53218 International Strategic Management Sample

Introduction

International Strategic Management is concerned with carrying out strategic activities at the international level. International strategic management includes developing strategies or plans of action for an organisation to expand its business activities in the international market. The study will discuss SEAT, a Spanish car manufacturer that sells its vehicles under SEAT and Cupra brands. The company was founded in 1950 and is headquartered in Martorell, Spain. The firm is strategically positioning itself from a vehicle manufacturer to a mobility services provider. In relation to these, two cities or Metropolitan areas, London and Sydney have been considered by the company. Based on the comparison of both the cities, London was selected where SEAT will launch Minimo.

Task 1- Comparative evaluation of two markets

| Political Factors – National Level | ||||||

| Factor | Data Source | Weighting Multiplier

(5 = most important; 1 = least important)

|

UK

Ranking / Data

Country Score out of 2 (2 = most attractive) |

UK

Score X Weighting Multiplier

|

Australia

Ranking / Data

Country Score out of 2 (2 = most attractive) |

Australia

Score X Weighting Multiplier

|

| Political risk | A | 5 | 2/5 = 2/2 | 2 x5 = 10 | 2/5 = 2/2 | 2 x5 = 10 |

| Future orientation of government | B | 4 | 10/141 = 2/2 | 2 x 4 = 8 | 15/141 = 2/2 | 2 x 4 = 8 |

| Corruption | B | 3 | 12/141 = 2/2 | 2 x 3 = 6 | 15/141 = 2/2 | 2 x 3 = 6 |

| Political Subtotal | 24 | 24 | ||||

| Legal Factors – National Level | ||||||||||

| Factor | Data Source | Weighting Multiplier

(5 = most important; 1 = least important)

|

UK

Ranking / Data

Country Score out of 2 (2 = most attractive) |

UK

Score X Weighting Multiplier

|

Australia

Ranking / Data

Country Score out of 2 (2 = most attractive) |

Australia

Score X Weighting Multiplier

|

||||

| Ease of doing business | C | 5 | 23/190 = 2/2 | 2×5 = 10 | 26/190 = ½ | 1×5 = 5 | ||||

| Intellectual property protection | B | 5 | 12/190 = 2/2 | 2×5 = 10 | 10/190 = 1/2 | 1×5 = 5 | ||||

| Prevalence foreign of foreign ownership | E | 4 | 15/137 = 1/2 | 4×1 = 4 | 30/137 = 2/2 | 2×4 = 8 | ||||

| Legal Subtotal | 24 | 18 | ||||||||

| Economic Factors – National Level | ||||||||||

| Factor | Data Source | Weighting Multiplier

(5 = most important; 1 = least important)

|

UK

Ranking / Data

Country Score out of 2 (2 = most attractive) |

UK

Score X Weighting Multiplier

|

Australia

Ranking / Data

Country Score out of 2 (2 = most attractive) |

Australia

Score X Weighting Multiplier

|

||||

| Economic risk | A

|

5 | 1/5 = 2/2 | 2 x 5 = 10 | 1/5 = 2/2 | 2 x 5 = 10 | ||||

| Financial risk | A | 5 | 1/5 = 2/2 | 2 x 5 = 10 | 1/5 = 2/2 | 2 x 5 = 10 | ||||

| GDP per capita | B | 4 | 40,284.64 = 2/2 | 2×4 = 8 | 51,812.15 = 2/2 | 2×4 = 8 | ||||

| Economic Factors – National Level Subtotal | 28 | 28 | ||||||||

| Economic Factors – Metropolitan Level | ||||||

| Factor | Data Source | Weighting Multiplier

(5 = most important; 1 = least important)

|

London

Ranking / Data

City Score out of 2 (2 = most attractive) |

London

Score X Weighting Multiplier

|

Sydney

Ranking / Data

City Score out of 2 (2 = most attractive) |

Sydney

Score X Weighting Multiplier

|

| Metropolitan working age population | G | 4 | 64.8 = 2/2 | 2×4 = 8 | 1 | 2×4 = 8 |

| Metropolitan GDP | G | 4 | 520 = 2/2 | 2×4 = 8 | 2×4 = 8 | |

| Metropolitan urbanized area | G | 5 | ,737.9 = 2/2 | 2×5 =10 | 12,367.7 = 2/2 | 2×5 = 10 |

| Metropolitan population density | G | 5 |

1510 = 2/2 |

2×5 = 10 | 442 = 1/2 | 1×4 = 4 |

| Economic Factors – Metropolitan Level – Subtotal | 36 | 32 | ||||

| Technological Factors – National Level | ||||||

| Factor | Data Source | Weighting Multiplier

(5 = most important; 1 = least important)

|

UK

Ranking / Data

Country Score out of 2 (2 = most attractive) |

UK

Score X Weighting Multiplier

|

Australia

Ranking / Data

Country Score out of 2 (2 = most attractive) |

Australia

Score X Weighting Multiplier

|

| Mobile broadband subscription | B | 5 | 5/121 = 2/2 | 2×5 = 10 | 7/121 = 2/2 | 2×5 = 10 |

| Adoption of emerging technologies | D | 5 | 8/134 = 2/2 | 2×5 = 10 | 8/134 = 2/2 | 2×5 = 10 |

| Innovation capability | B | 5 | 15/141 = 2/2 | 2×5 = 10 | 12/141 = 2/2 | 2×5 = 10 |

| Technological Subtotal | 30 | 30 | ||||

| Mobility Capability Factors – Metropolitan Level | |||||||||

| Factor | Data Source | Weighting Multiplier

(5 = most important; 1 = least important)

|

London

Ranking / Data

City Score out of 2 (2 = most attractive) |

London

Score X WeightingMultiplier

|

Sydney

Ranking / Data

City Score out of 2 (2 = most attractive) |

Sydney

Score X WeightingMultiplier

|

|||

| Overall performance resilience | H | 5 | 8/25 = 2/2 | 2×5 = 10 | 10/25 = 2/2 | 2×5 = 10 | |||

| Vision and leadership | H | 6 | 5/25 = 2/2 | 2×5 = 10 | 3/25 = 2/2 | 2×5 = 10 | |||

| Overall service & inclusion | H | 8 | 6/25 = 2/2 | 2×5 = 10 | 9/25 = 2/2 | 1×5 = 5 | |||

| Mobility Capability Factors – Metropolitan Level – Subtotal |

|

30 | 25 | ||||||

| Total Scores by Attractiveness | |||||||||

| UK / London | Australia / Sydney | ||||||||

| Factors | |||||||||

| Political (National) | 24 | 24 | |||||||

| Legal (National) | 24 | 18 | |||||||

| Economic (National) | 24 | 24 | |||||||

| Economic (Metropolitan) | 36 | 32 | |||||||

| Technological (National) | 30 | 30 | |||||||

| Mobility Capability (Metropolitan) | 30 | 25 | |||||||

| Total | 168 | 153 | |||||||

Task 2- 5 Forces Model

Car sharing is concerned with a model of car rental that provides affordable means of travelling. Car sharing helps people to use cars when needed on rent, and they do not need to buy cars. The market size of car sharing is continuously increasing. London is one of the cities where car sharing has significant scope because of its diversity and urbanisation. London has been selected as the city where SEAT can launch Minimo. The success of the business launch gets significantly affected by certain factors, and these factors are 5 forces of competition in the industry.

Figure 1 Porter’s five forces model

Porter’s five forces model in London are-

Threat of New Entrants: New entrants are those businesses that can enter into the industry and increase existing industry rivals. The threat of new entrants gets affected by barriers to entry in the industry that are resources, capabilities, and regulatory barriers. Concerned with the threat of new entrants in the car sharing industry in London, there are many platforms where individuals can list their car/s for sharing (Khurram et. al. 2020). Hence, it is not difficult to enter into the car sharing industry, and this is why there is a strong threat of new entrants in the car sharing industry in London. Individuals having a car/s can list their cars on different car sharing platforms, and they only need to follow regulations of these platforms where they are listing their cars. Barriers to entry in the car sharing industry are limited, and this is a favourable situation for SEAT when it launches Minimo in London.

Threat of Substitute: The threat of substitute is concerned with those products and services that can be used in place of Minimo by SEAT. Public transport and private vehicles owned by individuals and potential customers are some of the biggest substitutes for Minimo. Further, it gets affected by the preference of individuals in using means of mobility. The threat of substitutes gets affected by the number of substitutes and the cost of switching to the substitute. London has effective means of public transport and along with this large proportion of the population also have private vehicles. London has a strong train network, and this is why it is an easy and cost effective alternative of substitute for car sharing. Hence, there is a strong threat of substitutes is also high in the car sharing industry of London. The attractiveness of this force is low for SEAT when it launches Minimo in London.

Bargaining power of suppliers: The bargaining power of suppliers is a very important competitive force that can affect the overall cost of services or products. Cost ultimately affects prices that are charged from the user of services. The bargaining power of suppliers gets affected by the number of suppliers and products that are supplied by suppliers. Valuable and rarely available material and resource suppliers have the higher bargaining power to increase the cost of resources and price of service (AYDIN, 2017). The bargaining power of suppliers is also gets affected by the cost of switching suppliers. The bargaining power of suppliers is concerned with the ability of suppliers to increase the cost of material and resources. SEAT is a car manufacturing company in Spain, and there are several suppliers who can supply the required material and resources for SEAT. There are many suppliers in London who can provide the required resources in material to SEAT. Hence, the bargaining power of suppliers is low in suppliers bargaining power. The attractiveness of this force is very high for SEAT when it launches Minimo in London.

Bargaining power of buyers: Bargaining power of buyers is concerned with the power of customers to bring down the price of the product or service of the company. The power of buyers gets affected by the number of buyers as well as a number of sellers and substitutes available. In addition to this cost of switching is also an important determinant of the bargaining power of buyers. The bargaining power of buyers is high because of the availability of several car-sharing services in London. In addition to this, there is also an availability of substitutes for mobility in an urban area. Hence, there is a strong power of buyers in addition to this present customer-centric Business model also increases the power of buyers in the car sharing industry of London. Buyers can choose a platform or service which is more cost friendly for them and this is why it is important to consider the bargaining power of buyers. The attractiveness of this force is low for SEAT when it launches Minino.

Industry rivalry: This is concerned with rivalry among existing organisations within the industry in London. The maturity of the car sharing industry and strategic groups in the car sharing industry is also a factor that affects industry rivalry (Wu, 2020). The car sharing industry in London has been functioning for the last few years and has been a double-digit growth from the last few years. People are using car selling services to avoid having a lot of buying the car and maintaining the private vehicle. Car sharing also is having a positive effect on traffic and environmental concerns. There are several big car selling platforms like Zipcar and Virtuo leases Mercedes A-Class and GLA cars, E-Car Club, and Hiyacar. Hence, the attractiveness of this post is low for SEAT when it launches Minino in London.

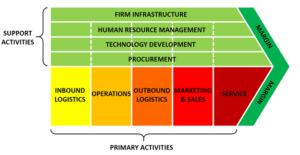

Task 3- Value Chain model

The value chain model is a model that involves the identification and analysis of the value activities of the company. The model has divided organisational activities into two parts that are primary activities and support activities. Primary activities are core activities for creating goods and services and selling them to the end user. Supportive activities are those activities that are carried out to support the primary activities of a business. Identifying the most valuable activity of a business can help in using the activity favourably to increase advantages and benefits for the business.

Figure 2 Value chain analysis

Value chain activities for SEAT when it launches Minimo in London are-

Primary activities

Inbound logistics

Inbound logistics involve getting inventory and raw material from suppliers and managing purchase orders. Inbound logistics include getting material and inventory, from outside in organisation at the manufacturing facility. Approaches of this can be just in time in which inventory is acquired at the manufacturing facility at the very time when it is required for manufacturing. In case just in time approach is not adopted then storage of raw material and inventory is also included in this activity (Muflikh et. al. 2021). This activity is mainly for manufacturers because they require obtaining input and material for manufacturing activities. SEAT when launches Minimo in London, it will require to obtain raw material which is cars in London. In other situations, when SEAT establishes a manufacturing facility in London, it will also require obtaining raw materials and resources for manufacturing.

Operations

Operations, is another primary activity that includes manufacturing or conversion of raw material and input into output and final product. Operations are carried out at the manufacturing facility and in, car manufacturing operations include Body Shop, assembly, and painting of cars. At this stage of activity SEAT will require to manufacture the final product or convert raw material into the finished product. Finished goods will be used for car sharing services. SEAT when sell its cars to car sharing service providers in such situation it requires to ensure that products are developed as per the requirements of business clients of the company. In large scale transactions, their specific requirements also are considered by the company.

Outbound logistics

Outbound logistics firstly include storage of final goods and services and delivering the final products to customers (Fernandez-Stark and Gereffi, 2019). In car manufacturing, before delivering vehicles to the final customer it is first delivered to mediators like dealers of vehicles. Delivery management is a part of outbound Logistics in the car manufacturing industry. SEAT when sell its cars to end users or customers, it requires to firstly deliver cars to dealers however, in business to business transaction it can directly deal with car sharing service providers.

Marketing and sales

Marketing and sales include activities like market research, market communication, and dealer network of car manufacturing companies. Marketing and sales also include activities of promotion and marketing and completing the sales transaction. SEAT will require to run promotional and advertising campaigns, and this helps in communicating with potential customers. It is also a way through which potential customers can be informed about the existence of car sharing services with SEAT cars. In this phase, the company also does promotions to inform the potential market about the benefits and value that the company provides. SEAT when sell its products to car sharing service providers, in such situation it will have to ensure that transaction completes in a business to business manner.

Service

In car manufacturing, services are a very important primary activity. Services include giving after-sales services to customers regarding spare parts, and complaint management and accessories are also a part of services that are provided to customers (Ishimoto et. al. 2020). Services, when the car is sold, involve providing maintenance services and also providing services for repair and additional related services. In case SEAT sells its vehicles to car sharing service providers instead of end users, company will require to provide services at large level to facilitate it for car sharing service providers.

Supportive activities

Human resources

Human resources are concerned with managing the workforce in the organisation who carry out all the primary activities of the value chain. It is not possible for an organisation to carry out its activities and achieve its objectives without a workforce and manpower to complete tasks and activities. Human resource management is a supportive activity that ensures that an organisation has an adequate number of people with the required competency to carry out organisational activities efficiently. SEAT will require individuals with varied knowledge and competencies to launch Minimo in London.

Research and development

Research and development are concerned with the activity in which organisations work on researching and developing new products. Research and development are done to improve existing processes and products and also to develop new products and processes as per the requirement of customers. Research and development is a very important supportive activity that ensures that the company is going in the right direction to meet the requirement of its customers (Békés and Muraközy, 2018). Research and development can include but is not limited to market research about customer taste and preferences and research about market trends. In addition to this, developing new products and improving existing products is also done through research and development. Effective R&D practices help in increasing market value and customers of SEAT.

Procurement

Procurement is also a very important supportive activity that includes procuring material and resources for the primary activities of SEAT. Procurement is required to ensure that inventory and material in the organisation come at the best price and in the best quality. Cost and quality are significantly affected by the efficiency of procurement in the organisation.

Infrastructure

SEAT is an automobile manufacturer and technology development is a very important supporting activity for the company. Technology/infrastructure development includes developing the latest technology and adding and enhancing the technology of products. Technology helps in carrying out primary activities efficiently by saving time and cost associated with primary activities.

Task 4- Modes of Entry

The mode of entry is concerned with selecting an entry strategy through which a firm can enter the international market. SEAT is willing to primarily sell its vehicles to business to consumer car sharing providers rather than end users (Calabrese and Manello, 2018). There are multiple ways through which SEAT can enter the international market. Some of the modes of entry that SEAT can consider are-

Exporting

It is one of the easiest ways to enter the international market as compared to other modes of entry. Direct export includes that it in its deal with London best car sharing provider company SEAT export its cars to that company. It is the simplest method of entering the international market because there are very limited barriers, and the investment required is also Limited. However, in exporting mode of market entry control is very limited because SEAT will not be able to control how its product is used. In addition to this, it also will not be able to control its products and activities beyond National boundaries. Export is simply like selling a product to a customer however, when the customer stays overseas it becomes export. Export is an applicable and suitable option for SEAT in which it can sell its vehicles to London-based car sharing service companies. Expenditure will be Limited, and it will be able to expand its presence in the car sharing services market.

Contractual

It is another mode of entry in the international market where SEAT has to develop a contract with other companies in the international market. For example, in London based company acquired the license of SEAT to sell products in its name. Franchising is also the mode of entry in the international market where SEAT can give its franchise to a London-based organisation where its resources and capabilities can be used by that firm. In the contractual mode of international market entry commitment risk and control increase (Daszkiewicz, 2017). Commitment increases because the firm requires to share its resources and capabilities with the franchise. Sharing of resources and capabilities increases control but at the same time goodwill and image of franchise directly affect the image of the franchisor in the international market. However, when contractual relationships are developed situation franchises or SEAT can also exercise strong control on activities of SEAT licensee or franchise. In relation to SEAT, this mode of entry is not applicable or suitable because the objective of the company is to sell products and not just expand its market. A contractual mode of entry is suitable when an organisation is solely interested in increasing its market presence and international expansion rather than selling its product.

Investment

This is the third option of entering into the international market in which the company requires significant investment to enter the international market. Different forms of investment are as follows-

Joint venture

The joint venture is one of the modes of entry through investment in which SEAT will require to establish a new venture with a London-based organisation. In this mode of entry to organisations jointly form a new and 3rd organisation where resources and capabilities are shared by both organisations. Along with resources and capabilities both organisations also share the risk associated with the joint venture. The advantage of this mode of entry is that it enables intonation form to venture with a local firm that has adequate knowledge of the local market. However, the form of market entry is not free of disadvantages in which significant investment required to establish a joint venture in a foreign country is a disadvantage. This option is suitable for SEAT in which it can establish a joint venture with a London-based organisation. The joint venture will provide the benefit of image and knowledge of London-based organisation.

Wholly owned subsidiary via acquisition

A wholly-owned subsidiary is a mode of entry in which a company is required to acquire a local company operating in the international market. In other words, a company of London that is operating in London is acquired by an international organisation will be considered a subsidiary of that International Organisation. A wholly-owned subsidiary via acquisition provides the benefit of complete control over the subsidiary. The international firm can manage the subsidiary as per its preferences and also utilise all the resources that the subsidiary has. Acquisition of a company has an advantage because it provides complete control over the subsidiary. However, the possibility of failure and the significant investment required are some of the disadvantages of this entry mode (Békés and Muraközy, 2018). This mode of entry is also applicable in suitable for SEAT because it will be able to exercise complete control over the firm it acquires.

Wholly owned subsidiary via Greenfield investment

Greenfield investment is concerned with establishing a new manufacturing facility in London. The newly established manufacturing facility by the company will be considered as its subsidiary company. It also allows benefits like complete control and using resources and capabilities available in London. A Greenfield investment r very complicated because there are a significant amount of regulations that a company needs to follow before establishing a manufacturing facility. Along with this investment required for Greenfield investment is also huge. This option can also be adopted by SEAT in which the company can sell its product in London by creating them in London.

Task 5- Creating share value Evaluation

It is a framework that is used by the company at the time of creating economic value which can easily address all the needs and challenges that are relied upon by society. It is mainly used by the business at the time when they start acting like a business. However, they can easily improve their profit along with improving environmental performance, financial security, nutrition, public health, and other measures of societal well-being. Mainly, it is performing a business for meeting needs a making a profit by creating economic prosperity and infinitely scalable and self-sustainable solutions.

The key concept of creating shared value is:

- They are Beyond corporate social responsibility and philanthropy

- The business creation of shared value is related to addressing all the needs and challenges by using a business model.

- It will also help the company for coming up with a wave of productivity and innovation in the global economy.

According to Suripto, (2019) the SEAT minimum will be the best example for the Spanish automobile manufacturer at the time of creating a shared value. It will help the company at the time of getting different types of opportunities by thinking differently about the needs of the customers, markets, and products at the core of their business. The opportunity is created based on three levels that are discussed below:

Figure 3 Three levels of creating shared value

Source: (Netbalance, 2021)

Reconceiving needs, products, and customers: With the help of this, the company can easily fulfil all society’s needs from their products. It serving of the products can be for both unserved and underserved customers. With the help of this, the company can also grow their revenue by improving their product and services so that they can easily be addressed other social issues.

Redefining productivity in the value chain: It will help the company at the time of improving their resource efficiently on the other hand it will also result in reducing the cost of the operations and the impact they have to face for their new product. It also includes different types of factors that are energy, logistics, resources, suppliers, and employees differently.

Enable local cluster development: However, creating shared value will help the company at the time of activating the supply chain so that they can easily increase their growth and productivity. It also helps them to improve their regulatory environment, supplier base, improving skills, and supporting institutions which are the things that affect the business. It will also result in strengthening the cluster of the company in which they are dependent.

Tart et. al. (2019) stated that Minimo is a type of creating shared value in which the company is using two business-to-consumer car-sharing models are known as station-based car sharing and free-floating car sharing. The main aim of this new launch by the company is that it will fulfil all the needs and desires of society. For example, the people do not afford to buy high ranges vehicles then it will be best for that at the time of having a trip. It will also include choice is life whether our individual want round trip or one-way trip. They can also choose a car by setting an operating area on their mobile app. Saenz, (2019) argued that it also has different types of benefits as it has autonomous technology which can easily pick up the user at the time when they have requested which is the main car-sharing user pain point. It will also fulfil the news of the people for the car as it provides is the parking, safe and a girl travel. It also has zero ambitions because of its all-electric powertrain. If the individual will do car sharing, then it will also reduce the operating cost for the provider by 50%.

According to Moon and Parc, (2019) the company creating share value will also result in reshaping their capitalism by having a good relationship with the society that can easily legitimize business again for a powerful force that can have positive change. The productivity of the company includes several types of things as environmental improvement, education, health, affordable housing, water use, education, health, community and economic development, energy efficiency, and worker safety. On the other hand, Jin, (2018) argued that it will also give different types of benefits to the company for creating values for the society so that they can easily fulfil all their needs and desires.

In the short term to medium term, the company can choose the approach of reconceiving products and services so that they can easily create shared value. Compared to this for the long term, the autonomous drivers can use for creating products and markets along with enabling local cluster development for their creating shared value. Along with this, there are also different type of the approach that can be used by the company for their long term, medium-term and short term. It will also give several benefits so that the company can easily increase its productivity and revenue.

No, Minimo is not a case of business as usual just like another electric vehicle because it provides different types of facilities to the people. It is designed with different types of features like it has zero ambitions because of its all-elected powertrain. Along with this, it will also reduce the operating cost of car-sharing providers that is by 50% because of their integrated batteries web system. It will also provide a smooth and convenient digital user experience that is mainly relied upon hyper-connectivity that will have built-in 5G technology. On the other hand, it will also have been a smaller ecological footprint that is 3.1 square meters is compared to a normal car which is 7.2 square meters at the time of providing agile travel, easy parking, and safety. Yes, Minimo is also a good case of public relations as it will give a different type of benefits that will fulfil societal needs.

Conclusion

Best on the above discussion it can be concluded that there are several reasons because of which companies consider their International expansion. However, the success of international expansion gets affected by several factors that were discussed in form of five forces. Five forces are mainly competitive forces that affect the attractiveness of a market foreign organisation. In addition to this value chain activity also affect the ability of a firm to perform in a particular market on the basis of its activities. A strong understanding of evaluating activities can help in becoming successful in an international market. Entry into the international market is highly complicated, and this is why it is important that organisations carefully select the mode of entry. For SEAT, export mode of entry is appropriate because it will help the organisation to utilise its existing resources efficiently. It will also allow it to enter the international market in a simplified way as compared to other modes of entry.

References

AYDIN, O. T. (2017). Assessing the Environmental Conditions of Higher Education: In a Theoretical Approach Using Porter’s Five Forces Model. Journal of Higher Education & Science/Yüksekögretim ve Bilim Dergisi, 7(2).

Békés, G., and Muraközy, B. (2018). The ladder of internationalization modes: evidence from European firms. Review of World Economics, 154(3), 455-491.

Calabrese, G. G., and Manello, A. (2018). Firm internationalization and performance: Evidence for designing policies. Journal of Policy Modeling, 40(6), 1221-1242.

Daszkiewicz, N. (2017). Foreign entry modes of high-tech firms in Poland. Studia Universitatis Babes Bolyai-Negotia, 62(2), 23-34.

Fernandez-Stark, K., and Gereffi, G. (2019). Global value chain analysis: A primer. In Handbook on global value chains. Edward Elgar Publishing.

Ishimoto, Y., Voldsund, M., Nekså, P., Roussanaly, S., Berstad, D., and Gardarsdottir, S. O. (2020). Large-scale production and transport of hydrogen from Norway to Europe and Japan: Value chain analysis and comparison of liquid hydrogen and ammonia as energy carriers. International Journal of Hydrogen Energy, 45(58), 32865-32883.

Jin, C.H., (2018). The effects of creating shared value (CSV) on the consumer self–brand connection: Perspective of sustainable development. Corporate Social Responsibility and Environmental Management, 25(6), pp.1246-1257.

Khurram, A., Hassan, S., and Khurram, S. (2020). Revisiting Porter Five Forces Model: Influence of Non-Governmental Organizations on Competitive Rivalry in Various Economic Sectors. Pakistan Social Sciences Review, 4.

Moon, H.C. and Parc, J., (2019). Shifting corporate social responsibility to corporate social opportunity through creating shared value. Strategic change, 28(2), pp.115-122.

Muflikh, Y. N., Smith, C., and Aziz, A. A. (2021). A systematic review of the contribution of system dynamics to value chain analysis in agricultural development. Agricultural Systems, 189, 103044.

Netbalance, (2021). Creating Shared Value. [Online]. Available through: <http://www.netbalance.com.au/csv-creating-shared-value>

Saenz, C., (2019). Creating shared value using materiality analysis: Strategies from the mining industry. Corporate Social Responsibility and Environmental Management, 26(6), pp.1351-1360.

Suripto, S., (2019). Corporate social responsibility and creating shared value: A preliminary study from Indonesia. International Journal Of Contemporary Accounting, 1(1), pp.23-36.

Tart, S., Wells, P. & Beccaria, S. (2019). Analysis of Business Models for Car Sharing. Shared Mobility Opportunities and Challenges for European Cities project, EU – http://stars-h2020.eu/wp-content/uploads/2019/06/STARS-D3.1.pdf

Wu, Y. (2020, February). The Marketing Strategies of IKEA in China Using Tools of PESTEL, Five Forces Model and SWOT Analysis. In International Academic Conference on Frontiers in Social Sciences and Management Innovation (IAFSM 2019) (pp. 348-355). Atlantis Press.

[A] A.M. Best Country Risk Report (2019), available at: http://www3.ambest.com/ratings/cr/crisk.aspx. Last accessed 02/06/2020.

[B] Schwab, K. & Sala-i-Martín, X. (2019). The Global Competitiveness Report 2019, World Economic Forum, available at: http://www3.weforum.org/docs/WEF_TheGlobalCompetitivenessReport2019.pdf. Last accessed 02/06/2020.

[C] Doing Business 2020 (2019), available at https://www.doingbusiness.org/en/reports/global-reports/doing-business-2020. Last accessed 02/06/2020.

[D] Portulans Institute (2020). The Network Readiness Index, available at: https://networkreadinessindex.org/. Last accessed 18/01/2021.

[E] Schwab, K. & Sala-i-Martín, X. (2017). The Global Competitiveness Report 2017–2018, World Economic Forum, available at: http://www3.weforum.org/docs/GCR2017-2018/05FullReport/TheGlobalCompetitivenessReport2017%E2%80%932018.pdf. Last accessed 02/06/2020.

[F] Index of Economic Freedom (2019), available at https://www.heritage.org/index/pdf/2019/book/index_2019.pdf. Last accessed 02/06/2020.

[G] OECD Metropolitan Area Statistics – https://stats.oecd.org/Index.aspx?DataSetCode=CITIES (latest year available 2018 unless indicated otherwise). Last accessed 02/06/2020.

[H] Deloitte City Mobility Index (2019), available at: https://www2.deloitte.com/insights/us/en/focus/future-of-mobility/deloitte-urban-mobility-index-for-cities.html. Last accessed 02/06/2020.

Know more about UniqueSubmission’s other writing services: