7BSP0353-0901 The Global Economy Assignment Sample

Question:

With reference to relevant theory, assess the factors contributing to the low rates of inflation in the euro area, the UK and the US in February 2021 and assess the likely path of inflation in 2021 given continued supportive monetary policy and fiscal stimulus packages.

Table 1:- Inflation rates in February 2021*

| Euro Area | UK | US | |

| Inflation rate | 0.9 | 0.9 | 1.7 |

*(percentage change on same month in the previous year, UK data is for January)

Answer:

Due to the covid 19 pandemic, the entire world is undergoing an economic crisis, Transportation and trade have been impacted thereby affecting trade and business globally. Major developed nations such as the UK, the US, and European Union has also witnessed such crisis and has run into inflation. Thus in this assessment, an analysis of the factors which have led to this crisis will be discussed.

During the great financial crisis, the euro chain and the UK took drastic steps to survive that situation. During 2008, the GDP of the UK was -0.8%. Interest rates have been adjusted several times. Bank of UK used Quantitative Easing as a part of monetary policy. As the economy was in recession, they started lowering interest rates which was going to increase the investment and simultaneously savings, and when they were checking that the inflation rate was going higher than the government expected, the bank would increase the rate of interest. Thus, the inflation rate which was 3.99% just fell to 0.9% now (Core.ac. the UK, 2015).

During this crisis, The Federal Reserve of the US also tried to keep the interest rate lower to improve the investment which would decrease unemployment. As the crisis hit the economy, the FED started reducing the federal funds rate. Federal Open Market Committee took the oath of employing all available tools to promote economic recovery and preserving price stability. The Taylor rule suggested lowering the funds’ rate by 1.3 percentage points if the unemployment rate rises by 1 percentage point (Bls.gov, 2021). Thus, the inflation rate which was 3.8% in 2008 fell to 1.7% now.

Between the year 2008 and 2009, the ECB lowered its main policy interest rates by 325 points (Google, 2018). They took the process of enhanced credit support and decreased the money market interest rate. In 2008, the inflation rate in the Euro area was 1.58% which fell to 0.9% now (Ec.europa.eu, 2021).

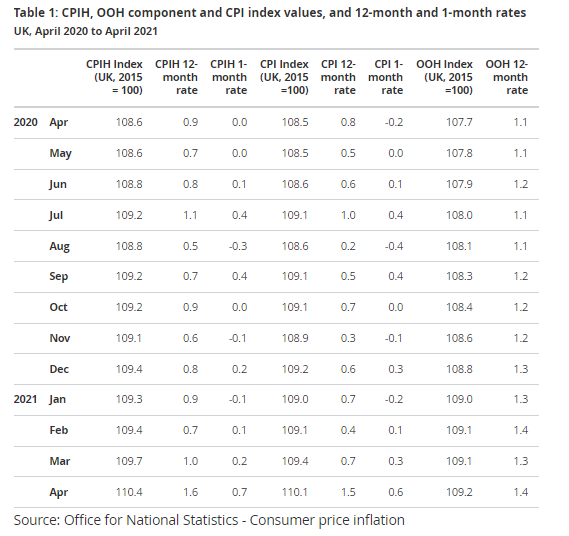

Figure 1: UK CPIH

(Source: Ons.gov.uk 2021)

In the analysis of this context, we first have to know what actually inflation denotes. Inflation is nothing but a rise in the average price of goods and serviced over time in a given geographical region. When inflation hits, the wealth may flow from the savers to borrowers as the prices change. The next discussion, therefore, will be about what happens in the market due to which the price level changes. The price level is the equilibrium point of the demand curve and supply curve of an economy. Let’s consider the economy of the UK. The bank needed more money in form of cash which was known as the Liquidity crisis. It led to a fall in business sectors directed to the unemployment of 2.6 million people (Economicshelp.org, 2021). The labour productivity also decreased drastically for cyclical reasons.

The GDP shrunk more than 6% between the 1st quarter of 2008and the 2nd quarter of 2009 (Economicshelp.org, 2021). Banks were not willing to lend to new businesses. Money circulation was hampered in the economy. Actually, according to the quantity theory of money, the general price level of goods and services is directly proportional to the amount of money being circulated and according to Keynes; a change in the quantity of money can be directed to a change in the rate of interest. It simultaneously forces the investment to change. Thus the lesser the liquidity of money, the higher is the interest rate and simultaneously lower investment (Economicshelp.org, 2021).

To tackle this unstable recession, the UK government took some monetary policy to prevent the banking and lending-related problems. The Bank of England kept the rate of interest low. As the economy went into a deep recession, the interest rate plunged into 0.5% from 5% in 2008/2009 (Ons.gov.uk 2018). Now, UK was experiencing a rise in Consumers Price Index inflation and the economic growth was very low. The bank fell into a liquidity trap (that is when the cuts in the rate of interest don’t give any such significant effect (Ons.gov.uk, 2021). In 2010, the inflation rate became 2.49% which is 0.9% in February 2021. The gap between RPI and CPI including housing costs has averaged about 80 points over the decade. Inflation may arise in the UK at the rate of about 2.3% (Ons.gov.uk, 2018).

Now, the inflation can be shown by the Phillips Curve which measures the relation between inflation and unemployment rate. It shows that the Phillips curve is getting flatter.

According to the monetarists, especially Milton Friedman, inflation is always a monetary phenomenon. When there is excess supply of money, the inflation always happens as the liquidity of the money is affected (MV).

When it comes to the United States, the economy started plunging continuously in 2007. The Fed lowered the federal funds rate as it was facing some recession from 2001 (Bls.gov, 2021). In 2007, many large lenders stopped their operation as they couldn’t fund subprime loans through the sale of MBS. Banks also stopped the same. During this time, the personal savings rate which was 3.6 percent in 2007 rose to 6.4 percent in 2008. In 2005, the households of the US were facing a 0.5% negative savings rate. The inflation rate turned out to be3.8% that fell to 1.64% in 2010 (Bls.gov, 2021).

Since 2008, US economy faced a positive unemployment gap which can lead to a fall in inflation. But the Phillips Curve just got too much flatter.

Though in this pandemic situation, the supply of goods and services was shocked which was again followed by a demand-side shock and the prices of the products and led to increasing unemployment and less income? According to the New Keynesian Phillips Curve Model, it is said that there is a structural relationship between inflation and unemployment which can be shown by the Phillips curve. In 2020, the inflation rate was 1.2% which is 1.7% in 2021 (Ons.gov.uk, 2021). The FED tried to stable the economy using many monetary policies. In May 2021, the Consumer Price Index for All Urban Consumers rose 0.6 percent which is rising 5.0 percent over the last 12 months (Ons.gov.uk, 2021). Here, Globalisation is also a factor. Globalization means opening up some emerging countries as the world market. Here, changes in the labour market are also a factor for the changes in the price level of products. Economists are watching that CPI has exceeded 3% in 2021 and to beat the inflation, the price will go up, and expectedly inflation may be capture at least 3% in 2030 (Google, 2021).

Corresponding to the analysis of the great crisis situation, it can be seen that almost every crisis-stricken economy pumped a huge amount of money in the market which could lead a huge inflation. However if the case of Japan is seen, the sophisticated interpretations have been hampered as it did not face a significant amount of inflation after injecting a large sum of money.

Last but not least is the Euro Area which was under a debt crisis that started from the fall of Iceland’s banking system and spread roughly to Italy, Ireland, Greece, and Portugal. The US Federal Reserve and the European Central Bank followed similar policies to battle the crisis by lowering the interest rates and increasing the supply of money (increasing the liquidity of money). In this case, Euro zone started adopting fiscal policy stimulus which was mostly welcomed by Spain, Greece, and Portugal (Ec.europa.eu, 2021). Governments of those countries started reducing spending to control the debt. In Euro zone, the inflation was 1.58% in 2008 which was 1.49% less than that in 2007.

The euro area started facing an inflation rate of about 0.9% in 2021 (Ecb.europa.eu, 2021). From the data of the Euro system and ECB, inflation can be expected about 2.1% in 2023 (Google, 2018). As the financial crisis hit the economy of euro area, the quantity theory of money was applicable in the area. As the amount of money increased, the level of price increased which led to inflation.

It is noted from the above analysis that, several countries have taken different steps to tackle the crisis. It also can be expected that inflation can get increased in the US further in the next decades which is nothing surprising for the cases of the United Kingdom and the countries of the Euro zone.

Reference list

Bls.gov 2021 U.S Bureau of Labor Statistics Available at: https://www.bls.gov/mobile/ (Accessed on: 12 June 2021)

Core.ac.uk 2015 The Great Financial Crisis: How Effective is Macroeconomic Policy Response in the United Kingdom? Available at: https://www.google.com/url?sa=t&source=web&rct=j&url=https://core.ac.uk/download/pdf/230937914.pdf&ved=2ahUKEwiO5cvph5LxAhW_zTgGHeEkCQwQFjABegQIBBAG&usg=AOvVaw0cU0GCrFhQCnoLWRXMzYRv (Accessed on: 12 June 2021)

Ec.europa.eu 2021 European recovery statistical dashboard Available at: https://ec.europa.eu/eurostat (Accessed on: 12 June 2021)

Ecb.europa.eu 2021 The European response to the financial crisis Available at: https://www.ecb.europa.eu/press/key/date/2009/html/sp091016_1.en.html (Accessed on: 12 June 2021)

Economicshelp.org 2021 UK Monetary Policy Available at: https://www.google.com/url?sa=t&source=web&rct=j&url=https://www.economicshelp.org/macroeconomics/monetary-policy/&ved=2ahUKEwiO5cvph5LxAhW_zTgGHeEkCQwQFnoECBoQAQ&usg=AOvVaw2wSankgv0M7fiKGXbE_tED&cshid=1623500283664 (Accessed on: 12 June 2021)

Google 2018 What Has the Eurozone Learned from the Financial Crisis? Available at: https://www.google.com/amp/s/hbr.org/amp/2018/09/what-has-the-eurozone-learned-from-the-financial-crisis (Accessed on: 12 June 2021)

Google 2021 U.S. inflation rate in 2010: 1.64% Available at: https://www.google.com/url?sa=t&source=web&rct=j&url=https://www.in2013dollars.com/inflation-rate-in-2010&ved=2ahUKEwjG5O_lnpLxAhXFXCsKHQDcBlYQFjAFegQILhAF&usg=AOvVaw0paUS4b_B7I3AC6UHgLioq (Accessed on: 12 June 2021)

Ons.gov.uk 2018 The 2008 recession 10 years on Available at: https://www.ons.gov.uk/economy/grossdomesticproductgdp/articles/the2008recession10yearson/2018-04-30#:~:text=GDP%20took%20five%20years%20to%20recover&text=The%20latest%20data%20show%20that,it%20was%20before%20the%20recession.&text=It%20shrank%20by%204%25%20during,UK%20economy%20as%20a%20whole (Accessed on: 12 June 2021)

Ons.gov.uk 2021 Consumer price inflation, UK: April 2021 Available at: https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/april2021 (Accessed on: 12 June 2021)

Ons.gov.uk 2021 Office for National Statistics Available at: https://www.ons.gov.uk/ (Accessed on: 12 June 2021)

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services: