U25292:ECONOMICS ASSIGNMENT SAMPLE 2023

Introduction

When a person borrows money from an institution or from a person they lend the money for something in return which shows the cost of borrowing the money is calculated interest. There are different types of interest calculation that have been used for the purpose of economical reconstruction and to measure the cost of money. From that time till the 21st century it is the main source of economic growth.

Discussion

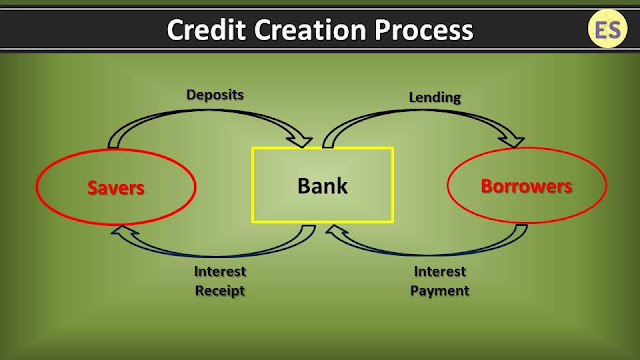

Figure 1: Credit creation process

(Source: lawcorner.in, 2021)

Loans are taken for many purposes like business loan, Education loan, Mortgage loan and other types of loans. The rate of interest simply can be calculated by the formula of “Interest Rate= (Simple Interest*100)/ (principal amount *Time period of the loan)”.

Inflation and interest rate

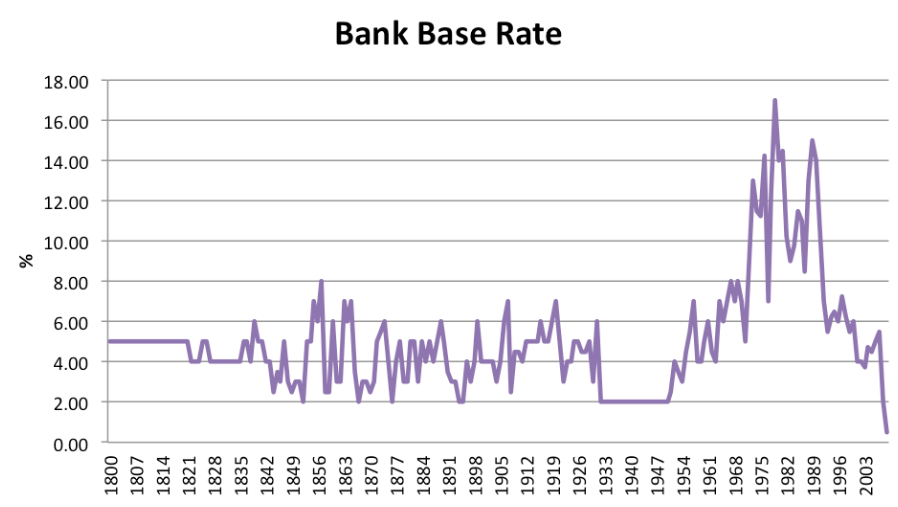

Figure 2: Bank base data over the year

(Source: lawcorner.in, 2021)

Inflation rate is what decreases the purchasing power of the money by which the price of the products also increases. If for certain situations the economy becomes unbalanced then the Central bank increases the REPO rate for the commercial banks (Economics, 2019). If the REPO rate increases then the bank has to pay a high amount of interest to lend money from the central bank. Then the commercial banks will lend money at a higher level of interest.

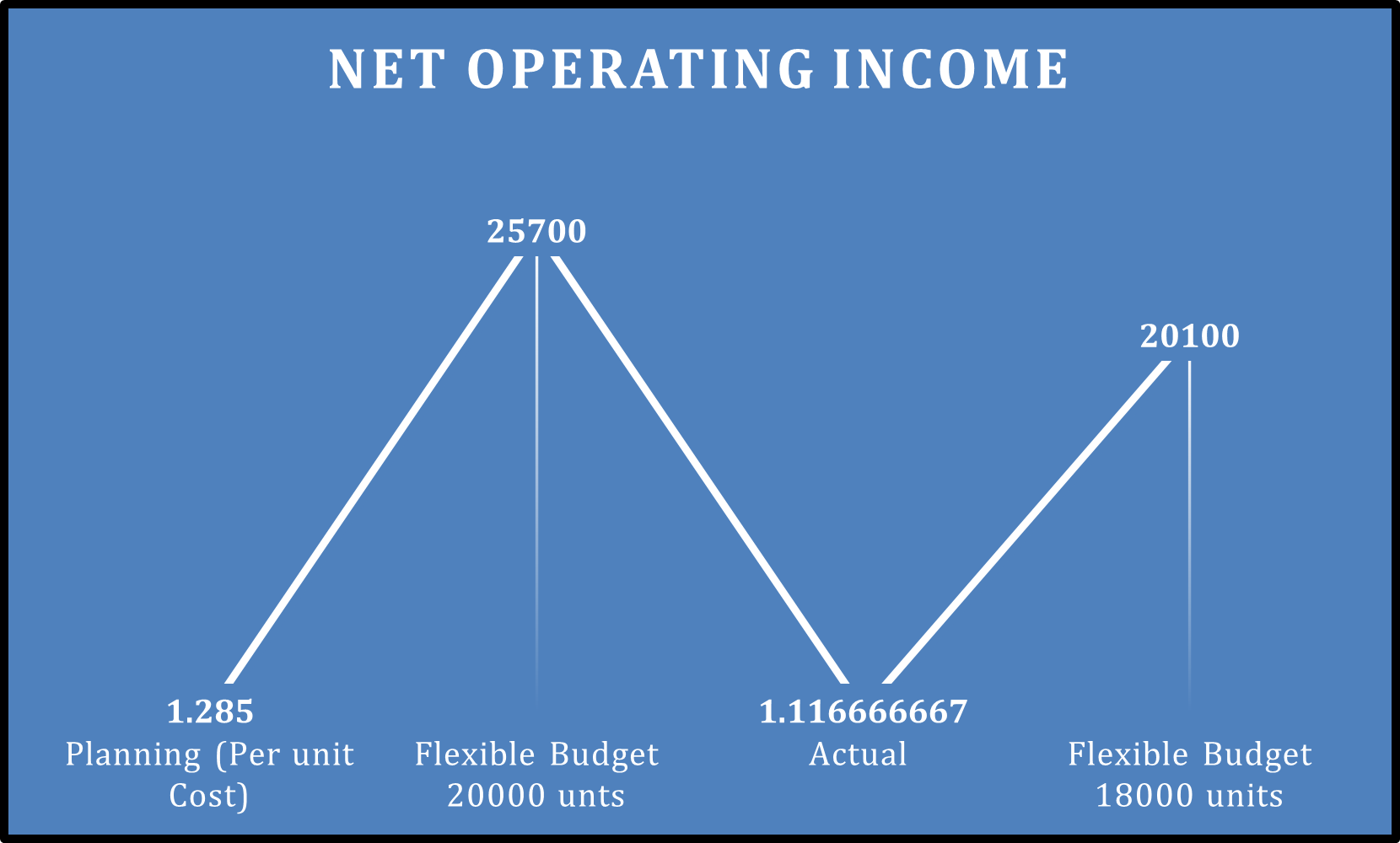

Compound and the simple interest

The simple interest overall is lower than the compounded interest. For example, if a person takes out a mortgage of 5000 dollars with a principle of 1000 yearly for 5 years with an interest of 5% a year. So for the first year he have to pay an interest amount of (5000*5%)= 250 with the initial amount of 1000 dollars (Goldfarb and Tucker, 2019). As over the year the value of the borrowed capital is the same it will show that at the end of the 5 years the payable amount including interest will be 6250 in the process of simple interest.

| Country | 2017 | 2018 | 2019 |

| United States of America | 1.38 | 2.38 | 1.62 |

| Canada | 1.00 | 1.75 | 1.75 |

| Australia | 1.5 | 1.5 | 0.75 |

Table 1: Consecutive 4 year interest rate of different country

(Sources: Self-created)

By the view of interest it can be seen that if a person invested 2000 dollars in a bank and the bank gives a rate of interest of 8% yearly. Then after 5 year his invested capital will be 2720. As the money value increases as the interest is added to the prior year principle.

Conclusion

The bank systematically uses the credit creation system to generate interest to pay the public debts. On the other hand, companies who borrow money from the banking institution for the project work and pay a moderate level of interest to the bank. If it has been analyzed then it can be seen that it’s a whole cyclical process of generating money from the money.

Reference list

Journal

Economics, G., 2019. GRAZING ECONOMICS. Retrieve from: https://www.paglc.org/wp-content/uploads/2015/02/Grazing-Economics_Final.pdf ,[ Retrieve on:20.10.2021]

Goldfarb, A. and Tucker, C., 2019. Digital economics. Journal of Economic Literature, 57(1), pp.3-43, Retrieve from: https://www.nber.org/system/files/working_papers/w23684/w23684.pdf. Retrieve on: 20.10.2021]

Webpage

lawcorner.in, 2021, credit rates of World, retrieves from: https://lawcorner.in/process-of-credit-creation-by-commercial-banks/ [retrieve on: 20.10.2021]

Know more about UniqueSubmission’s other writing services: