7024AFE – Financial Decision Making Assignment Sample

Module code and Title: 7024AFE – Financial Decision Making Assignment Sample

Introduction

In the present report, the factors affecting a Robotic company’s financial decision-making process have been critically analysed. The aspects of the investment methods and Robotic Limited’s financial sources are discussed for the decision-making process. The analysis of the different investment proposals in terms of the NPV valuation has been done which can be easily helped in understanding the business financial position of the business. All the sources of funding and their advantages have been discussed for a better understanding of the investment appraisal process (Eberhardt, et al. 2019).

Different tools for the financial purpose have been discussed on the basis of investment appraisal techniques, budgeting methods, as well as breakeven analysis with their importance, which has been critically evaluated for the changes in the financial decision-making process of the business. The financial performance of the company has been estimated within the methodological aspects of the tools and techniques of the business to increase the profit of the business.

Literature Review

The Robotic Limited Company is a subsidiary of Pullover Group Inc dealing with the financial services provided to property developers, investment in property funds, and SMEs (Miletic& Latinac, 2022). different tools and techniques have been followed by the company for the increment of the profit generation and stable the financial position of the business.

In the present study the methodological aspect of the investment appraisal techniques, including the preparation of the cash budget and the breakeven point, have been analysed including their importance in the management of the business financial position and resolving the issues regarding the decision-making process.

Cash Budget

Cash budget in the business refers to the method of preparing an estimation of the cash inflows and outflows in a business operation for a mentioned time period. The preparation of the cash budget can be done in terms of weekly, monthly, quarterly as well as on annual basis (Sijacic, et al. 2020). The availability of cash within the firm for the operation of the project is evaluated with the help of a cash budget.

This may also help to understand if the firm is having sufficient funds to operate a business. The cash requirements, including the surplus, can also be provided with the help of a cash budget. A cash budget is also helpful for establishing the credit amount provided to their customers to resolve their issues regarding liquidity shortage.

Break Even point

The situation of a business where the firm’s total cost invested as well as the amount of gain tends to be the same in the process. The break-even state is a situation where the firm neither has profit nor loss in the operation process. The determination of the product charges and their recovery amount can be easily evaluated over the cost of production (Derks, et al. 2018).

The analysis helps in the determination of the lowest number of investments in the process to earn profits in their operation. The margin of safety helps in the management of the business decision-making process and also in monitoring and controlling the cost of the business. The prediction of the investments and their return is done on the basis of the breakeven analysis of the business.

Investment appraisal

The method of investment appraisal in the business process helps in the analysis of the profitability level that a business earns for the means of investment. It refers to one of the methods of the financial management system of the business. The different appraisal techniques like “payback period calculation”, “accounting rate of return” as well as the “Net Present Valuation” can be done for better management processes in the decision-making process regarding the investments of the business (Robson, et al. 2018).

The investment appraisal method helps in the calculation of the expected profit levels over the investment. The decision regarding the amount of investments in a project can be easily understood with the implementation of the investment appraisal techniques. Investment decisions are required by the firm as they influence the growth and downfall of the firm in the long run process of the business.

Different Sources of Financing

The success of financing is the methods or the areas from where the business can avail cash in terms of both long terms as well as short-term. It is the method of raising funds for mitigating the expense of the business. Various methods or sources can be referred to as credits, loans as well as the amount invested as capital. There are certain sources of financing that can influence methods of financing in the business.

Equity shares

The larger entities can avail of the funds as they are generated by the equity shares of the company (Hasan, et al. 2020). The cost of equity shares funding tends to be more expensive as compared to debt finance. The method can be beneficial for availing the loans for the long-term process.

Assistance from the Government

There are several government agencies for availing cash to business entities as well as personal individuals. Government also provides a larger amount of loans for financial services.

Commercial bank loans and overdraft

One of the main sources for the finding process can be the loans granted by the bank, which can be highly profitable for small business entities (Chang, et al. 2019). The banks are tending to provide the services per the situation of the business or the customers with repayment methods. The bank provides loans to companies who are having a great credit rerecord. The method of bank loans can be a profitable idea for mitigating the requirements of ten cash in the business process.

Venture Capital

Venture capital tends to be the same as equity shares but did not involve the investors of the business. The investment by venture capitalists is done towards the new upcoming g companies.

Business Incubators

Business incubators are one of the sources of finding that provide a high level of support to the larger entity and the new upcoming business (Alpenidze, et al. 2019). It helps in the development of the business economically by creating jobs, hosting as well as sharing services.

Angels

The angels in the funding method of the business refer to the wealthy individuals that are responsible for the direct investments in the business process. For financial services, they acquire a high-level investment from their wealthy customers to increase the level of funding in the business process

Evaluation of different Investment appraisal techniques

For the two investments of the company “Net present value (NPV)” has been calculated. For the calculation of NPV, the discounted rate factor has been taken as 10%, and also various adjustments have been made.

| Net Present Value (Flexible Suite) | ||||||||

| Year | Cash inflow | Cash outflow | Net cash flow | Discounting rate | PV | |||

| Sales revenue | Freeze Module | Overheads | TA payment | |||||

| 0 | -£ 9,400 | -£ 9,400 | -£ 9,400 | |||||

| 1 | £ 3,150 | £ 567 | £ 252 | £ 168 | £ 2,163 | 10% | £ 1,966 | |

| 2 | £ 5,460 | £ 792 | £ 284 | £ 169 | £ 4,215 | 10% | £ 3,484 | |

| 3 | £ 7,875 | £ 1,012 | £ 378 | £ 170 | £ 6,315 | 10% | £ 4,745 | |

| 4 | £ 9,240 | £ 1,176 | £ 326 | £ 170 | £ 7,568 | 10% | £ 5,169 | |

| 5 | £ 9,660 | £ 1,500 | £ 294 | £ 169 | £ 7,697 | 10% | £ 4,779 | |

| Total PV | £ 20,143 | |||||||

| Initial cost | -£ 9,400 | |||||||

| NPV | £ 10,743 | |||||||

Table 1: Calculator of NPV for Flexible Suite (Source: Self-developed)

| Net Present Value (Solid State Suite) | ||||||||

| Year | Cash inflow | Cash outflow | Net cash flow | Discounting rate | PV | |||

| Sales revenue | Freeze Module | Overheads | TA payment | |||||

| 0 | -£ 12,400 | -£ 12,400 | -£ 12,400 | |||||

| 1 | £ 5,600 | £ 820 | £ 540 | £ 168 | £ 4,072 | 10% | £ 3,702 | |

| 2 | £ 6,900 | £ 1,050 | £ 640 | £ 169 | £ 5,041 | 10% | £ 4,166 | |

| 3 | £ 9,000 | £ 1,250 | £ 770 | £ 170 | £ 6,810 | 10% | £ 5,116 | |

| 4 | £ 11,200 | £ 1,480 | £ 900 | £ 170 | £ 8,650 | 10% | £ 5,908 | |

| 5 | £ 11,600 | £ 1,860 | £ 980 | £ 169 | £ 8,591 | 10% | £ 5,334 | |

| Total PV | £ 24,226 | |||||||

| Initial cost | -£ 12,400 | |||||||

| NPV | £ 11,826 | |||||||

Table 2: Calculator of NPV for Solid State Suite (Source: Self-developed)

There were a few adjustments made in the calculator of NPV for the flexible suits, as its Revenue and overhead have increased by 5% respectively. So, the cash inflow would be increased as the revenue is rising. The freeze module also increased by 5% due to inflation. There were also a few calculations in context to the payment of the Technical Advisor. So, these expenses have been subtracted from the cash inflow and net cash outflow has been calculated. In the case of Solid-state suite, there were no adjustments given so the revenue was considered as cash inflow and cash outflow is computed by subtracting the expenses.

So, the NPV value for the investment of a Flexible Suit is £ 10,743 and for a Solid state, the suit is £ 11,826. So, the latter investment is better as it can be seen that its NPV value is higher compared to the investment of Flexible Suit.

There are also various other investment methods that are as follows such as ARR, payback period, and IRR (Zhao, & Zhang, 2019). There are various disadvantages to be kept in mind while using these investment methods, they are as follows:

| Investment appraisal method | Disadvantage |

| ARR | ● In this method, the tax that has been paid over the year and various other cash inflows have been ignored (Stoenchev, et al 2020).

● It cannot be used if the investment is made in parts rather than investing once in full amount. ● The time value of the money has been completely ignored. |

| IRR | ● The size of the project has not been taken into consideration and all the projects are being treated as the same (Witkowska, & Kuźnik, 2019).

● Any contingent and dependent projects are being ignored in these projects. Even projects that are mutually exclusive have also been ignored. ● IRR does not measure the increase in wealth through investment. |

| Payback | ● Just like ARR it too ignores the time value of the money.

● It does not take into consideration the return on the investment after the payback period. ● Through this method, all cash flow is not covered (Shaturaev, 2022). |

Table 3: Disadvantages of different Investment appraisal techniques (Source: Self-developed)

Analysis of Cash Budget and breakeven

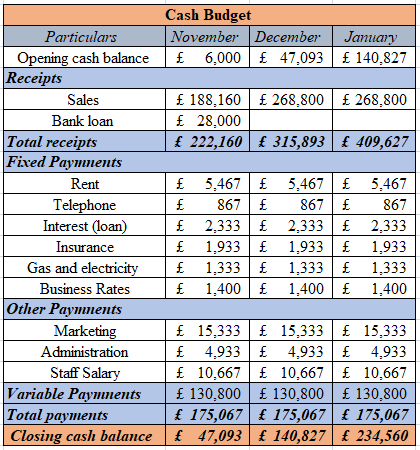

Figure 1: Cash budget for the company (Source: Self-developed)

Figure 1: Cash budget for the company (Source: Self-developed)

So, from the above calculation, it can be noticed that in the month of November the company has a loan of £ 28,000, which has been taken as a receipt as the money is a cash inflow. However, the company has to pay interest in 12 equal instalments which is the cash outflow for the company. The sales of the company are both on sales and credit. 70% of the sales that are made are cash for the company.

The rest 30% is the credit sales that would generate income in the following month so it can be noticed that the sales of the company in November are £188160 which is 70% of the total sales and from next monthly that is December the value increased to £268800 because it includes 70% cash sales of December that is £188160 (70% of £ 268800) plus 30% of the credit sales in the month of November whose revenue is received in December that is £80640 (30% of £ 268800).

The company loan amount has been divided into 12 months which is £ 2333 per month. Other fixed costs that have been provided are divided into three equal months. The same has been done with the other payments. In terms of Variable cost, the value is calculated on the basis of the product that is being sold per month. For BP the total variable cost is £190* 360 units which is £68,400.

whereas, for TP the cost is £260* 240 units which is £62,400. So, the total value of the variable cost for a month is £130,800. So it can be seen that the total cash is positive and the company is able to generate cash, and it’s been increasing every month. This says that the company’s performance is moving in a positive direction and the company should continue doing this.

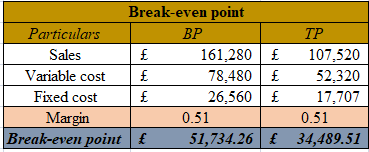

Figure 2: Break Even point for the company in terms of revenue (Source: Self-developed)

Figure 2: Break Even point for the company in terms of revenue (Source: Self-developed)

The break-even point is calculated on the basis of the revenue of the company. For the calculation of the breakeven point firstly the contribution margin is calculated by using the formula 1-(variable cost divided by Fixed cost). So the contribution margin of BP is 0.5 and the same is for the product TP. Then to calculate the breakeven point in terms of revenue the formula that is being used is Fixed cost divided by contribution margin separately for each product.

So the Breakeven point in terms of revenue for the product BP is £ 51,734.26 whereas for the product TP it is £34,489.51. So, the company has to generate this much money through both the products in order to cover all their expenses in the production of these two products.

The company is able to produce more than this value and so it can be seen that the company is in profit. The company in an adverse condition also tries to at least generate the following amount of revenue that would help the company to make its growth and its sustainability.

Other factors that play a role in an investment

There are various factors that should be considered while making the investment they are as follows:

Inflation rate: The current market situation can be identified through the inflation rate. If the inflation rate is high then making any investment would not be the right decision as the liquidity in the market would be low and so the purchasing power of the consumer would drop and this would not enable the company to generate revenue out of the investment (Yang, & Shafiq, 2020).

Global scenario: There are cat times when the world is facing some unnatural condition that has not been experienced before such as Covid-19, so investment in this period of time certainly will not generate a positive result through the investment.

Financial condition: If the company’s financial condition is not good and the company is in debt then it’s not recommended to make an investment as the company debt might further increase due to taking debt6 for the new investment. This will push the company towards sustainability in the market.

Laws and Taxation: the company should consider the policies and laws related to the new investment. So, the company should do research work and compile all the laws and regulations that should be met while doing a new investment.

Conclusion and Recommendation

The above analysis may conclude that the inclusion of the different appraisal methods in the business process helps in the method of decision-making in the financial services of the business. The calculation of the NPV shows that the valuation of the investment is higher as compared to the flexible suit investments. Both aspects of the appraisal method have been evaluated which recommended the company follow proper and profitable investment methods to avail high level of profit.

References

Alienize, O., Pauceanu, A. M., & Sanyal, S. (2019). Key success factors for business incubators in Europe: An empirical study. Academy of Entrepreneurship Journal, 25(1), 1-13.Retrieved from: https://www.researchgate.net/profile/Onise-Alpenidze/publication/332268546_KEY_SUCCESS_FACTORS_FOR_BUSINESS_INCUBATORS_IN_EUROPE_AN_EMPIRICAL_STUDY/links/5cd45ae292851c4eab8f13c6/KEY-SUCCESS-FACTORS-FOR-BUSINESS-INCUBATORS-IN-EUROPE-AN-EMPIRICAL-STUDY.pdf (Retrieved on: 05.11.2022)

Chang, A. Y., Cowling, K., Micah, A. E., Chapin, A., Chen, C. S., Ikilezi, G., … & Qorbani, M. (2019). Past, present, and future of global health financing: a review of development assistance, government, out-of-pocket, and other private spending on health for 195 countries, 1995–2050. The Lancet, 393(10187), 2233-2260.Retrieved from: https://www.sciencedirect.com/science/article/pii/S0140673619308414 (Retrieved on: 05.11.2022)

Derks, J., Gordijn, J., & Siegmann, A. (2018). From chaining blocks to breaking even: A study on the profitability of bitcoin mining from 2012 to 2016. Electronic Markets, 28(3), 321-338.Retrieved from: https://link.springer.com/article/10.1007/s12525-018-0308-3 (Retrieved on: 05.11.2022)

Eberhardt, W., de Bruin, W. B., & Strough, J. (2019). Age differences in financial decision making: The benefits of more experience and less negative emotions. Journal of behavioral decision making, 32(1), 79-93.Retrieved from:https://onlinelibrary.wiley.com/doi/pdfdirect/10.1002/bdm.2097 (Retrieved on: 05.11.2022)

Hasan, M., Popp, J., & Oláh, J. (2020). Current landscape and influence of big data on finance. Journal of Big Data, 7(1), 1-17.Retrieved from: https://journalofbigdata.springeropen.com/articles/10.1186/s40537-020-00291-z (Retrieved on: 05.11.2022)

Javed, M., & Zhuquan, W. (2018). Analysis of accounting reforms in the public sector of Pakistan and adoption of cash basis IPSAS. Universal Journal of Accounting and Finance, 6(2), 47-53. Retrieved from: https://pdfs.semanticscholar.org/202d/61e4cfdf915ad68a327ba4ff87dc2a0047a2.pdf (Retrieved on: 05.11.2022)

Miletic, M., & Latinac, D. Internal rate of return method-a commonly used method with few advantages and many disadvantages. Retrieved from:https://www.bib.irb.hr/1087533/download/1087533.full_paper__MiletiLatinac_reviewed.pdf (Retrieved on: 05.11.2022)

Robson, E. N., Wijayaratna, K. P., & Dixit, V. V. (2018). A review of computable general equilibrium models for transport and their applications in appraisal. Transportation Research Part A: Policy and Practice, 116, 31-53.Retrieved from: https://opus.lib.uts.edu.au/bitstream/10453/133023/4/2-s2.0-85048798882.pdf (Retrieved on: 05.11.2022

Shaturaev, J. (2022). Efficiency of Investment Project Evaluation in the Development of Innovative Industrial Activities. ASEAN Journal of Science and Engineering, 3(2), 147-162 , retrieved on 5th December 2022, retrieved from: https://www.researchgate.net/profile/Jakhongir-Shaturaev/publication/360235404_Efficiency_of_Investment_Project_Evaluation_in_the_Development_of_Innovative_Industrial_Activities/links/626a48816a39cb1180e13921/Efficiency-of-Investment-Project-Evaluation-in-the-Development-of-Innovative-Industrial-Activities.pdf

Sijacic-Nikolic, M., Ivanova, A., & Sirotkina, N. (2020, November). Economic advantages of innovative technologies for accelerated forest regeneration in Russia. In IOP Conference Series: Earth and Environmental Science (Vol. 595, No. 1, p. 012046). IOP Publishing.Retrieved from: https://iopscience.iop.org/article/10.1088/1755-1315/595/1/012046/pdf (Retrieved on: 05.11.2022)

Stoenchev, N., Kolev, K., Iliev, N., & Hrischeva, Y. (2020). Comparative characteristics of the rate of return on investments in a forest plantation and other real estates in Bulgaria. Forestry Ideas, 26(2), 289-301, retrieved on 5th December 2022, retrieved from:

Witkowska, D., & Kuźnik, P. (2019). Does the fundamental strength of the company influence its investment performance?. Dynamic Econometric Models, 19, 85-96, retrieved on 5th December 2022, retrieved from: https://apcz.umk.pl/DEM/article/download/DEM.2019.005/26547

Yang, X., & Shafiq, M. N. (2020). The Impact of Foreign Direct Investment, Capital Formation, Inflation, Money Supply and Trade Openness on Economic Growth of Asian Countries. iRASD Journal of Economics, 2(1), 25-34, retrieved on 5th December 2022, retrieved from:https://internationalrasd.org/journals/index.php/joe/article/download/142/530

Zhao, R., & Zhang, X. (2019, May). Analysis of Investment Decisions of SMEs. In 2019 International Conference on Management, Education Technology and Economics (ICMETE 2019) (pp. 427-430). Atlantis Press, retrieved on 5th December 2022, retrieved from: https://www.atlantis-press.com/article/125908443.pdf

Know more about UniqueSubmission’s other writing services: