7 ENT 1065 Financial Control Assignment Sample

Introduction

Financial ratio analysis is conducted and formulated to formulate a relationship between various sets of financial data to project the profitability, liquidity or efficiency levels of a company. The current report has been formulated to financially analyse the performances depicted by the Rolls Royce company having their headquarters in London, UK. The company was established in 1884 by Henry Royce which was further founded to launch their first car in 1904 (Rollsroyce, 2021). The report shall incorporate liquidity, profitability, efficiency and leverage ratios for understanding the financial performance of the firm.

Analysis of Rolls Royce’s financial position via ratio analysis

Profitability ratios

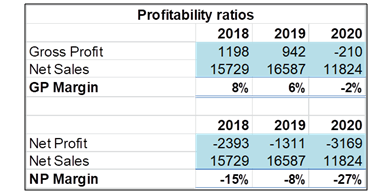

Ratios associated with the ability to generate income over the adjacent expenditures within a firm can be termed as profitability ratios (Sultan, 2014). Moreover, the net profit margin and Gross profit ratio has been calculated as follows,

Figure 1: Calculation of profitability ratios

(Source: Self Developed)

As depicted in figure 1, the GP margin ratio has significantly declined from 8% to -2% in the financial period of 2018-2020. Moreover, the NP margin ratio saw a drastic decline to -27% in 2020 while the ratio was unable to recover to positive levels in the concerned financial period.

Liquidity ratios

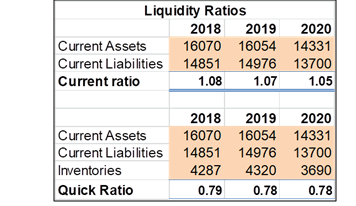

Liquidity ratios also help in the assessment of financial stability of a company through focusing on their strength to pay short-term liabilities (Madushanka and Jathurika, 2018). Moreover, cash and current ratio has been calculated for Rolls Royce below,

Figure 2: Calculation of liquidity ratios

(Source: Self Developed)

Current ratio for the company has emerged to be stable with an overall value of 1 throughout, abiding by the industrial standard. However, the gradual decline in the ratio from 1.08 to 1.05 is a concern for the firm. Quick ratio has been reflected just below the industrial standard of 1 ranging 0.79-0.78 during the financial period (Rollsroyce, 2020).

Efficiency ratios

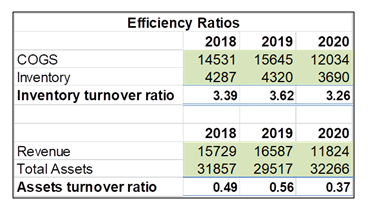

Efficiency ratio determines the ability of a firm to utilise the assets and inventory levels for generation of income (Sensoy, 2019). Furthermore, assets and inventory turnover ratio has been calculated for Rolls royce,

Figure 3: Calculation of efficiency ratios

(Source: Self Developed)

Figure 3 highlights an increase and decrease in the inventory turnover ratio as it increases to 3.62 from 3.39 in 2018-2019 which further declines to 3.26 in 2020 (Rollsroyce, 2020). However, the inventory turnover ratio is well above the industrial average of 2 which means a higher flow of sales and reduced idle inventory levels. Although, the asset turnover ratio has remained below 1 depicting reduced levels of financing the assets held within the firm.

Leverage ratios

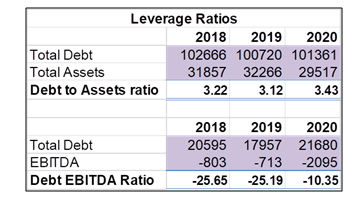

Leverage ratios are found to ascertain the liquidity and stability levels of a firm through the assessment of their levels of debt used for financing assets and other operational activities (Myšková and Hájek, 2017). The concerned leverage ratios for Rolls Royce has been depicted below,

Figure 4: Leverage ratio calculation

(Source: Self Developed)

Figure 4 highlights an unstable debt to assets ratio gradually increasing from 3.22 to 3.43 in 2018-2020 periods (Rollsroyce, 2020). Moreover, the company is seen to finance their assets through debts over the years which reduces and limits the creditworthiness of the firm. Furthermore, debt EBITDA ratio has recently decreased to -10.35 from -25.65 highlighting reducing the additional debts held within the firm.

Major financial issues highlighted for the company

Focusing on the calculations highlighted above, Rolls Royce was found to have a significantly low NP margin ratio due to reduced retained profits. In addition to that, the firm was found to scarcely finance their assets which have eventually reduced its asset turnover. The quick ratio being below industry average of 1 depicts the firm’s increasing liability levels in the upcoming years. In addition to that, the debt financing of the firm’s assets has reduced the credit facilities enjoyed in financial markets.

Scope for further improvement within the company

The firm should focus on maintaining the operational costs and reduce the purchasing of orders for raw materials from the suppliers. To improve their net profits, the company should focus on reducing their miscellaneous costs associated other than their production or operational costs. The assets financing of a firm can be improved through utilising their assets for generating additional revenue levels that shall help in further improvement of profitability (Åstebro and Serrano, 2015). This shall help in improvement of the firm’s liquidity as well as debt to EBITDA ratio, for the firm will have to depend less on undertaking credit to finance operations.

Conclusion

The current report was found to encapsulate the financial position of Rolls Royce Company through incorporation of financial ratios. Moreover, the results highlighted decline in gross and net profitability levels that were recommended to mitigate through reducing the miscellaneous costs apart from production. Additionally, unstable leverage ratios were also recommended to be mitigated through financing the idle assets held within the company.

Reference List

Åstebro, T. and Serrano, C.J., 2015. Business partners: Complementary assets, financing, and invention commercialization. Journal of Economics & Management Strategy, 24(2), pp.228-252.

Madushanka, K.H.I. and Jathurika, M., 2018.The impact of liquidity ratios on profitability.International Research Journal of Advanced Engineering and Science, 3(4), pp.157-161.

Myšková, R. and Hájek, P., 2017. Comprehensive assessment of firm financial performance using financial ratios and linguistic analysis of annual reports. Journal of International Studies, volume 10, issue: 4.

Rollsroyce, (2020).CONSOLIDATED FINANCIAL STATEMENTS Available at: https://www.rolls-royce.com/~/media/Files/R/Rolls-Royce/documents/annual-report/2020/2020-full-annual-report.pdf [Accessed on: 20/12/2021]

Rollsroyce, (2021).OUR HISTORY Available at: https://www.rolls-royce.com/about/our-history.aspx [Accessed on: 20/12/2021]

Sensoy, A., 2019. The inefficiency of Bitcoin revisited: A high-frequency analysis with alternative currencies. Finance Research Letters, 28, pp.68-73.

Sultan, A.S., 2014. Financial Statements Analysis-Measurement of Performance and Profitability: Applied Study of Baghdad Soft-Drink Industry. Research Journal of Finance and Accounting, 5(4), pp.49-56.

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services: