7024AFE Financial Decision Making Assignment Sample

Module code and Title: 7024AFE Financial Decision Making Assignment Sample

Introduction

The area of Finance is mainly classified into two parts: Managerial (or Corporate) Finance which allocates decisions regarding the Finance that Company’s manager takes, and the second part is Investment finance, which mainly focuses on how professional or individual Companies decide about their investment (Volk, et al. 2018). In this project, we will focus on both aspects of Finance.

It is not possible for everyone to understand the financial work of the company, so every company or organization needs to take help from a financial manager and know about their business position and situation. The decision regarding Finance is based on Information available about the performance of the business in financial books of analysis.

It gives an estimation regarding a business or organization by doing analysis, financial documents, and investment options available on “profit and loss statement, Cash flow statement and Balance sheet”. In the following report, we are going to discuss the Decision-making and business performance of Robert Limited Company.

The company Robert Limited is a subsidiary company of Pullover Group Inc. Robert limited operate in the UK for the last 15 years (Boyd, et al. 2019). This company provides Services regarding Finance to different medium and small firm Organizations. In the following report, we are going to discuss different sources of finance and appraisal of a new project of Robert limited.

Literature review

As per Gan, Wang, and Xu 2019, the investment adaptation of increasing funds is not the only reason why there is the existence of the listed company, but also the authority of the Market regulator and investors (Weis, et al. 2021). The constant mechanism of external integrity, market apparatus, and the organization in which the business operates are also interconnected towards this change.

According to O’Leary and Miller, 2018, Opportunities for investment can only be evaluated by using the techniques of Financial Analysis. This method is just one criterion that determines the SIDM Outcomes. The author looks into the Interchange between the compliance policies, market product, and the internal control of the business.

According to Dai and Liu, 2019, in the research project, it is found that large size firm or organizations mainly Change their project module regarding raising funds for Investment. In the long run market, this change does not reflect more profit, but in the short run, it shows results in profit.

As per Johnson, 2018, during Short-term business, the owners need to know their break-even point, because it shows the company’s situation regarding the company’s profit and cost price (Gerbaudo, 2021). They want to know when their company’s profit and their cost comes equal. This position indicates No loss no profit. Fixed cost, Variable cost, and Revenue are part of the Break-even. It helps the financial manager about taking important decisions regarding the business’s next profit percentage.

Explanation of Multiple Sources regarding Finance

Business is always worried about the Distribution and production of Services and Goods to meet the final Demands. To carry on the business Finance needs many activities. For this Finance is popularly called the Crucial Blood of the business.

A company can raise capital or can finance its business by various ways. Every source of finance has its different Features (Lempert, and Turner, 2021). Finance is required in business when the company owner wants to lunch a new branch or new business. The fund is also needed at the time of purchasing fixed assets like Furniture, chairs, desktops, pieces of equipment, and many more things.

Different Sources of Finance are as follows-

- Retained Earning

- Trade Credit

- Public Deposit

- Commercial Paper

- Issue of Shares

1. Retained Earnings:

In Maximum cases, businesses never release all of their Profit or do not share all of their profit with Shareholders. Some part of profits or earnings retained by the company to use in the future. It is called Self-finance and internal Finance. The company’s main aim is to maximize its profit by giving services or goods to customers at more price than the cost price. In this way, they earn profit. Moreover, if the company keeps some part of that profit in the business is called Retained earnings.

2. Trade Credit:

It is credit given to the trader from different traders during the purchase time of Services and products. It gives benefits to some individuals during purchasing time (Phillips, et al. 2019). If the customer has no sufficient money in his hand then he can purchase products from Seller on a credit basis. There is no need to pay the money at the time of purchase. It is only available or granted to the customer who has strong financial status and a good reputation in the market. In this way, the company can earn money in the future time or during an emergency time.

3. Public Deposit:

Public deposit is a system in which an organization collects money or deposits from different individual people. In return, the company pays them a high rate of interest in terms of the Bank (Melnychenko, 2020). The company also gives a deposit slip as proof of payment to the People who made a deposit in the organization.

4. Commercial Paper:

Commercial paper is also a source of finance. It is an Unbolted Promissory note. It was first used in the year 1990 in India to permit short-term funds to High rated organizations. After that All-India financial institution was authorized to give CP regarding covering the short-term needs of the company. Commercial paper can be issued in multiples of Rs 5 lakh with a maturity time from 7 days to 1 year.

5. Issue of Shares

The company raises their fund by selling its share to the public. By purchasing equity shares, the buyer becomes the owner of the company. By this, the company does not pay anything to shareholders except Dividends (Shrestha, 2019). The company pays some dividends to the shareholder from its profit.

By purchasing shares of the company, one can have voting rights and ownership. Preference share also the sources of finance to the company. Preference shareholders get some preference in comparison to equity shareholders. If there comes a liquidity situation in front of the company then the company pay Dividend first to Preference shareholders and then to Equity shareholders.

Evaluation, interpretation, and presentation of investment appraisal techniques

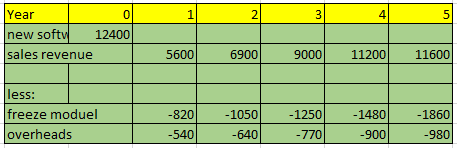

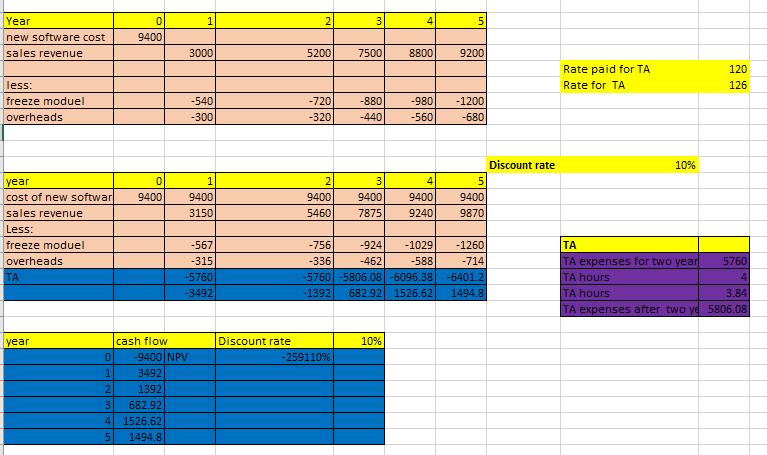

Calculation of NPV – Flexible suite

According to the above analysis, it is found that the NPV of the newly launched company is going to suffer losses in the future time (Gillis, and Spiess, 2019). NPV gives the “Net present value” of the new lunch business by showing differences between their Total inflow and Outflow of Cash during the time. Here in the case of the new venture lunch by Robert limited gives the Negative Value of NPV. It means this project is going to give losses in near future. Therefore, it is better to not start this business. [Referred to Appendix 1]

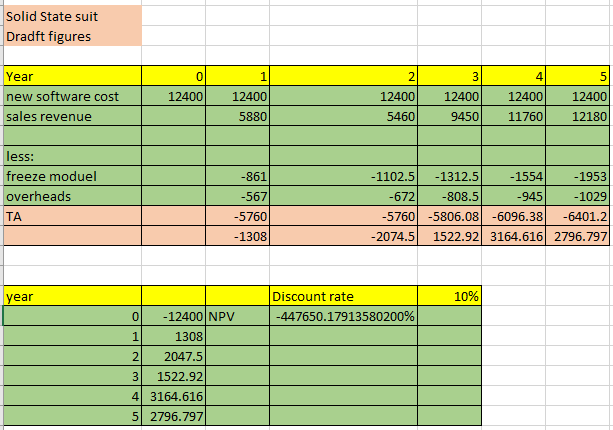

Calculation of NPV – Solid suite

NPV for this venture also gives a negative value to Robert limited. The solid Suite venture lunch by Robert Limited gives a negative percentage of NPV (Liang and Renneboog, , 2020). Therefore, we can say that this venture too is not going to give profit to the company. This is also not suitable to start.

Figure 1: NPV for Solid suite (Source: Self-created in MS Excel)

Figure 1: NPV for Solid suite (Source: Self-created in MS Excel)

If we compare which one to choose from both Flexible and Solid suite ventures, then we will go with Flexible suiter ventures. As both, ventures give negative value so no one is suitable to start. However, want to choose between these two then there is a clear advantage with Flexible Suite as it gives less negative value in comparison to Suitable suite.

Cash budget and break-even analysis

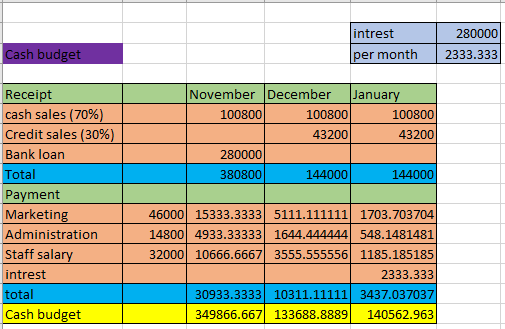

Cash Budget

Cash Flow is the total Cash inflow and Outflow from or within a business enterprise during a financial year. The total inflow and outflow of cash can be shown with the help of cash flow budget analysis (Sharma et al. , 2021). This analysis can be done by an organization at any interval in time like within a week, month, or yearly basis. It can be classified into two parts: Long term and Short term.

The short-term budget includes Liability, assets, and materials cash, and the long-term includes the flow of cash in the organization over two years. The following Analysis of Robert’s limited shows the total inflow of cash is Rs 3808000 and the Outflow or payment during the year is Rs 30733.33, so the total budget for the year is 349866.67 for November Month. The budget during the months of December and January is Rs133688.89 and Rs 140562.96 respectively. [Referred to Appendix 2]

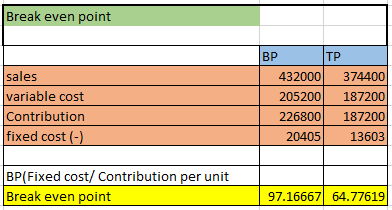

Break-even analysis

The break-Even point shows the point of business during which the costs of Business are equal to the profit of the business. If the total cost of the company is equal to the total value then this situation is called the Break-even point (Chromik, 2019). The following analysis shows a 97% Break-even point for BP products and 65% for TP. it means product BP is good as compared to TP in terms of the Beak-even point.

Figure 2: Break-Even Point (Source: Self-created in MS Excel)

Figure 2: Break-Even Point (Source: Self-created in MS Excel)

Discussion of the multiple issues and factors regarding investment decisions

The financial decision of any business is very helpful or necessary for the conducting. Its shows the performance of the company (Zuheros, et al. 2021). The different issues and factors that come regarding the investment decision are Return on investment, Economic growth, confidence, Risk, and Liquidity. Inflation matter also comes in the way of taking an investment decision.

Figure 3: Factors affecting Investment (Source: https://i.ytimg.com/vi/Tw-tymMikhw/mqdefault.jpg)

Figure 3: Factors affecting Investment (Source: https://i.ytimg.com/vi/Tw-tymMikhw/mqdefault.jpg)

Conclusion

As per the above discussion and analysis, one can conclude that for starting any new venture it is important to do an analysis. Without doing analysis, it is not possible to understand the company’s growth. It is important to understand the NPV of a new venture as well as the Cash flow budget, balance sheet need to understand the company’s status.

Recommendation

To conduct a financial Analysis of the organization every year and understand the place and Project were to start a new business, and in which project its needs to invest. It is important to arrange a meeting with all the staff and managers to give updates and discuss the current situation of the business. It is also necessary to keep a record of all the financial performance of the business.

Reference List

Journal

Weis, R., Hombosky, M.L., Schafer, K.K., Shulman, D. and Tull, J.K., 2021. Accommodation decision-making for postsecondary students with ADHD: Implications for neuropsychologists. Journal of Clinical and Experimental Neuropsychology, 43(4), pp.370-383.

Gerbaudo, P., 2021. Are digital parties more democratic than traditional parties? Evaluating Podemos and Movimento 5 Stelle’s online decision-making platforms. Party Politics, 27(4), pp.730-742.

Lempert, R.J. and Turner, S., 2021. Engaging multiple worldviews with quantitative decision support: A robust decision‐making demonstration using the lake model. Risk Analysis, 41(6), pp.845-865.

Phillips, J.P., Wilbanks, D.M., Rodriguez‐Salinas, D.F. and Doberneck, D.M., 2019. Specialty income and career decision making: a qualitative study of medical student perceptions. Medical Education, 53(6), pp.593-604.

Melnychenko, O., 2020. Is artificial intelligence ready to assess an enterprise’s financial security?. Journal of Risk and Financial Management, 13(9), p.191.

Shrestha, Y.R., Ben-Menahem, S.M. and Von Krogh, G., 2019. Organizational decision-making structures in the age of artificial intelligence. California Management Review, 61(4), pp.66-83.

Gillis, T.B. and Spiess, J.L., 2019. Big data and discrimination. The University of Chicago Law Review, 86(2), pp.459-488.

Liang, H. and Renneboog, L., 2020. Corporate social responsibility and sustainable finance: A review of the literature. European Corporate Governance Institute–Finance Working Paper, (701).

Sharma, A., Jolly, P.M., Chiles, R.M., DiPietro, R.B., Jaykumar, A., Kesa, H., Monteiro, H., Roberts, K. and Saulais, L., 2021. Principles of foodservice ethics: a general review. International Journal of Contemporary Hospitality Management.

Ward, A.F. and Lynch Jr, J.G., 2019. On a need-to-know basis: How the distribution of responsibility between couples shapes financial literacy and financial outcomes. Journal of Consumer Research, 45(5), pp.1013-1036.

Chromik, M., Eiband, M., Völkel, S.T. and Buschek, D., 2019, March. Dark Patterns of Explainability, Transparency, and User Control for Intelligent Systems. In IUI workshops (Vol. 2327).

Johnson, C.K., Gutzwiller, R.S., Gervais, J. and Ferguson-Walter, K.J., 2021, November. Decision-Making Biases and Cyber Attackers. In 2021 36th IEEE/ACM International Conference on Automated Software Engineering Workshops (ASEW) (pp. 140-144). IEEE.

Zuheros, C., Martínez-Cámara, E., Herrera-Viedma, E. and Herrera, F., 2021. Sentiment analysis based multi-person multi-criteria decision making methodology using natural language processing and deep learning for smarter decision aid. Case study of restaurant choice using TripAdvisor reviews. Information Fusion, 68, pp.22-36.

Appendices:

Appendix 1: NPV for Flexible suite (Source: Self-created in MS Excel)

Appendix 2: Cash Budget (Source: Self-created in MS Excel)

Know more about UniqueSubmission’s other writing services: