., Hutton, H. E., Odelola, O. A., Elf, J. L., & Apelberg, B. J. (2012). Impact of tobacco control interventions on smoking initiation, cessation, and prevalence: a systematic review. Journal of environmental and public health, 2012.

World Health Organization. (2015). WHO global report on trends in prevalence of tobacco smoking 2015. Europe: World Health Organization.